Are you ready to unlock the exciting world of online trading right here in South Africa? Finpros South Africa is your trusted partner, dedicated to providing a seamless and powerful trading experience for everyone, from absolute beginners to seasoned market veterans. We understand the unique aspirations of local investors and are here to guide you through every step of your financial journey.

The digital age has transformed how we approach investment opportunities. Gone are the days when trading was exclusive to the elite. Today, with the right platform and knowledge, anyone can participate in global financial markets. Finpros South Africa empowers you with the tools, resources, and insights needed to navigate these markets confidently and effectively.

Why choose online trading with Finpros South Africa?

- Accessibility: Trade from anywhere, at any time, with just an internet connection. Your office is wherever you are!

- Diverse Markets: Gain access to a vast array of instruments, including forex, commodities, indices, and CFDs.

- Empowerment: Take control of your financial future and make informed decisions based on real-time data.

- Growth Potential: Discover incredible opportunities to grow your capital through strategic trading.

We believe that successful online trading in South Africa starts with a solid foundation. That’s why Finpros focuses on delivering an intuitive trading experience, robust security, and comprehensive support. Whether you’re interested in short-term gains or long-term portfolio growth, our platform is designed to meet your needs.

Join the growing community of South African traders who are choosing Finpros for their online investment needs. Your ultimate guide to mastering the financial markets begins here.

- Understanding Finpros in the South African Market

- Why Consider Finpros for Your South African Trading Journey?

- Is Finpros Regulated for South African Traders?

- Why FSCA Regulation Matters for Your Trading Journey:

- Key Trading Platforms Offered by Finpros

- MetaTrader 4 (MT4): The Industry Standard

- MetaTrader 5 (MT5): The Next Generation

- Finpros WebTrader: Trade Directly from Your Browser

- Mobile Trading Apps: Trade on the Go

- MetaTrader 4 (MT4) for Finpros Clients

- MetaTrader 5 (MT5) Features and Benefits

- Finpros Account Types for South African Traders

- What to Expect from Finpros Account Options

- Key Considerations for Your Finpros Account

- Funding Your Finpros South Africa Account

- Choose Your Deposit Method

- A Simple Guide to Funding Your Account

- Why Fund with Finpros South Africa?

- Deposit Methods and Currencies

- Popular Deposit Options at Your Fingertips

- Trade in Your Preferred Currency

- What to Consider When Depositing

- Withdrawal Process and Timeframes

- How to Withdraw Your Funds

- What Influences Withdrawal Speed?

- Typical Withdrawal Methods and Their Timeframes

- Pro Tips for a Seamless Withdrawal

- Range of Tradable Assets with Finpros

- Forex (Foreign Exchange)

- Commodities

- Indices

- Cryptocurrencies

- Shares (Stocks)

- Understanding Finpros Trading Costs and Spreads

- The Essentials of Trading Spreads

- Beyond the Spread: Other Trading Costs

- Why Transparent Pricing Matters for Your Profitability

- Customer Support and Local Assistance

- Educational Tools and Resources for Beginners

- Your Essential Learning Toolkit

- Advantages of Using Educational Resources

- The Benefits of Choosing Finpros South Africa

- Why Finpros South Africa is Your Smart Choice:

- Potential Drawbacks to Consider for South African Users

- Regulatory Landscape and Broker Choices

- The Volatility of the South African Rand (ZAR)

- Practical Challenges: Deposits, Withdrawals, and Taxation

- How Finpros Compares to Other South African Brokers

- Getting Started: Opening a Finpros South Africa Account

- Your Smooth Path to Trading: The Finpros Account Opening Process

- What You Need: Documents for Verification

- Why Choose Finpros for Your South African Trading Journey?

- Finpros South Africa: Frequently Asked Questions

- What exactly is Finpros South Africa and what services do you offer?

- Is Finpros South Africa a regulated broker, and what safety measures are in place for my funds?

- What trading platforms does Finpros South Africa offer, and what are their key advantages?

- Why Choose Our Platforms?

- Frequently Asked Questions

Understanding Finpros in the South African Market

The financial landscape in South Africa is vibrant and dynamic, attracting a growing number of individuals eager to explore the world of online trading. Amidst this exciting environment, understanding platforms like Finpros becomes crucial for anyone looking to navigate forex, commodities, and other financial instruments. Finpros, as a player in this space, aims to provide tools and resources for traders, from novices taking their first steps to seasoned pros refining their strategies. Its presence in the South African market signifies a commitment to offering accessible trading opportunities to a diverse clientele.

South Africa presents a unique blend of opportunities and challenges for traders. A robust regulatory framework and increasing digital literacy contribute to a fertile ground for online trading platforms. However, local economic factors and specific market dynamics mean that a one-size-fits-all approach rarely works. This is where a platform’s adaptability and understanding of local nuances truly shine. We see a growing demand for user-friendly interfaces, reliable execution, and responsive customer support tailored to the South African context.

Why Consider Finpros for Your South African Trading Journey?

As you explore your trading options, here are some points that highlight the potential appeal of Finpros for South African traders:

- Local Market Relevance: Platforms that understand and cater to the specific trading hours, currency pairs, and regulatory environment pertinent to South Africa offer a distinct advantage.

- Accessibility and Usability: A platform designed for ease of use, ensuring that traders can focus on market analysis rather than grappling with complex software.

- Diverse Instrument Offerings: Access to a broad range of assets, including popular forex pairs, local indices, and commodities relevant to the global and African economies.

- Educational Resources: Support for learning and skill development is vital. This includes webinars, articles, and tutorials that help traders make informed decisions.

- Responsive Support: Knowing that help is readily available when you need it, ideally with an understanding of local time zones and communication preferences.

The journey into online trading can be incredibly rewarding, offering a path to financial independence and the thrill of engaging with global markets. Platforms like Finpros strive to be a reliable partner on this journey, offering the necessary infrastructure and support. Whether you are interested in short-term speculation or long-term investment strategies, a clear understanding of your chosen platform’s capabilities and its suitability for the South African market is paramount. It’s about empowering you to make confident decisions in an ever-evolving financial landscape.

Is Finpros Regulated for South African Traders?

Navigating the forex market as a South African trader brings a crucial question to the forefront: is your broker properly regulated? This isn’t just a technicality; it’s a fundamental pillar of secure and reliable trading. For those considering Finpros, understanding its regulatory status for South African traders is paramount to protecting your investments and ensuring a fair trading experience.

South Africa has a robust regulatory framework designed to safeguard investors. The primary watchdog in this landscape is the Financial Sector Conduct Authority (FSCA). The FSCA is responsible for overseeing financial institutions and ensuring market integrity within the country. Any legitimate forex broker wishing to offer services to South African residents must hold a valid Financial Services Provider (FSP) license issued by the FSCA.

When you look into a broker like Finpros, your first step should always be to verify their FSCA registration. You can usually find this information clearly displayed on the broker’s official website, often in the footer or a dedicated ‘About Us’ or ‘Regulation’ section. They will typically provide an FSP number, which you can then cross-reference directly on the FSCA’s public register. This simple check offers you immense clarity and peace of mind.

