Are you curious about the vast opportunities within the financial markets but feel intimidated by the high entry barriers or the perceived risks? You’re not alone. Many aspiring traders face this very challenge. However, your journey into the exciting world of currency exchange doesn’t have to start with a massive capital commitment or overwhelming anxiety. Enter the Finpros Cent Account – a revolutionary solution designed to make accessible forex trading a reality for everyone.

Imagine trading in real market conditions, executing trades, and experiencing the ebb and flow of global currencies, all while managing a remarkably low risk trading environment. That’s precisely what our Cent Account offers. Instead of trading standard lots or even mini lots, you trade in micro lots, where every dollar in your account is represented as 100 cents. This means you can open positions with significantly smaller volumes, drastically reducing your exposure to market fluctuations as you learn the ropes.

This account type is an absolute game-changer, especially for forex beginners. It provides a perfect bridge between demo trading, where there’s no real money on the line, and live trading with substantial capital. With a small initial investment, you gain invaluable hands-on trading experience, allowing you to test trading strategies and build confidence without the pressure of significant financial loss. You get to feel the thrill of profit and the sting of loss on a scale that truly reflects your learning curve, making every lesson affordable.

At Finpros, we understand that every successful trader starts somewhere. Our Cent Account allows you to:

- Familiarize yourself with the trading platform and its functionalities.

- Execute trades with micro lots under actual market conditions.

- Develop and refine your trading strategies without risking large sums.

- Manage your emotions in a live trading environment.

- Gradually transition to larger account types as your skills and confidence grow.

This isn’t just about reducing risk; it’s about empowering you to take control of your learning process. You no longer need to wait until you have a large sum of capital to start your trading journey. With the Finpros Cent Account, the door to the financial markets is wide open, inviting you to step in and explore at your own pace. Start building your expertise today and unlock your potential in the world of forex.

- Understanding the Finpros Cent Account: Basics and Benefits

- Key Advantages of Trading with a Finpros Cent Account:

- What is a Cent Account?

- Why Choose Finpros for Cent Trading?

- Key Advantages of Cent Trading with Finpros:

- Key Features of the Finpros Cent Account

- Unlocking Your Trading Potential: Core Benefits

- Minimum Deposit and Leverage Options

- Available Assets and Trading Platforms

- How to Open Your Finpros Cent Account

- Registration and Verification Steps

- Your Seamless Registration Journey:

- Understanding the Verification Process (KYC):

- Advantages of Completing Verification:

- Trading Conditions on the Finpros Cent Account

- What Makes Finpros Cent Account Stand Out?

- Who Benefits Most from the Finpros Cent Account?

- Spreads, Commissions, and Execution Speed

- The Lowdown on Spreads

- Decoding Commissions

- The Essence of Execution Speed

- Risk Management Strategies for Finpros Cent Account Holders

- Why Risk Management is Your Best Friend

- Key Strategies to Implement Immediately

- 1. Define Your Risk Per Trade

- 2. Implement Stop-Loss Orders Religiously

- 3. Master Position Sizing

- 4. Diversify Across Currency Pairs (Carefully)

- 5. Understand Leverage

- Is the Finpros Cent Account Ideal for New Traders?

- Understanding the Finpros Cent Account

- Key Considerations for New Traders

- Comparing Finpros Cent Account with Other Account Types

- Cent Account vs. Standard Account

- Cent Account vs. ECN Account

- Cent Account vs. Demo Account

- Advanced Techniques for Finpros Cent Account Users

- Refining Your Risk Management with Precision

- Unleashing the Power of Automated Trading (EAs)

- Mastering Scalping and High-Frequency Approaches

- Developing Your Trading Psychology Edge

- Finpros Customer Support and Resources for Cent Accounts

- Your Dedicated Support Channels

- Empowering Your Trading with Resources

- Security and Regulatory Aspects of Finpros

- What Does Finpros Do to Keep You Secure?

