Diving into the world of online trading requires a reliable partner, and Finpros stands out with its user-friendly approach to account funding. We know that getting started quickly and efficiently is paramount for our traders. That’s why we’ve streamlined our deposit process to be as straightforward as possible, ensuring you can focus on what truly matters: your trading strategies.

At Finpros, we prioritize both speed and security. We’ve implemented robust measures to protect your funds and personal information from the moment you initiate a deposit. Our platform offers a variety of payment methods, designed to cater to a global audience, making it easy for you to choose the option that best suits your needs and location.

When you decide to fund your Finpros account, you’ll find a clear, step-by-step guide within our client portal. We believe in transparency, so all information regarding minimum deposit amounts, processing times, and any associated fees is readily available. Our goal is to eliminate any guesswork, allowing you to deposit with complete confidence.

Here’s what makes our deposit process so convenient:

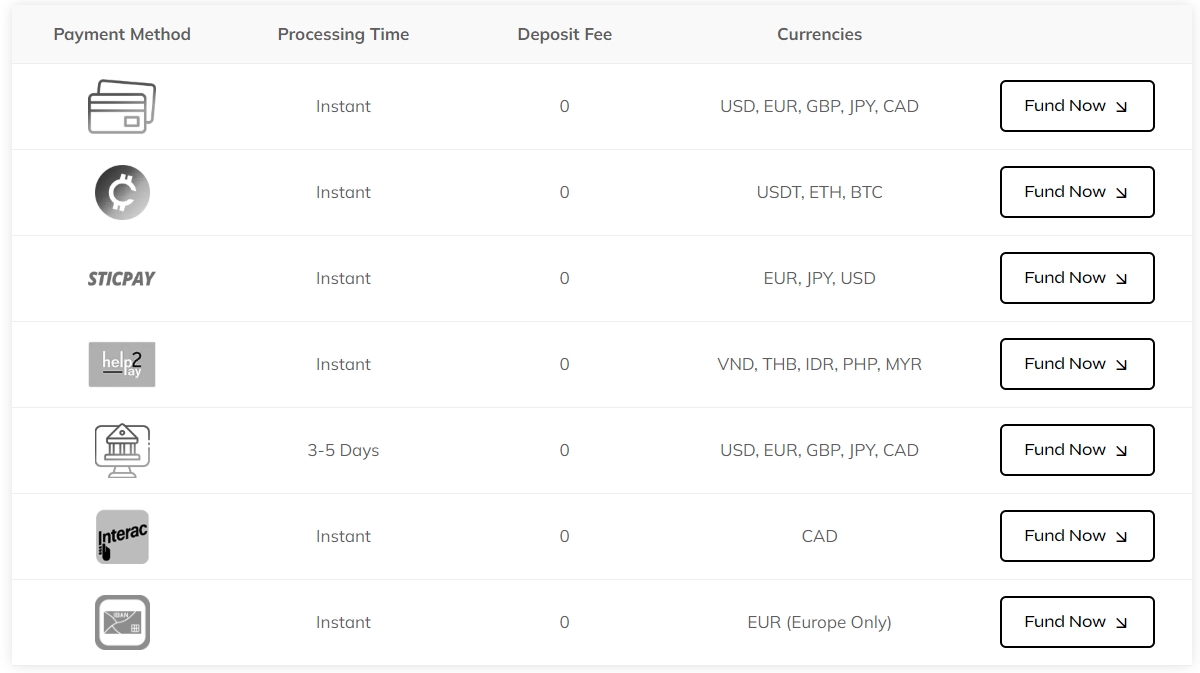

- Multiple Payment Options: Choose from a wide range of popular methods including credit/debit cards, bank transfers, and various e-wallets. We constantly review and expand our options to provide maximum flexibility.

- Fast Processing: Many of our deposit methods offer instant or near-instant funding, meaning your capital is available for trading almost immediately. Bank transfers might take a bit longer, typically 1-3 business days, depending on your bank and location.

- Secure Transactions: We employ state-of-the-art encryption and security protocols to safeguard every transaction. Your financial data remains private and protected at all times.

- Clear Instructions: Our platform guides you through each step of the deposit process with clear, concise instructions, making it easy even for first-time users.

- Dedicated Support: Should you encounter any questions or need assistance, our customer support team is always ready to help. You can reach out via live chat, email, or phone.

Our commitment is to provide a seamless funding experience so you can quickly access the markets and start your trading journey with Finpros. We want to empower you, giving you the tools and support needed to thrive in the dynamic forex landscape.

- Why Choose Finpros for Your Investment Funding Needs?

- What Sets Finpros Apart?

- Available Finpros Deposit Methods

- Bank Wire Transfers for Finpros Deposits

- Credit and Debit Card Options

- Why Traders Love Card Payments:

- Important Considerations for Card Users:

- E-Wallets and Online Payment Systems

- Advantages of Using E-Wallets and Online Payment Systems for Forex Trading:

- Step-by-Step Guide: How to Make a Finpros Deposit

- Log In to Your Finpros Account

- Navigate to the Deposit Section

- Choose Your Preferred Deposit Method

- Enter Your Deposit Amount

- Provide Necessary Payment Details

- Review and Confirm Your Transaction

- Complete the Security Verification (if applicable)

- Monitor Your Account for Funds

- Important Considerations for Your Finpros Deposit:

- Accessing the Deposit Section in Your Account

- Selecting Your Preferred Method and Inputting Amount

- Choosing Your Deposit Method

- Inputting Your Amount

- Confirming and Finalizing Your Finpros Deposit

- Finpros Deposit Limits: Minimums, Maximums, and Currency

- Minimum Deposit Requirements

- Maximum Deposit Limits

- Supported Currencies for Funding Your Account

- Finpros Deposit Fees and Processing Times Explained

- Deposit Fees at Finpros

- Deposit Processing Times

- Ensuring the Security of Your Finpros Deposit Transactions

- Our Core Security Pillars:

- Troubleshooting Common Finpros Deposit Issues

- What Happens After a Successful Finpros Deposit?

- Managing Your Funds: Finpros Withdrawals Post-Deposit

- Navigating the Finpros Withdrawal Process

- Key Considerations for Smooth Financial Management

- Proactive Fund Management Strategies

- Finpros Deposit FAQs

- Your Top Deposit Questions Answered

- Tips for a Seamless Deposit Experience

- Are there any Finpros deposit bonuses available?

- Can I deposit using a third-party account?

