Are you ready to explore the dynamic world of online trading? Finpros Indonesia opens the door to exciting opportunities, offering a reliable and secure platform for traders of all levels. We understand that choosing the right partner is crucial for your success, and that’s why we’ve built our reputation on trust, transparency, and top-tier support. With Finpros Indonesia, you gain access to a powerful trading environment designed to help you achieve your financial goals.

We believe in empowering our clients. Our platform combines intuitive design with robust functionality, making it easy for you to navigate markets and execute trades with confidence. Whether you’re a seasoned investor or just starting your journey, you’ll find the resources and tools you need right here. Joining Finpros Indonesia means stepping into a community focused on growth and professional trading experiences.

Why settle for less when you can partner with a leader? We dedicate ourselves to providing an unparalleled trading experience. From cutting-edge technology to comprehensive educational materials, we equip you with everything necessary to make informed decisions. Discover the difference of trading with a partner who truly puts your interests first. Your trading journey starts here, with Finpros Indonesia.

- What is Finpros Indonesia? An Overview

- What Finpros Indonesia Offers:

- Regulatory Compliance and Security at Finpros Indonesia

- Protecting Your Capital: Client Funds Security

- Fortifying Our Digital Fortress: Platform Security Measures

- Licenses and Client Fund Protection

- How Your Funds Stay Safe:

- Key Features and Advantages of Finpros Indonesia

- Unleashing Your Trading Potential

- The Finpros Indonesia Edge: Why Choose Us?

- Trading Accounts and How to Open One with Finpros Indonesia

- Discover Your Ideal Finpros Indonesia Trading Account

- Seamless Steps to Open Your Finpros Indonesia Trading Account

- Types of Accounts (e.g., Standard, ECN)

- Standard Accounts

- ECN (Electronic Communication Network) Accounts

- Cent Accounts

- Islamic Accounts (Swap-Free Accounts)

- Trading Platforms Available Through Finpros Indonesia

- MetaTrader 4 (MT4): The Industry Standard

- MetaTrader 5 (MT5): The Next Generation Platform

- Trading on the Go: Mobile and Web-Based Platforms

- MetaTrader Suite and Mobile Access

- Key Benefits of the MetaTrader Suite:

- Financial Instruments You Can Trade with Finpros Indonesia

- Forex: The World’s Largest Financial Market

- Commodities: Tangible Assets, Digital Trading

- Indices: Broad Market Exposure

- Forex, Commodities, and Indices

- Understanding Each Market:

- Deposits and Withdrawals: Funding Your Finpros Indonesia Account

- Making a Deposit: Fueling Your Trading Journey

- Withdrawing Your Profits: Enjoying Your Success

- Withdrawal Process Snapshot:

- Understanding Spreads, Commissions, and Fees at Finpros Indonesia

- The Core of Trading Costs: Spreads

- Unpacking Commissions: When and Why They Apply

- Beyond Spreads and Commissions: Other Important Fees

- Our Commitment to Transparent Pricing

- Customer Support and Educational Resources from Finpros Indonesia

- Unwavering Customer Support: Your Trading Companion

- Empowering Traders Through Comprehensive Education

- Our Educational Offerings Include:

- Getting Help and Learning Tools

- Unlock Your Potential with Comprehensive Resources

- Direct Support When You Need It Most

- User Reviews and Reputation of Finpros Indonesia

- What Clients Say: A Glimpse into Finpros Trading Experience

- Areas for Consideration Based on User Feedback

- The Bottom Line: Building Trust in Forex Broker Indonesia

- A Step-by-Step Guide to Getting Started with Finpros Indonesia

- Visit the Official Finpros Indonesia Website

- Complete the Online Registration Form

- Verify Your Identity (KYC Process)

- Fund Your Trading Account

- Download and Install the Trading Platform

- Start Trading!

- Advantages and Disadvantages of Using Finpros Indonesia

- The Upsides: What Makes Finpros Indonesia a Strong Contender?

- The Downsides: Points to Consider Before Joining Finpros Indonesia

- Finpros Indonesia: Final Verdict and Future Prospects

- Frequently Asked Questions

What is Finpros Indonesia? An Overview

Ever wondered about navigating the dynamic world of financial markets from Indonesia? Finpros Indonesia emerges as a prominent player, a professional online broker dedicated to providing access to global trading opportunities. Established with a vision to empower Indonesian traders, Finpros offers a robust platform for those looking to engage in the exciting realm of forex trading and other financial instruments.

At its core, Finpros Indonesia aims to be more than just a trading platform; it strives to be a comprehensive financial services partner. They understand the unique needs of local investors and are committed to delivering a secure, transparent, and efficient trading environment. Whether you are a seasoned investor or just beginning your journey into investment opportunities, Finpros positions itself as a reliable gateway.

What Finpros Indonesia Offers:

- Access to Global Markets: Trade major, minor, and exotic currency pairs in the vast forex market.

- Diverse Trading Instruments: Beyond foreign exchange, explore commodities, indices, and other CFDs.

- Cutting-Edge Technology: Benefit from advanced trading platforms designed for speed and reliability.

- Educational Resources: Get equipped with tools and learning materials to enhance your trading knowledge and strategies.

- Dedicated Support: Receive assistance from a team ready to help you navigate your trading experience.

Finpros Indonesia focuses on creating a user-friendly experience, ensuring that traders can execute their strategies with confidence. They prioritize clear communication and provide the necessary tools to make informed decisions. Many consider it a solid option for those seeking a local partner with international standards in the competitive online brokerage space.

In essence, Finpros Indonesia represents a commitment to fostering financial literacy and providing accessible financial markets to the Indonesian populace. It stands as an invitation for individuals to explore potential growth in the global economy, all from a locally supported and professionally managed platform.

Regulatory Compliance and Security at Finpros Indonesia

Stepping into the world of online forex trading requires confidence in your broker. At Finpros Indonesia, we understand that trust forms the bedrock of every successful trading journey. That’s why regulatory compliance and robust security measures aren’t just buzzwords for us; they are fundamental pillars of our operation. We dedicate ourselves to creating a safe and transparent environment for all our clients.

Our commitment begins with strict adherence to local regulations. Finpros Indonesia operates under the vigilant oversight of Bappebti (Badan Pengawas Perdagangan Berjangka Komoditi) – the Indonesian Commodity Futures Trading Regulatory Agency. This rigorous regulatory framework ensures we meet high standards for financial conduct, transparency, and operational integrity. You can trade with peace of mind, knowing a reputable authority closely monitors our practices, providing essential investor protection.

Protecting Your Capital: Client Funds Security

Your trading capital is paramount. We implement stringent protocols to safeguard your client funds:

- Segregated Accounts: Finpros Indonesia holds all client funds in separate bank accounts, completely distinct from our operational capital. This ensures your money remains yours, even in unforeseen circumstances for the company.

