Ever dreamed of navigating the exciting world of forex trading without the fear of financial loss? The Finpros demo account is your perfect starting point. It’s an invaluable tool designed for both beginners taking their first steps and experienced traders looking to refine their trading strategies. This comprehensive guide will walk you through everything you need to know about harnessing the power of a risk-free trading environment, helping you build confidence and competence in the financial markets.

- What is a Finpros Demo Account?

- Key Benefits of a Finpros Demo Account

- Zero Financial Risk

- Benefits of Trading with Zero Financial Risk:

- Strategy Development and Testing

- Testing Your Strategy: From Past to Present

- Step-by-Step: Opening Your Finpros Demo Account

- Why Start with a Finpros Demo Account?

- Your Path to Practical Trading:

- Registration Process

- Why a Smooth Registration Matters

- Account Configuration

- Key Aspects of Your Forex Trading Account Configuration:

- Exploring the Features of the Finpros Demo Platform

- Virtual Funds and Assets

- Analytical Tools and Indicators

- Technical Analysis: Uncovering Price Patterns

- Fundamental Analysis: Understanding Market Drivers

- How to Effectively Use Your Finpros Demo for Practice

- Key Strategies for Maximizing Your Finpros Demo Experience:

- Simulating Real Market Conditions on Finpros Demo

- Advantages of Practicing on a High-Fidelity Demo Account:

- Setting Up Your Virtual Portfolio with Finpros Demo

- Transitioning from Your Finpros Demo to Live Trading

- Readiness Assessment

- What to Expect in a Live Account

- Is the Finpros Demo Account Free and Unlimited?

- What does “unlimited” really mean for you?

- Common Pitfalls to Avoid While Using a Finpros Demo

- Advanced Tips for Maximizing Your Finpros Demo Experience

- Refine Your Strategy, Don’t Just Test It

- Embrace the Full Suite of Order Types

- Simulate Real-World Psychological Pressures

- Who Should Use a Finpros Demo Account?

- Conclusion: Why Choose the Finpros Demo for Your Trading Journey

- Frequently Asked Questions

What is a Finpros Demo Account?

Stepping into the dynamic world of forex trading can feel overwhelming, especially for newcomers. That’s where the Finpros Demo Account becomes your essential first stop. Think of it as your personal, risk-free training ground, a place where you can explore the intricacies of the forex market without putting a single cent of your actual capital at risk. It’s a powerful tool designed to help you build confidence and master the ropes before you engage in live trading.

A Finpros Demo Account provides a fully simulated trading environment. It replicates the live trading experience, giving you access to the same robust trading platform, real-time market conditions, and a wide array of currency pairs, commodities, and indices. The key difference? You trade with virtual funds, not your own money. This means you can experiment freely, make mistakes, and learn from them without any financial consequences.

Think of it as your personal forex simulator. You get to experience the dynamic ups and downs of the global currency market, execute trades, set stop-losses, and take profits, just like you would in a live account. The prices, charts, and news feeds are all real-time, giving you an authentic experience. It’s the perfect stepping stone for anyone looking to enter the world of forex, from absolute beginners to seasoned traders wanting to test new tactics.

This is perhaps the most crucial tip. Although you’re using virtual funds, pretend every trade involves your hard-earned capital. Develop discipline, manage your virtual funds responsibly, and avoid reckless decisions. This mindset builds good habits essential for when you eventually move to live forex trading and encounter real psychological pressure.

Key aspects of a demo account include:

- Virtual Funds: You receive a significant amount of fictional money to trade with.

- Real Market Conditions: Experience live price movements, spreads, and market volatility.

- Access to Tools: Utilize all the charting tools, indicators, and order types available on a live platform.

- No Risk Involved: Since it’s not real money, there’s zero financial risk to your personal funds.

- Practice Ground: An ideal space to develop and refine your trading skills and strategies.

In short, a demo account is your ultimate risk-free training ground. It empowers you to build confidence and understanding before you ever put real money on the line.

Key Benefits of a Finpros Demo Account

Choosing the right platform for practice trading makes all the difference. Finpros stands out by offering a robust and realistic trading platform experience that closely mirrors live trading. We believe in empowering our users with the best possible tools, ensuring your learning curve is efficient and effective. Our Finpros demo account provides access to a comprehensive suite of features, allowing you to truly immerse yourself in the financial markets.

Stepping into the world of forex trading can feel daunting, but it doesn’t have to be. A Finpros demo account offers a powerful, risk-free environment to explore, learn, and master your trading skills before you commit any real capital. Think of it as your personal sandbox, perfectly mirroring the live market without any financial pressure. This invaluable tool provides a crucial stepping stone for both beginners and experienced traders looking to refine their strategies.

You get to experience the full functionality of the Finpros trading platform. Navigate through different currency pairs, execute trades, set stop-loss and take-profit orders, and use all the analytical tools at your disposal. All of this happens with virtual funds, meaning every decision you make, every profit you earn, and every loss you incur teaches you a vital lesson without affecting your wallet. It is the ultimate practice ground for developing a robust trading mindset.

Practicing with virtual funds on a platform that mirrors the live environment allows you to develop critical skills that purely theoretical knowledge can’t provide. You learn to interpret market volatility, manage your virtual capital under pressure, and refine your risk-free trading strategies without the fear of financial loss. This hands-on experience is vital for building confidence and discipline, two cornerstones of successful trading.

Here are some compelling reasons why a Finpros demo account is an indispensable part of your trading journey:

- Risk-Free Exploration: Dive deep into the forex market without any financial exposure. Test your theories, make mistakes, and learn from them in a safe space. This allows you to build confidence at your own pace.

- Platform Mastery: Become intimately familiar with the Finpros platform’s interface, features, and tools. Understand how to place orders, manage positions, and interpret charts efficiently before trading with real money.

- Strategy Development and Testing: Experiment with various trading strategies and indicators. See what works best for different market conditions without the pressure of real losses. You can tweak and optimize your approach until you find what suits your style.

- Market Insight: Gain a practical understanding of how real-time market movements impact your trades. Observe price fluctuations, understand volatility, and learn to react to news events, all in a simulated live environment.

- Discipline Building: Practice emotional control and disciplined trading. A demo account helps you stick to your trading plan and manage risk effectively, essential habits for long-term success in the financial markets.

- Access to Real-Time Data: Despite being a simulation, your Finpros demo account provides access to live market prices. This ensures your learning experience is as realistic and relevant as possible, preparing you for actual trading conditions.

