Are you looking to tap into the dynamic and rapidly expanding market of Saudi Arabia? The Kingdom is experiencing an unprecedented era of economic transformation, creating a wealth of investment opportunities across various sectors. Finpros Saudi Arabia stands at the forefront, ready to guide you through this exciting landscape. We understand the unique intricacies of the Saudi market and provide the expertise you need to make informed decisions and capitalize on emerging trends. This isn’t just about investing; it’s about being part of a nation’s journey towards a vibrant future, and Finpros is your trusted partner every step of the way. We are here to help you navigate the rich potential of this powerful economy.

- Understanding Finpros and Its Presence in Saudi Arabia

- What Makes Finpros Stand Out?

- The Regulatory Environment for Brokers in Saudi Arabia

- What the CMA Does for Traders in Saudi Arabia:

- Is Finpros Regulated for Operations in Saudi Arabia?

- Key Features and Services Offered by Finpros Saudi Arabia

- Discover the Core Offerings from Finpros Saudi Arabia:

- Diverse Trading Platforms

- Comprehensive Range of Assets

- Flexible Trading Accounts

- Dedicated Customer Support

- Robust Educational Resources

- Advanced Trading Tools

- Available Trading Platforms

- Investment Products Accessible to Saudi Investors

- How to Open an Account with Finpros in Saudi Arabia

- Visit the Finpros Official Website

- Choose Your Account Type

- Complete the Registration Form

- Submit Necessary Verification Documents (KYC)

- Fund Your Account

- Start Trading

- Required Documentation for Saudi Residents

- Funding and Withdrawal Methods

- Deposit Funds: Get Started in Minutes

- Withdrawal Options: Your Profits, Your Way

- Finpros Fees, Spreads, and Commissions in Saudi Arabia

- Understanding Spreads: The Core Trading Cost

- Key Characteristics of Our Spreads:

- Commissions: When and How They Apply

- Additional Fees for Traders in Saudi Arabia

- Sharia-Compliant (Islamic) Accounts

- Deposit and Withdrawal Fees

- Inactivity Fees and Overnight Financing

- Advantages of Choosing Finpros for Saudi Arabian Investors

- Why Finpros is the Preferred Partner for Forex Trading KSA:

- A Clear Choice for Growth:

- Potential Drawbacks and Considerations for Finpros Users

- Market Volatility and Risk of Loss

- Understanding Leverage

- Learning Curve for Platform Features

- Fees, Spreads, and Swaps

- Customer Support Responsiveness

- Psychological Discipline

- Finpros Customer Support and Local Accessibility

- Dedicated Support Channels

- Understanding Local Accessibility

- Why Local Accessibility Matters for Traders:

- Security Measures and Fund Protection at Finpros Saudi Arabia

- Unwavering Regulatory Compliance

- Client Fund Segregation: Your Funds, Always Separate

- Advanced Technological Safeguards and Data Encryption

- Vigilant Risk Management and Account Monitoring

- Comparing Finpros with Other Brokers in the Saudi Market

- What Traders Look For: Key Comparison Points

- Finpros: A Closer Look at Its Edge

- Expert Tips for Successful Trading with Finpros

- Craft Your Trading Plan

- Master Risk Management

- Utilize Finpros’s Analytical Tools

- Embrace Continuous Learning

- Develop Trading Psychology

- Practice with a Demo Account

- The Future Outlook for Finpros in Saudi Arabia

- Vision 2030: A Catalyst for Financial Growth

- Key Growth Drivers and Emerging Opportunities

- Navigating the Regulatory Landscape

- Is Finpros Saudi Arabia the Right Investment Partner for You?

- Understanding Finpros’s Offering in the Saudi Market

- Advantages and Disadvantages of Considering Finpros Saudi Arabia

- Advantages:

- Disadvantages:

- Making Your Informed Decision

- Frequently Asked Questions

Understanding Finpros and Its Presence in Saudi Arabia

Finpros isn’t just another name in the financial world; it’s a rapidly growing force that’s making waves, especially in the Middle East. Think of Finpros as your dedicated partner, offering a suite of financial solutions designed to empower individuals and businesses alike. Our core mission revolves around providing accessible, transparent, and innovative trading and investment opportunities. We believe everyone deserves the chance to grow their wealth, and we work tirelessly to make that a reality for our clients.

What Makes Finpros Stand Out?

- Innovation at Core: We constantly adopt cutting-edge technology to enhance your trading experience.

- Client-Centric Approach: Your success is our priority. We offer tailored support and resources.

- Robust Security: We implement top-tier security measures to protect your assets and data.

- Diverse Offerings: From forex to commodities, we provide access to a wide range of markets.

Now, let’s talk about our strong foothold in Saudi Arabia. The Kingdom is a dynamic and thriving economic hub, ripe with opportunities. Finpros recognized this potential early on, establishing a significant presence to serve the unique needs of Saudi investors and traders. We understand the local market nuances, the regulatory landscape, and the aspirations of its people. This deep understanding allows us to offer services that resonate specifically with the Saudi Arabian community.

Our commitment to Saudi Arabia goes beyond just offering trading platforms. We actively engage with the local financial ecosystem, contributing to financial literacy and providing educational resources. We aim to be more than just a service provider; we strive to be a trusted advisor and a catalyst for financial growth within the Kingdom. Our team includes local experts who bring invaluable insights and ensure that our services are culturally relevant and exceptionally effective.

“Finpros is committed to empowering Saudi investors with cutting-edge financial tools and unparalleled support, fostering a new era of investment opportunities within the Kingdom.”

We see a bright future in Saudi Arabia, driven by Vision 2030 and an increasing appetite for sophisticated financial services. Finpros is here to meet that demand, offering reliable platforms, expert analysis, and dedicated customer support. Whether you’re a seasoned trader or just starting your investment journey, we provide the tools and guidance you need to navigate the markets with confidence. Join the growing community of satisfied Finpros clients in Saudi Arabia and unlock your financial potential.

The Regulatory Environment for Brokers in Saudi Arabia

Navigating the global financial markets requires a deep understanding of local regulations, and this is especially true for forex trading in Saudi Arabia. A robust regulatory framework provides a secure and transparent environment, giving traders confidence. Saudi Arabia has made significant strides in establishing clear guidelines for financial services, aiming to protect investors and maintain market integrity.

The primary authority overseeing financial markets, including forex brokers, in the Kingdom is the Capital Market Authority (CMA). The CMA acts as the gatekeeper, ensuring that all financial institutions operating within Saudi Arabia adhere to strict rules and ethical standards. This commitment to investor protection is a cornerstone of the Saudi financial system, making the market more appealing and trustworthy for both local and international participants.

What the CMA Does for Traders in Saudi Arabia:

- Licensing and Authorization: The CMA rigorously vets and licenses all entities wishing to offer investment services, including forex brokerage. This ensures that only reputable and financially stable firms operate in the market. Traders should always verify that their chosen broker holds a valid CMA license.

