Navigating the vibrant and competitive landscape of online trading requires a broker you can trust implicitly. For UK traders, selecting the right platform means prioritizing not just robust features but also unwavering regulatory compliance and superior customer support. This is precisely where Finpros United Kingdom enters the conversation, positioning itself as a notable player in the bustling forex trading UK market.

Our comprehensive review delves deep into what Finpros offers, meticulously examining every facet relevant to those trading from the United Kingdom. We understand that your capital and trading aspirations are serious business. Therefore, we provide an unbiased look at its core services, aiming to equip you with all the essential information needed to make an informed decision about your next trading partner.

What makes a broker truly stand out for a UK audience? It often comes down to a few critical areas that directly impact your trading experience and potential success:

- Regulatory Adherence: Operating under strict UK financial regulations is paramount for security and trust.

- Trading Platform Excellence: A user-friendly, powerful trading platform is crucial for efficient execution and analysis.

- Diverse Instrument Range: Access to a wide array of markets, from major forex pairs to indices and commodities, offers greater opportunity.

- Competitive Pricing: Transparent spreads and low commissions ensure your profits aren’t eroded by unnecessary costs.

- Reliable Customer Service: Responsive customer support tailored to local needs can make all the difference when you face an issue.

Throughout this review, we cut through the marketing noise to present a clear picture of Finpros United Kingdom’s capabilities. Whether you are an experienced trader or just beginning your journey into the financial markets, understanding the nuances of your chosen broker is non-negotiable. Join us as we explore if Finpros truly delivers on its promise to provide a top-tier trading environment for its UK clients, offering clarity and confidence in your choices.

- Understanding Finpros in the UK Market

- Is Finpros Regulated in the United Kingdom?

- Finpros Trading Platforms Available for UK Users

- Explore Your Trading Hubs with Finpros

- MetaTrader 4 (MT4): The Industry Standard

- MetaTrader 5 (MT5): The Next Generation

- Finpros WebTrader: Trade Directly from Your Browser

- Mobile Trading Apps: Markets in Your Pocket

- Why Choose Finpros Platforms for Your UK Trading Needs?

- Account Types and Opening Process for UK Residents

- Discovering Your Ideal Forex Account

- Key Considerations for UK Traders

- The Streamlined Account Opening Process for UK Residents

- Available Assets and Instruments on Finpros UK

- Forex (Foreign Exchange)

- Indices

- Commodities

- Shares (Stocks)

- Cryptocurrencies

- Finpros Fees, Spreads, and Commissions in the UK

- Unpacking Finpros Spreads

- Commissions: When and How They Apply

- Other Potential Trading Costs to Consider

- Deposit and Withdrawal Methods for United Kingdom Traders

- Customer Support and Service for Finpros UK Clients

- How Finpros UK Prioritizes Your Needs

- Connect with Our Support Team

- Security Measures and Data Protection at Finpros

- How Finpros Protects Your Trading Experience

- Your Data Privacy is Our Priority

- Pros and Cons of Using Finpros in the UK

- How Finpros Compares to Other UK Brokers

- What Makes Finpros Different?

- A Quick Comparison Snapshot

- User Reviews and Reputation of Finpros United Kingdom

- Educational Resources and Tools from Finpros UK

- Comprehensive Learning Paths

- Essential Trading Tools at Your Command

- Getting Started with Finpros for Traders in the UK

- Your First Steps with Finpros:

- The Future of Finpros in the British Trading Landscape

- Key Drivers Shaping the Finpro Future

- Opportunities for Growth and Specialization

- Navigating the Challenges Ahead

- The Enduring Value of Human Expertise

- Frequently Asked Questions

Understanding Finpros in the UK Market

Stepping into the world of online trading requires a clear understanding of the platforms available, especially when operating in a dynamic and regulated environment like the UK. Finpros emerges as a significant player, offering various financial instruments to a diverse range of traders. For those considering their options in the British Isles, comprehending Finpros’s operations and its positioning within the UK market is crucial. This helps you make informed decisions about your trading journey.

The UK financial landscape boasts a robust regulatory framework, primarily overseen by the Financial Conduct Authority (FCA). This body sets stringent rules for financial service providers, aiming to protect consumers and ensure market integrity. Any platform operating within the UK or serving UK residents must adhere to these regulations. This offers a layer of security and trust for traders.

What makes a platform like Finpros attractive to UK traders?

- Access to a wide array of financial markets, including popular forex pairs and commodity CFDs.

- Potentially competitive trading conditions, such as tight spreads and efficient execution.

- User-friendly trading platforms suitable for both beginners and experienced individuals.

- Customer support designed to assist with queries specific to the UK trading environment.

- Educational resources that help traders enhance their market knowledge and strategies.

Engaging with Finpros means exploring opportunities across various asset classes. Traders often look for platforms that offer flexibility, advanced analytical tools, and reliable customer service. In the UK, with its sophisticated financial ecosystem, the demand for high-quality, trustworthy brokers is ever-present. Finpros aims to meet these expectations by providing a comprehensive trading solution, allowing individuals to navigate the complexities of global markets from the comfort of their homes.

Your choice of trading partner significantly impacts your success. By understanding Finpros’s presence, offerings, and regulatory standing in the UK market, you empower yourself to select a platform that aligns with your trading goals and provides a secure foundation for your financial endeavors.

Is Finpros Regulated in the United Kingdom?

When you step into the world of online trading, especially in the dynamic forex market, one of the first questions on any savvy trader’s mind should be about regulation. It’s not just a formality; it’s the bedrock of your trading security. For brokers operating in the United Kingdom, regulation falls under the stringent oversight of the Financial Conduct Authority (FCA). This body sets incredibly high standards, ensuring transparency, fairness, and robust protection for clients.

So, regarding Finpros and its regulatory status in the UK, it’s crucial to understand what FCA regulation entails and how to confirm it. An FCA-regulated broker adheres to strict capital requirements, segregates client funds from company operational funds, and participates in the Financial Services Compensation Scheme (FSCS). This scheme can protect your funds up to a certain limit in the unlikely event of the firm’s insolvency.

