Ever wondered how to get a broad snapshot of an entire market, or even a specific sector, without having to track every single stock? That’s where indices come in, and Finpros Indices offer you a powerful gateway into this fascinating world. Think of an index as a meticulously curated basket of assets designed to reflect the performance of a particular market segment, an industry, or even a whole economy. Instead of focusing on individual company shares, Finpros Indices give you a bird’s-eye view, summarizing the health and direction of a large group of assets.

At Finpros, we provide access to a diverse range of these indices, covering everything from major global stock markets to specific commodities sectors. Each index is carefully constructed using specific methodologies, weighting the included assets to ensure it accurately represents the underlying market. This means when you look at a Finpros Index, you’re not just seeing an arbitrary number; you’re seeing a calculated representation of collective market sentiment and economic activity.

- What Makes Finpros Indices So Compelling for Traders?

- How Finpros Indices Work

- The Appeal of Trading Indices with Finpros

- Why traders find index trading particularly appealing:

- How Finpros Indices Reflect Market Performance

- What Finpros Indices Reveal

- The Precision Behind the Reflection

- Exploring the Range of Finpros Index CFDs

- What You Can Expect from Finpros Index CFDs:

- Major Global Indices Available on Finpros

- Regional and Sector-Specific Indices with Finpros

- Why Explore Regional and Sector-Specific Indices with Finpros?

- Leveraging Index Trading Opportunities on Finpros

- Effective Strategies for Trading Finpros Indices

- Essential Principles for Finpros Indices Trading Success

- Popular Trading Strategies for Finpros Indices

- 1. Trend Following

- 2. Range Trading

- 3. Breakout Trading

- 4. News and Event-Driven Trading

- Integrating Risk Management with Your Strategies

- The Role of Technical Analysis in Finpros Indices Trading

- Trend Following with Finpros Indices

- Scalping and Day Trading Finpros Indices

- Long-Term Position Trading on Finpros

- Why Consider Long-Term Position Trading with Finpros?

- Key Aspects of a Successful Position Trading Strategy on Finpros:

- The Finpros Trading Platform: A Gateway to Indices

- Key Advantages for Indices Trading with Finpros:

- Essential Risk Management for Finpros Index Traders

- Why Risk Management Matters More Than Ever

- Core Principles for Finpros Index Traders

- Position Sizing: Your First Line of Defense

- Stop-Loss Orders: The Non-Negotiable Tool

- Diversification: Spreading Your Bets Wisely

- Maintain a Trading Journal: Learn From Every Experience

- The Psychological Edge of Sound Risk Management

- Finpros Account Options for Index Trading

- Explore Your Ideal Finpros Index Trading Account

- Key Features Across Finpros Account Types

- Choosing the Best Finpros Account for You

- Getting Started: Opening Your Finpros Indices Trading Account

- Key Advantages of Choosing Finpros for Indices

- Unrivaled Trading Conditions

- Cutting-Edge Technology and Tools

- Diverse Range of Global Indices

- Dedicated Support and Educational Resources

- Educational Tools and Resources for Finpros Index Traders

- Market Access and Trading Hours for Finpros Indices

- Frequently Asked Questions

What Makes Finpros Indices So Compelling for Traders?

Trading Finpros Indices offers several unique advantages that make them a favorite among both novice and experienced traders:

- Broad Market Exposure: Instead of buying shares in one company, you gain exposure to an entire sector or market with a single trade. This diversification can naturally spread your risk.

- Simplified Analysis: You don’t need to analyze dozens of individual company reports. By focusing on the index, you can concentrate on macroeconomic factors, industry trends, and technical analysis of the index itself.

- Liquidity: Major indices are often highly liquid, meaning you can typically enter and exit trades with ease, experiencing tighter spreads.

- Benchmark for Performance: Investors and traders often use indices as benchmarks to measure the performance of their own portfolios. If your portfolio consistently outperforms a major index, you’re doing well!

- Ideal for Hedging: Traders can use indices to hedge against potential downturns in their individual stock holdings. If you own a lot of tech stocks, for example, you might short a tech-heavy index to protect against a sector-wide slump.

How Finpros Indices Work

Each Finpros Index is a numerical representation derived from the prices of its constituent assets. If the prices of the companies within an index go up on average, the index value rises. Conversely, if they decline, the index value falls. Some indices are weighted by market capitalization, meaning larger companies have a greater impact on the index’s movement. Others might be price-weighted or equally weighted.

Consider the difference between trading individual stocks and trading indices:

| Feature | Trading Individual Stocks | Trading Finpros Indices |

|---|---|---|

| Diversification | Lower, higher risk from single company events | Higher, spread across multiple companies/sectors |

| Analysis Focus | Company-specific financials, news, sector trends | Macroeconomics, overall market sentiment, geopolitical events |

| Volatility Source | Earnings reports, product launches, competitive landscape | Economic data releases, central bank decisions, global news |

| Exposure Type | Direct ownership in a specific company | Reflects overall market/sector performance |

At Finpros, we empower you to trade these powerful financial instruments with confidence, offering competitive conditions and robust platforms. Dive into the world of indices and discover a new way to interact with global markets!

The Appeal of Trading Indices with Finpros

Ever felt the pulse of the global economy? Index trading offers you a unique opportunity to do just that. Instead of focusing on individual stocks, you trade an entire basket of them, representing a specific market or sector. This approach provides a bird’s-eye view, allowing you to speculate on the broader economic health of nations or industries. It’s a powerful way to engage with the financial world, and with Finpros, the experience becomes even more compelling.

Finpros brings a professional edge to your index trading journey. We understand that traders seek both opportunity and reliability. Our platform is designed to provide seamless access to a wide range of global indices, from the bustling markets of Wall Street to the dynamic economies of Europe and Asia. You can participate in the movements of major benchmarks without the complexity of managing multiple individual assets.

Why traders find index trading particularly appealing:

- Diversification by Nature: Trading an index inherently offers diversification. You’re not putting all your eggs in one basket. If one company in the index performs poorly, others might offset that, leading to more stable movements compared to single stock trading. This can be a cornerstone of robust trading strategies.

- Access to Global Markets: Indices are gateways to the world’s leading economies. With Finpros, you gain an easy entry point into these major financial instruments, allowing you to react to global news and economic trends directly.

- Volatility Opportunities: While indices can offer stability, they also respond significantly to economic events, creating ample opportunities for skilled traders to capitalize on market volatility. This dynamic environment can be incredibly rewarding.

