Embarking on your forex trading journey in Nigeria requires a reliable partner, and Finpros Nigeria stands out as a prominent choice. We understand the unique dynamics of the local market while providing a global standard of trading experience. Finpros Nigeria is more than just an online trading platform; it’s a comprehensive ecosystem designed to empower both aspiring and experienced traders.

Our commitment is to deliver an accessible, secure, and feature-rich environment where you can navigate the exciting world of currency pairs and other financial instruments. Whether you’re taking your first steps into financial markets or looking to refine your advanced forex strategies, we equip you with the tools and resources you need to succeed.

Choosing Finpros Nigeria means opting for a partner that prioritizes your trading journey with integrity, innovation, and a deep understanding of what it takes to thrive in the dynamic world of online trading.

- What Finpros Nigeria Brings to Your Trading Desk:

- Is Finpros Nigeria a Regulated Broker?

- Account Types Available with Finpros Nigeria

- Discover Your Perfect Trading Fit:

- Standard Account

- Pro/ECN Account

- Cent/Micro Account

- Islamic/Swap-Free Account

- Demo Account

- Trading Platforms for Finpros Nigeria Users

- Key Platform Options Available

- Factors to Consider When Selecting Your Platform

- Platform Comparison at a Glance

- Assets You Can Trade on Finpros Nigeria

- Forex (Currency Pairs)

- Stocks (CFDs on Shares)

- Commodities

- Indices

- Cryptocurrencies

- Fees, Spreads, and Commissions at Finpros Nigeria

- What You Need to Know About Spreads

- Unpacking Trading Commissions

- Other Potential Fees at Finpros Nigeria

- Deposits and Withdrawals with Finpros Nigeria

- Funding Your Finpros Nigeria Trading Account

- Available Deposit Methods

- Withdrawing Your Forex Profits

- The Withdrawal Process at Finpros Nigeria

- Common Withdrawal Options

- Customer Support and Educational Resources

- Dedicated Customer Support: Your Trading Lifeline

- Empowering Your Journey with Extensive Educational Resources

- Security Measures and Fund Protection at Finpros Nigeria

- Pros and Cons of Using Finpros Nigeria

- Advantages of Using Finpros Nigeria

- Disadvantages of Using Finpros Nigeria

- How to Open an Account with Finpros Nigeria

- Finpros Nigeria for Beginners: A Step-by-Step Approach

- Advantages and Considerations for Finpros Beginners

- Expert Reviews and User Testimonials on Finpros Nigeria

- What the Experts Are Saying

- Voices from the Trading Community: User Testimonials

- Positive Feedback Highlights:

- Constructive Feedback Areas:

- The Overall Consensus

- Comparing Finpros Nigeria with Other Brokers in the Region

- What Makes a Broker Stand Out in Nigeria?

- Finpros Nigeria’s Position in the Market

- A Quick Look at Broker Types in the Region

- The Future Outlook for Finpros Nigeria in the Nigerian Market

- Strategic Growth Pillars for Finpros Nigeria:

- Frequently Asked Questions

What Finpros Nigeria Brings to Your Trading Desk:

- Diverse Trading Instruments: Gain access to a wide array of global financial markets. Trade major, minor, and exotic currency pairs, giving you ample opportunities to diversify your portfolio. We also offer various commodities and indices, expanding your trading horizons beyond just forex.

- Cutting-Edge Trading Platform: Experience seamless execution and intuitive navigation with our advanced online trading platform. It’s packed with powerful charting tools, real-time market data, and customizable indicators, all designed to help you make informed decisions quickly.

- Flexible Trading Account Types: We cater to every level of expertise. From accounts perfect for a beginner forex trader, offering smaller minimum deposits and micro-lots, to premium accounts with tighter competitive spreads and dedicated support for seasoned professionals. Explore options that align with your capital and trading style.

- Competitive Spreads and Leverage: Benefit from some of the most competitive spreads in the market, reducing your trading costs. We also provide flexible leverage trading options, allowing you to amplify your potential returns, understanding the associated risks.

- Robust Educational Resources: Knowledge is power, especially in forex trading Nigeria. Our extensive library of educational materials, including webinars, tutorials, and e-books, serves as your guide to mastering market analysis, risk management, and various trading techniques. We believe in fostering continuous financial education.

- Dedicated Customer Support: Our local customer support forex team is always ready to assist you. Available through multiple channels, we provide prompt and professional assistance, ensuring your trading experience is smooth and uninterrupted.

- Secure and Regulated Environment: Your security is our top priority. We implement robust security protocols to protect your funds and personal information. Finpros Nigeria operates with full regulatory compliance Nigeria, adhering to strict financial standards to provide a transparent and secure trading environment.

Choosing Finpros Nigeria means opting for a partner that prioritizes your trading journey with integrity, innovation, and a deep understanding of what it takes to thrive in the dynamic world of online trading.

Is Finpros Nigeria a Regulated Broker?

Navigating the dynamic world of forex trading requires a solid foundation, and one of the most critical elements you must consider before committing your capital is a broker’s regulatory status. The question “Is Finpros Nigeria a regulated broker?” is not just a detail; it’s a cornerstone of your trading security and peace of mind. For any serious trader in Nigeria, ensuring your chosen platform operates under a credible financial authority is an absolute priority. This due diligence protects your investments and ensures fair trading practices.

Why does regulation matter so much when choosing a forex broker? It’s simple: a regulated broker operates under strict guidelines designed to protect you, the investor. Here’s why you should always look for a licensed broker:

- Investor Protection: Regulatory bodies often require brokers to segregate client funds from their operational capital. This means your money is safe even if the broker faces financial difficulties.

- Fair Trading Practices: Regulators monitor brokers to prevent market manipulation, ensuring transparent pricing and execution. You can trust that the spreads and quotes you see are genuine.

- Dispute Resolution: Should any issue arise, a regulated broker typically falls under a clear dispute resolution mechanism provided by the regulatory body, offering you an avenue for recourse.

- Financial Stability: Licensed brokers usually need to maintain certain capital requirements, which speaks to their financial robustness and ability to meet their obligations.

In Nigeria, the financial landscape is primarily overseen by the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC). While the CBN focuses on monetary policy and commercial banking, the SEC regulates the capital markets and investment activities. When considering forex regulation Nigeria, it’s essential to understand that direct, specific licensing for retail forex brokers operating solely within Nigeria has evolved. However, any entity offering financial services or soliciting investments from Nigerian residents should comply with local financial laws and disclosures. A reputable broker will always be transparent about its licenses, whether they are local or international, ensuring they operate legally wherever they serve clients.