- Supervision and Compliance: Licensed brokers are under continuous supervision to ensure they comply with all regulations. This includes capital adequacy requirements, segregation of client funds, and transparent reporting practices.

- Investor Protection: The CMA establishes mechanisms to protect investors from fraud, malpractice, and unfair trading practices. This gives individual traders a layer of security, knowing there’s a body looking out for their interests.

- Market Integrity: By setting high standards, the CMA prevents market manipulation and promotes fair trading conditions for all participants in Saudi Arabia’s financial landscape.

Choosing a CMA-regulated broker offers several distinct advantages. It provides peace of mind, knowing your funds are held securely and the broker operates under a strict legal framework. This enhances transparency, as regulated entities must disclose their operational procedures and fees clearly. Moreover, it fosters trust, which is crucial when engaging in online forex trading. For anyone looking to enter the dynamic world of foreign exchange in Saudi Arabia, understanding and prioritizing the regulatory status of your broker is not just advisable; it’s essential for a secure and positive trading experience.

Is Finpros Regulated for Operations in Saudi Arabia?

Navigating the world of online forex trading requires confidence in your broker, and a major part of that confidence comes from knowing they operate under strict regulatory oversight. When it comes to Finpros and its operations within the Saudi Arabian market, traders often ask about its regulatory status. In the Kingdom of Saudi Arabia, the primary regulatory body responsible for overseeing financial markets and ensuring investor protection is the Capital Market Authority (CMA). Any financial institution, including forex brokers, that wishes to offer services to Saudi residents must adhere to the rigorous standards set by the CMA.

For any serious trader, partnering with a regulated broker is not just a preference; it’s a necessity for financial security. Unregulated entities often lack transparency, leaving your investments vulnerable. The CMA plays a crucial role in maintaining a stable and fair trading environment, which includes licensing, monitoring, and enforcing rules for all authorized financial service providers. Before you commit to any trading platform, always verify their official regulatory status directly with the relevant authorities.

Why does regulation matter so much for your forex trading journey?

- Investor Protection: Regulated brokers must segregate client funds from their operational capital, ensuring your money remains safe even if the company faces financial difficulties.

- Fair Trading Practices: Oversight bodies like the CMA enforce rules against market manipulation and deceptive practices, promoting a level playing field for all participants.

- Complaint Resolution: If a dispute arises, you have a formal channel to seek resolution through the regulatory authority.

- Transparency: Regulated entities must maintain high standards of financial reporting and disclosure, giving you a clearer picture of their operations.

When considering Finpros or any other broker for your trading activities in Saudi Arabia, always perform your due diligence. Check their official website for details regarding their licenses and cross-reference this information with the CMA’s public register. This diligent approach helps ensure your peace of mind and safeguards your valuable client funds while engaging in the dynamic world of forex trading.

Key Features and Services Offered by Finpros Saudi Arabia

Finpros Saudi Arabia stands out as a premier destination for traders seeking robust and reliable forex trading solutions. We understand the unique needs of the Saudi Arabian market, offering a suite of services designed to empower both novice and experienced traders. Our commitment revolves around providing an unparalleled online trading platform experience, complete with advanced tools, comprehensive support, and educational resources tailored to help you navigate the dynamic global financial markets effectively.

Embark on your trading journey with confidence, knowing that Finpros Saudi Arabia equips you with everything required for success. We focus on transparency, security, and user-centric design, ensuring every aspect of our service enhances your trading potential.

Discover the Core Offerings from Finpros Saudi Arabia:

-

Diverse Trading Platforms

Access the world’s most popular and powerful trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These industry-standard platforms offer intuitive interfaces, advanced charting tools, and a wide array of technical indicators, available across desktop, web, and mobile devices.

-

Comprehensive Range of Assets

Diversify your portfolio by trading a vast selection of financial instruments. Finpros Saudi Arabia offers access to major, minor, and exotic forex pairs, alongside commodities, indices, and even cryptocurrencies, giving you ample opportunities in various markets.

-

Flexible Trading Accounts

Choose from a variety of trading accounts designed to match different trading styles and capital requirements. We also provide Sharia-compliant accounts, ensuring our services align with Islamic finance principles for our clients in Saudi Arabia, offering a swap-free trading environment.

-

Dedicated Customer Support

Our professional and multilingual customer support team is available 24/5 to assist you with any queries or technical issues. We pride ourselves on providing prompt, efficient, and friendly service, ensuring a seamless trading experience.

-

Robust Educational Resources

Empower yourself with knowledge through our extensive library of educational materials. Access webinars, video tutorials, e-books, and in-depth market analysis. These resources are designed to enhance your understanding of forex trading strategies and market dynamics.

-

Advanced Trading Tools

Utilize a suite of powerful trading tools to gain an edge. This includes an economic calendar, real-time market news, analytical charts, and more, all designed to help you make informed trading decisions.

Available Trading Platforms

Choosing the right forex trading platform is like selecting the perfect cockpit for your flight into the financial markets. It’s your primary interface with the market, where you execute trades, analyze data, and manage your portfolio. A reliable and feature-rich platform makes all the difference in your online trading journey, giving you the tools you need to make informed decisions and react quickly to market movements.

You have several excellent options when it comes to sophisticated trading platforms. Each platform offers unique advantages, but some have become industry benchmarks due to their robust functionality and widespread adoption.

Let’s explore the most popular choices available to you:

- MetaTrader 4 (MT4): This is arguably the most recognized and widely used platform for retail forex trading. MT4 is famous for its user-friendly interface, powerful charting tools, and comprehensive analytical capabilities. Traders love its customizability, allowing them to use Expert Advisors (EAs) for automated trading and a vast array of custom indicators. It’s perfect for both beginners and experienced traders looking for a stable and proven environment.

- MetaTrader 5 (MT5): An evolution of MT4, MT5 offers all the strengths of its predecessor while introducing additional features. It supports more asset classes, including stocks and futures, alongside forex. MT5 provides more timeframes for analysis, enhanced technical indicators, and an economic calendar built right into the platform. If you desire advanced features and broader market access, MT5 is a fantastic choice, offering a streamlined trading experience.

- Broker-Specific Platforms: Many brokers also develop their own proprietary platforms. These often come with unique features tailored to their services, sometimes offering a simpler interface or specialized tools for their specific offerings. They aim to provide a seamless user experience, often integrating educational resources or social trading features directly within the platform.

No matter which platform you choose, ensure it provides excellent security, real-time data feeds, and reliable execution speeds. Look for platforms that offer strong mobile trading capabilities, allowing you to monitor your trades and manage your account on the go. The best platform for you will align with your trading style, the assets you wish to trade, and your technical analysis needs.

Investment Products Accessible to Saudi Investors

The investment landscape in Saudi Arabia is dynamic, offering a wide array of opportunities for local investors to grow their wealth. Whether you are a seasoned trader or just starting your investment journey, the market provides diverse avenues to suit different risk appetites and financial goals. Saudi investors today have unprecedented access to both local and global markets, making it an exciting time to explore your options.