- Simplified Analysis: Often, analyzing an index can be less daunting than researching dozens of individual companies. Traders can focus on macroeconomic factors, geopolitical events, and overall market sentiment.

Finpros elevates this appeal by providing an intuitive and robust Finpros platform. We focus on delivering competitive conditions, ensuring you have the tools and support needed to navigate the exciting world of index trading. Our commitment to transparent pricing and reliable execution means you can focus on your analysis and strategy, knowing your trades are handled with precision. Embrace the potential of accessible trading on some of the world’s most influential financial benchmarks.

How Finpros Indices Reflect Market Performance

Understanding the pulse of the financial world is crucial for any successful trader or investor. At Finpros, our comprehensive indices serve as powerful barometers, offering a crystal-clear reflection of market performance across various sectors and geographies. Think of them as sophisticated dashboards, constantly updated to give you an immediate snapshot of where the market stands and where it might be headed. We design these indices to be more than just numbers; they are insights, providing a deep dive into the underlying forces driving today’s global markets.

What Finpros Indices Reveal

Our indices are meticulously constructed to offer diverse perspectives on economic health and sector-specific performance. They aggregate data from a wide array of financial instruments, giving you a consolidated view that helps in making informed investment decisions. Here’s what they effectively reflect:

- Sector-Specific Strength: Observe which industries are flourishing or facing headwinds. Our specialized indices track technology, energy, finance, and more, allowing you to pinpoint growth areas or potential risks.

- Broad Market Trends: Gain a holistic understanding of the overall market direction. Our benchmark indices capture the sentiment of major economies, indicating general market trends and investor confidence.

- Economic Health Indicators: Finpros indices often mirror broader economic shifts. A strong uptrend in key indices can signal robust economic health, while a downturn might suggest an economic slowdown.

- Geographic Performance: Explore how different regions are performing. From emerging markets to established economies, our indices provide a comparative view of international market dynamics.

The Precision Behind the Reflection

What makes Finpros indices so effective at reflecting market performance? It’s our commitment to accuracy, real-time data, and methodological rigor. We employ advanced algorithms and data analysis techniques to ensure that every index provides an unbiased and timely representation. This precision allows traders to develop robust trading strategies, identifying opportunities for portfolio diversification and risk management. You receive information that is not only current but also reliable, empowering you to react swiftly to market movements.

“Accurate indices are the compass in the complex sea of financial markets. They don’t just show you where you are; they help you navigate to where you want to go.” – Finpros Market Analyst

Whether you are a seasoned professional or just starting your journey, Finpros indices are an indispensable tool. They simplify complex data into actionable insights, helping you to confidently assess market performance, anticipate future movements, and refine your approach to trading. Join us to experience how our indices can illuminate your path to understanding and mastering the financial markets.

Exploring the Range of Finpros Index CFDs

Are you ready to dive into the dynamic world of global stock markets without buying individual shares? Finpros offers an exciting gateway through its comprehensive range of Index CFDs. Trading Contract for Difference (CFDs) on indices allows you to speculate on the price movements of entire stock market indices, like the S&P 500 or the DAX, all from a single position. This means you gain exposure to a broad basket of stocks, offering a unique way to diversify your portfolio and capitalize on wider economic trends.

At Finpros, we understand that every trader has different interests and strategies. That’s why we’ve curated an extensive selection of index CFDs, covering major global economies and emerging markets alike. Whether your focus is on the robust performance of U.S. giants, the stability of European markets, or the rapid growth of Asian economies, our platform provides the tools and access you need to engage with these powerful financial instruments.

What You Can Expect from Finpros Index CFDs:

- Broad Market Exposure: Access the performance of an entire economy or sector with one trade.

- Diversification Opportunities: Spread your risk across multiple companies within an index, rather than relying on a single stock.

- 24/5 Trading: The global nature of indices means you can often trade around the clock, seizing opportunities as they arise in different time zones.

- Leverage Potential: Amplify your trading power, allowing you to control a larger position with a smaller initial capital outlay (always be mindful of the risks associated with leverage).

- Go Long or Short: Profit from both rising and falling markets. If you believe an index will decline, you can open a short position.

- No Physical Asset Ownership: Trade on price movements without the complexities of owning underlying shares.

Our commitment is to provide you with a seamless and powerful trading experience. Finpros offers competitive spreads, fast execution, and a robust trading platform designed for both novice and experienced traders. Imagine having the power to react to global news and economic data directly influencing major indices, all from the comfort of your home or on the go.

For example, if you’re interested in the technological innovations driving the U.S. market, you might consider an index CFD tracking the NASDAQ 100. Or perhaps you’re looking at the industrial strength of Germany, making the DAX a compelling choice. Our platform makes it easy to explore these options and many more.

Choosing to trade index CFDs with Finpros means partnering with a broker that prioritizes your trading journey. We provide transparent pricing, a secure environment, and the resources you need to make informed decisions. Start exploring our diverse range of index CFDs today and unlock new possibilities in your trading strategy!

Major Global Indices Available on Finpros

Step into the dynamic world of global stock market indices with Finpros! These powerful financial instruments are much more than just numbers; they offer a snapshot of economic health and investor sentiment across entire countries and industries. Trading major global indices gives you direct exposure to leading economies and top-tier companies, allowing you to diversify your portfolio and capitalize on broad market movements.

At Finpros, we provide access to a comprehensive selection of the world’s most influential indices. Whether you want to track the tech giants in the United States, the industrial powerhouses of Europe, or the fast-growing markets of Asia, we have you covered. Our platform empowers you to engage with global economic trends and seize trading opportunities as they emerge.

Explore some of the prominent global indices you can trade with us:

- S&P 500 (US 500): Representing 500 large US companies, this index offers a broad gauge of the American stock market’s performance. It is a benchmark for the US economy.

- Dow Jones Industrial Average (US 30): Comprising 30 significant US companies, the Dow reflects the health of key industrial sectors in the United States.

- NASDAQ 100 (US Tech 100): Focus on the biggest non-financial companies listed on the NASDAQ exchange, heavily weighted towards technology and growth stocks.

- DAX 40 (Germany 40): Tracking the 40 largest and most liquid German companies, the DAX provides insight into the strength of the European economic engine.

- FTSE 100 (UK 100): This index features the 100 largest companies by market capitalization on the London Stock Exchange, making it a key indicator for the UK economy.