Zero Financial Risk

Imagine diving into the thrilling world of forex trading without the nagging worry of losing your hard-earned money. Sounds too good to be true, right? Well, it’s not. Many top-tier platforms offer incredible opportunities for you to explore, learn, and even strategize with absolutely zero financial risk to your personal capital. This isn’t just a marketing gimmick; it’s a fundamental part of responsible trading education and preparation.

How does this work? Primarily through robust demo accounts. These simulated environments are powerful tools, mirroring live market conditions with precision. You get virtual funds to play with, allowing you to execute trades, observe market movements, and test various strategies as if you were using real money. The only difference? If a trade doesn’t go your way, your actual bank account remains untouched. This safe space is invaluable for newcomers and seasoned traders alike, offering a perfect playground to hone skills and build confidence before taking the plunge into live trading.

Benefits of Trading with Zero Financial Risk:

- Skill Development: Practice placing orders, setting stop-losses, and taking profits in a pressure-free environment.

- Strategy Testing: Experiment with different trading strategies without fear of monetary loss. See what works and what doesn’t.

- Platform Familiarization: Get comfortable with the trading platform’s interface, tools, and features before committing real funds.

- Market Understanding: Develop an intuitive feel for market volatility, price action, and how global events impact currency pairs.

- Emotional Discipline: Learn to manage your trading emotions, which is crucial for long-term success, without the added stress of financial exposure.

We encourage you to leverage these risk-free options. They provide a vital bridge between theoretical knowledge and practical application. You can gain extensive experience, make mistakes, and learn from them without any monetary repercussions. This approach empowers you to become a more informed and confident trader when you eventually decide to enter the live market. Your journey into forex can start with education and exploration, not financial anxiety.

Strategy Development and Testing

Every successful trader knows that consistent gains in the forex market don’t happen by chance. They come from a robust, well-defined approach. This is where mastering forex trading strategies development and rigorous testing becomes your ultimate advantage. Think of it as building a reliable compass before navigating a vast ocean.

Creating your unique trading blueprint involves several critical steps:

- Idea Generation: Start with market observations, technical analysis indicators, or fundamental principles that suggest potential profit opportunities.

- Defining Entry and Exit Rules: Precisely outline the conditions that trigger a trade and those that signal it’s time to close. Ambiguity is the enemy of consistency.

- Position Sizing: Determine how much capital to allocate per trade. This is a crucial element of effective risk management, protecting your capital.

- Stop-Loss and Take-Profit Levels: Set clear points where you will cut losses or secure profits, automating key decisions.

Once you have the theoretical framework, the real work begins: putting your trading plan through its paces. This validation process is non-negotiable for any strategy aiming for long-term viability.

Testing Your Strategy: From Past to Present

| Testing Phase | Description | Key Benefit |

|---|---|---|

| Backtesting | Applying your strategy to historical market data to see how it would have performed. This is your chance to really dive deep into backtesting forex methods. | Identifies historical strengths and weaknesses quickly. |

| Forward Testing (Demo Trading) | Executing your strategy in real-time, using a demo account trading environment with virtual money. | Tests real-world conditions, slippage, and your emotional discipline without financial risk. |

After initial testing, you often find areas for improvement. This leads to strategy optimization, where you fine-tune parameters and rules based on the data you’ve gathered. Remember, the goal isn’t to create a “perfect” strategy – no such thing exists – but rather a resilient one that aligns with your risk tolerance and trading style. This iterative process of testing, analyzing, and refining is what builds confidence and improves your edge in the market.

“An untested strategy is merely a hypothesis. A thoroughly tested strategy is a roadmap to potential profits.”

Step-by-Step: Opening Your Finpros Demo Account

Ready to dive into the exciting world of forex trading but not quite ready to commit real capital? A Finpros demo account is your perfect starting point! It’s like having a sandbox where you can build, test, and refine your trading skills without any financial risk. This invaluable tool gives you access to a realistic forex trading platform, complete with live market conditions and virtual funds. You get to experience the thrill of the market, understand how currency pairs move, and practice your strategies, all from the comfort of your home.

Why Start with a Finpros Demo Account?

Opening a Finpros demo account isn’t just a suggestion; it’s a strategic move for any aspiring trader. Here’s why it’s essential:

- Risk-Free Trading: Experiment with various trading strategies using virtual funds. Make mistakes, learn from them, and never worry about losing real money.

- Familiarize Yourself with the Platform: Get comfortable with the Finpros forex trading platform interface, its tools, charts, and order execution processes. This reduces anxiety when you eventually switch to a live account.

- Test Trading Strategies: Have a new idea for a strategy? Test its effectiveness in real-time market conditions without any commitment. See what works and what doesn’t.

- Understand Market Dynamics: Observe how global events and economic data impact currency prices. Develop your market analysis skills.

- Build Confidence: Gain the confidence you need before entering the live market. A successful run on a demo account can be incredibly motivating.

Your Path to Practical Trading:

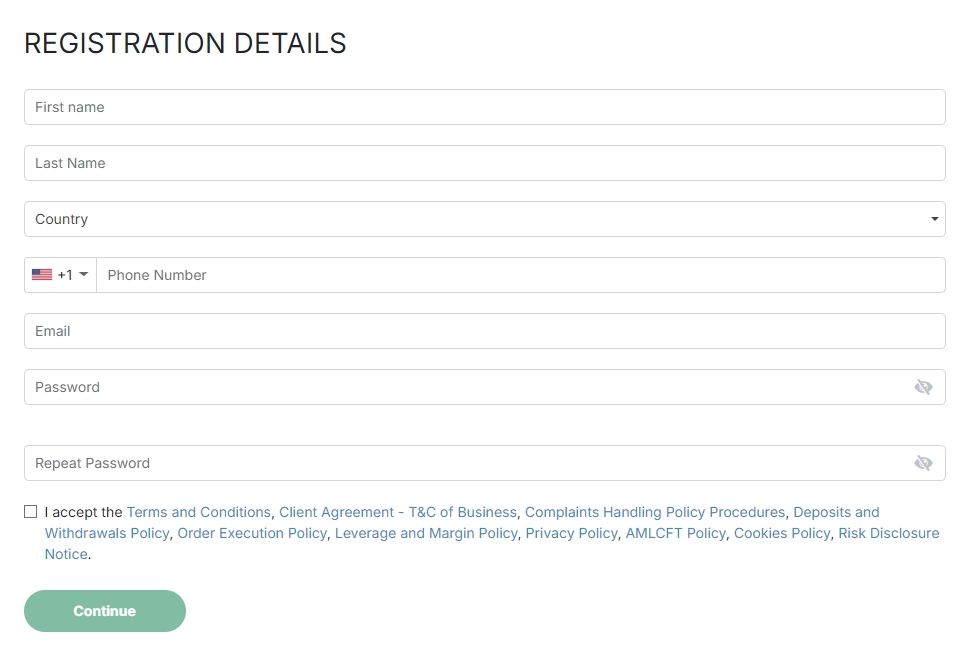

Opening your Finpros demo account is straightforward and takes just a few minutes. Follow these simple steps to begin your journey as a beginner forex trader:

- Visit the Finpros Website: Start by navigating to the official Finpros website. Look for a prominent “Open Demo Account” or “Sign Up” button, usually found on the homepage.

