Navigating the dynamic world of online trading requires a reliable partner, and for many in Europe, particularly Spain, Finpros Spain has emerged as a significant player. As a prominent online broker, Finpros offers a gateway to various financial markets, providing traders with the tools and resources needed to pursue their investment goals. But what exactly makes Finpros Spain stand out, and what should potential investors know about its operations?

Finpros Spain positions itself as a comprehensive trading solution, catering to both novice traders taking their first steps into the market and seasoned professionals seeking advanced functionalities. Their focus is on delivering an intuitive user experience combined with robust trading capabilities. This commitment aims to simplify the complexities of forex trading and other asset classes, making them accessible to a broader audience.

A reputable broker prioritizes transparency and security. Finpros Spain operates within a regulated framework, which offers an additional layer of assurance for its clients. This regulatory oversight is vital in the financial industry, as it ensures compliance with strict standards designed to protect investor interests. When you choose a broker, confirming their regulatory status is always a smart move to ensure you are trading in a secure and trustworthy environment.

When considering an online broker, understanding their core offerings is crucial. Finpros Spain provides access to a diverse range of trading instruments, allowing clients to diversify their portfolios effectively. Their platform is designed to be user-friendly while offering powerful analytical tools, essential for making informed trading decisions. This blend of accessibility and sophistication is a key aspect of their appeal.

- Key Aspects of Finpros Spain’s Service:

- Regulatory Compliance and Investor Protection in Spain

- What Investor Protection Means for You in Spain

- Key Trading Instruments and Investment Opportunities with Finpros Spain

- Discover the Diverse Range of Instruments

- Why Choose Finpros Spain for Your Investments?

- Advantages of Trading with Finpros Spain:

- Exploring Trading Platforms Offered by Finpros Spain

- What Makes a Great Trading Platform?

- Popular Trading Platforms Offered by Finpros Spain

- Account Types and Tailored Conditions for Finpros Spain Clients

- Discover Your Ideal Finpros Spain Account

- Key Advantages of Finpros Spain Accounts

- Spreads, Commissions, and Transparent Fee Structure at Finpros Spain

- What You Need to Know About Spreads at Finpros Spain

- Commissions: When and Why at Finpros Spain

- Beyond Spreads and Commissions: Our Transparent Fee Structure

- Deposits and Withdrawals: Funding Your Account with Finpros Spain

- Funding Your Trading Account: Deposits Made Easy

- Accessing Your Profits: Simple Withdrawals

- Withdrawal Methods and Typical Processing Times:

- Customer Support and Educational Resources from Finpros Spain

- Responsive and Accessible Customer Support

- Empowering Your Trading Journey with Educational Resources

- Advantages of Choosing Finpros Spain for Your Trading Needs

- What Makes Finpros Spain Stand Out?

- Trader Testimonial

- Comparative Benefits of Trading with Finpros Spain

- Potential Drawbacks and Considerations for Finpros Spain Users

- Regulatory Landscape and Compliance Hurdles

- Platform Performance and Technical Reliability

- Scrutinizing Fee Structures and Hidden Costs

- Challenges with Customer Support and Accessibility

- Understanding Potential Risks and Account Security

- How to Open an Account with Finpros Spain: A Step-by-Step Guide

- Your Path to Becoming a Finpros Spain Trader

- Visit the Official Finpros Spain Website

- Select Your Preferred Account Type

- Complete the Online Application Form

- Submit Required Verification Documents

- Fund Your Trading Account

- Start Trading on Our Advanced Platform

- What You Need to Prepare Before You Start

- Finpros Spain: User Reviews and Reputation Analysis

- Comparing Finpros Spain with Other Brokers in the Spanish Market

- The Future Outlook for Finpros Spain in the Iberian Peninsula

- Key Growth Drivers for Finpros in the Iberian Peninsula:

- Strategic Pillars for Future Success:

- Frequently Asked Questions

Key Aspects of Finpros Spain’s Service:

- Broad Market Access: Trade a variety of assets, including major and minor currency pairs in forex, commodities, indices, and potentially cryptocurrencies, depending on their current offerings.

- Advanced Trading Platform: Utilizes a state-of-the-art trading platform that supports real-time data, customizable charts, and a suite of technical indicators.

- Educational Resources: Offers educational materials, webinars, and market analysis to help traders enhance their skills and stay informed about market trends.

- Dedicated Customer Support: Provides responsive customer support to assist clients with any queries or technical issues they might encounter.

Ultimately, Finpros Spain aims to provide a reliable and efficient trading experience. They focus on empowering individuals to engage with financial markets confidently, offering the necessary technology, educational support, and responsive service. Whether your interest lies in short-term forex trading strategies or long-term investment opportunities, understanding the complete picture of what Finpros Spain offers is your first step towards making an informed decision.

Regulatory Compliance and Investor Protection in Spain

Navigating the global forex market demands a keen eye on regulatory compliance and investor protection. For those interested in forex trading in Spain, understanding the local regulatory landscape is paramount. Spain, as part of the European Union, adheres to robust financial regulations designed to safeguard traders and maintain market integrity.

The primary authority overseeing financial markets and investment services in Spain is the Comisión Nacional del Mercado de Valores (CNMV). This independent body plays a crucial role in ensuring transparency, efficiency, and proper conduct among financial service providers, including those offering forex trading platforms. When you choose to engage with a broker, verifying their CNMV registration and licensing is your first line of defense.

The CNMV’s mandate extends to several critical areas, directly impacting your security as an investor:

- Broker Licensing and Supervision: The CNMV grants licenses to financial firms, ensuring they meet strict capital requirements, operational standards, and ethical guidelines. They continuously supervise these entities to ensure ongoing compliance.

