Are you navigating the exciting yet challenging world of online trading and searching for a platform that truly meets your needs? Many traders encounter various options, and Finpros often emerges as a name to consider. But with so many choices available, how do you determine if Finpros is the right fit for your trading aspirations?

This comprehensive Finpros review cuts through the noise. We embark on an in-depth analysis, meticulously examining every facet of this platform. Our goal is to provide a clear, unbiased perspective, tailored specifically for active and aspiring traders. We want to equip you with all the vital information to make confident decisions about where you place your trust and capital in the dynamic financial markets.

- Introduction to Finpros Broker

- Understanding Finpros: What It Offers

- Key Offerings from Finpros

- Finpros Trading Platforms: A Closer Look

- What Makes Finpros Platforms Stand Out?

- Web Platform and Features

- Key Features That Elevate Your Trading:

- Mobile Trading Capabilities

- Account Types at Finpros: Choosing Your Fit

- Key Considerations When Selecting Your Finpros Account:

- Finpros Fees, Spreads, and Commissions Structure

- Spreads: Your Gateway to the Markets

- Commissions: For the Discerning Trader

- Other Finpros Account Fees to Note

- Transparent Pricing Overview

- The Power of Clarity in Forex Pricing

- Deposit & Withdrawal Methods: Ease and Efficiency

- Funding Your Forex Trading Account

- Seamless Withdrawals: Accessing Your Profits

- Available Options and Processing Times

- Common Deposit and Withdrawal Methods

- Available Assets for Trading on Finpros

- Currency Pairs (Forex)

- Commodities

- Global Indices

- Stocks (CFDs)

- Cryptocurrencies

- Is Finpros Regulated? Security Measures and Trust

- The Cornerstone of Confidence: Regulatory Oversight

- Fortifying Your Future: Advanced Security Measures

- Building Trust Through Action

- Regulatory Status of Finpros

- Client Fund Protection and its Level

- Finpros Customer Support: Accessibility and Quality

- How to Reach Us: Your Options for Support

- The Finpros Quality Standard: Expert Help When You Need It

- How to Contact Finpros Support

- Educational Resources and Tools by Finpros

- Why Finpros Education Stands Out

- Harnessing Practical Tools for Your Trading Journey

- Pros and Cons of Using Finpros

- The Advantages of Trading with Finpros

- The Disadvantages of Trading with Finpros

- Finpros Review: User Experiences and Testimonials

- Key Insights from Finpros Users

- What Traders Say: Finpros User Testimonials

- General Sentiment: A Positive Finpros Experience

- Conclusion: Making an Informed Decision on Finpros

- Frequently Asked Questions

Introduction to Finpros Broker

As someone deeply entrenched in the world of forex, I understand the critical importance of choosing the right partner. Let me introduce you to Finpros broker, an online broker that has quickly established itself as a formidable presence in the financial markets. Finpros is more than just a platform; it’s a dedicated gateway designed to empower traders like you, offering direct access to vast trading opportunities across global markets. Our mission focuses on providing a superior trading experience.

At its core, Finpros understands the dynamic needs of modern traders. We offer a robust investment platform that caters to both novices taking their first steps into forex trading and seasoned professionals seeking advanced strategies. You gain access to a wide array of diverse assets, ensuring you can always find the instruments that match your market view. Our commitment extends to delivering a secure trading environment where your focus remains on execution.

What truly sets Finpros apart as a reliable partner?

- Cutting-Edge Trading Tools: Access advanced charting, analytical resources, and real-time data to inform your decisions.

- User-Friendly Interface: Navigate the platform with ease, designed for intuitive operation across all devices.

- Competitive Spreads: Benefit from transparent and advantageous pricing structures, maximizing your potential returns.

- Exceptional Customer Support: Our dedicated team stands ready to assist you, ensuring a smooth journey every step of the way.

In the fast-paced world of financial markets, having a broker that prioritizes your success and provides unwavering support is invaluable. Finpros embodies this partnership philosophy, making them a top choice for serious traders.

Finpros broker is not just about transactions; it’s about building lasting relationships and fostering an environment where every trader can thrive. Explore the advantages of trading with a platform committed to your growth and success in the exciting realm of forex.

Understanding Finpros: What It Offers

Ever wondered what sets a trading platform apart in today’s dynamic financial world? Let’s dive deep into Finpros and explore its unique proposition. Finpros isn’t just another platform; it’s a comprehensive ecosystem designed for traders, by traders. Whether you’re taking your first steps into the market or you’re a seasoned professional seeking advanced tools, Finpros offers a tailored experience to help you navigate the complexities of financial trading with confidence and precision.

Our mission is simple: empower individuals to achieve their financial aspirations through accessible, cutting-edge technology and robust support. We believe that everyone deserves the opportunity to participate in global markets. This belief drives us to continuously innovate, ensuring our users have the best resources at their fingertips.

Key Offerings from Finpros

Finpros provides a suite of features meticulously crafted to enhance your trading journey. We focus on delivering value across multiple dimensions, from market access to educational resources.

- Diverse Asset Access: Trade a wide range of instruments, including major and minor forex pairs, commodities, indices, and more. This variety allows you to diversify your portfolio and explore different market opportunities.

- Advanced Trading Platforms: Benefit from industry-leading trading platforms that offer intuitive interfaces, powerful charting tools, and customizable features. Execute trades swiftly and efficiently, and analyze market trends with detailed precision.

- Competitive Spreads and Low Commissions: Maximize your potential returns with transparent and competitive pricing. We strive to offer some of the best trading conditions, reducing your costs and improving your bottom line.

- Robust Security Measures: Your security is our top priority. We employ state-of-the-art encryption and stringent protocols to safeguard your funds and personal information, giving you peace of mind as you trade.

- Exceptional Customer Support: Our dedicated support team is available around the clock to assist you with any questions or issues. We provide multilingual support, ensuring you receive timely and effective help whenever you need it.

- Comprehensive Educational Resources: Whether you’re a beginner or an experienced trader, our extensive library of educational materials, including webinars, articles, and tutorials, helps you continuously improve your trading knowledge and skills.

We understand that the financial markets never sleep, and neither do we. Finpros operates with a commitment to reliability and performance, ensuring that you always have access to the tools and information you need, precisely when you need them. Join a community that values growth, innovation, and success.