Let’s dive into some of the most popular and accessible investment products available to Saudi investors:

- Equities (Stocks): The Tadawul (Saudi Exchange) is a vibrant market where you can invest in shares of leading Saudi companies across various sectors. Furthermore, many local brokers offer access to international stock markets, allowing you to invest in global giants. Investing in stocks provides potential for capital appreciation and dividends.

- Bonds and Sukuk: For those seeking lower-risk options, government and corporate bonds, along with Sharia-compliant Sukuk, offer a more stable income stream. These fixed-income instruments provide predictable returns over a specified period, making them excellent for portfolio diversification.

- Mutual Funds and Exchange-Traded Funds (ETFs): If you prefer professional management or want instant diversification without buying individual stocks, mutual funds and ETFs are fantastic choices. These funds pool money from multiple investors to invest in a diversified portfolio of assets, managed by experts. Saudi Arabia has a robust market for both local and international funds.

- Real Estate Investment Trusts (REITs): For those interested in real estate without the hassle of direct property ownership, REITs offer a compelling alternative. These trusts own and operate income-generating real estate, allowing you to invest in properties like shopping centers, offices, or residential complexes and earn a share of the rental income.

- Commodities: Investing in commodities like gold, silver, oil, or agricultural products can be an exciting way to diversify. You can gain exposure to commodities through ETFs, futures contracts, or other derivative products offered by various brokers. This asset class often acts as a hedge against inflation.

- Forex Trading: As a forex expert, I can tell you that the foreign exchange market is the largest and most liquid financial market globally. Saudi investors can engage in forex trading through regulated brokers, speculating on currency pair movements. This market offers high leverage and 24/5 access, but it also comes with higher risk, demanding careful strategy and risk management.

“Smart Saudi investors understand that diversification is key to long-term success. Explore various products, align them with your financial goals, and always prioritize informed decision-making.”

Before making any investment, it’s always wise to conduct thorough research, understand the associated risks, and consider consulting with a financial advisor. The Saudi market offers incredible growth potential, and with the right strategy, you can embark on a successful investment journey.

How to Open an Account with Finpros in Saudi Arabia

Embarking on your forex trading journey in Saudi Arabia with Finpros is a straightforward and secure process. We understand the importance of a smooth start, and our account opening procedure is designed for efficiency and compliance with local regulations. Getting started with Finpros means gaining access to a world of trading opportunities, robust platforms, and dedicated support tailored to our clients in KSA. Let’s walk through the simple steps to set up your trading account today. Opening an account with Finpros in Saudi Arabia follows a few clear stages. We prioritize your security and ensure all necessary regulatory checks are in place, making the process both safe and efficient.

Here’s a step-by-step guide to opening your Finpros trading account:

-

Visit the Finpros Official Website

Your first step is to navigate to the official Finpros website. Look for the “Open Account” or “Register” button, usually prominently displayed on the homepage. This will take you to our secure online registration portal where your journey begins.

-

Choose Your Account Type

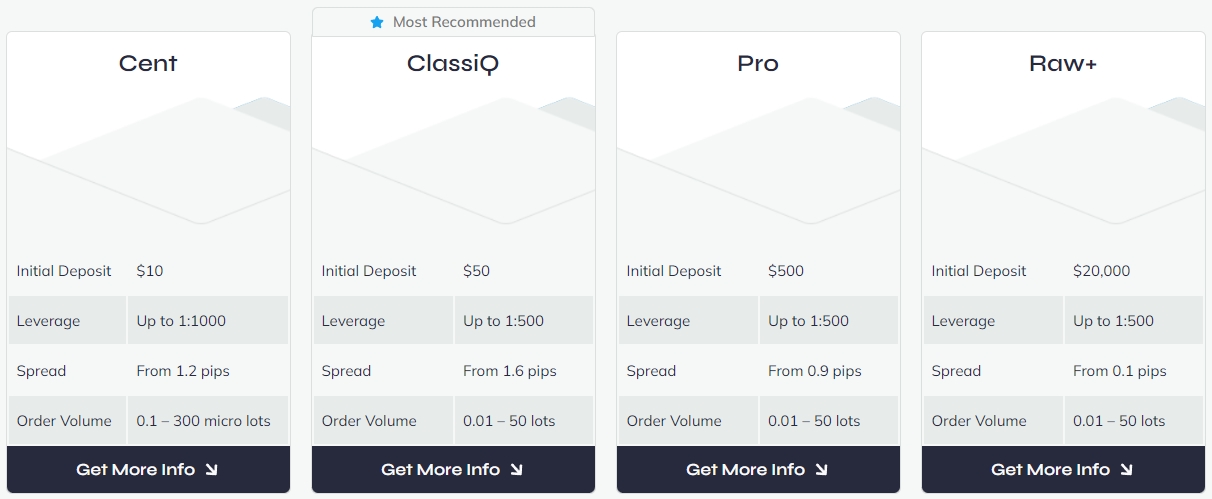

Finpros offers a variety of account types to suit different trading styles and experience levels. As a client in Saudi Arabia, you will find options that include Standard, ECN, and importantly, an Islamic (Swap-Free) account, which adheres to Sharia law principles by eliminating interest charges on overnight positions. Carefully review the features of each account and select the one that best fits your trading strategy and preferences.

-

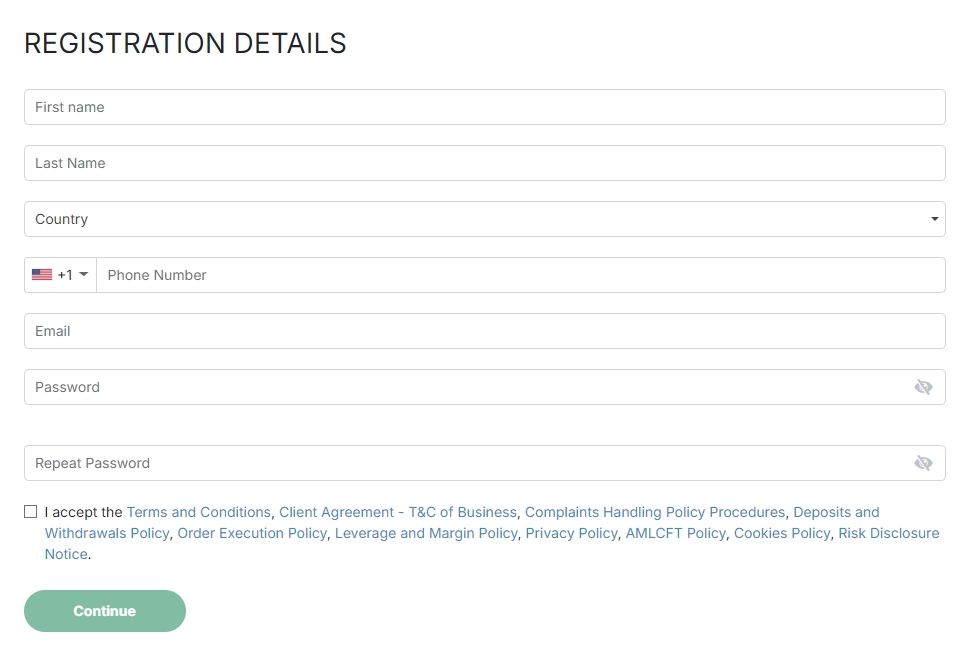

Complete the Registration Form

Fill out the online application form with accurate personal information. This typically includes your full name, email address, phone number, and residential address in Saudi Arabia. You will also need to create a secure password for your new account. Ensure all details are correct to avoid delays in the verification process.

