Are you ready to unlock the dynamic world of global financial markets? At Finpros, we believe everyone deserves a clear, efficient, and reliable path to trading. Our specialized trading accounts are meticulously designed to provide you with seamless market access, regardless of your experience level.

We understand that entering the trading arena can seem complex. That’s why Finpros simplifies the process, offering robust platforms and dedicated support to help you navigate currency pairs, commodities, indices, and cryptocurrencies with confidence. Imagine having the power to react to market movements and capitalize on opportunities right at your fingertips.

Choosing a Finpros trading account means more than just opening a gateway; it means partnering with a broker committed to your success.

Here’s what sets our accounts apart:

- Diverse Market Exposure: Gain access to a vast array of instruments across major global markets.

- Cutting-Edge Technology: Trade with industry-leading platforms that offer advanced charting tools and analytical resources.

- Competitive Conditions: Benefit from tight spreads and transparent pricing, enhancing your trading potential.

- Robust Security Measures: Rest assured your funds and personal information are protected with top-tier security protocols.

- Dedicated Support: Our expert team stands ready to assist you every step of the way, ensuring a smooth trading journey.

From beginners taking their first steps to seasoned traders seeking advanced functionalities, Finpros provides an account tailored to your specific needs. We empower you with the tools, resources, and confidence to make informed trading decisions. Dive into the markets with Finpros and discover a world of possibilities waiting for you to explore.

- Understanding Finpros Trading Accounts

- What Makes Finpros Accounts Tailored for You?

- Exploring Your Finpros Account Options

- Standard Account

- ECN (Electronic Communication Network) Account

- Islamic Account (Swap-Free)

- Demo Account

- How to Choose Your Ideal Finpros Account

- Exploring Types of Finpros Trading Accounts

- What Account Suits Your Trading Style?

- Finpros Account Features at a Glance

- Standard Finpros Accounts

- ECN Finpros Accounts

- Islamic Finpros Accounts (Swap-Free)

- What Makes Our Islamic Finpros Accounts Unique?

- Demo Finpros Accounts for Practice

- Key Features and Benefits of Finpros Accounts

- Unlocking Your Trading Potential with Finpros

- Advantages of Trading with Finpros

- Step-by-Step: How to Open a Finpros Trading Account

- Required Documentation for Finpros

- Proof of Identity

- Proof of Residency

- Account Verification Process

- What to Expect: Key Steps and Documents

- Tips for a Smooth and Quick Verification

- Why is This Important for You?

- Funding and Withdrawal Options for Finpros Accounts

- Depositing Funds into Your Finpros Account

- Withdrawing Your Earnings from Finpros

- Important Considerations for Fund Management

- Trading Platforms Supported by Finpros

- MetaTrader 4 (MT4): The Industry Standard

- MetaTrader 5 (MT5): The Next Evolution

- Web-Based and Mobile Trading Solutions

- Spreads, Commissions, and Fees on Finpros Trading Accounts

- Leverage and Margin Requirements with Finpros

- Unleashing Potential with Leverage

- Navigating with Margin Requirements

- Security and Regulation of Finpros Trading Services

- Why Regulation Matters in Forex Trading

- Finpros’ Unwavering Commitment to Regulatory Compliance

- Protecting Your Funds and Data

- Key Security Features at Finpros:

- The Finpros Advantage: Trading with Confidence

- Customer Support for Finpros Account Holders

- Educational Resources for Finpros Traders

- What Finpros Offers: A Learning Path for Every Trader

- Dive Deeper: Our Diverse Learning Formats

- Comparing Finpros Trading Accounts to Other Brokers

- What sets Finpros apart in the competitive landscape?

- Maximizing Your Trading Potential with Finpros

- What Finpros Offers to Boost Your Trading Potential:

- Frequently Asked Questions About Finpros Trading Accounts

Understanding Finpros Trading Accounts

Embarking on your trading journey with Finpros opens a world of possibilities, but choosing the right trading account is your first strategic move. It’s not just about signing up; it’s about aligning your account with your trading style, experience level, and financial goals. At Finpros, we understand that every trader is unique. That’s why we offer a diverse range of accounts, each meticulously designed to cater to specific needs, from the budding enthusiast to the seasoned market veteran.

A well-chosen account can significantly enhance your trading efficiency and overall profitability.

What Makes Finpros Accounts Tailored for You?

We pride ourselves on providing flexible and competitive trading environments. Here’s what you can generally expect from Finpros trading accounts:

- Competitive Spreads: Access to tight spreads helps you keep your trading costs low.

- Robust Platforms: Trade on industry-leading platforms that offer advanced charting tools and analytical features.

- Diverse Instrument Selection: Explore a wide range of assets, including currency pairs, commodities, indices, and more.

- Flexible Leverage Options: Manage your capital effectively with leverage options tailored to your risk appetite.

- Dedicated Support: Get assistance from a responsive customer support team whenever you need it.

Exploring Your Finpros Account Options

While specific account names might vary, most reputable brokers like Finpros structure their offerings to serve different trading profiles. Here are common types of accounts you might find, each with distinct advantages:

Standard Account

The Standard Account often serves as an excellent entry point for new traders and those who prefer a straightforward trading experience. It typically features commission-free trading (with spreads built into the price) and accessible minimum deposit requirements. This account type simplifies the trading process, making it less daunting for individuals taking their first steps in the forex market. You get full access to all major trading instruments and our comprehensive educational resources.

ECN (Electronic Communication Network) Account

For more experienced traders, the ECN Account provides direct access to interbank liquidity. This means tighter spreads, often as low as zero pips, in exchange for a small commission per trade. ECN accounts are ideal for scalpers, day traders, and those employing expert advisors (EAs) who demand the fastest execution speeds and minimal slippage. They offer a transparent trading environment where you see real market prices from multiple liquidity providers.

Islamic Account (Swap-Free)

Adhering to Sharia law principles, the Islamic Account is swap-free, meaning it incurs no overnight interest or rollover fees on positions held open for more than 24 hours. This account type is crucial for Muslim traders seeking to engage in the financial markets without violating their religious beliefs. While swap-free, it might involve administrative fees or wider spreads on certain exotic pairs to compensate for the absence of swap charges.

Demo Account

Before you commit real capital, a Demo Account is your ultimate practice ground. It allows you to trade with virtual funds in a real-time market environment, mirroring the conditions of our live accounts. Use it to test strategies, familiarize yourself with the platform, and build confidence without any financial risk. This is an invaluable tool for every trader, regardless of experience level, for continuous learning and strategy refinement.

How to Choose Your Ideal Finpros Account

Selecting the perfect account requires a bit of self-reflection. Consider these factors:

- Your Trading Experience: Are you new to trading, or do you have years under your belt?

- Your Trading Style: Do you scalp, day trade, swing trade, or invest long-term?

- Capital Available: What is your initial deposit amount? Minimum deposits vary between account types.

- Risk Tolerance: How much risk are you comfortable taking? Leverage levels differ.

- Cost Preference: Do you prefer commission-free trading with wider spreads, or tight spreads with commissions?

At Finpros, we make the account selection process straightforward. Our client support team stands ready to guide you, helping you understand the nuances of each account type and match you with the one that best suits your unique trading ambitions. Start your journey with confidence, knowing your Finpros trading account is built to support your success.

Exploring Types of Finpros Trading Accounts

Embarking on your forex trading journey with Finpros opens up a world of opportunities. But before you dive in, one of the most crucial decisions you’ll make is selecting the right trading account. Just like a chef chooses the perfect knife for each task, a smart trader picks an account that aligns with their experience, capital, and trading style. At Finpros, we understand that one size doesn’t fit all. That’s why we offer a diverse range of Finpros trading accounts, each meticulously designed to cater to different needs.