- Nikkei 225 (Japan 225): Dive into the Asian markets with Japan’s premier index, representing 225 major Japanese companies listed on the Tokyo Stock Exchange.

- ASX 200 (Australia 200): Get exposure to the Australian market through its primary index, which includes the 200 largest listed companies.

Trading these major global indices on Finpros offers compelling advantages. You gain instant diversification without needing to buy individual stocks. You can speculate on the overall direction of an entire economy or sector. This allows you to potentially profit from both rising and falling markets. Our robust trading environment ensures fair pricing and efficient execution, letting you focus on your trading strategy. Join Finpros and start exploring the vast potential of global index trading today!

Regional and Sector-Specific Indices with Finpros

Want to zoom in on specific parts of the global economy or target high-growth industries? Regional and sector-specific indices offer a powerful way to do just that. Finpros opens the door to these specialized investment opportunities, letting you dive deeper than just broad market movements. You no longer need to rely solely on broad market benchmarks.

Regional indices track the performance of companies within a specific geographical area, like Europe or Asia. Sector-specific indices, on the other hand, focus on industries such as technology, energy, or healthcare. They give you a granular view, helping you identify specific market trends and areas of strength or weakness. Understanding these indices enhances your ability to make more precise trading choices.

Why Explore Regional and Sector-Specific Indices with Finpros?

- Targeted Exposure: Pinpoint specific growth sectors or regions poised for expansion. You can align your investments with your insights into global developments.

- Portfolio Diversification: Enhance your portfolio diversification beyond major national benchmarks. This spreads your capital across various segments, reducing concentration risk.

- In-depth Market Insights: Gain unique perspectives on localized economic indicators and industry performance. This deep understanding empowers better decision-making.

- Strategic Trading: Craft sophisticated trading strategies based on specific geographical or industrial developments. You can react quickly to localized news or industry shifts.

- Improved Risk Management: By distributing your capital across different types of assets, you contribute to effective risk management. This approach helps cushion your portfolio against volatility in any single market.

With Finpros, accessing these intricate financial instruments is straightforward. We provide robust platforms and comprehensive resources to help you make informed decisions. Our tools simplify the analysis of these complex markets, making them accessible even for newer traders.

Consider the varied landscape of these indices:

| Index Category | Focus Area Example | Potential Benefit |

|---|---|---|

| Regional Equity | European Blue Chips | Exposure to developed European economies |

| Emerging Markets | Asian Growth Index | Capitalize on rapid economic expansion |

| Sector Technology | Global Tech Innovators | Invest in cutting-edge industries |

| Sector Energy | Renewable Energy Leaders | Target sustainable growth trends |

Ready to explore targeted global markets and capitalize on specific industry movements? Finpros empowers you to refine your market focus and uncover unique potential. Join us and broaden your trading horizon today. We make it easy to start exploring these specialized markets.

Leveraging Index Trading Opportunities on Finpros

Ever thought about trading the pulse of entire economies with a single click? That’s the power of index trading, and on Finpros, you unlock a world of potential. Instead of focusing on individual stocks, you can trade indices, which represent a basket of top-performing companies in a specific market or sector. This offers a unique way to participate in broader market movements, making it a favorite among savvy traders looking for diversification and exposure.

Finpros provides an intuitive platform that simplifies the process of engaging with global market trends. Whether you are a seasoned investor or just starting your journey, the tools and resources available empower you to make informed decisions. Imagine trading the performance of the US tech giants, European blue-chips, or Asian emerging markets – all through one streamlined account. Index trading on Finpros gives you that direct access, letting you capitalize on macroeconomic shifts and sector-specific growth without the complexity of analyzing countless individual companies.

Here’s why embracing index trading on Finpros can be a game-changer for your portfolio:

- Broad Market Exposure: Get instant diversification. When you trade an index, you’re not putting all your eggs in one basket. You’re spreading your risk across multiple companies within that index, often leading to more stable movements than individual stocks.

- Capitalize on Trends: Indices often reflect larger, more predictable economic trends. This makes them appealing for traders who prefer to follow big-picture movements rather than the volatility of single company news.

- Simplified Analysis: While still requiring research, the analysis for an index can often be less granular than for individual stocks, allowing you to focus on broader economic indicators and news events.

- Flexible Trading: With Finpros, you can go long or short on indices, meaning you can potentially profit whether the market goes up or down. This flexibility is crucial for adapting to various market conditions.

- Efficient Risk Management: Many find index trading a key component of their risk management strategy. By trading a diversified basket, you mitigate the impact of adverse news affecting just one company.

Finpros equips you with the competitive edge needed to navigate these exciting opportunities. Our platform offers competitive spreads and robust execution, ensuring you have the best possible environment to implement your trading strategies. Dive into the world of indices and let Finpros be your guide to unlocking powerful trading possibilities.

Effective Strategies for Trading Finpros Indices

Ready to unlock the potential of Finpros Indices trading? Navigating the dynamic world of index trading requires more than just enthusiasm; it demands a well-defined approach. Effective strategies are your compass in this exciting market, helping you identify opportunities and manage risks. Let’s explore some proven methods to enhance your Finpros Indices trading journey.

Successful Finpros Indices trading isn’t about guesswork. It’s about combining market understanding with a disciplined execution of your chosen trading strategies. These strategies give you a framework, turning market noise into actionable signals.

Essential Principles for Finpros Indices Trading Success

Before diving into specific strategies, remember these foundational principles:

- Develop a Robust Trading Plan: Define your entry/exit points, risk tolerance, and profit targets. Stick to it!

- Master Risk Management: Protecting your capital is paramount. Never risk more than you can afford to lose.

- Continuous Learning: Markets evolve, and so should your knowledge. Stay updated on market news and analysis.

- Emotional Discipline: Fear and greed are traders’ worst enemies. Maintain a clear, rational mindset.

Popular Trading Strategies for Finpros Indices

There are many ways to approach the market, but certain trading strategies prove consistently effective for Finpros Indices. Here are a few to consider:

1. Trend Following

This timeless strategy involves identifying the prevailing direction of the market and trading in alignment with it. When a strong upward trend is in place, you look for buying opportunities. Conversely, during a downtrend, you focus on selling. Trend following capitalizes on prolonged market movements.

Advantages:

- Can yield substantial profits during strong, sustained trends.

- Relatively straightforward to understand and implement using technical indicators like moving averages or MACD.

Disadvantages:

- Can suffer during choppy or range-bound market conditions.