- Regular Audits: Independent auditors routinely examine our financial practices. This adds an extra layer of transparency and verifies our compliance with financial regulations.

- Risk Management: We employ sophisticated internal risk management systems to protect against market volatility and operational risks, providing a reliable forex broker experience.

Fortifying Our Digital Fortress: Platform Security Measures

Security is not just a feature; it’s an ongoing process. We constantly upgrade our systems to stay ahead of potential threats.

| Security Feature | How It Protects You |

|---|---|

| Data Encryption (SSL) | All data transmitted between your device and our servers uses industry-standard SSL encryption, keeping your personal information and transactions private. |

| Firewall Protection | Robust firewalls prevent unauthorized access to our servers, creating a secure barrier against cyber threats. |

| Two-Factor Authentication (2FA) | Add an extra layer of security to your account. With 2FA, you need a second verification step, like a code from your phone, to log in, even if someone has your password. |

| Secure Data Centers | Our infrastructure resides in state-of-the-art data centers with advanced physical and digital security protocols. |

We empower our traders with tools and knowledge to protect themselves too. Always use strong, unique passwords and enable two-factor authentication for your Finpros Indonesia account. Choosing a trusted broker means partnering with a company that prioritizes your safety. We are committed to maintaining the highest standards of regulatory compliance and security, allowing you to focus on your trading goals with complete confidence.

Licenses and Client Fund Protection

When you embark on your forex trading journey, the first thing to look for in any platform is robust licensing and unwavering client fund protection. This isn’t just about compliance; it’s about your peace of mind and the safety of your hard-earned capital. A top-tier, regulated broker operates under strict oversight, adhering to rigorous financial standards designed to protect you, the trader.

What does this mean for you? It means choosing a partner who is held accountable by reputable financial regulatory bodies. These entities enforce rules on operational transparency, capital adequacy, and fair business practices. Knowing your broker holds a legitimate license from a recognized authority is the cornerstone of a secure trading experience.

How Your Funds Stay Safe:

- Client Fund Segregation: Your funds are kept in separate bank accounts from the broker’s operational capital. This critical measure ensures that even if the broker faces financial difficulties, your money remains untouched and accessible.

- Investor Compensation Schemes: Many jurisdictions offer schemes that provide a safety net, compensating clients up to a certain amount in the unlikely event of a broker’s insolvency. This adds an extra layer of trader security.

- Regular Audits and Reporting: Licensed brokers undergo frequent audits and must submit regular financial reports to their regulators. This scrutiny ensures they maintain sound financial health and adhere to all protective measures.

Choosing a platform with a strong emphasis on licenses and client fund protection allows you to focus purely on your trading strategies, free from unnecessary worries about the security of your investment. It’s a non-negotiable aspect of responsible forex trading, providing you with the confidence to navigate the markets effectively.

Key Features and Advantages of Finpros Indonesia

Are you ready to elevate your trading journey? Finpros Indonesia stands out as a premier choice for traders seeking a reliable and dynamic platform. We understand what it takes to succeed in the fast-paced world of forex trading, and our offerings reflect that commitment. Discover why so many traders trust us with their financial aspirations.

Unleashing Your Trading Potential

Finpros Indonesia is more than just a broker; it’s a complete ecosystem designed to empower your trading decisions. We focus on providing a seamless experience from your first trade to your most advanced strategies. Our platform blends cutting-edge technology with user-friendly interfaces, ensuring both novice and experienced traders find their stride.

Here are some core aspects that set Finpros Indonesia apart:

- Advanced Trading Platform: Access industry-standard platforms packed with powerful analytical tools, real-time data, and customizable charts. Execute trades with precision and speed, all within an intuitive environment.

- Competitive Trading Conditions: Benefit from tight spreads and transparent pricing. We strive to offer some of the most favorable conditions in the market, helping you maximize your potential returns on every transaction.

- Diverse Asset Selection: Explore a wide range of financial instruments, including major and minor currency pairs, commodities, and indices. Diversify your portfolio and capitalize on various market opportunities.

- Exceptional Customer Support: Our dedicated support team is always ready to assist you. Get timely and professional help with any queries, ensuring your trading journey remains smooth and uninterrupted.

- Robust Security Measures: Your security is our top priority. We employ advanced encryption and adhere to strict protocols to safeguard your funds and personal information, giving you peace of mind.

- Comprehensive Educational Resources: Whether you’re just starting or looking to refine your skills, our extensive library of educational materials, webinars, and market analysis provides valuable insights. Learn at your own pace and stay informed about market trends.

The Finpros Indonesia Edge: Why Choose Us?

When you choose Finpros Indonesia, you are opting for a partner committed to your growth. We believe in providing an environment where clarity, efficiency, and support converge to create an unparalleled trading experience. Our focus on competitive offerings and robust infrastructure means you can concentrate on your strategies, knowing you have a strong foundation.

Consider these compelling advantages:

| Advantage Factor | Benefit to You |

|---|---|

| Low Transaction Costs | More of your profits stay with you. |

| Reliable Execution | Your trades open and close when you intend. |

| Dedicated Support | Quick answers and guidance when you need it most. |

| Flexible Deposit & Withdrawal | Manage your funds conveniently and efficiently. |

| Continuous Learning Tools | Stay sharp and adapt to changing market conditions. |

Joining Finpros Indonesia means stepping into a world where your trading ambitions are met with powerful tools, dedicated support, and a commitment to your financial success. It’s time to experience the difference a truly client-focused broker makes.

Trading Accounts and How to Open One with Finpros Indonesia

Embarking on your forex trading journey requires a reliable trading account, and Finpros Indonesia stands out as your trusted online broker. Choosing the right account is crucial; it sets the stage for your trading style and caters to your unique investment goals. We understand that every trader is different, which is why we offer a range of options designed to suit both beginners and seasoned market participants.