Think of it as choosing your personal toolkit. Are you just starting out, or do you have years of market experience under your belt? Do you prefer tight spreads with commissions, or wider spreads without them? Your answers guide you to the perfect account. Understanding these distinctions is key to maximizing your potential and ensuring a smooth, effective trading experience. Let’s peel back the layers and explore the different types of Finpros trading accounts available to you.

What Account Suits Your Trading Style?

Selecting an account is more than just a formality; it’s about finding a home for your trading strategy. Each account type offers a unique blend of features, impacting everything from your trading costs to the speed of your executions. We want you to feel confident and empowered with your choice.

- Standard Accounts: Often the go-to for new and intermediate traders, these accounts typically feature wider, variable spreads but come with no commissions per trade. They offer a straightforward trading environment, making them excellent for learning the ropes and executing strategies without complex fee structures.

- ECN Accounts: For the more experienced and high-volume traders, ECN (Electronic Communication Network) accounts provide direct access to interbank market liquidity. This means razor-thin spreads, often starting from 0 pips, but you’ll pay a small commission per lot traded. They are perfect for scalpers and those who demand the fastest execution speeds.

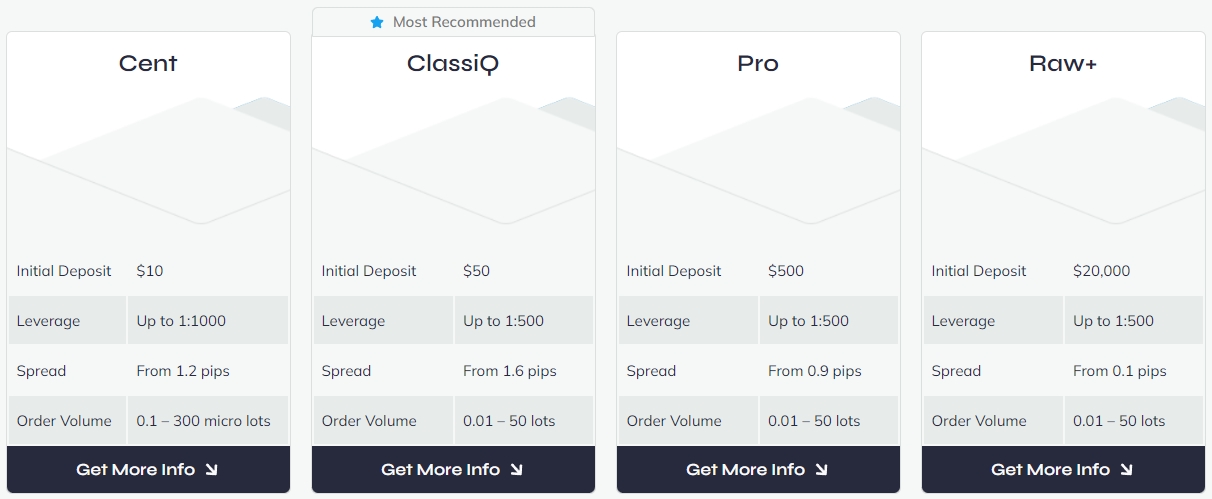

- Cent Accounts: If you’re new to live trading or wish to test new strategies with minimal risk, a Cent Account is an ideal stepping stone. Your deposits and trades are denominated in cents, allowing you to trade micro-lots with significantly reduced capital exposure. It’s a fantastic way to transition from demo to live trading without breaking the bank.

- Islamic Accounts (Swap-Free): Designed specifically for Muslim traders who adhere to Sharia law, these accounts are swap-free. This means no interest is charged or paid on overnight positions. They provide a compliant trading environment while still offering access to the global forex markets.

Finpros Account Features at a Glance

Here’s a quick comparison to help you visualize the core differences across our popular Finpros trading accounts:

| Account Type | Typical Spreads | Commissions | Minimum Deposit | Best For |

|---|---|---|---|---|

| Standard | Medium (Variable) | None | Accessible | New to Intermediate Traders |

| ECN | Tight (From 0 Pips) | Per Lot Traded | Higher | Experienced, High-Volume Traders |

| Cent | Medium (Variable) | None | Very Low | Beginners, Strategy Testing |

| Islamic (Swap-Free) | Varies by Account | Varies by Account | Varies by Account | Muslim Traders |

As you can see, each of our Finpros trading accounts is crafted with a specific purpose. We encourage you to evaluate your own trading goals, risk tolerance, and capital. Don’t rush this decision! The right account forms the bedrock of a successful trading experience. Choose wisely, and set yourself up for triumph in the dynamic world of forex.

Standard Finpros Accounts

Diving into the world of online trading can feel overwhelming, but a Standard Finpros Account offers a clear, straightforward path for many. Think of it as your reliable workhorse in the financial markets, designed to provide a balanced and accessible trading experience without unnecessary complexities. It’s an excellent entry point for those new to the scene, as well as seasoned retail traders looking for solid, dependable trading conditions.

At Finpros, our Standard Account is crafted to give you robust market access across a broad spectrum of instruments. We understand that traders value clarity and efficiency, and this account delivers precisely that. You get direct access to major, minor, and exotic currency pairs, precious metals like gold and silver, popular indices, and a variety of commodities, all within a user-friendly environment.

Choosing a Standard Finpros Account comes with several distinct advantages, making your trading journey smoother and more predictable:

- Competitive Spreads: We strive to offer tight, competitive spreads on a wide range of assets, ensuring your entry and exit costs are optimized. This means more of your capital stays in your pocket, ready for your next trade.

- No Commission on Trades: Enjoy commission-free trading on most instruments. This simplifies your cost structure significantly, allowing you to focus purely on market movements and your trading strategy.

- Flexible Leverage: Manage your capital effectively with flexible leverage options, giving you the power to amplify your trading positions responsibly.

- Access to Powerful Trading Platforms: Trade seamlessly using industry-leading platforms that provide advanced charting tools, technical indicators, and fast execution speed.

- Risk Management Tools: Benefit from essential risk management features like stop-loss and take-profit orders, empowering you to protect your capital and lock in profits.

- 24/5 Customer Support: Our dedicated support team is always ready to assist you, ensuring you have help whenever you need it during market hours.

Whether you’re taking your first steps into forex trading or you’re an experienced trader seeking a reliable, low-cost solution, the Standard Finpros Account is engineered to meet your needs, providing a transparent and efficient way to engage with global financial markets.

ECN Finpros Accounts

Are you ready to experience the true essence of forex trading? Our ECN Finpros Accounts put you directly in the market, bypassing any dealing desk intervention. This means you connect straight to a network of top-tier liquidity providers, securing you some of the tightest spreads available. We understand that in the fast-paced world of currency exchange, every millisecond and every pip counts. That’s why these accounts are designed for traders who demand transparency, speed, and real market conditions.

Choosing an ECN Finpros Account opens up a world of benefits:

- Direct Market Access (DMA): Your orders go straight to the interbank market, without any re-quotes or delays from a dealing desk.

- Ultra-Tight Spreads: We aggregate prices from multiple banks, offering you incredibly competitive spreads, often starting from 0.0 pips on major currency pairs.

- Lightning-Fast Execution: Our robust infrastructure ensures your trades are executed at remarkable speeds, crucial for taking advantage of volatile market movements.

- True Market Depth: You gain insight into the full range of buy and sell orders, providing a clearer picture of market liquidity.