- Conclusion: Making Your Finpros Deposit with Confidence

- Frequently Asked Questions

Why Choose Finpros for Your Investment Funding Needs?

Navigating the financial markets, especially forex trading, requires not just skill but also sufficient capital. Many talented traders hit a ceiling not because of a lack of strategy, but due to limited investment funding. This is where Finpros steps in, offering a robust platform designed to empower your trading journey.

At Finpros, we understand the aspirations of ambitious traders. Our goal is to bridge the gap between your trading expertise and the capital you need to truly thrive. We provide a unique opportunity for you to access significant funds, allowing you to scale your operations and unlock new levels of profit potential without risking your own capital.

What Sets Finpros Apart?

Choosing a funding partner is a critical decision. Finpros stands out through its commitment to trader success, transparent processes, and comprehensive support. Here’s a closer look at what makes us the preferred choice:

- Access to Substantial Capital: We offer generous funding programs, giving you the power to execute larger trades and diversify your strategies across various instruments in the forex market. This capital access is pivotal for serious growth.

- Fair and Achievable Evaluation: Our evaluation process is designed to identify genuine trading talent. We provide clear, straightforward rules and realistic targets, ensuring every aspiring funded trader has a fair chance to demonstrate their abilities.

- Lucrative Profit Sharing: When you succeed, we succeed. Finpros offers one of the most attractive profit-sharing models in the industry, allowing you to retain a significant portion of your earnings. Your hard work directly translates into substantial personal rewards.

- Advanced Trading Environment: Gain access to cutting-edge trading platforms and tools that enhance your analytical capabilities and execution efficiency. We equip you with the resources to make informed decisions and react swiftly to market movements.

- Supportive Community and Resources: Join a vibrant community of like-minded traders. Benefit from shared insights, educational materials, and responsive customer support. We foster an environment where continuous learning and improvement are encouraged.

- Focus on Risk Management: While we provide capital, we also emphasize responsible trading. Our programs inherently encourage sound risk management practices, helping you develop disciplined trading habits that protect your capital and ensure long-term sustainability.

We believe that your trading potential should not be constrained by your starting capital. With Finpros, you find a partner dedicated to your growth, providing not just funds but also the infrastructure and support necessary for sustained success in proprietary trading.

“Finpros transformed my trading. The capital allowed me to think bigger, and their support made the journey smoother. It’s more than just funding; it’s a partnership for growth.” – An anonymous funded trader.

Embrace the opportunity to elevate your trading career. Let Finpros be the catalyst for your financial aspirations, providing the capital and confidence you need to conquer the markets. Your journey to becoming a consistently profitable and highly compensated trader starts here.

Available Finpros Deposit Methods

Ready to jump into the exciting world of forex trading with Finpros? Funding your account is the first crucial step, and we make it incredibly straightforward and secure. We understand that traders value flexibility and efficiency, so we offer a diverse range of deposit methods to suit your preferences, no matter where you are in the world. Our goal is to ensure you can quickly get your funds into your trading account and start seizing market opportunities without delay.

Choosing the right deposit method can often depend on factors like transaction speed, fees, and convenience. At Finpros, we’ve carefully selected options that prioritize all these aspects, giving you peace of mind and more time to focus on your trading strategies. Let’s explore the convenient ways you can fund your Finpros account:

- Bank Wire Transfers: A classic and reliable method for larger deposits. Bank wire transfers offer robust security, ensuring your funds are safely moved from your bank to your Finpros trading account. While generally taking a bit longer to process, it’s a trusted option for significant investments.

- Credit and Debit Cards: For quick and easy funding, Visa and MasterCard are widely accepted. This is one of the most popular deposit methods due to its instant processing and familiar user experience. Simply enter your card details, and your funds are typically available in your Finpros account almost immediately, allowing you to react swiftly to market movements.

- E-Wallets (Digital Wallets): Experience lightning-fast transactions with popular e-wallets. Options like Skrill and Neteller provide a secure and efficient way to deposit funds without directly sharing your bank or card details with Finpros. They offer an extra layer of privacy and are perfect for traders who value speed and discretion.

- Local Payment Solutions: Depending on your geographical location, Finpros may offer specific local payment methods tailored to your region. These options are designed to provide maximum convenience, often facilitating deposits in your local currency and through banking systems you are already familiar with.

We are always working to expand our range of available Finpros deposit methods, aiming to provide even more choices in the future. Our dedicated support team is also on hand to assist you should you have any questions or require guidance on the best funding option for your needs. We believe that a smooth funding process is fundamental to a positive trading experience, and we are committed to making yours exceptional from the very start.

Bank Wire Transfers for Finpros Deposits

When you’re ready to power up your trading journey with Finpros, selecting the right deposit method is crucial. For many serious traders, bank wire transfers stand out as a highly reliable and secure option for Finpros deposits. This traditional yet incredibly robust method ensures your funds reach your trading account safely, giving you peace of mind as you enter the exciting forex market.

Making a wire transfer deposit with Finpros is straightforward. Follow these simple steps to fund your account:

- Log in to your Finpros account and navigate to the “Deposit” section.

- Choose “Bank Wire Transfer” as your preferred funding method.

- You will receive specific bank details for Finpros. These include the bank name, account number, SWIFT/BIC code, and beneficiary name.

- Take these details to your local bank branch or use your online banking portal to initiate the transfer.

- Always include your Finpros trading account number in the transfer reference or description. This ensures quick allocation of your funds.

- Confirm the transfer with your bank. Finpros will notify you once your funds are successfully credited.

Why do so many traders opt for bank wire transfers when making Finpros deposits? Let’s look at the key benefits:

- High Security: Banks employ advanced security protocols, making wire transfers one of the safest ways to move large sums of money. This offers excellent protection for your forex funding.

- No Limits (Generally): While other methods might have caps, bank wires typically accommodate larger deposit amounts, perfect for serious traders looking for substantial forex funding.

- Reliability: It’s a time-tested method. Once initiated, you can be confident your funds will arrive, ensuring your trading capital is always available.

- Global Reach: Bank wire transfers facilitate international transactions, making them accessible to traders worldwide for Finpros deposits.

However, it’s also wise to keep a few considerations in mind:

- Processing Time: Bank wire deposits usually take 1-5 business days to clear, depending on your bank and location. Plan your deposits accordingly to ensure your funds are ready when market opportunities arise.