Finpros Trading Platforms: A Closer Look

Diving into the world of online trading requires more than just a keen eye for market trends; it demands powerful, reliable tools. At Finpros, we understand this fundamental need, which is why we offer a suite of trading platforms designed to empower every trader, from the novice explorer to the seasoned market veteran. Your platform is your command center, and we ensure it’s equipped for every challenge and opportunity the financial markets present.

We pride ourselves on providing robust technology that facilitates seamless execution and in-depth analysis. Whether you prefer the industry-standard giants or crave the simplicity of a web-based solution, Finpros has tailored options to fit your trading style. Our goal is to make your trading journey as efficient and effective as possible, giving you the edge you need to navigate the dynamic forex market.

What Makes Finpros Platforms Stand Out?

Our platforms are more than just tools; they are comprehensive environments built for precision and performance. Here’s a quick look at what you can expect:

- Advanced Charting Tools: Visualize market data with a wide array of indicators and drawing tools to spot key patterns and make informed decisions.

- Blazing-Fast Execution: Experience minimal slippage and rapid order placement, crucial for capitalizing on fleeting market opportunities.

- Intuitive User Interface: Navigate effortlessly through various functions, customize your workspace, and access essential features with ease.

- Mobile Accessibility: Trade on the go with dedicated mobile apps, ensuring you never miss a market move, no matter where you are.

- Comprehensive Analysis: Access a wealth of market data, news feeds, and analytical resources directly within your platform to support your trading strategies.

- Customization Options: Tailor your trading environment to match your preferences, from chart layouts to notification settings.

We offer a selection that typically includes MetaTrader 4 (MT4) and MetaTrader 5 (MT5), widely recognized for their powerful features, extensive indicator libraries, and automated trading capabilities through Expert Advisors. For those who prefer a more direct approach without software installation, our proprietary web trader provides instant access to markets from any browser, blending simplicity with sophisticated functionality. Each platform option delivers a reliable and secure environment for your trading activities.

Choosing the right platform is a critical step in your trading journey. We encourage you to explore the capabilities of each Finpros platform to find the perfect fit for your individual needs. Our commitment to cutting-edge technology ensures that you always have the best tools at your fingertips, helping you to achieve your financial goals with confidence and control.

Web Platform and Features

Step into the exciting world of forex trading with our cutting-edge web platform. We designed it for both novice and experienced traders, offering a seamless and powerful trading experience directly from your browser. Forget about complex downloads or installations; our platform puts the global financial markets at your fingertips, ready when you are. You can access it from any device with an internet connection, ensuring you never miss a trading opportunity. Our focus is on providing robust functionality paired with an intuitive interface, making your journey into foreign exchange both productive and enjoyable.

Key Features That Elevate Your Trading:

- Advanced Charting Tools: Dive deep into market analysis with our comprehensive charting package. You get access to various chart types, timeframes, and over 100 technical indicators. Customize your charts to identify trends and patterns with precision.

- Real-Time Market Data: Stay ahead with live price feeds and instant market updates. Our platform delivers real-time quotes, ensuring you always have the most current information for informed decision-making.

- Lightning-Fast Trade Execution: Experience rapid order placement and execution. Our infrastructure minimizes latency, allowing you to enter and exit trades swiftly, crucial for volatile forex markets.

- One-Click Trading: Simplify your trading process with our convenient one-click trading function. Execute trades directly from the chart or market watch window, saving you valuable time.

- Integrated Economic Calendar: Keep track of important economic events and announcements that influence currency movements. Our integrated calendar helps you anticipate market volatility and plan your strategies accordingly.

- Robust Risk Management Tools: Protect your capital with essential risk management features. Set stop-loss and take-profit orders easily to define your risk exposure and secure your gains.

- Customizable Workspace: Tailor your trading environment to suit your preferences. Arrange windows, save layouts, and personalize your dashboard for an optimal and efficient workflow.

Our web-based trading platform is more than just a tool; it’s your command center for navigating the dynamic forex market. We continuously update and improve its features based on trader feedback, ensuring you always have access to the latest technological advancements. Join us and discover a superior online trading experience that empowers your financial ambitions.

Mobile Trading Capabilities

Modern forex traders understand the power of flexibility, and that’s exactly what robust mobile trading capabilities deliver. Imagine having the entire global currency market at your fingertips, accessible anytime, anywhere. A high-quality forex trading app transforms your smartphone or tablet into a portable trading station, empowering you to execute trades, monitor positions, and react to market movements no matter where your day takes you. This means true trading on the go, ensuring you never miss a potential opportunity.

The best mobile platforms are more than just scaled-down versions of their desktop counterparts. They are meticulously designed for intuitive use on smaller screens, offering a streamlined experience that doesn’t compromise on functionality. Here’s what you should expect from top-tier mobile forex trading:

- Real-time Market Data: Instantly access live quotes, news feeds, and economic calendars to stay informed.

- Advanced Charting Tools: Utilize a full suite of technical indicators and chart types directly on your device for in-depth analysis.

- One-Touch Trading: Execute trades swiftly with minimal clicks, perfect for fast-moving markets.

- Comprehensive Account Management: Deposit funds, withdraw profits, and review your transaction history securely from your phone.

- Customizable Push Notifications: Set up alerts for price levels, order execution, or breaking news, keeping you constantly connected.

- Robust Security Features: Benefit from encryption and authentication protocols that ensure your sensitive data and funds remain protected.

Embracing a powerful mobile forex trading app gives you unprecedented control over your financial ventures. Whether you are commuting, traveling, or simply away from your desk, you retain full command. You can analyze trends, place orders, and manage risk with confidence, knowing you have access to crucial tools and timely information. This level of accessibility means you are always responsive, able to adapt to market shifts and make informed decisions on the fly. It’s about empowering you with the freedom to trade your way, on your terms, with secure mobile trading a top priority for developers.