To determine Finpros Nigeria regulation status, it is always your responsibility to perform independent verification. A trustworthy broker will prominently display its regulatory licenses and registration numbers on its official website. You should look for details that allow you to cross-reference with the official databases of the stated regulatory bodies. For a broker operating in Nigeria, this could involve checking their business registration with the Corporate Affairs Commission (CAC) and any relevant licenses from financial sector regulators that permit them to offer specific investment services. Always navigate directly to the regulator’s website and use the provided search tools to confirm the broker’s legitimacy. Do not rely solely on information provided by the broker itself without independent confirmation.

Ultimately, selecting a forex broker is a significant decision. Prioritizing regulation ensures you are trading in a secure environment, minimizing risks beyond the market’s inherent volatility. Always do your homework, ask the right questions, and choose a broker that provides full transparency regarding its operational and regulatory framework.

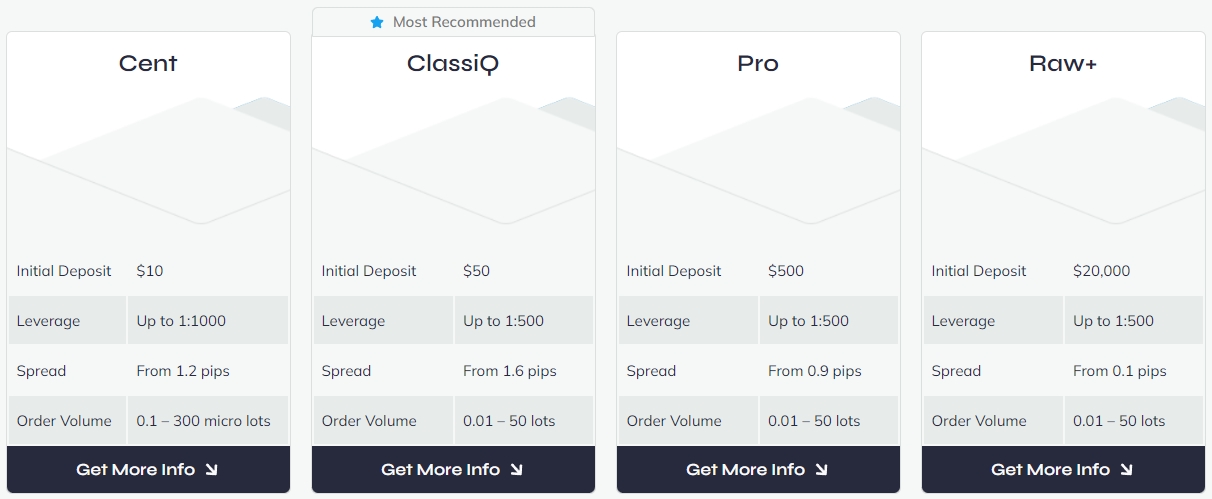

Account Types Available with Finpros Nigeria

Choosing the right trading account is a crucial step for every forex trader. It’s like picking the perfect tool for a specific job – the right one makes all the difference! At Finpros Nigeria, we understand that every trader has unique needs, experience levels, and financial goals. That’s why we offer a diverse range of account types designed to cater to everyone, from those just starting their trading journey to seasoned market veterans.

We believe in providing flexibility and transparency, ensuring you find an account that truly aligns with your trading style. Forget about one-size-fits-all solutions; we’ve crafted our accounts to empower your trading experience. Take a moment to explore the options and discover which Finpros Nigeria account is your ideal match for navigating the exciting world of forex.

Discover Your Perfect Trading Fit:

-

Standard Account

Our most popular choice, the Standard Account, offers a balanced trading environment. It’s excellent for new traders looking for a straightforward experience and also suitable for experienced traders who prefer standard market conditions. You get competitive spreads, access to all major currency pairs, and robust trading platforms without the complexity often found in advanced accounts.

-

Pro/ECN Account

If you’re an experienced trader seeking tighter spreads and deeper liquidity, our Pro/ECN Account is built for you. This account offers direct market access, meaning your orders bypass a dealing desk, leading to faster execution and potentially lower trading costs. It’s ideal for scalpers, day traders, and those employing expert advisors who demand precision and minimal latency.

-

Cent/Micro Account

Starting small but thinking big? The Cent/Micro Account is perfect for beginners who want to trade with real money but minimize risk. Trades are measured in cents instead of dollars, allowing you to practice your strategies, understand market dynamics, and build confidence with very small capital. It’s a fantastic stepping stone before moving to larger account types.

-

Islamic/Swap-Free Account

For traders who adhere to Sharia law, Finpros Nigeria proudly offers an Islamic Account. This swap-free account eliminates overnight interest charges (swaps) on positions held open past a certain time, ensuring compliance with Islamic financial principles. You still get access to our full suite of trading instruments and competitive conditions, all while respecting your faith.

-

Demo Account

Not ready to commit real capital? No problem! Our free Demo Account allows you to practice trading with virtual funds in a real-market environment. It’s an invaluable tool for testing strategies, familiarizing yourself with our trading platforms, and getting a feel for market movements without any financial risk. It mirrors the live trading experience, giving you the perfect preparation.

We encourage you to review the specific features, minimum deposits, and spread structures for each account type on our platform. Our dedicated support team is always ready to assist you in making an informed decision, ensuring your trading journey with Finpros Nigeria starts on the right foot.

Trading Platforms for Finpros Nigeria Users

Choosing the perfect trading platform is a cornerstone of your success in the dynamic forex market. For Finpros Nigeria users, having access to robust, reliable, and feature-rich platforms is not just a luxury, but a necessity. Your platform serves as your direct link to global financial markets, so it must be fast, intuitive, and equipped with the tools you need to make smart, informed decisions. Finpros understands this critical requirement and provides access to industry-leading platforms, ensuring you have the best instruments at your command.

Key Platform Options Available

We recognize that traders have diverse needs and preferences. That’s why Finpros Nigeria supports a range of powerful platforms, each designed to empower your trading journey:

- MetaTrader 4 (MT4): This platform remains a favorite among forex traders worldwide, and for good reason. It is celebrated for its incredible stability, extensive charting capabilities, and the robust support for Expert Advisors (EAs). Many Nigerian traders start their journey with MT4 due to its user-friendly interface and a vast, supportive community.