-

Submit Necessary Verification Documents (KYC)

To comply with international financial regulations and ‘Know Your Customer’ (KYC) policies, Finpros requires identity and residency verification. This step is crucial for the security of your account and for combating financial crime. You will typically need to upload clear copies of the following:

- Proof of Identity: A valid government-issued ID such as a National ID Card or passport.

- Proof of Residence: A recent utility bill (electricity, water, internet) or bank statement, dated within the last three months, clearly showing your name and address in Saudi Arabia.

Our team processes these documents swiftly and confidentially.

-

Fund Your Account

Once your account is verified and approved, the next step is to deposit funds. Finpros offers various secure and convenient funding methods for clients in Saudi Arabia, including bank transfers, credit/debit cards, and select e-wallets. Choose your preferred method, enter the amount you wish to deposit, and follow the on-screen instructions. Remember to consider the minimum deposit requirement for your chosen account type.

-

Start Trading

Congratulations! With your account funded, you are now ready to access our advanced trading platforms (MetaTrader 4 or MetaTrader 5) and begin trading a wide range of financial instruments. Explore the markets, develop your strategy, and take advantage of the opportunities presented.

Required Documentation for Saudi Residents

Embarking on your forex trading journey as a Saudi resident is an exciting step! To ensure a smooth and secure experience, every reputable forex broker requires specific documentation. This isn’t just a formality; it’s a vital part of regulatory compliance and client protection. Think of it as building a strong foundation for your trading operations. Providing the correct paperwork quickly helps you get started without unnecessary delays.

Here’s a breakdown of the typical documents you’ll need to prepare:

- Proof of Identity: This is crucial for verifying who you are. You’ll usually submit a clear, color copy of your valid National ID card or passport. Ensure the document is current and all details are easily readable.

- Proof of Residency: Brokers need to confirm your residential address in Saudi Arabia. Common documents for this include a recent utility bill (electricity, water, or telephone bill) issued within the last three to six months, showing your name and address. A bank statement or a government-issued residency certificate might also be accepted.

- Bank Statement: Often required to verify your bank account details for deposits and withdrawals. This statement helps confirm your financial identity and ensures that funds are going to and coming from an account in your name.

- Income Verification (Optional but Recommended): While not always mandatory for account opening, some brokers might request proof of income or employment. This is more common for higher trading limits or specific account types and helps ensure responsible trading practices.

Submitting these documents is straightforward. Most platforms allow you to upload high-quality scans or photos directly through their secure portal. Make sure each document is fully visible, not cropped, and all information is legible. Taking the time to prepare these items in advance will significantly speed up your account approval process, getting you closer to participating in the global currency market.

Tips for a Smooth Documentation Process:

- Clarity is Key: Use high-resolution scans or photos. Blurry images often lead to rejection and delays.

- Check Expiry Dates: Ensure all identification documents are valid and have not expired.

- Consistency Matters: Make sure the name and address on your proof of identity match your proof of residency and the details provided during registration.

- Privacy Assurance: Reputable forex brokers employ strict data protection measures to safeguard your personal information.

Funding and Withdrawal Methods

Getting your capital into your trading account and taking your profits out should always be a smooth and hassle-free experience. We understand that your time is valuable, and that’s why we’ve streamlined our processes to offer a wide array of convenient and secure options for both depositing and withdrawing funds. Our goal is to make managing your finances as easy as navigating the markets.

Deposit Funds: Get Started in Minutes

Ready to jump into the exciting world of forex trading? Funding your forex trading account is straightforward. We provide multiple payment methods to suit your preferences, ensuring you can quickly add capital and seize market opportunities. Our system prioritizes secure transactions, giving you peace of mind with every deposit.

- Credit/Debit Cards: Visa, MasterCard, and other major cards offer instant deposits. It’s fast, familiar, and incredibly convenient for quick top-ups.

- Bank Transfer: For larger amounts, a traditional bank transfer provides a reliable method. While it might take a bit longer, it’s a solid choice for substantial funding.

- E-Wallets: Solutions like Skrill, Neteller, and others provide rapid and often fee-efficient ways to deposit funds. These digital wallets are perfect for traders who value speed and discretion.

Withdrawal Options: Your Profits, Your Way

After a successful trading session, you’ll want to access your earnings. Our withdrawal options are designed for efficiency and transparency. We aim for quick processing times so you can enjoy your profits without unnecessary delays. Just like deposits, all withdrawals undergo strict security protocols to safeguard your money.

When you initiate a withdrawal, we typically send the funds back to the original source of your deposit. This approach enhances security and helps prevent fraud. If that’s not possible, we have alternative secure methods available. We believe in clear communication about any associated fees or minimum withdrawal amounts, ensuring there are no surprises.

| Method | Typical Processing Time | Notes |

|---|---|---|

| Credit/Debit Card | 3-5 Business Days | Funds returned to the card used for deposit. |

| Bank Transfer | 2-7 Business Days | Ideal for larger amounts; secure and reliable. |

| E-Wallets | 24-48 Hours | Fastest option for many, digital transfer to your e-wallet. |

We are constantly reviewing and expanding our range of methods to offer you the best experience possible. Our dedicated support team is always ready to assist you with any questions regarding your funding and withdrawals, ensuring your focus remains on trading.

Finpros Fees, Spreads, and Commissions in Saudi Arabia

Venturing into the dynamic world of forex and CFD trading with Finpros in Saudi Arabia means understanding the financial aspects that impact your trades. We prioritize clear communication regarding all trading costs, ensuring you can make informed decisions. Our fee structure is designed to be competitive, transparent, and easy to grasp, primarily revolving around spreads, commissions, and a few other potential charges.

Understanding Spreads: The Core Trading Cost

Spreads are the difference between the bid and ask price of any tradable asset. This small difference is essentially how brokers earn revenue on each transaction. At Finpros, we strive to offer highly competitive spreads that can vary based on market conditions, liquidity, and the specific instrument you are trading.

Key Characteristics of Our Spreads:

- Variable Spreads: Many of our most popular instruments, especially major forex pairs like EUR/USD and GBP/USD, feature variable spreads. This means the spread can fluctuate throughout the trading day, often tightening during peak market hours and potentially widening during periods of low liquidity or major economic news releases.

- Tight Spreads: We continuously work with top-tier liquidity providers to ensure you benefit from some of the tightest spreads available. This commitment helps reduce your transaction costs and enhance your potential profitability.