- Market Transparency: Regulated brokers must provide clear, concise, and accurate information about their services, fees, and the risks associated with forex trading. This helps you make informed decisions.

- Investor Protection Measures: Spain implements various measures to protect retail investors, aligning with EU directives like MiFID II (Markets in Financial Instruments Directive II). This includes rules on best execution, product governance, and disclosure requirements.

What Investor Protection Means for You in Spain

Beyond licensing, specific protections are in place to give you peace of mind when trading forex:

| Protection Measure | How It Helps You |

|---|---|

| Segregation of Client Funds | Your funds are held in separate bank accounts from the broker’s operational capital. This means your money is safe even if the broker faces financial difficulties. |

| Investor Compensation Scheme (FOGAIN) | Through the Fondo General de Garantía de Inversiones (FOGAIN), eligible investors may receive compensation up to a specified amount if a regulated firm defaults and cannot return client assets. |

| Negative Balance Protection | Many regulated brokers offer negative balance protection for retail clients, ensuring you cannot lose more than the funds in your trading account. This is a significant safeguard in volatile markets. |

| Risk Disclosure and Suitability | Brokers must provide clear warnings about the high risks involved in CFD and forex trading and assess if certain products are suitable for your investment knowledge and experience. |

Trust and transparency are the cornerstones of successful forex engagement. Spain’s commitment to strong regulatory oversight empowers investors to trade with greater confidence.

Choosing regulated brokers for your financial market regulation needs in Spain isn’t just a recommendation; it’s a strategic decision for your security. A robust regulatory framework, championed by the CNMV, creates a more secure and trustworthy environment for all participants. Always prioritize compliance to protect your investments and enjoy a more confident trading experience.

Before you commit, take the time to research a broker’s regulatory status with the CNMV. This due diligence ensures you are partnering with an entity that respects the rules designed for your benefit, upholding the integrity of the Spanish financial landscape.

Key Trading Instruments and Investment Opportunities with Finpros Spain

Diving into the world of trading can feel overwhelming, but with Finpros Spain, you gain access to a broad spectrum of market opportunities designed to help you achieve your financial goals. We believe in empowering our traders with choice, providing a robust platform that hosts an impressive array of key trading instruments. Whether you are a seasoned investor or just starting your journey, understanding these instruments is your first step towards unlocking your potential.

Discover the Diverse Range of Instruments

At Finpros Spain, we meticulously select instruments to give you maximum flexibility and exposure to global markets. Our platform offers access to:

- Forex (Foreign Exchange): Trade major, minor, and exotic currency pairs. The forex market is the largest and most liquid financial market in the world, offering constant opportunities for traders looking to capitalize on currency fluctuations. Predict movements between currencies like EUR/USD or GBP/JPY and make your move.

- Stocks & Shares (CFDs): Gain exposure to the price movements of thousands of global companies without owning the underlying asset. Trade Contracts for Difference (CFDs) on popular stocks from leading exchanges worldwide. This allows you to speculate on both rising and falling share prices.

- Indices (CFDs): Diversify your portfolio by trading CFDs on major stock market indices. These instruments represent the performance of a basket of shares from a specific region or sector, like the S&P 500 or the DAX. It’s a fantastic way to trade the broader market sentiment.

- Commodities (CFDs): Engage with the raw materials that fuel the global economy. Trade CFDs on precious metals like gold and silver, or energy commodities such as crude oil and natural gas. These assets often react to geopolitical events and supply-demand dynamics, offering unique trading patterns.

- Cryptocurrencies (CFDs): Step into the future of finance with crypto CFDs. Trade on the price movements of popular digital currencies like Bitcoin, Ethereum, and Ripple against fiat currencies. This volatile yet exciting market provides numerous short-term trading prospects.

Why Choose Finpros Spain for Your Investments?

Your investment journey with Finpros Spain is more than just access to instruments; it’s about a comprehensive trading experience. We focus on providing a secure, intuitive platform coupled with the resources you need to make informed decisions.

Advantages of Trading with Finpros Spain:

| Feature | Benefit to You |

|---|---|

| Wide Instrument Selection | Broaden your trading horizons and diversify your portfolio across various asset classes. |

| Competitive Spreads | Potentially lower your trading costs, enhancing your overall profitability. |

| Advanced Trading Platform | Utilize powerful tools and charts to analyze markets and execute trades efficiently. |

| Educational Resources | Enhance your trading knowledge with our extensive library of guides, webinars, and market insights. |

| Dedicated Support | Receive prompt and professional assistance whenever you need it from our expert team. |

We understand that every trader has unique goals. Whether you are aiming for short-term gains through active trading or building a long-term investment strategy, Finpros Spain offers the flexibility and support you need. Our commitment is to provide a transparent and reliable trading environment where you feel confident exploring the vast landscape of financial markets. Take control of your financial future and explore the exciting investment opportunities waiting for you.

Exploring Trading Platforms Offered by Finpros Spain

Are you ready to dive into the dynamic world of forex trading with Finpros Spain? Choosing the right trading platform is the first crucial step on your journey to financial freedom. Finpros Spain understands that traders have diverse needs, which is why they offer a selection of industry-leading trading platforms designed to cater to both novice and seasoned professionals. Let’s explore what makes their offerings stand out and how they can empower your trading experience.