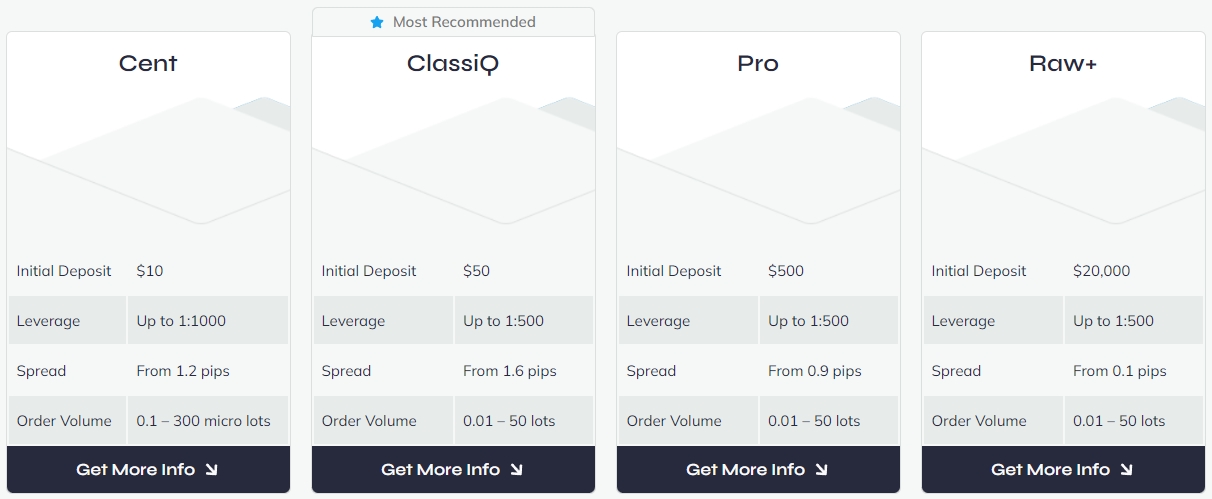

Discover Your Ideal Finpros Indonesia Trading Account

At Finpros Indonesia, we believe in providing flexibility and powerful tools right at your fingertips. Our diverse account types ensure you find the perfect fit to execute your strategies effectively:

- Standard Account: Perfect for most traders, offering competitive spreads and direct market access. This is a great starting point for those looking to engage with major currency pairs and commodities.

- ECN Account: For experienced traders seeking raw spreads and fast execution. This account type connects you directly to the interbank market, providing maximum transparency.

- Cent Account: An excellent choice for new traders who want to practice with smaller stakes. Trade in cents instead of standard lots, minimizing risk while gaining valuable experience.

- Demo Account: Risk-free practice is invaluable. Our free demo account allows you to explore the platform, test strategies, and familiarize yourself with the markets using virtual funds, without committing any real capital. It’s an essential tool before opening a live trading account.

Seamless Steps to Open Your Finpros Indonesia Trading Account

Opening a forex trading account with Finpros Indonesia is a straightforward and secure process designed for your convenience. We have streamlined the registration process to get you trading faster. Follow these simple steps to kickstart your trading journey:

- Visit Our Website: Navigate to the official Finpros Indonesia website. Look for the “Open Account” or “Register” button prominently displayed on the homepage.

- Complete the Registration Form: Fill out the online application form with your personal details. This includes your name, email address, phone number, and country of residence. Ensure all information is accurate to avoid delays.

- Choose Your Account Type: Select the type of trading account that best aligns with your experience level and trading objectives, whether it’s a Standard, ECN, or Cent account. You can always start with a demo account first.

- Verify Your Identity: As part of our commitment to security and regulatory compliance, you will need to complete the account verification process. Upload clear copies of your identification document (like a national ID card or passport) and proof of residence (such as a utility bill or bank statement). This step is crucial for activating your live trading account.

- Fund Your Account: Once your account is verified, you can deposit funds using a variety of secure payment methods. Finpros Indonesia offers convenient options to fund your account quickly and efficiently.

- Start Trading: With funds in your account, you are now ready to access the trading platform and begin executing your trades. Explore the markets and put your strategies into action!

We are dedicated to supporting you every step of the way. Our client support team is always available to assist you if you have any questions during the account opening process. Join the Finpros Indonesia family today and unlock your trading potential!

Types of Accounts (e.g., Standard, ECN)

Diving into the world of forex trading means understanding that not all trading accounts are created equal. Different account types cater to various experience levels, trading styles, and capital sizes. Choosing the right one is crucial for a smooth and effective trading journey. Let’s explore some of the most common options you’ll encounter and what makes each unique.

Standard Accounts

The standard account is often the go-to for many traders, especially those just starting out. It’s user-friendly and offers a balanced environment for trading major and minor currency pairs. Brokers typically offer competitive spreads and sometimes even commission-free trading, as the cost is built directly into the spread.

- Pros:

- Accessible for beginners with reasonable minimum deposit requirements.

- Usually offers fixed or variable spreads, making cost calculation straightforward.

- Brokers often provide a wide range of trading instruments.

- Cons:

- Spreads can sometimes be wider compared to ECN accounts.

- Execution might involve a dealing desk, which could introduce minor delays.

ECN (Electronic Communication Network) Accounts

For traders seeking lightning-fast execution and the tightest possible spreads, an ECN account is the gold standard. These accounts offer direct access to the interbank market, meaning your orders bypass any dealing desk and go straight to liquidity providers. You’re essentially trading with other market participants, not against your broker.

| Feature | Description |

|---|---|

| Spreads | Typically raw and very tight, often starting from 0.0 pips. |

| Commissions | A small commission per trade lot is usually charged, compensating for the tight spreads. |

| Execution | Direct market access (DMA) ensures no requotes and ultra-fast execution. |

| Transparency | High level of transparency, as you see the actual market prices. |

While ECN accounts are fantastic for experienced traders and those with larger capital, they might come with higher minimum deposit requirements and the added layer of understanding commission structures. They are excellent for scalpers and high-frequency traders who demand precision.

Cent Accounts

If you’re completely new to the game or want to test new strategies with minimal risk, a cent account is your best friend. All your trades are calculated in cents rather than dollars, meaning a $10 deposit shows as 1,000 cents in your account. This significantly reduces the risk per trade, allowing you to get comfortable with the trading platform and market dynamics without significant financial exposure.

“Cent accounts provide an invaluable sandbox for aspiring traders. You gain practical experience with live market conditions while protecting your capital.”

It’s the perfect stepping stone before moving on to larger accounts. While profit potential is limited due to the small trade sizes, the learning curve is immense.

Islamic Accounts (Swap-Free Accounts)

Designed for traders adhering to Sharia law, Islamic accounts are swap-free. This means they do not incur or pay interest rates on positions held overnight. In standard trading, overnight positions are subject to swap fees (either positive or negative), but Islamic accounts eliminate this. Instead, brokers may implement administrative fees or slightly wider spreads on specific instruments to compensate.

Always verify the specific terms and conditions with your chosen broker to ensure the account truly aligns with your needs and beliefs.

Trading Platforms Available Through Finpros Indonesia

Choosing the right trading platform is like selecting the perfect tool for a skilled artisan. It directly impacts your efficiency, access to information, and overall trading experience. At Finpros Indonesia, we understand this crucial need, which is why we offer a suite of robust and reliable trading platforms designed to empower both novice and seasoned traders. Our platforms provide the speed, stability, and advanced features you need to navigate the dynamic forex markets with confidence.