- Bank Fees: Your originating bank may charge a fee for initiating a wire transfer. Finpros does not charge for deposits, but always check with your financial institution regarding any potential charges for a wire transfer deposit.

- Accuracy: Double-check all bank details before confirming the transfer to avoid any delays or complications in funding your account.

Choosing bank wire transfers for your Finpros deposits is a solid choice for secure and substantial forex funding. It’s a method trusted by institutions and individual traders alike, ensuring your capital is ready when market opportunities arise. Dive into the world of trading with Finpros, confident in your funding method.

Credit and Debit Card Options

Funding your forex trading account should always be straightforward and secure. That’s why credit and debit cards remain one of the most popular and convenient payment methods for traders worldwide. They offer a familiar and reliable way to manage your deposits and withdrawals, letting you focus more on market analysis and less on payment logistics.

Why Traders Love Card Payments:

- Instant Deposits: Most credit and debit card deposits process almost instantly, meaning your funds are available in your trading account without delay. You can seize market opportunities as soon as they arise.

- Universal Acceptance: Major cards like Visa and Mastercard are accepted by virtually all reputable forex brokers, giving you consistent payment options no matter where you trade.

- Enhanced Security: Banks and card providers employ robust security measures, including encryption and fraud protection, to safeguard your financial information.

- Ease of Use: The process is simple. Just enter your card details, the amount, and confirm the transaction – something you likely do everyday.

Important Considerations for Card Users:

While cards offer immense convenience, it’s wise to be aware of a few points:

| Aspect | Details to Note |

|---|---|

| Processing Fees | Some brokers or card providers might charge a small fee for deposits or withdrawals. Always check your broker’s terms and conditions. |

| Withdrawal Times | While deposits are fast, withdrawals to credit or debit cards typically take a few business days to process and reflect in your bank account, depending on your bank and the broker. |

| Verification | For your security and compliance, brokers usually require you to verify your card by submitting a copy. This is a standard anti-money laundering (AML) procedure. |

| Deposit Limits | Minimum and maximum deposit limits apply. These vary per broker and often depend on your account verification level. |

Utilizing your credit or debit card for forex transactions offers a familiar and efficient path to the markets. Always confirm the specific terms with your chosen broker to ensure a seamless funding experience.

E-Wallets and Online Payment Systems

The fast-paced world of forex trading demands equally swift and secure methods for managing your funds. This is where e-wallets and various online payment systems step in, revolutionizing how traders deposit and withdraw capital. Gone are the days of long waits and complex banking processes. Modern digital solutions offer unparalleled convenience, allowing you to focus more on market analysis and less on administrative hassles.

Think of these systems as your personal financial express lane for trading. They provide a vital link between your bank account or credit card and your trading platform, streamlining every transaction. Whether you are funding your account to seize a sudden market opportunity or making withdrawals after a successful trade, the speed and efficiency of these digital tools are unmatched.

Advantages of Using E-Wallets and Online Payment Systems for Forex Trading:

- Instant Deposits: Fund your trading account almost immediately, ensuring you never miss a critical market entry point.

- Faster Withdrawals: Enjoy quicker access to your profits compared to traditional banking methods, often within hours or a few business days.

- Enhanced Security: Many systems offer advanced encryption and fraud protection, adding an extra layer of security to your financial information. You often share fewer personal banking details directly with your broker.

- Global Accessibility: Facilitate international forex transactions with ease, overcoming geographical barriers and currency conversion complexities.

- User-Friendly Interfaces: Most platforms are designed for simplicity, making deposits and withdrawals straightforward, even for new traders.

- Transaction Tracking: Keep a clear record of your financial movements within a single, dedicated platform.

Choosing the right online payment system can significantly improve your trading experience. It’s about more than just moving money; it’s about empowering your trading strategy with reliable and efficient financial infrastructure. Embrace these digital solutions to ensure your focus remains squarely on the opportunities the global currency markets present.

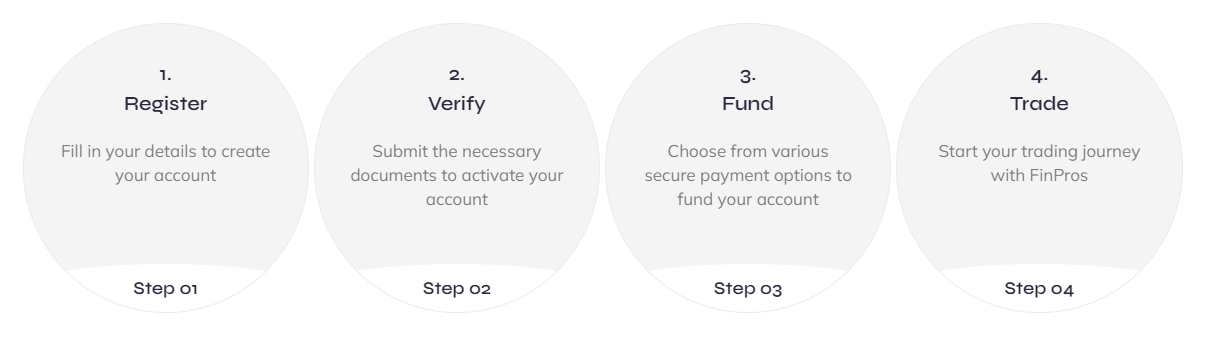

Step-by-Step Guide: How to Make a Finpros Deposit

Ready to dive into the exciting world of forex trading with Finpros? Your journey starts with funding your account. Making a Finpros deposit is a straightforward process designed for your convenience and security. We want to help you get your investment capital into your trading account quickly so you can seize market opportunities without delay. Let’s walk through the simple steps to fund your trading account and start exploring the vast potential of the financial markets.

Here’s how you can easily add funds to your Finpros account:

-

Log In to Your Finpros Account

Your first step is always to access your personal Finpros trading account. Head over to the Finpros website and enter your username and password. This takes you to your secure client portal, which is the hub for all your trading activities and account management.

-

Navigate to the Deposit Section

Once you are logged in, look for a prominent “Deposit,” “Fund Account,” or “Cashier” button or link. You typically find this in the main menu, on your dashboard, or within your account management area. Clicking this will lead you to the Finpros deposit page where all your funding options are laid out.

-

Choose Your Preferred Deposit Method

Finpros offers a variety of convenient deposit methods to suit your needs. You’ll likely see options such as credit/debit cards (Visa, MasterCard), bank transfers, and various e-wallets. Select the method that works best for you. Each method comes with its own processing times and potential limits, so pick the one that aligns with your urgency and financial setup.