To verify if Finpros holds an FCA license, you always need to consult the official FCA Financial Services Register. This public database is the definitive source for checking if any financial firm, including a forex broker, is authorized to operate in the UK. Simply input the firm’s name or its FCA registration number (FRN) into the search tool. The register will display details about their authorization, the services they are permitted to offer, and any trading names they use.

Why is checking this so important?

- Client Fund Security: Regulated brokers must keep your money in separate accounts, meaning your funds are safe even if the broker faces financial difficulties.

- Dispute Resolution: If you have an issue, you have access to official channels like the Financial Ombudsman Service (FOS).

- Fair Trading Practices: The FCA monitors brokers to ensure they offer fair pricing, transparent execution, and avoid misleading practices.

- Company Stability: Regulated firms must meet capital adequacy requirements, making them more financially stable.

Therefore, before committing any capital to Finpros or any other broker, take that vital step: check the FCA Register. It empowers you to make an informed decision and trade with greater peace of mind, knowing your chosen platform operates within a well-defined and protective legal framework.

Finpros Trading Platforms Available for UK Users

Are you a UK-based trader looking for powerful, reliable platforms to navigate the financial markets? Finpros understands the dynamic needs of its UK clientele, offering a suite of advanced trading platforms designed for precision, speed, and comprehensive analysis. Whether you are a seasoned forex expert or just starting your journey into CFD trading or spread betting, our platforms provide the tools you need to execute your strategies effectively.

We believe that a superior trading experience starts with a robust platform. That’s why Finpros ensures our UK traders have access to industry-leading technology, combining intuitive interfaces with powerful analytical capabilities. You’ll find a seamless trading environment, whether you prefer the desktop for in-depth analysis or mobile for on-the-go management of your positions.

Explore Your Trading Hubs with Finpros

Finpros brings a selection of top-tier platforms to your fingertips, each tailored to different trading styles and preferences. Our commitment to UK users means providing platforms that are not only powerful but also user-friendly and reliable for your daily trading activities.

MetaTrader 4 (MT4): The Industry Standard

For many UK forex traders, MetaTrader 4 remains the go-to platform. Its legendary stability and extensive customization options make it a favorite. With MT4 at Finpros, you get:

- Advanced charting tools for in-depth technical analysis.

- A wide array of built-in indicators and the ability to add custom ones.

- Support for Expert Advisors (EAs) for automated trading strategies.

- Real-time market quotes and diverse order types.

UK traders appreciate MT4 for its reliability and its massive community support, offering a wealth of resources and custom tools.

MetaTrader 5 (MT5): The Next Generation

Building on the success of MT4, MetaTrader 5 offers an even more robust and versatile trading environment. Finpros provides MT5 for UK traders seeking additional functionalities, including:

- More timeframes and analytical objects for enhanced market analysis.

- An economic calendar integrated directly into the platform.

- Additional pending order types.

- Access to more asset classes beyond just forex and CFDs, depending on Finpros’s offering.

MT5 is ideal for those who demand more power and flexibility from their Finpros trading platform, providing a comprehensive solution for various market instruments.

Finpros WebTrader: Trade Directly from Your Browser

Don’t want to download any software? Our Finpros WebTrader is your solution. This platform offers instant access to your account and the markets directly through your web browser. It’s perfect for UK traders who need flexibility without sacrificing functionality. Key advantages include:

- No download or installation required.

- Cross-device compatibility – access from any computer with an internet connection.

- Intuitive interface with essential trading tools and charting capabilities.

- Secure and efficient execution of trades.

The WebTrader ensures that you never miss a trading opportunity, whether you are at home, work, or on the move within the UK.

Mobile Trading Apps: Markets in Your Pocket

In today’s fast-paced world, mobile trading is essential. Finpros offers dedicated mobile trading applications for both iOS and Android devices, ensuring UK traders can manage their accounts and place trades anytime, anywhere. Our mobile apps deliver:

- Full account management features.

- Real-time quotes and interactive charts.

- The ability to open, close, and modify positions.

- Push notifications for market alerts and account activity.

Stay connected to the global financial markets with Finpros mobile apps, designed for convenience and powerful performance.

Why Choose Finpros Platforms for Your UK Trading Needs?

Choosing Finpros means opting for a trading partner that prioritizes your success. Our platforms are optimized to provide UK traders with a competitive edge.

“The right trading platform isn’t just about features; it’s about the feeling of control and confidence it gives you. Finpros delivers that with every click.” – A satisfied UK trader.

We focus on delivering:

| Feature | Benefit for UK Traders |

|---|---|

| Robust Security | Protecting your data and funds with advanced encryption and protocols. |

| Fast Execution | Minimizing slippage and ensuring your trades are executed at desired prices. |

| User-Friendly Interface | Easy navigation, making it simple for beginners while satisfying advanced users. |

| Comprehensive Tools | Access to a full suite of analytical indicators, charting options, and news feeds. |

| Multi-Device Access | Seamlessly switch between desktop, web, and mobile without losing progress. |

Our goal at Finpros is to empower every UK trader with the best possible tools. We continuously strive to enhance our offerings, ensuring that our platforms remain at the forefront of trading technology. Choose Finpros and experience the difference a high-quality trading platform can make to your financial endeavors.