- No Conflict of Interest: As an ECN broker, we profit from commissions, not from your losses, fostering a more aligned and trustworthy trading environment.

- Ideal for All Strategies: Whether you are a scalper, day trader, or employ automated trading systems, the ECN environment provides the optimal conditions for precision and efficiency.

With an ECN Finpros Account, you receive a transparent trading environment where your success is truly in your hands. You trade on pure price feeds, knowing you get the best available prices from the market at any given moment. This setup empowers you with the confidence to execute your strategies effectively, knowing that the playing field is level and fair.

Islamic Finpros Accounts (Swap-Free)

For traders whose faith guides their financial decisions, traditional forex accounts often present a dilemma due to interest-based charges, known as “swaps.” At Finpros, we understand this concern deeply. That’s why we proudly offer our Islamic Finpros Accounts, specifically designed to be fully Sharia-compliant and completely swap-free. This means you can engage in the dynamic world of forex trading with peace of mind, knowing your investments align with Islamic principles.

Our Islamic accounts eliminate the rollover interest, which is considered riba (usury) under Sharia law. Instead, we offer a transparent trading environment where fees are structured to be permissible. This dedication to ethical trading practices makes Finpros a preferred choice for Muslim traders worldwide seeking a Halal trading solution.

What Makes Our Islamic Finpros Accounts Unique?

- Swap-Free Trading: Absolutely no overnight interest charges or credits on positions held open, ensuring compliance with Islamic finance principles.

- No Hidden Fees: We maintain full transparency regarding all account features and potential charges, which are structured to be Sharia-compliant.

- Competitive Spreads: Enjoy tight spreads across a wide range of currency pairs, just like our standard accounts.

- Access to All Instruments: Trade major, minor, and exotic currency pairs, commodities, and indices without compromise.

- Flexible Leverage: Manage your risk effectively with flexible leverage options tailored to your trading strategy.

Choosing an Islamic Finpros Account means you don’t have to sacrifice market access or trading conditions for your beliefs. You get the same powerful trading platforms, robust security, and dedicated customer support that all Finpros clients enjoy, but with the added assurance of Sharia compliance.

“Trading should not only be profitable but also ethically sound. Our Islamic Finpros Accounts embody this principle, offering a secure and compliant gateway to global markets.”

We believe that everyone deserves the opportunity to participate in financial markets without compromising their values. Open an Islamic Finpros Account today and experience a trading journey that respects your faith while empowering your financial aspirations.

Demo Finpros Accounts for Practice

Are you curious about the world of online trading but hesitant to dive in with real capital? Finpros has the perfect solution for you. Our demo accounts are your ultimate training ground, a risk-free environment where you can explore, learn, and master the art of trading without any financial pressure. It’s an indispensable tool for both complete beginners taking their first steps and experienced traders looking to refine their strategies.

Finpros demo accounts accurately simulate the live trading experience. You gain access to real-time market data, a comprehensive suite of trading tools, and the intuitive Finpros platform, all while using virtual funds. This authentic setup allows you to get comfortable with market dynamics, test various trading approaches, and develop a strong trading mindset before you commit to live trading.

Here’s why practicing with a Finpros demo account is a smart move:

- You can trade with virtual money, ensuring you learn and make mistakes without any financial risk.

- Experiment with diverse trading strategies and indicators to discover what truly works for your style.

- Familiarize yourself completely with the Finpros platform, understanding order execution, charting tools, and account management.

- Develop crucial trading instincts and build your confidence in a stress-free environment.

- Explore different financial instruments like currency pairs, commodities, and indices to broaden your market understanding.

Setting up your Finpros demo account is quick and straightforward. You receive virtual capital instantly, allowing you to start practicing your trades right away. Use this powerful resource to understand market volatility, identify trading opportunities, and perfect your decision-making process. It’s your opportunity to practice, prepare, and pave your way to success in the live trading arena. Don’t just watch the market; actively engage with it!

Key Features and Benefits of Finpros Accounts

Ready to elevate your trading journey? Choosing the right brokerage account is crucial, and at Finpros, we design our accounts to empower traders like you. We understand that every trader has unique needs, which is why we offer a diverse range of Finpros accounts, each packed with powerful features and undeniable benefits. You get more than just access to the market; you gain a strategic partner dedicated to your success.

Our commitment begins with an intuitive and robust trading environment. We ensure you have all the tools to make informed decisions and execute trades swiftly. Let’s dive into what makes a Finpros account the smart choice for your forex trading ambitions.

Unlocking Your Trading Potential with Finpros

Here’s a glimpse at the core advantages you experience when you open an account with us:

- Competitive Spreads: Experience some of the industry’s tightest spreads on major currency pairs. Lower trading costs mean more potential profit for you.

- Advanced Trading Platforms: Access world-class platforms like MetaTrader 4 and MetaTrader 5, alongside our user-friendly web and mobile applications. Trade on the go, analyze markets with precision, and deploy sophisticated strategies effortlessly.

- Diverse Instrument Selection: Explore a vast array of trading instruments. Beyond forex pairs, diversify your portfolio with commodities, indices, and even cryptocurrencies. The global markets are at your fingertips.

- Robust Security Measures: We prioritize the safety of your funds and personal information. Finpros adheres to strict regulatory standards, employing advanced encryption and segregated client accounts to give you peace of mind.

- Educational Resources & Market Insights: Boost your trading knowledge with our extensive library of webinars, tutorials, and expert market analysis. Stay ahead of market trends and refine your trading strategies with our invaluable educational tools.

Moreover, Finpros accounts are celebrated for their flexibility. We cater to both new traders taking their first steps and seasoned professionals seeking advanced functionalities. You’ll find account types designed to match your experience level, trading volume, and risk tolerance.

Advantages of Trading with Finpros

When you choose Finpros, you’re not just picking a broker; you’re opting for a comprehensive trading ecosystem. Consider these compelling advantages:

| Feature | Your Benefit |

|---|---|

| Ultra-Fast Execution | Minimize slippage and capitalize on fleeting market opportunities. Our infrastructure ensures your orders execute in milliseconds. |

| Dedicated Client Support | Receive prompt and professional assistance from our multilingual support team. We are here to help you 24/5, resolving any queries quickly and efficiently. |

| Flexible Leverage Options | Tailor your leverage to suit your trading strategy and risk management preferences. Gain greater market exposure responsibly. |

| Seamless Funding Solutions | Enjoy a variety of secure and convenient deposit and withdrawal methods. Manage your funds with ease and confidence. |

As one of our long-term clients recently shared, “Finpros truly understands what traders need. The platform is powerful, the support is always there, and I feel confident my investments are secure. It’s a game-changer for my forex trading.”

Join the growing community of successful traders who trust Finpros. We empower you with the tools, knowledge, and support to navigate the dynamic world of forex and beyond. Open your Finpros account today and discover a superior trading experience!

Step-by-Step: How to Open a Finpros Trading Account

Ready to dive into the exciting world of forex trading? Opening a Finpros trading account is your first significant step towards exploring the global financial markets. We’ve designed a straightforward process to get you started quickly and efficiently. Forget complex forms and endless waiting – our system is built for your convenience, ensuring a smooth entry into online trading and helping you open a trading account with ease.

