Welcome to your essential resource for navigating the Finpros withdrawal process. As a dedicated trader, you’ve put in the effort, made strategic decisions, and now it’s time to enjoy the fruits of your labor by accessing your funds. We understand that a smooth and secure withdrawal is paramount to your trading experience. This guide is designed to empower you with all the necessary information, ensuring you can confidently move your money from your Finpros account to your personal bank account or preferred payment method without any hassle.

Getting your profits should never be a complicated affair. That’s why we’ve compiled a straightforward, step-by-step walkthrough covering everything from initiating your withdrawal request to understanding processing times and available methods. Our goal is to make accessing your money as clear and efficient as your trading strategies. You will find practical advice and key insights to ensure every Finpros withdrawal is a seamless experience.

Prepare to demystify the process and gain complete control over your earnings. Let’s make sure your journey from trading success to financial liquidity is as simple and stress-free as possible.

- Understanding the Finpros Withdrawal Process

- Your Steps to a Smooth Finpros Withdrawal

- Key Factors Influencing Your Withdrawal

- Available Finpros Withdrawal Methods

- Common Withdrawal Options at Finpros

- Key Considerations for Your Withdrawal

- Bank Transfer Options for Finpros Withdrawal

- E-wallet and Digital Payment Finpros Withdrawal Solutions

- Comparative Overview of Digital Withdrawal Features

- Other Supported Finpros Withdrawal Channels

- Direct Bank Transfers

- Credit and Debit Card Withdrawals

- Leading E-Wallet Solutions

- Cryptocurrency Withdrawals

- Step-by-Step Guide to Requesting a Finpros Withdrawal

- The Withdrawal Process at a Glance

- Before You Start: Essential Checks

- Initiating Your Finpros Withdrawal Request

- What Happens Next? Tracking Your Funds

- Logging In and Accessing the Finpros Withdrawal Section

- Completing the Finpros Withdrawal Form

- Tips for a Speedy Withdrawal:

- Confirming Your Finpros Withdrawal Request

- Finpros Withdrawal Fees and Associated Charges

- Common Withdrawal Charges You Might Encounter:

- Typical Finpros Withdrawal Timeframes

- Factors Influencing Your Withdrawal Speed

- Tips for Faster Withdrawals

- Finpros Withdrawal Limits: Minimum and Maximum Amounts

- Required Documents for Finpros Withdrawal Verification

- Why Finpros Needs These Documents

- Key Documents for Your Withdrawal

- Details on Each Required Document Type

- Proof of Identity (POI) Options:

- Proof of Residence (POR) Options:

- Proof of Payment Method (POP):

- Tips for a Seamless Verification Process

- Troubleshooting Common Finpros Withdrawal Problems

- Common Withdrawal Roadblocks and Solutions

- Quick Finpros Withdrawal Checklist

- Finpros Withdrawal Policy: Key Considerations

- Essential Elements of the Finpros Withdrawal Process:

- Ensuring a Secure Finpros Withdrawal Transaction

- Finpros’s Multi-Layered Security Approach

- Your Role in a Secure Withdrawal

- The Finpros Withdrawal Process at a Glance

- How Finpros Customer Support Assists with Withdrawals

- Tips for a Faster and Smoother Finpros Withdrawal

- Essential Steps for Rapid Finpros Payouts

- Practical Strategies to Optimize Your Finpros Withdrawal

- What Happens After Your Finpros Withdrawal Request?

- Comparing Finpros Withdrawal with Industry Standards

- Industry Benchmarks for Forex Withdrawals:

- Finpros vs. The Norm: A Snapshot

- Frequently Asked Questions About Finpros Withdrawal

- How Long Does a Finpros Withdrawal Typically Take?

- What Withdrawal Methods Can I Use with Finpros?

- Are There Any Fees Associated with Finpros Withdrawals?

- What is the Minimum and Maximum Finpros Withdrawal Amount?

- What Documents Do I Need for a Finpros Withdrawal?

- Frequently Asked Questions

Understanding the Finpros Withdrawal Process

Ready to access your trading profits? Navigating the Finpros withdrawal process is a crucial step for any successful trader. We know you work hard for your gains, and getting your funds out smoothly and efficiently is a top priority. Finpros is committed to providing a transparent and user-friendly experience, ensuring you can transfer your money with confidence.

The ability to easily manage your finances, including quick and secure withdrawals, is a hallmark of a reliable trading platform. Whether you’ve just closed a profitable trade or you’re simply managing your investment portfolio, understanding each step helps you plan your financial moves effectively. Our goal is to make the journey from your trading account to your bank account as straightforward as possible.

Your Steps to a Smooth Finpros Withdrawal

While the exact steps might vary slightly based on your chosen method, the general Finpros withdrawal process follows a clear path:

- Log In to Your Account: Start by accessing your secure Finpros trading account.

- Navigate to the Withdrawal Section: Look for the ‘Funds,’ ‘Wallet,’ or ‘Withdrawal’ option in your dashboard.

- Select Your Withdrawal Method: Choose from the available withdrawal options, which typically include bank transfers, e-wallets, or credit/debit cards.

- Enter Withdrawal Amount: Specify how much of your trading profits you wish to withdraw. Always double-check your figures!

- Confirm Details: Verify your chosen method and the amount. You might need to re-enter your account password or a two-factor authentication code for security.

- Submit Request: Once confirmed, submit your Finpros withdrawal request.

After submission, our team begins processing your request. You’ll usually receive a confirmation email, and you can track the status of your funds transfer within your account area.

Key Factors Influencing Your Withdrawal

To ensure a swift experience, keep these important points in mind:

- Account Verification: Have you completed all necessary KYC (Know Your Customer) verification? This is a mandatory step for security and regulatory compliance and often the most common reason for withdrawal delays.

- Withdrawal Methods: Different methods have varying processing times and potential fees. For instance, bank transfers might take a few business days, while e-wallet transactions could be much faster.

- Source of Funds: For regulatory reasons, withdrawals often must go back to the same method you used to deposit funds.

- Minimum/Maximum Limits: Be aware of any minimum withdrawal amounts or daily/monthly maximum limits set by the platform.

- Processing Times: While Finpros processes requests quickly, external factors like banking holidays or third-party payment provider schedules can affect the total time it takes for funds to appear in your account.

“Always ensure your account details are up-to-date and fully verified before initiating a Finpros withdrawal. Proactive verification dramatically speeds up the processing time and ensures your funds reach you without a hitch. Regular review of your preferred withdrawal options can also help you optimize for speed and convenience.”

We are dedicated to making your financial management as seamless as your trading. If you ever have questions about your specific Finpros withdrawal, our support team is always ready to assist you.

Available Finpros Withdrawal Methods

Once you’ve navigated the exciting world of forex trading and secured your profits, the next crucial step is accessing your funds. At Finpros, we understand that a smooth, secure, and efficient withdrawal process is just as vital as successful trading. That’s why we’ve streamlined our system to offer a variety of Finpros withdrawal methods, ensuring you can transfer your earnings quickly and with complete peace of mind.

Our commitment is to provide flexibility and security. We constantly review and optimize our options to ensure they meet the highest industry standards, allowing you to choose the method that best suits your needs. Your successful trading journey deserves an equally reliable exit strategy for your funds.