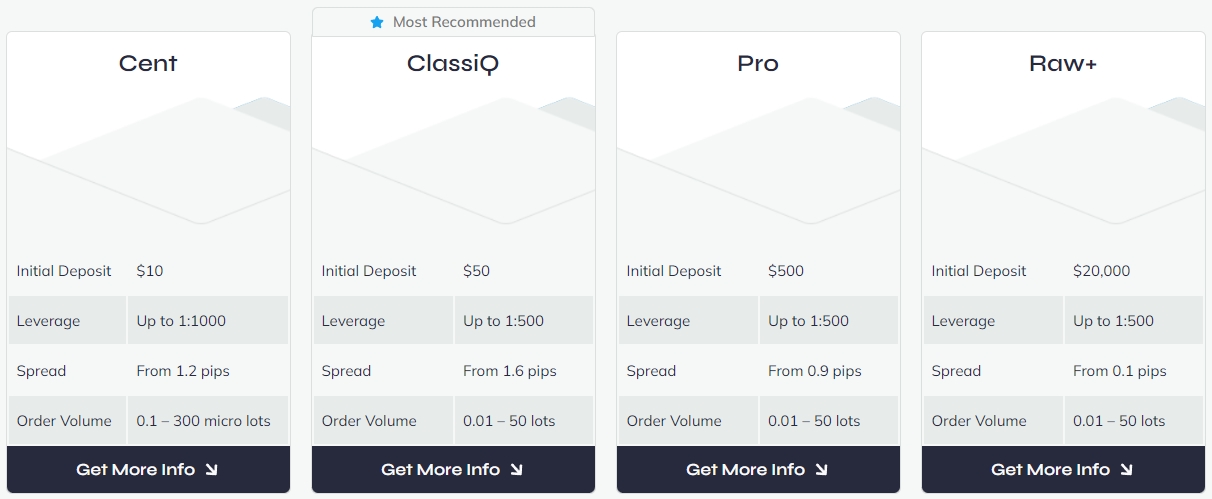

Account Types and Opening Process for UK Residents

Embarking on your forex trading journey in the United Kingdom starts with choosing the right account. It’s a pivotal decision that shapes your trading experience, affecting everything from your available leverage to the spreads you pay. We understand that UK residents are looking for reliability, transparency, and a seamless entry into the global financial markets. That’s why we offer a diverse range of forex trading accounts tailored to different experience levels and capital sizes, all while adhering to the stringent regulatory standards set by the Financial Conduct Authority (FCA).

Discovering Your Ideal Forex Account

Selecting the best account type is crucial for your success. We provide various options, each designed with specific trader needs in mind. Understanding the nuances of each can significantly impact your trading strategy and profitability.

- Standard Accounts: Often the most popular choice, offering competitive spreads and a wide range of tradable instruments. These accounts are suitable for most traders looking for a balanced trading environment.

- Mini Accounts: Perfect for beginners or those wishing to trade with smaller capital. They allow trading in mini-lots, reducing your market exposure and risk, making it an excellent stepping stone into live trading.

- ECN Accounts: For the more experienced trader, ECN (Electronic Communication Network) accounts offer direct access to interbank pricing. This means tighter spreads, often as low as zero, in exchange for a small commission per trade. It’s ideal for scalpers and high-volume traders seeking ultimate market depth.

- Islamic Accounts (Swap-Free): Designed for Muslim traders, these accounts comply with Sharia law, meaning no swap or rollover interest on overnight positions. You can engage in forex without compromising your beliefs.

- Demo Accounts: While not a live trading account, a demo account is an invaluable tool for all UK residents. It lets you practice strategies, familiarize yourself with our platform, and understand market dynamics using virtual funds, completely risk-free. It’s the perfect place to hone your skills before committing to a live trading environment.

Key Considerations for UK Traders

When you choose your forex trading account, consider these critical factors:

| Feature | Description |

|---|---|

| Minimum Deposit | The initial capital required to open and fund your live trading account. This varies significantly between account types. |

| Leverage Options | The amount of capital you can control with a smaller initial investment. FCA regulations cap leverage for retail clients, ensuring responsible trading. |

| Spreads and Commissions | The cost of trading. Spreads are the difference between bid and ask prices, while commissions are a direct fee per trade, often found on ECN accounts. |

| Available Instruments | The range of assets you can trade, including currency pairs, commodities, indices, and cryptocurrencies. |

The Streamlined Account Opening Process for UK Residents

Opening a forex trading account with us is a straightforward and secure process designed for UK residents. We prioritize ease of access while strictly adhering to regulatory requirements to protect your interests.

- Registration: Start by completing our online registration form. Provide basic personal details like your name, email, and phone number. This initial step takes only a few minutes.

- Account Type Selection: Choose the forex trading account type that best suits your trading style and capital. Remember, you can always start with a demo account to get comfortable.

- Personal Information: Complete the full application form, including your address, date of birth, and financial information, as required by regulatory bodies.

- Identity Verification (KYC): This is a mandatory step for all financial institutions. You will need to provide documents to verify your identity and proof of address. This ensures compliance with anti-money laundering (AML) regulations and enhances the security of your account.

- Fund Your Account: Once your account is verified, you can deposit funds using various secure payment methods, including bank transfer, debit card, or e-wallets. Your initial minimum deposit gets you ready for live trading.

- Start Trading: Access our advanced trading platforms, analyze the markets, and place your first trade! Our support team is always available if you need assistance.

“Regulatory compliance is at the heart of our operations. For UK residents, this means peace of mind, knowing your funds are segregated and your trading environment is fair and transparent. We are a fully FCA regulated broker, committed to upholding the highest standards of financial conduct.”

We invite you to experience the difference of trading with a client-focused, FCA regulated broker. Our commitment to providing excellent service, robust platforms, and a secure trading environment makes us a preferred choice for UK residents looking to engage in the dynamic world of forex. Join our growing community of successful traders today and take control of your financial future.

Available Assets and Instruments on Finpros UK

Diving into the world of trading requires a solid platform, and understanding the range of assets available to you is the first step towards building a diverse and robust portfolio. At Finpros UK, we pride ourselves on offering an extensive selection of trading instruments designed to cater to every trader’s strategy and risk appetite. Whether you are a seasoned investor or just starting your journey, our platform provides the tools and choices you need to explore global markets with confidence.

Here’s a glimpse into the diverse financial instruments you can access and trade:

Forex (Foreign Exchange)

The forex market is the largest and most liquid financial market in the world, and it’s where currencies are traded. With Finpros UK, you gain access to a wide array of currency pairs, allowing you to speculate on the fluctuating exchange rates between different global currencies. We offer both major and minor pairs, giving you ample opportunities to capitalize on market movements. Trading forex opens up a world of possibilities, from the stability of the USD/EUR to the dynamic shifts of exotic pairs. Our platform ensures you have real-time data and tight spreads to make informed decisions.

Indices

Want to trade the performance of an entire economy or a specific sector? Indices trading is your answer. An index represents a basket of stocks from a particular stock exchange or industry. When you trade indices, you are essentially speculating on the overall direction of that market. Finpros UK provides access to popular global indices like the S&P 500, FTSE 100, DAX 40, and Nikkei 225. This allows you to gain broad market exposure without having to analyze individual company shares, offering a powerful way to diversify your trading approach and react to macroeconomic trends.