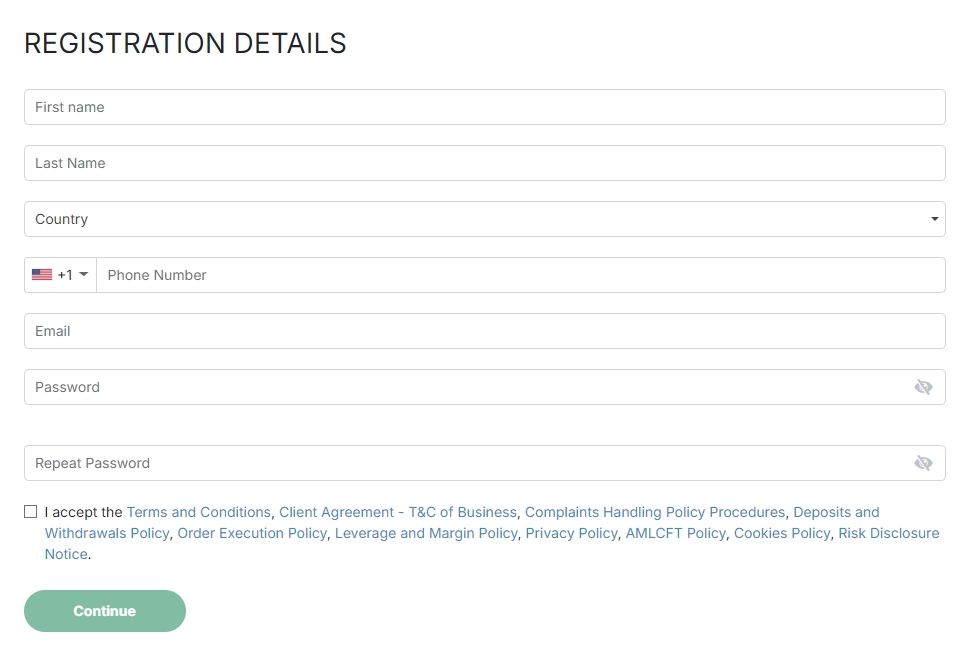

Embarking on your Finpros journey is simpler than you might imagine. We guide you through each stage, from initial registration to your first deposit, so you can focus on what truly matters: your trading strategy. Here’s a breakdown of the easy steps to get your Finpros account up and running:

-

Visit the Finpros Website: Your journey begins on our official Finpros website. Look for the “Open Account” or “Register” button, usually prominently displayed at the top right corner of the homepage. This will direct you to our secure registration portal, where you can start your online trading account setup.

-

Complete the Registration Form: You’ll need to fill in some basic personal information. This includes your full name, email address, phone number, and country of residence. Make sure all details are accurate, as they will be used for your account verification. Creating a strong password is also crucial at this stage to safeguard your future Finpros account.

-

Verify Your Email Address: After submitting the form, we’ll send a verification link to the email address you provided. Click this link to confirm your email and proceed to the next stage of setting up your online trading account. This step is vital for security and confirms your intent to open a trading account.

-

Provide Necessary Documents for Verification (KYC): To comply with regulatory standards and ensure the safety of our trading platform, you’ll need to complete our Know Your Customer (KYC) process. This involves uploading identification and proof of residency. Here’s a quick look at what you typically need for account verification:

- Proof of Identity: A clear, color scan or photo of your valid government-issued ID (passport, national ID card, or driver’s license).

- Proof of Residency: A recent utility bill (electricity, water, gas, internet) or a bank statement, dated within the last three months, showing your name and address.

Our dedicated team reviews these documents swiftly, aiming to complete your account verification within a short timeframe. This step ensures a secure environment for all forex trading activities.

-

Fund Your Account: Once your Finpros trading account is verified, you’re ready to make your initial deposit. We offer a variety of convenient funding methods, including bank transfers, credit/debit cards, and popular e-wallets. Choose the option that best suits you to deposit funds. Remember to consider your trading goals and risk management strategy when deciding on your deposit amount for online trading.

-

Start Trading! Congratulations! With funds in your account, you now have access to our powerful trading platform. You can begin exploring various financial markets, analyzing charts, and executing your first trades. If you’re new to live trading, consider starting with a demo account first to practice your strategies without real financial risk. Your journey into forex trading has officially begun!

Why choose Finpros when you decide to open a trading account and dive into the financial markets? Our commitment to your success and security sets us apart:

- User-Friendly Trading Platform: Intuitive design suitable for both beginners and experienced traders, making online trading accessible.

- Robust Security: Advanced encryption and regulatory compliance protect your funds and personal data, ensuring peace of mind for your Finpros account.

- Dedicated Support: Our customer service team is always ready to assist you throughout your forex trading experience, from account verification to trade execution.

- Educational Resources: Access to a wealth of tools and guides to help you enhance your knowledge of financial markets and refine your trading skills.

As you open your Finpros account and prepare for online trading, keep these essential tips in mind for a successful start:

- Understand the Markets: Spend time learning about the instruments you plan to trade within the financial markets.

- Practice with a Demo Account: Utilize our free demo account to hone your skills and test strategies before engaging in live trading with real funds.

- Start Small: Begin with a manageable investment and gradually increase it as you gain experience and confidence in your forex trading journey.

- Develop a Trading Plan: Define your goals, risk tolerance, and strategy before entering any trade. Effective risk management is key to sustained success.

We’re excited to welcome you to the Finpros community. Your journey into the global financial markets is just a few clicks away! Get ready to open your trading account and explore the opportunities that await.

Required Documentation for Finpros

Opening a new forex trading account with Finpros is an exciting step, and ensuring a secure and compliant environment for all our traders is our top priority. Just like any reputable financial institution, we need to gather some essential documentation. This process, often called account verification or KYC (Know Your Customer), is a standard industry practice. It protects your funds, prevents fraud, and allows us to meet strict regulatory compliance requirements, ensuring a safe and transparent trading experience for everyone on our platform.

The documentation helps us confirm your identity and residency, which is crucial for client security and the smooth operation of our financial services. Here’s a breakdown of what you’ll typically need to provide:

Proof of Identity

To verify who you are, we require a clear, valid government-issued photo ID. This helps confirm your personal details and ensures that your forex trading account is truly yours.

- Passport: A copy of the photo page of your valid international passport. Make sure all four corners are visible and the image is clear.

- National ID Card: Both front and back copies of your valid national identification card. Ensure the expiry date is clearly visible.

- Driver’s License: Both front and back copies of your valid driver’s license. Again, confirm it is current and readable.

Please make sure the document is not expired and all information is clearly legible. Blurry or cut-off images might lead to delays in your smooth onboarding process.

Proof of Residency

We also need to verify your current residential address. This document must show your full name and address, matching the information you provided during your Finpros registration. It typically needs to be dated within the last three to six months, depending on the document type.

- Utility Bill: A recent electricity, water, gas, or landline phone bill. Mobile phone bills are generally not accepted.

- Bank Statement: A statement from your bank or credit card company. Ensure it shows your name, address, and is recently issued.

- Government-Issued Tax Document: A recent tax assessment or other official document from a government agency displaying your residential address.

The name on your proof of residency document must exactly match the name on your proof of identity and your Finpros trading account. Inconsistencies can cause delays in activating your account, so double-check everything before submission.

Our team works hard to make this process as straightforward as possible. Once you submit your documents, we’ll review them promptly, helping you get started with your forex trading journey quickly and securely. Your trust and security are paramount to us at Finpros, and these steps are foundational to maintaining a robust and reliable trading environment.

Account Verification Process

Embarking on your forex trading journey is exciting, and a crucial first step is the account verification process. Don’t let this sound daunting! It’s a standard, straightforward procedure designed to keep your funds safe, comply with global financial regulations, and ensure a secure trading environment for everyone. Think of it as building a strong foundation for your future success in the market.