Why FSCA Regulation Matters for Your Trading Journey:

- Investor Protection: The FSCA enforces strict rules regarding client fund segregation. This means your money stays separate from the broker’s operational funds, offering protection if the broker faces financial difficulties.

- Fair Trading Practices: Regulated brokers must adhere to ethical standards and transparent pricing. This helps prevent manipulation and ensures you get fair execution on your trades.

- Complaint Resolution: If a dispute arises, you have a formal channel to seek resolution through the FSCA. They act as an impartial mediator, providing an essential layer of recourse.

- Capital Requirements: Regulated brokers must meet specific capital adequacy requirements, demonstrating their financial stability and ability to meet their obligations.

- Transparency: Regulators demand clear and honest communication from brokers regarding their services, fees, and risks, empowering you to make informed decisions.

Therefore, before you commit your capital, always prioritize verifying the regulatory status of Finpros or any other broker you consider. This due diligence isn’t merely a recommendation; it’s an essential part of responsible forex trading in South Africa. Choose a regulated broker to ensure a secure and trustworthy environment for your financial aspirations.

Key Trading Platforms Offered by Finpros

At Finpros, we understand that a powerful and reliable trading platform is the cornerstone of a successful trading journey. That’s why we equip our traders with access to industry-leading platforms, designed to meet the diverse needs of both new and experienced market participants. Each platform offers unique features and functionalities, ensuring you find the perfect environment to execute your strategies, analyze the market, and manage your portfolio with precision.

We carefully selected these platforms based on their robust performance, user-friendly interfaces, and extensive toolkits. Whether you prefer the desktop experience, web-based convenience, or the flexibility of mobile trading, Finpros has you covered. Explore the options and discover which platform aligns best with your trading style:

MetaTrader 4 (MT4): The Industry Standard

MetaTrader 4 remains the most popular choice among forex traders worldwide, and for good reason. It offers an unparalleled combination of advanced charting tools, technical analysis indicators, and the ability to automate your trading strategies using Expert Advisors (EAs). Finpros proudly supports MT4, providing a stable and secure environment for your trades.

- Comprehensive Charting: Access multiple timeframes and an array of analytical objects.

- Expert Advisors (EAs): Automate your trading around the clock without manual intervention.

- Customizable Interface: Tailor your workspace to fit your personal preferences.

- Reliable Performance: Execute trades quickly and efficiently with minimal latency.

- Extensive Indicator Library: Utilize a vast selection of built-in and custom indicators.

MetaTrader 5 (MT5): The Next Generation

For traders seeking even more power and flexibility, MetaTrader 5 builds upon the success of its predecessor by offering enhanced features and access to a broader range of markets. MT5 from Finpros is a multi-asset platform, perfect for those who want to diversify their trading beyond just currency pairs.

| Feature | MT5 Advantage |

|---|---|

| Number of Timeframes | 21 different timeframes for in-depth analysis. |

| Economic Calendar | Integrated calendar for tracking key market events. |

| Order Types | Advanced order types, including Buy Stop Limit and Sell Stop Limit. |

| Market Depth | View market depth (Level II data) to gauge liquidity. |

MT5 provides additional analytical tools, more graphical objects, and faster processing speeds, making it an excellent choice for scalpers and day traders who demand immediate data and swift execution.

Finpros WebTrader: Trade Directly from Your Browser

No downloads, no installations – just pure, seamless trading directly from your web browser. Our Finpros WebTrader platform offers instant access to your trading account from any computer, anywhere in the world. This is ideal for traders who value convenience and flexibility without sacrificing powerful features.

Advantages of WebTrader:

- Accessibility: Trade from any internet-connected device.

- User-Friendly Interface: Intuitive design makes it easy for beginners and pros alike.

- Real-Time Data: Stay updated with live market prices and charts.

- Secure Environment: Your data and transactions are protected with advanced encryption.

Whether you’re traveling, using a public computer, or simply prefer a clutter-free trading environment, our WebTrader ensures you never miss a market opportunity.

Mobile Trading Apps: Trade on the Go

The fast-paced world of forex demands constant connectivity, and Finpros delivers with robust mobile trading applications for both iOS and Android devices. Our mobile platforms put the market at your fingertips, allowing you to monitor your trades, analyze charts, and execute orders anytime, anywhere.

With our mobile apps, you get the full functionality of desktop platforms, optimized for smaller screens. Manage your positions, check your account balance, and react to market news in real-time. Experience the freedom of true mobile trading with Finpros.

MetaTrader 4 (MT4) for Finpros Clients

Are you ready to elevate your trading experience? As a Finpros client, you gain access to the industry-standard MetaTrader 4 (MT4) platform. This powerful tool is a favorite among forex traders worldwide for its robust features, intuitive interface, and unparalleled reliability. We know you seek precision and control in your trading, and MT4 delivers exactly that.

MT4 isn’t just a platform; it’s your complete trading workstation. It offers a suite of advanced tools designed to help you analyze markets, execute trades, and manage your portfolio with confidence. Imagine having everything you need at your fingertips, from in-depth analysis to automated trading capabilities.

Here’s why MT4 is the perfect match for your Finpros trading journey:

- Advanced Charting Tools: Dive deep into market trends with an extensive range of customizable charts, timeframes, and analytical objects. You can spot opportunities others miss.

- Expert Advisors (EAs): Automate your trading strategies with EAs. This allows you to trade 24/5 without constant manual intervention, following your predefined rules.

- Mobile Trading: Stay connected to the markets wherever you are. Access your account, monitor trades, and execute new orders directly from your smartphone or tablet.

- Secure and Reliable: Trade with peace of mind. MT4 employs high-level security protocols to protect your data and transactions, ensuring a safe trading environment.

- User-Friendly Interface: Whether you’re a beginner or an experienced trader, you’ll find MT4 easy to navigate. Its clean layout puts essential functions within quick reach.

When you combine Finpros’s competitive spreads, fast execution, and dedicated customer support with MT4’s superior technology, you create a powerful synergy. This combination gives you a distinct edge in the dynamic forex market. It’s about empowering you to make informed decisions and act swiftly when opportunities arise.

Don’t just trade; trade smarter. Experience the full potential of your trading strategies with MetaTrader 4, tailored for Finpros clients. Download the platform today and take control of your financial future.

MetaTrader 5 (MT5) Features and Benefits

Are you ready to elevate your trading game? MetaTrader 5, often known as MT5, offers a significant leap forward for serious traders. This powerful trading platform goes beyond the basics, providing an extensive suite of tools designed to give you an edge in the dynamic financial markets. It’s not just an upgrade; it’s a complete powerhouse for diverse investment strategies.

MT5 empowers you with superior analytical capabilities and flexible trading options. Here are some of its standout features:

- Expanded Asset Classes: Access a wider range of instruments. Trade not only forex but also stocks, commodities, and futures from a single platform.

- Advanced Charting Tools: Dive deep into technical analysis with 21 timeframes and 38 built-in technical indicators. You also get a vast array of graphical objects to pinpoint market trends and patterns.

- Enhanced Algorithmic Trading: Build and run your custom Expert Advisors (EAs) using the robust MQL5 programming language. This allows for sophisticated automated trading strategies and faster backtesting capabilities.