- Complete the Registration Form: You’ll be directed to a quick registration form. You typically need to provide basic information such as your name, email address, and phone number. Make sure your details are accurate.

- Choose Your Account Type: Finpros might offer different demo account options. For most beginners, a standard demo account will suffice. You might also select your preferred trading platform (e.g., MT4 or MT5, if applicable) and the amount of virtual funds you wish to start with.

- Confirm Your Account: You might receive an email verification link. Click it promptly to activate your Finpros demo account.

- Download or Access the Platform: Choose to download our dedicated trading software or access the web-based platform directly from your browser.

- Start Trading with Virtual Funds: Your Finpros demo account will be funded with virtual funds, ready for you to begin your practice trading journey immediately!

Remember, the goal of using your Finpros demo account is to learn and prepare. Treat it as if it were a real account. This approach will help you develop disciplined habits and a solid understanding of market conditions, setting you up for success when you decide to transition to live trading.

Registration Process

Embarking on your journey to become a successful forex trader starts with a simple, straightforward registration. We know you’re eager to dive into the markets, so we’ve designed our sign-up process to be as quick and hassle-free as possible. Our goal is to get you trading efficiently, allowing you to focus on developing your skills as a true forex expert.

Here’s a snapshot of what you can expect:

- Step 1: Account Creation. Begin by providing your email address and creating a secure password. This is your initial gateway to the platform.

- Step 2: Personal Details. Next, we collect some basic information such as your full name, date of birth, and country of residence. This helps us tailor your experience and comply with regulatory standards.

- Step 3: Identity Verification. To ensure a secure and compliant trading environment, you will submit identification documents. This typically includes a government-issued ID (like a passport or driver’s license) and a proof of address (such as a utility bill or bank statement). This crucial step safeguards your account and maintains the integrity of the platform.

- Step 4: Fund Your Account. Once your details are verified, you are ready to make your first deposit. Choose from our range of convenient and secure payment methods to fund your trading account.

Our intuitive interface guides you through each step, making the entire process smooth and efficient. We prioritize your privacy and security, ensuring all your information remains confidential and protected. You don’t need to be an SEO content creator to appreciate a well-organized signup flow!

Why a Smooth Registration Matters

A seamless registration experience sets the stage for your entire trading adventure. It means less time spent on paperwork and more time dedicated to market analysis and strategy. When you complete the registration quickly and accurately, you gain:

- Rapid Access: Start exploring the trading platform and its features without unnecessary delays.

- Enhanced Security: Proper verification protects your funds and personal data from unauthorized access.

- Regulatory Compliance: Adhering to KYC (Know Your Customer) regulations ensures a safe and legitimate trading environment for everyone.

- Focused Trading: Get straight to what you love – analyzing charts, placing trades, and building your portfolio.

Our support team is always ready to assist if you encounter any questions during your registration. Your journey into the exciting world of forex trading is just a few clicks away!

Account Configuration

Setting up your forex trading account isn’t just about opening it; it’s about tailoring it to your unique trading style and goals. Think of it as customizing your command center before you embark on a crucial mission. Proper account configuration ensures you have the right tools and parameters at your fingertips, making your trading journey smoother and more efficient from day one.

Every professional trader understands the value of personalized account settings. You’re not just accepting defaults; you’re actively shaping your trading environment. This proactive approach helps you manage your trades with precision and confidence.

Key Aspects of Your Forex Trading Account Configuration:

- Leverage Options: Decide on the leverage ratio that aligns with your risk tolerance and trading strategy. High leverage can amplify gains but also losses, so choose wisely.

- Platform Customization: Personalize your trading platform layout, chart settings, indicators, and watchlists. A well-organized workspace enhances your decision-making process.

- Currency Pairs: Select your preferred currency pairs to monitor and trade. While major pairs are common, your strategy might favor specific minors or exotics.

- Risk Management Tools: Configure features like stop-loss and take-profit defaults. This is crucial for automating parts of your risk control strategy.

- Deposit Methods: Choose the most convenient and secure deposit methods for funding your account. Understanding withdrawal options is also part of smart setup.

- Notifications and Alerts: Set up price alerts or news notifications to stay informed about market movements that impact your chosen currency pairs.

Taking the time to adjust these account settings is an investment in your trading success. It empowers you to build a resilient trading routine and maintain control over your positions. When your forex trading account is configured perfectly, you can focus purely on market analysis and execution, free from unnecessary distractions.

Exploring the Features of the Finpros Demo Platform

Are you eager to step into the exciting world of forex trading but want to gain confidence first? The Finpros demo platform offers the ideal starting point. It provides a comprehensive, risk-free environment where you can explore the dynamic possibilities of the market without risking your actual capital. This powerful tool is more than just a simulation; it’s a vital bridge to real-world trading, meticulously designed to build your skills and enhance your understanding.

We understand that diving directly into live trading can feel overwhelming. That’s why our demo account precisely mimics the actual trading experience. You gain access to a full suite of features, all aimed at helping you master the art of forex before you commit real money. Think of it as your personal, high-fidelity training ground.

Here’s a closer look at the key features you will love on the Finpros demo platform:

- Generous Virtual Funds: Start with a substantial amount of virtual funds. This lets you practice trading with realistic position sizes, allowing you to truly understand potential profits and losses.

- Real-Time Market Data: Experience the thrill of live trading with actual, real-time market data. You see price movements exactly as they happen in the global forex market, which is crucial for developing effective trading strategies.

- Full Access to Various Assets: Explore a wide range of trading instruments, including major and minor currency pairs, commodities, and indices. This helps you diversify your practice and find markets that resonate with your interests.

- Advanced Technical Analysis Tools: Utilize a comprehensive suite of charting tools and indicators. These are the same powerful technical analysis tools available on our live platform, enabling you to refine your market insights and decision-making.

- Realistic Execution Speed: Our demo platform provides an execution speed that closely mirrors our live environment. This is vital for understanding how your orders are filled and for managing market volatility effectively.