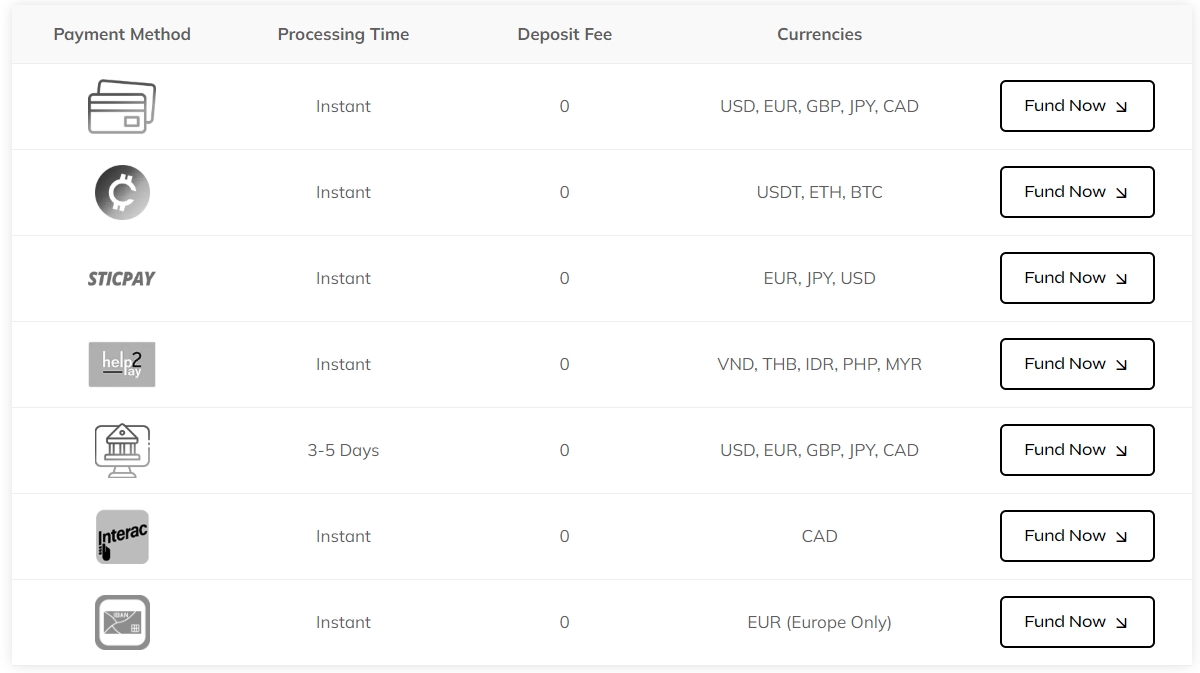

Common Withdrawal Options at Finpros

We provide a range of popular and reliable options for Finpros withdrawals. Each method comes with its own set of advantages, catering to different preferences regarding speed, convenience, and transaction size.

- Bank Wire Transfer: A traditional and highly secure method, perfect for larger withdrawal amounts. While processing times might be slightly longer, bank transfers offer unparalleled security and are accepted globally.

- Credit/Debit Card Withdrawals: A convenient option for many traders, allowing you to withdraw funds directly back to your Visa or MasterCard. This method often boasts faster processing times compared to bank wires, especially for initial withdrawals.

- E-Wallet Solutions: Experience swift and efficient transactions with popular e-wallets like Skrill and Neteller. These digital solutions are renowned for their speed, making them an excellent choice if you prioritize fast withdrawals. They add an extra layer of privacy by not directly linking to your bank account for every transaction.

- Other Localized Payment Methods: Depending on your region, Finpros may also support various localized payment solutions, offering even more convenience tailored to your specific country. Always check your personal Finpros account for the most up-to-date options available to you.

Key Considerations for Your Withdrawal

Choosing the right Finpros withdrawal method depends on several factors. Consider these points to ensure a seamless experience:

| Consideration | What It Means for You |

|---|---|

| Processing Times | How quickly funds reach your account. E-wallets are often fastest, while bank wires take longer. |

| Fees | Some methods may incur small transaction fees, which can vary based on the provider. Finpros aims to keep these transparent. |

| Minimum/Maximum Limits | Each method has specific thresholds for the smallest and largest amounts you can withdraw in a single transaction. |

| Verification Requirements | For security and regulatory compliance, you may need to complete a verification process before your first withdrawal. This ensures secure transactions. |

| Origin of Funds | Typically, you must withdraw funds back to the original source used for your deposit, adhering to anti-money laundering regulations. |

Our goal is to make your experience with Finpros as rewarding and hassle-free as possible, from your first trade to your latest withdrawal. We’re here to support your financial journey every step of the way, providing secure transactions and diverse withdrawal options.

Bank Transfer Options for Finpros Withdrawal

Initiating a Finpros withdrawal via bank transfer typically involves a few simple steps within your Finpros account. You will need to provide your bank details, including your account number and SWIFT/BIC code for international bank transfers, ensuring accuracy to prevent any delays. This method is especially beneficial for larger sums, as it minimizes the hassle often associated with other payment processors and provides a clear audit trail for your finances. We prioritize the secure transfer of your funds, implementing robust protocols to safeguard your transactions.

While bank transfers are known for their strong security, it is important to be aware of the processing time involved. Generally, an international bank transfer can take anywhere from 3 to 5 business days to clear, though this can vary depending on your bank and geographical location. Always check for any potential transaction fees that your bank or intermediary banks might levy, as these can sometimes impact the final amount received. Finpros aims for transparency, so you can always find detailed information regarding withdrawal options and any associated costs directly within the platform’s dedicated withdrawal section or by contacting customer support.

Choosing a bank transfer for your Finpros withdrawal is an excellent option for those seeking a dependable and globally recognized method to move their funds. It connects directly to your established banking infrastructure, making it a powerful choice among various forex withdrawal methods. Experience the peace of mind that comes with knowing your investment returns are securely making their way back to you.

E-wallet and Digital Payment Finpros Withdrawal Solutions

When you achieve success in the exciting world of forex trading, getting your profits quickly and efficiently is paramount. That’s where e-wallet and digital payment solutions truly shine for your Finpros withdrawal. Forget the days of lengthy bank transfers; these modern methods offer unparalleled speed and convenience, making your journey from trading success to cash in hand smoother than ever before. We understand that timely access to your funds is crucial, and digital options are built for exactly that.

The global shift towards secure and instant online transactions has transformed how traders manage their finances. For your Finpros withdrawal, e-wallet payments provide an excellent, secure bridge between your trading account and your personal funds. They are designed for the modern trader who values efficiency and control over their money.

Here’s why choosing digital payment solutions for your withdrawals is a smart move:

- Speed: Experience fast forex withdrawals, with funds often appearing in your e-wallet account within hours, not days. This means you get access to your capital almost instantly.

- Convenience: Manage your funds from anywhere in the world using just your computer or mobile device. A few clicks are all it takes to initiate your Finpros withdrawal.

- Security: Benefit from advanced encryption, multi-factor authentication, and robust fraud protection protocols. These features ensure your online transactions are always safe and secure.

- Accessibility: Most e-wallet payments are widely accepted globally, giving you flexibility no matter where you are or what your local banking situation might be.

- Tracking: Easily monitor all your transactions, providing a clear overview of your withdrawals and financial activity.

Using e-wallet payments for your Finpros withdrawal is straightforward. Simply navigate to the withdrawal section in your Finpros account, select your preferred digital payment solution from the available options, enter the amount you wish to withdraw, and confirm the transaction. The process is designed to be intuitive and user-friendly, allowing you to focus on your trading strategies rather than cumbersome paperwork.

Comparative Overview of Digital Withdrawal Features

To give you a clearer picture, here’s how digital payment solutions generally stack up against traditional methods for your Finpros withdrawal:

| Feature | E-wallet / Digital Payment Solutions | Traditional Bank Transfers |

|---|---|---|

| Withdrawal Speed | Very Fast (often same-day or within 24 hours) | Slow (typically 3-5 business days) |

| Security | High (advanced encryption, fraud monitoring) | High (standard banking security) |

| Fees | Varies (often low or competitive) | Can be higher for international transfers |

| Convenience | Excellent (mobile access, global use, instant setup) | Moderate (requires bank details, potential forms) |

| Accessibility | Worldwide acceptance, easy account creation | Dependent on bank networks and specific country regulations |

Embracing these efficient digital payment solutions means you spend less time worrying about accessing your funds and more time focusing on what truly matters: refining your trading strategy and maximizing your potential. Make your Finpros withdrawal a seamless and stress-free experience with the convenience and reliability of e-wallet payments.

Other Supported Finpros Withdrawal Channels

At Finpros, we understand that getting your funds out quickly and securely is just as important as putting them in. That’s why we support a wide array of reliable withdrawal channels, giving you ultimate flexibility and control over your finances. Our goal is to make sure your experience is smooth from start to finish, ensuring you have convenient fund access whenever you need it.