- MetaTrader 5 (MT5): As an upgraded iteration, MT5 offers a more expansive trading environment. It provides access to a broader range of asset classes, including stocks and futures, alongside more timeframes and advanced analytical tools. MT5 brings a richer selection of indicators and order types, making it ideal for traders seeking broader market access and enhanced functional depth.

- Finpros WebTrader: For those who prefer not to download software, our proprietary WebTrader is a game-changer. It allows you to trade directly from your web browser, making it perfect for quick access and on-the-go trading. You can manage your positions and monitor the market from any device, ensuring you never miss a trading opportunity. It’s often simpler, highly accessible, and streamlined for efficiency.

Factors to Consider When Selecting Your Platform

Making the right choice for your trading platform depends on several personal and strategic factors. Consider these points before you commit:

- Your Experience Level: Are you new to trading or do you possess years of market experience? Some platforms offer more simplified interfaces, while others cater to advanced strategies.

- Required Features: Do you need advanced charting tools, the ability to automate trades with EAs, or are basic order execution and real-time quotes sufficient for your strategy?

- Accessibility: What is your preferred trading environment? Do you primarily trade from a desktop, rely on web access, or need robust mobile trading capabilities?

- Asset Variety: Do you exclusively trade forex pairs, or are you interested in diversifying into other instruments like commodities, indices, or cryptocurrencies?

Platform Comparison at a Glance

| Platform | Key Advantages | Ideal For |

|---|---|---|

| MetaTrader 4 (MT4) | Exceptional stability, EA support, extensive community resources, vast indicator library. | Forex-focused traders, algo traders, beginners and experienced users alike. |

| MetaTrader 5 (MT5) | Broader market access (forex, stocks, futures), more timeframes, enhanced analytical tools. | Multi-asset traders, those seeking advanced analytical features, scalpers. |

| Finpros WebTrader | No download required, instant browser access, user-friendly interface, seamless mobile experience. | On-the-go traders, users prioritizing accessibility and simplicity, casual traders. |

Finpros ensures seamless integration with all these platforms. You benefit from competitive spreads, lightning-fast execution, and unparalleled customer support, all within the trading environment you choose. We strive to make your trading experience smooth and efficient, allowing you to focus purely on executing your strategies and achieving your financial goals.

Assets You Can Trade on Finpros Nigeria

Are you ready to diversify your portfolio and explore a world of trading opportunities right from Nigeria? Finpros Nigeria opens up a robust universe of financial instruments, putting global markets at your fingertips. We believe in providing access to a wide range of assets, ensuring you can always find a market that aligns with your trading strategy and risk appetite. Whether you’re a seasoned trader or just starting your journey, our platform offers the variety you need to thrive.

Here’s a glimpse into the exciting assets you can trade with confidence:

Forex (Currency Pairs)

Step into the largest and most liquid financial market in the world – the foreign exchange market. Trade major, minor, and exotic currency pairs, capitalizing on global economic shifts. Imagine trading EUR/USD, GBP/JPY, or even local pairs, leveraging your insights into international economies. The forex market offers unparalleled liquidity and round-the-clock action, making it a favorite for many Finpros Nigeria clients.

Stocks (CFDs on Shares)

Gain exposure to the performance of leading companies from around the globe without owning the underlying shares. With Contracts for Difference (CFDs) on stocks, you can speculate on price movements of giants like Apple, Google, Tesla, or even popular Nigerian companies. This means you can potentially profit whether the market goes up or down, offering incredible flexibility.

Commodities

Hedge against inflation or speculate on global supply and demand dynamics by trading commodities. Our platform allows you to trade CFDs on precious metals like gold and silver, energy resources such as crude oil and natural gas, and even agricultural products. These assets often provide diversification and respond to different market drivers than currencies or stocks.

“The key to successful trading isn’t just about making good choices, but having a wide range of good choices available to you. Finpros Nigeria delivers exactly that, empowering your strategy.”

Indices

Want to trade an entire stock market at once? Indices offer you this opportunity. Trade CFDs on major global stock market indices like the S&P 500, NASDAQ 100, FTSE 100, DAX 40, and more. This allows you to speculate on the overall health of an economy or a specific sector, providing a broader market perspective without focusing on individual stocks.

Cryptocurrencies

Dive into the dynamic and rapidly evolving world of digital assets. Finpros Nigeria provides access to CFDs on popular cryptocurrencies such as Bitcoin, Ethereum, Ripple, and Litecoin. Experience the volatility and high-growth potential of these innovative assets, adding a modern edge to your trading portfolio. Keep in mind, while exciting, crypto markets can be highly volatile, requiring careful risk management.

Our commitment at Finpros Nigeria is to provide you with a robust platform that makes trading these diverse assets seamless and secure. Explore the possibilities, plan your strategy, and execute your trades with confidence. The financial markets are vast, and with us, you are well-equipped to navigate them successfully.

Fees, Spreads, and Commissions at Finpros Nigeria

Understanding the costs associated with trading is crucial for any successful forex journey. At Finpros Nigeria, we believe in transparent and competitive pricing, ensuring you can focus on your trading strategy without hidden surprises. We know that every naira saved on fees means more potential profit for you. Let’s break down the key charges you might encounter when you trade with us.

What You Need to Know About Spreads

The spread is the difference between the bid (buy) and ask (sell) price of a currency pair. It’s essentially the cost of making a trade. Finpros Nigeria strives to offer some of the tightest and most competitive forex spreads in the market, especially on major pairs like EUR/USD or GBP/JPY. We offer both variable and fixed spreads, depending on the account type you choose. Variable spreads fluctuate with market volatility, often narrowing during liquid periods, while fixed spreads remain constant, offering predictability.

- Tight Spreads: We work with top-tier liquidity providers to ensure minimal differences between bid and ask prices.

- Competitive Pricing: Our spreads are designed to give you a cost-effective trading experience across a wide range of currency pairs, commodities, and indices.

- Transparency: You can always see our real-time spreads directly on our trading platforms before you place a trade.

Unpacking Trading Commissions

While many of our account types feature commission-free trading where the cost is built into the spread, some advanced accounts, like our ECN (Electronic Communication Network) accounts, may involve a small commission per trade. This structure often comes with even tighter raw spreads, making it an attractive option for high-volume traders or those using specific strategies like scalping. These trading commissions are always clearly stated and applied uniformly, giving you full clarity on your transaction costs.