- Intuitive Platform Interface: Navigate a user-friendly and highly intuitive platform interface. Get comfortable with order placement, account management, and monitoring your open positions without any pressure.

The Finpros demo platform is an indispensable resource for both beginners and experienced traders. Newcomers can learn the basics of the market, understand terminology, and get accustomed to the platform without any financial risk. Experienced traders can use it to test new trading strategies, fine-tune existing ones, or even explore different markets they haven’t traded before. It’s a perfect environment for continuous learning and adaptation.

| Benefit | Description |

|---|---|

| Risk-Free Exploration | Trade with virtual money, eliminating financial risk while you learn and experiment. |

| Skill Development | Build confidence building your trading skills, from placing orders to managing risk. |

| Strategy Testing | Test and refine your trading strategies against real market conditions. |

| Platform Familiarity | Become proficient with the platform interface and all its powerful features. |

As one industry expert often says,

“A demo account isn’t just practice; it’s the foundation of disciplined trading.”

This rings true for the Finpros demo platform, where every simulated trade helps you build that crucial foundation.

Don’t just take our word for it. Many successful traders began their journey on a demo account. It provides that essential bridge, allowing you to practice trading until you feel completely ready for the live markets. It’s an investment in your trading education, setting you up for long-term success. Take control of your learning and start exploring the Finpros demo platform today!

Virtual Funds and Assets

Diving into the world of online trading often brings you face-to-face with the concept of virtual funds and assets. These aren’t just buzzwords; they represent a significant shift in how we manage capital and identify investment opportunities. Think of virtual funds as the digital currency you use within an online trading platform – the balance in your account that facilitates your trades. It’s the lifeblood of your operation, ready to be deployed across various markets.

Then we have virtual assets, which encompass a broader range of digital instruments. The most prominent example, of course, is cryptocurrency. These digital assets have revolutionized the financial landscape, offering new avenues for profit and diversification alongside traditional currency pairs in forex trading. Understanding their unique characteristics, like how market volatility can impact their value, is key to navigating this dynamic space.

Engaging with virtual funds and assets requires a strategic approach. Consider these key aspects:

- Digital Wallet Management: Securely storing your virtual currency is paramount. Choose reputable online trading platforms with strong security protocols.

- Cryptocurrency Trading: Beyond using crypto as a funding method, you can actively trade various virtual currencies. Learn to analyze price movements and identify trends.

- Diversification Opportunities: Including digital assets in your investment strategy can potentially reduce overall portfolio risk, but it also introduces new types of risk.

- Regulatory Landscape: Stay informed about the evolving regulations surrounding virtual currency in different jurisdictions.

Embracing virtual funds and digital assets opens up exciting possibilities. It’s about leveraging cutting-edge technology to enhance your trading experience and explore a global network of opportunities. Are you ready to integrate these powerful tools into your trading arsenal?

Analytical Tools and Indicators

Diving into the world of forex trading requires more than just enthusiasm; it demands a sharp mind and the right tools. Think of analytical tools and indicators as your compass and map in the vast ocean of currency markets. They help you decipher complex price movements, identify potential opportunities, and make informed decisions. Mastering these is a cornerstone of successful trading, transforming raw data into actionable insights.

There are primarily two major schools of thought when it comes to analyzing the market: technical analysis and fundamental analysis. Each offers a unique lens through which to view the market, and combining their strengths often yields the most robust strategies.

Technical Analysis: Uncovering Price Patterns

Technical analysis is all about studying historical price action and volume to predict future movements. It operates on the premise that all relevant information is already reflected in the market price. Here’s a glimpse into some vital components:

- Trading Indicators: These mathematical calculations, based on price, volume, or open interest, are plotted on charts to help traders identify trends, momentum, volatility, and overbought/oversold conditions.

- Candlestick Patterns: Visual representations of price movements over a specific period, these patterns can signal potential reversals or continuations. Recognizing a “hammer” or an “engulfing pattern” can be incredibly powerful.

- Support and Resistance: These are price levels where the market has historically found difficulty in moving higher (resistance) or lower (support). They act as crucial zones for entry and exit points.

- Trend Lines: Drawing lines on your forex charts connecting a series of highs or lows helps you visualize the prevailing trend and anticipate future price direction.

Some of the most popular and effective trading indicators you’ll encounter include:

| Indicator Name | Primary Function | What it helps identify |

|---|---|---|

| Moving Averages (MA) | Smooths price data over time | Trend direction, potential support/resistance |

| Relative Strength Index (RSI) | Measures speed and change of price movements | Overbought/oversold conditions, momentum |

| Moving Average Convergence Divergence (MACD) | Reveals trend strength, direction, momentum, and duration | Trend reversals, momentum shifts |

| Fibonacci Retracement | Identifies potential levels of support and resistance | Entry/exit points, price targets |

As one seasoned trader aptly put it, “Your charts are talking to you; you just need to learn their language. Technical indicators are the dictionary.”

Fundamental Analysis: Understanding Market Drivers

While technical analysis looks at the charts, fundamental analysis delves into the economic, social, and political forces that influence currency values. It seeks to understand the intrinsic value of a currency pair. Key tools here include:

- Economic Calendars: Track upcoming economic data releases like interest rate decisions, inflation reports, employment figures, and GDP growth. These events can trigger significant market volatility.

- Market Sentiment: Understanding the general attitude of investors towards a particular currency or market. Is everyone bullish or bearish? This can significantly impact price direction.

- News Feeds and Reports: Staying updated on global news, geopolitical events, and central bank statements is crucial.

We encourage you to explore these powerful analytical tools and indicators. Learning how to apply them effectively will sharpen your trading edge and significantly enhance your ability to navigate the dynamic forex market. Join our community to master these techniques and transform your trading journey!

How to Effectively Use Your Finpros Demo for Practice

Are you ready to dive into the exciting world of forex trading but hesitant to risk real capital? That’s where your Finpros demo account becomes your best ally. It’s not just a toy; it’s a powerful training ground designed to hone your skills without any financial pressure. Think of it as your personal, risk-free laboratory where you can experiment, learn, and perfect your strategies before you ever commit a single dollar of your own money.

Many new traders underestimate the immense value of a demo account, often treating it as a game. This is a common mistake. To truly benefit, you must approach your Finpros demo with the same seriousness and discipline you would bring to live trading. It’s an essential step in your journey to becoming a confident and profitable forex trader. Let’s explore how to get the most out of this invaluable tool.

Key Strategies for Maximizing Your Finpros Demo Experience:

- Familiarize Yourself with the Platform: Spend time exploring every button, chart option, and order type. Understand how to place market orders, limit orders, and stop-loss orders. The more comfortable you are with the Finpros interface, the smoother your transition to live trading will be.