When you join the Finpros Spain community, you gain access to powerful tools built for precision and speed. These platforms are not just a gateway to the markets; they are comprehensive ecosystems offering advanced charting capabilities, real-time market data, and a suite of analytical instruments. Whether your strategy involves intricate technical analysis or fundamental market observations, you’ll find the resources you need at your fingertips.

What Makes a Great Trading Platform?

A superior trading platform should offer a blend of functionality, reliability, and user-friendliness. Here are some key attributes we believe are essential for effective forex trading:

- Intuitive Interface: Easy to navigate, even for beginners, allowing quick access to essential features.

- Advanced Charting Tools: A wide range of indicators, drawing tools, and customizable chart types to support your analysis.

- Real-time Data: Up-to-the-minute price quotes and market news to make informed decisions.

- Robust Security: Ensuring the safety of your funds and personal information.

- Execution Speed: Rapid order execution to capitalize on fleeting market opportunities.

- Mobile Accessibility: Trade on the go from your smartphone or tablet, maintaining control wherever you are.

Popular Trading Platforms Offered by Finpros Spain

Finpros Spain proudly offers access to widely recognized and highly respected trading platforms. Each one brings unique advantages to the table, ensuring you can select the perfect fit for your individual trading style and preferences.

| Platform Feature | Benefit to Trader |

|---|---|

| User-Friendly Interface | Quick learning curve, seamless navigation for efficient trading. |

| Multi-Asset Trading | Access to a wide range of instruments beyond just forex trading. |

| Algorithmic Trading Support | Automate your strategies, ideal for advanced traders. |

| Comprehensive Analytical Tools | In-depth market analysis for smarter decision-making. |

| Mobile & Desktop Versions | Flexibility to trade from any device, anytime, anywhere. |

As one experienced trader eloquently put it, “Your trading platform is your cockpit. It needs to be comfortable, efficient, and provide you with all the vital information at a glance. Finpros Spain understands this implicitly.”

Choosing your platform with Finpros Spain means opting for reliability and innovation. They constantly update their offerings to ensure you have access to the latest technological advancements in the trading world. Take the time to explore each option, perhaps even with a demo account, to find the environment where your trading strategies can truly flourish. Your journey into profitable forex trading starts with the right platform, and Finpros Spain is here to guide you every step of the way.

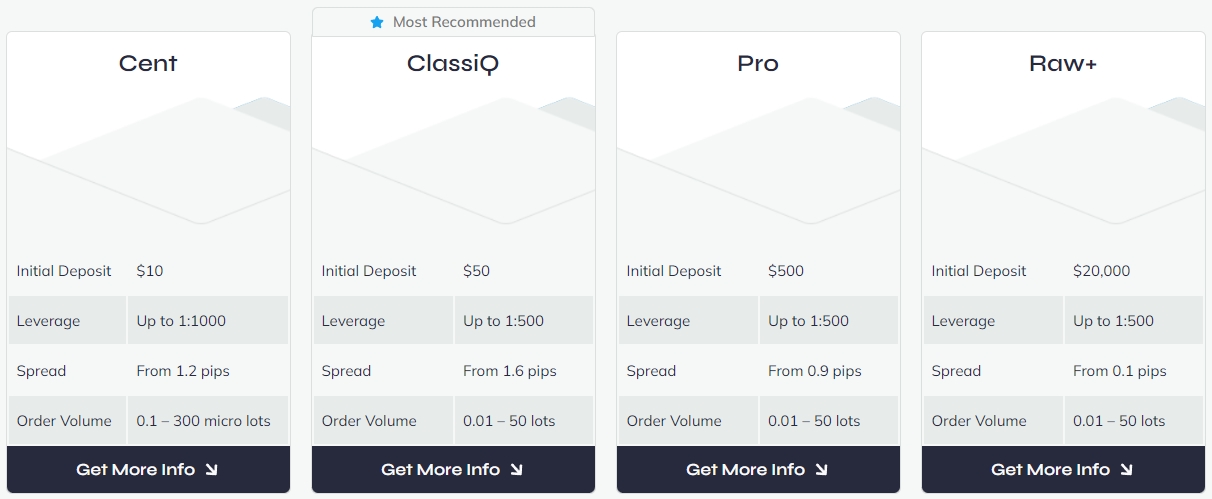

Account Types and Tailored Conditions for Finpros Spain Clients

Navigating the world of forex trading requires the right tools, and for clients in Spain, choosing an account type that aligns with your individual trading goals and experience level is crucial. Finpros Spain understands that every trader is unique, offering a comprehensive suite of account options designed to cater to both beginners taking their first steps and seasoned professionals seeking advanced features. We believe your trading environment should adapt to you, not the other way around.

Our commitment to providing exceptional **trading conditions** for the **Spanish market** means we constantly review and optimize our offerings. This ensures you always have access to highly competitive spreads, flexible leverage options, and robust execution, all backed by world-class technology.

Discover Your Ideal Finpros Spain Account

We pride ourselves on diversity, presenting various **account options** to suit different trading preferences and capital sizes. Here’s a glimpse into the tailored features you can expect:

- Standard Account: Perfect for new traders or those preferring a straightforward approach. Enjoy competitive spreads, no commissions on major currency pairs, and access to a full range of trading instruments.

- Premium Account: Designed for more active traders seeking tighter spreads and enhanced features. This account often comes with lower trading costs and personalized support.

- ECN Account: For experienced traders who demand raw spreads directly from liquidity providers. This account type typically features commissions per trade but offers the purest execution environment.

- Islamic Account (Swap-Free): Adhering to Sharia law, these accounts allow traders to participate in the forex market without accruing or paying swap charges on overnight positions.