Direct Bank Transfers

For those who prefer traditional and robust methods, direct bank transfers remain a staple. This method offers a tried-and-true way to receive larger sums directly into your bank account. While it might take a few business days to process, it’s an excellent choice for substantial withdrawals, offering peace of mind through secure payment options. Many traders rely on this method for its unwavering reliability.

Considerations for Bank Transfers:

- Processing Time: Typically 3-5 business days.

- Fees: May incur bank-specific processing fees.

- Best For: Larger withdrawal amounts.

Credit and Debit Card Withdrawals

Pulling funds back to your Visa or MasterCard is one of the most popular and straightforward methods. This option provides quick payouts, usually reflecting in your account within a few business days after processing. It combines convenience with speed, making it a go-to choice for many traders looking for easy access to funds they’ve earned. Just remember to use the same card you used for your initial deposit.

Leading E-Wallet Solutions

For maximum speed and efficiency, our supported e-wallet solutions are second to none. Finpros partners with top e-wallets like Skrill, Neteller, and others to offer you rapid withdrawals. These digital wallets provide efficient payout solutions, often processing within hours once approved. If you value speed and seamless online transactions, e-wallet withdrawals are likely your best bet among our diverse withdrawal methods. They are especially popular with traders who manage funds across various online platforms.

Benefits of Using E-Wallets:

- Speed: Often the fastest withdrawal method.

- Convenience: Easy to use for online forex withdrawals.

- Security: Advanced encryption protects your financial data.

Cryptocurrency Withdrawals

Stepping into the future, Finpros embraces innovative withdrawal options, including select cryptocurrencies. For traders who engage with digital assets, withdrawing your profits in Bitcoin (BTC) or Tether (USDT) offers a modern, decentralized, and often very fast way to manage your capital. This method provides an alternative for those seeking enhanced privacy and quick cross-border transactions, making it an increasingly attractive option for global traders.

Choosing the right withdrawal channel depends entirely on your personal preferences for speed, fees, and the amount you wish to transfer. Finpros is committed to providing flexible and secure ways for you to access your trading profits, ensuring a positive financial experience every step of the way.

Step-by-Step Guide to Requesting a Finpros Withdrawal

Ready to access your profits from Finpros? Navigating the withdrawal process should be as straightforward as your trading strategy. We understand that getting your funds quickly and securely is a top priority. This guide breaks down each step, making sure you can initiate your Finpros withdrawal with confidence and ease. No more guessing, just a clear path to your money.

At Finpros, we’ve designed our system to be user-friendly, ensuring that your journey from a successful trade to a successful withdrawal is seamless. Whether you’re a seasoned trader or just starting out, follow these simple steps to bring your earnings home.

The Withdrawal Process at a Glance

- Log in to your secure Finpros account.

- Navigate to the “Withdrawal” or “Funding” section.

- Select your preferred withdrawal method.

- Enter the amount you wish to withdraw.

- Confirm your request and track its status.

Let’s dive deeper into each stage so you know exactly what to expect. Transparency is key when it comes to managing your funds, and we aim to provide you with all the necessary information.

Before You Start: Essential Checks

Before you even click the withdrawal button, take a moment for a few quick checks. These ensure a smooth process:

- Verify Your Account: Is your Finpros account fully verified? This is a crucial step for regulatory compliance and security. If you haven’t completed it, do so now to avoid delays.

- Check Your Balance: Confirm that you have sufficient available funds in your trading account. Remember, some funds might be tied up in open positions.

- Review Withdrawal Policies: Familiarize yourself with Finpros’s current withdrawal policies, including any minimum or maximum limits, and potential processing times for different methods.

Taking these small precautions beforehand can save you time and frustration. We want your experience to be as efficient as possible.

Initiating Your Finpros Withdrawal Request

Once you’ve done your checks, it’s time to make your request:

- Access Your Trading Dashboard: Log into your Finpros trading portal using your credentials. This is your command center for all trading and account management activities.

- Locate the Withdrawal Section: Look for a clearly labeled “Withdrawal,” “Funds,” or “Banking” section. It’s usually found in the main menu or your account management area.

- Choose Your Method: Finpros typically offers various withdrawal options, such as bank wire transfers, credit/debit cards, and e-wallets. Select the method that suits you best and aligns with how you deposited funds (often, withdrawals must go back to the original source).

- Specify the Amount: Carefully enter the exact amount you wish to withdraw. Double-check this figure to prevent errors.

- Provide Necessary Details: Depending on the method, you might need to enter banking details, e-wallet IDs, or card information. Ensure all details are accurate to prevent your request from being rejected.

- Confirm and Submit: Review all the information one last time. Once you’re certain everything is correct, click the “Submit” or “Confirm” button to send your request.

You’ll usually receive an immediate confirmation that your request has been received. This starts the processing phase.

What Happens Next? Tracking Your Funds

After submission, your Finpros withdrawal enters our processing queue. Here’s what to expect:

Finpros diligently processes all withdrawal requests, striving for efficiency and security. Our finance team reviews each request to ensure compliance with regulatory standards and internal policies. This typically involves:

- Internal Review: We verify the details of your request against your account information and our security protocols.

- Processing Time: The time it takes for funds to reach you depends on the withdrawal method. E-wallet transfers are often quicker, while bank wires can take several business days.

- Notification: You will receive email updates on the status of your withdrawal, from submission to completion.

We believe in keeping you informed every step of the way. If you have any questions or encounter any issues during this process, our dedicated support team is always ready to assist you. Your financial security and peace of mind are our priority.

Logging In and Accessing the Finpros Withdrawal Section

Ready to manage your funds and access your trading profits? Getting into the Finpros withdrawal area is a straightforward process designed for your convenience. Think of it as a smooth path to your earnings.

First, you need to securely log into your Finpros trading account. This is your personal gateway to all account management features, including deposits and, of course, withdrawals. Always ensure you are on the official Finpros website to protect your account details.

Here’s how you typically navigate to the withdrawal section:

- Open Your Browser: Launch your preferred web browser and type in the official Finpros URL.

- Locate the Login Button: You’ll usually find this prominently displayed at the top right corner of the homepage. Click it.

- Enter Your Credentials: Input your registered username (or email) and your secure password. Double-check for typos!

- Solve Any Security Checks: Some platforms might require a CAPTCHA or two-factor authentication (2FA) for an extra layer of security. Complete these steps.

- Access Your Dashboard: Once logged in, you’ll land on your personal trading dashboard. This is your command center.

- Find the Wallet/Funds Section: Look for a menu option labeled something like “Wallet,” “Funds,” “My Account,” or “Deposit/Withdraw.” This is where all your financial transactions live.

- Select “Withdrawal”: Within the funds management area, you’ll clearly see an option for “Withdrawal” or “Request Withdrawal.” Click this, and you’re in!

This section is your dedicated space for managing outward transactions. Here, you’ll see your available balance, a list of withdrawal methods, and the necessary forms to initiate your request. It’s designed to be intuitive, giving you full control over your money.

Completing the Finpros Withdrawal Form

Navigating the Finpros platform is straightforward, and when it comes to accessing your hard-earned funds, the Finpros withdrawal form is your essential tool. Properly completing this form is crucial for a smooth and efficient withdrawal process, ensuring your trading profits reach you without unnecessary delays. We understand that withdrawing your money should be as hassle-free as making a deposit, so let’s walk through the steps to get it right the first time.

The journey to withdrawing your funds begins right in your Finpros client portal. You’ll find the dedicated withdrawal section easily accessible from your dashboard. Our platform is designed for user convenience, making sure you can initiate a secure transaction with just a few clicks. Remember, accuracy in filling out the form is key to a swift transfer.

Here’s a simple guide to help you complete your Finpros withdrawal form:

- Access Your Client Area: Log in to your Finpros account using your credentials. This is your secure hub for all trading and account management activities.

- Locate the Withdrawal Section: On your dashboard or in the main menu, look for “Withdrawal” or “Funds Management.” Click on it to proceed.

- Select Your Trading Account: If you manage multiple trading accounts, choose the specific account from which you wish to withdraw funds.