- Develop and Test Your Trading Strategy: This is the core purpose. Don’t just trade randomly. Research different strategies – trend following, scalping, swing trading – and then rigorously test them in the demo environment. See what works for you and what doesn’t without real-world consequences.

- Manage Your Virtual Capital Like Real Money: Allocate your demo funds as if they were your actual investment. If you have $10,000 in your demo, don’t open positions that would be impossible with a smaller real account. Practice realistic position sizing and risk management from day one.

- Maintain a Trading Journal: Record every trade you make – entry and exit points, reasons for the trade, and your emotional state. Analyzing your demo trades in a journal is crucial for identifying patterns in your decision-making and improving your consistency.

- Understand Market Psychology: While emotions might not be as intense with virtual money, observe how market news and economic data impact currency pairs. Pay attention to how prices react to major announcements, simulating a real-world trading environment.

- Experiment with Different Currency Pairs: Don’t stick to just one. Explore various major, minor, and exotic pairs to understand their unique characteristics, volatility, and trading hours.

Your Finpros demo account offers a unique opportunity to build a solid foundation. You get access to real-time market data, exactly what you would see on a live account, allowing you to react to price movements and economic events as they happen. This realistic environment helps you bridge the gap between theoretical knowledge and practical application. Remember, consistency is key; regular practice in your demo account builds muscle memory for sound trading decisions.

By treating your Finpros demo with the respect it deserves, you transform it from a mere simulation into an indispensable learning tool. It empowers you to refine your approach, build confidence, and prepare effectively for the challenges and rewards of the live forex market. Embrace this learning phase, and you’ll set yourself up for greater success when you’re ready to trade with real funds.

Simulating Real Market Conditions on Finpros Demo

Embarking on the exciting journey of forex trading demands practice, but not just any practice. To truly prepare yourself for the dynamic world of currency markets, you need an environment that mirrors reality as closely as possible. That’s precisely what the Finpros demo account offers: a meticulously crafted simulation designed to immerse you in authentic market scenarios without the financial risk. Forget generic simulators; Finpros provides a robust platform where you can hone your skills and test your strategies against live market movements, just like professional traders do.

Our commitment to replicating real market conditions means every aspect of your trading experience on the Finpros demo is engineered for accuracy. Here’s what sets our platform apart:

- Live Market Quotes: Access real-time price feeds directly from the market, ensuring every candle, every pip movement, and every price fluctuation you see is genuine. This isn’t delayed data; it’s the heartbeat of the live market.

- Authentic Spreads and Commissions: Experience variable spreads and realistic commission structures that reflect actual trading costs. Understanding these costs is crucial for accurate profit and loss calculations and effective strategy development.

- Full Range of Financial Instruments: Trade on the same wide selection of currency pairs, commodities, indices, and cryptocurrencies available on our live accounts. This breadth allows you to diversify your practice and explore various market opportunities.

- Realistic Trade Execution: Observe how your orders are executed under different market conditions, including periods of high volatility. This practical understanding of trade execution is invaluable for managing expectations and improving your tactical entry and exit points.

Practicing with virtual funds on a platform that mirrors the live environment allows you to develop critical skills that purely theoretical knowledge can’t provide. You learn to interpret market volatility, manage your virtual capital under pressure, and refine your risk-free trading strategies without the fear of financial loss. This hands-on experience is vital for building confidence and discipline, two cornerstones of successful trading.

Advantages of Practicing on a High-Fidelity Demo Account:

Leveraging the Finpros demo for your trading practice comes with significant benefits:

- Strategy Validation: Rigorously test your trading strategies against real market data to see how they perform in various scenarios before committing real capital.

- Risk Management Mastery: Practice implementing proper risk management techniques, setting stop-losses, and taking profits, all in a controlled, educational setting.

- Platform Familiarity: Become intimately familiar with the Finpros platform’s features, charting tools, and order types, ensuring a smooth transition when you decide to go live.

- Emotional Control: Develop the emotional resilience needed for trading by experiencing virtual wins and losses, helping you stay objective when real money is on the line.

- Adaptability: Learn to adapt to changing market conditions and economic news, understanding how these factors influence currency movements.

The Finpros demo account is more than just a trial; it’s a powerful educational tool designed to bridge the gap between learning and earning. Treat your practice seriously, as if it were a live account, and you will unlock its full potential for accelerated learning and skill development. Start simulating real market conditions today and prepare yourself for true trading success.

Setting Up Your Virtual Portfolio with Finpros Demo

Embarking on the exhilarating journey of forex trading doesn’t have to start with real money on the line. Imagine a world where you can practice, learn, and refine your skills without any financial risk. That’s precisely what a virtual portfolio offers, and Finpros Demo is your ultimate gateway to this invaluable experience. Setting up your virtual trading space is a smart move for anyone looking to master the markets, whether you’re a complete novice or an experienced trader wanting to test new strategies. This simulated trading environment replicates real market conditions, providing an authentic feel for how currency pairs move and react to global events.

Your Finpros Demo account isn’t just a toy; it’s a powerful educational tool. It gives you a chance to get familiar with the platform’s interface, understand order types, and interpret market data without the pressure of actual capital at stake. Think of it as your personal sandbox for forex trading practice. Here, you can experiment freely, make mistakes, and learn from them, all while building confidence before you ever commit a single dollar of your hard-earned money.

Why is a Finpros virtual portfolio indispensable for every aspiring trader? Let’s look at the clear advantages:

- Risk-Free Exploration: Dive into the market without any fear of financial loss. This allows you to focus purely on learning.

- Strategy Testing Ground: Develop and refine your trading strategies in a live-market setting. See what works and what doesn’t before applying it to your real account.

- Platform Familiarity: Get comfortable with every feature of the Finpros demo trading platform. Learn where everything is, how to execute trades, and how to analyze charts.

- Emotional Control: Practice managing your emotions in a simulated environment. Learning to handle wins and losses without real money involved helps build discipline.

- Market Understanding: Gain a deeper understanding of currency movements, economic indicators, and geopolitical events that influence the forex market.

Getting started with your virtual portfolio is remarkably simple. Typically, it involves a quick registration process on the Finpros website, where you create an account and access your demo trading platform. You’ll receive virtual funds, often a substantial amount, allowing you to execute trades as if they were real. Use this opportunity to trade various currency pairs, indices, or commodities available on the platform. Treat this paper trading experience as seriously as you would real trading. Develop a trading plan, set realistic goals, and meticulously track your performance. This disciplined approach will pay dividends when you decide to transition to a live account. Whether you are a beginner forex trader just starting out or an advanced trader looking for a no-stakes environment, the Finpros Demo offers an unparalleled opportunity to hone your skills and boost your trading prowess.