- Requires patience to wait for clear trend confirmation.

2. Range Trading

Not all markets trend. Sometimes, Finpros Indices will trade within a defined price channel, bouncing between support and resistance levels. Range trading involves buying near the support level and selling near the resistance level. This strategy thrives in periods of low volatility.

Key elements for Range Trading:

- Identify Support and Resistance: Use chart patterns and historical price action.

- Confirm Boundaries: Ensure the index respects these levels repeatedly.

- Set Tight Stop-Loss Orders: If the range breaks, your position could quickly turn against you.

3. Breakout Trading

Breakout trading is the opposite of range trading in some respects. It involves entering a trade when the price of a Finpros Index moves beyond an established support or resistance level with significant momentum. The assumption is that this breakout signals the beginning of a new trend.

When you see a strong move past a key level, that’s often your signal. This could be a breakout from a consolidation pattern or a major price barrier. It’s crucial to confirm the strength of the breakout with volume or other technical indicators to avoid false signals.

4. News and Event-Driven Trading

Major economic announcements, geopolitical events, or company-specific news can cause rapid and significant price movements in Finpros Indices. This strategy involves taking positions based on the expected or actual impact of such events. Keeping an eye on the economic calendar is vital here.

For instance, an unexpected interest rate decision or a major earnings report can spark immediate reactions across the market. This approach requires quick decision-making and a deep understanding of how different news events influence the indices you trade.

Integrating Risk Management with Your Strategies

No matter which Finpros Indices trading strategy you adopt, robust risk management is non-negotiable. It’s the shield that protects your capital.

| Risk Management Component | Description | Application |

|---|---|---|

| Stop-Loss Orders | Automatically closes your position if the price moves against you beyond a set point. | Use them on every trade to limit potential losses. |

| Take-Profit Levels | Automatically closes your position once a predefined profit target is reached. | Secure gains and avoid giving back profits. |

| Position Sizing | Determining the appropriate number of units to trade based on your capital and risk tolerance. | Never risk more than 1-2% of your total trading capital on a single trade. |

| Diversification | Spreading your investments across different indices or asset classes. | Reduces overall portfolio risk, though index trading inherently offers some diversification. |

As the legendary trader Jesse Livermore once said, “The game taught me that it was wrong to take a chance when in doubt.” This wisdom directly applies to risk management. If you are unsure, reducing your position size or waiting for a clearer signal is always the best path.

The Role of Technical Analysis in Finpros Indices Trading

Most effective strategies for Finpros Indices rely heavily on technical analysis. This involves studying past market data, primarily price and volume, to identify patterns and predict future price movements. Common technical indicators you might use include:

- Moving Averages (MA)

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Bollinger Bands

These tools help confirm trends, identify overbought/oversold conditions, and pinpoint potential entry and exit points for your trades.

Mastering Finpros Indices trading strategies takes time, practice, and consistent effort. Start by understanding one or two strategies thoroughly, backtest them, and then apply them with strict discipline. The goal is to develop a systematic approach that fits your trading style and risk profile. Keep learning, stay disciplined, and always prioritize protecting your capital as you navigate the exciting world of index trading.

Trend Following with Finpros Indices

Embarking on a journey into the world of financial markets often leads traders to discover the power of trend following. This popular trading strategy focuses on identifying and riding the momentum of an established market direction, aiming to profit from prolonged price movements. Instead of predicting tops and bottoms, trend followers simply jump on board when a trend emerges and stay with it until it shows signs of reversal.

Finpros Indices offer an exceptional suite of tools designed to empower your trend following strategy. Our carefully curated indices provide a broader market perspective, allowing you to capture the overall sentiment and direction without getting bogged down by the volatility of individual assets. This approach can be particularly effective for those seeking a more systematic and less emotional way to engage with the markets.

Here’s why embracing trend following with Finpros Indices makes sense:

- Clarity in Market Direction: Finpros Indices help cut through market noise, highlighting clear market trends that are easier to identify and act upon.

- Reduced Over-Analysis: You don’t need to predict future prices. Your focus shifts to observing existing price action and reacting to it.

- Potential for Substantial Gains: Major trends can last for extended periods, offering significant profit potential if you stay disciplined.

- Broad Market Exposure: Trading indices allows you to diversify your exposure across a basket of assets, reducing reliance on the performance of a single stock or commodity.

- Simplified Decision-Making: Once you define your trend following rules, the strategy becomes quite mechanical, removing much of the guesswork.

Think of it this way: “The trend is your friend,” as the old trading adage goes. With Finpros Indices, you gain the analytical edge to spot these friendships early and ride them effectively. Our platform provides the reliable data and execution capabilities you need to implement a robust trend following strategy, whether you are an experienced trader or just starting to explore dynamic forex trading techniques.

Success in trend following isn’t about perfection; it’s about consistency and patience. By leveraging the comprehensive data and intuitive interface of Finpros, you can refine your approach to identify powerful shifts in market direction and position yourself to capitalize on them. Discover how Finpros can transform your trading experience and help you master the art of following the prevailing market currents.

Scalping and Day Trading Finpros Indices

Diving into the fast-paced world of Finpros Indices with strategies like scalping and day trading can be incredibly exhilarating and rewarding. These approaches appeal to traders who thrive on quick decisions and capitalize on short-term market movements. If you enjoy rapid action and seek to generate profits from even the smallest price fluctuations, then mastering these techniques with Finpros Indices might be your calling.

Scalping Finpros Indices involves opening and closing trades within minutes, sometimes even seconds. The goal is to capture tiny price discrepancies, often just a few pips, multiple times throughout the trading session. This strategy demands intense focus, lightning-fast execution, and a deep understanding of market microstructure. Traders utilizing this method usually rely heavily on advanced charting tools and real-time market data to spot immediate opportunities.

On the other hand, day trading Finpros Indices extends the timeframe slightly, with positions typically held for several minutes to a few hours, but always closed before the market closes for the day. Day traders aim for larger moves than scalpers, focusing on significant intraday trends or reversals. They use technical indicators, chart patterns, and often integrate fundamental news analysis that impacts index performance within a single day. Both strategies benefit from the inherent volatility and liquidity of Finpros Indices, which offer ample opportunities for price action.

Consider these vital aspects when engaging in short-term trading with Finpros Indices:

- High Volatility: Indices often experience significant intraday swings, creating numerous entry and exit points for quick trades.

