Welcome to Finpros Metals, where your financial future truly shines! We stand as your premier choice for navigating the dynamic world of precious metal investments. In an ever-changing economic landscape, securing your wealth with tangible assets like gold, silver, platinum, and palladium offers a unique blend of stability and growth potential. Finpros Metals empowers you to diversify your portfolio effectively, providing a reliable hedge against inflation and market volatility.

We believe in making precious metal investments accessible and straightforward for everyone, from seasoned investors to those just beginning their journey. Our commitment to transparency, security, and exceptional client support sets us apart. When you choose Finpros Metals, you choose a partner dedicated to helping you achieve your long-term financial goals through smart and strategic precious metal acquisitions. Let’s build a brighter, more secure future together.

- Understanding Finpros Metals: A Comprehensive Overview

- What Finpros Metals Offers

- Why Choose Finpros Metals?

- The Appeal of Investing in Precious Metals

- Key Advantages of Precious Metals Investment

- Explore the Finpros Metals Product Range

- What Finpros Offers in Metals Trading:

- Gold Investment Opportunities

- Considerations for Gold Investing

- Silver Investment Options

- Advantages and Considerations for Popular Silver Investment Types

- Platinum and Palladium Selections

- Advantages of Trading Platinum and Palladium:

- Considerations for Traders:

- Security and Trust with Finpros Metals

- Our Pillars of Security

- Why Traders Choose Finpros Metals for Security

- Getting Started: Opening Your Finpros Metals Account

- Your Path to Trading: A Simple Breakdown

- Why Choose a Finpros Metals Account?

- Before You Begin: What You Need

- Explore Your Options: Live vs. Demo Account

- Navigating the Finpros Metals Trading Platform

- Your Grand Tour: Getting Started and Dashboard Overview

- Exploring the Metals Markets: Finding Your Opportunity

- Executing Your Vision: Placing a Trade on Finpros

- Mastering Your Positions: Monitoring and Managing Trades

- Expert Insights and Market Analysis from Finpros

- What Finpros’s Market Analysis Provides:

- Transparent Fees and Pricing at Finpros Metals

- What Our Transparent Pricing Means for You:

- Dedicated Customer Support for Finpros Metals Clients

- Regulatory Adherence and Investor Protection

- What Regulatory Adherence Means for You

- Identifying a Secure Trading Partner

- Comparing Finpros Metals to Other Providers

- A Closer Look at the Differences

- The Future of Precious Metals with Finpros

- Frequently Asked Questions About Finpros Metals

- What exactly is Finpros Metals?

- What metals can I trade through Finpros?

- Why should I consider trading metals with Finpros?

- Key Benefits of Trading Metals with Finpros:

- How do I begin my metals trading journey with Finpros?

- Frequently Asked Questions

Understanding Finpros Metals: A Comprehensive Overview

Diving into the world of commodities can feel like navigating a complex maze, but with the right partner, it becomes an exciting journey. Finpros Metals stands out as a premier platform for those looking to engage with precious and industrial metals. Whether you’re a seasoned trader or just beginning to explore the vast potential of commodities, understanding what Finpros Metals brings to the table is crucial for making informed decisions and maximizing your trading opportunities.

Finpros Metals isn’t just another trading platform; it’s a specialized gateway designed to connect you with the lucrative market of physical and derivative metals. We empower individuals and institutions alike to participate in a market that has historically served as a hedge against inflation and a store of value during economic uncertainties. Our commitment is to provide a transparent, efficient, and user-friendly environment for all your metals trading needs.

What Finpros Metals Offers

Our platform focuses on providing access to a diverse range of metals, each with its unique market dynamics and investment potential. Here’s a snapshot of what you can expect:

- Precious Metals: Gold, Silver, Platinum, Palladium – these enduring assets are highly sought after for their intrinsic value and safe-haven appeal.

- Industrial Metals: Copper, Aluminum, Zinc – vital components of global manufacturing and infrastructure, offering different risk-reward profiles.

- Comprehensive Market Data: Access real-time price feeds, historical data, and analytical tools to inform your trading strategies.

- Flexible Trading Instruments: Trade metals through various instruments, including spot contracts and CFDs, giving you versatility in how you engage with the market.

Why Choose Finpros Metals?

We believe your trading experience should be seamless and supported. Here are some key advantages our users consistently highlight:

- Robust Platform: Experience a stable and intuitive trading interface designed for speed and reliability.

- Competitive Spreads: Benefit from tight spreads and transparent pricing, ensuring you get the most out of your trades.

- Dedicated Support: Our expert team is always ready to assist you with any queries or technical challenges.

- Educational Resources: Access a wealth of materials, from beginner guides to advanced strategies, to sharpen your market insights.

As a professional forex expert, I often emphasize diversification, and metals offer an excellent way to achieve that. The inherent stability of precious metals, coupled with the growth potential of industrial metals, creates a compelling case for their inclusion in any well-rounded portfolio. Finpros Metals provides the ideal ecosystem to explore these possibilities effectively.

“In the volatile landscape of global finance, metals often serve as a beacon of stability and an invaluable tool for portfolio diversification. Understanding their dynamics is the first step towards securing your financial future.” – A. Jackson, Senior Market Analyst

Understanding Finpros Metals is more than just knowing about a trading platform; it’s about recognizing an opportunity to engage with fundamental assets that drive the global economy. We invite you to explore the depth and breadth of what we offer, equipping you with the tools and knowledge necessary to succeed in the dynamic world of metals trading.

The Appeal of Investing in Precious Metals

Ever wonder why gold, silver, and other precious metals have captivated investors for centuries? It’s not just about their sparkling allure; these tangible assets offer a unique set of benefits that appeal to a wide range of individuals, from seasoned portfolio managers to first-time investors. They stand as a testament to enduring value in an often unpredictable financial world.