Other Potential Fees at Finpros Nigeria

Beyond spreads and commissions, it’s good practice to be aware of other potential charges, though we aim to keep these to a minimum and always upfront. Our commitment is to make your online forex trading experience as clear and straightforward as possible.

| Fee Type | Description | Application |

|---|---|---|

| Swap/Rollover Fees | Charges or credits for holding positions overnight (past 5 PM EST). These depend on interest rate differentials between the two currencies in a pair. | Applies to positions held open overnight. |

| Deposit Fees | Generally, Finpros Nigeria does not charge deposit fees. We absorb most of the processing costs. | Rarely applied; check specific payment method terms. |

| Withdrawal Fees | While we strive for free withdrawals, some payment providers may levy a small charge, or we may apply a minimal fee for certain methods to cover processing costs. | Varies by withdrawal method; details available in your client portal. |

| Inactivity Fees | A small fee may be charged to accounts that remain dormant (no trading activity, deposits, or withdrawals) for an extended period, typically 6-12 months. | Applies to inactive accounts after a specified period. |

At Finpros Nigeria, our goal is to offer competitive and fair pricing that supports your financial growth. We encourage you to review our full terms and conditions for the most current and detailed information on all our fees and charges. We are here to empower your trading journey with transparency and excellent service.

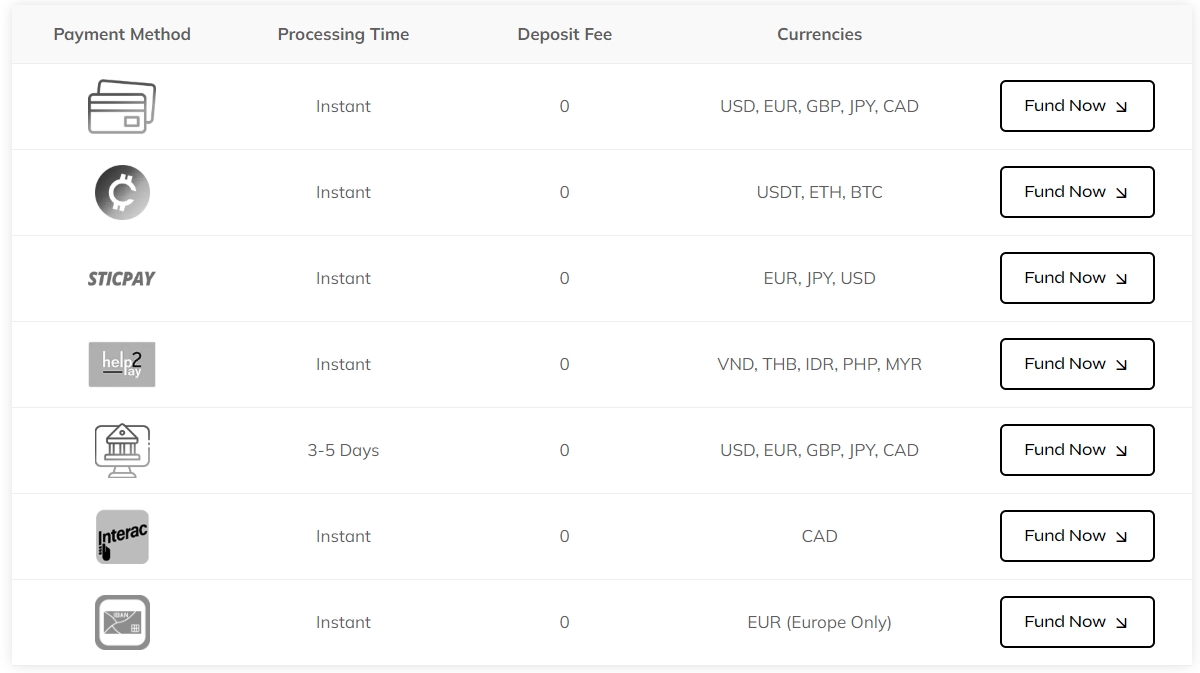

Deposits and Withdrawals with Finpros Nigeria

Seamless management of your funds is crucial for a successful trading journey. At Finpros Nigeria, we understand this completely. That’s why we’ve built a robust and user-friendly system for both depositing and withdrawing your trading capital. Our goal is to make sure you spend less time worrying about transactions and more time focusing on market opportunities. We empower you to fund your account quickly and access your profits without any unnecessary hurdles.

Funding Your Finpros Nigeria Trading Account

Getting started with forex trading at Finpros Nigeria is straightforward. We offer a range of convenient deposit methods tailored to our clients in Nigeria. We prioritize security and efficiency, ensuring your funds are ready for trading in no time. Our system is designed to provide you with peace of mind, knowing your investments are handled with the utmost care.

Available Deposit Methods

- Local Bank Transfers: Fund your Finpros Nigeria account directly from your Nigerian bank. This is a familiar and reliable option for many traders.

- Online Payment Gateways: Utilize popular and secure online payment solutions for instant deposits. These methods offer quick processing and ease of use.

- Debit/Credit Cards: Use your local Naira cards (Visa, MasterCard) for immediate account funding. This is often the fastest way to get capital into your trading account.

When you initiate a deposit, our system guides you through each step. You receive clear instructions, and our dedicated support team is always available if you have any questions. We aim for instant or near-instant processing times for most deposit methods so you can seize market movements without delay.

Withdrawing Your Forex Profits

Making a profit is exciting, and accessing your earnings should be just as easy. Finpros Nigeria ensures a smooth and secure withdrawal process, allowing you to enjoy the fruits of your trading success. We believe that getting your money out should be as simple as putting it in.

The Withdrawal Process at Finpros Nigeria

- Log In to Your Account: Access your secure Finpros Nigeria client portal.

- Navigate to Withdrawals: Find the dedicated withdrawal section.

- Select Method & Amount: Choose your preferred withdrawal method and specify the amount you wish to withdraw.

- Confirm Details: Verify your information and submit the request.

We typically process withdrawal requests swiftly. The exact time it takes for funds to reach your account depends on the chosen method and the processing times of the respective financial institutions. Rest assured, our team works diligently to ensure timely payouts.

Common Withdrawal Options

| Withdrawal Method | Estimated Processing Time (after approval) |

|---|---|

| Local Bank Transfer | 1-3 Business Days |

| Online Payment Gateway (where applicable) | Up to 24 Hours |

We maintain full transparency regarding any potential fees or minimum withdrawal limits. You will see all relevant information clearly displayed before confirming your withdrawal request. Our commitment is to provide you with a hassle-free experience every step of the way, reinforcing why Finpros Nigeria is a trusted partner for your forex trading needs.