- Choose Your Withdrawal Method: Finpros offers various payment methods to suit your needs. Select your preferred option, such as bank wire, e-wallets, or other available methods. Be aware that the method often needs to match your deposit method due to regulatory requirements.

- Enter Withdrawal Amount: Clearly state the amount you wish to withdraw. Double-check that this amount is available in your balance and meets any minimum withdrawal requirements.

- Provide Necessary Details: Depending on your chosen payment method, you might need to enter bank account details, e-wallet IDs, or other relevant information. Ensure all details are current and correct.

- Complete Account Verification: For your security and compliance with financial regulations, Finpros may require you to have completed account verification. This often involves submitting identity and address proofs. If you haven’t done so, complete this step promptly to avoid delays.

- Review and Submit: Before hitting submit, carefully review all the information you’ve entered. Any discrepancies could cause processing delays. Once satisfied, submit your request.

Tips for a Speedy Withdrawal:

- Verify Your Account Early: Complete your full Finpros account verification as soon as possible. This is a one-time process that significantly speeds up all future transactions.

- Match Deposit and Withdrawal Methods: Whenever possible, use the same method for both deposits and withdrawals. This streamlines the process and helps comply with anti-money laundering regulations.

- Check for Pending Trades: Ensure you have no open positions that could affect your available balance for withdrawal.

- Understand Processing Times: While we aim for rapid processing, external factors like bank holidays or interbank transfer times can influence when funds appear in your account. Finpros typically processes requests quickly on our end.

By following these steps, you empower yourself to manage your trading profits effectively. Our commitment at Finpros is to provide a transparent and secure environment for all your financial operations. Completing the Finpros withdrawal form accurately is a critical step towards enjoying the fruits of your successful trading strategies.

Confirming Your Finpros Withdrawal Request

You’ve navigated the exciting world of forex trading, made smart decisions, and now it’s time to enjoy the fruits of your labor! Initiating a withdrawal from your Finpros account is just the first step. The crucial part is confirming that request so your funds can reach you smoothly and without delay.

Once you submit your withdrawal request through the Finpros platform, our system immediately begins processing it. However, to ensure the highest level of security for your funds and to comply with regulatory standards, there’s a quick confirmation process. This isn’t just a formality; it’s a vital safeguard for your financial well-being.

What happens next?

- Email Notification: You’ll receive an instant email from Finpros confirming receipt of your withdrawal request. This email will summarize the amount requested, the chosen withdrawal method, and a unique transaction ID. Keep this ID handy for any future inquiries.

- Verification Checks: Our dedicated finance team conducts a series of swift, internal verification checks. They look for consistency with your account information and trading activity, ensuring everything is in order. This typically involves cross-referencing your registered details to prevent unauthorized access.

- Additional Documentation (If Needed): In rare instances, or for larger withdrawal amounts, we might ask for additional identification or proof of ownership for the withdrawal method. This is a standard anti-money laundering (AML) and know-your-customer (KYC) procedure designed to protect everyone involved. We aim to make this as unobtrusive as possible, requesting only what’s absolutely necessary.

Rest assured, we prioritize getting your funds to you efficiently. We understand that quick access to your profits is important, and our goal is to make this final step as seamless and stress-free as your trading journey has been. Stay vigilant for our confirmation email and any follow-up communication to ensure a swift transfer.

Finpros Withdrawal Fees and Associated Charges

Navigating the world of online trading means understanding all aspects of your financial transactions, and withdrawal fees are a crucial part of that. At Finpros, we believe in complete transparency, ensuring you know exactly what to expect when you access your hard-earned profits. We work hard to keep our fee structure straightforward, so you can focus on your trading strategies rather than hidden costs.

When it’s time to withdraw funds from your Finpros account, you might encounter a few types of associated charges. These aren’t always unique to Finpros; they are often standard practice across the financial industry, driven by banking networks and payment processors. Understanding these can help you plan your withdrawals effectively.

Common Withdrawal Charges You Might Encounter:

- Processing Fees: Some payment methods or banking partners may levy a small charge for processing the withdrawal request itself. These are typically a fixed amount or a very small percentage.

- Bank Transfer Fees: If you choose a direct bank wire transfer, your own bank or intermediary banks might apply their own fees for receiving international or even domestic funds. This is outside Finpros’s control.

- Currency Conversion Fees: Should your trading account currency differ from your local bank account currency, a conversion will take place. This usually involves a small spread or fee from the financial institution performing the conversion.

- Third-Party Payment Provider Fees: If you use e-wallets or other third-party services, they might have their own outbound transaction fees.

We always recommend reviewing the specific terms and conditions for withdrawals on our platform, which detail the charges associated with each payment method. You’ll find a dedicated section outlining these potential costs before you confirm any withdrawal request. This way, you have a clear picture of the net amount you will receive.

Our commitment is to facilitate swift and secure withdrawals while keeping any associated charges as competitive and transparent as possible. We encourage you to reach out to our customer support team if you have any questions about withdrawal processes or fees. They are always ready to provide clarity and assistance, helping you manage your funds with confidence.

Typical Finpros Withdrawal Timeframes

When you’re actively trading, the ability to access your funds quickly is paramount. At Finpros, we understand that timely fund withdrawal is a critical aspect of your trading experience. We strive to make the Finpros withdrawal process as efficient and transparent as possible, ensuring you can manage your capital with confidence. While we process your requests swiftly, the total time for funds to reach your account can vary based on several factors.

Factors Influencing Your Withdrawal Speed

Understanding what influences the speed of your payment methods is key to setting realistic expectations. Here are the primary elements that can affect your overall withdrawal timeframes:

- Internal Processing: This is the time Finpros takes to review and approve your withdrawal request. Our team works diligently to ensure security and compliance.

- Chosen Payment Method: Different payment methods have inherently different transfer speeds. An e-wallet withdrawal, for instance, is often much faster than a traditional bank transfer withdrawal.

- Bank or Payment Provider Processing: Once Finpros releases the funds, your bank or payment service provider takes over. Their own internal processing times can add to the overall duration.

- Account Verification Status (KYC): For your first Finpros withdrawal, or if your account details have recently changed, a Know Your Customer (KYC) verification might be required, which can slightly extend the initial processing time.

- Currency Conversion: If you withdraw funds in a currency different from your trading account base currency, additional processing time for conversion may apply.

- Weekends and Public Holidays: Financial institutions typically do not process transactions on non-business days, which can naturally extend the overall withdrawal timeframe.

Typically, Finpros aims to process all withdrawal requests within 1 business day. After our internal processing is complete, the subsequent arrival time depends on the chosen method. Here’s a general overview:

| Payment Method | Finpros Internal Processing | Estimated Funds Arrival (After Finpros Processing) |

|---|---|---|

| E-wallets (e.g., Skrill, Neteller) | Up to 1 business day | 1 – 2 business days |

| Credit/Debit Cards | Up to 1 business day | 2 – 5 business days |

| Bank Transfers | Up to 1 business day | 3 – 7 business days |

These are typical withdrawal timeframes. Please remember that unforeseen circumstances with banking networks or international transfers can occasionally cause slight variations. However, our commitment is always to facilitate your fund withdrawal promptly.

Tips for Faster Withdrawals

Want to ensure your trading funds reach you as quickly as possible? Here are a few expert tips:

- Complete Verification Early: Ensure your Finpros account is fully verified (KYC compliant) before you even initiate your first withdrawal. This prevents delays.

- Use Consistent Methods: Whenever possible, withdraw funds using the same method you used to deposit. This can streamline the security checks.

- Check Your Details: Double-check all banking or e-wallet details before submitting your withdrawal request to avoid rejections and subsequent delays.

- Be Mindful of Cut-off Times: Submitting your request early in the business day can sometimes help it get processed faster.

“A smooth withdrawal process is a cornerstone of trust in a broker. At Finpros, we continuously optimize our systems to ensure your financial control is never compromised.”

Your ability to access your capital freely and efficiently is a top priority. We are dedicated to providing clear expectations and a streamlined process for all Finpros withdrawal operations, making your financial management as effortless as your trading.