One of the primary reasons people turn to precious metals is their renowned status as a “safe haven.” When economic storms gather, traditional investments like stocks and bonds can become volatile. During these periods of uncertainty, precious metals often shine, providing a sense of security and stability that few other assets can match. They tend to hold their value, or even increase, when other markets falter, making them an excellent counter-cyclical asset to consider for your financial plan.

Beyond their role as a crisis hedge, these metals also offer powerful diversification benefits. Imagine building a strong, resilient investment portfolio. By including assets that don’t always move in the same direction as your stocks or real estate, you can significantly reduce overall portfolio risk. Precious metals often exhibit a low correlation with other asset classes, meaning they can help smooth out the ups and downs of your investments, protecting your wealth during market downturns and enhancing long-term stability.

Key Advantages of Precious Metals Investment

- Inflation Hedge: As the cost of living rises and fiat currencies lose purchasing power, precious metals historically maintain their value, acting as a reliable store of wealth against inflation.

- Tangible Asset: You own a physical asset, not just a promise or a digital entry. This tangibility eliminates counterparty risk, giving you direct control over your investment.

- Global Demand: With industrial, jewelry, and investment demand spanning the globe, these metals possess an inherent and widespread value that transcends borders and economic systems.

- Limited Supply: Unlike paper money that can be printed endlessly, precious metals are finite resources. Their scarcity contributes to their enduring value and potential for appreciation.

The decision to invest in precious metals is often a strategic one, aimed at protecting capital and ensuring long-term financial health. Whether you’re looking to safeguard against inflation, diversify your holdings, or simply hold a globally recognized store of value, the enduring appeal of these gleaming assets continues to draw investors seeking stability and growth in their portfolios.

Explore the Finpros Metals Product Range

Ready to diversify your portfolio and tap into markets with deep historical value? Finpros brings you an exciting and comprehensive metals product range, offering you direct access to some of the world’s most sought-after commodities. Trading metals with us means engaging with assets that often serve as a safe haven during economic uncertainty, providing unique opportunities for both short-term gains and long-term wealth preservation. We empower you to navigate these markets with confidence, backed by robust technology and expert insights.

Our carefully curated selection includes the titans of the precious metals world. Each metal offers distinct characteristics and market dynamics, allowing you to tailor your trading strategy to your specific goals and risk appetite. You’re not just trading a commodity; you’re participating in a global economic narrative that unfolds daily.

What Finpros Offers in Metals Trading:

- Gold (XAU/USD): The quintessential safe-haven asset. Gold consistently draws attention from investors globally, acting as a hedge against inflation and currency devaluation. Its market movements often reflect geopolitical tensions and economic data, offering various entry and exit points.

- Silver (XAG/USD): Known for its dual role as a precious metal and an industrial commodity. Silver’s price can be highly volatile, providing exciting opportunities for traders seeking more dynamic movements. Its industrial demand component adds another layer to its market analysis.

- Platinum (XPT/USD): A rare and highly valuable metal used in automotive catalysts, jewelry, and various industrial applications. Platinum often trades at a premium to gold, reflecting its scarcity and diverse uses.

- Palladium (XPD/USD): Another crucial industrial precious metal, primarily used in catalytic converters. Palladium’s price can be significantly influenced by automotive industry demand and supply-side constraints, making it a fascinating asset for observation and trading.

Finpros provides you with the competitive spreads, fast execution, and powerful analytical tools you need to make informed decisions across our entire metals product range. We understand the nuances of these markets, and our platform is designed to give you the edge. Whether you’re a seasoned trader looking to capitalize on market volatility or a newcomer exploring diversification, our platform supports your ambitions. You gain the flexibility to trade on both rising and falling markets, expanding your potential for profit.

Trading metals through Finpros means you’re not just buying or selling; you’re engaging with a market that reacts to global events, economic reports, and shifts in investor sentiment. We ensure you have access to real-time data and comprehensive charts, allowing you to perform thorough technical and fundamental analysis. Join the thousands of traders who trust Finpros to access and navigate the exciting world of precious metals.

Gold Investment Opportunities

Gold stands as a timeless beacon in the investment world, attracting savvy investors for centuries. Its enduring appeal as a safe haven asset, especially during economic uncertainty, makes it a crucial component for a well-rounded portfolio. When you think about long-term wealth preservation and growth, gold investing often comes to mind, offering a unique blend of stability and potential appreciation.

You have several compelling avenues to explore if you want to add precious metals to your investment strategy:

- Physical Gold: This includes buying gold bullion bars or coins. You hold a tangible asset, a direct store of value. Many investors find comfort in owning physical gold, knowing it’s a real asset that withstands market volatility.

- Gold Exchange-Traded Funds (ETFs): Gold ETFs offer an easy way to gain exposure to gold price movements without owning the physical metal. You buy shares in a fund that holds physical gold or gold-related derivatives. It’s a liquid and convenient option for many.

- Gold Mining Stocks: Invest in companies that mine for gold. Their performance often correlates with gold prices, but also depends on company-specific factors like operational efficiency and exploration success. This can provide leverage to gold price increases.

- Gold Futures and Options: For experienced traders, gold futures and options contracts offer a way to speculate on future gold prices. These derivatives can provide significant leverage but also carry higher risks.

Diversifying your holdings with gold can protect your wealth against inflation and currency devaluation. Many financial experts view it as an essential hedge, especially when market conditions become unpredictable. Gold historically maintains its purchasing power, making it an excellent store of value across generations.

Considerations for Gold Investing

| Advantages | Considerations |

|---|---|

| Acts as an inflation hedge. | Does not generate income (like dividends). |

| Provides portfolio diversification. | Storage costs for physical gold. |

| Globally recognized store of value. | Price can be volatile in the short term. |

| High liquidity for major forms (ETFs, futures). | Geopolitical events heavily influence prices. |

Understanding these aspects helps you make informed decisions. Gold often shines brightest during times of uncertainty, offering a stable anchor when other assets falter. Whether you are a conservative investor seeking safety or an aggressive trader looking for market opportunities, gold has a place in your strategy.