Customer Support and Educational Resources

Embarking on your forex trading journey, whether you’re a beginner or an experienced investor, demands more than just a trading platform. It requires robust customer support and comprehensive educational resources. Imagine navigating the dynamic world of currency exchange without a compass or a helpful guide. That’s precisely why we prioritize giving you the best tools and assistance possible, ensuring you never feel lost.

Dedicated Customer Support: Your Trading Lifeline

When you’re dealing with live markets, every second can count. Timely and effective customer support isn’t just a luxury; it’s a necessity. We understand that questions can arise at any moment, and issues sometimes pop up unexpectedly. That’s why our dedicated team stands ready to assist you.

Our support channels are designed for your convenience:

- 24/5 Live Chat: Get instant answers to your queries directly on our platform. Our agents are here to help during trading hours.

- Email Support: For more detailed inquiries or when you prefer a written record, send us an email. We strive for swift and thorough responses.

- Phone Support: Sometimes, speaking directly to someone makes all the difference. Our phone lines connect you with knowledgeable professionals ready to guide you.

We take pride in our multilingual team, ensuring you receive assistance in a language you’re comfortable with. Our goal is to resolve your concerns quickly and efficiently, letting you focus on what matters most: your trading strategy.

Empowering Your Journey with Extensive Educational Resources

Knowledge is your most powerful asset in the forex market. A deep understanding of market mechanics, technical analysis, and risk management can significantly enhance your trading decisions. We believe in empowering our traders, which is why we offer an extensive library of educational resources designed for all skill levels.

Here’s a glimpse of what you can access to sharpen your trading edge:

- Comprehensive Trading Guides: From the basics of “what is forex” to advanced strategies, our step-by-step guides break down complex topics into easy-to-understand modules.

- Interactive Webinars and Seminars: Join live sessions with expert traders and analysts. Learn about current market trends, practical trading techniques, and ask your questions in real-time.

- Video Tutorials: Visual learners rejoice! Our video library covers platform navigation, strategy implementation, and market analysis in an engaging format.

- E-books and Whitepapers: Dive deep into specific topics with our curated collection of digital books, offering in-depth insights into various aspects of forex trading.

- Forex Glossary: Never get confused by industry jargon again. Our glossary defines all the essential terms you’ll encounter.

- Free Demo Account: Practice your strategies and get familiar with our platform in a risk-free environment. It’s the perfect way to apply what you learn before trading with real capital.

We constantly update our educational content, keeping it fresh and relevant to the ever-evolving financial markets. Our commitment is to provide you with actionable insights and practical skills, helping you to confidently navigate the complexities of forex trading and achieve your financial goals. Your success is our mission, and it starts with unparalleled support and robust education.

Security Measures and Fund Protection at Finpros Nigeria

At Finpros Nigeria, safeguarding your investments and personal information is our absolute top priority. We understand that trust is built on reliability, especially in the dynamic world of forex trading. That’s why we employ a multi-layered approach to security, designed to protect your funds and ensure a secure trading environment from the moment you join us.

One of the cornerstones of our fund protection strategy is the use of segregated accounts. This means we hold all client funds in separate bank accounts, completely distinct from Finpros Nigeria’s operational capital. This crucial measure ensures that your money is always safe and accessible, even in the unlikely event of any financial challenges faced by the company. It’s an industry best practice, and we implement it rigorously to give you peace of mind.

Beyond segregated accounts, we continuously invest in cutting-edge technology and robust protocols to shield your trading experience. Here’s how we keep your assets and data secure:

- Advanced Encryption: We use industry-standard SSL (Secure Socket Layer) encryption across our entire platform. This technology scrambles your data during transmission, making it virtually impossible for unauthorized parties to intercept your sensitive information, such as personal details or transaction data.

- Two-Factor Authentication (2FA): For an added layer of protection, we offer 2FA. When enabled, this feature requires a second verification step, usually a code sent to your mobile device, in addition to your password, before you can access your account. This significantly reduces the risk of unauthorized access.

- Robust Firewalls and Network Security: Our servers are protected by sophisticated firewalls and advanced network security systems that constantly monitor for and prevent malicious attacks, ensuring the integrity and availability of our trading platform.

- Regular Security Audits: Independent security experts frequently audit our systems and processes. These thorough evaluations help us identify and address any potential vulnerabilities, ensuring our defenses remain strong against evolving cyber threats.

- Secure Payment Gateways: We partner with reputable and secure payment processors. All deposit and withdrawal methods are carefully vetted to ensure they adhere to the highest security standards, protecting your financial transactions.

- Strict Data Privacy Policies: We adhere to stringent data protection regulations. Your personal data remains confidential and we never share it with third parties without your explicit consent. Our privacy policy outlines exactly how we manage and protect your information.

Trading with Finpros Nigeria means you can focus on making informed decisions in the market, confident that your funds are protected by comprehensive security measures. Join our community and experience a truly secure and reliable trading journey.

Pros and Cons of Using Finpros Nigeria

Diving into the world of online trading requires careful consideration, especially when choosing a broker that operates within your local financial landscape. Finpros Nigeria presents itself as a contender in the bustling forex trading Nigeria scene. But like any financial service, it comes with its own set of advantages and potential drawbacks. Understanding these can help you make an informed decision about whether this online brokerage aligns with your trading goals and risk tolerance.

Advantages of Using Finpros Nigeria

When you consider joining a platform like Finpros Nigeria, several aspects might appeal to both new and experienced traders:

- Localized Support and Understanding: Finpros Nigeria often provides customer support tailored to the Nigerian market. This means you get assistance in a local context, potentially with local languages, and an understanding of specific regional challenges or banking practices. They understand the nuances of the local financial markets.

- Easier Funding and Withdrawals: With a local presence, funding your trading account and withdrawing your profits can be significantly smoother. They usually support local payment gateways and bank transfers, reducing the hassle and potential fees associated with international transactions.

- Accessibility for Nigerian Traders: Finpros Nigeria aims to make forex trading more accessible. This might include lower minimum deposit requirements, making it easier for new entrants to start exploring currency pairs and other instruments without a large initial investment.

- Educational Resources: Many local brokers focus on educating their client base. Finpros Nigeria could offer seminars, webinars, or comprehensive guides designed to help Nigerian traders understand market dynamics, apply risk management strategies, and utilize their trading platform effectively.

Disadvantages of Using Finpros Nigeria

While the benefits are clear, it’s equally important to consider the potential downsides:

- Regulation Concerns: The regulatory environment for forex brokers can vary significantly. While Finpros Nigeria might be locally registered, ensuring they hold robust licenses that truly protect your funds is crucial. Less stringent regulation could expose you to higher risks.