-

Enter Your Deposit Amount

Now, clearly state how much money you wish to deposit into your Finpros trading account. Be mindful of the minimum deposit requirement, which the platform will usually display. Always ensure you are depositing an amount you are comfortable with and that aligns with your trading strategy and risk management plan.

-

Provide Necessary Payment Details

Depending on your chosen method, you will need to input specific information. For credit/debit cards, this includes card number, expiry date, and CVV. For bank transfers, Finpros will provide you with their bank details to complete the transfer from your bank. E-wallet deposits will usually redirect you to your e-wallet provider’s secure payment gateway for authentication.

-

Review and Confirm Your Transaction

Before finalizing anything, take a moment to review all the details of your Finpros deposit. Double-check the amount, the chosen method, and any personal information. Accuracy is key here to avoid any delays. Once you are certain everything is correct, hit the “Confirm” or “Submit” button.

-

Complete the Security Verification (if applicable)

For enhanced security, some payment methods or amounts may trigger an additional verification step. This could involve a one-time password sent to your phone or email, or a redirection to your bank’s secure verification page. Follow the prompts to complete this step.

-

Monitor Your Account for Funds

After successful completion, Finpros will process your deposit. Funds from credit cards and e-wallets often appear in your account almost instantly, allowing you to start trading forex right away. Bank transfers might take a bit longer, typically 1-3 business days, depending on bank processing times. You can always check your account balance on your Finpros dashboard.

Important Considerations for Your Finpros Deposit:

- Verification: Ensure your Finpros account is fully verified to avoid any withdrawal delays later on. This often involves submitting identity and address proofs.

- Fees: While Finpros strives to offer fee-free deposits, some payment providers or banks might impose their own charges. Always check the terms before confirming.

- Currency: Be aware of the currency your account is in and the currency you are depositing. Currency conversion fees might apply if they differ.

- Support: If you encounter any issues or have questions during the Finpros deposit process, do not hesitate to contact Finpros customer support. They are there to help!

With your account funded, you are now ready to explore the exciting possibilities of the financial markets and execute your trading strategies. Happy trading!

Accessing the Deposit Section in Your Account

Ready to power up your trading journey? The first step is often to fund your account, and that’s where the deposit section comes into play. Think of it as your financial control center, a dedicated space designed for you to seamlessly add funds to your trading capital. We’ve made accessing it straightforward and secure, ensuring you can focus on what matters most: your trading strategy.

Getting to this crucial part of your platform is simple. Here’s a quick guide to help you navigate directly to your deposit options:

- Log In to Your Account: Start by securely logging into your trading platform using your credentials. Your security is our top priority, so always ensure you are on our official website.

- Locate the Dashboard/Menu: Once logged in, you’ll typically land on your main dashboard or overview page. Look for a main navigation menu, often found on the top bar or a sidebar. Common labels include “Account,” “My Funds,” “Wallet,” or a simple icon representing your profile.

- Find the “Deposit” or “Funds” Option: Within this menu, you’ll quickly spot an option clearly labeled “Deposit,” “Add Funds,” or “Fund My Account.” Click on this to proceed.

- Enter the Deposit Section: Congratulations! You are now in the dedicated deposit section. Here, you will find a variety of payment methods available to fund your trading account, along with instructions for each.

Once inside, you’ll discover a user-friendly interface that presents all your available secure deposit process options. From traditional bank transfers to modern e-wallets, we offer a variety of payment methods designed for your convenience. This section is also where you can often view your deposit history and manage your account balance, providing a clear overview of your financial dashboard.

“A well-funded account is the foundation of confident trading. Our deposit section is crafted for ease and security, giving you peace of mind.”

We constantly work to ensure every transaction is smooth and efficient, allowing you to quickly move from funding to active trading. Should you ever encounter any questions while trying to access or use the deposit section, our dedicated support team is always ready to assist you.

Selecting Your Preferred Method and Inputting Amount

Once you’re ready to fund your trading journey, the next critical step is straightforward yet important: selecting your deposit method and deciding how much capital to allocate. This process is designed for your convenience, offering a variety of secure options to get you trading quickly. Think of it as opening the gateway to the financial markets.

Choosing Your Deposit Method

Forex brokers understand that traders come from diverse backgrounds with different banking preferences. This is why you’ll find a wide array of payment solutions. Your choice often depends on factors like transaction speed, fees, and the availability of the method in your region. Always aim for a method you trust and are familiar with.

Commonly available deposit methods include:

- Credit/Debit Cards: Visa, MasterCard, and sometimes American Express are popular for their instant processing and ease of use.

- Bank Wire Transfers: Ideal for larger sums, offering high security, though processing times can be longer, usually 1-3 business days.

- E-Wallets: Services like Skrill, Neteller, PayPal, and WebMoney provide fast transactions and an extra layer of privacy.

- Local Payment Solutions: Depending on your country, you might find specific local bank transfers or online payment services.

Inputting Your Amount

After choosing your preferred method, you’ll need to specify the amount you wish to deposit. This is a crucial decision that should align with your trading strategy and risk tolerance. Most brokers have a minimum deposit requirement, so make sure your chosen amount meets this threshold.

Consider the following when inputting your amount:

| Consideration | Details |

|---|---|

| Minimum Deposit | Ensure your amount meets the broker’s lowest acceptable deposit. |

| Risk Capital | Only deposit funds you can afford to lose; never trade with essential living expenses. |

| Trading Strategy | Your capital should support your chosen strategy (e.g., long-term vs. short-term, lot sizes). |

| Leverage | Understand how your deposit interacts with leverage to manage exposure. |

Once you confirm your amount and method, you’ll typically be redirected to a secure payment gateway to complete the transaction. Always double-check all details before finalizing. A smooth deposit process sets the stage for a confident start to your trading activities.

“Success in trading starts with smart preparation. Choosing your funding method wisely and allocating capital responsibly are the first trades you make.”

Confirming and Finalizing Your Finpros Deposit

Once you’ve initiated your deposit with Finpros, the next crucial step is ensuring everything is confirmed and your funds are ready for trading. We’ve streamlined this process to be as efficient and transparent as possible, so you can focus on what matters: the market.

Here’s what to expect as you finalize your Finpros transaction:

- Instant Notifications: Immediately after your deposit request, you’ll receive an email or an in-platform notification confirming that we’ve received your request. This is your first peace of mind that the Finpros deposit confirmation process has begun.