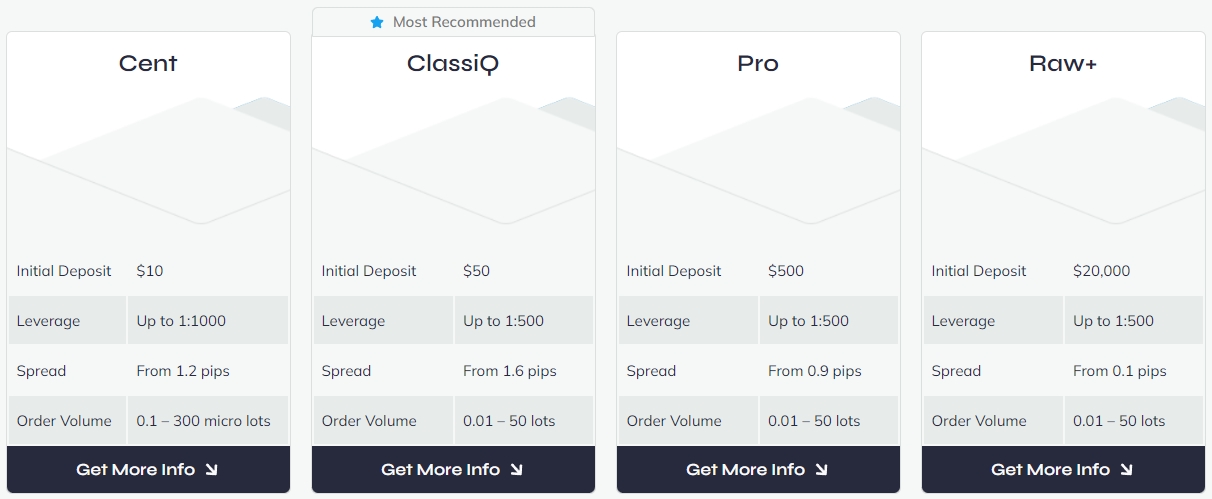

Account Types at Finpros: Choosing Your Fit

Embarking on your trading journey at Finpros begins with a crucial decision: selecting the account type that perfectly aligns with your ambitions and trading style. We understand that every trader is unique, bringing different levels of experience, capital, and risk appetite to the market. That’s why Finpros offers a diverse spectrum of accounts, each meticulously designed to empower you.

Think of it as choosing the right tool for the job. You wouldn’t use a wrench to hammer a nail, right? Similarly, the ideal trading account can significantly enhance your experience, providing the right leverage, spreads, and support tailored specifically for you. We don’t believe in a one-size-fits-all approach; instead, we offer flexibility and options to ensure your success.

Key Considerations When Selecting Your Finpros Account:

- Experience Level: Are you just starting, or do you have years of active trading under your belt? Some accounts offer more simplified interfaces and educational resources, while others provide advanced tools for seasoned professionals.

- Trading Capital: Your initial deposit often determines the available account tiers. Finpros has options that cater to various budget sizes, from modest beginnings to substantial investments.

- Trading Strategy: Do you prefer short-term scalping, day trading, swing trading, or long-term position holding? Certain account features, like tighter spreads or specific commission structures, might better suit your preferred methodology.

- Risk Tolerance: Leverage levels can vary significantly between account types. Understand how much risk you’re comfortable taking and choose an account that offers appropriate margin requirements.

- Access to Tools & Features: Some accounts provide premium analytical tools, dedicated account managers, or exclusive market insights. Consider which resources are most valuable for your trading decisions.

Finpros prides itself on transparency and support. We provide clear, concise information about each account’s features, benefits, and requirements. Our dedicated support team is always ready to guide you through the selection process, answering any questions you may have. We help you navigate the options so you can make an informed decision that sets you up for optimal performance in the dynamic forex market.

Finpros Fees, Spreads, and Commissions Structure

Understanding the costs associated with your trading is crucial for maximizing your profitability. At Finpros, we believe in transparent pricing, ensuring you always know what to expect. Our Finpros trading costs are designed to be competitive, offering a balance between tight spreads, low commissions, and high-quality execution. We aim to empower your trading journey without hidden surprises, making your forex trading experience as cost-effective as possible.

Spreads: Your Gateway to the Markets

The spread is the difference between the bid and ask price of a currency pair, and it’s a primary component of Finpros trading costs. We strive to provide some of the most competitive spreads in the industry, especially on major currency pairs. Our advanced technology and deep liquidity partnerships allow us to offer variable spreads that react in real-time to market conditions. This means you often benefit from significantly tighter spreads during periods of high liquidity.

Consider the following examples of typical minimum spreads on our most popular instruments:

- EUR/USD: As low as 0.0 pips

- GBP/USD: Starting from 0.8 pips

- USD/JPY: From 0.7 pips

- Gold (XAU/USD): Competitive spreads reflecting market depth

These figures can fluctuate based on market volatility and the type of account you hold. Our commitment to transparent pricing means you see the live spread directly in your trading platform before you even execute a trade.

Commissions: For the Discerning Trader

For traders seeking the absolute tightest spreads and direct market access, Finpros offers accounts that include a small, straightforward commission per trade. This structure is common in ECN (Electronic Communication Network) environments, where you benefit from raw interbank spreads. When you choose an account with commissions, your Finpros commissions are clearly stated and applied per standard lot traded.

Here’s how our commission structure typically works:

| Account Type | Typical Commission (per standard lot round turn) | Key Benefit |

|---|---|---|

| Standard Account | None (spread-only) | Simplicity, no separate commission fee |

| ECN Account | Starts from $3.50 per side | Ultra-tight spreads, direct market pricing |

We designed these structures to cater to different trading styles and preferences. Whether you prefer the simplicity of a spread-only account or the razor-thin spreads of an ECN setup, Finpros provides options that align with your trading strategy.

Other Finpros Account Fees to Note

Beyond spreads and commissions, Finpros aims to keep other Finpros account fees to a minimum. We pride ourselves on a clear fee structure, avoiding many of the hidden charges found elsewhere. Here’s what you should know:

- Deposit Fees: We do not charge fees for most common deposit methods.

- Withdrawal Fees: While Finpros generally doesn’t impose withdrawal fees, some payment providers may levy their own charges. We advise checking with your chosen method.

- Inactivity Fees: To keep your account active and avoid potential fees, ensure you engage in at least one trade or maintain a minimum balance over a specified period. Details are always available in our terms and conditions.