Every reputable forex broker implements what’s known as a Know Your Customer (KYC) process. This isn’t just bureaucracy; it’s a vital part of protecting both you and the brokerage from fraud and illicit activities. Completing your account verification smoothly means you unlock full access to all trading features, deposits, and withdrawals without any hiccups. It’s all about creating a transparent and trustworthy space for your forex trading account.

What to Expect: Key Steps and Documents

The verification process typically involves submitting a few key documents to confirm your identity and address. Here’s a general overview of what most brokers will ask for:

- Proof of Identity: This confirms who you are.

- Valid Passport

- National ID Card

- Driver’s License

- Proof of Residence: This verifies where you live.

- Utility Bill (electricity, water, gas – usually within the last 3 months)

- Bank Statement (also typically within the last 3 months)

- Government-issued tax invoice

Ensure your documents are current, clearly legible, and show all four corners. Blurry images or expired IDs can delay your secure trading experience.

Tips for a Smooth and Quick Verification

Nobody likes waiting, especially when you’re eager to start trading. Follow these simple tips to sail through your account verification:

- Use High-Quality Images: Snap clear, well-lit photos of your documents. No blurry edges!

- Check Expiry Dates: Make sure your ID isn’t expired.

- Match Details Exactly: The name and address on your proof of identity must match your proof of residence and the details you provided during registration.

- Understand Requirements: Some brokers have specific file format or size requirements. Check their guidelines!

- Be Patient: Once submitted, the broker’s compliance team needs a little time to review everything. This usually takes just a few hours to a couple of business days.

Why is This Important for You?

Regulatory compliance benefits you directly. Here’s how:

| Benefit | Explanation |

|---|---|

| Enhanced Security | Protects your funds and personal information from unauthorized access and fraud. |

| Full Access | Unlocks all features of your trading account, including seamless deposits and withdrawals. |

| Regulatory Compliance | Ensures the broker operates legally, offering you a safer trading environment. |

| Building Trust | Demonstrates the broker’s commitment to transparency and ethical practices. |

By completing this step, you’re not just jumping through hoops; you’re fortifying your position as a legitimate trader and ensuring your entire experience is as secure and seamless as possible. It’s a small investment of time for immense peace of mind in the dynamic world of forex.

Funding and Withdrawal Options for Finpros Accounts

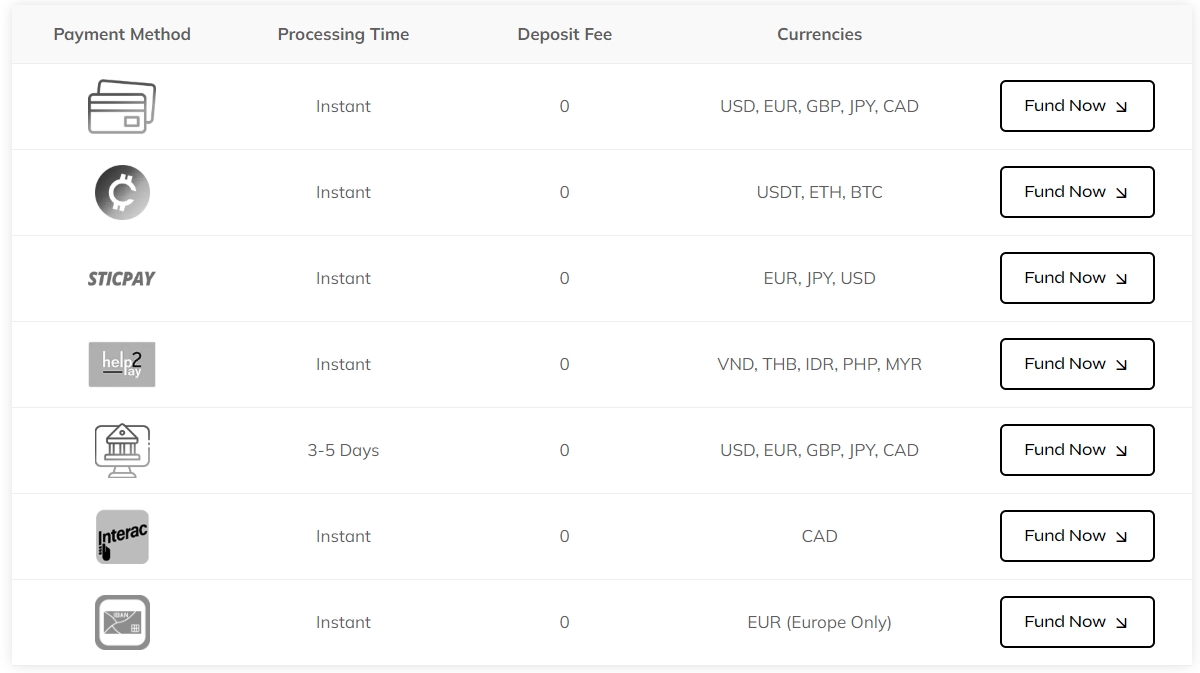

Embarking on your trading journey with Finpros means having seamless control over your funds. We understand that efficient and secure funding and withdrawal options are paramount for every trader. That’s why Finpros offers a robust suite of methods designed for your convenience, ensuring you can manage your capital with confidence and ease. Whether you’re topping up your trading account or cashing in on your profits, our systems are built for reliability and speed.

Depositing Funds into Your Finpros Account

Getting started with Finpros is straightforward. We provide a variety of popular deposit methods to cater to your preferences, all designed to get you trading without unnecessary delays. Our aim is to make your funding process as smooth as possible, allowing you to focus on market opportunities.

- Bank Wire Transfers: For larger amounts or traditional banking preferences, direct bank transfers offer a secure way to fund your Finpros account.

- Credit/Debit Cards: Visa and MasterCard options provide instant funding, allowing you to react quickly to market shifts. It’s a popular choice for its speed and simplicity.

- E-Wallets: Utilize various electronic wallet services for swift and secure deposits. These methods often provide an extra layer of privacy and expedited processing.

Most deposits are processed swiftly, with many methods crediting your Finpros trading account almost instantly, so you can seize market opportunities without delay. We prioritize your financial security with advanced encryption and fraud prevention measures for all transactions.

Withdrawing Your Earnings from Finpros

When it’s time to enjoy the fruits of your trading success, Finpros makes the withdrawal process just as simple and secure as funding. We believe in providing fast and transparent access to your profits, ensuring peace of mind.

To initiate a withdrawal, you typically follow a few easy steps within your Finpros client portal. We aim to process all withdrawal requests promptly, understanding that quick access to your funds is important. For security reasons, withdrawals are generally processed back to the original source of the deposit, ensuring the highest standards of financial integrity.

Here’s a look at some common withdrawal considerations:

| Method | Typical Processing Time | Key Benefit |

|---|---|---|

| Bank Wire Transfer | 3-5 business days | High limits, widely accepted |

| Credit/Debit Card | 2-3 business days | Convenient, familiar method |

| E-Wallet | Within 24 hours | Fastest, often low fees |

Please note that processing times can vary depending on the specific method and any intermediary banking processes. Finpros strives to minimize any delays from our end.

Important Considerations for Fund Management

Before you make a deposit or withdrawal, keep these points in mind for a smooth experience:

- Account Verification: To comply with regulatory requirements and enhance security, you will need to complete our account verification process. This ensures the safety of your funds and helps prevent fraud.

- Fees: Finpros endeavors to keep transaction costs minimal. While we may not charge deposit fees, third-party payment providers or banks might apply their own charges. We recommend reviewing our terms or consulting your bank for any potential fees.

- Currency Conversion: If your deposit or withdrawal currency differs from your Finpros account base currency, a conversion fee might apply at prevailing market rates.