- Market Depth (Level II Pricing): Gain unparalleled transparency with real-time access to the order book. This feature helps you understand market sentiment and execute trades more precisely.

- Integrated Economic Calendar: Stay ahead of major market-moving events directly within the platform. Make informed decisions by monitoring economic news releases instantly.

- Hedging and Netting Options: MT5 supports both hedging (opening multiple positions on the same instrument) and netting (combining positions into a single one), offering greater flexibility for your trading style.

The benefits of using MT5 extend beyond just its features. They truly enhance your overall trading experience:

- Greater Flexibility: Handle multiple asset classes from one account, simplifying your portfolio management across forex trading and other markets.

- Superior Execution: Experience faster processing speeds and more efficient trade execution, critical in volatile market conditions.

- Deeper Market Insights: With more advanced analytical tools and market depth, you gain a clearer picture of market dynamics, helping you make smarter trading decisions.

- Robust Security: Trade with confidence knowing the platform employs advanced encryption protocols to protect your data and transactions.

- Customization at Your Fingertips: Tailor your workspace with custom indicators, scripts, and Expert Advisors, creating a trading environment perfectly suited to your needs.

- Community Support: Join a vibrant community of MQL5 developers and traders, access a marketplace for indicators, EAs, and trading signals, and find solutions to any trading challenge.

MT5 isn’t just a trading platform; it’s a comprehensive ecosystem built for the modern trader who demands power, flexibility, and precision. It genuinely transforms how you interact with the financial markets, paving the way for more sophisticated and potentially profitable trading strategies.

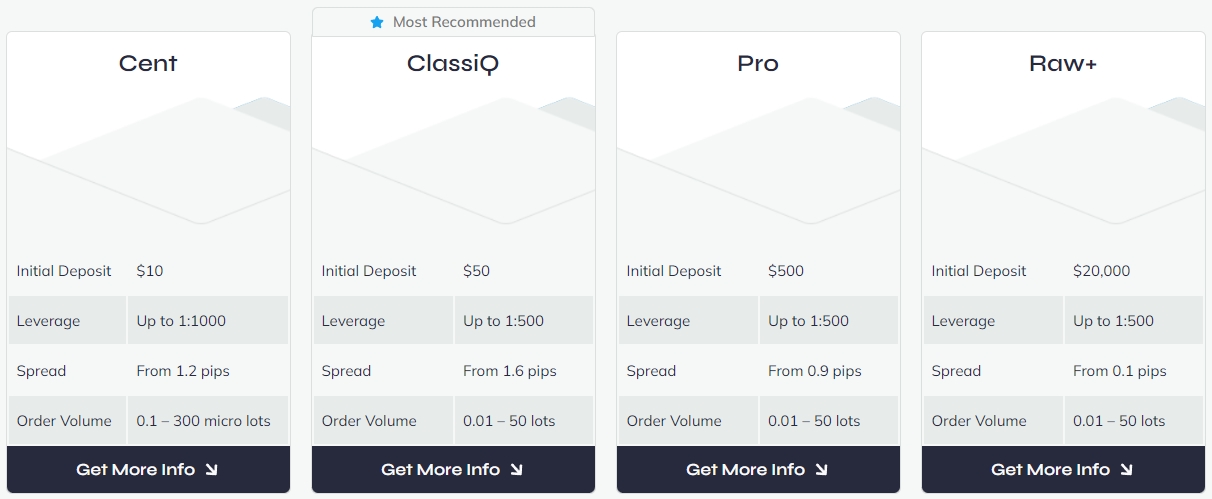

Finpros Account Types for South African Traders

Are you a South African trader looking for a robust and reliable platform? Understanding the different Finpros account types is your first step towards a successful trading journey. Finpros recognizes the unique needs of traders, from beginners just entering the market to seasoned professionals seeking advanced features. We design our accounts to provide flexibility, competitive conditions, and a secure trading environment tailored for the local market.

Choosing the right account type significantly impacts your trading experience. It affects everything from your available leverage and spread conditions to the minimum deposit required and the range of assets you can access. Finpros focuses on transparency and empowering you with options that align with your trading style and financial goals. You need an account that complements your strategy, not one that restricts it.

What to Expect from Finpros Account Options

Finpros strives to offer a diverse range of accounts, ensuring every South African trader finds their perfect fit. While specific names and features might vary, here’s a general overview of the types of benefits and conditions you can typically expect from a leading broker like Finpros:

- Beginner-Friendly Accounts: Perfect for new traders. These often feature lower minimum deposits, educational resources, and a simpler trading interface. They help you get comfortable with the forex market without high initial risk.

- Standard Trading Accounts: A popular choice offering balanced features. You usually get competitive spreads, access to a wide range of instruments, and reliable execution. These accounts suit most retail traders seeking a solid all-around experience.

- Advanced Trader Accounts: Designed for experienced traders who demand superior conditions. Expect tighter spreads, potentially lower commissions, and access to more sophisticated tools and perhaps even dedicated support.

- Specialized Accounts: Sometimes, brokers offer accounts catering to specific needs, such as swap-free (Islamic) accounts or those optimized for particular trading strategies like scalping.

Our commitment to South African traders means you can also look forward to local payment solutions and the possibility of funding your account directly in ZAR. This removes currency conversion hassles and makes managing your capital much simpler. We understand that local relevance boosts your confidence and improves your overall trading efficiency.

Key Considerations for Your Finpros Account

Ultimately, Finpros aims to provide South African traders with a choice that empowers them. Take your time to review the details of each account option. Consider your trading goals, your experience level, and how much capital you plan to invest. This thoughtful approach ensures you select a Finpros account that truly supports your ambition in the dynamic world of forex trading.

| Feature | Why It Matters for You |

|---|---|

| Minimum Deposit | Determines your entry point. Choose an account that fits your initial capital. |

| Spreads & Commissions | Impacts your trading costs. Lower spreads or commissions mean more profit potential. |

| Leverage Options | Allows you to trade with more capital than you deposit. Understand the risks and benefits. |

| Available Instruments | Ensures you can trade your preferred currency pairs, commodities, or indices. |

| Execution Speed | Fast execution is crucial for volatile markets and effective strategy implementation. |

| Customer Support | Reliable and responsive support in your time zone offers peace of mind. |

Ultimately, Finpros aims to provide South African traders with a choice that empowers them. Take your time to review the details of each account option. Consider your trading goals, your experience level, and how much capital you plan to invest. This thoughtful approach ensures you select a Finpros account that truly supports your ambition in the dynamic world of forex trading.

Funding Your Finpros South Africa Account

Ready to dive into the exciting world of forex trading with Finpros? Your journey begins with a crucial step: funding your account. At Finpros South Africa, we understand that convenience, security, and speed are paramount when you’re managing your capital. We’ve streamlined the deposit process to ensure you can get started quickly and confidently, focusing on what truly matters – your trading strategy.

We’ve tailored our funding options to cater specifically to our South African traders, offering a range of reliable and accessible methods. Our goal is to make sure you experience seamless transactions, allowing you to seize market opportunities without unnecessary delays.

Choose Your Deposit Method

Finpros provides a variety of secure and efficient ways to deposit funds into your trading account. We prioritize methods that are commonly used and trusted within South Africa, giving you peace of mind with every transaction.