Each account type is meticulously crafted to provide a distinct **forex trading experience**, ensuring that whether you’re trading minor pairs or major indices, you have the ideal setup.

Key Advantages of Finpros Spain Accounts

Choosing Finpros Spain means opting for a partner dedicated to your success. Our account offerings come packed with benefits that empower your trading journey:

| Feature | Benefit to You |

|---|---|

| Competitive Spreads | Minimize your trading costs with some of the tightest spreads in the industry, especially on popular currency pairs. |

| Flexible Leverage | Manage your risk and potential returns with leverage options that you can adjust to your comfort level, in line with regulatory guidelines. |

| Advanced Trading Platforms | Access industry-leading platforms like MetaTrader 4 and MetaTrader 5, renowned for their powerful charting tools, analytical features, and automated trading capabilities. |

| Diverse Deposit Methods | Fund your account easily and securely through a variety of convenient **deposit methods**, including bank transfers, credit/debit cards, and e-wallets, tailored for the Spanish market. |

| Dedicated Customer Support | Receive multilingual **customer support** from a team that understands the local market, ready to assist you with any query. |

We understand the local nuances and preferences of Spanish traders. This insight allows us to provide more than just a trading account; we offer a complete support system. From educational resources specifically designed for the **Finpros Spain accounts** to responsive **customer support**, we strive to make your trading journey as smooth and profitable as possible. We are here to help you unlock your full potential in the global financial markets.

Spreads, Commissions, and Transparent Fee Structure at Finpros Spain

Understanding trading costs is crucial for any successful forex trader. At Finpros Spain, we believe in crystal-clear communication about our fee structure. This commitment to transparency ensures you always know exactly what you pay, allowing you to manage your capital effectively and focus purely on your trading strategies. We empower our clients with a straightforward, no-hidden-surprises approach to trading expenses.

What You Need to Know About Spreads at Finpros Spain

The spread is the difference between the bid and ask price of a currency pair, and it’s a primary trading cost in the forex market. Finpros Spain is proud to offer highly competitive spreads across a vast range of instruments. Our goal is to provide tight spreads, especially on major currency pairs, so your entry and exit points are as close as possible to the market price.

- Variable Spreads: We generally offer variable spreads, which fluctuate based on market conditions, liquidity, and volatility. This dynamic pricing often leads to tighter spreads during peak trading hours.

- Major Pairs Advantage: You’ll find particularly attractive spreads on popular pairs like EUR/USD, GBP/USD, and USD/JPY, making your day trading and scalping strategies more viable.

- Market Depth: Our advanced technology connects you to deep liquidity pools, contributing directly to our ability to offer some of the industry’s most favorable spreads.

Commissions: When and Why at Finpros Spain

While many of our trading instruments are offered with spread-only pricing, Finpros Spain also provides account types that feature commissions. This typically applies to our ECN (Electronic Communication Network) accounts, which offer raw, interbank spreads that are incredibly tight, sometimes even zero during calm market conditions. In return for these minimal spreads, a small commission applies per trade.

Here’s how our commission structure typically works:

| Account Type | Spread Type | Commissions |

|---|---|---|

| Standard Account | Variable Spreads | None (Spread-only) |

| ECN Account | Raw Spreads | Small Per-Lot Charge |

This hybrid model allows you to choose the pricing structure that best fits your individual trading style and preferences. If you prefer the lowest possible entry costs, an ECN account with commissions could be your ideal choice.

Beyond Spreads and Commissions: Our Transparent Fee Structure

Finpros Spain is committed to a fully transparent fee environment. We ensure all potential trading costs are clear and easily accessible. Here are other elements of our fee structure you should be aware of:

Overnight (Swap) Fees: When you hold positions open past a certain time each day (typically 5 PM EST), you might incur or receive a swap fee. This charge reflects the interest rate differential between the two currencies in a pair. Some pairs might generate positive swaps, meaning you earn interest, while others incur a charge.

Inactivity Fees: We do not impose inactivity fees on your account. We believe your funds should be available when you need them, without penalty for periods of non-trading.

Deposit and Withdrawal Fees: Finpros Spain strives to minimize transaction costs. We generally do not charge for deposits. While some withdrawal methods might have a nominal fee imposed by the payment processor, we aim to offer several free withdrawal options to ensure you can access your funds efficiently and affordably.

At Finpros Spain, our transparent fee structure is designed to build trust and provide you with a predictable trading environment. We want you to focus on market analysis and strategy, not on deciphering complex cost breakdowns. Join us and experience trading with clarity and confidence.

Deposits and Withdrawals: Funding Your Account with Finpros Spain

Your journey into the exciting world of forex trading requires a reliable and secure way to manage your funds. At Finpros Spain, we understand this critical need. We have streamlined our deposit and withdrawal processes to be as efficient, secure, and user-friendly as possible, ensuring you can focus on what truly matters: your trading strategy.

Getting your trading capital into your Finpros Spain account and taking profits out should never be a hurdle. We offer a variety of popular methods, each designed for speed and convenience, while upholding the highest standards of financial security. Our commitment is to give you peace of mind, knowing your money is always safe and accessible.

Funding Your Trading Account: Deposits Made Easy

Adding funds to your Finpros Spain account is a straightforward process, designed to get you trading without unnecessary delays. We provide multiple options to suit your preferences, ensuring flexibility for all our clients.

- Bank Transfers: A traditional and secure method for larger deposits. Funds typically reflect in your account within 1-3 business days, depending on your bank and location.

- Credit/Debit Cards: Instant and convenient. Use your Visa or MasterCard for immediate access to your trading capital. This is often the quickest way to fund your account.