- Overnight (Swap) Fees: When you hold positions open overnight, you may incur or receive swap charges, which reflect the interest rate differential between the two currencies in a pair. These are standard in forex trading and vary by currency pair and market conditions.

“At Finpros, our commitment to transparent pricing goes beyond just numbers. It’s about building trust, ensuring fair play, and empowering every trader to make informed decisions about their Finpros trading costs. We equip you with the tools to understand and manage your expenses effectively.”

We work tirelessly to maintain a highly competitive and straightforward Finpros fees structure. This allows you to focus more on your trading strategies and less on unexpected costs, contributing to a more effective and potentially profitable trading experience.

Transparent Pricing Overview

Understanding the true forex trading costs is fundamental for any serious trader. We believe in providing a transparent pricing model so you always know exactly what you’re paying. No surprises, no hidden charges – just straightforward information that empowers your trading decisions. This clarity builds trust and allows you to accurately calculate your potential profits and risks, making your trading journey much smoother and more predictable.

When you engage in forex trading, you’ll primarily encounter a few core trading fees. Let’s break down the typical components of our transparent pricing model:

- Spreads: This is the difference between the buy (ask) and sell (bid) price of a currency pair. It’s often the main way brokers earn revenue. Tighter spreads generally mean lower forex trading costs for you, directly impacting your potential gains on every trade.

- Commissions: Some account types, especially those offering raw or interbank spreads, might charge a fixed commission per trade or per lot. This is an explicit fee that adds to your overall trading fees, but often compensates for extremely tight spreads.

- Swap Rates (Overnight Interest): If you hold a position open overnight, you might either pay or receive swap rates. This is an interest adjustment based on the interest rate differential between the two currencies in a pair. It’s a crucial consideration for long-term strategies.

The Power of Clarity in Forex Pricing

Why does clarity in forex pricing matter so much? Here are the undeniable advantages that a truly transparent pricing model brings to your trading experience:

| Advantage | Benefit to Trader |

|---|---|

| Accurate Budgeting | You can accurately forecast your forex trading costs, making better strategic decisions without unexpected drains on your capital. |

| Increased Trust | Knowing all trading fees upfront fosters a strong sense of trust between you and your broker, creating a reliable partnership. |

| True Performance Evaluation | Easily assess the real profitability of your strategies without unexpected hidden charges eroding your hard-earned gains. |

| Effective Comparison | Transparent brokers make it simple to compare their pricing model against others, ensuring you always get the best value for your trades. |

A reputable broker clearly publishes all spreads, commissions, and swap rates on their website, often in a dedicated section. They provide detailed contract specifications for each instrument. Furthermore, their customer support should be able to answer any questions about trading fees directly and without hesitation. Watch out for brokers that make it difficult to find this information or use vague language about forex trading costs – that’s a red flag for potential hidden charges.

Ultimately, a transparent pricing model is a cornerstone of a successful and stress-free forex trading experience. It ensures you focus on the markets and your strategy, not on deciphering your bill.

Deposit & Withdrawal Methods: Ease and Efficiency

Embarking on your journey in the world of forex trading requires not only sharp strategies but also a seamless financial experience. You need confidence that managing your money is straightforward, secure, and swift. That’s precisely what we offer with our robust deposit methods and withdrawal options. We understand that quick access to your capital and profits is paramount for successful online trading.

Funding Your Forex Trading Account

Getting started with your forex trading account is incredibly easy. We provide a diverse range of ways to deposit funds, ensuring you can choose the method that best suits your needs. Our aim is to make your initial deposit, and all subsequent ones, as smooth as possible, allowing you to focus on market analysis rather than payment processing.

- Credit/Debit Cards: Use your Visa or MasterCard for instant deposits. It’s a familiar, fast, and highly convenient way to fund your account directly.

- Bank Wire Transfers: For larger amounts, traditional bank transfers offer a secure and reliable option. While they may take a little longer, they are trusted globally for significant transactions.

- E-Wallets: Popular digital payment solutions like Skrill, Neteller, and PayPal provide an excellent balance of speed and security. These methods often facilitate instant deposits, giving you immediate access to the markets.

- Local Payment Solutions: Depending on your region, we offer various localized payment options designed for your convenience.

Each deposit method is designed for your ease. We employ advanced encryption technology to protect your financial details, ensuring every transaction to deposit funds is a secure transaction.

Seamless Withdrawals: Accessing Your Profits

After a successful trading session, getting your hands on your profits should be just as easy as putting money in. We prioritize fast withdrawals, understanding that timely access to your funds is crucial for managing your capital and enjoying the fruits of your trading efforts. Our withdrawal process is streamlined and transparent, ensuring you can retrieve your money without unnecessary delays.

Here’s how our withdrawal process ensures efficiency:

| Withdrawal Method | Processing Time (Approx.) | Key Benefit |

|---|---|---|

| Credit/Debit Cards | 2-5 Business Days | Convenient & widely accepted |

| Bank Wire Transfers | 3-7 Business Days | High limits & secure for large amounts |

| E-Wallets (Skrill, Neteller, PayPal) | 24-48 Hours | Fastest processing for many users |

Before your first withdrawal, we typically require a simple verification process. This vital step is for your protection, ensuring your funds are released only to you, preventing unauthorized access and maintaining the highest standards of security for all your financial transactions. Our dedicated support team is always ready to guide you through any questions regarding deposit methods or withdrawal options, making sure your experience is nothing short of excellent.

Available Options and Processing Times

Understanding how your money moves in and out of your trading account is just as crucial as your trading strategy. You want your funds to be accessible when you need them, whether you are depositing to seize an opportunity or withdrawing your well-earned profits. Most reputable forex brokers offer a range of convenient payment solutions, each with its own characteristics regarding speed and accessibility.