- Processing Timeframes: The time it takes for your funds to reflect in your trading account depends on the method you chose. E-wallets and credit/debit card deposits are typically near-instantaneous. Bank transfers might take a bit longer due to banking protocols, usually within 1-3 business days. We always aim for the quickest possible account funding Finpros experience.

- Account Balance Update: The ultimate confirmation comes when your trading account balance updates. You can easily check this by logging into your Finpros client portal. Navigate to the ‘My Account’ or ‘Wallet’ section to see your new available balance.

- Confirmation Email: Upon successful processing and the funds reflecting in your account, Finpros will send you a final confirmation email. This message serves as your official record that your deposit is complete and you’re ready to trade.

We prioritize the security and integrity of all your transactions. Rest assured, every step of confirming and finalizing your Finpros deposit is handled with the highest level of encryption and diligence, giving you a secure Finpros deposit experience every time.

Finpros Deposit Limits: Minimums, Maximums, and Currency

Understanding the ins and outs of depositing funds into your Finpros trading account is crucial for a seamless trading experience. At Finpros, we strive to offer flexibility while maintaining security and regulatory compliance. This means having clear guidelines on how much you can deposit, and in which currencies, ensuring you can manage your account balance effectively from the get-go. Knowing these parameters helps you plan your funding strategy without unexpected hitches.

Minimum Deposit Requirements

Getting started with Finpros is straightforward, and we’ve set an accessible minimum deposit amount to welcome traders of all levels. Our aim is to lower the entry barrier, allowing more individuals to explore the exciting world of forex trading. Typically, the initial minimum deposit is designed to let you open a live account and place your first trades with a comfortable sum. Always check the specific requirements on your account type, as these can sometimes vary. This initial funding helps you build your trading capital and gain practical experience.

Maximum Deposit Limits

While we believe in providing ample flexibility, Finpros also implements maximum deposit limits. These limits are put in place for several reasons, including security protocols, regulatory compliance, and responsible trading practices. It’s important to understand that your maximum deposit limit might not be a fixed, universal number. Factors influencing this can include:

- Your chosen deposit methods (e.g., bank transfer, credit/debit card, e-wallets).

- Your account verification status (fully verified accounts often have higher limits).

- Jurisdictional regulations that may impose specific transaction limits.

For high-volume traders or those looking to deposit larger sums, contacting Finpros customer support is always a good idea to discuss your options and potential adjustments to the maximum deposit limit.

Supported Currencies for Funding Your Account

Finpros understands that our global client base requires diverse currency options for funding their accounts. We support a range of major currencies to make your deposit process as convenient as possible, minimizing conversion fees and simplifying your financial management. When you fund your Finpros account, you can typically choose from:

Available Deposit Currencies:

- USD (United States Dollar)

- EUR (Euro)

- GBP (Great British Pound)

- AUD (Australian Dollar)

- CAD (Canadian Dollar)

Choosing your base currency at account registration is important, as your account will typically be denominated in this currency. While you can often deposit in other supported currencies, be aware that a conversion fee might apply if it differs from your account’s base currency. This ensures transparency when you manage your funds and view your account balance.

Finpros Deposit Fees and Processing Times Explained

Understanding the financial practicalities of your trading platform is crucial for efficient forex operations. When you choose Finpros, knowing about deposit fees and processing times helps you manage your capital effectively and avoid any surprises. We believe in transparent financial operations, ensuring you have all the information at your fingertips before you even make your first deposit.

At Finpros, we strive to make your funding experience as seamless and cost-effective as possible. Our primary goal is to help you get started with trading quickly, without unnecessary hurdles or hidden charges. Let’s break down what you can expect when adding funds to your Finpros account.

Deposit Fees at Finpros

Many traders worry about deposit fees eating into their initial capital. We understand this concern. Finpros maintains a policy of zero deposit fees for most of our widely used payment methods. This means that when you deposit funds into your trading account, the full amount you send is the amount credited to your balance, ready for trading. We absorb the transaction costs on our end, so you don’t have to.

While Finpros strives to offer fee-free deposits, some payment providers or banks might impose their own charges. Always check the terms before confirming.

However, it’s important to note a few exceptions:

- Your chosen payment provider (e.g., your bank, e-wallet service) might levy their own charges for transferring funds. We recommend checking with them directly about any outbound transaction fees they may apply.

- For certain less common or international transfer methods, a small fee might be applied by Finpros. Any such fees will always be clearly stated at the point of deposit before you confirm the transaction.

Our commitment is to transparency. You will always see the exact amount that will be credited to your account, along with any potential deductions, before finalizing your deposit.

Deposit Processing Times

Timeliness is key in the fast-paced world of forex trading. We work hard to ensure your deposits are processed as quickly as possible, allowing you to seize market opportunities without delay. The processing time largely depends on the payment method you select:

| Payment Method | Typical Processing Time | Notes |

|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Instant | Funds are usually available in your account within minutes. |

| E-wallets (Skrill, Neteller, PayPal) | Instant | Fastest option, perfect for immediate trading needs. |

| Bank Wire Transfers | 1-3 Business Days | Processing time can vary based on your bank and international banking holidays. |

| Local Bank Transfers | Same Day – 1 Business Day | Often quicker than international wires, depending on your region. |

While we process all incoming transactions swiftly on our end, external factors can sometimes influence the final crediting time. These include:

- Bank Holidays: Deposits made during public holidays or weekends may experience slight delays.

- Verification Procedures: For your security and compliance, larger deposits or deposits from new sources might require additional verification, which could add a short delay.

- Payment Provider Delays: Rarely, issues on the side of the payment service provider can cause unexpected hold-ups.

Rest assured, our dedicated support team constantly monitors deposit flows and is always ready to assist if you encounter any issues or have questions regarding your transaction status. Our aim is to make funding your Finpros trading account straightforward, cost-effective, and fast, so you can focus on what matters most: your trading strategy.

Ensuring the Security of Your Finpros Deposit Transactions

When you decide to trade the forex market, the safety of your funds remains your top priority. At Finpros, we understand this concern deeply. We put robust measures in place to ensure every single one of your deposit transactions is secure, giving you peace of mind to focus on your trading strategy. Your financial security is not just a feature; it’s a fundamental part of our commitment to you.