Commodities

Commodities are essential raw materials that drive global industries and economies. They offer unique trading opportunities, often influenced by supply and demand, geopolitical events, and seasonal changes. With Finpros UK, you can trade a variety of hard and soft commodities. Imagine speculating on the price of gold as a safe-haven asset, or silver for its industrial demand. You can also engage with energy commodities like crude oil and natural gas, or agricultural products. Commodities trading adds a tangible dimension to your portfolio, providing diversification away from traditional financial assets.

Shares (Stocks)

Directly own a piece of the world’s leading companies? Share trading allows you to do just that. Finpros UK gives you the opportunity to trade CFDs on individual shares from some of the biggest global exchanges. This means you can take a position on the performance of companies like Apple, Google, Amazon, Tesla, and many more, without owning the underlying asset. Trading CFDs on shares offers flexibility, allowing you to go long or short, and potentially profit from both rising and falling markets. It’s an exciting way to engage with corporate success stories and market innovation.

Cryptocurrencies

The digital revolution has brought forth a new era of trading with cryptocurrencies. These digital assets, powered by blockchain technology, have captured global attention with their significant volatility and growth potential. Finpros UK allows you to trade CFDs on a selection of the most popular cryptocurrencies, including Bitcoin, Ethereum, Ripple, and Litecoin. This means you can speculate on their price movements without needing a digital wallet or direct ownership. Cryptocurrencies offer dynamic opportunities for traders looking to engage with cutting-edge technology and high-volatility markets.

Our commitment at Finpros UK is to provide a comprehensive and user-friendly platform that supports your trading ambitions across this wide range of assets. We continuously strive to enhance our offerings, ensuring you have access to the markets that matter most to you.

Finpros Fees, Spreads, and Commissions in the UK

Understanding the costs associated with trading is crucial for every successful trader, and at Finpros, we believe in complete transparency, especially when it comes to our fee structure in the UK. We want you to focus on your trading strategies, not on hidden charges. Our pricing model is designed to be competitive, offering clear spreads, commissions, and other potential costs so you always know where you stand.

Unpacking Finpros Spreads

Spreads are the core of forex trading costs, representing the difference between the bid and ask price of a currency pair. At Finpros UK, we pride ourselves on offering competitive spreads that are often variable, reflecting real-time market conditions. This means during periods of high liquidity, you might benefit from even tighter spreads, reducing your entry and exit costs.

- Tight Spreads: We strive to provide some of the tightest spreads on major currency pairs, helping you maximize your potential returns.

- Variable Nature: Our spreads fluctuate with market volatility and liquidity, giving you a dynamic and fair pricing experience.

- No Hidden Markups: What you see is what you get; we don’t add hidden markups to our spreads.

Commissions: When and How They Apply

While many of our trading instruments are commission-free, some specific account types or asset classes might involve a commission charge. This is often the case with our ECN (Electronic Communication Network) accounts, where we offer raw, interbank spreads, and a small, fixed commission is applied per trade. This structure appeals to advanced traders who prioritize razor-thin spreads and high execution speed.

For most standard accounts, you’ll find that Finpros operates on a spread-only basis, meaning your trading cost is simply the bid-ask difference. We make it very clear which instruments and account types incur a commission, so there are no surprises as you navigate your trading journey.

Other Potential Trading Costs to Consider

Beyond spreads and commissions, a few other charges might occasionally apply, ensuring you have a full picture of your trading expenses:

| Fee Type | Description | How It Applies |

|---|---|---|

| Overnight/Swap Fees | Charges or credits applied for holding positions open overnight. | Calculated based on interest rate differentials of the currency pair and your position size. |

| Inactivity Fees | A small fee charged if an account remains dormant for an extended period. | Typically applies after 6-12 months of no trading activity, deposit, or withdrawal. |

| Deposit/Withdrawal Fees | Finpros generally doesn’t charge for deposits, but third-party payment processors might. Some withdrawal methods may incur a nominal fee. | Varies by payment method and provider; always check our funding section for specifics. |

We are dedicated to maintaining a fair and transparent pricing model across all our services in the UK. Our goal is to empower you with clear information, allowing you to manage your trading capital effectively. We encourage you to review our detailed pricing schedule available on the Finpros platform for the most current information.

Deposit and Withdrawal Methods for United Kingdom Traders

When you jump into the exciting world of forex trading, one of your first practical considerations is how to fund your account and, just as importantly, how to withdraw your profits. For United Kingdom traders, having access to convenient, secure, and efficient deposit methods and withdrawal methods is not just a luxury; it’s a necessity for a smooth trading experience. Let’s explore the best ways to manage your funds and ensure your focus remains squarely on your forex trading strategy.

You’ll find a variety of payment options available, each offering its own blend of speed, cost, and security. Understanding these differences helps you make smart choices for your financial movements, ensuring fast payments when you need them and secure transactions always.

- Debit Cards (Visa Debit, MasterCard Debit): These are arguably the most popular deposit methods among United Kingdom traders due to their instant processing. You can typically fund your account immediately, allowing you to react quickly to market opportunities. Most brokers also support withdrawals back to your debit card, usually taking 1-3 business days to process.

- Bank Transfers (Faster Payments, BACS): For larger sums, bank transfers offer a high level of security. While BACS transfers can take a few days, the UK’s Faster Payments system often clears funds within hours, sometimes even minutes, making it a robust option for both deposit and withdrawal methods. This method ensures direct and secure transactions with your bank.

- E-Wallets (PayPal, Skrill, Neteller): E-wallets provide an excellent balance of speed and privacy. They act as an intermediary, allowing for instant deposits and often very rapid withdrawals – sometimes within hours. If you value fast payments and prefer to keep your primary bank details separate from your broker, e-wallets are a fantastic choice for your forex trading activities.

Choosing the right payment method goes beyond mere availability. Consider these critical factors to ensure your forex trading journey is seamless and your financial transactions are handled with care.

- Processing Times

- How quickly do you need your funds to hit your trading account or your bank? While many debit card deposit methods are instant, bank withdrawals can take several business days. E-wallet transactions often offer the fastest payments for both deposits and withdrawals, which can be crucial for responsive trading.