Here’s a look at the typical options you will encounter and what you can expect regarding their processing times:

Common Deposit and Withdrawal Methods

| Method | Typical Deposit Time | Typical Withdrawal Time | Notes |

|---|---|---|---|

| Bank Wire Transfer | 1-5 Business Days | 3-7 Business Days | Reliable for larger sums, but often the slowest method. Bank holidays can extend times. |

| Credit/Debit Cards (Visa, MasterCard) | Instant | 1-3 Business Days | Popular for speed and convenience. Withdrawals usually return to the card used for deposit. |

| E-wallets (Skrill, Neteller, PayPal, etc.) | Instant | Within 24 Hours | Favored by many traders for their exceptional speed. You need an existing e-wallet account. |

| Local Bank Transfers/Online Banking | Instant to a few hours | 1-2 Business Days | Region-specific options providing fast transfers directly from your bank account. |

| Cryptocurrencies (Bitcoin, Ethereum) | Minutes to a few hours | Minutes to a few hours | Increasingly offered for their speed and decentralization, but transaction fees can vary. |

Keep in mind that while deposits are often instantaneous, especially with cards and e-wallets, withdrawals always involve a processing period. Brokers need to conduct internal security checks and comply with regulatory requirements, like “Know Your Customer” (KYC) procedures. This is a standard and necessary part of the process to protect both you and the broker from fraud. Furthermore, your bank or payment processor might add their own processing time on top of the broker’s, so always factor that in when planning your withdrawals.

It’s always a smart move to review your chosen broker’s specific funding pages. They detail their exact policies, any potential fees, and the most accurate processing times for each method they support. Choosing a method that aligns with your trading frequency and financial needs ensures a smoother, stress-free experience.

Available Assets for Trading on Finpros

Embark on your trading journey with Finpros and discover a world of diverse financial instruments at your fingertips. We understand that a robust trading strategy often involves access to a wide array of markets, allowing you to seize opportunities and manage risk effectively. Our platform offers a comprehensive selection of popular trading assets, catering to both seasoned traders and those just starting out in the exciting realm of financial markets.

Here’s a closer look at the key asset classes you can explore on Finpros:

Currency Pairs (Forex)

Dive into the largest financial market globally with forex trading. Exchange rates constantly fluctuate, presenting endless opportunities for traders. Finpros provides access to a vast selection of currency pairs, from major pairs with high liquidity to more volatile exotic pairs.

- Major Pairs: These include the most traded currencies like EUR/USD, GBP/USD, USD/JPY. They offer tight spreads and significant trading volume.

- Minor Pairs: Featuring one major currency and another non-USD major currency, such as EUR/GBP or AUD/JPY.

- Exotic Pairs: These involve a major currency paired with a currency from a developing economy, like USD/MXN or EUR/TRY. They can offer higher volatility but also carry increased risk.

Commodities

Trade a range of essential commodities that influence global economies. Commodity trading allows you to speculate on price movements of raw materials, often seen as a hedge against inflation or a play on global supply and demand dynamics.

You can engage with both hard and soft commodities:

| Category | Examples on Finpros |

|---|---|

| Precious Metals | Gold, Silver |

| Energies | Crude Oil (Brent, WTI), Natural Gas |

| Agricultural | (Availability varies, but common examples include Coffee, Wheat, Sugar) |

Global Indices

Gain exposure to entire national or regional economies by trading global indices. These instruments represent a basket of top-performing stocks from a specific market, reflecting the overall health and sentiment of that economy.

Some of the most popular indices for online trading include:

- S&P 500 (US)

- Dow Jones Industrial Average (US)

- DAX 40 (Germany)

- FTSE 100 (UK)

- Nikkei 225 (Japan)

Trading indices offers a way to diversify your portfolio without needing to analyze individual company performance, focusing instead on broader economic trends.

Stocks (CFDs)

Access the equity market by trading Contracts for Difference (CFDs) on individual stocks from leading global companies. Stock CFDs allow you to speculate on price movements of shares without actually owning the underlying asset. This means you can profit from both rising and falling markets.

Finpros provides opportunities to trade CFDs on shares from various sectors and geographies, including tech giants, automotive leaders, and financial institutions. Explore investment opportunities in companies you know and follow.

Cryptocurrencies

Step into the fast-paced world of digital assets. Cryptocurrency trading has gained immense popularity due to its high volatility and potential for significant price movements. Finpros offers access to popular cryptocurrencies as CFDs, allowing you to speculate on their value against traditional currencies.

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

Remember that the cryptocurrency market can be highly unpredictable, offering both substantial rewards and considerable risks.

“A diversified portfolio of trading assets is like a well-built ship; it can weather more storms than one made of a single material.” – Acknowledging the wisdom of diversification in financial markets.

Finpros strives to provide a comprehensive selection of trading assets, empowering you to build a diversified portfolio and adapt your strategies to ever-changing market conditions. Explore these exciting markets and unlock your trading potential today!

Is Finpros Regulated? Security Measures and Trust

When you venture into the dynamic world of forex trading, one of your top concerns should always be the safety of your capital and personal information. You need assurance that your chosen broker operates with the highest standards of integrity and transparency. So, let’s address the crucial question: Is Finpros regulated? And what robust security measures do we have in place to earn your trust?

The Cornerstone of Confidence: Regulatory Oversight

Your peace of mind starts with knowing your broker operates under strict regulatory frameworks. Finpros is committed to providing a secure and compliant trading environment. We understand that strong regulation is not just a formality; it’s a shield that protects you, the trader. Our operations are overseen by reputable financial authorities, ensuring we adhere to stringent capital requirements, fair trading practices, and transparent reporting. This means we operate with accountability, putting your interests first.

- Client Fund Segregation: Your trading capital is held in segregated accounts, entirely separate from the company’s operational funds. This critical measure ensures your money remains protected, even in unforeseen circumstances.

- Financial Transparency: We maintain a high level of financial disclosure, undergoing regular audits by independent firms. This commitment to openness builds a foundation of trust.

- Fair Trading Practices: Regulatory bodies enforce rules that ensure fair execution of trades, transparent pricing, and robust dispute resolution mechanisms. We strictly follow these guidelines.

Fortifying Your Future: Advanced Security Measures

Beyond regulatory compliance, Finpros implements state-of-the-art technology and protocols to safeguard your assets and data. We take the responsibility of protecting your information and funds very seriously. Our multi-layered security approach creates a resilient defense against threats, letting you focus on your trading strategies with confidence.