- Potentially Wider Spreads and Fees: Compared to some larger, international brokers that operate on massive scales, Finpros Nigeria might offer less competitive spreads or charge higher commissions on trades. Always compare their trading costs before committing.

- Limited Range of Instruments: Some local brokers might offer a narrower selection of tradable assets. While they will likely cover major currency pairs, you might find fewer options for exotic pairs, commodities, indices, or cryptocurrencies compared to global platforms.

- Platform Features and Technology: The trading platform offered by a smaller, local broker might not always match the advanced features, charting tools, and execution speeds of industry-leading global platforms. Assess if their technology meets your trading demands.

- Withdrawal Process Specifics: While local withdrawals can be easier, some users might still encounter delays or specific limits based on the broker’s internal policies or local banking regulations. Always review the withdrawal process terms carefully.

Ultimately, your choice depends on your priorities. If local support, ease of deposits, and a focused approach to the Nigerian market are key for you, Finpros Nigeria might be a strong candidate. However, if you prioritize ultra-competitive spreads, a vast array of instruments, and advanced platform features, it’s wise to compare them with global alternatives.

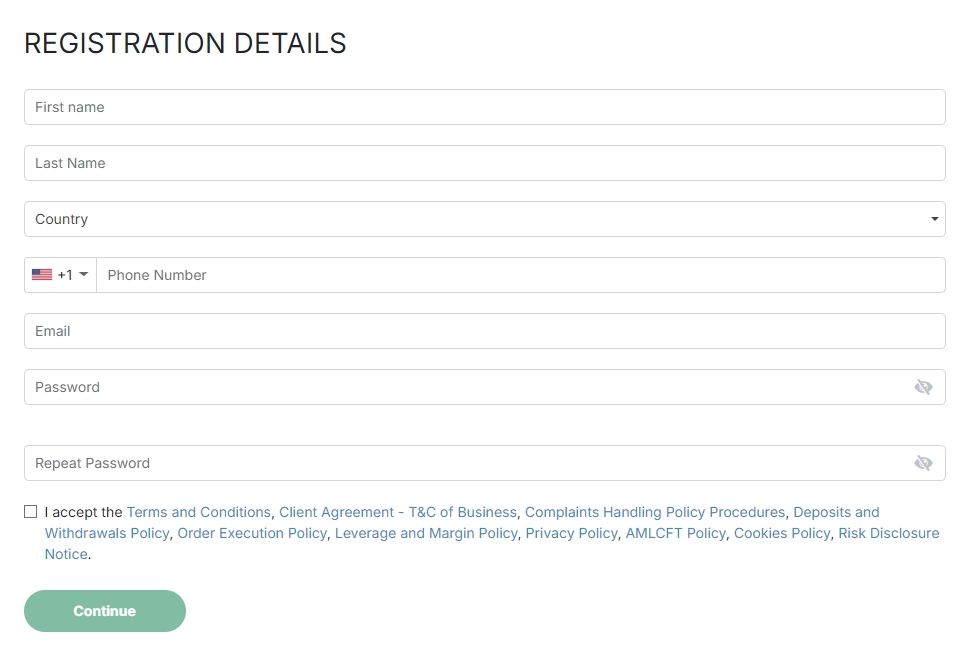

How to Open an Account with Finpros Nigeria

Ready to dive into the exciting world of forex trading? Opening your trading account with Finpros Nigeria is a straightforward process, designed to get you started quickly and securely. We understand you’re eager to begin your journey, and we’ve streamlined everything to make it as smooth as possible. Forget complicated paperwork and endless waiting – your gateway to the global financial markets is just a few clicks away!

At Finpros Nigeria, we prioritize your convenience and security. Our registration process ensures compliance with international standards while keeping user experience at the forefront. Whether you’re a seasoned trader or taking your very first steps, our platform is built to support you.

Here’s a simple breakdown of how you can open an account and join our growing community of successful traders:

- Visit the Finpros Nigeria Website: Your first stop is our official website. Look for the prominent “Open Account” or “Sign Up” button, usually located at the top right corner of the homepage. Give it a click to begin!

- Fill in Your Details: We’ll ask you for some basic personal information – things like your name, email address, phone number, and country of residence. Make sure to provide accurate details, as this helps us keep your account safe and compliant.

- Choose Your Account Type: Finpros Nigeria offers a range of account types tailored to different trading styles and experience levels. You can opt for a live trading account or even start with a demo account to practice your strategies without risk. Take a moment to review the features of each to find the perfect fit for your aspirations.

- Complete the Verification Process (KYC): This is a crucial step for your security and regulatory compliance. We require you to submit identification documents, such as a government-issued ID (passport, driver’s license, or national ID card) and proof of address (a utility bill or bank statement). This Know Your Customer (KYC) procedure protects you and maintains the integrity of our trading environment. Uploading these documents is usually quick and hassle-free through our secure portal.

- Fund Your Account: Once your account is verified, you’re ready to deposit funds. Finpros Nigeria offers various convenient and secure payment methods, including local bank transfers, debit/credit cards, and popular e-wallets. Choose the option that works best for you and make your initial deposit to start trading.

- Start Trading! With funds in your account, you now have full access to our powerful trading platform. Explore the markets, analyze charts, and execute your first trades. Our intuitive platform makes forex trading accessible and engaging for everyone.

Opening an account with Finpros Nigeria means gaining access to competitive spreads, fast execution, and dedicated customer support. Don’t wait to start building your financial future. The opportunities in the forex market are vast, and we are here to help you seize them!

Finpros Nigeria for Beginners: A Step-by-Step Approach

Are you looking to dive into the exciting world of forex trading but feel overwhelmed by where to start? Finpros Nigeria offers a fantastic entry point for aspiring traders, particularly if you’re just beginning your journey in the financial markets. We understand that taking the first step can be daunting, but with our structured approach, you’ll find navigating the complexities of online trading much simpler. Finpros is designed to equip you with the knowledge and tools you need to trade confidently.

Embarking on your forex adventure requires a clear roadmap. Here’s a straightforward, step-by-step guide tailored for beginner traders in Nigeria to get started with Finpros:

- Open Your Finpros Account: This is your initial gateway. The registration process is designed to be quick and user-friendly. You’ll need to provide some basic information and complete a verification process to ensure the security of your account and comply with regulations.

- Explore the Demo Account: Before risking any real capital, take full advantage of the free demo account. This is a crucial step for any beginner. It allows you to practice trading in real market conditions with virtual money, helping you understand the trading platform, execute trades, and test various strategies without financial pressure. Think of it as your personal training ground for forex trading.