- Associated Fees

- Always check the fine print for any fees. Some brokers absorb all transaction costs, while others might charge a percentage or a fixed fee, especially for certain deposit methods or withdrawal methods. These small charges can add up and impact your overall forex trading profitability, so always be aware.

- Security Measures

- Ensuring secure transactions is non-negotiable. Reputable forex brokers use advanced encryption and security protocols for all financial operations. Debit cards and bank transfers come with robust banking-level security, while e-wallets add an extra layer of privacy by not sharing your full bank details directly with the broker.

- Deposit/Withdrawal Parity

- Many regulatory bodies, including the FCA in the UK, require brokers to process withdrawals back to the original deposit method. This anti-money laundering measure is common practice and ensures secure transactions by tracing the flow of funds. It’s an important point for all United Kingdom traders to remember.

To give you a clearer picture, here’s a quick comparison of common deposit and withdrawal methods popular among United Kingdom traders:

| Method | Typical Deposit Speed | Typical Withdrawal Speed | Common Fees | Security Level |

|---|---|---|---|---|

| Debit Cards | Instant | 1-3 Business Days | Often Low/None | High (Bank-level) |

| Bank Transfers (Faster Payments) | Hours to 1 Business Day | 1-3 Business Days | Variable (Broker/Bank) | Very High (Direct Bank) |

| E-Wallets (PayPal, Skrill, Neteller) | Instant | Hours to 1 Business Day | Variable (E-wallet/Broker) | High (Encrypted Gateway) |

As a forex expert, I always advise you to review your chosen broker’s specific terms and conditions regarding all deposit methods and withdrawal methods. Understanding these details upfront empowers you to manage your funds effectively and enjoy a smoother, more efficient forex trading experience. Prioritize methods that offer both secure transactions and fast payments to keep you in control.

Customer Support and Service for Finpros UK Clients

At Finpros UK, we understand that exceptional customer support isn’t just a luxury; it’s a fundamental pillar of a successful trading journey. Our commitment goes beyond providing advanced trading platforms and competitive conditions. We believe every Finpros UK client deserves prompt, knowledgeable, and reliable assistance whenever they need it. Think of our support team as your dedicated co-pilot in the dynamic world of forex trading.

We pride ourselves on offering a comprehensive suite of support services designed to address every query, from technical platform issues to account management and general trading assistance. Your peace of mind is our priority, and we have structured our customer service to be as accessible and efficient as possible.

How Finpros UK Prioritizes Your Needs

Our approach to forex customer service is built on three core principles:

- Accessibility: We ensure you can reach us through multiple channels at your convenience.

- Expertise: Our team consists of highly trained professionals with deep knowledge of our platforms and the financial markets.

- Responsiveness: We strive to provide quick and effective solutions, minimizing any potential disruption to your trading.

Whether you are a seasoned trader or just starting your journey, having a responsive help system makes all the difference. Our multilingual support team stands ready to assist you in various languages, breaking down communication barriers and ensuring you receive clear, understandable guidance.

Connect with Our Support Team

We offer several convenient ways to get in touch with our expert team. Choose the method that best suits your needs:

- Live Chat Support: For immediate assistance with urgent queries, our live chat is available directly through our website. Get real-time answers without the wait.

- Email Support: Send us a detailed email for less urgent inquiries or complex issues that require thorough investigation. We aim to respond promptly to all email correspondence.

- Phone Support: Prefer speaking to someone directly? Our dedicated phone lines connect you with a knowledgeable representative who can provide personalized trading assistance.

- Dedicated Account Manager: For eligible clients, we offer the personalized service of a dedicated account manager. This individual understands your specific trading needs and can offer tailored support and insights.

Our 24/5 support ensures that help is always at hand during trading hours, covering the major forex markets across the globe. We understand that trading opportunities don’t adhere to a 9-to-5 schedule, and neither do we.

Finpros UK support team members undergo continuous training to stay updated with the latest market trends, platform features, and regulatory requirements. This commitment to ongoing education means you always receive accurate and current information. We constantly gather feedback from our clients to refine and enhance our services, ensuring a superior client satisfaction experience. Your input helps us grow and improve.

Security Measures and Data Protection at Finpros

In the fast-paced world of forex trading, your peace of mind is paramount. At Finpros, we understand that a secure trading environment isn’t just a feature; it’s the bedrock of a successful journey. We dedicate significant resources to implementing stringent security measures and robust data protection protocols, ensuring your assets and personal information remain safe from unauthorized access.

Our commitment begins with cutting-edge technology and extends to every aspect of our operations. We want you to trade with confidence, knowing a fortress protects your investments and privacy.

How Finpros Protects Your Trading Experience

We employ a multi-layered approach to security, addressing threats from all angles. This comprehensive strategy covers everything from your login to every transaction you make.

- Advanced Data Encryption: Every piece of data flowing between your device and our servers uses industry-leading 256-bit SSL encryption. This powerful encryption scrambles your sensitive information, making it unreadable to any third parties. It ensures the privacy and integrity of your personal details and transaction history.

- Client Fund Segregation: Your trading funds remain completely separate from Finpros’ operational capital. We hold all client funds in segregated accounts with top-tier financial institutions, providing an additional layer of protection and ensuring your money is always available and safe, even under unforeseen circumstances. This adheres to strict regulatory compliance standards.

- Robust Cybersecurity Protocols: Our infrastructure relies on advanced firewall systems and intrusion detection systems to proactively identify and mitigate potential threats. Our cybersecurity team works around the clock, constantly monitoring our networks for suspicious activity and staying ahead of evolving cyber risks.

- Two-Factor Authentication (2FA): For an extra layer of account protection, we strongly recommend and support two-factor authentication. This requires a second verification step, usually from your mobile device, in addition to your password, making it extremely difficult for unauthorized individuals to access your account.

- Regular Security Audits: Independent experts regularly audit our systems and processes. These rigorous assessments help us identify and address any potential vulnerabilities, ensuring our security posture remains strong and compliant with the highest industry standards.

Your Data Privacy is Our Priority

We treat your personal data with the utmost respect and adhere to strict global privacy regulations. Our approach to privacy protection focuses on transparency and control. You have a right to know how we handle your information.