- Instrument-Specific: Spreads will naturally differ across various asset classes. For example, major forex pairs typically have tighter spreads than exotic pairs or certain CFD instruments. You’ll find real-time spread information directly on our trading platforms.

Commissions: When and How They Apply

While spreads are a common way for brokers to charge, commissions represent another fee structure, often tied to specific account types or asset classes. Our approach ensures flexibility for different trading styles.

| Account Type / Asset Class | Commission Details | Impact on Trading |

|---|---|---|

| Standard & Most CFD Accounts | Generally commission-free. The primary cost is the spread. | Simplified cost calculation; ideal for traders who prefer all-inclusive spreads. |

| Certain Raw Spread / ECN Accounts | A small, fixed commission per lot traded, in addition to very tight, raw spreads. | Favored by high-volume traders seeking minimal spread impact; total cost is spread + commission. |

| Stock CFDs | May involve a small commission per trade or per share, depending on the specific stock and exchange. | Reflects the underlying market structure for equity trading; details provided per instrument. |

We encourage you to review the specific terms associated with your chosen account type and the instruments you plan to trade. This ensures full clarity on commission structures.

Additional Fees for Traders in Saudi Arabia

We understand that a complete picture of trading costs includes more than just spreads and commissions. Here are other considerations:

Sharia-Compliant (Islamic) Accounts

For our clients in Saudi Arabia who require it, Finpros offers Sharia-compliant Islamic accounts. A key feature of these accounts is the absence of swap fees (interest on overnight positions), aligning with Islamic finance principles. Instead of swaps, Islamic accounts may involve:

- An administrative fee applied after a certain number of holding days on specific instruments.

- Slightly wider spreads on certain instruments compared to standard accounts, especially for long-term positions.

We provide comprehensive details on the specific terms for Islamic accounts upon request, ensuring full compliance and transparency.

Deposit and Withdrawal Fees

We strive to make funding and withdrawing from your account as straightforward and cost-effective as possible.

“Our commitment is to minimize transaction costs for our valued clients. We typically do not impose deposit fees, but always be aware of potential charges from your own bank or payment service provider for international transfers or currency conversions.”

Regarding withdrawals, while Finpros aims to process them without charge, a small administrative fee might apply for certain methods or if the withdrawal amount falls below a specific threshold. All applicable fees are clearly displayed in your client portal before you confirm a transaction.

Inactivity Fees and Overnight Financing

- Inactivity Fees: To cover administrative costs, an inactivity fee might be applied to accounts that remain dormant for an extended period (e.g., 6-12 months) without any trading activity or open positions. We always send timely notifications before any such fee is imposed.

- Swap Fees (Overnight Financing) for Non-Islamic Accounts: If you hold a position open overnight in a non-Islamic account, you will either incur a swap fee or receive a swap credit. This is an interest adjustment reflecting the interest rate differential between the two currencies in a pair. Swaps can be positive or negative, depending on the instrument and prevailing market rates.

At Finpros, our goal is to empower your trading journey in Saudi Arabia with a clear, competitive, and fair cost structure. Should you have any questions about specific fees, spreads, or commissions, our dedicated client support team is always ready to assist you.

Advantages of Choosing Finpros for Saudi Arabian Investors

Making smart investment choices is crucial for building wealth, and for Saudi Arabian investors, the right partner makes all the difference. Finpros stands out as a premier choice, offering a suite of benefits specifically tailored to meet the unique needs and preferences of traders in the Kingdom. We understand what matters most to you: security, ethical trading, and strong support.

Why Finpros is the Preferred Partner for Forex Trading KSA:

- Robust Regulatory Framework: Finpros adheres to strict international regulatory standards, ensuring a secure and transparent trading environment. This commitment to compliance gives our Saudi Arabian clients peace of mind, knowing their investments are handled with the utmost integrity.

- Sharia-Compliant Trading Options: We recognize the importance of faith in financial decisions. Finpros proudly offers comprehensive Sharia-compliant forex trading accounts, designed to align with Islamic finance principles. Our swap-free accounts mean you can trade confidently without incurring interest, making us a leading choice for those seeking ethical investment solutions.

- Competitive Spreads and Fast Execution: Experience the advantage of trading with low spreads and lightning-fast execution speeds. This directly impacts your profitability, allowing you to capitalize on market movements efficiently. Our advanced technology infrastructure is built to provide a seamless trading experience.

- Dedicated Localized Support: Our team understands the nuances of the local market. Finpros offers dedicated customer support, often in Arabic, available to assist you with any queries or concerns, ensuring you receive timely and relevant help when you need it most. We are here to guide you every step of the way.

- Cutting-Edge Trading Platforms: Access industry-leading trading platforms that are intuitive, powerful, and packed with analytical tools. Whether you’re a beginner or an experienced trader, our platforms offer the functionality you need to make informed decisions and execute trades effectively.

For individuals looking to expand their diversified investment portfolio, Finpros provides access to a wide range of assets beyond just currency pairs. This allows you to explore various markets and manage your risk effectively. Our commitment is to empower you with the tools, knowledge, and support necessary to achieve your financial aspirations in the dynamic world of forex trading.

A Clear Choice for Growth:

When you choose Finpros Saudi Arabia, you’re not just picking a broker; you’re partnering with a firm dedicated to your success. We combine global expertise with local understanding, delivering an unmatched trading experience for investors across the Kingdom.

Potential Drawbacks and Considerations for Finpros Users

Stepping into the world of online trading platforms like Finpros brings exciting opportunities, but it’s crucial to approach it with a clear understanding of potential challenges. While the platform offers robust tools and resources, every trader should be aware of certain aspects to ensure a well-informed and strategic journey. Being prepared for these considerations helps you navigate the markets more effectively and manage your expectations.Here are some key considerations for anyone using Finpros:

-

Market Volatility and Risk of Loss

Forex and CFD trading naturally involve significant risk. Market prices can change rapidly due to economic news, geopolitical events, or other unexpected factors. You must understand that you can lose all your invested capital. Responsible trading means never investing more than you can comfortably afford to lose and always prioritizing sound risk management strategies. Developing a strong trading plan and sticking to it, even during market turbulence, becomes absolutely essential.

-

Understanding Leverage

Finpros, like many other brokers, offers leverage, which allows you to control a large position with a smaller amount of capital. While leverage can amplify your profits, it dramatically increases your potential losses as well. A small market move against your position can lead to significant account drawdown. Before using high leverage, ensure you fully grasp its implications and how it impacts your overall risk exposure.

-

Learning Curve for Platform Features

Finpros provides a comprehensive suite of tools, charting options, and analytical features. For new traders, or those transitioning from simpler platforms, the sheer depth of functionality might initially feel overwhelming. While powerful, mastering these tools takes time and practice. Invest time in exploring the platform’s full capabilities and utilize any available demo accounts to become proficient without risking real money.

-

Fees, Spreads, and Swaps

Always have a clear understanding of the costs associated with your trading activity. This includes spreads (the difference between buying and selling prices), overnight swap fees for holding positions open past a certain time, and any potential commission charges. These costs, though seemingly small individually, can accumulate and impact your overall profitability, especially with frequent trading or longer-term positions. Transparency about these charges is key to smart financial planning.