We employ a multi-layered approach to safeguard your capital from the moment you initiate a deposit. This comprehensive strategy protects your funds against unauthorized access and potential threats, allowing you to fund your account with complete confidence.

Our Core Security Pillars:

- Regulatory Compliance: Finpros operates under strict regulatory oversight. Adhering to these rigorous standards means we follow specific rules for client fund management and operational transparency, ensuring a secure environment for your investments.

- Segregated Client Accounts: We hold all client funds in separate bank accounts, completely distinct from the company’s operational capital. This segregation ensures that your money remains untouched and protected, even in unforeseen circumstances, offering unparalleled deposit protection.

- Advanced Encryption Technology: All data transmissions, including your personal and financial information during deposit transactions, are secured using state-of-the-art SSL encryption. This technology creates an encrypted link between our server and your browser, making sure your sensitive data stays private and secure from cyber threats.

- Secure Payment Gateways: We partner exclusively with reputable and secure payment service providers. These established gateways use their own advanced security protocols to process your transactions, adding another layer of protection to your funds.

- Two-Factor Authentication (2FA): For an added layer of security, we encourage and support the use of Two-Factor Authentication for account access and sensitive operations. This means you need two forms of identification to log in or confirm a transaction, significantly reducing the risk of unauthorized access to your Finpros account.

Your trust is paramount, and we continually upgrade our security infrastructure to meet evolving challenges. We regularly review and enhance our protocols to maintain the highest standards of safety for your Finpros deposit transactions and overall trading experience. Our dedicated team actively monitors all systems around the clock, ready to address any potential vulnerabilities swiftly. We are committed to making your journey with Finpros both profitable and incredibly secure.

Troubleshooting Common Finpros Deposit Issues

Ever hit that “deposit” button only to be met with an error message or, worse, nothing at all? It’s frustrating, right? Especially when you’re eager to get back into the market and seize a trading opportunity. Don’t worry, many common Finpros deposit problems are straightforward to solve. As your dedicated guide, I’ll walk you through the most frequent snags and how to get your funds where they need to be, quickly and smoothly, ensuring your trading journey remains uninterrupted.

When you encounter a situation where your Finpros funding failed, it can stem from several typical causes. Perhaps you made a simple typo in your card number or expiry date, or maybe you’ve encountered insufficient funds in your bank account. Sometimes, a bank or card issuer might place a security restriction on online transactions, especially with international brokers, leading to a “deposit declined” message. Other times, you might be using an unsupported payment method for your region, or have inadvertently exceeded daily transaction limits set by either Finpros or your payment provider. Even temporary technical glitches can sometimes cause a Finpros payment issue that prevents your deposit from showing on Finpros immediately.

Don’t let a stalled deposit disrupt your trading strategy. Here’s a powerful action plan with simple steps to effectively troubleshoot Finpros deposits and get your capital ready:

- Verify Your Information Meticulously: First and foremost, meticulously re-enter all your payment details. A small error in card numbers, expiration dates, or security codes can prevent your funds from processing. Double-check everything before confirming.

- Check Your Available Balance: Confirm you have enough funds in your chosen account. It’s a fundamental step that’s easy to overlook, but vital for successful transactions.

- Contact Your Bank or Card Issuer: If your deposit was declined, a quick call to your bank can often clear things up. Explain you’re making a legitimate transaction to Finpros. They can remove any temporary blocks or clarify the reason for the rejection.

- Explore Alternative Payment Methods: If one option isn’t working, consider using another. Finpros typically supports various methods like bank transfers, popular e-wallets, and different card options. Trying an alternative can often be a fast Finpros deposit solution.

- Review Transaction Limits: Be aware of both Finpros’ deposit limits and any set by your bank or payment provider. If you’ve hit a ceiling, adjust your deposit amount accordingly or wait for the limit to reset.

- Address Technical Hiccups: For web-based deposits, a simple browser refresh, or clearing your cache and cookies, can sometimes resolve minor technical issues. You could also try a different browser or device to rule out local software problems.

To help you ensure a smooth deposit process, here’s a quick reference:

| Deposit Checklist Item | What to Verify |

|---|---|

| Payment Details | Accuracy of card number, expiry, CVV, account details. |

| Account Balance | Sufficient funds in bank/e-wallet. |

| Bank Approval | No security blocks or flags from your bank. |

| Method Compatibility | Selected method supported in your region and by Finpros. |

| Transaction Limits | Staying within daily/per-transaction limits. |

You’ve tried everything, and your “why Finpros deposit declined” issue persists? Don’t let it become a major headache. It’s time to leverage the experts. Don’t hesitate to contact Finpros support. When you reach out, provide them with as much detail as possible. This includes the exact time and date of the attempted deposit, the payment method you used, any specific error messages you received, and the steps you’ve already taken to troubleshoot. Their dedicated team is there to assist you, investigate the specific reasons behind your deposit not showing Finpros, and guide you through the next steps to ensure your funds reach your trading account without unnecessary delays.

What Happens After a Successful Finpros Deposit?

Congratulations! You just completed a successful deposit with Finpros. This isn’t just a transaction; it’s your gateway to the exciting world of financial markets. You’ve taken a significant step toward unlocking your trading potential. So, what comes next? Let’s walk through the immediate and thrilling opportunities that open up for you.

Immediately after your funds clear, your Finpros trading account becomes fully active and ready for live trading. Our system confirms your deposit swiftly, often within minutes for common payment methods. You’ll typically receive an email confirmation, a digital high-five, if you will, confirming that your capital is now accessible within your secure account area. This means you have full control over your deposited funds and can start navigating the vast forex trading landscape.

Here’s what you can expect:

- Full Platform Access: Dive straight into our cutting-edge Finpros trading platform. Whether you prefer our intuitive web trader or a robust desktop application, all features are now at your fingertips. Explore real-time market data, interactive charts, and a wide array of technical indicators. Place your first trades, set pending orders, and manage your positions with confidence.

- Unleash Educational Resources: Your journey just began, and we’re here to support you every step of the way. With a funded account, you gain complete access to our comprehensive suite of educational materials. This includes in-depth tutorials, webinars led by industry experts, market analysis reports, and strategic guides designed to sharpen your skills. Learn effective risk management techniques and develop a robust trading strategy.

- Dedicated Support: Our professional customer support team is on standby to assist you. Whether you have questions about specific trading instruments, need help navigating the platform, or require clarification on market events, we are just a click or call away. We ensure your trading experience remains smooth and uninterrupted.