Silver Investment Options

Thinking about adding silver to your investment portfolio? You’re onto something smart! Silver, often called “poor man’s gold,” is far from poor in its investment potential. It serves as both a precious metal and a vital industrial commodity, making it a unique asset with diverse demand drivers. Its affordability compared to gold also makes it an accessible entry point for many investors looking to diversify their holdings.

There isn’t just one way to get involved with silver; you have several avenues, each with its own set of advantages and considerations. Choosing the right option depends on your investment goals, risk tolerance, and how much hands-on involvement you prefer. Let’s explore the most popular ways to invest in this shining metal:

- Physical Silver: This is the most straightforward and tangible way to own silver. It includes buying silver bullion in the form of bars or rounds, or collecting government-issued silver coins like American Silver Eagles or Canadian Silver Maples. You literally hold the asset, providing a sense of security and a direct hedge against inflation.

- Silver Exchange-Traded Funds (ETFs): For those who prefer convenience without the hassle of storage and insurance, silver ETFs are an excellent choice. These funds hold physical silver on behalf of their investors, or track the price of silver through futures contracts. You buy shares in the fund, which trade just like stocks on major exchanges, offering liquidity and ease of trading.

- Silver Mining Stocks: Investing in companies that mine silver offers a different kind of exposure. When you buy shares in a silver mining company, you’re not just betting on the price of silver, but also on the company’s operational efficiency, management, and growth prospects. These stocks can provide leveraged gains when silver prices rise, but also carry company-specific risks.

- Silver Futures and Options: These are more advanced financial instruments primarily used by experienced traders for speculation or hedging. Futures contracts involve an agreement to buy or sell a specific amount of silver at a predetermined price on a future date. Options give you the right, but not the obligation, to buy or sell silver. While they offer high leverage, they also come with significant risk.

Each method caters to a different investor profile. For instance, if you value direct ownership and a long-term store of value, physical silver might be your preference. If you’re looking for ease of trading and diversification within your stock portfolio, silver ETFs could be more appealing. And if you’re comfortable with higher risk for potentially higher returns, mining stocks or even derivatives might fit your strategy.

Advantages and Considerations for Popular Silver Investment Types

| Investment Type | Advantages | Considerations |

|---|---|---|

| Physical Silver | Tangible asset, direct ownership, safe haven asset, no counterparty risk. | Storage costs, insurance, liquidity for large amounts, potential for premiums. |

| Silver ETFs | High liquidity, easy to trade, no storage issues, diversification benefits. | Management fees, no direct ownership, counterparty risk (fund issuer), tracking error. |

| Silver Mining Stocks | Potential for leveraged gains, dividends (for some), exposure to company growth. | Company-specific risks (operational, geopolitical), volatility, not a direct silver price play. |

Ultimately, a well-rounded precious metals strategy might even include a mix of these options. Before making any decisions, take the time to research each one thoroughly and consider how it aligns with your overall financial objectives. Silver’s unique role in both finance and industry makes it an intriguing asset worth exploring for any serious investor.

Platinum and Palladium Selections

Venturing into the world of platinum and palladium offers unique opportunities for the astute trader. These precious metals are more than just shiny commodities; they are industrial powerhouses and fascinating assets within the broader precious metals trading landscape. Unlike gold or silver, which are often seen primarily as safe-haven assets, platinum and palladium boast significant industrial demand, especially in the automotive sector, making their market dynamics particularly intriguing.

When you consider platinum and palladium selections for your portfolio, you’re looking at metals driven by supply and demand dynamics that react sensitively to global economic shifts, technological advancements, and even geopolitical events. Understanding these drivers is key to crafting effective forex strategies and achieving successful commodity trading outcomes.

Here’s a closer look at what makes each of these metals a compelling choice:

- Platinum Market Dynamics: Often referred to as “rich man’s gold,” platinum is rarer than gold and has diverse applications. While a significant portion goes into catalytic converters for diesel vehicles, it also features prominently in jewelry, chemical processes, and medical instruments. Its price is heavily influenced by automotive sales, mining output from South Africa, and its role as a luxury good. Traders often observe its correlation with global economic health.

- Palladium Investment Appeal: Palladium has seen remarkable growth in recent periods, largely due to its critical role in catalytic converters for gasoline-powered vehicles. Its supply is notoriously tight, with Russia and South Africa being major producers. This scarcity, coupled with strong industrial demand, contributes to its volatility and makes palladium investment a dynamic area. Analyzing automotive emissions regulations and manufacturing trends is crucial for those trading palladium.

Diversification is a core principle for any robust trading portfolio, and incorporating these two metals can certainly enhance it. However, they come with their own set of characteristics to consider:

Advantages of Trading Platinum and Palladium:

- High Industrial Demand: Their essential role in various industries, particularly automotive, provides a fundamental driver for their value.

- Rarity and Scarcity: Both are significantly rarer than gold or silver, potentially amplifying price movements during supply shortages.

- Volatility Opportunities: Their sensitivity to industrial cycles and supply issues can create significant trading opportunities for those who master market analysis.

Considerations for Traders:

- Economic Sensitivity: Their prices can be heavily impacted by global economic slowdowns or shifts in industrial production.

- Supply Concentration: Production is concentrated in a few regions, making them susceptible to geopolitical risks and supply disruptions.

- Alternative Technologies: The rise of electric vehicles, while still nascent, presents a long-term consideration for demand, particularly for palladium.

As you explore platinum and palladium selections, remember that market analysis is paramount. Staying informed about industrial reports, automotive sales figures, and mining news will provide you with a clearer picture of potential price movements. These metals offer distinct pathways for those looking to expand their commodity trading horizons beyond the more conventional choices, presenting both challenges and exciting prospects for growth within the forex strategies you employ.