-

Customer Support Responsiveness

In fast-moving markets, timely support is critical. While Finpros aims to provide excellent service, evaluating the responsiveness and availability of their customer support channels is wise. Consider what methods of communication they offer (live chat, email, phone) and how quickly they address inquiries or technical issues. Knowing you have reliable support when you need it offers peace of mind.

-

Psychological Discipline

Trading is as much a psychological game as it is analytical. Emotions like fear, greed, and impatience can lead to impulsive decisions that deviate from your trading strategy. Maintaining emotional discipline, sticking to your predetermined entry and exit points, and not chasing losses are vital for long-term success. Finpros provides the tools, but your mental fortitude drives your trading outcomes.

By carefully considering these aspects, Finpros users can better prepare themselves for the challenges of the financial markets. An informed trader is a confident trader, equipped to make smarter decisions and pursue their trading goals with greater awareness.

Finpros Customer Support and Local Accessibility

Embarking on your forex trading journey with a reliable partner is paramount. At Finpros, we understand that seamless support and a deep connection to your local trading environment are not just preferences, but necessities. Our commitment extends beyond providing advanced trading platforms; we prioritize building a robust support system designed to assist you every step of the way, wherever you are in the world.

Dedicated Support Channels

When you trade with Finpros, you gain access to a multi-faceted customer support network. We’ve meticulously crafted our support structure to ensure you receive timely and effective assistance for any query or technical issue. Your peace of mind is our priority.

- 24/5 Live Chat: Get instant answers to your questions, connect with our support team in real-time. This is perfect for quick queries about your account, platform navigation, or trading conditions.

- Email Support: For more detailed inquiries or when you need to send documents, our email support team provides thorough and comprehensive responses. We aim to address all emails promptly.

- Phone Assistance: Sometimes, a direct conversation is best. Our dedicated phone lines connect you with experienced representatives who can guide you through complex issues or provide personalized solutions.

Understanding Local Accessibility

True support goes beyond just answering questions; it means understanding your context. Finpros prides itself on its local accessibility, ensuring that your trading experience feels tailored and intuitive, no matter your location. This commitment makes a significant difference in how effectively you can manage your trades and seize market opportunities.

Why Local Accessibility Matters for Traders:

| Aspect | Finpros Approach | Trader Benefit |

|---|---|---|

| Multilingual Support | Our teams speak a wide array of languages, ensuring you communicate comfortably. | Clear communication, fewer misunderstandings, and faster issue resolution in your native tongue. |

| Regional Market Insight | We monitor local market trends and regulations, adapting our services accordingly. | Relevant trading information, localized market analysis, and compliant trading environment. |

| Time Zone Coverage | Our support operates across major time zones to be available when you need us most. | Access to support during your active trading hours, regardless of your geographical location. |

At Finpros, we believe that robust customer support combined with genuine local accessibility creates an unmatched trading environment. We aim to empower you, providing the confidence and tools you need to navigate the dynamic forex markets successfully. Join our community and experience the difference that dedicated, locally aware support can make in your trading journey.

Security Measures and Fund Protection at Finpros Saudi Arabia

When you navigate the dynamic world of forex trading, one thing stands paramount: the safety of your investments. At Finpros Saudi Arabia, we understand this concern deeply. We commit to providing a trading environment where your capital is not just managed, but meticulously protected through a robust framework of advanced security measures and stringent fund protection protocols. Your peace of mind is our priority, allowing you to focus on your trading strategies with confidence.

Unwavering Regulatory Compliance

Operating within the financial landscape of Saudi Arabia demands adherence to the highest standards. Finpros Saudi Arabia operates under a strict regulatory framework designed to safeguard investors. This commitment to regulatory compliance ensures transparency, fairness, and accountability in all our operations. We regularly audit our practices and uphold all necessary licenses, giving you a clear picture of our dedication to investor protection.

Client Fund Segregation: Your Funds, Always Separate

One of the cornerstones of our fund protection strategy is client fund segregation. This critical measure means that your trading capital is held in separate bank accounts, distinct from Finpros Saudi Arabia’s operational funds. This separation ensures that your money is not used for our business expenses and remains accessible to you. In the unlikely event of any financial instability for the company, your funds are ring-fenced and secure, providing an essential layer of forex fund protection.

Here’s what client fund segregation at Finpros Saudi Arabia means for you:

- Independent Accounts: Your capital resides in dedicated client accounts with top-tier financial institutions.

- No Commingling: We never mix your funds with our own operational capital.

- Increased Security: This practice significantly reduces risk, offering enhanced security for your investments.

- Regulatory Mandate: It’s a core requirement for regulated brokers, reinforcing our commitment to best practices.

Advanced Technological Safeguards and Data Encryption

In the digital age, cybersecurity is non-negotiable. Finpros Saudi Arabia employs state-of-the-art technological safeguards to protect your personal information and trading activities. Our secure trading platform uses advanced data encryption to shield all data transmissions between your device and our servers. This means your sensitive information, from account details to transaction history, remains confidential and protected from unauthorized access.

Our comprehensive cybersecurity measures include:

| Security Feature | Benefit to You |

|---|---|

| SSL Encryption (Secure Socket Layer) | Encrypts all data transfers, securing your personal and financial information. |

| Firewall Protection | Acts as a barrier against unauthorized access to our network. |

| Secure Servers | Hosted in highly secure data centers with redundant systems. |

| Two-Factor Authentication (2FA) | Adds an extra layer of security for account logins, if enabled by the client. |

| Regular Security Audits | Proactive checks to identify and address potential vulnerabilities. |

We continuously invest in robust systems and professional expertise to stay ahead of evolving cyber threats. This proactive approach ensures a secure trading platform for every client.

Vigilant Risk Management and Account Monitoring

Effective risk management is integral to maintaining a stable and secure trading environment. Finpros Saudi Arabia implements comprehensive risk management strategies to monitor market exposure and protect client accounts. We provide tools and resources to help you manage your own trading risks, but also employ internal controls to prevent excessive leverage and ensure market integrity.

Our systems also feature continuous account monitoring for unusual activity. If anything seems out of the ordinary, our dedicated security team quickly investigates, providing an additional layer of protection for your Finpros Saudi Arabia security. We believe that empowering you with secure tools and maintaining vigilant oversight are key to fostering a trustworthy trading experience.

Comparing Finpros with Other Brokers in the Saudi Market

Navigating the forex landscape in Saudi Arabia presents unique opportunities and challenges for traders. The market is dynamic, and choosing the right broker is paramount to your trading success. While many international brokers operate here, understanding how Finpros stands out among its peers can make a significant difference in your trading journey. We’re talking about more than just numbers; it’s about the entire trading experience.

When you evaluate a forex broker in the Saudi market, several critical factors come into play. Traders often look for a blend of reliability, advanced tools, competitive pricing, and local understanding. Let’s explore how Finpros measures up against common offerings from other brokers.