- E-Wallets: Popular digital payment solutions like Skrill and Neteller offer fast and secure transactions, often reflecting funds within minutes.

We prioritize your security above all else. All deposit methods utilize advanced encryption technologies to protect your personal and financial information. Rest assured, your funds are segregated in top-tier banks, providing an extra layer of safety.

Accessing Your Profits: Simple Withdrawals

When you’ve achieved your trading goals and want to withdraw your profits, Finpros Spain makes the process equally simple and secure. We aim for quick processing times so you can access your earnings without hassle.

To ensure the utmost security and comply with international financial regulations, we may require standard verification documents before processing your first withdrawal. This is a one-time step that protects both you and your funds from unauthorized access.

Withdrawal Methods and Typical Processing Times:

| Method | Typical Processing Time (after approval) | Notes |

|---|---|---|

| Bank Transfer | 3-5 Business Days | Secure, suitable for larger amounts. |

| Credit/Debit Card | 2-5 Business Days | Funds returned to the original card used for deposit. |

| E-Wallets | 1-2 Business Days | Fastest option for many clients. |

Remember, withdrawal times can sometimes vary depending on the specific payment provider and your bank’s processing procedures. Our dedicated support team is always ready to assist you with any questions regarding your transactions.

“Effortless funding and swift withdrawals are foundational to a great trading experience. At Finpros Spain, we’ve built our system to provide exactly that: reliability and convenience at every step.” – Finpros Spain Client Relations Team

Choose Finpros Spain for a seamless financial experience. Focus on your trading strategies and let us handle the secure and efficient management of your deposits and withdrawals. Your success is our priority.

Customer Support and Educational Resources from Finpros Spain

At Finpros Spain, we understand that successful forex trading hinges on more than just robust platforms and competitive spreads. It requires unwavering support and continuous learning. That’s why we dedicate ourselves to providing top-tier customer support and comprehensive educational resources designed to empower every trader, from novice to expert. Our goal is to ensure you never feel alone on your trading journey.

Responsive and Accessible Customer Support

Our dedicated customer support team stands ready to assist you with any questions or issues that may arise. We believe in proactive, clear communication, ensuring you receive the help you need precisely when you need it. We know time is critical in the financial markets, and our team is trained to provide swift, accurate solutions.

- Multi-Channel Availability: Reach our support specialists through live chat, email, or phone. Choose the method that best suits your needs and get a prompt response.

- Local Expertise: Our team members are familiar with the unique aspects of trading in Spain and are ready to provide tailored assistance.

- Expert Guidance: Whether you need help navigating your trading platform, understanding account settings, or clarifying market conditions, our knowledgeable professionals are here for you.

We pride ourselves on creating a supportive environment where every client feels valued and heard. Your success is our priority, and our customer support reflects that commitment every single day.

Empowering Your Trading Journey with Educational Resources

Knowledge is power, especially in the dynamic world of forex trading. Finpros Spain offers an extensive library of educational resources, meticulously crafted to help you master the markets and refine your trading strategies. We cover everything from the basics of currency pairs to advanced technical analysis, ensuring a structured path for continuous improvement.

Our educational offerings are designed to cater to diverse learning styles and experience levels:

For Beginners:

- Introductory Guides: Learn the fundamentals of the forex market, common terminology, and how to place your first trade.

- Video Tutorials: Visual step-by-step guides on using our trading platforms and essential features.

- Webinars for New Traders: Live sessions breaking down core concepts and common pitfalls to avoid.

For Experienced Traders:

- Advanced Strategy Articles: Dive deep into complex trading strategies, risk management techniques, and market psychology.

- Expert Market Analysis: Gain insights from our seasoned analysts on current market trends, economic indicators, and potential trading opportunities.

- Live Webinars and Workshops: Participate in interactive sessions focusing on advanced technical analysis, fundamental drivers, and practical application of trading theories.

By leveraging these comprehensive educational resources, you can sharpen your skills, make more informed decisions, and build confidence in your ability to navigate the global currency markets. Finpros Spain is your partner in achieving your trading ambitions, providing the tools and knowledge you need to thrive.

Advantages of Choosing Finpros Spain for Your Trading Needs

Embarking on your trading journey requires a partner you can trust, one that offers both robust technology and unwavering support. Finpros Spain stands out as a premier choice for traders looking to navigate the dynamic world of financial markets. We understand the intricacies of online trading and have tailored our services to meet the diverse needs of both novice and experienced investors.

Our commitment extends beyond just providing a platform; we aim to empower you with the tools, knowledge, and secure environment necessary to achieve your trading aspirations. From cutting-edge technology to dedicated local expertise, discover why Finpros Spain is the intelligent decision for your financial future.

What Makes Finpros Spain Stand Out?

Choosing the right brokerage can significantly impact your trading success. Finpros Spain offers a comprehensive package designed to give you an edge in the markets:

- Robust Regulatory Compliance: Operating under stringent financial regulations, we ensure a secure and transparent trading environment. Your capital’s safety is our top priority, giving you peace of mind as you focus on your strategies.

- Advanced Trading Platform: Access our intuitive, powerful trading platform equipped with state-of-the-art charting tools, real-time market data, and lightning-fast execution speeds. Whether you prefer desktop, web, or mobile trading, our platform adapts to your style.

- Diverse Investment Opportunities: Expand your portfolio with a wide range of trading instruments. From major and minor forex pairs to commodities, indices, and cryptocurrencies, Finpros Spain provides access to global markets right at your fingertips.