- Instant EFT (Electronic Funds Transfer): A popular and trusted method for South African users, allowing direct transfers from your local bank account. It’s fast, secure, and familiar.

- Credit/Debit Cards: Fund your account instantly using major Visa and MasterCard credit or debit cards. This is often the quickest way to get started.

- Local Bank Transfers: For those who prefer traditional banking, direct bank transfers are available. While they may take a bit longer to process, they offer a secure way to move larger sums.

- E-wallets: Explore various e-wallet solutions that offer speed and an additional layer of security for your deposits.

A Simple Guide to Funding Your Account

We believe in simplicity. Follow these straightforward steps to deposit funds into your Finpros South Africa trading account:

- Log In to Your Finpros Portal: Access your secure client area using your unique credentials. This is your command center for all account management.

- Navigate to the Deposit Section: Locate the “Deposit” or “Fund Account” option, usually found in your dashboard or the main menu.

- Select Your Preferred Method: Choose from the list of available funding options that best suits your needs and convenience.

- Enter Deposit Details: Specify the amount you wish to deposit and provide any required payment information securely.

- Confirm and Complete: Review your details and confirm the transaction. You’ll often receive an instant confirmation or a notification once the funds reflect in your account.

Why Fund with Finpros South Africa?

When you choose Finpros, you’re not just picking a broker; you’re partnering with a platform dedicated to your trading success. Our funding process reflects this commitment:

“We empower traders by making every step, from funding to trading, as intuitive and secure as possible. Your capital’s safety and your trading efficiency are our top priorities.”

Consider these advantages:

- Security First: We employ advanced encryption and security protocols to protect your personal and financial information during every transaction.

- Localised Convenience: Our payment options are carefully selected to meet the specific needs and preferences of South African traders.

- Fast Processing: Many of our deposit methods offer instant or near-instant funding, allowing you to react quickly to market movements.

- Transparent Fees: We maintain full transparency regarding any potential deposit fees, ensuring you know exactly what to expect.

- Dedicated Support: Our local support team is always ready to assist you with any funding queries you might have.

Getting your account funded is the gateway to unlocking the vast opportunities in the forex market. Finpros South Africa makes this initial step effortless, so you can focus on building your trading expertise and reaching your financial goals.

Deposit Methods and Currencies

Ready to jump into the exciting world of forex trading? Funding your account is the first crucial step, and we make it incredibly straightforward and secure. We understand that traders need flexibility and speed, which is why we offer a wide range of deposit methods designed to suit your preferences, no matter where you are.

Popular Deposit Options at Your Fingertips

Accessing your funds quickly and easily is a top priority. We’ve curated a selection of the most reliable and efficient deposit methods so you can focus on what matters most: your trading strategy. Here’s a quick look at how you can fund your trading journey:

- Credit/Debit Cards: Visa, MasterCard, and other major cards offer instant deposits, getting you into the market without delay. It’s convenient, widely accepted, and very user-friendly.

- Bank Transfers: For larger deposits or those who prefer traditional banking, direct bank transfers are a secure option. While they may take a bit longer to process, they offer peace of mind.

- E-Wallets: Services like Skrill, Neteller, and others provide a fast and secure way to move your money. E-wallets are excellent for traders looking for speedy transactions and an extra layer of privacy.

- Cryptocurrencies: Embracing modern financial trends, we also support deposits via popular cryptocurrencies. This method offers decentralization and often faster processing times.

Trade in Your Preferred Currency

Currency convenience is key to a smooth trading experience. We support a broad array of base currencies for your trading account, helping you avoid unnecessary conversion fees and simplifying your financial management. You can often choose to fund your account and trade in:

| Common Currencies | Benefits |

|---|---|

| USD (US Dollar) | Widely accepted, highly liquid, standard for most forex pairs. |

| EUR (Euro) | Popular in Europe, strong economic backing, good for EUR pairs. |

| GBP (British Pound) | Preferred by UK traders, strong global presence. |

| JPY (Japanese Yen) | Ideal for Asian market participants, often used for carry trades. |

| AUD (Australian Dollar) | Commodity-linked currency, popular in Oceania. |

| CAD (Canadian Dollar) | North American favorite, commodity-driven. |

| CHF (Swiss Franc) | Safe-haven currency, known for stability. |

Selecting your account currency upfront helps you maintain clarity on your profit and loss and simplifies deposit and withdrawal processes. Always choose the currency that best aligns with your financial operations to minimize exchange rate fluctuations on your deposited funds.

What to Consider When Depositing

Choosing the right deposit method isn’t just about speed; it’s about finding what works best for you. Think about factors like:

- Processing Time: How quickly do you need your funds available for trading?

- Fees: Are there any charges associated with your chosen method? We strive to keep deposit fees low or non-existent.

- Minimum/Maximum Limits: Ensure your deposit amount falls within the acceptable range for the method you select.

- Security: All our methods are secure, but you might have a personal preference for an extra layer of security.

Embark on your trading journey with confidence, knowing that funding your account is a hassle-free experience. We are here to support every step you take in the exciting forex market!

Withdrawal Process and Timeframes

Once your trading journey yields profits, getting your funds back into your hands is a crucial step. Understanding the withdrawal process and typical timeframes ensures a smooth and stress-free experience. No one wants to wait longer than necessary for their hard-earned money!

How to Withdraw Your Funds

Initiating a withdrawal from your forex trading account is usually straightforward. Here are the common steps you will follow:

- Log in: Access your secure client portal or trading account dashboard.

- Navigate: Find the “Withdrawal” or “Funds Management” section. This is usually clearly labeled.

- Select Method: Choose your preferred withdrawal method. Make sure it’s one you’ve used for depositing, as many brokers have a “back to source” policy for anti-money laundering regulations.

- Enter Amount: Specify the exact amount you wish to withdraw. Always double-check this figure.

- Confirm Details: Verify all your payment information to prevent delays.

- Submit Request: Finalize your request. You’ll often receive an email confirmation of your submission.

What Influences Withdrawal Speed?

The speed at which your funds reach you can vary. Several factors play a role in how quickly your withdrawal request is processed and completed:

- Broker’s Processing Time: Each broker has an internal processing period to verify requests, typically 24-48 business hours.

- Chosen Method: Different payment methods have their own inherent transfer speeds.

- Verification Status: If your account isn’t fully verified (KYC documents submitted), your withdrawal might be paused until verification is complete.

- Bank Holidays: National holidays in your country, your broker’s country, or the payment processor’s country can add delays.

- Weekend Requests: Requests made on weekends are usually processed on the next business day.

- Withdrawal Fees: While not directly affecting speed, some methods might incur fees, which are often deducted from your withdrawal amount.

Typical Withdrawal Methods and Their Timeframes

Here’s a quick glance at common withdrawal methods and their average timeframes after the broker processes your request:

| Method | Average Timeframe | Common Fees (Varies by Broker) |

|---|---|---|

| Bank Wire Transfer | 3-7 Business Days | Medium to High |

| Credit/Debit Card | 2-5 Business Days | Low to Medium |

| e-Wallets (e.g., Skrill, Neteller) | 1-2 Business Days | Low |

| Cryptocurrencies | Often within 24 Hours (after network confirmations) | Low (network fees apply) |

Pro Tips for a Seamless Withdrawal

For the smoothest experience when taking out your profits, keep these points in mind:

- Always ensure your account is fully verified with up-to-date documentation.