- Our Commitment to Regulatory Compliance

- Optimizing Your Experience with a Finpros Cent Account

- Potential Downsides and Considerations of a Cent Account

- Limited Profit Potential

- Psychological Pitfalls

- Broker-Specific Restrictions

- Scaling Challenges

- Conclusion: Is a Finpros Cent Account Right for You?

- Frequently Asked Questions

Understanding the Finpros Cent Account: Basics and Benefits

Are you stepping into the exciting world of forex trading, or perhaps looking for a low-risk environment to refine your strategies? The Finpros Cent Account offers a unique and highly beneficial solution for traders at all levels. It’s a fantastic entry point that lets you experience real market conditions without the intimidating capital requirements or the high-stress exposure often associated with standard accounts. With Finpros, we make forex trading accessible and less daunting, helping you build a solid foundation for future success.

At its core, a Finpros Cent Account operates much like a standard trading account, but with one crucial difference: your balance and trade sizes are measured in cents, not dollars. Imagine depositing $100; on a cent account, your balance would display as 10,000 cents. This simple yet powerful mechanism dramatically reduces your actual risk per trade, making it perfect for those who want to learn and grow their trading skills confidently. You execute trades, manage positions, and observe market movements just as you would on any other account, but with significantly lower financial exposure. This innovative approach allows beginner traders to gain invaluable experience.

Key Advantages of Trading with a Finpros Cent Account:

- Exceptional Risk Management: Trade with real money but with minimized financial exposure. This allows you to experiment with new trading strategies without the fear of substantial losses, making it ideal for effective risk management practices.

- Experience Real Market Conditions: Unlike demo accounts, a Finpros Cent Account connects you to live markets. You’ll feel the true emotional and psychological aspects of trading, which is vital for developing discipline and understanding market dynamics.

- Perfect for Beginner Traders: If you are new to forex, this account provides the ultimate training ground. It helps you get accustomed to the Finpros platform, understand order execution, and manage trades under authentic scenarios with low capital.

- Test Drive New Trading Strategies: Experienced traders often use cent accounts to backtest and forward-test new systems or indicators. It’s an efficient way to see how a strategy performs in live markets before committing larger capital.

- Build Confidence Organically: Starting small and achieving consistent wins, even if they are in cents, builds tremendous confidence. This psychological edge is invaluable as you progress in your trading journey and scale up your investments.

- Accessibility: Finpros Cent Accounts require a very low minimum deposit, making forex trading accessible to almost anyone interested in participating in the global markets.

Many aspiring traders wonder if they should jump straight into a standard account. We often hear stories of traders who lost significant capital early on due to inexperience or emotional trading. A Finpros Cent Account acts as a buffer, giving you the necessary time and space to develop sound trading habits and robust trading strategies. It bridges the gap between theoretical knowledge and practical application, ensuring you are well-prepared for whatever the market throws your way.

“The Finpros Cent Account transformed my approach to forex trading. It allowed me to learn without the constant fear of heavy losses, giving me the confidence I needed to eventually move to larger positions. It’s truly the best starting point for anyone serious about mastering the markets.”

Choosing the Finpros Cent Account is a strategic move for anyone committed to long-term success in forex trading. It’s not just about smaller trade sizes; it’s about a smarter way to learn, practice, and refine your skills under real market conditions. We encourage you to explore this fantastic option and start your trading journey with Finpros today, setting yourself up for a stable and confident future in the financial markets.

What is a Cent Account?

Ever wondered about dipping your toes into the exciting world of forex trading without risking a large sum? A Cent Account is your perfect starting point! It’s a specialized type of trading account where your balance is displayed and trades are executed in cents, rather than standard currency units like dollars or euros. So, if you deposit $10, your account balance will show as 1,000 cents. This simple yet powerful difference makes it incredibly accessible.