- Competitive Spreads and Transparent Pricing: We believe in fair and clear pricing. Benefit from tight spreads and transparent fee structures, ensuring you always know the costs associated with your trades. There are no hidden charges to surprise you.

- Exceptional Customer Support: Our dedicated, multilingual support team is available to assist you with any questions or issues. We pride ourselves on prompt, professional service, ensuring your trading experience is as smooth as possible.

- Comprehensive Educational Resources: Whether you’re just starting or looking to refine your strategies, our extensive library of educational materials, webinars, and market analysis articles will help you grow as a trader. Knowledge is power, and we equip you with plenty of it.

Trader Testimonial

“I’ve traded with several brokers over the years, but Finpros Spain truly stands out. The platform is incredibly user-friendly, and their customer service is top-notch. It feels like they genuinely care about my success. The competitive spreads on forex pairs have made a noticeable difference to my bottom line.” – Alejandro M., Finpros Spain Client

Comparative Benefits of Trading with Finpros Spain

| Feature | Benefit for You |

|---|---|

| Regulated Environment | Enhanced security and trust for your capital. |

| Advanced Platform | Efficient execution and powerful analytical tools. |

| Wide Asset Selection | Diversify your portfolio across various global markets. |

| Tight Spreads | Lower trading costs, potentially increasing profitability. |

| Local Spanish Support | Personalized assistance tailored to your needs. |

| Educational Tools | Continuous learning and skill development. |

Choosing Finpros Spain means opting for a trusted partner dedicated to your trading success. We combine state-of-the-art technology with a human touch, offering an environment where you can learn, grow, and thrive in the financial markets.

Potential Drawbacks and Considerations for Finpros Spain Users

Every financial platform, no matter how promising, comes with its own set of challenges and factors to weigh carefully. While Finpros Spain offers numerous opportunities for traders, it’s vital for potential and current users to understand the potential drawbacks and make informed decisions. Being aware of these points helps you navigate your trading journey with greater confidence and manage your expectations effectively.

Regulatory Landscape and Compliance Hurdles

Operating within a specific national framework means adhering to local regulations, which can sometimes introduce complexities. The regulatory environment in Spain, while designed to protect consumers, can also lead to specific limitations or requirements for the trading platform. Users might encounter:

- Changes in leverage limits on certain instruments, directly impacting your trading strategy.

- Stricter verification processes, potentially extending the time needed to open or fully activate an account.

- Specific reporting obligations that might differ from those in other jurisdictions.

Staying updated on these aspects of regulatory compliance is crucial for a smooth user experience and to avoid unexpected surprises.

Platform Performance and Technical Reliability

Even the most advanced technology can face glitches. While Finpros Spain strives for robust performance, users might occasionally encounter:

- Temporary platform downtime during peak trading hours, which can affect order execution.

- Latency issues, especially during periods of high market volatility, leading to slight delays in price updates.

- Bugs or minor technical issues that could impact the seamless operation of certain features.

Understanding these possibilities allows you to prepare for them and have contingency plans, like monitoring market news through other sources.

Scrutinizing Fee Structures and Hidden Costs

While a platform might advertise competitive spreads, it’s essential to dig deeper into the entire fee structure. Some considerations for Finpros Spain users include:

| Consideration | Potential Impact |

|---|---|

| Inactive Account Fees | Charges for accounts that remain dormant for an extended period, eating into your capital. |

| Withdrawal Fees | Some methods for the withdrawal process might incur charges, reducing the amount you receive. |

| Overnight/Swap Fees | Costs associated with holding positions open overnight, which can accumulate significantly for long-term trades. |

Always review the full terms and conditions to ensure you have a complete picture of all potential costs, ensuring a transparent user experience.

Challenges with Customer Support and Accessibility

Effective customer support is the backbone of any reliable financial service. While Finpros Spain aims to assist users, potential considerations include:

- Availability hours that might not perfectly align with all trading schedules, especially for those trading outside standard business times.

- Language barriers, although less likely in Spain, can still be a concern if specific technical terms are not clearly communicated.

- Response times during periods of high demand, where getting immediate assistance might be challenging.

It’s always wise to test the support channels yourself before depositing significant capital.

Understanding Potential Risks and Account Security

Trading inherently involves risk, and no platform can eliminate the chance of losses. Users of Finpros Spain must deeply understand the potential risks associated with leveraged products and market volatility. Beyond market risks, considerations for account security include:

Always employ strong, unique passwords and enable two-factor authentication. Vigilance against phishing attempts and unauthorized access is paramount for protecting your investments.

No system is entirely immune to sophisticated cyber threats. Taking personal responsibility for your account’s security protocols is a vital layer of protection.

How to Open an Account with Finpros Spain: A Step-by-Step Guide

Ready to dive into the exciting world of global financial markets? Opening an account with Finpros Spain is your first step towards unlocking incredible trading opportunities. Whether you’re a seasoned investor or taking your very first steps in forex trading, our straightforward process makes getting started incredibly easy. We guide you through every stage, ensuring a smooth journey from application to your very first trade.

Your Path to Becoming a Finpros Spain Trader

We’ve streamlined the account opening process to be as efficient and user-friendly as possible. Follow these simple steps to begin your investment journey with confidence:

-

Visit the Official Finpros Spain Website

Your journey begins at our secure, user-friendly website. Navigate to the “Open Account” or “Register” section, typically found prominently on the homepage. This is where you’ll initiate the online application process. Our platform ensures your data remains protected from the moment you start.