- Liquidity: Finpros Indices typically boast high liquidity, ensuring you can enter and exit positions efficiently without significant slippage.

- Technical Analysis: Both scalpers and day traders rely heavily on technical analysis. Master chart patterns, support/resistance levels, and indicators like Moving Averages, RSI, or MACD.

- Risk Management: This is paramount! Always use stop-loss orders to protect your capital from unexpected market shifts. Define your maximum risk per trade clearly.

- Trading Costs: Be mindful of spreads and commissions. Frequent trading can accumulate costs, so factor these into your profit calculations.

- Focus and Discipline: These strategies require unwavering concentration and strict adherence to your trading plan. Emotional decisions can quickly lead to losses.

Engaging with Finpros Indices through scalping or day trading offers a dynamic way to participate in the financial markets. It’s a high-energy pursuit that can deliver consistent results for those who approach it with discipline, comprehensive knowledge, and effective risk controls. Are you ready to seize those fleeting market opportunities?

Long-Term Position Trading on Finpros

Are you someone who prefers to see the bigger picture, letting market movements unfold over an extended period rather than jumping in and out of trades multiple times a day? Then long-term position trading might be your ideal strategy, and Finpros offers a robust environment to execute it effectively. This approach involves holding financial instruments for weeks, months, or even years, focusing on significant market trends rather than short-term fluctuations.

Position traders often rely heavily on fundamental analysis, studying economic indicators, geopolitical events, and company earnings reports to predict major shifts in currency pairs, commodities, or stocks. Technical analysis also plays a role, but usually on higher timeframes like weekly or monthly charts, to confirm the broader trend.

Why Consider Long-Term Position Trading with Finpros?

- Reduced Stress: You spend less time glued to your screen, as daily volatility holds less significance for your overall strategy. This means more freedom in your daily life.

- Significant Profit Potential: Capturing a large portion of a major trend can lead to substantial gains, often surpassing what short-term strategies might offer.

- Lower Transaction Costs: Fewer trades mean lower commission fees and spread costs over time, which can significantly impact your net profitability. Finpros is designed to support various holding periods.

- Time for Deeper Analysis: This approach allows you to conduct thorough research and analysis without the pressure of making split-second decisions.

Key Aspects of a Successful Position Trading Strategy on Finpros:

| Aspect | Description |

|---|---|

| Patience | This is perhaps the most crucial trait. You need to endure minor pullbacks and consolidations without abandoning your well-researched trade. |

| Strong Conviction | Base your trades on solid fundamental and technical reasoning. Trust your analysis over fleeting market sentiment. |

| Robust Risk Management | While aiming for large gains, protecting your capital is paramount. Implement appropriate stop-loss orders and position sizing relative to your trading capital. Finpros provides the tools for precise order placement. |

| Understanding of Swap Costs | Holding positions overnight, especially for extended periods, incurs swap charges or credits. Factor these into your overall profitability calculations. |

Finpros offers a stable platform with competitive conditions that suit the long-term trader. You gain access to a wide array of markets, allowing you to diversify your portfolio and find the best opportunities aligned with your long-term investment horizon. Focus on the big picture, let your analysis guide you, and leverage Finpros to achieve your financial goals with patience and strategic execution.

The Finpros Trading Platform: A Gateway to Indices

Are you ready to explore the dynamic world of global stock market indices? The Finpros trading platform offers you an unparalleled gateway to these exciting financial instruments. It is more than just a platform; it is your comprehensive partner, designed for both novice and experienced traders looking to navigate the complex yet rewarding landscape of indices trading. We understand that market access, reliability, and robust tools are crucial for success, and Finpros delivers on all fronts.

With Finpros, you gain direct entry to a vast selection of global indices. These instruments reflect the performance of entire economies or specific sectors, allowing you to speculate on broader market movements without needing to analyze individual stocks. It’s an efficient way to diversify your portfolio and capitalize on large-scale economic trends. Our platform makes online trading accessible and intuitive, ensuring you can focus on your strategy.

Key Advantages for Indices Trading with Finpros:

- Diverse Market Access: Trade on the world’s leading indices, from the major US benchmarks like the S&P 500 and Dow Jones, to European powerhouses such as the DAX and FTSE 100, and even Asian markets. This extensive range provides ample opportunities for your trading strategy.

- Advanced Trading Tools: Benefit from a suite of powerful analytical tools, charting features, and indicators. These resources empower you to conduct thorough market analysis and make informed trading decisions with confidence.

- Real-Time Data: Stay ahead with live, streaming real-time data. Instant updates on price movements, news, and economic events are critical when trading fast-paced markets like global indices.

- User-Friendly Interface: Our intuitive and clean interface makes managing your trades simple. Execute orders swiftly, monitor your positions, and navigate the platform with ease, whether you are on desktop or mobile.

- Competitive Spreads: We provide competitive pricing on indices, helping you maximize your potential returns. Lower trading costs mean more of your capital works for you.

Choosing the right platform for indices trading significantly impacts your potential for success. The Finpros trading platform is engineered to offer a seamless and powerful trading experience. We combine cutting-edge technology with a deep understanding of what traders need to thrive in the financial markets. Experience the difference that a dedicated and feature-rich platform makes in your trading journey.

Whether you aim to capitalize on short-term volatility or position yourself for long-term market trends, Finpros provides the resources and environment to achieve your goals. Join a community of traders who trust our platform to deliver reliable performance and extensive market access. Your gateway to the world of indices awaits.

Essential Risk Management for Finpros Index Traders

Navigating the dynamic world of index trading with Finpros offers incredible opportunities, but it also comes with inherent risks. Mastering effective risk management isn’t just a good idea; it’s absolutely fundamental to your long-term success. Think of it as your trading compass, guiding you through market volatility and protecting your capital. Without a solid risk management strategy, even the most promising trading signals can lead to significant setbacks. For Finpros index traders, this means understanding, implementing, and consistently adhering to principles that safeguard your investments and ensure you stay in the game.

Why Risk Management Matters More Than Ever

In the fast-paced environment of index trading, market movements can be swift and unpredictable. A single economic report or geopolitical event can trigger significant shifts. Effective risk management acts as your primary defense, helping you:

- Preserve capital during adverse market conditions.

- Avoid emotional decisions driven by fear or greed.

- Maintain consistency in your trading approach.

- Identify and mitigate potential threats before they escalate.