Security and Trust with Finpros Metals

Your journey into the exciting world of metals trading demands more than just opportunity; it requires a foundation built on unwavering security and absolute trust. At Finpros Metals, we understand this completely. We dedicate ourselves to creating a trading environment where your capital, your data, and your peace of mind are our highest priorities. You can trade with confidence, knowing you are backed by robust systems and a commitment to transparency that sets us apart.

We believe that true partnership in trading starts with trust. We implement stringent measures across all our operations to safeguard your interests, ensuring every aspect of your experience with us is secure and reliable. You deserve nothing less than a platform that not only performs but also protects.

Our Pillars of Security

Finpros Metals stands firmly on several core principles that define our commitment to your safety:

- Regulatory Adherence: We operate under strict regulatory guidelines, ensuring compliance with industry best practices. This oversight provides an additional layer of protection for all our clients. We consistently review and update our procedures to meet evolving standards.

- Segregation of Client Funds: Your funds are always kept in separate, segregated bank accounts, distinct from Finpros Metals’ operational capital. This crucial measure ensures that your money remains untouched and fully accessible, even in unforeseen circumstances.

- Advanced Data Encryption: We employ cutting-edge encryption technologies to protect your personal information and transaction data. Your privacy is paramount, and our systems are designed to prevent unauthorized access, keeping your sensitive details secure.

- Transparent Trading Practices: We provide a clear and fair trading environment. Our execution models are designed for speed and accuracy, giving you confidence in every trade you make. No hidden fees, no opaque processes – just honest trading.

- Robust Risk Management Protocols: We equip you with tools and features to manage your trading risks effectively. Our platform offers various order types and educational resources, empowering you to make informed decisions and control your exposure.

Why Traders Choose Finpros Metals for Security

Many traders choose Finpros Metals because we consistently demonstrate our dedication to their security. It’s not just a claim; it’s how we operate every single day. Here’s a quick overview of our advantages:

| Aspect | Finpros Metals’ Approach |

|---|---|

| Fund Safety | Segregated accounts, reputable banking partners. |

| Data Protection | SSL encryption, secure servers, privacy policies. |

| Trading Integrity | Transparent pricing, fast execution, no manipulation. |

| Client Support | Dedicated, responsive support team ready to assist. |

“At Finpros Metals, we don’t just offer a trading platform; we offer a secure sanctuary for your financial ambitions. Your trust is our most valuable asset, and we work tirelessly to earn and maintain it.”

— The Finpros Metals Commitment Team

We invite you to experience the difference that genuine security and trust can make in your trading. Join Finpros Metals and discover a platform where your peace of mind is as valued as your success.

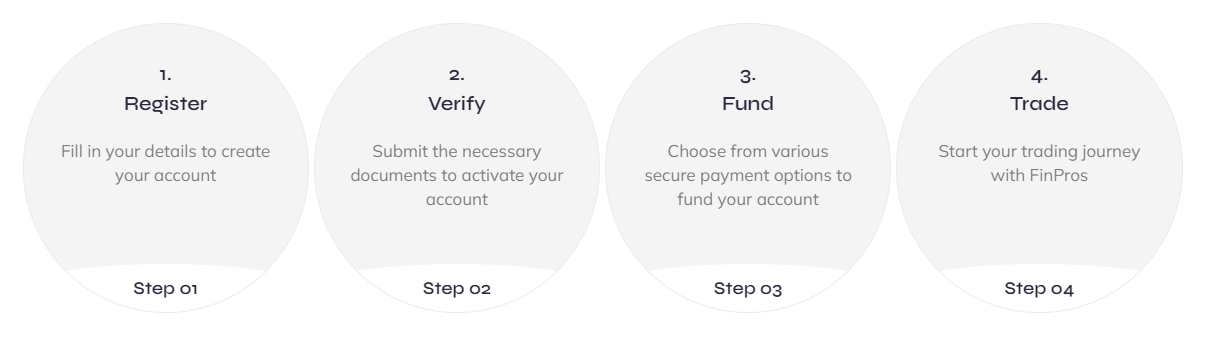

Getting Started: Opening Your Finpros Metals Account

Ready to dive into the exciting world of metals trading? Opening your Finpros Metals account is your first step towards unlocking unparalleled opportunities. We’ve streamlined the process to make it as smooth and straightforward as possible, ensuring you can begin your trading journey with confidence and ease. Forget complex forms and endless waiting – we believe your focus should be on the markets, not on administrative hurdles.

Your Path to Trading: A Simple Breakdown

Embarking on your journey with Finpros Metals is incredibly easy. We guide you through each stage, from initial sign-up to your first trade. Here’s a quick overview of what to expect:

- Visit Our Website: Head over to the Finpros Metals homepage and locate the “Open Account” button. It’s prominently displayed for your convenience.

- Fill Out the Form: Complete our secure online registration form. We ask for basic personal details to create your trading profile. This step is quick and intuitive.

- Verify Your Identity: To comply with regulatory standards and ensure a safe trading environment for everyone, you’ll upload a few documents for identity verification. This is a crucial step for your security.

- Fund Your Account: Once verified, you can choose from a range of secure funding methods to deposit capital into your new Finpros Metals account.

- Start Trading: Access our advanced trading platform, explore the markets, and place your first trades!