Here’s a snapshot of our data handling principles:

| Principle | Description |

|---|---|

| Minimal Data Collection | We only collect information essential for providing our services, ensuring a smooth trading experience, and meeting regulatory obligations. |

| Strict Access Controls | Only authorized personnel with a legitimate business need can access client data, and we continuously monitor their activities. |

| Anonymization & Pseudonymization | Where possible and appropriate, we anonymize or pseudonymize data to further protect your identity. |

| Data Retention Policies | We retain your data only for as long as necessary to fulfill the purposes for which it was collected or to comply with legal requirements. |

At Finpros, we don’t just talk about security; we embody it. We commit to providing you with a truly secure trading environment, allowing you to focus on what matters most: making informed trading decisions. Your trust drives our continuous efforts in maintaining the highest standards of safety and data integrity.

Pros and Cons of Using Finpros in the UK

Finpros has carved out a distinct presence in the bustling UK financial sector, offering a range of services primarily aimed at currency traders and other investment enthusiasts. For anyone considering an **online trading platform** to dive into **forex trading UK**, understanding what Finpros brings to the table – both good and bad – is a critical first step. Let’s unpack the key strengths and potential weaknesses for traders operating within the United Kingdom.Finpros presents several compelling reasons for UK-based traders to consider its services. These advantages often resonate with both new market entrants and experienced participants looking for reliable execution and comprehensive support.

- Robust Financial Regulation: Operating in the UK means Finpros typically adheres to the stringent standards set by the Financial Conduct Authority (FCA). This strong **financial regulation** offers a significant layer of security and investor protection, ensuring segregated client funds and fair trading practices, which is a major comfort for any trader.

- Advanced Trading Tools: The platform often comes equipped with a suite of sophisticated **trading tools**. These typically include state-of-the-art charting capabilities, a wide array of technical indicators, and real-time **market analysis** features. Such resources empower traders to make informed decisions, whether you are a seasoned professional or just starting out.

- Dedicated Customer Support: Access to reliable **customer support** is absolutely crucial in the fast-paced world of trading. Finpros generally offers multi-channel support for its UK clients, including phone, email, and live chat, often with localized service hours. Prompt assistance can be invaluable, particularly when navigating live market conditions or platform queries.

- Comprehensive Educational Resources: Many UK traders, especially beginners, benefit immensely from accessible and comprehensive **educational resources**. Finpros often provides webinars, detailed tutorials, and insightful articles designed to help users understand **risk management**, various trading strategies, and the overall intricacies of the forex market. This commitment to trader education is a significant plus.

However, no platform is without its drawbacks, and Finpros is no exception. Potential users in the UK should carefully weigh these points to ensure the platform aligns with their individual trading style and expectations.

- Competitive Spreads and Commissions: While Finpros aims to be competitive, traders must always scrutinize the **spreads** and potential **commissions** on various assets. Depending on your trading volume and preferred instruments, these costs can accumulate and might impact your overall profitability compared to some other brokers available in the UK.

- Potentially Limited Asset Variety: While Finpros often excels in **forex trading UK**, some users might find the range of other financial instruments (such as specific stocks, less common commodities, or a very broad array of cryptocurrencies) to be less extensive than global multi-asset brokers. This could be a consideration if you prefer to build a highly diversified portfolio through a single platform.

- Platform Complexity for Novices: The advanced nature of its **trading tools** can sometimes feel overwhelming for absolute beginners. While excellent educational materials are usually available, the initial learning curve to fully master the platform’s capabilities might be steeper for those entirely new to **online trading platform** interfaces.

- Withdrawal Process Speed: While generally efficient, some users might occasionally report varying speeds in the withdrawal process. This can depend on the specific method chosen, bank processing times, and internal verification procedures. It’s always wise to review the platform’s terms and conditions regarding fund transfers to manage expectations.

In summary, Finpros offers a robust and regulated environment for **forex trading UK**, packed with features that can be highly beneficial for serious traders. However, potential users should carefully evaluate its fee structure, asset availability, and the learning curve against their personal trading needs and current experience level before making a commitment.

How Finpros Compares to Other UK Brokers

Navigating the bustling world of forex trading in the UK means you have a wealth of choices when it comes to brokers. But how does Finpros truly stand out in this competitive landscape? We understand that choosing the right partner is crucial for your trading journey, and we pride ourselves on offering a distinctive blend of features designed to empower you.

Many UK brokers offer solid trading environments, but Finpros goes the extra mile by focusing on a holistic trader experience. While others might excel in one area, we strive for consistent excellence across the board, from our cutting-edge technology to our dedicated customer support.

What Makes Finpros Different?

When you stack Finpros against other prominent UK forex brokers, you’ll notice several key differentiators that set us apart:

- Unmatched Transparency: We believe in clear pricing and no hidden fees. Our spreads are competitive, and our execution is swift, ensuring you get the most out of every trade without unwelcome surprises. Many brokers in the UK market have complex fee structures; we keep it simple.

- Advanced Trading Tools: Beyond the standard MetaTrader platforms, Finpros offers a suite of proprietary tools and indicators developed to give our traders an edge. These are not always standard offerings with other brokers.

- Dedicated Educational Resources: While many brokers provide educational content, Finpros offers personalized coaching sessions and in-depth webinars tailored to various experience levels. We aim to transform aspiring traders into confident market participants.

- Superior Customer Support: Our support team isn’t just about troubleshooting. They are knowledgeable about the forex market and can guide you through platform features, account queries, and even general market insights. This level of informed support is a significant advantage over many competitors.

- Flexible Account Options: Finpros understands that every trader is unique. We offer a range of account types designed to meet different trading styles and capital requirements, from micro accounts for beginners to advanced ECN accounts for seasoned pros. This flexibility is often a premium feature with other providers.