Explore some of our key security features:

| Security Aspect | How Finpros Protects You |

|---|---|

| Data Encryption | We use advanced SSL (Secure Socket Layer) encryption across our entire platform. This technology encrypts all data transmitted between your browser and our servers, keeping your personal details and transaction information private. |

| Network Security | Our network infrastructure is protected by robust firewalls and intrusion detection systems. We constantly monitor for suspicious activities to prevent unauthorized access. |

| Account Verification | We implement a thorough account verification process (KYC – Know Your Customer) to confirm your identity, adding another layer of security against fraud and identity theft. |

| Secure Payment Gateways | All deposits and withdrawals are processed through trusted and secure payment gateways, ensuring that your financial transactions are handled with the utmost care and security. |

Building Trust Through Action

Trust isn’t just about showing a license; it’s about consistent, reliable action. At Finpros, we build trust through our unwavering dedication to your security and success. Our commitment extends beyond mere compliance; it’s embedded in our culture. You deserve a trading partner who values your investment as much as you do, and we strive to be that partner every single day.

Join Finpros and trade with the confidence that comes from robust regulation, advanced security, and a broker truly committed to your peace of mind.

Regulatory Status of Finpros

Understanding the regulatory landscape is paramount when you choose a forex broker. It’s the bedrock of trust and security in your trading journey. At Finpros, we recognize the critical importance of robust oversight and operate with utmost transparency and strict adherence to industry-leading standards.

Finpros proudly operates as a fully regulated forex broker. This means we are subject to rigorous examination and ongoing supervision by respected financial regulatory bodies. These authorities ensure that we maintain high capital adequacy, employ strict risk management protocols, and uphold fair business practices for all our clients. Our commitment to this regulated environment demonstrates our dedication to your safety and the integrity of your trading experience.

- Enhanced Client Fund Security: Your invested capital is segregated from the company’s operational funds, held in separate accounts with top-tier banks. This crucial measure provides an additional layer of investor protection, safeguarding your assets even in unforeseen circumstances.

- Fair and Transparent Operations: Regulatory compliance mandates transparent pricing, clear execution policies, and honest dealings across all our services. This ensures a level playing field and consistent fairness for every trader engaging with our platform.

- Robust Dispute Resolution: Should any issues or concerns arise, the regulatory framework provides clear, independent channels for resolution. This structure gives you peace of mind, knowing that your interests are protected by an external authority.

- Commitment to Ethical Practices: We consistently meet and exceed strict compliance standards set by financial authorities. This reflects our unwavering dedication to ethical and professional conduct in every aspect of our service, from client onboarding to trade execution.

We believe that being a licensed trading platform is not just a regulatory requirement; it is a fundamental pillar of our promise to you. Our strong regulatory status underscores our unwavering commitment to providing a secure, reliable, and trustworthy trading environment for all global forex trading participants.

Client Fund Protection and its Level

When you venture into the exciting world of forex trading, one of your top concerns should always be the security of your capital. Understanding client fund protection is absolutely crucial. It’s not just about finding a profitable strategy; it’s about knowing your money is safe, even in unforeseen circumstances. Reputable brokers go to great lengths to ensure the safety of your investment, implementing a variety of robust mechanisms designed to shield your funds.

The cornerstone of safeguarding your money is the use of segregated accounts. This means your trading capital is kept entirely separate from the broker’s operational funds. Think of it like this: your money is in its own secure vault, distinct from the company’s own assets. This critical practice ensures that even if a broker faces financial difficulties, your funds remain untouched and accessible, protected from creditors.

Beyond segregation, the level of protection often hinges on regulatory oversight. Different jurisdictions offer varying degrees of security. Here’s a breakdown of common protective measures:

- Regulatory Guarantees: Brokers regulated by top-tier authorities (like the FCA in the UK, CySEC in Cyprus, or ASIC in Australia) often participate in investor compensation funds or deposit guarantee schemes. These schemes provide an extra layer of security, offering financial compensation up to a certain limit if a regulated broker becomes insolvent.

- Negative Balance Protection: This is a powerful safety net, especially for retail traders. It guarantees that you cannot lose more money than you have deposited in your trading account. If market movements cause your account balance to fall below zero, the broker absorbs the loss, preventing you from owing them money. This is a common feature among many regulated brokers.

- Internal Risk Management: Beyond external regulations, a broker’s internal risk management policies play a vital role in financial safety measures. This includes robust technological infrastructure, continuous monitoring, and sound operational practices to prevent security breaches and maintain liquidity.

The “level” of protection you receive directly correlates with the broker’s regulatory framework and their commitment to client safety. Always look for brokers operating under strong regulatory bodies, as they are mandated to adhere to strict financial standards and conduct regular audits. This transparency and accountability ensure that your trust accounts are managed with the utmost integrity.

Finpros Customer Support: Accessibility and Quality

In the fast-paced world of forex trading, having reliable and accessible customer support isn’t just a luxury; it’s a necessity. At Finpros, we understand that questions can arise at any moment, and issues need swift, expert resolution. That’s why we’ve built our customer support system around two core pillars: unparalleled accessibility and unwavering quality. We want you to feel confident and supported every step of your trading journey, knowing a knowledgeable team is always ready to assist.

How to Reach Us: Your Options for Support

We believe in making it easy for you to connect with us, no matter where you are or what time it is. Our multi-channel approach ensures you can choose the method that best suits your needs:

- Live Chat: Get instant answers to your pressing questions with our 24/7 live chat service. Our friendly and expert representatives are just a click away, ready to provide real-time assistance and guidance.

- Email Support: For more detailed inquiries or when you need to send supporting documents, our email support team offers comprehensive and thoughtful responses. We commit to prompt replies, ensuring your concerns are addressed thoroughly.

- Phone Support: Sometimes, a direct conversation is the most effective way to resolve an issue. Our dedicated phone lines connect you with experienced support specialists who can talk you through any challenge or query you might have.

The Finpros Quality Standard: Expert Help When You Need It

Accessibility is only one part of the equation; the quality of the support you receive is equally vital. Our customer support team consists of highly trained professionals with deep knowledge of the forex market and the Finpros platform. They are not just problem-solvers; they are trading advocates committed to enhancing your experience.

- Expert Knowledge: Our team members undergo rigorous training, ensuring they possess comprehensive knowledge of our platform, trading instruments, and market dynamics. They can provide accurate and relevant information, helping you navigate complex situations.