- Use the same method for withdrawal that you used for deposit whenever possible. This speeds up compliance checks.

- Check your broker’s specific withdrawal policies and any associated fees beforehand.

- Keep an eye on your email for updates or requests for additional information from your broker.

- Contact customer support if your withdrawal takes significantly longer than the stated timeframe.

Getting your money is the rewarding part of successful trading. Understanding these steps and factors helps you manage expectations and ensures you access your funds efficiently!

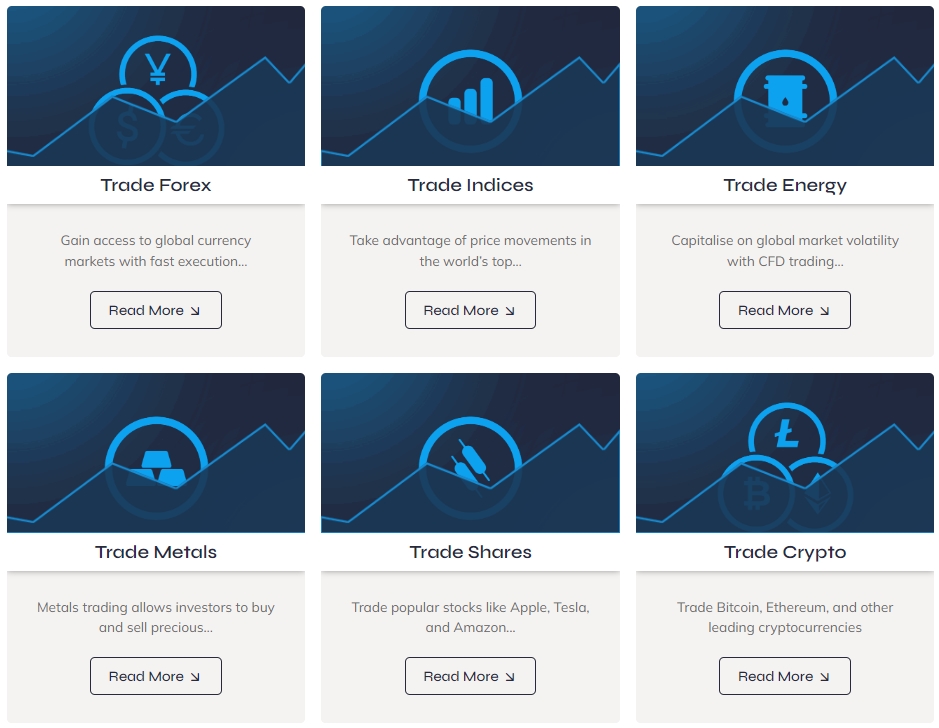

Range of Tradable Assets with Finpros

At Finpros, we understand that a truly dynamic trading experience comes from a vast array of choices. We open the doors to global markets, empowering you to explore, diversify, and capitalize on opportunities across numerous asset classes. Whether you are a seasoned investor or just starting your journey, our comprehensive selection ensures you find the instruments that align with your strategy and risk appetite. Dive into the world of diverse trading possibilities right here.

Our platform offers an impressive spectrum of financial instruments, carefully curated to give you maximum exposure to the markets that matter most. You’re not just trading; you’re building a versatile portfolio designed for growth and resilience.

-

Forex (Foreign Exchange)

Step into the largest financial market globally with a wide selection of currency pairs. Trade major pairs like EUR/USD, GBP/JPY, and USD/CAD, alongside an exciting range of minor and exotic pairs. Experience high liquidity and tight spreads, making currency trading accessible and engaging.

-

Commodities

Hedge against inflation or speculate on global demand with our extensive list of commodities. Trade precious metals such as gold and silver, energy resources like crude oil and natural gas, and various agricultural products. These assets offer unique opportunities, often reacting differently to economic events than traditional equities.

-

Indices

Gain broad exposure to the world’s leading economies by trading major stock market indices. Access popular global benchmarks like the S&P 500, Dow Jones Industrial Average, NASDAQ, DAX, FTSE 100, and more. Indices allow you to speculate on the overall performance of an entire stock market sector or national economy with a single trade.

-

Cryptocurrencies

Embrace the future of finance with our growing selection of popular cryptocurrencies. Trade Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and other digital assets against the USD. Leverage the volatility and innovative potential of the crypto market to discover new trading avenues.

-

Shares (Stocks)

Invest directly in some of the world’s most recognized companies. Trade CFDs on individual shares from global markets, including tech giants, established corporations, and emerging innovators. With Finpros, you can speculate on the price movements of your favorite companies without owning the underlying asset.

Our commitment is to provide you with a robust trading environment where choice is paramount. This extensive range of assets allows you to effectively diversify your trading portfolio, mitigate risks, and seize opportunities across different market conditions. Join Finpros and unlock your full trading potential by exploring a universe of financial instruments!

Understanding Finpros Trading Costs and Spreads

Embarking on your forex trading journey with Finpros? Excellent choice! To truly master the markets and maximize your potential, you must grasp the crucial role of trading costs and spreads. These aren’t just minor details; they significantly impact your overall profitability. At Finpros, we believe in complete transparency, ensuring you know exactly what to expect.

The Essentials of Trading Spreads

So, what exactly is a spread? Simply put, it’s the difference between the bid (buy) price and the ask (sell) price of a currency pair. Think of it as the market price you pay to enter or exit a trade. This small difference is one of the primary ways brokers like Finpros generate revenue, and understanding its dynamics is key to smart trading.

Finpros strives to offer highly competitive spreads across a wide range of currency pairs, ensuring you get excellent value. A tighter spread means less cost for you when opening and closing positions, directly contributing to better trade outcomes. We constantly monitor market conditions to provide some of the best pricing available, reflecting our commitment to your success in forex trading.

Beyond the Spread: Other Trading Costs

While spreads are a major component of your trading costs, they aren’t the only factor. Here are other elements to consider when trading with Finpros:

- Commissions: For certain account types or specific instruments, Finpros might charge a commission per trade. This is usually a fixed amount per lot traded, offering you even tighter spreads in return. We make sure any commission structure is clear and upfront.

- Swap Fees (Overnight Financing): If you hold a position open overnight, you might incur or receive a swap fee. This reflects the interest rate difference between the two currencies in a pair. It can be positive or negative, depending on the currency pair and the direction of your trade.

- Withdrawal Fees: While not a direct trading cost, it’s worth noting that some payment methods may carry a small fee when you withdraw your funds. Finpros aims to keep these to a minimum and always displays them clearly.

Why Transparent Pricing Matters for Your Profitability

Understanding these costs isn’t just about financial literacy; it’s about making informed decisions that boost your trading profitability. When you know your exact trading costs, you can:

- Accurately calculate potential profits and losses.

- Choose the most cost-effective currency pairs or instruments.

- Develop more effective risk management strategies.