-

Select Your Preferred Account Type

Finpros Spain offers various account types tailored to different trading styles and experience levels. Consider whether you need a demo account to practice with virtual funds or a live trading account to access real financial markets. You’ll also choose between an individual or corporate account based on your legal entity. We provide flexibility to match your specific needs.

-

Complete the Online Application Form

Fill out the comprehensive online form with accurate personal and financial information. This includes details like your name, contact information, country of residence (Spain, in this case), and relevant trading experience. We ask these questions to ensure we provide you with the most suitable services and comply with stringent regulatory standards.

-

Submit Required Verification Documents

As a regulated online broker, Finpros Spain requires identity and residency verification to ensure the security of your account and comply with global anti-money laundering (AML) regulations. Prepare clear, readable copies of documents such as a valid government-issued ID (passport or national ID card) and a proof of address (a recent utility bill or bank statement dated within the last three months). Upload these securely through our dedicated portal. Our team works quickly to review your submissions.

-

Fund Your Trading Account

Once your application and documents are approved, it’s time to deposit funds into your new trading account. Finpros Spain supports various secure payment methods, including bank transfers, major credit/debit cards, and popular e-wallets. Choose the method most convenient for you and ensure you meet the minimum deposit requirement. We make funding easy so you can focus on your trades.

-

Start Trading on Our Advanced Platform

Congratulations! With your account funded, you now have full access to our powerful trading platform. Explore the wide range of instruments, utilize our advanced analytical tools, and execute your first trade with confidence. Our platform is designed for both beginner traders and experienced investors, offering robust features and intuitive navigation for an optimal trading experience.

What You Need to Prepare Before You Start

To ensure a smooth and rapid account opening process, have the following items ready:

- A valid email address and an active phone number.

- Your national ID card or passport for identity verification.

- A recent utility bill or bank statement (dated within the last three months) as proof of address.

- Basic information about your financial situation and any previous trading experience.

“Opening your Finpros Spain account is a straightforward path to engaging with global financial markets. Our dedicated support team is always ready to assist you if you encounter any questions during the process. Take this step today and begin your exciting investment journey with a trusted partner!”

Finpros Spain: User Reviews and Reputation Analysis

Diving into the world of online trading demands trust, and for many in Spain, Finpros has emerged as a significant player. But what do their actual users say? Understanding the real-world experiences of traders is paramount to grasping a broker’s true standing. We’re not just looking at glossy marketing; we’re peeling back the layers to see the unfiltered feedback that shapes Finpros Spain’s reputation.

User reviews offer invaluable insights, painting a picture that official statements often miss. They highlight the practical aspects of trading with Finpros, from the ease of account setup to the speed of trade execution and the crucial process of withdrawing funds. A strong, positive reputation isn’t built on promises; it’s forged through consistent, reliable service that meets and often exceeds trader expectations.

When you sift through forums, social media, and dedicated review sites, several themes consistently appear regarding Finpros Spain. Traders frequently comment on:

- Platform Usability: Is the trading interface intuitive for beginners and powerful enough for seasoned pros?

- Customer Support Responsiveness: How quickly and effectively does Finpros address queries and resolve issues?

- Withdrawal Process: This is a major point for any broker. Are withdrawals smooth, timely, and free from unexpected hurdles?

- Educational Resources: Does the broker provide tools and materials to help traders improve their skills?

- Pricing and Fees: Are the spreads competitive, and are there any hidden costs?

Analyzing the aggregate sentiment reveals a mixed but generally positive outlook for Finpros Spain. Many users praise their dedicated customer service team and the reliability of their trading platform. They appreciate the range of assets available for trading, giving them diverse opportunities. However, like any large broker, there are always areas for improvement, and some reviews point to occasional delays during peak market volatility or specific account verification processes. It’s a testament to their commitment that Finpros often responds directly to feedback, demonstrating an effort to engage and improve.

Ultimately, Finpros Spain’s reputation is a living entity, constantly evolving with each new trade and every interaction. It reflects a broker striving to build a reliable environment for traders in a competitive market, balancing robust features with responsive support to foster trust and long-term relationships.

Comparing Finpros Spain with Other Brokers in the Spanish Market

Choosing the right broker in the vibrant Spanish market is a crucial decision for anyone looking to dive into forex trading and CFDs. With numerous options available, understanding where Finpros Spain stands among its competitors can help you make an informed choice. We’ll explore key areas where brokers differentiate themselves, from trading platforms to regulatory compliance and customer support.

When evaluating brokers, you generally look for a blend of features that align with your trading style and investment goals. Factors like competitive spreads, available account types, and robust risk management tools play a significant role. Let’s stack Finpros Spain against some common offerings you might find.

Consider these vital aspects when comparing brokers:

- Regulatory Compliance: Is the broker regulated by reputable authorities, offering investor protection?

- Trading Platforms: Do they offer industry-standard platforms like MetaTrader or a proprietary, user-friendly interface?

- Spreads and Commissions: How competitive are their pricing structures for various assets?

- Market Access: What range of instruments can you trade – currency pairs, commodities, indices, stocks?

- Customer Support: Is local language support available, and how responsive are they?

- Educational Resources: Do they provide tools and materials for both beginner traders and experienced investors?