Many successful traders often say, “It’s not about how much you make when you’re right, but how little you lose when you’re wrong.” This sentiment perfectly encapsulates the essence of diligent risk management.

Core Principles for Finpros Index Traders

Successful risk management isn’t complex, but it requires discipline. Here are some cornerstone principles every Finpros index trader should embrace:

Position Sizing: Your First Line of Defense

This is arguably the most critical aspect. Never risk more than a small percentage of your total trading capital on any single trade. A common guideline is to risk no more than 1-2% of your account balance per trade. This means if you have a $10,000 account, your maximum loss on any one trade should be $100-$200. This conservative approach ensures that a series of losing trades won’t wipe out your account. Calculate your position size based on your stop-loss level, not just an arbitrary number.

Stop-Loss Orders: The Non-Negotiable Tool

Always, without exception, use stop-loss orders. A stop-loss is an instruction to close a trade automatically once it reaches a certain price, thereby limiting your potential loss. It’s your safety net. Determine your stop-loss level based on technical analysis, such as support and resistance levels, before you even enter a trade. Sticking to your pre-defined stop-loss helps eliminate emotional trading decisions and protects your capital from unexpected market reversals.

Diversification: Spreading Your Bets Wisely

While index trading often involves a basket of stocks, you might also trade multiple indices or combine index trading with other asset classes. Diversification helps reduce the impact of a poor performance in any single asset or index. Avoid putting all your capital into one or two highly correlated trades. Evaluate the correlation between the indices you trade to ensure your diversification truly provides a buffer.

Maintain a Trading Journal: Learn From Every Experience

A detailed trading journal is an invaluable tool for risk management. Record every trade, including entry and exit points, position size, reasons for the trade, and your emotional state. This allows you to review your performance objectively, identify recurring mistakes, and refine your strategy. Learning from past errors is a powerful way to enhance your future risk management practices.

The Psychological Edge of Sound Risk Management

Trading is as much a mental game as it is a strategic one. Fear and greed can quickly derail even the most well-planned strategy. Effective risk management instills discipline and reduces emotional stress. When you know you’ve limited your downside, you can approach each trade with greater confidence and less anxiety. This allows for clearer thinking and better decision-making, which are priceless assets for any Finpros index trader.

Embracing these risk management essentials will not only protect your capital but also pave the way for a more consistent and ultimately more profitable trading journey with Finpros.

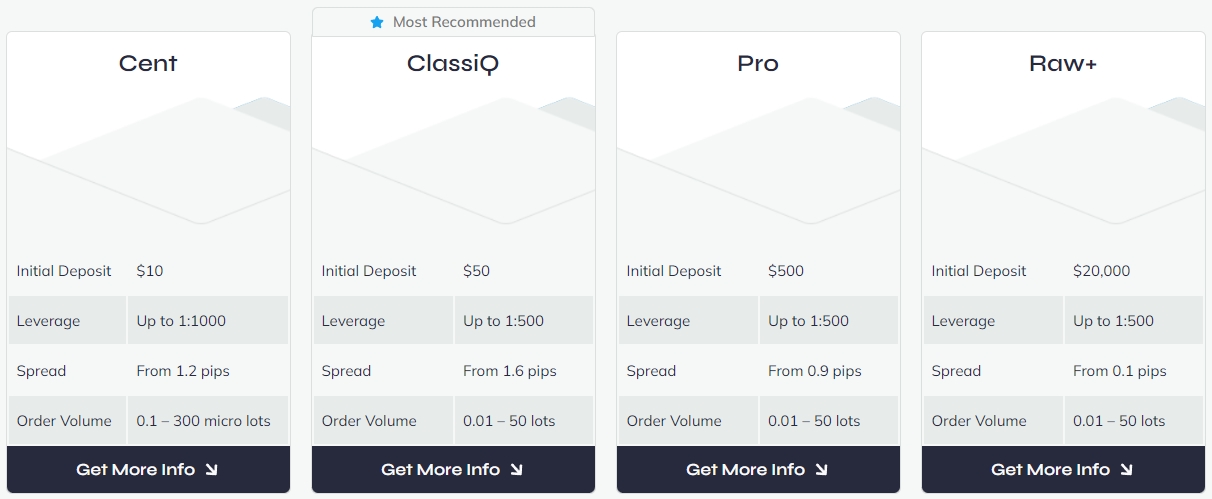

Finpros Account Options for Index Trading

Diving into the world of index trading with Finpros opens up a realm of possibilities. We understand that every trader has unique goals, experience levels, and capital. That’s why we’ve designed a suite of flexible Finpros account options specifically tailored for those looking to trade indices. Our aim is to provide you with the perfect environment to execute your strategies and navigate the global markets with confidence.

Choosing the right account is a crucial step in your trading journey. It dictates everything from the spreads you experience to the leverage available and the support you receive. We make it simple to find an account that aligns perfectly with your trading style, whether you’re just starting out or you’re a seasoned professional looking for advanced features. Discover how Finpros supports your index trading ambitions.

Explore Your Ideal Finpros Index Trading Account

We offer a range of accounts designed to empower every index trader. Here’s a breakdown of our popular choices:

- Standard Account: Perfect for new traders or those preferring a straightforward experience. You get competitive spreads, no commission on trades, and access to a wide array of global indices. It’s an excellent starting point for understanding market dynamics without overwhelming complexities.

- Pro Account: Tailored for more experienced traders, this account offers tighter spreads and lower trading costs. If you’re actively involved in index trading and require more precision in your entries and exits, the Pro Account delivers superior execution and advanced charting tools.

- VIP Account: Our premium offering for high-volume traders and seasoned investors. Enjoy the tightest spreads, dedicated account management, and exclusive access to market research and analytical tools. The VIP Account maximizes your trading efficiency and provides a personalized service experience.

Key Features Across Finpros Account Types

Regardless of the Finpros account you choose for index trading, you benefit from our robust infrastructure and commitment to your success. Here are some consistent advantages:

| Feature | Benefit for Index Trading |

|---|---|

| Access to Major Global Indices | Trade prominent indices like the S&P 500, FTSE 100, DAX 40, and Nikkei 225. Diversify your portfolio and capitalize on global economic movements. |

| Leverage Options | Amplify your trading power. We provide flexible leverage to suit various risk appetites and trading strategies in the dynamic index markets. |

| Advanced Trading Platforms | Utilize industry-leading platforms with powerful charting tools, technical indicators, and seamless execution. Analyze market data effectively and make informed decisions. |

| Dedicated Customer Support | Our expert support team is available to assist you with any queries, ensuring a smooth and uninterrupted trading experience. Your success is our priority. |

| Educational Resources | Access a wealth of educational materials, webinars, and market insights. Enhance your knowledge and sharpen your index trading skills. |

Choosing the Best Finpros Account for You

Deciding on the perfect Finpros account for your index trading endeavors is straightforward. Consider these points:

- Your Experience Level: Are you new to trading indices or do you have years of market exposure? Our Standard account is excellent for beginners, while Pro and VIP accounts cater to more seasoned traders.