We pride ourselves on providing access to industry-standard platforms known for their reliability and comprehensive functionalities. Here’s a look at the powerful tools available through Finpros Indonesia:

MetaTrader 4 (MT4): The Industry Standard

MetaTrader 4 remains the most popular platform among forex traders worldwide, and for good reason. Its user-friendly interface combined with powerful analytical tools makes it an indispensable asset. Finpros Indonesia offers MT4, giving you access to a rich trading environment.

- Advanced Charting Tools: Dive deep into market trends with an extensive range of customizable charts and timeframes.

- Technical Analysis Indicators: Utilize over 30 built-in technical indicators to pinpoint entry and exit points.

- Expert Advisors (EAs): Automate your trading strategies with algorithmic trading capabilities.

- Customization Options: Personalize your workspace to suit your trading style and preferences.

- Security: Enjoy robust data encryption, ensuring the safety and confidentiality of your trading activities.

MetaTrader 5 (MT5): The Next Generation Platform

For traders seeking even more advanced features and greater market access, MetaTrader 5 steps up as the modern successor to MT4. Finpros Indonesia provides MT5, equipping you with cutting-edge tools for an enhanced trading journey.

MT5 offers several significant improvements and additions:

| Feature | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Timeframes | 9 | 21 |

| Technical Indicators | 30 | 38+ |

| Analytical Objects | 31 | 44 |

| Pending Order Types | 4 | 6 (including Buy Stop Limit, Sell Stop Limit) |

| Economic Calendar | No | Yes (integrated) |

| Depth of Market (DOM) | No | Yes |

| Hedging/Netting Options | Hedging Only | Hedging & Netting |

These enhancements make MT5 particularly appealing for traders who engage in various financial instruments beyond just forex, and those who demand a broader range of analytical options and order management tools.

Trading on the Go: Mobile and Web-Based Platforms

In today’s fast-paced world, staying connected to the markets is essential. Finpros Indonesia ensures you never miss a beat, no matter where you are:

- Mobile Trading: Access the full power of MT4 and MT5 directly from your smartphone or tablet. Our mobile applications are available for both iOS and Android devices, offering full trading functionality, real-time quotes, and charting tools at your fingertips. Manage your positions, monitor market movements, and execute trades from anywhere, at any time.

- WebTrader: Don’t want to download any software? Our web-based platforms provide instant access to your trading account directly through your web browser. Enjoy a secure, powerful, and intuitive interface without any installation required. It’s perfect for quickly checking your portfolio or trading from any computer.

At Finpros Indonesia, we believe in providing our clients with a seamless and powerful trading experience. Our selection of platforms, from the robust MetaTrader series to convenient mobile and web options, ensures you have the tools you need to pursue your trading goals effectively. Explore the markets with confidence, backed by reliable technology and expert support.

MetaTrader Suite and Mobile Access

In the fast-paced world of forex, having the right tools at your fingertips is not just an advantage—it’s a necessity. That’s where the industry-leading MetaTrader Suite comes into play. We understand that our traders need robust, reliable, and responsive platforms, which is why we offer comprehensive access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

These powerful platforms are the gold standard for forex trading, providing an extensive array of features designed to enhance your trading experience. Whether you are a newcomer learning the ropes or a seasoned pro executing complex strategies, the MetaTrader Suite delivers.

Key Benefits of the MetaTrader Suite:

- Advanced Charting Tools: Dive deep into market trends with a wide selection of technical indicators and graphical objects.

- Expert Advisors (EAs): Automate your trading strategies with custom-built EAs, allowing for 24/5 market participation without constant monitoring.

- Secure Trading Environment: Trade with confidence knowing your data and transactions are protected by robust encryption protocols.

- Customizable Interface: Tailor your workspace to fit your personal trading style and preferences.

- Real-Time Market Data: Stay informed with live price quotes and news feeds directly within the platform.

The flexibility of the MetaTrader Suite extends beyond your desktop. We recognize that opportunity doesn’t wait, and neither should you. Our mobile trading app ensures you can manage your trades, monitor your portfolio, and react to market changes from anywhere, at any time.

Imagine being able to check your positions while commuting, execute a quick trade during a lunch break, or perform essential market analysis from your tablet. Our mobile access solutions for both MT4 and MT5 empower you to stay connected to the global forex markets, putting the power of our platforms right into your pocket.

“The market never sleeps, and neither should your ability to engage with it. Mobile access to MetaTrader isn’t just a convenience; it’s a strategic advantage for the modern forex trader.” – Our Lead Market Analyst.

Embrace the freedom of trading on the go. With our MetaTrader Suite and seamless mobile integration, you’re always just a tap away from the world’s most dynamic financial markets.

Financial Instruments You Can Trade with Finpros Indonesia

Are you ready to explore the dynamic world of online trading? With Finpros Indonesia, you gain access to a powerful platform that unlocks a diverse range of financial instruments. We understand that every trader has unique goals and risk appetites, which is why we offer a comprehensive selection designed to give you ample opportunities in the global markets. Whether you are a seasoned investor or just starting your trading journey in Indonesia, our platform empowers you to diversify your portfolio and capitalize on market movements.

Forex: The World’s Largest Financial Market

Dive into the vibrant foreign exchange market, where currencies are traded around the clock. Forex trading with Finpros Indonesia means you can speculate on the price movements of major currency pairs like EUR/USD, GBP/JPY, and USD/IDR, as well as a wide array of minors and exotics. The forex market offers high liquidity and volatility, presenting numerous short-term and long-term trading possibilities. Our competitive spreads and robust execution make it an ideal environment for currency enthusiasts.

Commodities: Tangible Assets, Digital Trading

Trade a selection of popular commodities without owning the physical asset. Finpros Indonesia provides access to energy commodities like Crude Oil, precious metals such as Gold and Silver, and more. Commodity trading allows you to diversify beyond traditional financial markets and potentially hedge against inflation or geopolitical events. These instruments often react strongly to global supply and demand dynamics, creating exciting trading opportunities for astute market watchers.

Indices: Broad Market Exposure

Gain exposure to entire stock markets with just one trade. Trading indices with Finpros Indonesia allows you to speculate on the performance of leading stock market benchmarks from around the world. Imagine trading on the movements of the S&P 500, the Dow Jones Industrial Average, or the DAX 30. This approach offers a way to participate in the overall economic health of a region or country, rather than focusing on individual company stocks. It’s an efficient way to diversify and capture broader market trends.

Our commitment at Finpros Indonesia is to provide you with a secure, user-friendly platform and the tools you need to succeed across these exciting financial markets. Explore our offerings and discover how you can expand your trading horizons today.

Forex, Commodities, and Indices

Are you ready to explore the vast opportunities within the global financial markets? When you step into the world of online trading, you’ll quickly discover a rich landscape of instruments beyond just stocks. Three of the most dynamic and popular avenues for traders are Forex, Commodities, and Indices. Each offers unique characteristics and potential, and understanding them is crucial for building a diversified and robust trading strategy.