- Prompt Resolution: We pride ourselves on efficiency. Our goal is to resolve your queries quickly and effectively, minimizing downtime and letting you focus on what matters most – your trading.

- Personalized Approach: We don’t believe in one-size-fits-all solutions. Our team takes the time to understand your specific situation, offering tailored advice and solutions that genuinely address your needs.

- Multilingual Support: Trading knows no borders, and neither does our support. We offer assistance in multiple languages, ensuring you can communicate comfortably and clearly.

Finpros’ commitment to exceptional customer support means you always have a reliable partner by your side. We’re here to empower your trading journey with accessible, high-quality assistance whenever you need it.

How to Contact Finpros Support

Navigating the dynamic world of forex trading requires reliable support, and Finpros understands this completely. When you have questions, encounter an issue, or simply need guidance, reaching out to our dedicated support team is straightforward and hassle-free. We believe that exceptional customer service is a cornerstone of your successful trading journey.

- Live Chat: For immediate assistance, our live chat feature is your fastest option. Simply click the chat icon on our website, and one of our friendly support agents will be ready to help you with real-time solutions to your queries. This is perfect for quick questions about your account, platform navigation, or trading conditions.

- Email Support: If your query is less urgent or requires detailed explanation, sending an email to our support desk is an excellent choice. You can typically find our support email address on the “Contact Us” page of the Finpros website. We commit to responding to all email inquiries promptly, providing comprehensive answers and solutions.

- Phone Support: For those who prefer direct conversation, Finpros offers phone support. Speaking directly with a support specialist allows for a more personalized interaction, especially for complex issues or when you need verbal clarification. You can find the relevant phone numbers for your region on our official contact page.

Our commitment is to provide you with expert assistance whenever you need it. Whether you are a seasoned trader or just starting your forex journey, the Finpros support team is always here to ensure your experience is smooth and efficient. We are passionate about helping you achieve your trading goals.

Educational Resources and Tools by Finpros

Diving into the fast-paced world of forex trading might seem daunting at first, but with the right guidance, anyone can learn to navigate its exciting currents. At Finpros, we believe that education is the cornerstone of successful trading. We empower our community with a comprehensive suite of learning materials and innovative tools designed to transform aspiring traders into confident market participants. Forget guesswork; embrace knowledge.

Why Finpros Education Stands Out

We don’t just give you information; we provide actionable insights and practical skills. Our educational philosophy centers on clarity, relevance, and accessibility, ensuring that whether you’re a complete beginner or an experienced trader looking to refine your strategies, you’ll find immense value.

- Expert-Led Webinars: Join live sessions with seasoned forex professionals. Ask questions, understand market dynamics, and get real-time analysis directly from the experts. These interactive sessions cover everything from basic concepts to advanced trading strategies.

- In-Depth E-Books and Guides: Access a rich library of digital resources that break down complex topics into easy-to-understand modules. Learn about technical analysis, fundamental indicators, risk management, and much more at your own pace.

- Intuitive Video Tutorials: Visual learners rejoice! Our library of video tutorials guides you step-by-step through platform features, order placement, and chart interpretation, making complex tasks simple.

- Comprehensive Trading Glossary: Never feel lost with unfamiliar terminology again. Our detailed glossary explains all the essential forex terms, ensuring you speak the language of the market fluently.

Harnessing Practical Tools for Your Trading Journey

Knowledge alone isn’t enough; you need the right instruments to put that knowledge into practice. Finpros equips you with state-of-the-art tools that complement your learning and enhance your trading performance.

| Tool Category | Description | Key Benefit for You |

|---|---|---|

| Demo Accounts | Practice trading with virtual funds in a real market environment. Experience our platform without any financial risk. | Develop strategies, test theories, and build confidence before using real capital. |

| Advanced Charting Tools | Access powerful charting capabilities with multiple indicators, drawing tools, and timeframes. | Identify trends, spot patterns, and make informed trading decisions with clarity. |

| Economic Calendar | Stay updated on crucial global economic events, news releases, and their potential market impact. | Anticipate market volatility and plan your trades around significant fundamental drivers. |

| Market Analysis & Insights | Receive daily market updates, expert commentaries, and strategic insights directly from our analysts. | Gain a deeper understanding of market movements and potential trading opportunities. |

“Investing in knowledge pays the best interest.” At Finpros, we live by this philosophy, providing you with the finest educational resources and tools to ensure your journey in forex trading is both enlightening and profitable. Join our community and start building your trading expertise today!

We are constantly updating our educational content and introducing new tools to keep you ahead of the curve. Your success is our mission, and empowering you with knowledge and the right instruments is how we achieve it. Ready to learn and grow? Finpros is here to guide every step of the way.

Pros and Cons of Using Finpros

Diving into the world of online trading platforms requires careful consideration. When you look at Finpros, you find a dynamic environment built for traders, but like any powerful tool, it comes with its own set of advantages and challenges. Understanding these aspects helps you make an informed decision about whether it aligns with your trading goals and style.

The Advantages of Trading with Finpros

Finpros often stands out for several compelling reasons that attract both new and seasoned traders. Its design focuses on empowering users with the right tools and information.

- Intuitive Interface: Many users praise Finpros for its clean, easy-to-navigate platform. You won’t spend hours trying to figure out how to place a trade or analyze a chart. Everything feels logical and accessible, making your trading journey smoother.

- Diverse Asset Offerings: Beyond standard currency pairs, Finpros typically provides access to a broad spectrum of trading instruments. You can explore opportunities in commodities, indices, and even some cryptocurrencies, allowing for excellent portfolio diversification.

- Robust Analytical Tools: For those who love data, Finpros offers a comprehensive suite of charting tools and technical indicators. These features help you conduct in-depth market analysis, identify trends, and spot potential entry and exit points with greater precision.

- Strong Educational Resources: Finpros understands that knowledge is power. They often provide extensive educational materials, from beginner guides to advanced strategy webinars. This commitment to learning helps you continuously refine your skills and understanding of the markets.

- Competitive Cost Structure: Trading costs matter. Finpros typically aims to offer competitive spreads and transparent commission structures. This means more of your potential profits stay in your pocket.