Think of it as a bridge between a demo account and a standard live trading account. You get to experience the real market conditions, with live prices and actual execution, but the financial exposure is significantly reduced. This setup is a game-changer for several types of traders:

- Beginner Traders: Newcomers can learn the ropes, understand market dynamics, and build confidence without the pressure of substantial losses.

- Strategy Testers: Experienced traders can experiment with new strategies or Expert Advisors (EAs) in a real trading environment using small capital.

- Risk Management Enthusiasts: It allows for precise control over risk, as even small changes in price movements result in minimal profit or loss in dollar terms.

The beauty of a Cent Account lies in its ability to allow you to trade micro lots – or even “cent lots” – making positions much smaller. This means you can open trades with real money, but the impact of those trades on your actual funds is drastically scaled down. It’s an invaluable tool for gaining practical experience and mastering your trading psychology before committing to larger investments.

Why Choose Finpros for Cent Trading?

Embarking on your forex journey can feel daunting, but with Finpros, it doesn’t have to be. We understand the unique needs of new traders and those who prefer a low-risk environment. Our cent trading accounts are specifically designed to offer an accessible entry point into the dynamic world of currency markets, making your transition smooth and confident.

At Finpros, we pride ourselves on providing a robust and user-friendly platform that truly supports your growth. You get to experience real market conditions, execute actual trades, and develop your strategies without the pressure of significant capital investment. It’s the perfect training ground where every trade is a learning opportunity, not a high-stakes gamble.

Key Advantages of Cent Trading with Finpros:

- Unmatched Accessibility: Start trading with a very small deposit. Our cent accounts convert your funds into cents, giving you more units to trade. This means you can open positions with micro lots and gain hands-on experience without risking much capital. It’s the ultimate beginner friendly forex solution.

- Superior Risk Management: Learning to manage risk is crucial in trading. With a Finpros cent trading account, you can test various strategies, understand market volatility, and refine your approach in a controlled environment. The financial impact of a losing trade is significantly reduced, allowing you to learn from mistakes without major setbacks.

- Real Market Experience: You’re not trading on a demo. You are engaging with live market data, feeling the true emotions of winning and losing, and understanding how market news affects prices. This authentic experience is invaluable for developing the psychological resilience every successful trader needs.

- Practice with Precision: Our platform offers advanced tools and analytical features, even for cent accounts. You can practice technical analysis, set stop-loss and take-profit orders, and gain comfort with the trading interface. It’s an ideal way to master the mechanics of trading before scaling up.

- Seamless Transition: As your confidence grows and your strategies prove profitable, upgrading from a cent account to a standard account at Finpros is straightforward. We ensure a consistent trading environment, so your transition feels natural and empowering.

Choose Finpros for your cent trading journey and discover a supportive partner committed to your trading education and success. We make professional trading accessible, offering you the ideal foundation to build a thriving career in forex.

Key Features of the Finpros Cent Account

Are you ready to dive into the exciting world of forex trading without the hefty initial investment? The Finpros Cent Account is your perfect gateway, designed with accessibility and smart risk management in mind. It empowers both new traders and those refining their strategies to experience real market conditions using minimal capital. Let’s explore the standout features that make this account a top choice for aspiring traders.

At its core, the Finpros Cent Account redefines how you approach trading. It translates your deposits into cents instead of dollars, meaning a $10 deposit shows as 1000 cents in your account. This innovative approach allows you to trade with micro-lots, offering unprecedented flexibility and significantly reducing your market exposure. You get to learn, practice, and grow your confidence without the pressure of large sums of money on the line.

Unlocking Your Trading Potential: Core Benefits

- Low Entry Barrier: Begin your forex journey with a remarkably small initial deposit. This makes trading accessible to everyone, ensuring you don’t need a huge budget to start experiencing the markets. It’s perfect for testing strategies or getting comfortable with the trading platform.