Finpros Withdrawal Limits: Minimum and Maximum Amounts

Understanding Finpros withdrawal limits is crucial for managing your funds effectively. Whether you’re looking to take profits or reallocate capital, knowing the minimum and maximum amounts you can withdraw ensures a smooth and predictable experience. Finpros designs its transaction limits to balance accessibility for all traders with the security and efficiency of its financial operations.

Finpros sets a specific minimum withdrawal amount to ensure that transaction processing remains efficient and cost-effective for both you and the platform. Attempting to withdraw less than this specified amount typically results in a declined request. This minimum threshold often varies slightly depending on the payment method you choose, such as bank transfer or various e-wallets. For most standard withdrawal methods, Finpros generally maintains a user-friendly minimum, making it accessible for traders to access their profits without needing to accumulate a massive balance first. Always check the specific requirements within your Finpros account dashboard for the most current figures.

The maximum Finpros withdrawal amount usually comes with more flexibility and can depend on several factors. These upper limits are in place for security reasons and to comply with financial regulations, ensuring the integrity of your funds transfer. You might find a higher maximum limit if your account is fully verified, demonstrating a commitment to secure and legitimate trading. Different withdrawal methods may also carry their own specific caps. For instance, a bank transfer might allow for a significantly larger single transaction compared to certain e-wallet services. Finpros aims to accommodate substantial withdrawals, especially for successful traders. If you need to withdraw an amount exceeding the standard maximum, contacting customer support might provide options for alternative arrangements or staggered withdrawals, improving your overall withdrawal process experience.

Several key factors can influence your Finpros withdrawal limits:

- Account Verification Status: Fully verified accounts often enjoy higher limits and smoother processing times.

- Chosen Withdrawal Method: Bank transfers, various e-wallets, and other options might have distinct minimum and maximum thresholds.

- Regulatory Compliance: Finpros adheres to strict financial regulations that can impact withdrawal caps and overall transaction limits.

- Account Activity and History: Consistent, legitimate trading activity can sometimes contribute to greater trust and flexibility in your available methods.

Finpros strives for transparency regarding its withdrawal policy. Before initiating any funds transfer, we strongly recommend that you navigate to the withdrawal section within your personal Finpros dashboard. There, you will find precise details on the current minimum and maximum withdrawal limits applicable to your account and preferred method. This proactive approach helps avoid any unexpected delays or complications during your withdrawal process, ensuring you always know your options for accessing your funds.

Required Documents for Finpros Withdrawal Verification

Are you ready to enjoy the fruits of your trading success? Withdrawing your funds from Finpros is a straightforward process, but like all reputable financial institutions, we require a brief verification to ensure the security of your account and comply with global financial regulations. This isn’t just a formality; it’s a vital step to protect your money from unauthorized access and combat financial crime. Think of it as an extra layer of security, safeguarding your hard-earned profits. Let’s walk through the essential documents you’ll need to make your Finpros withdrawal smooth and hassle-free.

Why Finpros Needs These Documents

Finpros operates under strict Know Your Customer (KYC) and Anti-Money Laundering (AML) policies. These global standards protect both you and the platform. By verifying your identity and residence, we prevent fraud, ensure funds go to the rightful owner, and maintain a secure trading environment for everyone. Our commitment to these regulations means you can trade and withdraw with peace of mind, knowing your financial integrity is our top priority.

Key Documents for Your Withdrawal

To finalize your withdrawal request, you typically need to provide clear, valid copies of the following documents. Make sure all information is up-to-date and easily readable.

- Proof of Identity (POI): This document confirms who you are. We need to see your full name, date of birth, photograph, and expiration date. Ensure it’s not expired!

- Proof of Residence (POR): This verifies your current residential address. It helps us confirm that your account is linked to a legitimate physical location.

- Proof of Payment Method (POP): Depending on how you funded your account, we might need to confirm ownership of the payment method. This is crucial for preventing credit card fraud and unauthorized transactions.

Details on Each Required Document Type

Here’s a closer look at what falls under each category and what makes them valid for submission:

Proof of Identity (POI) Options:

You can choose one of the following official government-issued photo IDs. Remember, all four corners of the document must be visible, and the image must be clear and in color.

| Document Type | Key Requirements |

|---|---|

| National Passport | Full name, photo, date of birth, signature, issue/expiry dates. Must be valid. |

| National ID Card | Full name, photo, date of birth, unique ID number, issue/expiry dates (both sides if applicable). Must be valid. |

| Driver’s License | Full name, photo, date of birth, license number, issue/expiry dates (both sides if applicable). Must be valid. |

“Verifying your identity is the cornerstone of secure financial transactions. It’s about protecting you from unauthorized access to your funds.”

Proof of Residence (POR) Options:

This document should be issued in your name and clearly show your current residential address. Importantly, it must be dated within the last three to six months (check Finpros’s specific timeframe as it can vary slightly).

- Utility Bill (electricity, water, gas, internet, landline phone bill)

- Bank Statement or Credit Card Statement (showing your address, not transactions)

- Government-issued Tax Bill or official correspondence

- Council Tax Bill

Important Note: Mobile phone bills are generally not accepted as Proof of Residence. Ensure the document is recent and not older than the specified period.

Proof of Payment Method (POP):

If you deposited funds using a credit/debit card, we need to verify that you own that card. This involves providing a clear image of your card with specific details obscured for security. For e-wallets, a screenshot of your account page showing your name and account number might be needed.

- For Credit/Debit Cards:

- Front of the card: Display only the first six and the last four digits of the card number. Cover the middle six digits.

- Cover the CVV/CVC code on the back.

- Ensure your name and the card’s expiry date are clearly visible.

- For Bank Wire Transfers: A bank statement confirming the transaction to Finpros, showing your name and bank account details.

- For E-Wallets (e.g., Skrill, Neteller): A screenshot of your account profile page clearly showing your name and email address/account ID associated with the e-wallet.

Tips for a Seamless Verification Process

To ensure your withdrawal verification goes through as quickly as possible, keep these pointers in mind:

- Clarity is Key: All documents must be clear, legible, and in high resolution. Blurry or cut-off documents will delay the process.

- Consistency Matters: The name on your Finpros account must exactly match the name on your Proof of Identity and Proof of Residence documents.

- Timeliness: Provide documents that are valid and, for POR, within the required timeframe.

- Complete Submission: Send all required documents at once. This prevents back-and-forth communication and speeds up approval.

- File Format: Generally, JPG, JPEG, PNG, or PDF formats are accepted. Check Finpros’s specific requirements.

By preparing these documents in advance and following these guidelines, you’ll make your Finpros withdrawal verification a smooth and efficient experience. We are here to help you every step of the way, so if you have any questions, our support team is always ready to assist.

Troubleshooting Common Finpros Withdrawal Problems

You’ve had a successful run on the markets, and now it’s time to enjoy your profits. But what happens when your Finpros withdrawal doesn’t go as smoothly as planned? Don’t panic! Encountering a hiccup during the withdrawal process is more common than you think. Often, a quick check of a few key areas can resolve the issue swiftly. Let’s dive into the most frequent reasons for withdrawal delays or rejections and how you can tackle them head-on.

When your funds seem stuck, the first step is always to remain calm. Most issues have straightforward solutions. Think of yourself as a detective, ready to uncover the mystery behind your pending transaction.

Common Withdrawal Roadblocks and Solutions

- Incomplete Account Verification (KYC): This is perhaps the most frequent culprit. Financial regulations require brokers like Finpros to verify your identity before processing withdrawals. If your “Know Your Customer” (KYC) documents – like your ID, proof of address, or bank statement – are outdated, unverified, or incomplete, your withdrawal will likely be on hold.

- Solution: Log into your Finpros account, navigate to the verification section, and ensure all required documents are uploaded, approved, and up-to-date. Sometimes, a document expires, or the quality isn’t clear enough.

- Incorrect Payment Details: A simple typo can cause significant delays. Double-check your bank account number, e-wallet ID, or crypto wallet address. Even a single digit out of place can send your money to the wrong destination or cause a rejection.