The Disadvantages of Trading with Finpros

While Finpros brings many benefits, it’s also important to acknowledge potential drawbacks. Every platform has areas where it might not perfectly fit every trader’s needs.

- High Leverage Risks: While Finpros offers significant leverage, this can be a double-edged sword. High leverage magnifies both gains and losses, posing a substantial risk, especially for less experienced traders. It requires disciplined risk management.

- Complexity for Absolute Beginners: Despite its user-friendly interface, the sheer volume of features and market data can still feel overwhelming for someone completely new to financial trading. A steep learning curve might be present initially.

- Geographical Restrictions: Due to regulatory requirements, Finpros might not be available in all countries or regions. This limits access for potential users in specific locations.

- Dependency on Internet Connectivity: Like all online trading platforms, your ability to trade effectively relies heavily on a stable and fast internet connection. Any disruption can lead to missed opportunities or difficult situations during volatile market periods.

- Withdrawal Process Time: While deposits are often instantaneous, withdrawals can sometimes take a few business days to process. This isn’t unique to Finpros, but it’s a factor to consider if you need immediate access to your funds.

Ultimately, your success with Finpros, or any platform, hinges on your personal trading style, risk tolerance, and dedication to continuous learning. Weighing these pros and cons helps you decide if Finpros is the right partner for your financial endeavors.

Finpros Review: User Experiences and Testimonials

When you consider a new trading platform, hearing directly from other users is invaluable. What’s the real buzz about Finpros? We dive deep into the everyday experiences and shared insights from traders navigating the dynamic forex markets with Finpros. Discover firsthand accounts that paint a clearer picture of what you can expect from this platform.

Key Insights from Finpros Users

- Intuitive Trading Platform: Many users consistently praise the ease of use of the Finpros trading platform. Its clean interface and logical layout make navigating the markets straightforward for both new and experienced traders.

- Supportive Customer Service: The dedication of the Finpros customer support team often receives special mention. Traders report prompt, helpful responses to their queries, significantly enhancing their overall forex trading experience.

- Smooth Withdrawal Process: A critical aspect for any trader is the ability to access their funds without hassle. Finpros users frequently commend the efficiency and transparency of the withdrawal process, citing quick execution times.

- Valuable Educational Resources: Beginners especially highlight the accessible educational materials provided by Finpros. These resources are often credited with making their initial foray into forex less daunting and more successful.

What Traders Say: Finpros User Testimonials

“As a beginner, I was nervous about forex, but Finpros’s guides and demo account made my learning curve so much smoother. The customer support team answered all my silly questions with patience. My forex trading experience has been surprisingly positive thanks to them!”

— Maria K., New Trader

“I’ve been trading forex for years, and the Finpros trading platform offers the stability and features I need. The execution is fast, and I’ve never had issues with my withdrawal process. It’s a solid choice for serious traders looking for a reliable partner.”

— Ben T., Experienced Pro

“I had a technical question late one evening, and Finpros customer support was there, resolving my issue quickly. That kind of responsiveness is what builds trust. Truly a great Finpros review from me!”

— Sofia L., Active Trader

General Sentiment: A Positive Finpros Experience

The collective Finpros user testimonials largely paint a picture of a reliable and supportive trading environment. Traders appreciate the platform’s balance between advanced features for seasoned professionals and beginner-friendly resources. The overall user experience appears to be a key priority for Finpros, fostering a community of traders who feel well-equipped and supported in their forex journey. While every platform has areas for minor improvements, the overwhelming sentiment points to Finpros as a reputable and effective choice for forex trading.

Conclusion: Making an Informed Decision on Finpros

Embarking on your forex trading journey requires careful consideration, especially when selecting your broker. We’ve unpacked various aspects of Finpros, aiming to give you a clear picture of what the platform brings to the table. Ultimately, making an informed decision about Finpros means aligning its offerings with your unique trading style, financial goals, and comfort with risk.

Think of this as a critical crossroads in your investment path. You want a partner that supports your ambitions in the dynamic world of forex trading. Consider how Finpros’s features, tools, and support structure resonate with your personal approach to the markets. Does it offer the educational resources you need to grow? Do the available assets align with your investment strategy? These are crucial questions for any serious trader.

Before you make your final choice, ask yourself these key questions:

- Does Finpros’s regulatory standing meet your trust criteria?

- Are the trading costs and spreads competitive for your typical trade volume?

- Does the trading platform offer the functionality and ease of use you expect for effective market analysis?

- Will their customer support effectively assist you when you need it most?

- Do their account types and leverage options suit your capital and risk management strategy?

Your investment decisions profoundly shape your financial future. Take your time, weigh all factors, and choose a broker that empowers your forex trading success. Finpros might be that broker, but only your diligent assessment can confirm it. We encourage you to explore their demo account, if available, to experience the platform firsthand before committing your capital.

Frequently Asked Questions

What is Finpros, and what does it offer traders?

Finpros is an online broker providing direct access to global financial markets with a robust investment platform. It offers diverse assets, cutting-edge tools, competitive spreads, and a secure trading environment for both new and experienced traders.

What trading platforms are available on Finpros?

Finpros offers industry-leading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their advanced features and automated trading. A proprietary web trader and dedicated mobile apps are also available for convenient trading on the go.

How are Finpros’s fees, spreads, and commissions structured?

Finpros offers competitive and transparent pricing. Spreads are variable and can be as low as 0.0 pips on major pairs. Some account types, like ECN, may include commissions (e.g., from $3.50 per side per standard lot) in exchange for tighter spreads. Deposit fees are generally zero, while withdrawal and overnight (swap) fees may apply depending on the method and position held.

Is Finpros a regulated broker, and how are client funds protected?

Yes, Finpros operates as a fully regulated forex broker under respected financial authorities, ensuring adherence to stringent capital requirements and fair practices. Client funds are protected through segregation in separate accounts from the company’s operational funds, and advanced security measures like SSL encryption and KYC verification are employed.

What kind of customer support does Finpros provide?

Finpros offers accessible and high-quality customer support through multiple channels. Traders can reach the support team via 24/7 live chat for instant help, email for detailed inquiries, or phone support for direct conversations with expert specialists. Multilingual assistance is also available.