A Quick Comparison Snapshot

Here’s a simplified look at how Finpros often compares in specific areas:

| Feature | Finpros | Typical UK Broker |

|---|---|---|

| Spreads | Highly competitive, often tighter on major pairs | Varies, can be wider during volatile periods |

| Execution Speed | Ultra-fast, minimal slippage | Generally good, but can see occasional delays |

| Educational Support | Personalized coaching, advanced webinars, extensive library | Standard articles, basic tutorials |

| Customer Service | Multilingual, expert-level, responsive 24/5 | Standard, often less personalized |

| Proprietary Tools | Exclusive indicators, sentiment analysis, custom dashboards | Primarily relies on standard platform features |

| Account Types | Wide range (Micro, Standard, ECN, Islamic) | Limited standard options |

Ultimately, your choice of broker boils down to your personal trading style and needs. However, when you prioritize a blend of advanced technology, educational empowerment, robust support, and transparent trading conditions, Finpros consistently emerges as a leading choice among UK forex brokers. We invite you to experience the difference and see how our commitment to your success sets us apart.

User Reviews and Reputation of Finpros United Kingdom

Exploring the user reviews and understanding the overall reputation of Finpros United Kingdom is a critical step for anyone considering this platform. Real-world experiences shared by active traders offer unparalleled insights into the broker’s performance, customer service, and overall user satisfaction. These testimonials provide a valuable, unfiltered perspective, helping you form a comprehensive view beyond what marketing materials might convey.

The collective voice of the trading community often reveals recurring themes, whether positive or highlighting areas for development. We delve into various feedback sources to understand what current and past clients say about their journey with Finpros United Kingdom in the dynamic forex market.

Commonly, users express satisfaction with several key aspects of the Finpros United Kingdom experience:

- Platform Usability: Many reviews praise the intuitive design and user-friendly interface, making navigation straightforward for both novice and seasoned traders.

- Customer Support Responsiveness: Traders frequently commend the support team for their quick, helpful, and professional responses to inquiries and technical issues.

- Asset Diversity: The wide array of trading instruments available is often highlighted as a significant advantage, allowing for robust portfolio diversification.

- Educational Resources: Newcomers especially appreciate the accessible learning materials, which assist in demystifying complex trading strategies and market concepts.

However, like any service, there are always areas where user feedback suggests room for enhancement. A few points that occasionally appear in reviews include:

- Spread Competitiveness: On some less frequently traded currency pairs, a segment of users wishes for slightly more competitive spreads.

- Advanced Tools: While generally well-equipped, some highly experienced traders occasionally express a desire for even more sophisticated analytical tools integrated directly into the platform.

“A strong reputation in the financial world is not just built; it’s earned through consistent reliability, transparent operations, and a genuine commitment to client success. User reviews act as a powerful barometer for this trust.”

The reputation of Finpros United Kingdom is not solely dependent on individual reviews. It also stems from its regulatory standing, long-term operational history, commitment to client fund security, and continuous investment in technology and educational offerings. These foundational elements contribute significantly to a broker’s standing and trustworthiness within the competitive United Kingdom financial landscape. A company that consistently upholds these standards naturally fosters a positive and dependable image.

Ultimately, while these general insights are helpful, we encourage every potential client to conduct their own thorough investigation. Explore various review sites, consider what aspects align best with your personal trading style, and weigh both positive and constructive feedback before making an informed decision about Finpros United Kingdom.

Educational Resources and Tools from Finpros UK

Embarking on the exciting journey of forex trading requires more than just capital; it demands knowledge, skill, and continuous learning. At Finpros UK, we deeply understand this need. That’s why we’ve committed ourselves to building a robust suite of educational resources and sophisticated trading tools designed to empower every trader, from the absolute beginner to the seasoned expert. Our goal is simple: to give you the confidence and competence to navigate the dynamic global markets successfully.

We believe that an informed trader is a successful trader. Our comprehensive educational programs cover everything you need to know to make well-thought-out trading decisions. You’ll find a wealth of information at your fingertips, crafted by industry professionals with years of experience.

Comprehensive Learning Paths

- Forex Trading Education for Beginners: Start strong with foundational courses that demystify market basics, terminology, and how the forex market operates. Learn about currency pairs, pips, leverage, and the core concepts that drive trading.

- Advanced Trading Strategies: Elevate your game with in-depth modules on complex trading strategies. Explore technical analysis, fundamental analysis, price action, and various indicators to refine your approach.

- Risk Management Essentials: Understand the critical importance of protecting your capital. Our resources teach you effective risk management techniques, including setting stop-loss and take-profit orders, and managing position sizing.

- Trading Platform Tutorials: Get hands-on guidance with our intuitive trading platform. Our step-by-step tutorials ensure you master every feature, from placing trades to customizing charts.

- Webinars and Live Sessions: Participate in interactive webinars led by market analysts. These sessions cover current market events, offer live market analysis, and provide opportunities to ask questions directly.

- eBooks and Guides: Download free eBooks and detailed guides on a variety of trading topics, perfect for self-paced learning and deep dives into specific areas of interest.

Beyond theoretical knowledge, practical application is key. Finpros UK provides a suite of advanced market analysis tools designed to give you an edge. These tools help you monitor market movements, identify opportunities, and execute your strategies with precision.

Essential Trading Tools at Your Command

| Tool Name | Primary Benefit | How It Helps You Trade |

|---|---|---|

| Economic Calendar | Stay informed on major market-moving events. | Track upcoming economic data releases, central bank announcements, and geopolitical events that can impact currency prices. |

| Advanced Charting Tools | Visualize market trends with clarity. | Utilize a wide array of indicators, drawing tools, and multiple chart types to perform in-depth technical analysis and identify trading signals. |

| Forex Calculators | Simplify complex trading calculations. | Instantly calculate pip values, margin requirements, and potential profit/loss for various currency pairs, aiding your trade planning. |

| Real-time Market News Feed | Access breaking financial news instantly. | Receive curated news directly within your platform, ensuring you are always up-to-date with global developments affecting the markets. |

| Trading Signals | Identify potential trading opportunities. | Receive alerts based on specific market conditions or technical setups, helping you spot entries and exits more efficiently. |

Our commitment at Finpros UK is to provide you with the best possible environment to grow as a trader. By combining extensive forex trading education with powerful market analysis tools, we equip you to face the markets with confidence. Start exploring our resources today and take a significant step towards mastering your trading journey.

Getting Started with Finpros for Traders in the UK

Are you based in the UK and looking to dive into the dynamic world of forex trading? Finpros offers a robust platform designed to meet the needs of both new and experienced traders across the United Kingdom. Getting started with us is a straightforward process, built for efficiency and security, ensuring you can begin your trading journey with confidence.