- Explore Trading Opportunities: The financial world never sleeps, and neither do the opportunities. With your funded Finpros account, you can access a diverse range of assets, including major and minor currency pairs, commodities, indices, and more. Use our tools to identify potential entry and exit points, analyze market trends, and execute your trades with precision.

Your successful deposit with Finpros empowers you to engage directly with the global markets. It’s an invitation to apply your knowledge, test your strategies, and pursue your financial goals. Get ready to experience the dynamic thrill of forex trading!

Managing Your Funds: Finpros Withdrawals Post-Deposit

You’ve made your initial deposit, dived into the exciting world of forex trading with Finpros, and now you’re thinking about accessing your earnings or managing your capital. Understanding the Finpros withdrawal process post-deposit is just as crucial as understanding how to place a trade. It’s about securing your financial gains and ensuring seamless access to your money whenever you need it. At Finpros, we make sure that your journey from deposit to successful profit withdrawal is straightforward and secure.

Your ability to efficiently manage your capital, including withdrawing funds, defines a significant part of your trading experience. We know you work hard for your profits, and we’ve designed our system to reflect that dedication. Let’s walk through how you can confidently access your funds and maintain excellent financial control.

Navigating the Finpros Withdrawal Process

Initiating a withdrawal from your Finpros account is designed for clarity and security. Once you decide to withdraw a portion of your profits or initial capital, follow these simple steps:

- Log In to Your Account: Access your secure Finpros client portal using your credentials.

- Locate the Withdrawal Section: Navigate to the ‘Funds’ or ‘Wallet’ section, and then select ‘Withdraw Funds.’

- Choose Your Method: Select your preferred withdrawal method. Finpros typically offers various options, often mirroring your deposit methods for enhanced security and compliance.

- Enter Withdrawal Amount: Clearly specify the exact amount you wish to withdraw from your available balance.

- Confirm Details: Review all transaction details carefully before submitting your request. This helps prevent any delays.

After submission, our team processes your request. You will receive notifications regarding the status of your Finpros withdrawal, keeping you informed every step of the way.

Key Considerations for Smooth Financial Management

To ensure your fund withdrawal is as smooth as possible, keep a few important points in mind:

- Account Verification: We prioritize your security. Fully verified accounts experience the fastest processing times. If you haven’t completed your KYC (Know Your Customer) documents, do so before attempting a large withdrawal. This includes providing identification and proof of address.

- Withdrawal Methods: We generally recommend using the same method for withdrawal as you used for your initial deposit. This is a standard anti-money laundering (AML) practice and often speeds up the process. Common methods include bank wire transfers, credit/debit cards, and various e-wallets.

- Processing Times: While Finpros processes requests promptly, the actual time for funds to appear in your account can vary. Factors like the chosen method, bank processing times, and international holidays can influence this. We always aim for efficiency in delivering your funds.

- Fees: Be aware of any potential fees associated with certain withdrawal methods. Finpros strives to keep these transparent, so always check the terms on the withdrawal page.

Proactive Fund Management Strategies

Effective financial management goes beyond just trading. It includes planning your fund withdrawals. Here are some strategies:

Consider setting regular financial goals that involve profit taking. For instance, if you hit a certain profit target, plan to withdraw a portion. This helps you lock in gains and manage your trading capital responsibly. Never withdraw funds that you actively need to maintain open positions or meet margin requirements. Always leave sufficient capital to manage your ongoing trades effectively and avoid margin calls.

Benefits of Timely Withdrawals:

| Benefit | Description |

|---|---|

| Secures Profits | Removes earned funds from market exposure. |

| Boosts Confidence | Seeing real returns validates your trading strategy. |

| Financial Flexibility | Allows you to use your earnings for personal expenses or investments. |

| Manages Risk | Reduces the amount of capital at risk in your trading account. |

Your journey with Finpros is about empowering you with the tools and support to trade successfully and manage your finances confidently. We are committed to making your withdrawal experience as secure and straightforward as your trading experience. If you ever have questions about the process or need assistance, our dedicated support team is always ready to help you navigate your fund management needs.

Finpros Deposit FAQs

Ready to power up your trading journey with Finpros? We understand that getting your funds into your account should be a smooth and straightforward process. This section is your go-to guide for all your deposit-related questions, ensuring you can quickly fund your trading account and seize those market opportunities. We’ve compiled the most common inquiries to make your experience hassle-free. Let’s dive into the details so you can deposit funds with confidence and start trading sooner!

Your Top Deposit Questions Answered

- What payment methods can I use to deposit funds?

- Finpros offers a variety of convenient payment methods to suit your needs. You can typically deposit using major credit/debit cards (Visa, MasterCard), bank wire transfers, and popular e-wallets (like Skrill and Neteller). We constantly review our options to provide secure and efficient ways for you to fund your account. Always check the deposit section within your client portal for the most current and available methods in your region.

- What is the minimum deposit required to start trading with Finpros?

- The minimum deposit amount is designed to be accessible, allowing traders of all levels to get started. While it can vary based on your chosen account type and payment method, it’s typically set at a reasonable entry point. You’ll find the specific minimum deposit requirement clearly stated in your Finpros client portal when you initiate a deposit.

- How long does it take for my Finpros deposit to process?

- Processing times depend on the selected payment method. Deposits via credit/debit cards and e-wallets are usually instant or completed within minutes. Bank wire transfers may take 1-5 business days to clear, depending on your bank and international banking procedures. Finpros always aims to process secure transactions as quickly as possible.

- Does Finpros charge any fees for deposits?

- Finpros generally maintains a policy of zero deposit fees for most widely used payment methods. However, your own bank or chosen payment provider might levy their own charges for transferring funds. Any potential Finpros fees for less common methods will be transparently displayed before you confirm your transaction.

- How does Finpros ensure the security of my deposit transactions?

- Finpros employs a multi-layered security approach for all deposit transactions. This includes strict regulatory compliance, segregating client funds in separate bank accounts, utilizing advanced SSL encryption technology, partnering with secure payment gateways, and encouraging Two-Factor Authentication (2FA) for added protection against unauthorized access.

Tips for a Seamless Deposit Experience

- Verify Your Account Early: Complete your account verification as soon as you open your account to avoid any delays when you’re ready to deposit.

- Check Payment Provider Limits: Be aware of any daily or transactional limits imposed by your bank or e-wallet service.

- Use Your Own Account: Always deposit funds from a payment method registered in your own name. Third-party deposits are strictly prohibited for security reasons.