What Traders Look For: Key Comparison Points

Here’s a snapshot of what savvy traders consider when sizing up brokers:

- Regulatory Compliance: Is the broker regulated by a reputable authority? This offers a layer of security for your investments. Many brokers serve the Saudi market, but their regulatory frameworks can vary widely.

- Trading Platforms: Do they offer industry-standard platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5)? What about proprietary platforms? Ease of use, advanced charting, and mobile accessibility are crucial.

- Spreads and Commissions: How competitive are the trading costs? Tight spreads and low commissions directly impact your profitability. Some brokers might offer tempting low spreads but hide higher commissions or vice versa.

- Account Types: Are there options for different trading styles and capital levels, such as standard, ECN, or Islamic accounts? Islamic accounts are particularly important in the Saudi market due to Sharia principles.

- Customer Support: Is local support available? Can you get help in Arabic? Prompt and effective customer service, especially during trading hours, is invaluable.

- Educational Resources: Do they provide training materials, webinars, and market analysis to help you grow as a trader? Beginner-friendly resources are a huge plus.

- Deposit and Withdrawal Options: Are local payment methods supported, making transactions smooth and hassle-free?

Finpros: A Closer Look at Its Edge

Finpros has carved a niche in the Saudi market by focusing on specific aspects that truly matter to local traders. While other brokers may offer a broad range of services, Finpros often excels in areas such as:

- Tailored Local Support: Many other brokers offer generic international support. Finpros often provides dedicated local teams who understand the nuances of the Saudi market and communicate effectively in Arabic. This personalized touch makes a big difference.

- Sharia-Compliant Trading: Recognizing the importance of Islamic finance, Finpros prioritizes offering robust Islamic (swap-free) accounts, ensuring compliance with religious principles without compromising on trading opportunities. Not all brokers provide this with the same level of commitment or clarity.

- Competitive Cost Structure: Finpros consistently works to maintain transparent and competitive pricing. You’ll find that their spreads and commission structures are designed to be straightforward, allowing you to clearly calculate your potential profit without hidden fees often seen elsewhere.

- User-Friendly Platforms with Advanced Features: While many brokers offer MT4/MT5, Finpros often enhances the experience with additional tools, resources, and a seamless interface. They focus on stability and speed, which are critical for fast-moving forex markets.

When you stack Finpros against many generalist brokers operating in the Saudi market, its specialized focus on local needs, clear cost structures, and dedicated support often places it in a strong position. It’s not just about having a platform; it’s about providing a comprehensive trading environment that respects and caters to the specific requirements of traders in Saudi Arabia. Make sure you compare features that align with your trading style and priorities for an informed decision.

Expert Tips for Successful Trading with Finpros

Embarking on the trading journey, especially in the dynamic world of forex, requires more than just capital. It demands strategy, discipline, and the right tools. With Finpros, you gain access to a powerful platform, but true success comes from how you leverage it. As a seasoned expert, I’m here to share invaluable insights to elevate your trading game and help you thrive.

Successful traders don’t rely on luck; they rely on a well-thought-out approach. Here are some fundamental principles and expert tips that will guide you towards consistent results with Finpros:

-

Craft Your Trading Plan

Before you place a single trade, define your goals, risk tolerance, and chosen strategies. A comprehensive trading plan acts as your roadmap. It includes your entry and exit points, position sizing, and how you will manage your capital. Adhering to this plan is crucial for maintaining discipline and avoiding impulsive decisions. Finpros provides the tools to execute your plan flawlessly, but the plan itself originates from your analysis.

-

Master Risk Management

This is arguably the most important aspect of sustainable trading. Never risk more than a small percentage of your capital on any single trade. Use stop-loss orders diligently to protect your investments from unexpected market shifts. Learn to calculate your risk-reward ratio before entering a trade. Effective risk management ensures you stay in the game longer, allowing your winning strategies to accumulate profits over time. Finpros offers robust order types to help you manage your exposure.

-

Utilize Finpros’s Analytical Tools

Your Finpros platform isn’t just for executing trades; it’s a treasure trove of analytical resources. Explore the charting tools, technical indicators, and economic calendars available. Performing thorough market analysis before trading is non-negotiable. Understand support and resistance levels, identify trends, and stay informed about global economic events that impact currency pairs. Leveraging these features empowers you to make informed decisions.

-

Embrace Continuous Learning

The financial markets are constantly evolving. What worked yesterday might not work tomorrow. Stay updated with new forex trading strategies, market news, and platform enhancements. Read, research, and refine your approach. A curious mind is a profitable mind. Finpros often provides educational resources and market insights to support your learning journey.

-

Develop Trading Psychology

Your mindset plays a significant role in your trading success. Control your emotions; avoid trading based on fear or greed. Stick to your plan even when the market is volatile. Understand that losses are part of trading; learn from them and move on without letting them affect your confidence. A calm, rational approach will serve you far better than emotional reactions.

-

Practice with a Demo Account

If you’re new to a strategy or the Finpros platform, always start with a demo account. It allows you to test your forex trading strategies in a real-time market environment without risking actual capital. This practice builds confidence and familiarity, making your transition to live trading smoother and more effective.

By integrating these expert tips into your trading routine with Finpros, you position yourself for long-term success. Remember, trading is a marathon, not a sprint. Consistency, discipline, and a commitment to continuous improvement are your greatest assets.

The Future Outlook for Finpros in Saudi Arabia

Saudi Arabia is rapidly transforming its economic landscape, and the financial sector stands at the forefront of this evolution. For professional forex traders – or “Finpros” – the Kingdom presents a fascinating blend of traditional wealth and forward-thinking digital innovation. We’re witnessing an unprecedented push towards diversification, fueled by Vision 2030, which actively seeks to position Saudi Arabia as a global investment powerhouse and a hub for advanced financial services. This ambitious vision creates fertile ground for Finpros, offering exciting opportunities to navigate and profit from the Kingdom’s burgeoning markets.

Vision 2030: A Catalyst for Financial Growth

The Kingdom’s strategic blueprint, Vision 2030, is not just an economic plan; it’s a complete societal transformation. Its core tenets directly impact the financial sector, creating a dynamic environment for professional traders:

- Economic Diversification: Moving beyond oil, Saudi Arabia invests heavily in new sectors like technology, tourism, and manufacturing. This diversification generates new asset classes and market dynamics, ripe for analysis and trading.

- Digital Transformation: A massive emphasis on digitalization across all industries means faster, more efficient financial infrastructure, advanced trading platforms, and greater access to market data.

- Financial Sector Development Program (FSDP): A key pillar of Vision 2030, the FSDP aims to make Saudi Arabia a leading financial center, boosting capital market depth, enabling financial institutions to grow, and enhancing financial literacy and inclusion.

- Attracting Foreign Investment: The Kingdom actively encourages foreign direct investment, leading to increased capital flows and more sophisticated market participants, which in turn creates deeper, more liquid trading environments.

These initiatives aren’t just theoretical; they are tangible drivers shaping the future for Finpros operating within or looking to enter the Saudi market.