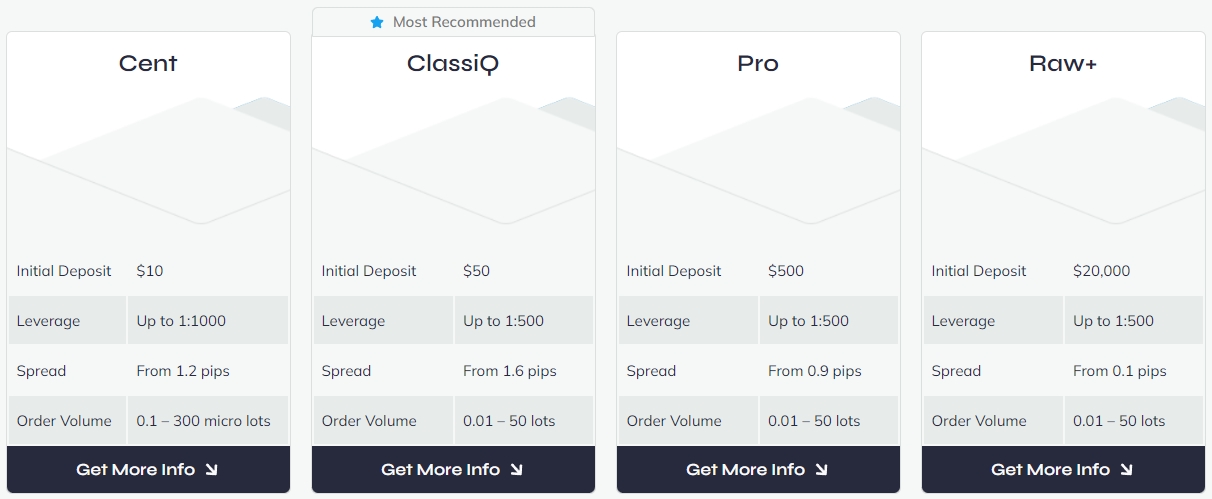

Why Choose a Finpros Metals Account?

When you open a Finpros Metals account, you’re not just getting access to a trading platform; you’re gaining a partner committed to your success. Our robust infrastructure and dedicated support are designed to empower traders of all levels.

Here are some advantages:

- Intuitive Platform: Navigate markets with ease using our user-friendly interface.

- Competitive Spreads: Maximize your potential profits with some of the best rates in the industry.

- Fast Execution: Experience rapid trade execution, crucial in fast-moving metals markets.

- Comprehensive Resources: Access educational materials and market analysis to sharpen your skills.

- Dedicated Support: Our customer support team is always ready to assist you.

Before You Begin: What You Need

To make your Finpros Metals account registration as swift as possible, have these items ready. These documents are standard for any regulated financial institution and help us protect your account.

| Document Type | Purpose | Examples |

|---|---|---|

| Proof of Identity | To confirm who you are. | Valid passport, national ID card, driver’s license. |

| Proof of Residency | To verify your current address. | Utility bill (electricity, water, gas), bank statement (dated within the last three months). |

Our secure portal ensures that all your submitted documents are handled with the utmost confidentiality and security. This identity verification process is a cornerstone of responsible trading and protection for all our clients.

Explore Your Options: Live vs. Demo Account

“Every great trader started somewhere. A demo account provides a risk-free environment to learn and experiment, while a live trading account is where real opportunities unfold.”

Whether you’re a seasoned trader or just starting, Finpros Metals offers the right account type for you. We understand that practice makes perfect, and risk management is key. Consider starting with a Finpros Metals demo account. It allows you to simulate live trading conditions using virtual funds, giving you invaluable experience without any financial risk. It’s the perfect way to familiarize yourself with our platform and test strategies. When you feel ready, upgrading to a live Finpros Metals account is seamless, opening the door to real market engagement and the potential for real gains.

Navigating the Finpros Metals Trading Platform

Stepping into the world of metals trading with Finpros is an exciting journey, and we built our platform to make your path as smooth as possible. Forget complex interfaces and confusing menus. The Finpros trading platform offers a sleek, intuitive design, ensuring you can focus on making informed decisions rather than struggling with the technology. Whether you are a seasoned trader or just beginning your exploration of precious metals, our system empowers you with everything you need, right at your fingertips.

Your Grand Tour: Getting Started and Dashboard Overview

Your first interaction with the Finpros trading platform begins with a secure login. Once inside, you’ll immediately land on your personalized account dashboard. Think of this as your mission control center. Here, you get an instant snapshot of your entire trading universe. Key features on this initial screen include:

- Account Summary: Quickly view your equity, margin usage, and available balance. Transparency is key to effective risk management.

- Open Positions: See all your active metals trades at a glance, with real-time profit and loss updates.

- Watchlists: Customize and monitor your favorite precious metals, like gold, silver, platinum, or palladium, without constantly searching.

- Recent Activity: Keep track of your latest transactions and order history.

Everything is designed for clarity and quick access, ensuring you always know where you stand.

Exploring the Metals Markets: Finding Your Opportunity

Ready to dive into the specifics of metals trading? The Finpros platform makes market exploration incredibly straightforward. Look for the “Markets” or “Instruments” section, usually found in a prominent sidebar or top menu. From there, you can easily filter for “Metals.” You’ll see a comprehensive list of tradable precious metals.

Clicking on a specific metal, like Gold (XAU/USD), opens up its dedicated instrument panel. Here, you gain access to essential market data:

- Real-time price quotes.

- Interactive charting tools with various timeframes and indicators.

- Fundamental news directly impacting that metal.

Utilize these powerful analytical tools to identify trends and potential entry or exit points. Our robust trading tools help you dissect the market with confidence.

Executing Your Vision: Placing a Trade on Finpros

Once you’ve identified a trading opportunity, executing your trade is just a few clicks away. The order panel is typically located directly on the instrument’s page. This is where your strategy comes to life. Here’s how you place an order:

- Select Buy/Sell: Decide whether you believe the price will rise (Buy) or fall (Sell).

- Choose Order Type:

Order Type Description Market Order Execute immediately at the best available price. Limit Order Buy below or sell above the current market price. Stop Order Set a price to close a losing position or open a new one. - Define Volume: Specify the amount of metal you wish to trade.

- Set Stop Loss/Take Profit: Crucial for effective risk management. Automatically close your trade if the price moves against you too much (stop loss) or reaches your target profit (take profit).

Confirm your parameters, and with a final click, your order is live! Our platform prioritizes swift and accurate trade execution.