Understanding Each Market:

Let’s take a closer look at what each of these exciting markets brings to the table:

- Forex (Foreign Exchange): This is the largest and most liquid financial market in the world. When you engage in forex trading, you’re buying one currency while simultaneously selling another. It’s all about exchanging currency pairs, like EUR/USD or GBP/JPY. The market operates 24 hours a day, five days a week, making it incredibly accessible for traders across different time zones. Its sheer size means high liquidity, which often translates to tighter spreads and faster execution. Many traders are drawn to the foreign exchange market due to its constant movement and potential for short-term gains.

- Commodities: Think of the raw materials that power our world – that’s what commodities are! Commodities trading involves tangible goods like gold, silver, crude oil, natural gas, and agricultural products. These markets are often influenced by supply and demand dynamics, geopolitical events, and even weather patterns. Precious metals, for instance, are often seen as safe-haven assets during times of economic uncertainty, while energy commodities like oil are vital for global industry. Trading commodities can offer excellent opportunities for those who understand these fundamental drivers.

- Indices: An index represents a basket of stocks from a particular exchange or sector, giving you a snapshot of a market’s overall performance. Instead of trading individual company shares, you can trade an entire market segment, such as the S&P 500 (representing 500 large U.S. companies), the FTSE 100 (UK’s top 100 companies), or the DAX 40 (Germany’s leading companies). Trading stock indices allows you to speculate on the general direction of an economy or industry without having to analyze dozens of individual companies. It’s a way to gain exposure to broader market movements with a single trade.

Trading across these diverse asset classes can significantly enhance your market opportunities. For example, if equity markets are flat, you might find more action in market volatility within the forex or commodities space. This ability to rotate between different financial instruments is a powerful tool for active traders.

Diversification is key in trading. By engaging with Forex, Commodities, and Indices, you open doors to multiple opportunities and spread your risk, adapting to changing global market conditions.

Whether you’re looking for the fast-paced action of currency pairs, the fundamental drivers of crude oil, or the broad market perspective of stock indices, these three pillars offer a comprehensive trading experience. Each market has its own rhythm and factors to consider, providing a rich educational journey for any aspiring or experienced trader. Get ready to explore the exciting potential each of these markets holds!

Deposits and Withdrawals: Funding Your Finpros Indonesia Account

Getting started with forex trading or managing your existing portfolio with Finpros Indonesia should be a smooth and straightforward experience, especially when it comes to your funds. We understand that quick, secure, and hassle-free deposits and withdrawals are essential for every trader. Your trading capital is the heartbeat of your market activity, and accessing your profits efficiently is just as crucial. That’s why we’ve designed our funding options to be both diverse and incredibly user-friendly, catering specifically to our Indonesian clients.

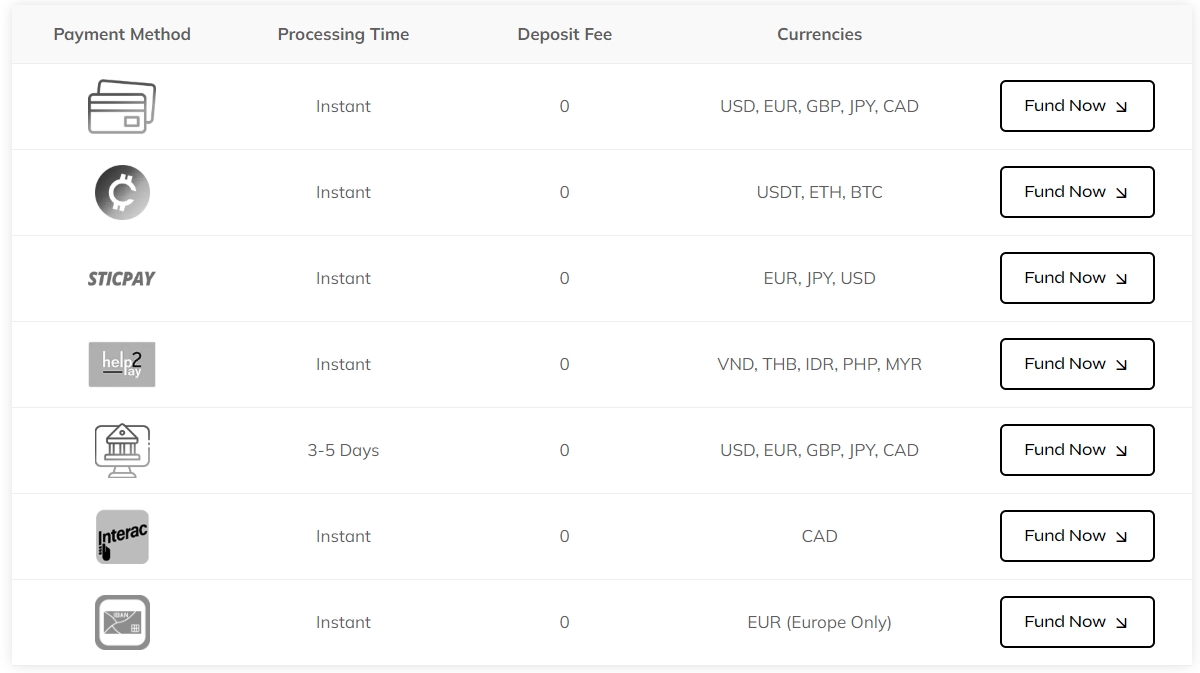

Making a Deposit: Fueling Your Trading Journey

Ready to jump into the exciting world of forex? Funding your Finpros Indonesia account is the first step. We offer a variety of convenient methods to help you deposit funds swiftly, ensuring you can seize market opportunities without delay. Our goal is to make the process as seamless as possible, allowing you to focus on your trading strategies.

- Local Bank Transfers: This is a popular and secure method for many Indonesian traders. You can easily transfer funds directly from your local bank account. We support major banks across Indonesia, making it incredibly convenient.

- E-Wallets: For those who prefer digital solutions, we integrate with various e-wallet providers, offering a fast and efficient way to top up your trading capital.

- Other Payment Gateways: We continuously review and add new payment solutions to provide you with maximum flexibility. Keep an eye on your Finpros Indonesia account portal for the latest options available.

Every deposit is processed with the highest security standards, ensuring your financial information is always protected. We aim for instant processing where possible, so your funds reflect in your account quickly.

Withdrawing Your Profits: Enjoying Your Success

The best part of successful trading is enjoying your returns! When you decide to withdraw profits from your Finpros Indonesia account, we make sure the process is just as efficient and secure as your deposits. We pride ourselves on offering fast withdrawals, so your hard-earned money reaches you without unnecessary delays.