- Educate Yourself: Finpros Nigeria provides a wealth of educational resources. Spend time learning about fundamental analysis, technical analysis, and key forex terminology. Understanding how economic events impact currency pairs and how to read chart patterns is vital for making informed trading decisions.

- Fund Your Account: Once you feel comfortable and confident with the demo account, you can deposit real funds into your live trading account. Finpros offers several convenient and secure deposit methods suitable for Nigerian users. Start with a manageable amount that you are comfortable potentially losing, as all trading involves risk.

- Develop a Trading Strategy: Don’t just trade randomly. Based on your learning and demo experience, formulate a trading strategy. This includes defining your entry and exit points, determining your risk tolerance, and choosing which currency pairs you want to focus on.

- Implement Risk Management: This cannot be stressed enough. Always use stop-loss orders to limit potential losses and take-profit orders to secure gains. Effective risk management is the cornerstone of sustainable forex trading. Never risk more than a small percentage of your total account on any single trade.

- Start Trading and Monitor: Begin with small trade sizes and closely monitor your positions. Learn from every trade, whether it’s a win or a loss. The market is constantly evolving, and so should your understanding.

Choosing Finpros Nigeria means opting for a platform that prioritizes your learning and success. Our robust trading platform is intuitive, even for those new to the game, and offers a suite of tools that can enhance your market analysis. We believe that every successful trader started as a beginner, and with dedication and the right resources, you can achieve your financial goals.

Advantages and Considerations for Finpros Beginners

| Advantages for Beginners | Important Considerations |

|---|---|

| User-Friendly Interface: Our platform is designed for ease of use, making navigation straightforward for new online traders. | Market Volatility: The forex market can be unpredictable. Be prepared for rapid price movements that can impact your trades. |

| Comprehensive Education: Access a rich library of learning materials to build a strong foundation in forex trading. | Learning Curve: While Finpros simplifies things, mastering trading still requires time, effort, and continuous learning. |

| Risk-Free Demo Account: Practice strategies and familiarize yourself with the platform without any financial risk. | Psychological Discipline: Emotions like fear and greed can affect your decisions. Sticking to your plan is crucial. |

| Local Support: Get assistance tailored to the Nigerian context, ensuring smoother operations and clearer communication. | Capital Requirements: While you can start small, sufficient capital helps in better risk management and opportunity capture. |

As renowned trader Paul Tudor Jones once said, “The most important rule of trading is to play great defense, not great offense.” This wisdom applies perfectly to beginner traders. Focus on protecting your capital, learning consistently, and managing your risk effectively, and you will set yourself up for a sustainable journey in the world of forex with Finpros Nigeria. Take control of your financial future today!

Expert Reviews and User Testimonials on Finpros Nigeria

Diving into the world of online trading platforms can feel like navigating a complex maze. That’s why hearing from those who’ve walked the path before you – both industry experts and everyday traders – offers invaluable insights. We’ve gathered a comprehensive look at what the trading community says about Finpros Nigeria, bringing you a balanced perspective that highlights its strengths and areas where users seek more.

What the Experts Are Saying

Financial analysts and industry watchers often scrutinize platforms like Finpros Nigeria for their technological robustness, educational offerings, and regulatory adherence. The consensus among many professionals points to Finpros Nigeria’s commitment to user education and platform stability.

“Finpros Nigeria distinguishes itself with a user-friendly interface that caters to both novices and seasoned traders. Their dedication to providing comprehensive educational materials is a significant plus, empowering users to make informed decisions.”

Experts frequently commend Finpros Nigeria for its competitive spreads and a wide array of trading instruments, giving traders ample opportunities across various markets. They also highlight the platform’s robust security measures, which are crucial for building trust in the volatile forex environment.

- Platform Reliability: Often cited for minimal downtime and fast execution speeds.

- Educational Resources: A strong library of webinars, articles, and tutorials for all skill levels.

- Regulatory Compliance: Operating under local financial regulations provides a layer of confidence.

Voices from the Trading Community: User Testimonials

Beyond the expert lens, the experiences of actual traders offer a grassroots view of Finpros Nigeria. We’ve compiled a selection of sentiments shared by users, reflecting their real-world interactions with the platform.

Positive Feedback Highlights:

- Ease of Use: “I was new to forex, and Finpros Nigeria’s platform made it incredibly easy to get started. The charts are clear, and placing trades feels intuitive.” – Biodun O.

- Responsive Support: “Whenever I had a question, their customer service team was quick to respond and very helpful. It’s good to know someone is there.” – Aisha S.

- Smooth Withdrawals: “I’ve had no issues with withdrawals. They process them efficiently, which is a big relief after a good trading week.” – Chinedu A.

- Diverse Instruments: “I appreciate the range of currency pairs and other assets available. It gives me a lot of options to diversify my strategy.” – Nkechi E.

Constructive Feedback Areas:

While many experiences are positive, some users have shared areas where they hope for further enhancements. These insights are vital for continuous improvement and for prospective traders to set realistic expectations.

Some users occasionally mention a desire for even more advanced analytical tools or a broader range of payment options tailored specifically for the Nigerian market. Others suggest extending live chat support hours to cover a wider array of time zones more comprehensively. Finpros Nigeria consistently monitors this feedback, working to integrate these suggestions into future platform updates, demonstrating a commitment to evolving with its user base.

The Overall Consensus

Combining expert assessments with user experiences paints a clear picture: Finpros Nigeria stands as a reliable and user-centric platform in the Nigerian forex market. Its strengths lie in its accessible platform, extensive educational support, and commitment to security. While there’s always room for growth, especially concerning specific feature requests, the overwhelming sentiment suggests Finpros Nigeria provides a robust environment for anyone looking to engage in online trading.

Comparing Finpros Nigeria with Other Brokers in the Region

Choosing the right forex broker in Nigeria is a crucial decision for any trader. The regional market offers a variety of platforms, each with its unique strengths and weaknesses. When you compare Finpros Nigeria with other brokers, you start to see a clearer picture of what truly sets a service apart. It’s not just about flashy promotions; it’s about reliable trading conditions, robust support, and a platform that genuinely understands the needs of Nigerian traders.

Many local and international brokers operate within Nigeria, presenting a spectrum of choices. Some excel in offering extremely low spreads, while others might focus more on extensive educational resources. The key is to find a balance that aligns with your trading style and financial goals.

What Makes a Broker Stand Out in Nigeria?