Mastering Your Positions: Monitoring and Managing Trades

After placing a trade, you need to monitor its performance. Head back to your dashboard or the “Positions” section. Here, you can:

- Track live profit and loss for each open position.

- Modify stop loss and take profit levels as market conditions change.

- Close positions manually at any time.

Effective management of your open trades is paramount to successful metals trading. The Finpros platform gives you the control and visibility you need to adjust your strategy on the fly. We provide you with the necessary information to adapt and react to the dynamic precious metals market.

Expert Insights and Market Analysis from Finpros

Navigating the dynamic world of forex trading requires more than just instinct; it demands a solid foundation of expert insights and comprehensive market analysis. At Finpros, we pride ourselves on delivering exactly that. Our team of seasoned financial analysts works tirelessly, poring over market data, economic indicators, and geopolitical events to bring you clarity amidst the complexity. We cut through the noise, providing you with actionable intelligence that can genuinely enhance your trading decisions.

Our commitment goes beyond just reporting what happened. We delve deep, offering forward-looking perspectives that anticipate market shifts and potential opportunities. From detailed technical breakdowns of currency pairs to fundamental analysis of key economic releases, Finpros offers a holistic view. We believe that an informed trader is a confident trader, and our goal is to empower you with the knowledge to make strategic moves.

What Finpros’s Market Analysis Provides:

- Timely Market Updates: Receive real-time analysis of breaking news and its potential impact on currency values.

- In-Depth Research Reports: Access comprehensive reports covering major and minor currency pairs, helping you understand long-term trends.

- Technical Analysis Breakdowns: Learn to identify key support and resistance levels, trend lines, and chart patterns with expert guidance.

- Fundamental Factor Explanations: Understand how economic data, central bank policies, and global events influence forex markets.

- Sentiment Indicators: Gauge market mood and positioning to anticipate potential reversals or continuations.

- Risk Management Perspectives: Gain insights into managing your exposure and protecting your capital based on market conditions.

Many traders tell us that Finpros’s analysis acts as their compass in the often-turbulent forex seas. As one trader recently shared, “Before Finpros, I felt like I was guessing. Now, I understand the ‘why’ behind market movements, and my trading has become far more strategic.” This kind of feedback fuels our dedication to providing top-tier market intelligence.

We translate complex financial data into understandable, usable information. This means you spend less time deciphering charts and reports yourself, and more time focusing on executing well-informed trades. Whether you are new to the forex market or a veteran trader looking for an edge, our expert insights and market analysis are designed to equip you with the strategic advantage you need to thrive.

Transparent Fees and Pricing at Finpros Metals

Ever feel like you need a detective to uncover all the costs when trading? We understand that hidden fees can eat into your profits and create unnecessary stress. At Finpros Metals, we believe your focus should be on making smart trading decisions, not on decoding complex fee structures. That’s why transparency in fees and pricing is a cornerstone of our service.

At Finpros Metals, we believe your focus should be on making smart trading decisions, not on decoding complex fee structures. That’s why transparency in fees and pricing is a cornerstone of our service.

We are committed to providing you with clear, upfront information about every potential cost involved in your trading journey. You will never encounter unexpected charges or baffling footnotes with us. Our goal is to empower you with all the knowledge you need to manage your finances effectively.

What Our Transparent Pricing Means for You:

- No Hidden Surprises: We lay out all our fees, from spreads and commissions to swap rates and overnight charges, right from the start. You always know what to expect.

- Clear Spreads: Our spreads are competitive and clearly displayed on our trading platforms. You can see the buying and selling price difference instantly, allowing for precise trade calculations.

- Straightforward Commissions: For accounts that involve commissions, our rates are simple, easy to understand, and communicated clearly. No confusing tiers or variable charges.

- Accessible Information: All our pricing models and fee schedules are readily available on our website and within your account dashboard. You can review them anytime, anywhere.

Choosing a broker with transparent fees is not just about avoiding extra costs; it’s about building trust. It allows you to plan your trading strategies with confidence, knowing exactly how much each transaction will cost you. This clarity helps you make informed decisions, optimize your trading performance, and ultimately, achieve your financial goals.

We work hard to maintain fair and competitive pricing across all our products and services. Our commitment to transparency is unwavering because we believe it’s essential for a strong, long-term relationship with our traders. Join Finpros Metals and experience the peace of mind that comes with truly transparent trading.

Dedicated Customer Support for Finpros Metals Clients

At Finpros Metals, we understand that exceptional trading experiences go hand-in-hand with outstanding support. That’s why we’ve built a dedicated customer support team specifically tailored to the needs of our metals clients. We know the markets never sleep, and sometimes, you need answers fast. Our goal is to provide you with seamless assistance, ensuring your trading journey is as smooth and efficient as possible.

Our support isn’t just about troubleshooting; it’s about empowering you. Whether you have a question about platform navigation, need clarity on a specific metals contract, or require help with account management, our experts are ready. We pride ourselves on being more than just a helpdesk; we are an extension of your trading success. You can always count on us to provide timely, accurate, and professional guidance.

What makes our Finpros Metals client support stand out?

- Expert Knowledge: Our team members are well-versed in the intricacies of metals trading and our platform. They speak your language.

- Rapid Response: We value your time. Expect quick and effective solutions to your inquiries, minimizing any disruption to your trading.

- Personalized Attention: We treat every client as an individual. You’re not just a ticket number; you’re a valued member of the Finpros Metals community.

- Multi-Channel Access: Reach out to us through various convenient channels, making it easy to get the support you need, when you need it.

We are committed to building long-term relationships with our clients. Your feedback drives our continuous improvement, and your satisfaction is our top priority. Trust Finpros Metals to be there for you, every step of your trading path.

Regulatory Adherence and Investor Protection

Embarking on your forex trading journey is exciting, but navigating the global currency markets demands a keen eye on safety. This is where forex regulation steps in as your ultimate safeguard. Understanding regulatory adherence isn’t just a technical detail; it’s the bedrock of your trading security, directly impacting your peace of mind and the integrity of your investments.