- Solution: Carefully review and re-enter your payment information. If you’re unsure, contact your bank or e-wallet provider to confirm the correct details.

- Minimum/Maximum Withdrawal Limits: Every broker sets limits on how much you can withdraw per transaction or within a certain period. If your request falls outside these boundaries, it won’t proceed.

- Solution: Adjust your withdrawal amount to fit within Finpros’s specified limits. You can usually find these details in the withdrawal section of your account or their terms and conditions.

- Unfulfilled Bonus Terms and Conditions: Many trading bonuses come with specific trading volume requirements. If you haven’t met these conditions, your bonus funds, and sometimes even your profits, might be locked.

- Solution: Review the terms and conditions of any active bonuses you accepted. Understand the trading volume or time requirements. If you still have an active bonus, contact support to clarify how it affects your withdrawal.

- Mismatch in Deposit and Withdrawal Methods: For security and anti-money laundering purposes, many brokers require you to withdraw funds using the same method you used for your deposit, especially up to the deposited amount.

- Solution: Try initiating the withdrawal using the original deposit method. If this isn’t possible (e.g., a card expired), contact Finpros support to explore alternative, compliant options.

- System Delays or Maintenance: Occasionally, the processing delay isn’t on your end. Payment gateways, banks, or even Finpros’s internal systems might experience temporary issues or scheduled maintenance.

- Solution: Check Finpros’s official announcements for any system updates or maintenance notices. Give it a little time, and if the issue persists, reach out to support.

Quick Finpros Withdrawal Checklist

Use this handy checklist before or after initiating a withdrawal to preempt or resolve common issues:

| Check Item | Action to Take |

|---|---|

| Account Verified? | Confirm all KYC documents are approved and current. |

| Payment Details Correct? | Double-check bank account, e-wallet, or crypto address for accuracy. |

| Within Limits? | Ensure withdrawal amount is between minimum and maximum allowed. |

| Bonus Terms Met? | Verify all trading conditions for active bonuses are satisfied. |

| Method Match? | Attempt to use the same method as your deposit, if applicable. |

| No Pending Issues? | Check your Finpros messages or notifications for any account alerts. |

If you’ve gone through this list and your withdrawal issue remains unresolved, don’t hesitate to contact Finpros’s customer support. Provide them with all relevant details, including your account ID, withdrawal request number, and any error messages you received. Their dedicated team is there to guide you through any complexities and ensure your funds reach you safely and efficiently. Remember, effective communication is key to a swift resolution!

Finpros Withdrawal Policy: Key Considerations

Understanding the withdrawal process is a crucial step for any trader. At Finpros, we make sure that accessing your funds is straightforward, secure, and transparent. Our withdrawal policy is designed with your convenience and financial security in mind, ensuring a smooth experience from start to finish. We believe in empowering our clients with clear information, so you always know what to expect when you’re ready to withdraw your trading profits.

Before initiating any withdrawal from your Finpros account, it’s wise to familiarize yourself with the key aspects of our policy. This helps prevent delays and ensures a hassle-free transfer of your hard-earned money. We prioritize the safety of client funds, which means certain security protocols are in place to protect your capital.

Essential Elements of the Finpros Withdrawal Process:

- Account Verification (KYC): Your security is paramount. Before your first withdrawal, you must complete our Know Your Customer (KYC) verification process. This typically involves submitting identification documents and proof of address. This step safeguards your funds against unauthorized access and complies with global financial regulations.

- Available Withdrawal Methods: Finpros offers a variety of withdrawal methods to suit your needs. These generally include bank wire transfers, credit/debit cards, and popular e-payment solutions. We strive to provide options that are both convenient and widely accessible for our diverse client base.

- Processing Times: We process all withdrawal requests promptly. While Finpros aims for quick internal processing, the total time it takes for funds to reach your account can vary. This depends on the chosen withdrawal method and the policies of the receiving financial institution. E-wallet withdrawals often appear faster than traditional bank transfers.

- Withdrawal Fees: While Finpros endeavors to minimize costs, certain withdrawal methods may incur small fees from third-party payment processors or banks. Any applicable fees are clearly displayed during the withdrawal request process, so you’re always informed before confirming your transaction.

- Minimum and Maximum Amounts: There are specific minimum and maximum withdrawal limits that depend on your chosen method. These limits are in place to ensure efficient processing and compliance. You can easily find these details within your client portal when you initiate a withdrawal.

- Withdrawal to Original Source: For security and anti-money laundering purposes, Finpros generally requires withdrawals to be made back to the same source from which the funds were deposited. For instance, if you funded your account via a specific credit card, withdrawals will typically return to that same card.

- Impact of Trading Bonuses: If you’ve received a trading bonus, it’s essential to review the specific terms and conditions associated with that bonus. Often, bonuses come with trading volume requirements that must be met before you can withdraw the bonus funds or any profits derived from them. Our client support team can always clarify these terms for you.

Our commitment is to provide a transparent and efficient withdrawal experience. If you ever have questions about the Finpros withdrawal policy or need assistance with a specific transaction, our dedicated client support team is ready to help. We are here to guide you every step of the way, ensuring you can confidently manage your finances with Finpros.

Ensuring a Secure Finpros Withdrawal Transaction

When you’ve achieved success in your trading journey, the next logical step is to access your earnings. At Finpros, we understand that withdrawing your funds needs to be as straightforward and secure as possible. Your peace of mind is paramount, and we employ robust measures to protect your money throughout the entire withdrawal process. We believe that financial security is not just a feature; it’s a fundamental promise.

Finpros’s Multi-Layered Security Approach

Our commitment to your security is unwavering. We utilize a combination of cutting-edge technology and stringent protocols to safeguard your transactions. Here’s how we ensure every Finpros withdrawal is secure:

- Advanced Encryption: All data transmitted during your withdrawal request, including personal and financial details, is protected with state-of-the-art encryption. This makes it incredibly difficult for unauthorized parties to intercept sensitive information.

- Strict Verification Protocols: Before any funds leave your account, we implement comprehensive identity verification steps. This multi-factor authentication ensures that only you, the rightful account holder, can initiate and approve withdrawals.

- Segregated Client Accounts: Your trading capital is held in segregated bank accounts, completely separate from Finpros’s operational funds. This critical measure ensures your money is always safe, even in unforeseen circumstances.

- Regulatory Compliance: Finpros adheres to strict regulatory standards set by financial authorities. These regulations often mandate specific security measures and regular audits, adding another layer of protection for your funds.

Your Role in a Secure Withdrawal

While Finpros provides a secure environment, your active participation is also vital. Following these simple guidelines can significantly enhance the security of your withdrawal transaction:

- Keep Login Credentials Confidential: Never share your username, password, or any two-factor authentication codes with anyone.

- Use Strong, Unique Passwords: Create complex passwords that are difficult to guess and different from those used for other online services.

- Monitor Your Account Activity: Regularly review your transaction history. If you notice any suspicious activity, report it to Finpros immediately.

- Be Wary of Phishing Attempts: Always check the sender’s email address and the legitimacy of links before clicking. Finpros will never ask for your password via email.

- Ensure Your Device is Secure: Keep your operating system, web browser, and antivirus software up to date to protect against malware.

The Finpros Withdrawal Process at a Glance

We’ve designed our withdrawal process to be both secure and user-friendly. Here’s a general overview of the steps you can expect:

| Step | Action | Security Implication |

|---|---|---|

| 1. Initiate Request | Log into your Finpros account and navigate to the withdrawal section. Select your preferred method and amount. | Protected by your secure login credentials. |

| 2. Verification Check | Complete any required identity verification steps, which may include a one-time password or security question. | Confirms you are the legitimate account holder. |

| 3. Processing | Finpros internal team reviews and processes your request, adhering to strict compliance protocols. | Prevents unauthorized transactions and ensures regulatory compliance. |

| 4. Fund Transfer | Your funds are securely transferred to your designated bank account or e-wallet. | Encrypted transfers to verified financial institutions. |

Finpros adheres to strict regulatory standards set by financial authorities. These regulations often mandate specific security measures and regular audits, adding another layer of protection for your funds.