Key Growth Drivers and Emerging Opportunities

Several factors contribute to the optimistic outlook for Finpros:

- Young, Tech-Savvy Population: A significant portion of Saudi Arabia’s population is young and highly connected. This demographic is eager to explore digital investment opportunities, creating a growing base for retail trading and financial education services.

- Government Support for FinTech: Regulatory bodies like the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA) are proactive in establishing regulatory sandboxes and frameworks to foster FinTech innovation. This supportive environment encourages new platforms and services catering to advanced trading strategies.

- Increasing Market Liquidity: As more local and international investors enter the market, liquidity naturally increases. High liquidity is crucial for Finpros, enabling larger trades with minimal price impact and tighter spreads.

- Sophisticated Trading Infrastructure: Ongoing investments in high-speed connectivity, advanced trading platforms, and data analytics tools are providing Finpros with the resources they need to execute complex strategies efficiently.

Consider the potential emerging opportunities:

| Opportunity Area | Impact for Finpros |

|---|---|

| Digital Asset Trading | Exploration of regulated crypto and blockchain-based assets as the regulatory framework evolves. |

| Algorithmic Trading & AI | Demand for automated strategies and AI-driven insights, leveraging advanced local infrastructure. |

| Wealth Management Integration | Opportunities to partner with wealth managers to offer specialized forex trading solutions for high-net-worth individuals. |

| Cross-Border Flow Optimization | Leveraging Saudi Arabia’s growing global trade relations to specialize in currency pairs linked to new partnerships. |

Navigating the Regulatory Landscape

Saudi Arabia’s financial regulators, primarily SAMA and the CMA, are committed to creating a robust yet secure environment. They strive to balance innovation with investor protection. For Finpros, understanding and adhering to these regulations is paramount. While they aim to attract foreign investment and foster a dynamic market, they also maintain strict oversight to prevent market manipulation and ensure fair play. This commitment to a regulated and transparent market actually benefits professional traders by creating a more predictable and trustworthy trading ecosystem.

The future for Finpros in Saudi Arabia looks exceptionally bright. The Kingdom’s unwavering commitment to economic transformation, coupled with significant investments in digital infrastructure and a supportive regulatory framework, sets the stage for unprecedented growth. Professional traders who can adapt to the evolving landscape, leverage technological advancements, and understand the unique market dynamics will find themselves at the forefront of a truly exciting financial revolution.

Is Finpros Saudi Arabia the Right Investment Partner for You?

Deciding on an investment partner in a dynamic market like Saudi Arabia requires careful consideration. You want a firm that not only understands the local landscape but also aligns with your personal financial aspirations. Finpros Saudi Arabia presents itself as a contender, offering a suite of services designed for traders and investors. But does it truly fit your unique needs?

Before committing your capital, it is crucial to evaluate various aspects of any brokerage. We will explore what Finpros brings to the table, weighing its potential benefits against common investor concerns, to help you make an informed decision about your financial future.

Understanding Finpros’s Offering in the Saudi Market

Finpros aims to provide a comprehensive trading experience for individuals in Saudi Arabia. They typically offer access to various financial instruments, catering to both seasoned traders and those new to the world of online investing. Their platform is often highlighted for its user-friendly interface, designed to simplify complex market navigation.

Here are some key areas to consider:

- Asset Diversity: Explore whether Finpros provides access to the markets you are interested in, such as forex, commodities, indices, or even cryptocurrencies. A broader selection gives you more opportunities to diversify your investment portfolio.

- Trading Platform: Assess the technology they offer. Is it robust, reliable, and does it include features like advanced charting tools, technical indicators, and fast execution speeds? A good trading platform is the backbone of successful market engagement.

- Educational Resources: For many investors, especially beginners, access to quality educational materials, webinars, and market analysis is invaluable. Does Finpros offer resources that can help you sharpen your trading skills and market knowledge?

- Customer Support: Responsive and knowledgeable customer support is vital. Look into their availability, languages offered (especially Arabic support), and the channels through which you can reach them (phone, email, live chat).

Advantages and Disadvantages of Considering Finpros Saudi Arabia

Every investment platform comes with its own set of strengths and weaknesses. Understanding these can help you gauge if Finpros aligns with your personal trading style and risk tolerance.

Advantages:

- Local Market Focus: Potentially a deeper understanding of the Saudi Arabian financial regulations and investor preferences.

- Accessible Entry: Often designed to be accessible for a wide range of investors, potentially with lower minimum deposit requirements.

- Diverse Trading Instruments: Could offer a wide selection of markets for diversified trading strategies.

- Technology-Driven Platform: A modern and intuitive trading interface that enhances user experience.

Disadvantages:

- Regulatory Clarity: It is essential to verify their specific regulatory status within Saudi Arabia to ensure your investments are protected.

- Spreads and Fees: Trading costs can impact profitability. Always compare their spreads, commissions, and other fees with competitors.

- Market Depth: While offering diverse instruments, the depth of liquidity for certain niche markets might vary.

- Experience Level Match: While beginner-friendly, advanced traders might look for more sophisticated tools or institutional-grade services.

Making Your Informed Decision

Ultimately, the choice of an investment partner rests on your individual circumstances. Consider your financial goals, your risk appetite, and the level of support and resources you expect from a brokerage.

“A wise investor always conducts thorough due diligence, ensuring their chosen partner not only offers competitive services but also prioritizes the security and growth of their capital.”

Take the time to explore Finpros Saudi Arabia’s official website, read user reviews, and perhaps even try a demo account if available. Engage with their customer service to get a direct feel for their responsiveness and expertise. Your financial journey is unique, and selecting the right partner is a crucial step toward achieving your investment objectives.

Frequently Asked Questions

What is Finpros Saudi Arabia’s core mission?

Finpros Saudi Arabia aims to provide accessible, transparent, and innovative trading and investment opportunities, empowering individuals and businesses to grow their wealth within the dynamic Saudi market.

What is the role of the CMA in Saudi Arabia’s financial market?

The Capital Market Authority (CMA) is the primary authority overseeing financial markets in Saudi Arabia, rigorously vetting and licensing financial institutions, supervising compliance, and protecting investors from fraud and unfair practices.

What types of trading accounts does Finpros Saudi Arabia offer, particularly for local investors?

Finpros Saudi Arabia offers various trading accounts, including Standard, ECN, and notably, Sharia-compliant (Swap-Free) accounts to align with Islamic finance principles by eliminating interest charges on overnight positions.

What security measures does Finpros Saudi Arabia implement to protect client funds?

Finpros Saudi Arabia implements client fund segregation (holding client funds in separate bank accounts from operational funds), advanced SSL encryption, firewall protection, secure servers, and regular security audits to protect client investments and data.

Why is Finpros considered a preferred partner for forex trading in Saudi Arabia?

Finpros is preferred due to its robust regulatory adherence, offering Sharia-compliant trading options, competitive spreads and fast execution, dedicated localized (often Arabic) support, and cutting-edge trading platforms.