- Trade in Cents (Micro Lots): Instead of standard lots, you trade in cent lots. This means you open positions in cents, giving you incredibly precise control over your trade size. Imagine trading 0.01 standard lots, but your Finpros Cent Account shows it as 100 units. This truly minimizes risk and helps you understand market movements without financial stress.

- Real Market Conditions: Experience live market execution, real-time spreads, and actual price action, just like a standard account. You gain invaluable experience navigating the complexities of the forex market in a simulated low-stakes environment.

- Access to Diverse Instruments: Don’t limit your horizons! Even with a cent account, you get access to a wide range of trading instruments, including major and minor currency pairs. This allows you to diversify your portfolio and explore different market opportunities.

- Flexible Leverage Options: Tailor your leverage to match your comfort level and strategy. Finpros offers competitive leverage options, enabling you to amplify your potential gains while still managing your exposure carefully, especially beneficial when trading with smaller cent values.

- Full Platform Functionality: Utilize industry-leading trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) with all their features. Enjoy advanced charting tools, technical indicators, and automated trading capabilities (Expert Advisors) without compromise.

- Exceptional Risk Management: This is where the Finpros Cent Account truly shines. Trading with smaller units naturally enhances your risk management capabilities. You can experiment with stop-loss and take-profit levels more effectively, learning crucial risk control techniques that will serve you well as your trading career progresses.

The Finpros Cent Account is more than just a stepping stone; it’s a strategic tool designed for smart trading. It helps you build confidence, master your trading platform, and understand market dynamics, all while keeping your financial exposure low. Start your trading adventure with Finpros today and experience the difference a well-designed cent account makes!