- Trading Volume and Frequency: How often do you plan to trade? Higher volume traders will benefit significantly from the tighter spreads and lower costs associated with our Pro and VIP options.

- Capital Available: Your initial deposit and trading capital often influence the account type best suited for you. Each account has different minimum requirements designed to match various investment sizes.

- Desired Features: Do you need advanced analytics, personal account management, or simply a reliable platform for execution? Match your needs with the features offered by each account.

Join Finpros today and unlock your potential in the exciting world of index trading. We are here to support your journey with transparent conditions, powerful tools, and dedicated service. Select the Finpros account that empowers your trading and start exploring the global index markets.

Getting Started: Opening Your Finpros Indices Trading Account

Ready to dive into the exciting world of indices trading? Opening your Finpros indices trading account is your first step towards exploring dynamic opportunities in the financial markets. We have streamlined our easy account setup process to be intuitive and quick, ensuring you can start navigating the online trading platform without unnecessary delays.

We understand that getting started should be straightforward. Here’s a simple breakdown of how to open your Finpros trading account:

- Step 1: Begin Your Application. Head over to our official website and locate the “Open Account” button. It’s prominent and designed to guide you right into the application portal.

- Step 2: Fill in Your Details. Complete the secure online form with your personal information. We only ask for what’s necessary to create your account and ensure a safe trading environment.

- Step 3: Verification Made Simple. Upload the required identification documents, such as a valid ID and proof of address. Our team works hard to ensure fast verification, so you can move forward quickly.

- Step 4: Fund Your Account. Once your account receives approval, you can deposit funds using a variety of secure payment methods. Choose the one that suits you best!

- Step 5: Start Trading! With funds in your account, you are ready to access our powerful online trading platform and begin your indices trading journey.

For a smooth onboarding experience, please have these items ready for upload:

- A valid government-issued identification document (e.g., passport, driver’s license).

- A recent proof of residence (e.g., utility bill, bank statement) dated within the last three months.

At Finpros, we prioritize your security and convenience. Once your Finpros indices trading account is active, you gain immediate access to a suite of benefits:

| Feature | Benefit to You |

|---|---|

| Intuitive Platform | Effortless navigation and efficient trade execution. |

| Access Global Markets | Trade major indices from around the world. |

| Demo Account Option | Practice with a demo account before committing to live trading. |

| Dedicated Support | Receive assistance from our responsive customer support team. |

Joining Finpros means choosing a secure trading environment where your trading goals matter. We believe “clarity is key to confidence.” Don’t let hesitation hold you back from exploring the vast possibilities of indices trading. Open your Finpros indices trading account today and prepare for a rewarding live trading experience!

Key Advantages of Choosing Finpros for Indices

Ready to explore the dynamic world of indices trading? Choosing the right broker makes all the difference. At Finpros, we’ve meticulously crafted an environment where both novice and experienced traders can thrive. We understand what it takes to succeed in the fast-paced markets, and our platform reflects that commitment to your trading journey. Discover why Finpros stands out as your premier partner for indices.

Unrivaled Trading Conditions

We pride ourselves on offering some of the most competitive trading conditions in the industry. Trading indices means looking for precision and value, and Finpros delivers on both fronts. Our pricing structure is designed to keep your costs low, maximizing your potential returns.

- Ultra-Tight Spreads: Experience some of the industry’s lowest spreads on major global indices, reducing your transaction costs.

- Transparent Pricing: No hidden fees or commissions. What you see is what you get, ensuring clarity in every trade.

- Flexible Leverage Options: Tailor your leverage to match your risk appetite, giving you greater control over your market exposure.

Cutting-Edge Technology and Tools

Success in indices trading often hinges on having the right tools at your fingertips. Finpros empowers you with a robust trading platform packed with features designed for analysis, execution, and strategy development. Our technology is built for speed and reliability, ensuring you can react to market movements instantly.

Consider these technological benefits:

| Feature Category | Finpros Advantage |

|---|---|

| Platform Performance | Lightning-fast execution speeds and minimal latency, even during peak volatility. |

| Charting Capabilities | Advanced charting with multiple indicators and drawing tools for in-depth technical analysis. |

| Mobile Trading | Seamless trading experience across desktop, web, and mobile devices, so you never miss an opportunity. |

| Automated Trading | Support for Expert Advisors (EAs) and automated strategies to execute trades based on your predefined rules. |

Diverse Range of Global Indices

Diversification is a cornerstone of sound investment strategy. With Finpros, you gain access to a broad selection of the world’s most prominent stock market indices. This extensive market access allows you to capitalize on global economic trends and spread your risk effectively.

“Broad market access allows traders to diversify portfolios and respond to global economic shifts, a key advantage in today’s interconnected financial landscape.”

Whether you are interested in the US markets, European powerhouses, or emerging Asian economies, Finpros offers the instruments you need to build a robust portfolio. Explore opportunities across various sectors and regions with ease.

Dedicated Support and Educational Resources

We believe that an informed trader is a confident trader. That’s why Finpros provides extensive educational resources and responsive customer support to help you navigate the complexities of indices trading. Our team is here to assist you every step of the way.

- Multilingual Support: Our dedicated support team is available around the clock to answer your questions and resolve issues.

- Educational Materials: Access a rich library of articles, tutorials, and webinars covering everything from basics to advanced strategies.

- Market Analysis: Stay ahead with daily market insights and expert analysis from our team of financial specialists.

Choosing Finpros for indices means opting for a platform that prioritizes your success, offering a blend of superior trading conditions, advanced technology, vast market access, and unwavering support. Join us and elevate your indices trading experience today!

Educational Tools and Resources for Finpros Index Traders

Diving into the world of Finpros index trading means more than just opening an account. It means empowering yourself with knowledge, skill, and strategic insights. For every Finpros index trader, we understand that continuous learning is not just an advantage – it’s a necessity. The markets are dynamic, always evolving, and staying ahead requires access to top-tier educational materials that are both comprehensive and easy to digest.