Transitioning from Your Finpros Demo to Live Trading

You have honed your skills, tested strategies, and navigated the markets with the Finpros demo account. It is an invaluable training ground, a safe space where mistakes become lessons, not losses. Now, a new chapter beckons: stepping into the exhilarating world of live forex trading. This transition marks a significant milestone in your trading journey, moving from simulation to actual market engagement. You have developed a solid understanding of market dynamics, order execution, and risk management through practice.

The move to a live account with Finpros is not just about changing an account type; it is about embracing the full spectrum of emotions and opportunities that real money trading presents. The adrenaline, the discipline, the strategic thinking – they all amplify when actual capital is on the line. But do not let this daunt you! Your time spent on the demo has prepared you for this moment. You built your confidence and refined your approach.

| Aspect | Finpros Demo Account | Finpros Live Account |

|---|---|---|

| Capital | Virtual Funds | Real Money |

| Risk | Zero Financial Risk | Real Financial Risk |

| Pressure | Low Psychological Pressure | High Psychological Pressure |

| Learning Focus | Strategy & Platform | Execution & Discipline |

| Readiness Indicator | Consistent profitability and confidence in your trading strategies over a sustained period. | Comfort with market conditions, robust risk management, and emotional control. |

Consider these key points as you make your move:

- Psychological Readiness: Trading with real money introduces a psychological element absent in demo trading. Greed and fear can influence decisions. Acknowledge these emotions, but do not let them dictate your actions. Stick to your proven trading plan.

- Starting Small: You do not need to invest a large sum immediately. Begin with a smaller capital amount that you are comfortable risking. This approach allows you to adjust to the live environment without undue pressure, gradually increasing your stake as your confidence and account grow.

- Refined Risk Management: While you practiced risk management in your demo, applying it in live trading is crucial. Set clear stop-loss and take-profit levels for every trade. Never risk more than a small percentage of your total account on a single position.

- Continuous Learning: The markets constantly evolve. Your demo account provided a foundation, but live trading offers new insights. Stay informed about market news, economic indicators, and global events that impact currency pairs.

“The best way to predict the future is to create it,” a sentiment that perfectly applies to your trading journey. You have created a strong foundation with your Finpros demo account. Now, it is time to build on that foundation and realize the potential of real market opportunities. Finpros ensures a seamless transition, providing robust platforms, competitive spreads, and reliable support to help you navigate every step of your live trading experience. Your readiness is evident; the markets await your calculated moves.

Readiness Assessment

Before you dive headfirst into the exciting world of forex trading, it’s crucial to take a moment for a thorough readiness assessment. Think of this as your pre-flight check before an important journey. It’s not just about having an account; it’s about preparing yourself mentally, financially, and strategically for the unique dynamics of currency markets. A solid assessment helps you understand your starting point and what areas you might need to strengthen before you commit your capital.

Consider these vital components as you evaluate your preparedness:

- Knowledge and Education: Do you understand the basics of forex trading, including how currency pairs move, the influence of economic data, and key terminology? Have you explored various trading strategy concepts? Without a foundational understanding, you are navigating without a map.

- Financial Capital: How much capital are you truly comfortable risking? This isn’t just about having money; it’s about allocating funds you can afford to lose without impacting your lifestyle. Effective risk management starts with smart capital allocation.

- Emotional Discipline: Forex markets can be volatile, presenting both exciting opportunities and challenging moments. Are you prepared to manage your emotions, avoid impulsive decisions, and stick to your trading plan even when things get tough? Emotional resilience is a cornerstone of successful trading.

- Time Commitment: Trading requires time for analysis, execution, and review. How much time can you realistically dedicate each day or week to learning, planning, and monitoring your trades? Your available time often dictates the type of trading strategy you can effectively implement.

Here’s a simple self-assessment checklist. Be honest with yourself as you answer:

| Readiness Factor | Yes/No |

|---|---|

| I have completed a beginner’s course in forex trading. | |

| I understand the concept of leverage and its risks. | |

| I have a dedicated trading budget that I can afford to lose. | |

| I am prepared to accept losses as part of the trading process. | |

| I have practiced on a demo account for at least a few weeks. | |

| I can dedicate consistent time to market analysis and trade management. | |

| I have a clear idea of my trading goals and risk tolerance. |

As the legendary trader Jesse Livermore once said, “The game of speculation is the most fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the man of poor emotional balance, or the adventurer who seeks to get rich quick.” Your readiness assessment isn’t just a formality; it’s a critical step toward building a sustainable and potentially profitable journey in the forex market. Take your time, prepare well, and set yourself up for success.

What to Expect in a Live Account

Transitioning from a demo account to a live trading environment is a significant step for any forex trader. It’s where the real excitement – and the real lessons – begin. While a demo account perfectly simulates market conditions, a live account introduces a crucial element: your actual capital is at stake. This changes everything, from your emotional responses to the very real impact of market fluctuations on your balance.

Here’s a breakdown of what you should anticipate when you go live:

- Emotional Rollercoaster: Get ready for your emotions to play a much larger role. Fear, greed, excitement, and frustration become more prominent when real money is on the line. Maintaining discipline and sticking to your trading plan is paramount. You will feel the wins and the losses far more acutely than you ever did in demo mode.

- Real Market Execution: While demo accounts often show perfect fills, a live account exposes you to real-world market execution. This means you might experience slippage (your order fills at a slightly different price than expected) during volatile periods. Spreads can also widen more significantly during major news events or illiquid times.

- Understanding Trading Costs: In a live account, every trade incurs real costs. Be fully aware of your broker’s spreads, commissions, and overnight swap fees. These small amounts add up and directly impact your profitability. Factor them into your trading strategy.

- The Importance of Risk Management: This concept becomes tangible. You’re no longer just learning about stop-loss orders; you’re actively using them to protect your actual investment. Position sizing, capital preservation, and drawdown management are no longer theoretical exercises but critical daily practices.

- Funding and Withdrawals: You’ll engage with the practical side of managing your capital. Understand your broker’s deposit and withdrawal methods, processing times, and any associated fees. This is a vital part of your overall trading experience.

- Access to Support and Resources: Live account holders often receive dedicated customer support and access to exclusive resources like advanced charting tools, market analysis, or educational webinars. Utilize these to enhance your trading journey.

Trading with real money adds a psychological layer that no simulation can replicate. It sharpens your focus, tests your patience, and truly hones your decision-making under pressure. Embrace this challenge, stay disciplined, and always prioritize risk management. This is where you truly grow as a forex trader.