Here’s a quick glance at how Finpros Spain might compare in a few key areas with typical offerings in the Spanish market:

| Feature | Finpros Spain | Competitor A (Large International Broker) | Competitor B (Niche Local Broker) |

|---|---|---|---|

| Regulatory Body | CNMV (Spain), CySEC (EU) | FCA (UK), CySEC (EU) | CNMV (Spain) |

| Trading Platform | MetaTrader 4/5, Proprietary Web Platform | MetaTrader 4/5, cTrader, Proprietary | MetaTrader 4/5 |

| Average EUR/USD Spread | From 1.0 pips | From 0.8 pips | From 1.2 pips |

| Customer Support | Spanish-speaking, 24/5 via phone, chat, email | Multi-language, 24/5 global coverage | Spanish-speaking, business hours |

| Educational Resources | Extensive webinars, articles, market analysis | Videos, tutorials, market insights | Basic articles, platform guides |

Finpros Spain really shines with its commitment to localized support and a strong emphasis on providing excellent educational resources. This makes it an attractive choice for both those new to online trading and seasoned traders seeking to refine their strategies. Their market access is broad, allowing you to diversify your investment opportunities effectively. The user-friendly trading platform ensures a smooth experience, critical for managing your positions efficiently and reacting to market movements quickly. The focus on strong regulatory compliance also offers peace of mind.

While some larger international brokers might boast slightly tighter spreads on a few popular currency pairs, Finpros Spain often balances this with transparency and a comprehensive service package. For instance, the execution speed on trades is consistently reliable, which is a major advantage during volatile market conditions. For Spanish traders, having dedicated, local customer support is invaluable for navigating any queries or technical issues without language barriers.

“Choosing a broker is not just about the lowest spread. It’s about a complete ecosystem that supports your trading journey, from reliable platforms to responsive support and robust security measures.” – Market Analyst, Global FX Insights.

Ultimately, your ideal broker depends on your unique needs. Finpros Spain presents a very strong case for traders in the Spanish market, offering a blend of strong regulatory oversight, diverse trading instruments, and excellent client-focused services. It consistently proves itself a reliable partner for your forex and CFD investment pursuits, making it a compelling option against other brokers in the competitive landscape.

The Future Outlook for Finpros Spain in the Iberian Peninsula

The Iberian Peninsula, encompassing Spain and Portugal, presents a dynamic landscape for financial technology and trading platforms. Finpros Spain is strategically positioned to capitalize on this vibrant market. We see a future filled with significant growth, driven by an increasing demand for sophisticated yet accessible financial tools and education.

Our vision for Finpros in this region is not merely about expansion; it’s about deepening our commitment to our users and the financial community. We aim to become the undisputed leader in providing a secure, innovative, and user-centric trading experience across the entire peninsula.

Key Growth Drivers for Finpros in the Iberian Peninsula:

- Digital Transformation: The ongoing shift towards digital financial services continues to accelerate. More individuals and businesses are embracing online trading platforms, recognizing the convenience and efficiency they offer.

- Economic Resilience: Spain and Portugal demonstrate strong economic resilience. This fosters a conducive environment for investment and trading activities, attracting both seasoned traders and newcomers.

- Increased Financial Literacy: There’s a growing appetite for financial knowledge and personal wealth management. Finpros Spain is dedicated to empowering users through comprehensive educational resources and intuitive platforms.

- Technological Innovation: Continuous advancements in trading technology, including AI-driven analytics and enhanced mobile trading capabilities, will further drive adoption and engagement.

Strategic Pillars for Future Success:

| Pillar | Description |

|---|---|

| Market Penetration | Strengthening our presence in key Spanish cities and expanding our reach into the Portuguese market with tailored offerings. |

| Product Diversification | Introducing new asset classes and innovative trading tools to meet the evolving needs of our diverse user base. |

| User Experience Excellence | Investing in cutting-edge platform development to ensure seamless, intuitive, and highly responsive user interfaces on all devices. |

| Community Building | Fostering a strong community through local events, webinars, and dedicated support, positioning Finpros as a trusted partner. |

“The Iberian Peninsula represents a fertile ground for innovation in financial services. Finpros Spain is committed to leading this charge, delivering unparalleled value and empowering traders with the tools and knowledge they need to succeed.”

The path forward involves navigating competitive landscapes and adapting to evolving regulatory frameworks. However, with our robust technology, dedicated team, and customer-first approach, Finpros Spain is exceptionally well-prepared to overcome any challenges. We envision a future where Finpros is synonymous with reliable, intelligent, and empowering trading for every individual across Spain and Portugal.

Frequently Asked Questions

What is Finpros Spain?

Finpros Spain is a prominent online broker offering comprehensive trading solutions across various financial markets, including forex, commodities, indices, stocks, and cryptocurrencies, catering to both novice and experienced traders in Spain and the wider Iberian Peninsula.

Is Finpros Spain regulated, and how does it protect investors?

Yes, Finpros Spain operates under a regulated framework, adhering to robust financial regulations overseen by the Comisión Nacional del Mercado de Valores (CNMV) in Spain. It implements measures like segregation of client funds, investor compensation schemes (FOGAIN), and negative balance protection to safeguard client interests.

What types of trading instruments are available on Finpros Spain?

Finpros Spain provides access to a diverse range of trading instruments, including Forex (major, minor, exotic currency pairs), Stocks & Shares (CFDs), Indices (CFDs), Commodities (CFDs like gold, oil), and Cryptocurrencies (CFDs like Bitcoin, Ethereum).

What trading platforms does Finpros Spain offer?

Finpros Spain offers industry-leading trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside a proprietary web platform. These platforms are equipped with advanced charting tools, real-time data, and mobile accessibility for flexible trading.

How can I open a trading account with Finpros Spain?

Opening an account with Finpros Spain involves visiting their official website, selecting an account type (e.g., Standard, Premium, ECN), completing an online application form, submitting required verification documents (ID, proof of address), funding your account, and then you can start trading.