- Minimum/Maximum Limits: Each payment method may have specific minimum and maximum transaction limits. You can find these details easily within your Finpros client area when initiating a transaction.

At Finpros, your financial security is our top priority. We employ state-of-the-art encryption technologies and adhere to strict regulatory guidelines to protect your personal and financial information. Our dedicated support team is always ready to assist you with any questions regarding funding or withdrawal, ensuring a stress-free trading experience.

Trading Platforms Supported by Finpros

At Finpros, we understand that the right trading platform is the cornerstone of your success in the dynamic world of forex. That’s why we’ve committed to supporting a suite of robust, intuitive, and highly functional forex trading platforms designed to meet the diverse needs of both new and experienced traders. We believe that empowering you with superior technology is key to unlocking your full trading potential, ensuring fast execution, reliable data, and a seamless trading experience.

Our goal is to provide you with a flexible environment where you can execute your strategies with confidence, whether you’re analyzing charts, managing positions, or deploying complex automated systems. Finpros carefully selects platforms that offer unparalleled performance and a rich array of trading tools, making your journey with us truly exceptional.

MetaTrader 4 (MT4): The Industry Standard

For years, MetaTrader 4, widely known as MT4, has reigned as the most popular platform in the forex market, and for good reason. It’s a powerful, user-friendly platform offering comprehensive charting tools and analytical capabilities. Traders around the globe choose MT4 for its reliability and its extensive support for algorithmic trading via Expert Advisors (EAs).

- Advanced Charting: Access to multiple timeframes, various chart types, and a wide selection of indicators for in-depth technical analysis.

- Expert Advisors (EAs): Automate your trading strategies without constant manual intervention, allowing for continuous market monitoring.

- Customizable Interface: Tailor your workspace to your preferred style, ensuring all your essential information is just a glance away.

- Robust Security: Encrypted data transmission provides a secure trading environment for your funds and personal information.

- Vast Community: Benefit from a massive global community for shared insights, indicators, and EAs.

“Choosing the right platform is like choosing your co-pilot for a complex journey. With Finpros, you get the best in class, ensuring smooth navigation through market turbulence.”

MetaTrader 5 (MT5): The Next Evolution

Building on the legacy of its predecessor, MetaTrader 5, or MT5, offers an enhanced trading experience with even more features and analytical capabilities. While MT4 remains a staple for many forex trading platforms, MT5 extends your market access beyond forex, potentially including stocks and futures, depending on your Finpros account type. It’s designed for traders seeking more advanced tools and greater market versatility.

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

|---|---|---|

| Number of Timeframes | 9 | 21 |

| Analytical Objects | 44 | 38 |

| Indicators | 30 built-in | 38 built-in |

| Order Types | 4 (Buy Limit, Sell Limit, Buy Stop, Sell Stop) | 6 (including Buy Stop Limit, Sell Stop Limit) |

| Market Depth | No (Level 1 data) | Yes (Level 2 data) |

| Hedging Support | Yes | Yes (Netting & Hedging) |

Web-Based and Mobile Trading Solutions

We understand that not everyone wants to download software, and the market doesn’t wait for you to be at your desk. That’s why Finpros also supports convenient web-based platforms and intuitive mobile trading applications. Our web traders offer instant access to your account and the markets directly from your browser, without any downloads. For trading on the go, our mobile apps for iOS and Android devices provide full trading functionality, real-time quotes, and charting tools, ensuring you never miss an opportunity, no matter where you are.

Finpros is dedicated to providing a superior trading environment. By offering a selection of top-tier platforms like MT4 and MT5, alongside accessible web and mobile solutions, we ensure that every client finds their perfect match for effective Finpros trading. Our diverse platform support reflects our commitment to empowering you with the technology and flexibility you need to succeed.

Spreads, Commissions, and Fees on Finpros Trading Accounts

Understanding the full picture of your trading costs is absolutely essential for every successful trader. At Finpros, we believe in crystal-clear transparency regarding all aspects of your Finpros trading accounts. We lay out the forex spreads, trading commissions, and any other relevant charges upfront, ensuring you know exactly where you stand before you place a single trade. This clear approach empowers you to manage your capital effectively and make smart trading decisions.

Spreads are the most common cost in forex trading. They represent the tiny difference between the bid (sell) and ask (buy) price of a currency pair. Finpros offers highly competitive spreads that adapt to current market conditions. You will find variable spreads on most of our account types, meaning they fluctuate based on factors like liquidity and market volatility. Our constant goal is to provide you with tight spreads, which allows you to enter and exit the market efficiently. We work tirelessly with our liquidity providers to secure the best rates, ensuring you always receive excellent value when trading with Finpros.

Here’s what typically influences the spreads you see on Finpros:

- Market Volatility: When markets are more active and volatile, spreads can sometimes widen.

- Liquidity Levels: Currency pairs with higher trading volume generally enjoy tighter spreads.

- Time of Day: Spreads might be slightly wider during off-peak trading hours when liquidity is lower.

- Account Type: Different Finpros account types can offer varying spread structures to suit diverse trading styles.

You can rest assured that you won’t encounter any unexpected or hidden fees when it comes to spreads at Finpros. What you see displayed on your trading platform is precisely what you get.

Beyond spreads, commissions become a factor for traders who prefer ultra-tight raw spreads. Commissions are a direct fee charged per trade, most commonly applying to our ECN or raw spread accounts. Instead of a wider spread, you pay a small, fixed amount per standard lot traded. This model is often preferred by high-volume traders and those employing scalping strategies, as it can potentially lead to lower overall trading costs. We clearly outline our commission structure, so there are absolutely no surprises. Our low commission forex options are specifically designed to give professional traders the precise edge they need.

What about other potential costs? While we always strive for competitive pricing across the board, it’s wise to be aware of other fees that might apply under specific circumstances. Finpros ensures complete transparency for these as well:

- Swap Rates (Overnight Fees): If you hold a position open overnight, you might incur or receive a swap fee. This is an interest adjustment based on the interest rate differential between the two currencies in a pair. We provide comprehensive details on our swap rates Finpros trading platform, enabling you to factor them accurately into your long-term strategies.

- Inactivity Fees: Very rarely, an inactivity fee might apply to dormant accounts after an extended period without any trading activity. This fee helps us manage resources for truly inactive accounts, but we always provide ample prior notification before it applies.

- Withdrawal Fees: Many of our withdrawal methods are completely free. However, some, especially international bank transfers, may incur a small charge. We are always transparent about any such fees upfront, allowing you to choose the most cost-effective method for your needs.

At Finpros, our unwavering commitment is to provide a transparent and cost-effective trading environment. We make sure that all our fees, whether they are forex spreads, commissions, or other charges, are clearly stated and easily accessible. We empower you to trade with absolute confidence, knowing exactly what you are paying. Explore our different account types today to find the structure that perfectly suits your unique trading style and financial goals!

Leverage and Margin Requirements with Finpros

Diving into the world of forex with Finpros, you’ll quickly encounter two crucial concepts: leverage and margin. These powerful tools can significantly amplify your trading potential, but understanding them is key to successful navigation. At Finpros, we empower you to maximize market opportunities while providing clear guidelines for responsible trading.

Unleashing Potential with Leverage

Leverage is like a financial magnifying glass. It allows you to control a large trading position with a relatively small amount of your own capital. Imagine having $1,000 in your trading account. With 1:100 leverage, you can open a position worth $100,000! This means you can gain much greater market exposure than your initial deposit would typically allow.

Finpros offers competitive leverage options, tailored to various instruments and regulatory guidelines. Our aim is to provide flexibility while ensuring you have the tools for effective risk management. High leverage can boost profits, but it also means potential losses can escalate quickly. It’s a double-edged sword that demands respect and a well-thought-out trading strategy.