To ensure a secure transaction and comply with regulatory requirements, a one-time account verification process is necessary before your first withdrawal. This simple step safeguards your funds and confirms your identity, protecting you from unauthorized access.

Withdrawal Process Snapshot:

| Step | Description |

|---|---|

| Initiate Request | Log in to your Finpros Indonesia account and navigate to the withdrawal section. |

| Choose Method | Select your preferred withdrawal method, typically back to your registered local bank account. |

| Enter Amount | Specify the amount you wish to withdraw. |

| Confirm & Submit | Review your details and submit the request. Our team then processes it promptly. |

We believe in transparency, and our dedicated customer support team is always ready to assist you if you have any questions regarding your deposit funds or withdrawing profits. Our commitment is to provide a seamless process, letting you manage your finances with complete peace of mind.

Understanding Spreads, Commissions, and Fees at Finpros Indonesia

When you step into the world of forex trading, understanding the costs involved is just as crucial as understanding market movements. These costs, primarily spreads, commissions, and various fees, directly impact your potential profitability. At Finpros Indonesia, we believe in complete transparency, ensuring you clearly know what you pay so you can make informed trading decisions. Let’s break down these essential elements.

The Core of Trading Costs: Spreads

A spread is the fundamental cost of trading. It represents the difference between the bid price (what you can sell for) and the ask price (what you can buy for) of a currency pair. Think of it as the market maker’s compensation for facilitating your trade. Spreads can be variable, changing with market liquidity and volatility, or fixed, remaining constant regardless of market conditions. Lower spreads mean lower transaction costs for you, which is why Finpros Indonesia constantly strives to offer highly competitive spreads across a wide range of instruments. We connect with top-tier liquidity providers to ensure you get the tightest possible quotes.

Unpacking Commissions: When and Why They Apply

While spreads are omnipresent, commissions typically apply to specific account types, especially ECN (Electronic Communication Network) accounts. With an ECN account, you often benefit from extremely tight, raw spreads, sometimes as low as zero pips. In exchange for these minimal spreads, you pay a small, fixed commission per lot traded. This model often appeals to high-volume traders and scalpers who prioritize precision and minimal spread impact. Finpros Indonesia structures its commission rates to be straightforward and fair, allowing you to accurately calculate your trading expenses without surprises. We ensure our commission structure is clear upfront, letting you choose the trading environment that best suits your strategy.

Beyond Spreads and Commissions: Other Important Fees

While spreads and commissions form the bulk of your trading costs, other fees might occasionally come into play. It’s smart to know about them:

- Swap Fees (Overnight Interest): If you hold a position open overnight, you might incur or receive a swap fee. This is an interest adjustment based on the interest rate differential between the two currencies in a pair. Depending on the direction of your trade and the currencies involved, this can be positive (you earn) or negative (you pay).

- Deposit and Withdrawal Fees: Finpros Indonesia aims to keep these costs minimal or non-existent for most popular methods. However, third-party payment processors or banks might impose their own charges, which are outside our control. We always recommend checking our website for the latest details on funding options and associated fees.

- Inactivity Fees: Some brokers charge a small fee if an account remains dormant for an extended period. Finpros Indonesia believes in active trading and aims to encourage participation, so we provide clear guidelines on any such policies, should they apply.

Our Commitment to Transparent Pricing

At Finpros Indonesia, we prioritize transparency in all our pricing. We believe that a clear understanding of your trading costs empowers you to manage your capital more effectively and focus on developing your trading edge. We publish all our spread averages, commission rates, and any other potential fees directly on our platform and website. Our goal is to provide a trading environment where you can trade with confidence, knowing exactly what to expect. Understanding these costs is your first step toward building a successful and sustainable trading journey with us.

Customer Support and Educational Resources from Finpros Indonesia

Embarking on your forex trading journey or looking to sharpen your existing skills requires more than just a powerful platform; it demands robust support and comprehensive education. At Finpros Indonesia, we understand this crucial need. That’s why we’ve built a world-class customer support system and an extensive library of educational resources designed to empower every trader, from novice to expert. We believe that informed traders are successful traders, and we’re here to guide you every step of the way.

Unwavering Customer Support: Your Trading Companion

Navigating the dynamic world of forex can sometimes feel overwhelming. Questions arise, technical glitches might occur, or you simply need clarification on a trading strategy. This is where Finpros Indonesia’s dedicated customer support team steps in. We are committed to providing timely, accurate, and friendly assistance, ensuring your trading experience is as smooth and worry-free as possible.

Our support channels are designed for your convenience:

- 24/5 Live Chat: Get instant answers to your queries directly from our website or trading platform. Our team is ready almost around the clock.

- Email Support: For more detailed inquiries or documentation, our email support ensures a thorough response within a business day.

- Phone Support: Speak directly with a knowledgeable representative who can guide you through any issue or question you might have.

- Dedicated Account Managers: For eligible clients, a personal account manager provides tailored support and insights, helping you maximize your trading potential.

We pride ourselves on the professionalism and expertise of our support staff. They are not just problem-solvers; they are fellow enthusiasts of the financial markets, equipped to provide insights and assistance that genuinely make a difference.

Empowering Traders Through Comprehensive Education

Knowledge is your strongest asset in forex trading. Finpros Indonesia is passionate about equipping our clients with the tools and understanding necessary to make informed trading decisions. Our educational resources are meticulously crafted, covering a wide spectrum of topics essential for success in the currency markets.

Our Educational Offerings Include:

| Resource Type | Description | Benefit to Trader |

|---|---|---|

| Webinars & Seminars | Live interactive sessions with expert analysts covering market analysis, trading strategies, and platform tutorials. | Real-time learning, direct Q&A, latest market insights. |

| Video Tutorials | Short, digestible videos explaining complex concepts, platform features, and trading techniques. | Visual learning, accessible anytime, practical application. |

| eBooks & Guides | In-depth written materials on fundamental analysis, technical analysis, risk management, and trading psychology. | Detailed understanding, foundational knowledge, reference material. |

| Glossary & FAQs | Comprehensive definitions of financial terms and answers to common trading questions. | Quick reference, clarity on industry jargon, immediate problem-solving. |

| Market Analysis | Daily and weekly reports, economic calendars, and news updates from our team of analysts. | Stay informed, identify trading opportunities, understand market drivers. |

We constantly update our educational library to reflect current market trends and trader feedback. Our goal is to demystify forex trading, making it accessible and understandable for everyone. Whether you’re learning how to place your first trade, mastering advanced technical indicators, or developing robust risk management strategies, Finpros Indonesia provides the resources you need to build confidence and competence.

An educated trader is a confident trader. At Finpros Indonesia, we invest heavily in your success by providing not just a platform, but a complete ecosystem of support and learning.