At its core, regulatory adherence means that forex brokers operate under strict rules and guidelines set by specific governmental or financial authorities. These bodies exist to maintain a fair, transparent, and orderly market. Choosing a regulated broker isn’t merely a suggestion; it’s a critical decision for robust investor protection.

What Regulatory Adherence Means for You

When a broker commits to regulatory adherence, they commit to upholding certain standards that directly benefit you. It’s about creating an environment where your funds are secure and your trading experience is equitable. Here are some key protections you gain:

- Segregated Accounts: Reputable, regulated brokers keep client funds separate from their operational capital. This means your money remains safe, even if the broker faces financial difficulties. It’s an essential layer of security.

- Capital Requirements: Regulators often demand brokers maintain a certain level of operational capital. This ensures the broker has sufficient funds to meet their obligations, offering you more stability.

- Fair Trading Practices: Rules are in place to prevent manipulation and ensure transparent pricing. You get real market quotes and fair execution of your trades, promoting market integrity.

- Dispute Resolution Mechanisms: If a problem arises, regulated brokers must provide clear channels for dispute resolution. You have an avenue to address concerns, often through independent bodies, which champions client advocacy.

- Transparency in Fees and Charges: Regulators require brokers to be upfront about all costs. You know exactly what you’re paying, avoiding hidden fees and surprises.

Identifying a Secure Trading Partner

Your responsibility as a trader includes verifying the regulatory status of any broker you consider. This simple step is your first line of defense against potential scams and ensures you’re trading with a platform committed to compliance standards.

Here’s how you can check:

| Action | Benefit to You |

|---|---|

| Check the broker’s website for regulatory licenses. | Confirms they are overseen by a legitimate financial authority. |

| Verify the license number directly with the regulator’s database. | Ensures the license is active and valid, protecting against false claims. |

| Look for clear terms and conditions, and a transparent fee structure. | Demonstrates the broker’s commitment to honesty and clarity. |

Choosing a broker with a strong record of risk management and strict adherence to regulatory guidelines isn’t just about avoiding problems; it’s about empowering yourself with confidence. When you trade with a platform that prioritizes regulatory adherence, you’re not just making a trade; you’re making a smart investment in your trading future.

Comparing Finpros Metals to Other Providers

Choosing the right trading partner is a pivotal decision that shapes your journey in the financial markets. With so many options available, understanding where Finpros Metals stands out from the crowd becomes crucial. We believe in transparency and empowering you with the knowledge to make an informed choice. Let’s delve into what truly sets us apart when you compare us to other providers.

Many brokers offer a wide range of assets, but often lack depth in specific areas. At Finpros Metals, while we provide robust forex trading and other CFDs, our specialization in metal trading gives us a distinct edge. This focus means you get tailored tools, sharper insights, and more precise execution for your precious metals strategies. When you look at the landscape of trading platforms, it’s easy to see how some prioritize quantity over quality, leading to a diluted trading experience.

Here’s what typically matters when you compare brokerage services:

- Instrument Specialization: Do they truly understand the nuances of the assets you trade most?

- Platform Performance: Is the trading platform reliable, intuitive, and feature-rich?

- Cost Efficiency: Are the competitive spreads genuinely competitive, and are fees transparent?

- Security and Trust: What level of regulation protects your investments?

- Support Quality: Can you count on responsive and knowledgeable customer support?

- Educational Tools: Do they offer valuable educational resources and market analysis?

- Account Flexibility: Are there diverse account types and manageable leverage options?

A Closer Look at the Differences

When you place Finpros Metals side-by-side with many generalist brokers, our commitment to excellence in specific domains becomes clear. While many offer basic charting and generic news feeds, we provide advanced charting tools, specialized indicators for metals, and dedicated market analysis focusing on the drivers of gold, silver, and other precious commodities. This targeted approach empowers you to make more informed decisions, directly impacting your trading success.

Another area where we frequently receive positive feedback is our customer support. While other providers might route you through lengthy automated systems or offer generic answers, our team is trained to understand the complexities of trading and provide personalized assistance. We know that timely help can make all the difference, especially when navigating volatile markets.

Consider this quick comparison:

| Feature | Finpros Metals | Typical Generalist Provider |

|---|---|---|

| Metal Trading Specialization | Deep expertise, tailored tools, focused insights. | Metals offered, but as one of many general instruments. |

| Trading Platforms | Robust, user-friendly, optimized for various assets including metals. | Standard platforms, sometimes with limited customization. |

| Spreads & Fees | Highly competitive spreads, transparent cost structure. | Varying spreads, potential hidden fees or wider spreads on niche assets. |

| Customer Support | Responsive, knowledgeable, personalized assistance. | Often automated, generic responses, longer wait times. |

| Educational Resources | Curated content, webinars, and market analysis specific to current market conditions. | Generic articles, basic tutorials. |

| Risk Management Tools | Comprehensive and easy-to-use tools embedded in platform. | Basic tools, sometimes requiring manual setup. |

Our dedication to providing a secure and reliable environment for your trades is paramount. We adhere to stringent regulation, ensuring that your funds and data are protected. The clarity in our withdrawal process and the variety of account types further enhance the user experience, making Finpros Metals a robust choice for serious traders. When you seek a partner that truly understands your trading needs and equips you with the tools to succeed, the choice becomes clear.

The Future of Precious Metals with Finpros

Precious metals have always been a cornerstone of wealth and a reliable safe haven during economic uncertainty. Gold, silver, platinum, and palladium are more than just commodities; they represent stability, a hedge against inflation, and a tangible store of value. As the global financial landscape continues to evolve, so too does the way investors approach these timeless assets. We’re seeing a shift towards greater accessibility, sophisticated analysis, and integrated trading platforms.