When evaluating different forex trading platforms, consider these critical aspects:

- Regulatory Compliance: Is the broker regulated by a reputable authority? This offers a layer of security for your funds.

- Trading Conditions: Look at spreads, leverage options, and execution speed. Are they competitive?

- Account Types: Do they offer accounts that suit beginners, experienced traders, and those with different capital levels?

- Deposit and Withdrawal Options: Are local payment methods supported, making transactions easy and fast for Nigerian traders?

- Customer Support: Is local support available in English, responsive, and knowledgeable about regional issues?

- Trading Platforms: Do they offer popular platforms like MetaTrader 4 or 5, and are they stable?

- Educational Resources: Are there webinars, tutorials, or articles to help you improve your forex trading skills?

Finpros Nigeria’s Position in the Market

Finpros Nigeria aims to carve out a distinct space by focusing on what truly matters to its clients. While some brokers might offer a broad, generic service, Finpros often emphasizes a tailored approach for its Nigerian clientele. This could manifest in specific local deposit and withdrawal solutions, dedicated customer support teams familiar with the region, or even educational content relevant to the local economic landscape. For many, a broker with a strong local presence and understanding simplifies the entire trading journey.

When you stack up Finpros Nigeria against other brokers, you often find a strong commitment to transparent pricing and reliable execution, which are pillars of successful forex trading. While some might boast lower spreads on specific pairs, Finpros tends to offer a consistent and stable environment across its range of financial instruments.

A Quick Look at Broker Types in the Region

The forex market in Nigeria features a diverse range of brokers, each appealing to different trader profiles:

- Established International Brokers: These often have a global presence, offering a vast array of instruments and advanced platforms. However, their customer support might not always be localized, and payment methods could be less convenient for Nigerian users.

- Local Niche Brokers: Some smaller, regionally focused brokers might offer very specific services or products. While they might excel in one area, their overall offering could be limited.

- Hybrid Brokers (like Finpros Nigeria): These often combine the reliability and technology of international standards with a strong emphasis on local support, payment methods, and an understanding of the Nigerian market’s nuances. They strive to offer the best of both worlds.

Ultimately, your choice of broker will heavily influence your trading experience. By carefully comparing Finpros Nigeria with the alternatives, considering all the factors above, you can make an informed decision that supports your journey in the dynamic world of forex.

The Future Outlook for Finpros Nigeria in the Nigerian Market

Nigeria presents an exciting, dynamic landscape for financial innovation and growth. As a leading player, Finpros Nigeria is uniquely positioned to capitalize on this vibrant market. The future outlook for Finpros is not just promising; it’s an opportunity to redefine the standards of online trading and financial accessibility for millions across the nation.

The core of this optimism stems from several key demographic and economic trends. Nigeria boasts a youthful, tech-savvy population eager for modern financial solutions. With increasing internet penetration and smartphone adoption, the demand for accessible, user-friendly trading platforms is skyrocketing. Finpros Nigeria is at the forefront, offering cutting-edge technology and a commitment to local needs.

Strategic Growth Pillars for Finpros Nigeria:

- Technological Innovation: Continuously enhancing our trading platforms with advanced tools, faster execution, and intuitive interfaces. We focus on mobile-first solutions, understanding that most Nigerians access the internet via their phones.

- Financial Education: Empowering traders through comprehensive educational resources, webinars, and localized content. Knowledge is key to successful trading, and Finpros Nigeria is dedicated to fostering an informed community.

- Market Diversification: Expanding our range of trading instruments to meet the diverse interests of Nigerian traders. This includes offering access to a broader spectrum of global and local assets.

- Regulatory Compliance and Trust: Operating with the highest standards of transparency and adherence to local financial regulations. Building and maintaining trader trust is paramount for sustained success in the Nigerian market.

- Community Engagement: Building a strong community of traders through local support, events, and a responsive customer service team that understands the local context.

The Nigerian financial sector is evolving rapidly, driven by a push for financial inclusion and digitalization. Finpros Nigeria is well-aligned with these national objectives. We anticipate continued growth in the number of retail investors seeking opportunities in the global markets. Our platform provides a gateway for everyday Nigerians to participate in forex trading and other financial instruments, offering potential for wealth creation and financial independence.

While opportunities abound, the market also presents its unique challenges, such as infrastructure development and navigating the evolving regulatory framework. Finpros Nigeria addresses these proactively through robust technological infrastructure, dedicated local teams, and a continuous dialogue with relevant authorities. Our agile approach ensures we adapt quickly to market changes, always prioritizing the security and success of our traders.

In summary, the future for Finpros Nigeria in the Nigerian market is bright and full of potential. By focusing on innovation, education, trust, and community, we are not just building a trading platform; we are fostering a new generation of empowered Nigerian traders. Join Finpros Nigeria as we embark on this exciting journey, shaping the future of online trading across the nation.

Frequently Asked Questions

What is Finpros Nigeria and what services does it offer?

Finpros Nigeria is an online trading platform designed for Nigerian traders, offering access to a wide range of global financial markets including forex, stocks, commodities, indices, and cryptocurrencies. It provides cutting-edge trading platforms, diverse account types, competitive spreads, robust educational resources, and dedicated customer support.

Is Finpros Nigeria a regulated broker?

Finpros Nigeria operates with regulatory compliance, adhering to strict financial standards to provide a transparent and secure trading environment. While specific licensing for retail forex brokers within Nigeria has evolved, a trustworthy broker will prominently display its regulatory licenses and registration numbers on its official website, which users should independently verify.

What types of trading accounts are available with Finpros Nigeria?

Finpros Nigeria offers a variety of account types to suit different traders, including Standard Accounts for balanced trading, Pro/ECN Accounts for experienced traders seeking tighter spreads, Cent/Micro Accounts for beginners to minimize risk, Islamic/Swap-Free Accounts for Sharia compliance, and Demo Accounts for risk-free practice.

What assets can I trade on Finpros Nigeria?

With Finpros Nigeria, you can trade a diverse range of assets through CFDs (Contracts for Difference), including Forex (major, minor, and exotic currency pairs), Stocks (on leading global and local companies), Commodities (like gold, silver, crude oil), Indices (major global stock market indices), and Cryptocurrencies (Bitcoin, Ethereum, Ripple, etc.).

How can beginners get started with Finpros Nigeria?

Beginners can start by opening a Finpros Nigeria account and then extensively using the free Demo Account to practice with virtual funds. It’s crucial to educate yourself using their comprehensive resources, develop a trading strategy, implement strict risk management, and then gradually transition to live trading with manageable capital.