- Avoid surprises and trade with greater confidence.

Finpros prides itself on transparent pricing. We empower our traders by providing all necessary information, so you can focus on executing your strategy without worrying about hidden fees. Join Finpros and experience a trading environment where clarity and fairness pave the way for your success in the dynamic world of forex.

Customer Support and Local Assistance

When you navigate the dynamic world of forex, robust support is not just a luxury; it’s a necessity. We understand that your forex trading journey can present questions, challenges, and opportunities at any hour, from any location. That’s why we pride ourselves on delivering dedicated customer support designed to empower your trading experience. Our commitment extends beyond just providing a platform; we offer a lifeline of expert guidance whenever you need it most.

Accessing our assistance is straightforward and convenient. You can connect with our friendly and knowledgeable team through various channels:

- Live Chat: Get instant answers to your queries around the clock. Our 24/7 assistance means help is always just a click away.

- Email Support: Send us your detailed questions and receive thorough responses. We aim for swift resolution and comprehensive explanations.

- Phone Assistance: Speak directly with an expert for immediate, personalized help with your trading needs.

Understanding that the forex market is global, but your trading needs are often local, we also provide invaluable local assistance. Our multilingual team members possess deep understanding of regional specificities, market holidays, and local payment methods. This ensures you receive culturally relevant and accurate advice, making your experience smoother and more efficient. We offer local market insights to help you navigate specific regional challenges and opportunities.

Whether you are just starting your forex trading journey or you are an experienced trader, our reliable support gives you peace of mind. We are here to offer swift resolution to technical issues, clarify market conditions, or guide you through platform features. Our goal is to ensure you feel supported, confident, and well-equipped to make informed trading decisions. Don’t hesitate to reach out; your success is our priority!

Educational Tools and Resources for Beginners

Stepping into the world of forex trading feels exciting, but don’t rush in without a map! Success in the currency markets isn’t about luck; it’s built on a solid foundation of knowledge. For every aspiring trader, equipping yourself with the right educational tools and resources is your first, most crucial step. Think of it as your flight school before you take off solo. We’re here to guide you through the essential learning materials that will empower your journey from a curious newcomer to a confident participant.

Your Essential Learning Toolkit

Navigating the forex landscape requires more than just opening an account. You need to understand market dynamics, technical analysis, and risk management. Here are some of the most effective tools and resources designed specifically to help beginners grasp these complex concepts:

- Demo Accounts: This is arguably your most important tool. A demo account allows you to trade with virtual money in a real market environment. You practice placing trades, setting stop-losses, and managing positions without any financial risk. It’s the perfect sandbox to test strategies and get comfortable with your trading platform before committing real capital.

- Online Courses and Tutorials: Many reputable brokers and educational platforms offer structured courses. These often cover everything from the basics of what forex is, to reading charts, understanding economic indicators, and developing your first trading plan. Look for courses that include video lectures, quizzes, and practical exercises.

- Webinars and Live Trading Sessions: Participate in live webinars hosted by experienced traders or market analysts. These often provide real-time insights, answer common questions, and demonstrate strategies in action. Some even offer live trading sessions where you can watch professionals make decisions.

- E-books and Comprehensive Guides: Dive deep into specific topics with well-written e-books and guides. These resources offer in-depth explanations of complex concepts like technical indicators, fundamental analysis, and advanced trading strategies. Choose resources from trusted sources to ensure accuracy.

- Trading Forums and Communities: Connect with other aspiring and experienced traders. Forums offer a space to ask questions, share insights, and learn from the collective experience of the community. Just remember to critically evaluate information and not take every piece of advice as gospel.

- Economic Calendars: Stay ahead of major market-moving news events. An economic calendar lists upcoming economic data releases, central bank announcements, and other events that can significantly impact currency prices. Understanding these events helps you anticipate potential market volatility.

Advantages of Using Educational Resources

Embracing these learning materials provides significant benefits:

| Advantage | Description |

|---|---|

| Reduces Risk | Educated traders make informed decisions, significantly lowering the chance of costly mistakes. You learn about risk management before risking actual money. |

| Builds Confidence | Understanding how the market works and practicing with demo accounts gives you the confidence to execute trades without hesitation. |

| Develops Discipline | Learning about trading psychology and strategy implementation helps you develop the discipline needed to stick to your plan, even during volatile periods. |

| Faster Learning Curve | Structured resources help you learn efficiently, avoiding common pitfalls and accelerating your progress toward profitable trading. |

Never underestimate the power of continuous learning. The forex market constantly evolves, and so should your knowledge base. Start with the basics, practice diligently with your demo account, and gradually expand your understanding. This dedicated approach will build a robust foundation for your trading career, turning uncertainty into clarity and potential into profit.

The Benefits of Choosing Finpros South Africa

Are you ready to take your financial future into your own hands? Navigating the dynamic world of forex trading requires a partner you can trust, one that understands your unique needs as a South African trader. Finpros South Africa stands out as a premier choice, offering a robust and supportive environment designed for both novice and experienced participants in the global financial markets. We believe in empowering our community with the right tools and knowledge to achieve their trading goals.

Choosing the right broker is not just about executing trades; it’s about finding a comprehensive ecosystem that supports your growth, ensures your security, and provides a seamless trading experience. Finpros South Africa delivers on all these fronts, making us a top contender for anyone looking to excel in forex trading.

Why Finpros South Africa is Your Smart Choice:

- Tailored for South African Traders: We understand the local market nuances and offer services that resonate directly with the needs of our South African clientele. This local focus ensures a more relevant and efficient trading journey for you.

- Robust Security Measures: Your peace of mind is paramount. Finpros employs advanced security protocols and maintains segregated client accounts, safeguarding your capital against unforeseen events. You can trade with confidence, knowing your funds are secure.

- Cutting-Edge Trading Platform: Access industry-leading trading platforms that provide powerful analytical tools, real-time market data, and lightning-fast execution. Whether you prefer desktop, web, or mobile trading, our platforms offer flexibility and performance.

- Diverse Range of Instruments: Expand your portfolio beyond traditional forex pairs. Finpros South Africa offers access to a wide array of financial instruments, including commodities, indices, and cryptocurrencies, giving you more opportunities to diversify and profit.

- Competitive Spreads and Transparent Pricing: We believe in clear, fair pricing. Benefit from competitive spreads and a transparent fee structure, ensuring you get the most value from every trade. No hidden costs, just straightforward trading.

- Dedicated Local Support: Our expert customer support team is always ready to assist you. With a deep understanding of the local landscape, they provide prompt, helpful, and culturally relevant assistance whenever you need it. You are never alone on your trading journey.

- Comprehensive Educational Resources: Knowledge is power in the financial markets. Finpros provides an extensive library of educational materials, from beginner guides to advanced market analysis and webinars. We empower you to make informed decisions and continuously improve your trading skills.

At Finpros South Africa, we are more than just a broker; we are your partner in success. We are committed to fostering a thriving community of traders by providing unparalleled support, innovative technology, and a secure trading environment. Join us and discover the difference a truly dedicated trading partner can make to your forex trading experience.