Our commitment to your success as a trader is reflected in the extensive suite of educational tools and resources we provide. Whether you’re taking your first steps into the market or you’re a seasoned pro looking to refine your approach, Finpros offers everything you need to enhance your understanding of market dynamics, perfect your trading strategies, and ultimately, make more informed decisions.

At Finpros, we believe that education should be accessible, practical, and tailored to different learning styles. That’s why we’ve curated a robust library designed to cater to every Finpros index trader.

Our educational resources cover several key areas vital for any successful Finpros index trader:

- In-Depth Trading Guides: Explore detailed articles and tutorials on a wide range of topics, from the basics of Finpros index trading to advanced trading strategies. Understand how to interpret market analysis, utilize technical indicators, and apply fundamental analysis effectively.

- Interactive Webinars and Seminars: Participate in live webinars hosted by industry experts. These sessions offer real-time insights, Q&A opportunities, and deep dives into current market trends and risk management techniques. They are invaluable for understanding complex concepts directly from professionals.

- Video Tutorials: Visual learners will appreciate our library of video tutorials, which break down complex topics into easily digestible segments. Learn how to navigate the Finpros trading platform, execute trades, and manage your portfolio with clarity.

- Glossaries and FAQs: Quickly look up financial terms and get answers to common questions about Finpros index trading, ensuring you’re always up to speed with industry jargon and best practices.

- Practice with a Demo Account: Perhaps one of the most powerful educational tools, our demo account allows you to apply what you’ve learned in a risk-free environment. Test your trading strategies, get comfortable with the trading platform, and build confidence before using real capital.

These resources are specifically designed to help you build a solid foundation, refine your existing knowledge, and adapt to changing market conditions. We cover essential areas like effective risk management, which is critical for protecting your capital, and advanced market analysis techniques to spot potential opportunities. Our comprehensive approach supports continuous learning, which is a hallmark of successful Finpros index traders.

Here’s a snapshot of what Finpros index traders gain from our educational offerings:

| Resource Type | Key Benefit | Ideal For |

|---|---|---|

| Written Guides & Articles | Comprehensive understanding of concepts like market analysis and technical indicators. | Beginners & those seeking detailed theoretical knowledge. |

| Live Webinars & Workshops | Real-time expert insights, interactive learning, practical trading strategies. | All levels, especially for practical application and market updates. |

| Video Tutorials | Visual step-by-step instructions for Finpros platform navigation and trade execution. | Visual learners, quick practical tips. |

| Demo Account | Risk-free application of learned trading strategies and Finpros trading platform familiarity. | All levels, essential for practical experience and confidence building. |

We constantly update our educational content to reflect the latest market developments and provide you with fresh perspectives. Our goal is to ensure that every Finpros index trader feels confident and well-equipped to navigate the complexities of the financial markets. Unlock your full trading potential by taking advantage of these robust tools and resources today!

Market Access and Trading Hours for Finpros Indices

Diving into the world of Finpros Indices means embracing unparalleled market access and flexible trading hours designed for the modern trader. We understand that opportunities don’t wait, and neither should you. Our platform ensures you can engage with global indices effortlessly, placing the power of diverse markets right at your fingertips.

At Finpros, we bridge geographical gaps, offering robust access to a wide array of international stock market indices. Whether you are keen on tracking major US benchmarks, European powerhouses, or dynamic Asian markets, our intuitive platform makes connecting simple and direct. You gain exposure to the pulse of the global economy, allowing you to diversify your portfolio and capitalize on movements across different regions.

One of the most significant advantages of trading Finpros Indices is the extensive trading window. The financial world rarely sleeps, and neither do our trading opportunities. We provide nearly 24/5 market access, ensuring you can react to economic news, geopolitical events, or shifts in market sentiment as they happen, no matter your time zone.

Consider the typical trading hours for various index types:

- Major US Indices: These often follow a schedule that allows trading from Sunday evening to Friday afternoon, accommodating both pre-market and after-hours activity.

- European Indices: Engage with European markets during their primary trading sessions, extending into the global overnight hours for many traders.

- Asian Indices: Access these markets as their trading day begins, often overlapping with late evening or early morning for traders in other parts of the world.

This extended availability is a game-changer. It means greater flexibility for traders with busy schedules, allowing them to manage their positions or open new trades at times that suit them best. You can develop trading strategies that account for market openings and closings across different continents, giving you a comprehensive view and more opportunities to execute your plans.

Moreover, the ability to trade outside of conventional hours can be crucial. Imagine a significant economic report released during the night in your local time. With Finpros, you have the option to act on that information immediately, rather than waiting for the market to open. This responsiveness can be a key differentiator in a fast-moving market environment.

While the market is largely open, it’s always wise to be aware of potential changes in liquidity and volatility, especially during less active periods. However, our commitment to providing deep liquidity ensures that your orders are executed efficiently across these extended trading windows. Finpros empowers you with the tools and the access to navigate the global indices market on your terms, maximizing every trading moment.

Frequently Asked Questions

What are Finpros Indices, and how do they work?

Finpros Indices are curated baskets of assets designed to reflect the performance of a specific market segment, industry, or economy. They work by aggregating prices of constituent assets, with the index value rising or falling based on their collective movement. Trading them offers broad market exposure without individual stock analysis.

Why should I trade indices with Finpros?

Finpros offers competitive trading conditions, robust platforms with advanced tools, diverse market access to major global indices, and dedicated educational resources. It provides a professional edge, enabling traders to capitalize on global economic trends with transparent pricing and reliable execution.

What trading strategies can I use for Finpros Indices?

Finpros supports various trading strategies, including Trend Following (riding market momentum), Range Trading (buying/selling within defined channels), Breakout Trading (entering trades when prices move beyond support/resistance), and News/Event-Driven Trading. Long-term position trading, scalping, and day trading are also popular approaches.

How do I open a Finpros Indices trading account?

To open an account, visit the Finpros website, complete the online application form with your personal details, upload required identification documents (ID and proof of address), fund your account using a secure payment method, and then you can start trading.

What are essential risk management tools for index trading on Finpros?

Key risk management principles for Finpros index traders include careful position sizing (risk 1-2% of capital per trade), always using stop-loss orders, diversifying investments across multiple indices or asset classes, and maintaining a detailed trading journal to learn from past experiences.