Navigating with Margin Requirements

If leverage is the power to open larger positions, margin is the safety net that makes it possible. Margin is the initial deposit or collateral required by your broker (Finpros, in this case) to keep your leveraged position open. It’s not a fee, but rather a portion of your account balance that is set aside as a guarantee against potential losses.

Here’s a quick breakdown of how margin works:

- Required Margin: This is the amount of capital Finpros needs to open a specific trade. It’s calculated as a percentage of the total trade value, determined by the leverage offered for that particular asset.

- Used Margin: This shows the total margin currently allocated to your open positions.

- Free Margin: This is the remaining equity in your account that is available for new trades or to absorb potential losses from existing trades. It’s your breathing room!

- Margin Call: If your free margin drops too low, indicating your open positions are moving against you, Finpros might issue a margin call. This is a notification that you need to deposit more funds or close some positions to meet the minimum margin requirements.

Understanding your margin levels is crucial for managing your risk. Finpros provides real-time updates on your account status, ensuring you always know your available capital and your margin health. We encourage all traders to monitor their free margin closely and avoid over-leveraging their trading capital.

Let’s look at a simple example with Finpros:

| Scenario | Details | Impact |

|---|---|---|

| Account Balance | $10,000 | Starting capital. |

| Leverage (Finpros) | 1:200 | For every $1 of your capital, you control $200. |

| Trade Size | 1 standard lot (100,000 units) of EUR/USD | A common trading volume. |

| Required Margin | $100,000 / 200 = $500 | This $500 is set aside from your $10,000. |

| Free Margin | $10,000 – $500 = $9,500 | Your remaining capital for new trades or loss absorption. |

Finpros strives to make leverage and margin transparent and easy to understand. We provide resources and support to help you effectively incorporate these powerful tools into your overall trading strategy, ensuring you can confidently engage in the forex market while keeping a close eye on your risk exposure.

Security and Regulation of Finpros Trading Services

In the dynamic world of forex trading, feeling secure and confident in your broker is paramount. At Finpros, we understand that trust is built on transparency, robust security measures, and unwavering adherence to financial regulations. That’s why we place the highest emphasis on safeguarding your investments and personal information, allowing you to focus on your trading strategies with complete peace of mind.

Why Regulation Matters in Forex Trading

When you choose a trading partner, their regulatory status should be one of your top considerations. A properly regulated broker operates under strict guidelines designed to protect traders and maintain market integrity. This commitment to **financial regulation** ensures fair practices, transparent operations, and a level playing field for everyone. It’s not just a formality; it’s a shield against unscrupulous activities and a guarantee of accountability.

“A broker’s commitment to robust security and stringent regulation isn’t just a feature; it’s the bedrock of a trustworthy trading experience. It empowers traders to operate with confidence, knowing their interests are protected.”

Finpros’ Unwavering Commitment to Regulatory Compliance

Finpros operates with full dedication to **regulatory compliance**, ensuring our services meet the highest industry standards. We believe in building a trading environment where you feel secure every step of the way. This involves regular audits, strict internal protocols, and a constant monitoring of our operations to ensure we consistently uphold our obligations to our clients and the broader financial community. Our goal is to provide a seamless and secure platform for your trading journey.

Protecting Your Funds and Data

Your capital is your hard-earned asset, and its protection is our top priority. Finpros employs advanced measures for **client fund protection**, separating client accounts from our operational funds. This segregation ensures that your money is always accessible and never used for company expenses. Furthermore, the **forex trading security** of your personal data is critical. We utilize state-of-the-art encryption technologies and stringent data protection protocols to shield your information from unauthorized access. Your privacy and financial safety are non-negotiable.

Key Security Features at Finpros:

- Segregated Client Accounts: Your funds are held in separate bank accounts from Finpros’ operational capital.

- Advanced Encryption: We use SSL encryption to secure all data transfers and personal information.

- Two-Factor Authentication (2FA): An optional but highly recommended layer of security for your account login.

- Regular Audits: Independent financial audits ensure our compliance and financial stability.

- Robust Network Security: Our **trading platform security** infrastructure is fortified against cyber threats.

The Finpros Advantage: Trading with Confidence

Choosing Finpros means choosing a partner committed to your success and security. We combine cutting-edge **trading platform security** with a deep understanding of financial markets, all underpinned by a strong regulatory framework. Our aim is to foster an environment where you can explore the exciting opportunities in forex trading, knowing that a **regulated broker** is steadfastly looking out for your interests. Join us and experience the difference that true security and professional regulation make in your trading endeavors.

Customer Support for Finpros Account Holders

Navigating the dynamic world of forex trading requires more than just sharp strategies; it demands reliable support whenever you need it. At Finpros, we understand this crucial need. That’s why we have built a robust and responsive customer support system designed specifically for our valued account holders. We ensure you always have a trusted partner ready to assist, making your trading journey smoother and more confident.

Our dedicated support team stands ready to address your questions and resolve any issues promptly. Whether you are a seasoned trader or just starting out, you might encounter technical glitches, need clarification on platform features, or have questions about your account. We have got you covered with a range of accessible contact options:

- Live Chat: Get immediate assistance through our real-time chat service, available directly on our platform. This is perfect for quick queries and instant solutions, connecting you with Finpros support in moments.

- Email Support: For more detailed inquiries or when you need to send documents, our email support ensures a thorough and well-documented response. Our team works efficiently to provide comprehensive answers to your forex trading assistance needs.

- Phone Assistance: Prefer to speak with someone directly? Our phone lines connect you with experienced representatives who can guide you through complex issues, providing personalized Finpros account support.

Our support agents are not just helpdesk personnel; they are forex-savvy professionals trained to understand the intricacies of our trading platforms and financial markets. They can provide expert assistance with everything from funding your account and managing withdrawals to troubleshooting trading platform issues and explaining margin requirements. Plus, to serve our global community, we offer multilingual support, ensuring you can communicate comfortably in your preferred language and receive clear guidance on your account management queries.

Beyond direct contact, Finpros also empowers account holders with extensive self-help resources. Our comprehensive knowledge base and detailed FAQ section cover a wide array of common questions and topics. You can find step-by-step guides, video tutorials, and articles designed to help you quickly find answers and enhance your understanding of our services and the forex market. This empowers you to resolve minor issues independently and learn more at your own pace, complementing the personalized Finpros support you receive from our team.

Educational Resources for Finpros Traders

Embarking on your forex trading journey or looking to sharpen your existing skills? Finpros stands as your ultimate partner, offering an expansive suite of educational resources designed to transform ambition into achievement. We believe that well-informed traders make the best decisions, and our commitment to your growth is unwavering. Whether you’re a curious newcomer or a seasoned pro, our comprehensive forex trading education platform provides everything you need to navigate the dynamic currency markets with confidence.

Our goal is simple: empower you with the knowledge, tools, and insights required to excel. We understand that effective trading isn’t just about spotting opportunities; it’s about understanding the underlying forces, managing your emotions, and executing your plan with precision. Finpros’ educational offerings bridge the gap between theory and practical application, ensuring you gain real-world proficiency.

What Finpros Offers: A Learning Path for Every Trader

We’ve meticulously structured our educational content to cater to every level of expertise. Here’s a glimpse into the diverse learning paths available:

- For the Beginner Forex Trader: Start your journey with foundational courses that demystify the forex market. Learn essential terminology, understand how currency pairs work, and grasp the basics of order types. Our step-by-step guides make complex concepts easy to digest, setting a strong foundation for future learning.