Potential Drawbacks to Consider for South African Users

While the world of forex trading offers exciting opportunities for South Africans, it is essential to approach it with a clear understanding of potential challenges specific to the local context. Being aware of these aspects helps you make informed decisions and navigate the market more effectively.

Regulatory Landscape and Broker Choices

South Africa has a robust financial regulatory body, the Financial Sector Conduct Authority (FSCA). For your safety and peace of mind, choosing an FSCA-regulated broker is paramount. However, many South African traders might encounter or be tempted by offshore, unregulated brokers. While these might seem to offer enticing conditions, they often come with significant risks, including:

- Limited Investor Protection: Unregulated brokers do not operate under the same stringent rules, meaning fewer safeguards for your funds.

- Dispute Resolution Issues: If a problem arises, resolving disputes with an offshore, unregulated entity can be incredibly difficult and costly.

- Potential Scams: Unfortunately, the unregulated space is more susceptible to fraudulent schemes.

Always prioritize security and regulation over potentially superficial benefits when selecting your trading partner.

The Volatility of the South African Rand (ZAR)

The South African Rand (ZAR) is known for its relatively high volatility compared to major global currencies. This can be a double-edged sword for local traders:

ZAR Volatility Snapshot

| Aspect | Implication for Traders |

|---|---|

| High Fluctuation | Potential for larger price swings, leading to quicker profit (or loss) realization. Requires robust risk management. |

| Impact of Local News | Local political developments, economic data (inflation, interest rates), and commodity prices can heavily influence ZAR value. Constant monitoring is key. |

| Global Sensitivity | As an emerging market currency, the ZAR is highly sensitive to global risk sentiment and major economic announcements. |

Understanding the factors that influence the ZAR is crucial. This includes closely following local economic news and global market sentiment, which can significantly impact your trades involving the Rand.

Practical Challenges: Deposits, Withdrawals, and Taxation

Transacting in forex from South Africa can sometimes present practical hurdles:

- Deposit and Withdrawal Methods: While many international brokers support various payment methods, South African users might face higher fees or longer processing times for international bank transfers. Currency conversion fees also apply when moving funds between ZAR and your trading account’s base currency.

- FICA Requirements: Local banks often have strict FICA (Financial Intelligence Centre Act) requirements for large transactions, including international transfers for trading purposes. Ensure you comply with all necessary documentation.

- Tax Obligations: Forex trading profits are generally taxable in South Africa. Navigating SARS (South African Revenue Service) regulations for declaring and paying tax on your trading income can be complex. It is highly advisable to seek professional advice from a tax consultant specializing in forex or investment income to ensure full compliance.

These considerations are not insurmountable barriers, but rather important aspects to factor into your trading strategy and financial planning. By acknowledging and preparing for them, you can build a more resilient and successful forex trading journey in South Africa.

How Finpros Compares to Other South African Brokers

The South African forex market is a vibrant and competitive space, offering traders a wide array of choices. Navigating these options to find a broker that truly aligns with your trading aspirations can feel overwhelming. Finpros steps into this dynamic landscape, not just as another option, but by distinguishing itself through specific attributes that set it apart from many other local and international players. We understand what South African traders look for, and our approach reflects this deep understanding.

Many brokers in the region offer standard services, but Finpros focuses on elevating the trading experience across several key areas. We believe in transparency, advanced technology, and unwavering support, cornerstones that define our unique value proposition.

Here’s how Finpros consistently stands out:

- Robust Local Regulation: While many brokers serve the South African market, Finpros places a paramount emphasis on stringent local regulation. This commitment ensures a secure and transparent trading environment, often exceeding the baseline standards provided by some international or less regulated entities operating in the region. You trade with confidence, knowing your investments are protected under local oversight.

- Superior Trading Technology: Traders need tools that work seamlessly. Our cutting-edge trading platforms deliver exceptional execution speeds, advanced charting capabilities, and a suite of analytical tools. This often provides a significant edge over the more basic or generic platform offerings commonly found among other brokers, empowering you to make informed decisions swiftly.

- Competitive and Transparent Pricing: We understand that trading costs impact profitability. Finpros consistently provides highly competitive spreads and a clear, straightforward fee structure. Many traders find this approach a refreshing contrast to some brokers whose costs can be less transparent or whose spreads widen significantly during volatile periods, affecting your bottom line.

- Dedicated Localized Support: Your trading journey deserves excellent support. Finpros prides itself on a dedicated, locally-focused customer service team. This means you receive prompt, knowledgeable assistance from professionals who understand the specific nuances and challenges of the South African market, a stark difference from generic international support lines that might lack local context.

- Comprehensive Educational Resources: Empowerment through knowledge is a core Finpros principle. We invest heavily in developing extensive educational materials, webinars, and market insights. These resources go beyond elementary guides, offering in-depth analysis and strategies that equip traders of all levels, often surpassing the more limited educational content available elsewhere.

When you weigh these crucial factors, Finpros consistently emerges as a strong contender for discerning South African traders. We actively strive to offer a blend of security, advanced technology, exceptional value, and personalized, localized support that sets a new benchmark in the South African forex brokerage scene. We do not just aim to meet expectations; we aim to exceed them, providing a trading environment where you can truly thrive.

Getting Started: Opening a Finpros South Africa Account

Ready to dive into the exciting world of forex trading? Opening an account with Finpros South Africa is your first step towards unlocking incredible market opportunities. We’ve streamlined our process to be as straightforward and user-friendly as possible, ensuring you can begin your trading journey without unnecessary delays. Imagine accessing global markets right from your fingertips, all backed by a trusted platform designed with your success in mind. It’s time to transform your financial aspirations into tangible achievements.

Your Smooth Path to Trading: The Finpros Account Opening Process

We understand you want to start trading, not get bogged down in paperwork. That’s why we’ve made our account opening journey clear and efficient. Follow these simple steps, and you’ll be on your way to exploring the markets.

- Visit Our Website: Navigate to the Finpros South Africa official website. Look for the “Open Account” or “Register” button, usually prominently displayed.

- Complete the Registration Form: You’ll provide essential personal details like your name, email, phone number, and residential address. Ensure all information is accurate to prevent future verification issues.

- Choose Your Account Type: Finpros offers various account types tailored to different trading styles and experience levels. Consider your trading goals and capital when making your selection. Don’t worry, you can always discuss options with our support team if you’re unsure.

- Verify Your Identity: This crucial step complies with regulatory requirements and keeps your account secure. You will typically need to upload clear copies of identification and proof of address.

- Fund Your Account: Once your account is verified, deposit funds using one of our convenient payment methods. We offer various options to suit your preferences, making it easy to start trading.

- Start Trading: With funds in your account, you are now ready to access the trading platform, analyze markets, and execute your first trades.

What You Need: Documents for Verification

To ensure the highest level of security and regulatory compliance, we require a few standard documents. Gathering these beforehand will make your account opening experience even smoother.

Required Documents:

- Proof of Identity: A clear, valid copy of your South African ID card, passport, or driver’s license. The document must not be expired and show your full name, photograph, and date of birth.

- Proof of Address: A recent utility bill (electricity, water, gas), bank statement, or council tax bill, dated within the last three to six months. It must clearly display your name and residential address.