Is the Finpros Demo Account Free and Unlimited?

Absolutely! If you’re wondering about diving into the world of online trading with Finpros, you’ll be thrilled to know that our demo account is indeed both completely free and unlimited. This isn’t just a marketing gimmick; it’s a fundamental part of our commitment to empowering traders, from absolute beginners to seasoned market veterans.

We understand that navigating the complexities of the financial markets, especially forex trading, can feel daunting at first. That’s why we remove the financial risk from your learning curve. Our Finpros demo account provides a robust, risk-free environment where you can explore every facet of our trading platform without spending a single cent of your real money.

What does “unlimited” really mean for you?

- No Time Limits: Unlike some brokers who cap your demo access, Finpros lets you practice for as long as you need. Whether it’s a few weeks or several months, your virtual playground remains open.

- Full Platform Access: You get to experience the exact same trading platform, tools, and features that our live account holders use. This means no surprises when you transition to real trading.

- Replenishable Virtual Funds: Ran out of your initial virtual capital while testing aggressive strategies? No problem! You can easily top up your demo balance, ensuring your learning never stops.

Think of it as your personal financial simulator. You get to execute trades, set stop-loss and take-profit orders, analyze charts, and experiment with various trading strategies, all while facing real-time market conditions. This hands-on experience is invaluable for building confidence and developing a solid understanding of how the market moves.

For those new to forex trading, the Finpros demo account is the perfect starting point. It allows you to learn the ropes at your own pace, without the pressure of losing actual funds. Experienced traders also find it incredibly useful for testing new strategies or familiarizing themselves with our platform’s unique features before committing real capital. It’s a vital tool for refinement and continuous improvement.

So, go ahead and explore without hesitation. The Finpros demo account is your passport to practice, learn, and master the art of trading, completely free and with no strings attached. It’s truly unlimited learning potential at your fingertips!

Common Pitfalls to Avoid While Using a Finpros Demo

Diving into the world of online trading often starts with a demo account, an invaluable tool for practice. Yet, many new traders inadvertently fall into traps that can hinder their real-world success. A Finpros demo offers a risk-free environment, but only if you use it wisely. Let’s explore these common missteps and how to steer clear of them.

Here are crucial pitfalls to avoid when utilizing your Finpros demo account:

- Treating it like a game. It’s easy to forget that while using virtual money, a demo account still simulates real market conditions. Many traders take excessive risks they would never consider with actual capital. This builds poor habits that can be hard to break. Always approach your Finpros demo sessions with the same seriousness and discipline you would apply to live trading.

- Ignoring proper risk management. With seemingly unlimited virtual funds, the temptation to over-leverage or skip stop-loss orders is strong. This completely bypasses a critical aspect of successful trading. Use your Finpros demo to rigorously practice setting stop-loss and take-profit levels, managing position sizes, and understanding the impact of leverage. Build a robust risk strategy from day one.

- Not replicating real market conditions accurately. While a Finpros demo aims to be realistic, certain factors like slippage during fast-moving markets or the intense emotional pressure of losing real money aren’t fully present. Don’t expect your Finpros demo experience to be an exact psychological match for live trading, but strive to simulate your planned strategy as closely as possible. Consider trading during active market hours for better realism.

- Rushing through the learning process. Some individuals jump into live trading after just a few “successful” demo trades. A Finpros demo is for extensive learning and strategy refinement. Take your time to understand technical indicators, master fundamental analysis, and become truly comfortable with the platform’s features. Patience here is a virtue that pays off significantly.

- Trading without a concrete plan. A demo account can sometimes become a playground for random, impulsive trades without a coherent strategy. This is a significant missed opportunity. Develop a clear trading plan—including entry and exit rules, risk-reward ratios, and market analysis—and execute it consistently on your Finpros demo. This is your prime chance to refine your approach before real capital is on the line.

- Neglecting to review your trades. Just like in live trading, reviewing your performance on the Finpros demo is absolutely essential. Analyze your winning and losing trades in detail. What worked well? What didn’t? Keep a dedicated trading journal for your demo account to identify patterns, strengths, and areas for improvement. Learning from your past actions accelerates your progress.

To truly maximize your Finpros demo experience, adopt the right mental approach from the start. Here’s a quick comparison of mindset differences between demo and live trading that you must internalize:

| Aspect | Incorrect Demo Mindset | Correct Live Trading Mindset |

|---|---|---|

| Capital Perception | “Play money,” unlimited supply | “Real money,” finite and valuable |

| Risk Tolerance | High, reckless experimentation | Calculated, managed, protective |

| Emotional Impact | Minimal or absent | Significant, requires strict discipline |

| Primary Goal | “Win” trades, chase quick profits | Execute strategy, manage risk, achieve consistent growth |

By consciously avoiding these common pitfalls, you transform your Finpros demo account from a simple practice tool into a powerful, skill-building simulator. Maximize this opportunity to prepare yourself thoroughly for the complexities and challenges of the live markets. Your success hinges on how diligently you prepare today, so make every demo trade count.

Advanced Tips for Maximizing Your Finpros Demo Experience

You’ve taken the first step by opening a Finpros demo account – excellent! But don’t just use it for basic buy and sell orders. Your demo account is a powerful, risk-free laboratory designed for deep learning and strategy refinement. Think of it as your personal forex dojo, where you can hone your skills without fear of losing real capital. To truly maximize its potential, you need to go beyond the basics and embrace advanced simulation techniques. This isn’t just about practicing trades; it’s about building robust trading habits and a solid understanding of market dynamics before you ever commit real funds.

Refine Your Strategy, Don’t Just Test It

Many new traders use their demo account simply to see if a strategy works. Advanced users, however, use it to refine and optimize. This means iterating on your entry and exit points, adjusting stop-loss and take-profit levels, and even experimenting with different timeframes for your analysis. Your goal is to find the sweet spot where your strategy consistently performs under varying market conditions.

- Scenario Simulation: Actively seek out different market conditions – trending, ranging, volatile, quiet – and test how your strategy reacts. Does it perform better in certain environments?

- Parameter Tweaking: Don’t just stick to the default settings for your indicators. Adjust moving average periods, RSI levels, or Bollinger Band deviations to find what truly resonates with your trading style.

- Multi-Asset Exploration: While focusing on a few currency pairs is wise, use the demo to understand how different pairs behave. Some are more volatile, others trend more smoothly. Learn their unique personalities.

Embrace the Full Suite of Order Types

The Finpros platform offers a variety of order types beyond simple market orders. Mastering these can significantly enhance your trading precision and risk management. Use your demo account to become intimately familiar with each one.