Our goal is to make your withdrawal experience smooth and worry-free, allowing you to focus on what matters most: your financial growth and freedom. We are constantly reviewing and enhancing our security measures to stay ahead of potential threats, ensuring that your funds always remain in safe hands.

How Finpros Customer Support Assists with Withdrawals

At Finpros, we understand that accessing your funds quickly and smoothly is paramount. Your financial independence is our priority, and our dedicated customer support team is here to ensure your withdrawal experience is as seamless as possible. We go beyond just answering questions; we actively guide you through every step of the Finpros withdrawal process, making sure you feel confident and informed every time.

Our support specialists are trained to provide comprehensive assistance for all your withdrawal inquiries. They are not just problem-solvers; they are your partners in ensuring your funds reach you efficiently and securely. Here’s how our experts simplify your withdrawal journey:

- Step-by-Step Guidance: Unsure about the form or the next step? Our team provides clear, concise instructions, walking you through each stage of your withdrawal request. We clarify what to do and when to do it.

- Understanding Payment Methods: We help you navigate the various payment methods available. Our team explains processing times, any associated costs, and specific requirements for each, whether it’s a bank transfer, e-wallet, or another option.

- Expediting Account Verification: Sometimes, quick account verification is crucial for compliance and to prevent delays. Our support team clarifies KYC (Know Your Customer) requirements and assists you in submitting the correct documents swiftly.

- Troubleshooting Common Issues: Did a withdrawal seem to get stuck? Our specialists promptly investigate and resolve common issues, providing effective solutions to get your client funds moving again without unnecessary waiting.

- Policy Clarification: We explain withdrawal policies, potential fees (if any), and any other relevant terms in plain language. This ensures complete transparency, empowering you to make informed decisions about your money.

Connecting with our customer support team is easy and convenient. We offer multiple channels to ensure you receive timely assistance, no matter your preferred method of communication for your secure transactions:

- Live Chat: Get instant answers to your urgent questions. This is perfect for real-time assistance and quick clarifications about your withdrawal.

- Email Support: For more detailed inquiries or when you need to send documents, our email support ensures a thorough and documented response, giving you a clear record.

- Phone Assistance: Speak directly with an expert for personalized guidance and immediate resolution of complex issues related to your withdrawals.

Choosing Finpros means choosing peace of mind, especially when it comes to managing your money. Our proactive approach to withdrawal support sets us apart, ensuring you always experience fast withdrawals and reliable service.

| Feature of Finpros Withdrawal Support | Benefit to You |

|---|---|

| Dedicated Specialists | Receive expert, personalized attention for every inquiry. |

| Multi-Channel Availability | Access help whenever and however you prefer, fitting your schedule. |

| Proactive Problem Solving | Issues are identified and resolved quickly, ensuring your funds reach you without delay. |

| Transparent Communication | Always understand the process, requirements, and status of your funds with clear explanations. |

We are committed to making your experience with Finpros as smooth and rewarding as possible. When it comes to accessing your earnings, our support team is your most reliable ally, ensuring efficiency and confidence.

Tips for a Faster and Smoother Finpros Withdrawal

Navigating the Finpros withdrawal process should be as straightforward as your trading journey. We all want our funds quickly and without hassle. While Finpros works hard to process payouts efficiently, a few smart moves on your part can significantly speed things up and ensure a smooth experience. Let’s unlock the secrets to getting your profits in your pocket faster.

Essential Steps for Rapid Finpros Payouts

Preparing in advance is key. Think of it as setting the stage for success. Here are the core elements you need to nail down:

- Complete Account Verification Early: This is arguably the most critical step. Fully verify your Finpros account as soon as you open it, not just when you’re ready to withdraw. Delays often stem from incomplete KYC (Know Your Customer) documentation. Submit your proof of identity and address promptly. A verified account means your first fast Finpros withdrawal is ready when you are.

- Choose the Right Withdrawal Method: Not all methods are created equal in terms of speed. Bank transfers might take longer than e-wallets, depending on your region and bank. Understand the available withdrawal methods Finpros offers and select one that aligns with your urgency and convenience. Generally, using the same method for both deposits and withdrawals can streamline the process.

- Check Withdrawal Limits and Fees: Be aware of any minimum or maximum withdrawal limits Finpros might have. Also, understand if any Finpros fees apply to your chosen method. Unexpected fees or attempting to withdraw outside limits can cause delays. A quick check of the terms and conditions will save you time later.

Practical Strategies to Optimize Your Finpros Withdrawal

Beyond the basics, these actionable tips will help you bypass common bottlenecks and ensure a seamless transfer of your funds.

Pre-empting Potential Issues:

Before you even click “withdraw,” take a moment to review these points:

- Match Your Details: Ensure the name on your Finpros account exactly matches the name on your bank account or e-wallet. Any discrepancies will flag your request for manual review, causing delays.

- Review Your Withdrawal Request: Double-check all details – bank account numbers, e-wallet IDs, amounts – before submitting. A simple typo can halt your smooth Finpros payout.

- Understand Processing Times: While Finpros strives for quick processing, external factors like bank holidays or interbank transfer times can affect the final arrival of funds. Factor these into your expectations.

Comparing Withdrawal Options for Speed:

Different methods offer varying speeds. Here’s a general idea, but always check Finpros’s specific terms for the most current information:

| Method Type | Typical Finpros Processing Time | Notes for Speed |

|---|---|---|

| E-wallets (e.g., Skrill, Neteller) | Often within 24-48 hours | Usually the fastest once approved by Finpros. |

| Bank Transfers | 3-7 business days | Can be slower due to interbank processing. Ensure all bank details are perfect. |

| Credit/Debit Cards | 2-5 business days | Reversal to the card used for deposit. Timing can depend on your card provider. |

Keep in mind that the Finpros withdrawal process typically involves an internal review period before funds are dispatched. Choosing an efficient payment processor on your end can significantly impact the overall speed.

When to Contact Finpros Support:

Don’t hesitate to reach out if you have questions or concerns. Proactive communication can prevent issues. If your Finpros withdrawal seems to be taking longer than expected, a polite query to Finpros support can help clarify the status and identify any potential roadblocks. They are there to help ensure your funds reach you.

By following these tips, you’re not just requesting a withdrawal; you’re optimizing the entire experience. Enjoy your faster and smoother Finpros withdrawal!

What Happens After Your Finpros Withdrawal Request?

So, you’ve hit that “withdraw” button on your Finpros account. Exciting, right? You’ve made some profitable trades or perhaps you’re simply managing your funds. Now, a crucial question arises: what exactly unfolds behind the scenes after you submit that withdrawal request? Understanding this process can help you manage your expectations and feel more confident about getting your funds. Let’s peel back the curtain and see what happens next.

Your withdrawal request isn’t just a simple click; it kicks off a structured process designed to ensure security, compliance, and ultimately, the safe delivery of your money to your chosen destination. Finpros prioritizes the integrity of your funds, so there are a few essential steps involved.

Here’s a typical breakdown of the journey your funds take after you initiate a withdrawal:

- Initial Submission and Confirmation: The moment you submit your request, Finpros registers it. You’ll usually receive an immediate on-screen confirmation and often an email confirming receipt of your request. This is your first touchpoint, acknowledging that the system has captured your instruction.

- Internal Review and Verification: This is where Finpros’s compliance and finance teams step in. They review your request against several parameters. This includes checking for any pending bonuses, ensuring you’ve met all verification requirements (KYC – Know Your Customer), and confirming that the withdrawal method aligns with your deposit method, a standard anti-money laundering (AML) protocol. If anything looks unusual or incomplete, they might reach out to you.

- Processing by Finpros: Once your request passes the internal review, Finpros processes the funds. This means they deduct the requested amount from your trading account and prepare it for transfer. The speed of this internal processing can vary slightly but is generally quite efficient.

- External Transfer to Your Payment Provider: After internal processing, Finpros sends the funds to your chosen payment method – be it a bank wire, e-wallet, or credit card. This is where the external part of the process begins. The transfer time now largely depends on the payment provider you’ve selected.