Join Finpros Indonesia and experience the difference that superior customer support and empowering educational resources make in your trading journey. We’re more than just a broker; we’re your partner in the dynamic world of forex.

Getting Help and Learning Tools

Embarking on your forex trading journey feels exciting, but it also comes with a lot to learn. That’s why having access to robust help and comprehensive learning tools is not just a luxury; it’s a necessity. Successful traders constantly refine their skills and seek knowledge, ensuring they stay ahead in the dynamic financial markets.

Unlock Your Potential with Comprehensive Resources

We believe every trader deserves the best support to navigate the complexities of currency pairs and execute sound trading strategies. Here’s a breakdown of the invaluable resources at your fingertips:

- Educational Library: Dive into a rich collection of articles, e-books, and guides covering everything from basic concepts to advanced market analysis techniques. Understand intricate indicators and master various chart patterns with our easy-to-digest content.

- Video Tutorials: Visual learners rejoice! Our extensive library of video tutorials walks you through platform features, explains specific trading strategies, and offers insights into effective risk management. Watch, learn, and apply.

- Webinars and Live Sessions: Join expert-led webinars that cover current market trends, answer your burning questions live, and often introduce new perspectives on forex trading. Engage directly with seasoned professionals.

- Demo Account: Practice makes perfect. Utilize a free demo account to test your strategies and get familiar with our trading platform without risking real capital. It’s the ultimate sandbox for your trading ideas.

- Community Forums: Connect with fellow traders, share experiences, discuss potential setups, and learn from diverse viewpoints. A strong community accelerates your learning curve.

Direct Support When You Need It Most

Even with all the learning tools, questions can arise. Our dedicated support team stands ready to assist you. Whether you need help understanding a specific function on the trading platform or clarity on a market event, we’re here.

Our support channels include:

- 24/5 Live Chat: Instant assistance from our knowledgeable support specialists.

- Email Support: For detailed inquiries, our team provides thorough and timely responses.

- Extensive FAQ Section: Find quick answers to common questions about accounts, deposits, withdrawals, and platform usage.

Embrace these resources. They are designed to empower you, transforming your initial steps in forex trading into confident strides. Continuous learning and reliable support are your allies in achieving consistent success.

User Reviews and Reputation of Finpros Indonesia

When you navigate the dynamic world of forex trading, understanding a broker’s reputation is as crucial as analyzing market trends. For many, delving into Finpros Indonesia reviews provides a window into the real-world experiences of traders just like them. It’s not just about what a company says about itself; it’s about the collective voice of its user base that truly paints a picture of its operational integrity and service quality.

The reputation of Finpros Indonesia, like any established financial institution, is a mosaic built from various interactions – from the seamlessness of account opening to the efficiency of trade execution and the responsiveness of customer support. We observe a consistent effort by Finpros Indonesia to foster a positive trading environment, which often reflects in client testimonials.

What Clients Say: A Glimpse into Finpros Trading Experience

Exploring client feedback offers valuable insights. Here’s a summary of common themes found in discussions about Finpros Indonesia:

- Platform Stability: Many traders appreciate the reliability of the trading platforms offered, citing minimal downtime and smooth performance during volatile market conditions.

- Customer Support: The responsiveness and helpfulness of the Finpros Indonesia support team frequently receive positive mentions, particularly for local language assistance.

- Educational Resources: Beginners often highlight the value of educational materials, finding them useful for understanding forex trading fundamentals.

- Withdrawal Process: Feedback on withdrawal speed is generally favorable, suggesting efficient processing times that build trust among users.

Areas for Consideration Based on User Feedback

No broker is without areas for growth, and a balanced perspective requires looking at constructive criticism. While overall Finpros Indonesia reputation leans positive, some users occasionally mention:

- Spread Fluctuations: Like many brokers, some traders observe varying spreads during high-impact news events, a common market dynamic but sometimes noted as a point of attention.

- Product Range Expansion: A few reviews suggest a desire for an even broader range of tradable instruments beyond the core forex offerings.

The Bottom Line: Building Trust in Forex Broker Indonesia

The collective sentiment surrounding Finpros Indonesia reviews generally points towards a broker that prioritizes client satisfaction and maintains a professional approach. Transparency in operations, robust platform performance, and accessible customer service are key pillars that contribute to its standing in the competitive Indonesian forex market. For those considering their options, exploring various Finpros user feedback sources can provide the confidence needed to make an informed decision.

A Step-by-Step Guide to Getting Started with Finpros Indonesia

Are you ready to dive into the exciting world of forex trading? Finpros Indonesia offers a robust platform designed to empower both new and experienced traders. Getting started with us is a straightforward process, built for your convenience and security. We’re here to guide you every step of the way, ensuring a smooth entry into the global financial markets. Let’s unlock your trading potential together!

Here’s how you can join the Finpros Indonesia community and begin your trading journey:

-

Visit the Official Finpros Indonesia Website

Your first step is to navigate to the official Finpros Indonesia website. Make sure you are on the legitimate site to ensure your security and access the correct information. Our homepage is designed to be user-friendly, providing easy access to registration and platform details.

-

Complete the Online Registration Form

Look for the “Register” or “Open Account” button, usually prominently displayed. You will then fill out an online registration form with your personal details. This typically includes your full name, email address, phone number, and country of residence. Ensure all information is accurate to avoid delays.

-

Verify Your Identity (KYC Process)

As a regulated financial service provider, Finpros Indonesia is committed to strict Know Your Customer (KYC) procedures. This involves submitting identification documents such as a government-issued ID (KTP for Indonesian residents) and proof of address (utility bill or bank statement). This crucial step helps us maintain a secure trading environment for everyone. Our team reviews these documents quickly, often within a business day.

-

Fund Your Trading Account

Once your account is verified, you are ready to make your first deposit. Finpros Indonesia supports various convenient funding methods, including local bank transfers and other popular payment gateways in Indonesia. Choose the method that suits you best. Always review the minimum deposit requirements and any associated fees before initiating your transaction. Your funds are segregated in secure accounts, offering peace of mind.

-

Download and Install the Trading Platform

With your account funded, the next exciting step is to access our trading platform. Finpros Indonesia typically offers industry-leading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), available for desktop, web, and mobile devices. Download the platform that fits your trading style and device preference. Installation is simple, and our support team can assist if you encounter any issues.

-

Start Trading!

Congratulations! You are now set to explore the forex market. Log in to your trading platform using the credentials provided during registration. Begin by familiarizing yourself with the platform’s interface, charting tools, and order execution features. We recommend starting with smaller trades or utilizing a demo account to practice your strategies before committing larger capital. Embrace the journey and trade wisely!