Consider the following advanced order types:

| Order Type | Description | Demo Practice Benefit |

|---|---|---|

| Limit Orders | Allows you to buy or sell at a specific price or better. | Practice getting optimal entry/exit prices without constant monitoring. |

| Stop Orders | Triggers a market order when a certain price is reached. | Crucial for risk management; learn to place effective stop-losses. |

| Trailing Stop | A stop-loss order that automatically adjusts as the price moves favorably. | Experiment with locking in profits while minimizing downside risk. |

| OCO (One Cancels the Other) | A pair of conditional orders where if one order executes, the other is automatically cancelled. | Perfect for pre-planning entry and exit scenarios in volatile markets. |

Try combining these orders. For instance, set a limit order to enter a trade and simultaneously place an OCO order for your stop-loss and take-profit. This level of pre-planning is a hallmark of professional trading.

Simulate Real-World Psychological Pressures

The biggest challenge in trading often isn’t the charts, but managing your own emotions. While a demo account doesn’t involve real money, you can still simulate psychological pressure to build mental fortitude.

“Treat your demo account like it’s real money. Maintain the same discipline, risk parameters, and emotional detachment you would with your live funds. This is where true trading character is forged.” – A seasoned Finpros mentor.

Ways to simulate pressure:

- Strict Risk Management: Adhere to your planned risk per trade, even if it feels like ‘just demo money’. Don’t overleverge.

- Trading Journal Discipline: Meticulously log every trade, noting your thought process, emotions, and the outcome. Reviewing this will reveal patterns in your decision-making.

- Time-Bound Trading: Practice trading only during specific market sessions or for a limited duration, just as you would with a real account, to build focus and endurance.

By engaging in these advanced practices, your Finpros demo experience transforms from a simple trial into an indispensable training ground, preparing you thoroughly for the challenges and opportunities of live trading.

Who Should Use a Finpros Demo Account?

Are you curious about the world of forex trading but hesitant to dive in with real money? Or perhaps you’re an experienced trader looking to refine your strategies without risk? A Finpros demo account is your perfect playground, offering a realistic trading environment without any financial commitment. It’s a powerful tool designed for a wide range of individuals, from complete beginners to seasoned market participants.

Here’s a breakdown of who truly benefits from stepping into the simulated world of Finpros trading:

- Beginners Taking Their First Steps: If terms like “pips,” “leverage,” and “margin” sound like a foreign language, a demo account is your essential learning companion. You can explore the platform, place trades, and understand market movements at your own pace. It’s an ideal way to build foundational knowledge without the pressure of losing capital.

- Experienced Traders Testing New Strategies: Even seasoned pros need a sandbox. A Finpros demo account allows you to experiment with new trading systems, indicators, or automated strategies (EAs) in live market conditions. You can fine-tune your approach, evaluate its effectiveness, and identify potential flaws before applying it to your live trading.

- Individuals Familiarizing with the Finpros Platform: Every broker platform has unique features, charting tools, and order execution methods. If you’re new to Finpros, the demo account lets you navigate our interface, customize your workspace, and become proficient with all the available tools. Get comfortable with placing various order types, managing positions, and understanding the platform’s layout before you go live.

- Risk-Averse Learners: Some people prefer to master the basics and gain significant confidence before committing their hard-earned money. The demo account offers a completely risk-free environment to develop your trading skills and psychological resilience. You can experience both winning and losing trades without any actual financial impact, helping you build a robust mindset.

- Students and Educators: For academic purposes or teaching others about financial markets, a demo account provides an invaluable resource. It allows for practical application of theoretical knowledge, enabling students to see how economic news impacts currency pairs and how various trading principles play out in real-time.

In essence, if you want to learn, practice, test, or simply get acquainted with forex trading and the Finpros platform without any financial pressure, a demo account is precisely what you need. It’s your zero-risk gateway to market mastery.

Conclusion: Why Choose the Finpros Demo for Your Trading Journey

Embarking on the exciting world of forex trading requires more than just enthusiasm; it demands preparation, knowledge, and hands-on experience. This is precisely where the Finpros demo account becomes an indispensable tool for anyone serious about their trading journey. It’s not just a practice account; it’s your personal, risk-free training ground designed to set you up for success in the dynamic financial markets.

Choosing the Finpros demo means you’re investing in your own trading education without spending a single dollar. You gain immediate access to real market conditions, allowing you to:

- Master Trading Platforms: Navigate the intuitive Finpros trading platform with ease, familiarizing yourself with all its features before live trading.

- Develop and Refine Strategies: Test various forex trading strategies, identify what works best for your style, and optimize your approach without financial pressure.

- Build Confidence: Execute trades, manage virtual capital, and experience wins and losses in a simulated environment, building the mental fortitude essential for real trading.

- Understand Market Dynamics: Observe how global events and economic data impact currency pairs, gaining valuable insights into market behavior.

- Explore Diverse Instruments: Practice trading across a wide range of assets available on Finpros, expanding your market horizons.

Your trading journey deserves the best start, and the Finpros demo account provides just that. It’s a powerful educational resource that bridges the gap between theoretical knowledge and practical application. You can make mistakes, learn from them, and adjust your approach, all without any financial risk. This invaluable experience is crucial for developing the sharp analytical skills and disciplined mindset needed to navigate the complexities of forex trading.

Don’t just jump into the deep end; prepare yourself thoroughly. The Finpros demo is your gateway to understanding the markets, honing your skills, and building the confidence to transition to live trading when you are truly ready. Take control of your learning curve and give your trading aspirations the solid foundation they deserve. Your future in forex trading starts with informed choices and robust practice.

Frequently Asked Questions

Is the Finpros demo account truly free?

Absolutely! Setting up and using your Finpros demo account costs you nothing. It’s designed as a free resource to help you learn and practice forex trading.

How long can I use my Finpros demo account?

Typically, Finpros demo accounts offer an extended period of use, often indefinitely, as long as there is some activity. This ensures you have ample time for practice trading and skill development.

Does the Finpros demo account use real-time market data?

Yes, our Finpros demo account provides access to live, real-time market data, ensuring your simulated environment is as authentic as possible to actual market conditions.

Can I reset my virtual funds if I run out?

In most cases, yes. If you deplete your virtual funds or wish to start fresh, you can usually request a top-up through the platform’s support or account settings, allowing you to continue your learning.

Is the Finpros trading platform on demo the same as live?

Functionality-wise, yes. The trading platform for your Finpros demo account is nearly identical to the live version, offering the same charts, indicators, and order types. This provides a seamless transition and familiar experience.