We understand that entering the financial markets can feel daunting. That’s why Finpros streamlines the initial setup, providing you with all the tools and support you need right from the start. Our platform is intuitive, making it easy for UK traders to navigate market complexities and seize opportunities.

Your First Steps with Finpros:

- Account Registration: Begin by visiting the Finpros website. You’ll find a simple registration form asking for essential details. This ensures we comply with UK regulatory standards, keeping your investments secure.

- Verification Process: As part of our commitment to security and regulatory compliance, we require all UK users to complete a verification process. This typically involves providing proof of identity and address. We make this quick and secure, often completed within a few hours.

- Funding Your Account: Once your account is verified, you can easily deposit funds using a variety of secure payment methods popular in the UK, including bank transfers, debit cards, and e-wallets. Choose the option that suits you best.

- Platform Familiarization: Before you place your first trade, take some time to explore the Finpros trading platform. We offer a demo account feature, allowing you to practice strategies with virtual funds in a real market environment. This is an excellent way for UK traders to gain confidence without risking real capital.

- Access Resources: Finpros provides a wealth of educational materials, market analysis, and trading tools. Utilize these resources to deepen your understanding of the forex market and refine your trading approach. Our goal is to empower every UK trader with knowledge.

Joining the Finpros community means gaining access to competitive spreads, fast execution, and dedicated customer support tailored for UK clients. We are committed to fostering a supportive trading environment where you can grow and succeed. Our platform is built for stability and performance, essential for navigating the fast-paced global currency markets.

Consider this a prime opportunity to elevate your trading experience. Finpros is more than just a broker; it’s your partner in the financial markets. We focus on providing a seamless experience, allowing you to concentrate on your trading strategies and market analysis. Start your journey with Finpros today and discover why many UK traders choose us.

The Future of Finpros in the British Trading Landscape

The British trading landscape is a crucible of innovation and tradition, constantly reshaped by global forces and local ingenuity. In this vibrant environment, the role of financial professionals, or Finpros, is not just evolving – it’s undergoing a profound transformation. Understanding this shift is key to success for anyone involved in the British forex market or broader financial services.

Key Drivers Shaping the Finpro Future

Several powerful currents are dictating the trajectory for financial professionals across the UK. These aren’t just minor ripples; they are fundamental shifts creating new demands and opportunities.

- Technological Innovation: Artificial intelligence, machine learning, and advanced algorithmic trading are no longer futuristic concepts; they are integral tools. Finpros must embrace these to offer a competitive edge.

- Regulatory Evolution: The UK’s financial regulatory framework is always adapting. Staying ahead of these changes, particularly those impacting retail traders and institutional clients, is crucial for compliance and building client trust.

- Market Volatility: Global events frequently introduce periods of high market volatility. Finpros who can effectively navigate and advise clients through these turbulent times will be highly valued.

- Shifting Client Expectations: Clients now expect more personalized, transparent, and digitally accessible services. They seek not just transactions, but genuine partnership and informed guidance.

Opportunities for Growth and Specialization

Despite the challenges, the future is bright for proactive Finpros ready to adapt. New specializations are emerging, creating avenues for significant professional development.

Consider these areas where Finpros can truly shine:

- Data Analytics Experts: Transforming vast datasets into actionable trading insights.

- Ethical AI Advisors: Guiding the responsible implementation of automated trading systems.

- Sustainable Finance Specialists: Advising on environmentally and socially conscious investment strategies, a growing demand in the UK.

- Behavioral Finance Coaches: Helping clients understand and manage the psychological aspects of trading decisions.

Navigating the Challenges Ahead

No journey of progress is without its hurdles. Finpros in the British trading landscape must be prepared to face several significant challenges.

| Challenge | Mitigation Strategy |

|---|---|

| Keeping pace with rapid technological advancement | Continuous learning and skill acquisition in areas like fintech and cybersecurity. |

| Intensifying competition from automated platforms | Focus on personalized service, human insight, and complex problem-solving that AI cannot replicate. |

| Increased scrutiny from regulatory bodies | Proactive compliance efforts, strong ethical frameworks, and clear client communication. |

| Maintaining client trust in a digital age | Emphasize transparency, data privacy, and a strong track record of ethical conduct. |

As one industry veteran recently put it, “The future belongs to the Finpros who don’t just understand the market, but who also understand the human element within it. Technology is a tool, but trust and insight remain paramount.” This sentiment perfectly captures the dual demands placed on modern financial professionals.

The Enduring Value of Human Expertise

While technological innovation will continue to redefine how trades are executed and data is analyzed, the core value of a skilled Finpro will persist. Human judgment, empathy, and the ability to build robust client relationships are irreplaceable. Finpros who master the new tools while retaining their human touch will undoubtedly lead the British trading landscape into its next exciting chapter. The economic outlook UK provides a dynamic backdrop for these professionals to truly make their mark.

Frequently Asked Questions

What is Finpros United Kingdom?

Finpros United Kingdom is an online trading platform providing various financial instruments to UK traders, aiming to offer a reliable and regulated trading environment for both new and experienced market participants.

Is Finpros regulated in the UK?

Yes, Finpros adheres to the stringent standards set by the Financial Conduct Authority (FCA), ensuring client fund segregation, fair trading practices, and participation in the Financial Services Compensation Scheme (FSCS) for added protection.

What trading platforms does Finpros offer for UK traders?

Finpros provides UK traders with access to industry-leading platforms including MetaTrader 4 (MT4), MetaTrader 5 (MT5), Finpros WebTrader for browser-based trading, and dedicated mobile trading apps for both iOS and Android devices.

What types of accounts can UK residents open with Finpros?

Finpros offers diverse account types tailored for UK residents, including Standard, Mini, ECN, and Islamic (Swap-Free) accounts. Additionally, a risk-free Demo Account is available for practicing strategies with virtual funds.

What assets can I trade on Finpros UK?

Finpros UK offers a comprehensive selection of trading instruments, allowing you to access global markets including Forex (currency pairs), Indices, Commodities, Shares (as CFDs), and Cryptocurrencies (as CFDs).