- Arrival in Your Account: Finally, the funds arrive in your personal bank account or e-wallet. You’ll see the transaction reflected there, completing the entire cycle.

It’s natural to wonder about the timeline. While Finpros strives for quick processing, external factors play a big role. Different payment methods have varying typical clearing times.

Consider these common withdrawal methods and their usual timelines:

| Withdrawal Method | Finpros Processing Time | Estimated External Transfer Time |

|---|---|---|

| Bank Wire Transfer | 1-2 Business Days | 3-7 Business Days |

| Credit/Debit Card | 1-2 Business Days | 2-5 Business Days |

| E-Wallets (e.g., Skrill, Neteller) | Within 1 Business Day | Instant to 2 Business Days |

“Patience is a virtue, especially when waiting for funds to clear through banking systems,” as many seasoned traders will tell you. While the internal Finpros process is often swift, external banking networks operate on their own schedules, which can be affected by weekends, public holidays, and interbank processing times.

Staying informed is key. Always check your email for updates from Finpros regarding your withdrawal status. If you have any concerns or if the process seems to be taking longer than expected, don’t hesitate to reach out to Finpros customer support. They are there to assist you and provide clarity on your specific request. Your peace of mind matters, and understanding each step helps you navigate the financial side of your trading journey with confidence.

Comparing Finpros Withdrawal with Industry Standards

For any forex trader, the ability to access their hard-earned capital quickly and securely is paramount. A smooth withdrawal process isn’t just a convenience; it’s a testament to a broker’s reliability and commitment to its clients. When we talk about forex broker withdrawal mechanisms, there are established industry benchmarks that traders universally expect. Let’s delve into how Finpros stacks up against these critical standards, ensuring you have a clear picture of what to expect.

The core elements defining an excellent withdrawal experience typically revolve around speed, cost, and method availability. Traders desire quick withdrawals that don’t get bogged down in bureaucratic delays. Transparency in withdrawal processing times and any associated costs is equally vital for a positive forex trading experience.

Industry Benchmarks for Forex Withdrawals:

- Processing Speed: Most reputable brokers aim to process withdrawal requests within 1-3 business days. The actual receipt of funds can then depend on the chosen payment methods (e.g., bank wires might take longer than e-wallets).

- Withdrawal Fees: While some brokers offer completely free withdrawals, especially for popular methods or above a certain threshold, it’s common to see a small fee for bank wires or multiple withdrawals within a short period. The industry standard leans towards minimal or no fees.

- Variety of Methods: A diverse range of options, including bank wire transfers, credit/debit cards, and popular e-wallets (Skrill, Neteller, PayPal), ensures flexibility for traders worldwide.

- Security and Transparency: Robust security protocols, including encryption and verification processes, protect client funds security. Clear communication about the withdrawal process, potential delays, and required documentation is also expected.

- Minimum/Maximum Limits: Reasonable limits for both minimum withdrawal amounts and maximum daily/monthly withdrawals are crucial.

Now, let’s consider Finpros in this light. Our commitment at Finpros is to facilitate a seamless process for fund access. We understand that timely withdrawals build trust and enhance your overall trading journey. Our operational procedures are designed to meet, and in many cases, exceed these common expectations, focusing on efficiency and security.

Finpros vs. The Norm: A Snapshot

| Feature | Industry Standard (Typical) | Finpros Approach |

|---|---|---|

| Request Processing Time | 1-3 business days | Dedicated team ensures efficient processing, often within 24-48 hours. |

| Available Methods | Bank wire, credit/debit card, several e-wallets | Broad selection covering major global and regional options for your convenience. |

| Associated Fees | Often free for certain methods/volumes; small fees for others. | Transparent fee structure, often free for standard methods, clearly outlined. |

| Security Protocols | SSL encryption, KYC verification | Advanced encryption and stringent verification for utmost client funds security and regulatory compliance. |

As one experienced trader famously stated, “A broker is only as good as its withdrawal process.” We firmly believe in upholding this sentiment. While external factors like bank processing times are beyond any broker’s direct control, Finpros strives to minimize the internal handling time, making your funds available as swiftly as possible. Our goal is to set a new standard for a hassle-free and reliable withdrawal experience, ensuring that when you’re ready to take profits, the process is as rewarding as your trades.

Frequently Asked Questions About Finpros Withdrawal

Navigating the world of online trading brings many questions, and understanding how to access your funds is always a top priority. At Finpros, we believe in clarity and efficiency, especially when it comes to your money. This section addresses the most common questions our clients have about the Finpros withdrawal process, ensuring you feel confident and informed every step of the way. We want your experience to be as smooth as your trading journey.

How Long Does a Finpros Withdrawal Typically Take?

One of the most frequent inquiries we receive concerns the speed of your funds reaching your account. Processing times for a Finpros withdrawal can vary depending on several factors, including the chosen withdrawal method and any necessary verification procedures. Generally, our internal processing takes approximately 1-2 business days. After we approve your request, the time it takes for the funds to reflect in your bank or e-wallet account depends on the specific payment provider. For example:

- Bank Transfers: Usually take 3-5 business days after our internal processing.

- Credit/Debit Cards: Funds often appear within 2-7 business days, though this can sometimes be quicker.

- E-wallets (e.g., Skrill, Neteller): These are typically the fastest, often reflecting funds within 1-2 business days post-approval.

We always strive to expedite your Finpros withdrawal, but external factors are sometimes beyond our immediate control.

What Withdrawal Methods Can I Use with Finpros?

Finpros offers a variety of convenient withdrawal methods to suit your preferences. We understand that flexibility is key. You can typically choose from the same methods you used to deposit funds, which helps maintain security and compliance. Popular Finpros withdrawal options include:

- Bank Wire Transfer

- Credit and Debit Cards (Visa, MasterCard)

- Various E-wallet services (e.g., Skrill, Neteller)

It is important to remember that, for security reasons and anti-money laundering regulations, we usually require you to withdraw funds using the same method and to the same account from which you made your initial deposit, up to the deposited amount. Any profits can then be withdrawn via other available methods.

Are There Any Fees Associated with Finpros Withdrawals?

We aim to keep our fee structure transparent and competitive. While Finpros does not charge internal fees for most withdrawal methods, some third-party payment processors or your own bank might impose their charges. These can include transaction fees, currency conversion fees, or intermediary bank fees for international wire transfers. We always recommend checking with your specific payment provider for their fee schedule. You will see any applicable Finpros withdrawal fees clearly displayed during the withdrawal request process before you finalize it.

What is the Minimum and Maximum Finpros Withdrawal Amount?

Finpros sets minimum withdrawal limits to ensure efficient processing and to cover any potential transaction costs. The minimum Finpros withdrawal amount usually depends on the method you select. For instance, e-wallet withdrawals might have a lower minimum than bank wire transfers. Maximum withdrawal limits also apply, which can be per transaction or per day/month, depending on your account status and verification level. You can find the specific limits for each method clearly stated within your Finpros client portal when you initiate a withdrawal request. If you need to withdraw a larger sum, you might require additional verification or need to make multiple requests.

What Documents Do I Need for a Finpros Withdrawal?

To ensure the security of your funds and comply with international financial regulations (KYC – Know Your Customer and AML – Anti-Money Laundering), Finpros requires all clients to complete a verification process. If you have not fully verified your account yet, you will need to provide the following documents before your first Finpros withdrawal:

- Proof of Identity: A clear copy of a government-issued photo ID (passport, national ID card, or driver’s license).

- Proof of Address: A utility bill, bank statement, or government-issued document showing your name and address, dated within the last three to six months.

Sometimes, we might also request proof of ownership for the payment method used, such as a photo of your credit card (with sensitive numbers obscured) or an e-wallet screenshot. We process all documentation with the utmost confidentiality and security. Completing your verification early helps avoid delays when you decide to withdraw your profits.

Frequently Asked Questions

How long does a Finpros withdrawal typically take?

Finpros typically processes withdrawal requests within 1-2 business days internally. After internal approval, the funds’ arrival depends on the method: 3-5 business days for bank transfers, 2-7 business days for credit/debit cards, and 1-2 business days for e-wallets.

What withdrawal methods are available at Finpros?