- Keep Records: Save confirmation emails or transaction screenshots until your funds reflect in your trading account.

At Finpros, we’re committed to providing a secure and efficient environment for all your financial operations. Our aim is to make funding your trading account as easy as possible, allowing you to focus on what matters most: your trading strategy. Should you have any further questions or require assistance, our customer support team is always ready to help you navigate your deposit journey.

Are there any Finpros deposit bonuses available?

Many traders eagerly look for deposit bonuses when choosing a forex broker, and it’s a smart move to maximize your trading capital. Regarding Finpros, their approach to promotional offers, including deposit bonuses, can change based on their marketing strategy and regulatory environment. Brokerage firms often adjust their campaigns, so what might be available today could be different tomorrow, or vice versa.

Historically, deposit bonuses have been a popular incentive for new clients. These bonuses typically involve the broker matching a percentage of your initial deposit, effectively boosting your trading account balance. This extra capital can give you more leverage or allow you to open larger positions, potentially enhancing your trading experience right from the start. However, it’s crucial to understand that these funds often come with specific trading requirements before you can withdraw them.

To get the most accurate and up-to-date information on any Finpros deposit bonuses or other promotions, the best course of action is always to check their official website directly. Brokers usually dedicate a specific section to “Promotions,” “Bonuses,” or “Offers.” Alternatively, you can reach out to Finpros customer support. They are equipped to provide the latest details on any available schemes, their eligibility criteria, and the specific terms and conditions attached.

When considering any bonus, always pay close attention to the small print. Key elements to look for include:

- Minimum Deposit: The smallest amount you need to deposit to qualify for the bonus.

- Bonus Percentage: How much of your deposit the broker will match (e.g., 50% or 100%).

- Trading Volume Requirements: The amount you need to trade before you can withdraw the bonus funds or profits generated from them.

- Time Limits: Whether the bonus expires if you don’t meet the conditions within a certain timeframe.

- Eligible Accounts: If the bonus applies to specific account types only.

Understanding these terms ensures you can make an informed decision and fully benefit from any Finpros deposit bonuses without unexpected surprises. Always trade responsibly, whether you use bonus funds or your own capital.

Can I deposit using a third-party account?

This is a common question, and it’s important to understand the standard practice across the financial industry, especially in the world of forex trading. For the vast majority of regulated brokers, including ours, the answer is a clear no. You cannot deposit funds into your trading account using a third-party account.

Our strict policy on deposits directly relates to the security of your funds and compliance with international financial regulations. We prioritize keeping your money safe and ensuring all transactions are legitimate and traceable. Think of it as a protective measure for everyone involved.

Here’s why third-party deposits are not permitted:

- Regulatory Compliance: We adhere to stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules require us to verify the source of all funds and ensure they originate from the account holder. This prevents illicit financial activities.

- Client Fund Security: Our primary goal is to protect your investment. Allowing deposits from third parties introduces a significant security risk, making it harder to track funds and verify their ownership if any issues arise. This policy safeguards your capital against potential fraud and unauthorized access.

- Fraud Prevention: Disallowing third-party deposits is a critical step in preventing fraud. It ensures that only the verified account holder can fund their trading account, thereby minimizing the risk of someone else using your funds or someone else’s funds being used without proper authorization.

- Account Integrity: Maintaining the integrity of your personal trading account means that all inflows and outflows must directly correlate with the account holder’s verified identity. This ensures a transparent and secure trading environment.

When you are ready to fund your forex trading journey, please ensure that any deposit methods you use – whether it’s a bank transfer, credit card, or e-wallet – are registered directly in your name, matching the details on your trading account. Any attempt to deposit using an account held by a different person or entity will result in the transaction being rejected and the funds returned, potentially causing delays in your ability to trade. We make this process straightforward and secure when you use your own verified accounts.

Conclusion: Making Your Finpros Deposit with Confidence

You’ve journeyed through the details, understood the robust security protocols, and seen firsthand how straightforward making a deposit with Finpros truly is. This isn’t just about moving funds; it’s about setting a solid foundation for your financial aspirations. When you choose Finpros, you’re not just selecting a broker; you’re partnering with a platform dedicated to clarity, security, and your success.

The confidence you feel now comes from knowing that every step of the deposit process is meticulously designed for your peace of mind. From diverse payment methods to advanced encryption, your capital and personal information remain protected. Our commitment to transparent operations ensures you always know what to expect, eliminating any guesswork.

Making your Finpros deposit is more than a transaction; it’s an empowering decision. It signifies your readiness to engage with the markets, explore new opportunities, and take charge of your financial future. We’ve equipped you with all the necessary insights, and now, the path forward is clear and secure.

Here’s what you gain by making that confident step:

- Unwavering Security: Your funds are safeguarded with industry-leading measures.

- Seamless Experience: Enjoy a smooth and user-friendly deposit process.

- Full Support: Access a responsive team ready to assist whenever you need it.

- Market Access: Unlock the full potential of Finpros’s trading tools and opportunities.

Embrace the power of an informed decision. Join the thriving community of traders who trust Finpros to be their reliable gateway to the financial markets. Your trading journey starts with this confident step.

Frequently Asked Questions

What payment methods are available for Finpros deposits?

Finpros offers a variety of convenient payment methods, including major credit/debit cards (Visa, MasterCard), bank wire transfers, and popular e-wallets like Skrill and Neteller. The available options are typically displayed in your client portal.

What are the typical processing times for Finpros deposits?

Deposits made via credit/debit cards and e-wallets are usually processed instantly or within a few minutes. Bank wire transfers may take 1-5 business days to clear, depending on your bank and international banking procedures.

Does Finpros charge fees for deposits?

Finpros generally does not charge deposit fees for most widely used payment methods. However, your bank or chosen payment provider might apply their own charges for transactions. Any potential fees from Finpros will be clearly stated before you confirm your deposit.

What are Finpros’ minimum and maximum deposit limits?

The minimum deposit is designed to be accessible, varying by account type and payment method. Finpros also implements maximum deposit limits for security and regulatory compliance. These limits can depend on your chosen method, account verification status, and jurisdictional regulations.

How does Finpros ensure the security of deposit transactions?

Finpros prioritizes security through regulatory compliance, segregated client accounts, advanced SSL encryption technology for data transmissions, partnerships with secure payment gateways, and encouraging Two-Factor Authentication (2FA) for account access and sensitive operations.