Joining Finpros Indonesia means stepping into a world of opportunity with a reliable partner by your side. Our dedicated customer support team is always available to answer your questions and provide assistance throughout your trading career. Don’t hesitate to reach out if you need help at any stage.

Advantages and Disadvantages of Using Finpros Indonesia

Choosing a financial partner for your trading journey is a big decision. When you consider Finpros Indonesia, it’s smart to weigh both the good and the not-so-good. Like any service, it comes with its own set of benefits that might perfectly match your needs, alongside some drawbacks that could make you pause. We want you to make an informed choice, so let’s break down what you can expect when you engage with Finpros Indonesia. Understanding these points helps you align their offerings with your personal trading style and goals.The Upsides: What Makes Finpros Indonesia a Strong Contender?

Many traders find Finpros Indonesia an appealing choice, especially those based locally. Here’s a quick look at why it might be the right fit for you:

- Local Regulation and Trust: Operating under Indonesian regulatory bodies, Finpros Indonesia offers a layer of security and trust. This local oversight means your funds and trading activities are subject to specific national financial laws, giving many traders peace of mind.

- Tailored Local Support: You get customer support in Bahasa Indonesia, staffed by individuals who understand the local market nuances and challenges. This makes communication smoother and problem-solving more efficient, without language barriers or time zone differences getting in the way.

- Convenient Local Payment Options: Depositing and withdrawing funds often becomes much easier. Finpros Indonesia typically integrates with local banks and payment gateways, simplifying transactions and potentially reducing fees or processing times associated with international transfers.

- Market Insights Relevant to You: Access to analysis and educational materials specifically geared towards the Indonesian market can be invaluable. This localized content helps you navigate regional economic factors and trading opportunities more effectively.

- Community Connection: Being part of a local platform can foster a sense of community. You might find it easier to connect with fellow Indonesian traders, share experiences, and learn from each other within a familiar context.

The Downsides: Points to Consider Before Joining Finpros Indonesia

While the advantages are clear, it’s equally important to look at areas where Finpros Indonesia might not meet every expectation. Being aware of these points helps you set realistic expectations:

| Aspect | Potential Disadvantage |

|---|---|

| Instrument Diversity | You might find a more limited range of trading instruments compared to larger international brokers. If you want to trade very niche assets, this could be a constraint. |

| Competitive Pricing | Spreads or commissions might be less competitive than those offered by some global platforms that benefit from massive scale. Always compare trading costs. |

| Platform Features | While functional, the trading platform might not always offer the same advanced features, tools, or third-party integrations as some of the leading global platforms. |

| Technological Infrastructure | Execution speeds or server stability, while generally good, might not always match the ultra-low latency environments provided by top-tier international brokers with global data centers. |

Ultimately, your choice depends on your priorities. Consider what truly matters for your trading success and how Finpros Indonesia’s offerings align with those crucial factors.

Finpros Indonesia: Final Verdict and Future Prospects

After a thorough examination of its services, platform, and overall market presence, Finpros Indonesia stands out as a significant player in the competitive forex trading landscape. We’ve delved into its regulatory compliance, user experience, educational resources, and customer support to form a comprehensive understanding. Our final verdict isn’t just a simple thumbs up or down; it’s a nuanced assessment that considers the needs of diverse traders, from newcomers to seasoned professionals navigating the complexities of the global financial markets.

When assessing the final verdict for Finpros Indonesia, several key aspects solidify its position:

- Robust Regulation: Adherence to local financial authorities provides a foundational layer of trust and security, crucial for any trader seeking a reliable brokerage. This commitment to regulatory standards protects client funds and ensures fair trading practices.

- User-Friendly Platform: The trading platform offers an intuitive interface, making it accessible for beginners while providing advanced tools and features for experienced traders. Its stability and execution speed are vital for capitalizing on market movements.

- Comprehensive Educational Resources: Finpros Indonesia invests in its traders’ success by offering a wealth of educational materials, including webinars, articles, and tutorials. This focus on knowledge empowerment helps traders make informed decisions and refine their strategies.

- Responsive Customer Support: Prompt and knowledgeable customer service is a hallmark of a good broker. Finpros Indonesia’s support team addresses inquiries efficiently, ensuring a smooth trading journey for its clients.

Looking ahead, the future prospects for Finpros Indonesia appear bright, underpinned by a continuous drive for innovation and market adaptation. The forex market is dynamic, constantly evolving with new technologies and regulatory shifts. Finpros Indonesia is well-positioned to leverage these changes, focusing on enhancing its technological infrastructure and expanding its service offerings.

Potential areas for future growth and development include:

- Technological Advancements: Expect further investment in cutting-edge trading technology, possibly integrating AI-driven insights or more sophisticated analytical tools to give traders an edge.

- Product Diversification: There’s potential to broaden the range of tradable instruments beyond traditional forex pairs, perhaps including more commodities, indices, or even cryptocurrencies, catering to a wider investor base.

- Enhanced Localized Services: Deepening its roots within the Indonesian market by offering more localized content, payment solutions, and community engagement initiatives will strengthen its regional dominance.

- Sustainable Trading Practices: Promoting responsible trading and offering resources for risk management will likely remain a core focus, aligning with global industry best practices.

“Finpros Indonesia has consistently shown a commitment to its traders. Their proactive approach to education and regulatory compliance sets a high standard. I believe their focus on continuous platform improvement and client success will drive significant growth in the years to come.”

— A seasoned forex analyst

In conclusion, Finpros Indonesia has built a solid foundation on trust, technology, and trader support. Its final verdict is overwhelmingly positive, cementing its status as a reliable and effective platform for forex trading. With a clear vision for the future, centered on innovation and client empowerment, Finpros Indonesia is poised not just to maintain its standing but to significantly expand its influence within the competitive financial industry. Traders can look forward to an evolving platform that continues to meet and exceed their expectations.

Frequently Asked Questions

What is Finpros Indonesia?

Finpros Indonesia is an online broker providing access to global financial markets, including forex, commodities, and indices, with a focus on empowering Indonesian traders.

Is Finpros Indonesia a regulated broker?

Yes, Finpros Indonesia operates under the oversight of Bappebti (Badan Pengawas Perdagangan Berjangka Komoditi), the Indonesian Commodity Futures Trading Regulatory Agency, ensuring regulatory compliance and security.

What trading platforms does Finpros Indonesia provide?

Finpros Indonesia offers industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available for desktop, web, and mobile (iOS and Android) devices.

How can I open a trading account with Finpros Indonesia?

You can open an account by visiting the official Finpros Indonesia website, completing the online registration form, verifying your identity (KYC), funding your account, and then downloading and installing the trading platform.

What are the main advantages of trading with Finpros Indonesia?

Key advantages include local regulation, tailored local support, convenient local payment options, relevant market insights for the Indonesian market, and a strong sense of community.