The future of precious metals investing isn’t just about holding physical assets. It’s about smart, informed participation in a dynamic market. New technologies, geopolitical shifts, and changing investor demographics are all playing a role in shaping this future. Digital solutions are making it easier than ever to diversify portfolios with precious metals, offering both security and liquidity. The demand for expert insights and robust trading tools is higher than ever, as investors seek to navigate these complex waters with confidence.

This is where Finpros steps in, redefining how you engage with precious metals. We blend traditional market wisdom with cutting-edge technology to offer an unparalleled trading experience. Our platform is designed to put you ahead of the curve, providing the resources you need to capitalize on emerging trends and manage risk effectively. Consider these advantages when you choose Finpros for your precious metals investments:

- Unmatched Market Access: Trade a wide range of precious metals with competitive pricing and excellent liquidity.

- Advanced Analytical Tools: Leverage our comprehensive charts, real-time data, and expert analysis to make informed decisions.

- Robust Security Measures: Your investments are protected with top-tier security protocols, giving you peace of mind.

- Educational Resources: Enhance your understanding of the precious metals market through our extensive learning materials.

- Dedicated Support: Our team of professionals is always ready to assist you, ensuring a smooth trading journey.

At Finpros, we believe the future of precious metals is bright and accessible to all. We are committed to empowering our clients with the tools, knowledge, and secure environment necessary to thrive in this exciting market. Join us and discover a smarter way to invest in gold, silver, and other valuable metals.

Frequently Asked Questions About Finpros Metals

Embarking on a journey into the world of precious metals trading can spark many questions. At Finpros, we believe in clarity and providing all the information you need to trade with confidence. Here, we tackle some of the most common inquiries about Finpros Metals, giving you a clear picture of what we offer and how you can benefit from online trading in this dynamic market.

What exactly is Finpros Metals?

Finpros Metals is your dedicated gateway to the exciting world of precious metals trading. We provide a sophisticated yet user-friendly platform where you can engage with global markets and trade a variety of sought-after commodities. Whether you are looking to diversify your portfolio, hedge against inflation, or simply capitalize on price movements, our service offers the tools and access you need. We connect individual traders and institutions to the enduring value and opportunities within the metals market.

What metals can I trade through Finpros?

With Finpros, you gain access to a diverse range of popular precious metals, allowing you to tailor your trading strategy. Our platform typically offers:

- Gold (XAU): Often considered a safe-haven asset, gold trading remains a cornerstone for many investors seeking stability and a store of value.

- Silver (XAG): Known for its dual role as a precious metal and industrial commodity, silver trading presents unique opportunities for market participants.

- Platinum (XPT): Rarer than gold and used in various industrial applications, platinum offers distinct market dynamics for those looking to expand their metals exposure.

- Palladium (XPD): With significant demand from the automotive industry, palladium trading can provide another fascinating dimension to your commodity portfolio.

We strive to provide competitive access to these key instruments, ensuring you have ample choice for your metals trading endeavors.

Why should I consider trading metals with Finpros?

Choosing Finpros for your metals trading journey brings several distinct advantages. We focus on providing a premium experience that empowers our clients:

Key Benefits of Trading Metals with Finpros:

- Competitive Spreads: We work to offer tight, competitive spreads on our precious metals, aiming to enhance your potential profitability in the market.

- Advanced Trading Platform: Access cutting-edge technology with our robust Finpros trading platform. It features powerful charting tools, real-time market analysis, and intuitive navigation.

- Security and Reliability: Your security is our top priority. We operate under stringent regulatory guidelines, ensuring a secure and reliable environment for your online trading activities.

- Dedicated Client Support: Our team of knowledgeable professionals stands ready to assist you. From account setup to complex trading queries, expect prompt and expert assistance.

- Educational Resources: Whether you’re a beginner or an experienced trader, our comprehensive library of educational materials, including insights on gold trading and silver trading, helps you refine your skills and understanding of the commodities market.

How do I begin my metals trading journey with Finpros?

Starting your metals trading journey with Finpros is straightforward and designed for ease. Follow these simple steps to open your account and begin exploring the opportunities in precious metals:

- Open an Account: Visit our website and complete the quick registration process. We guide you through providing the necessary identification to ensure compliance and security.

- Fund Your Account: Choose from a variety of secure funding methods to deposit capital into your Finpros trading account. We support multiple payment options for your convenience.

- Explore the Platform: Download our trading platform or access it directly via your web browser. Take time to familiarize yourself with its features, tools for market analysis, and available precious metals.

- Start Trading: Once you feel ready, you can place your first trade. Utilize our educational resources to refine your strategy and make informed decisions in your gold trading, silver trading, or other metals ventures.

We are here to support you every step of the way as you navigate the exciting world of commodities trading.

Frequently Asked Questions

What is Finpros Metals?

Finpros Metals is a specialized platform providing access to the dynamic market of physical and derivative metals, including precious and industrial metals, designed to help individuals and institutions diversify their portfolios and hedge against economic uncertainties.

What types of metals can I trade or invest in through Finpros Metals?

Finpros Metals offers access to a diverse range of metals. This includes precious metals like Gold (XAU/USD), Silver (XAG/USD), Platinum (XPT/USD), and Palladium (XPD/USD), as well as industrial metals such as Copper, Aluminum, and Zinc.

What are the key advantages of investing in precious metals like gold and silver?

Precious metals serve as a safe haven during economic uncertainty, a hedge against inflation, and provide powerful diversification benefits to a portfolio. They are tangible assets with global demand and limited supply, contributing to their enduring value.

How does Finpros Metals ensure the security of my investments and personal data?

Finpros Metals prioritizes security through regulatory adherence, segregation of client funds in separate bank accounts, advanced data encryption, transparent trading practices, and robust risk management protocols to protect client capital and information.

How can I get started with trading metals on the Finpros platform?

To begin, visit the Finpros Metals website and click “Open Account” to complete the registration form and verify your identity. After funding your account using secure methods, you can access the trading platform and start exploring the metals markets. A demo account is also available for practice.