Our dedicated team reviews all submissions promptly. If any issues arise, we will contact you directly to guide you through the process, ensuring a hassle-free setup for your Finpros South Africa trading account.

Why Choose Finpros for Your South African Trading Journey?

Selecting the right broker is paramount for your trading success. At Finpros South Africa, we pride ourselves on offering a robust and supportive environment for traders of all levels.

| Feature | Benefit to You |

|---|---|

| Regulated Platform | Trade with confidence, knowing your funds are secure and your broker operates under strict regulatory standards. |

| Competitive Spreads | Minimize your trading costs with tight spreads across a wide range of instruments, maximizing your potential profits. |

| Intuitive Trading Platforms | Access industry-leading platforms like MetaTrader 4 and 5, equipped with advanced tools for analysis and execution. |

| Local Support | Benefit from customer service that understands your needs, offering timely and effective assistance whenever you require it. |

| Educational Resources | Enhance your trading knowledge with a wealth of free educational materials, from tutorials to webinars. |

Joining Finpros means becoming part of a community that values your growth and provides the resources you need to thrive in the forex market. We are committed to empowering you with the tools and support essential for a rewarding trading experience in South Africa.

Finpros South Africa: Frequently Asked Questions

Welcome to our FAQ section, where we tackle the most common questions about Finpros South Africa. We understand you might have queries before diving into the exciting world of forex trading. Our aim is to provide transparent, straightforward answers, helping you make informed decisions. Let’s get straight to it!

What exactly is Finpros South Africa and what services do you offer?

Finpros South Africa is a dedicated online forex broker providing a robust platform for individuals to engage in the global currency markets. We offer access to a wide range of financial instruments, including major and minor currency pairs, commodities, and indices. Our services are designed for both novice traders looking to learn the ropes and experienced professionals seeking advanced trading tools.

Our core services include:

- Access to Global Markets: Trade a diverse selection of assets.

- Cutting-Edge Trading Platforms: Utilize industry-standard software for seamless execution.

- Comprehensive Educational Resources: From guides to webinars, we empower your trading journey.

- Responsive Customer Support: Our team is ready to assist you every step of the way.

- Competitive Spreads and Low Commissions: Maximize your potential returns with favorable trading conditions.

We pride ourselves on fostering a secure and efficient trading environment, ensuring you have the best possible experience when you trade forex with us.

Is Finpros South Africa a regulated broker, and what safety measures are in place for my funds?

Absolutely, regulation and client fund security are paramount at Finpros South Africa. We operate under stringent regulatory guidelines to ensure a safe and trustworthy trading environment for all our clients. We understand that peace of mind is crucial when you invest your capital.

Here’s how we prioritize your security:

| Security Measure | Description |

|---|---|

| Regulatory Compliance | We adhere to local financial regulations, providing a framework of accountability and transparency. This means regular audits and strict operational standards are in place. |

| Segregated Accounts | Client funds are held in separate accounts from the company’s operational capital. This practice ensures your money is protected and cannot be used for company expenses, even in unforeseen circumstances. |

| Advanced Encryption | We employ state-of-the-art encryption technologies (SSL) to protect all your personal data and financial transactions, safeguarding your information from unauthorized access. |

| Negative Balance Protection | This crucial feature ensures that you can never lose more money than you have deposited in your trading account, providing an essential safety net for your investment capital. |

Our commitment is to provide a secure and reliable platform where you can focus on your trading strategies without worrying about the safety of your funds. We believe a strong regulatory foundation is key to building lasting trust with our clients who are looking to embark on their forex trading journey.

What trading platforms does Finpros South Africa offer, and what are their key advantages?

At Finpros South Africa, we understand that a powerful and intuitive trading platform is the cornerstone of successful online trading. We offer industry-leading platforms known for their robust features, user-friendly interface, and advanced analytical tools. Our goal is to provide you with the best tools to analyze markets and execute trades efficiently.

We primarily offer access to:

- MetaTrader 4 (MT4): This platform is a global favorite for forex traders due to its powerful charting tools, extensive range of technical indicators, and support for automated trading via Expert Advisors (EAs). Many traders find its interface familiar and highly customizable. It’s perfect for detailed market analysis and swift trade execution.

- MetaTrader 5 (MT5): Building on the success of MT4, MT5 offers even more analytical objects, timeframes, and order types. It provides access to a broader range of financial instruments, including stocks and futures, making it a comprehensive multi-asset platform. If you’re looking for an advanced experience with more features and deeper market depth, MT5 is an excellent choice.

The advantages of using our platforms include:

Why Choose Our Platforms?

- User-Friendly Interface: Easy for beginners, yet powerful enough for advanced traders.

- Advanced Charting Tools: Perform in-depth technical analysis with a variety of indicators and drawing tools.

- Mobile Trading: Trade on the go with dedicated apps for iOS and Android devices, ensuring you never miss an opportunity.

- Automated Trading: Implement your strategies with Expert Advisors (EAs) for hands-free trading.

- High Customization: Tailor your trading environment to suit your personal preferences and strategies.

- Fast Order Execution: Experience rapid trade entry and exit, crucial in volatile markets.

“Choosing the right platform can significantly impact your trading success. Our platforms offer the versatility and power you need to navigate the forex market effectively.”

Whether you’re new to the foreign exchange market or an experienced professional, our platforms provide the tools necessary to analyze market trends, manage your positions, and execute your trading strategies with confidence. You can trade with flexibility and precision, making the most of every trading opportunity.

Frequently Asked Questions

Is Finpros South Africa a regulated broker?

Yes, Finpros South Africa operates under stringent regulatory guidelines. The article emphasizes that for South African traders, the Financial Sector Conduct Authority (FSCA) is the primary watchdog. You should verify their FSCA registration, typically found on their official website with an FSP number.

What trading platforms does Finpros offer to South African traders?

Finpros South Africa provides access to industry-leading platforms including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). They also offer Finpros WebTrader for browser-based trading and dedicated mobile trading apps for iOS and Android devices, ensuring flexibility and advanced tools for all traders.

What types of trading accounts does Finpros South Africa offer?

Finpros offers a diverse range of account types tailored for various needs, including beginner-friendly accounts, standard trading accounts for most retail traders, and advanced trader accounts for experienced professionals. They also cater to specific needs, such as swap-free (Islamic) accounts. The choice impacts leverage, spreads, minimum deposit, and accessible assets.

How can I fund and withdraw from my Finpros South Africa account?

Finpros South Africa offers convenient and secure funding options like Instant EFT, Credit/Debit Cards (Visa/MasterCard), Local Bank Transfers, and E-wallets. For withdrawals, common methods include Bank Wire Transfer, Credit/Debit Card, and E-wallets, with typical processing times varying from 1-7 business days after broker processing. Always verify account details and ensure full KYC verification for smooth transactions.

What assets can I trade with Finpros South Africa?

Finpros provides access to a comprehensive range of financial instruments. South African traders can trade Forex (major, minor, exotic pairs), Commodities (gold, silver, oil, natural gas), Indices (S&P 500, Dow Jones, NASDAQ, DAX, FTSE 100), Cryptocurrencies (Bitcoin, Ethereum, Litecoin, Ripple), and Shares (CFDs on individual stocks from global markets).

“`