- For Intermediate Traders: Elevate your skills with modules on advanced chart patterns, indicator usage, and developing personal trading strategies. We delve into more nuanced aspects of the market, helping you refine your analytical approach.

- For Advanced Traders: Access cutting-edge insights and sophisticated methodologies. Our advanced trading courses explore complex arbitrage techniques, high-frequency trading principles, and in-depth quantitative analysis. Stay ahead of market trends with expert perspectives.

Dive Deeper: Our Diverse Learning Formats

Finpros presents information in various engaging formats to suit your preferred learning style. You’ll never get bored with our dynamic educational offerings:

| Resource Type | Key Focus Areas | Benefits for Traders |

|---|---|---|

| Interactive Webinars & Video Tutorials | Real-time market analysis, expert Q&A, strategy demonstrations, live trading examples. | Engage directly with market experts, observe real-time application of strategies, clarify doubts instantly. |

| Comprehensive E-books & Guides | In-depth coverage of technical analysis tools, fundamental analysis principles, economic indicators, and risk management techniques. | Build a solid theoretical understanding, reference complex topics anytime, learn at your own pace. |

| Practice Accounts (Demo Trading) | Risk-free environment to test strategies, familiarize with the platform, and build confidence. | Apply learned concepts without financial risk, hone execution skills, develop a trading routine. |

| Articles & Blog Posts | Daily market commentary, quick tips, insights into trading psychology, and current event impact on forex. | Stay updated with market news, gain practical advice, understand the mental game of trading. |

We place immense importance on risk management – it’s the cornerstone of sustainable trading. Our curriculum dedicates significant sections to understanding position sizing, stop-loss orders, and capital preservation. Moreover, we help you master trading psychology, teaching you how to manage emotions and maintain discipline under pressure. This holistic approach ensures you develop not just trading skills, but also the mental fortitude required for long-term success.

Join our regular live trading webinars for an opportunity to interact with professional traders. These sessions provide invaluable practical insights and allow you to see strategies applied in real-time. Our commitment is to provide a continuous learning environment where you can constantly evolve and adapt to market changes. With Finpros, your educational journey is just as important as your trading journey.

Comparing Finpros Trading Accounts to Other Brokers

Stepping into the world of online trading means making crucial decisions, and your choice of broker tops the list. You want a platform that not only meets your needs but empowers your trading journey. When you look at Finpros trading accounts, you quickly see how we stack up against the broader market. We focus on providing a distinct edge through tailored solutions and transparent conditions, rather than just offering a one-size-fits-all approach.

Many traders start by simply comparing spreads or leverage, but the true value lies in the overall trading environment. While other brokers might offer a multitude of account types, sometimes the complexity outweighs the benefit. Finpros streamlines its offerings, ensuring each account option provides clear advantages for different trading styles, from beginners to seasoned professionals. We believe in clarity over confusion, giving you the confidence to execute your strategies effectively.

What sets Finpros apart in the competitive landscape?

- Tailored Account Structures: Unlike many brokers who offer generic accounts, Finpros designs its trading accounts with specific trader profiles in mind. We provide options that genuinely cater to varying capital sizes, trading frequencies, and risk appetites.

- Transparent Costing: We pride ourselves on clear, competitive spreads and commissions. You won’t find hidden fees or unexpected charges that can erode your profits, a common frustration reported by traders with other platforms.

- Dedicated Support: While many brokers offer customer service, Finpros provides proactive and knowledgeable support, acting as a true partner in your trading endeavors. We understand that timely assistance can make all the difference.

- Robust Technology: Access to cutting-edge trading platforms and tools is standard at Finpros. We invest in technology that ensures fast execution, reliable data, and a seamless user experience, often surpassing the basic offerings of our competitors.

- Educational Resources: Beyond just providing a platform, Finpros empowers its traders with extensive educational materials and market insights. This commitment to trader growth is often a secondary focus for many other brokers.

When you evaluate Finpros trading accounts against the myriad of options available, consider what truly matters for your long-term success. Is it just the lowest spread, or is it a combination of competitive pricing, reliable technology, strong support, and educational backing? We constantly refine our offerings to ensure we provide a superior trading experience that goes beyond the basics. We invite you to explore the Finpros difference and discover an environment built for your trading evolution.

Maximizing Your Trading Potential with Finpros

Are you ready to unlock your full potential in the dynamic world of forex trading? Every trader, from novice to seasoned professional, strives to achieve peak performance and consistent results. This isn’t just about making trades; it’s about strategic growth, continuous learning, and leveraging the right tools. With Finpros, you gain a powerful partner dedicated to elevating your trading journey. We understand the challenges and opportunities you face, and we’ve designed our platform and services to empower you at every step.

Finpros provides a comprehensive ecosystem built for traders who are serious about their success. We focus on giving you an edge through cutting-edge technology, unparalleled resources, and a supportive trading environment. Forget the frustration of outdated platforms or limited access to critical information. Here, you discover a path to smarter decisions and greater confidence in your trading strategy.

What Finpros Offers to Boost Your Trading Potential:

- Advanced Trading Tools: Access a suite of sophisticated analytical and execution tools designed to give you precision and control. From customizable charts to real-time data, our platform puts powerful features at your fingertips.

- Extensive Educational Resources: Whether you’re mastering the basics or refining complex strategies, our rich library of educational content, webinars, and tutorials helps you expand your knowledge. Learn at your own pace and build a solid foundation.

- Competitive Spreads and Fast Execution: Experience favorable trading conditions that directly impact your profitability. We offer tight spreads and rapid order execution, ensuring you seize opportunities as they arise without unnecessary delays.

- Dedicated Support: Our expert support team is always ready to assist you. Get timely answers and professional guidance, allowing you to focus on what matters most: your trades.

- Diverse Asset Selection: Explore a wide range of financial instruments, including major, minor, and exotic currency pairs, giving you ample opportunities to diversify your portfolio and capitalize on various market movements.

Don’t just trade; thrive. Finpros is more than just a platform; it’s a commitment to your growth. We believe that with the right guidance and resources, every trader can achieve remarkable outcomes. Embrace a trading experience that prioritizes your success and provides the foundation for you to truly maximize your trading potential.

Frequently Asked Questions About Finpros Trading Accounts

What types of trading accounts does Finpros offer to cater to different traders?

Finpros offers a diverse range of accounts, including Standard for beginners, ECN for experienced traders seeking direct market access and tight spreads, Islamic (swap-free) for Sharia-compliant trading, and Demo accounts for practice without financial risk.

How does Finpros ensure transparency regarding trading costs?

Finpros is committed to clear transparency, detailing forex spreads, trading commissions, and other potential charges like swap rates upfront. Spreads are competitive and variable, and commissions apply only to specific account types like ECN, ensuring no hidden fees.

What role do leverage and margin play in Finpros trading accounts?

Leverage allows traders to control larger positions with less capital, amplifying potential profits but also risks. Margin is the initial capital required to open and maintain a leveraged position, acting as a guarantee. Finpros provides flexible leverage and real-time margin updates for responsible trading.

What security measures and regulations does Finpros adhere to for client protection?

Finpros operates as a fully regulated broker, adhering to strict financial regulations. Key security features include segregated client accounts, advanced SSL encryption for data, two-factor authentication, regular audits, and robust network security, ensuring your funds and personal information are protected.

What educational resources are available for Finpros traders to enhance their skills?

Finpros provides an expansive suite of educational resources, including interactive webinars, video tutorials, comprehensive e-books, guides on technical and fundamental analysis, and articles on trading psychology. Demo accounts are also available for risk-free practice.