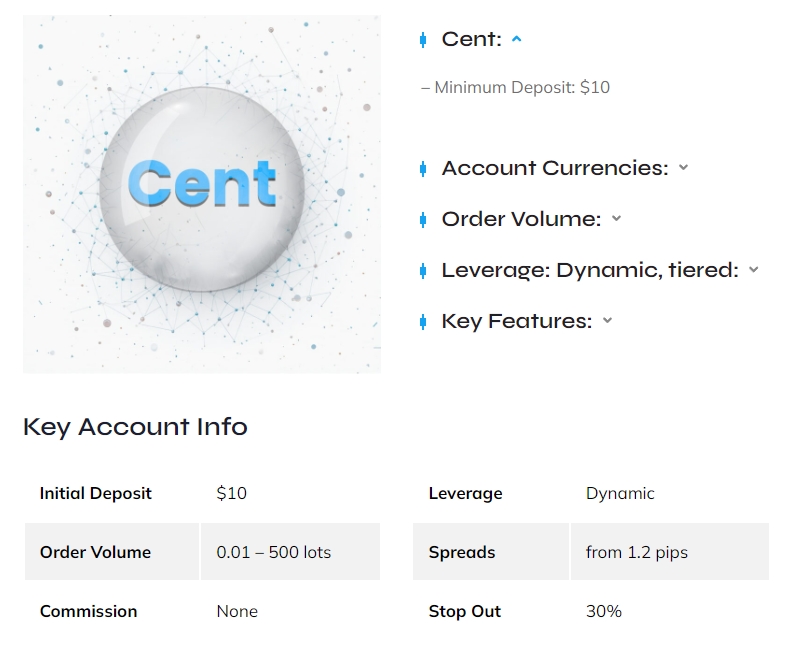

Minimum Deposit and Leverage Options

When you step into the exciting world of forex trading, two crucial factors often catch the eye of every newcomer: the minimum deposit required to open a trading account and the leverage options available. These elements directly impact your initial commitment and your potential for both profit and loss. Understanding them thoroughly sets the stage for a more informed trading journey. Understanding the minimum deposit is your first step. Brokers offer a range of entry points, designed to accommodate various levels of initial capital. Some platforms might let you start with as little as $10 or $50, making forex accessible to almost anyone. Others might require a few hundred or even a few thousand dollars. A lower minimum deposit is excellent for beginners who want to test the waters without significant financial commitment, allowing them to gain practical experience with live market conditions. However, remember that a smaller deposit, while reducing initial risk, also means less flexibility in trade sizing and potentially fewer opportunities to withstand market fluctuations if you do not manage risk effectively. It’s about finding a balance that suits your comfort level. Now, let’s talk about leverage options, a powerful tool in forex trading. Leverage allows you to control a much larger position in the market than your initial capital would typically permit. For instance, with 1:100 leverage, a $1,000 trading account can control a $100,000 position. This ability to magnify returns is incredibly appealing. Even small price movements can translate into substantial profits with the right strategy. The allure of turning small amounts into significant gains is one of the primary reasons traders are drawn to forex. However, leverage is a double-edged sword. While it amplifies potential gains, it also amplifies potential losses. A small adverse move can quickly erode your initial capital, leading to a margin call where you need to deposit more funds to maintain your positions or face automatic closure of your trades. This is why a thorough understanding of risk management is paramount when using leverage. Always consider using stop-loss orders to limit your downside exposure and protect your capital. Here are some key considerations regarding leverage:- Higher Leverage: Offers greater potential for profit from small capital, but significantly increases risk exposure. It demands strict discipline and robust risk management strategies.

- Lower Leverage: Reduces the potential for large gains but also mitigates the risk of substantial losses. Many experienced traders and those new to the market prefer lower leverage for a more conservative approach.

Available Assets and Trading Platforms

Step into the dynamic world of online trading and discover an incredible array of financial instruments at your fingertips. We believe in empowering our traders with choice, offering a diverse portfolio that goes far beyond traditional currency exchange. Expanding your trading horizon means more opportunities to capitalize on market movements, no matter your interest or strategy.

Here’s a glimpse into the exciting assets you can explore:

- Major and Minor Currency Pairs: Dive into the vibrant world of forex trading with popular pairs like EUR/USD, GBP/JPY, and USD/CAD, offering high liquidity and tight spreads.

- Exotic Currency Pairs: Venture into less common but potentially rewarding markets, exploring unique opportunities with currencies from emerging economies.

- Commodities: Trade the global forces of supply and demand with precious metals like gold and silver, or energy assets such as crude oil.

- Indices: Speculate on the performance of entire stock markets, gaining exposure to broad economic trends without trading individual shares.

- Cryptocurrencies: Embrace the digital revolution by trading popular digital assets such as Bitcoin, Ethereum, and other leading cryptocurrencies against fiat currencies.

Your access to these markets comes through cutting-edge trading platforms, designed for speed, reliability, and ease of use. Choosing the right platform is critical; it’s your command center for market analysis and trade execution. We provide access to industry-leading solutions, ensuring you have the tools to succeed.

Consider these popular platforms and their strengths:

| Platform Name | Key Benefits | Ideal For |

|---|---|---|

| MetaTrader 4 (MT4) | Robust charting, extensive customization, strong for algorithmic trading via Expert Advisors (EAs). | Experienced forex traders, automated strategies. |

| MetaTrader 5 (MT5) | Multi-asset capabilities (stocks, commodities, indices), deeper market analysis, more timeframes. | Traders seeking a broader range of assets and advanced tools. |

| cTrader | Sleek, intuitive interface, Level II pricing, fast execution, cAlgo for custom bots. | Beginners, ECN trading, those who value a modern user experience. |

| Proprietary Web/Mobile Platforms | User-friendly design, instant access from any device, integrated research and news. | On-the-go trading, new traders looking for simplicity. |

Each platform offers a unique set of features to match different trading strategy styles and preferences. Whether you’re a seasoned pro using complex indicators or a new trader starting with basic market analysis, a powerful and reliable platform awaits you. Explore the options, find your perfect match, and unlock your trading potential today!

How to Open Your Finpros Cent Account

Ready to jump into the dynamic world of currency exchange? Opening your Finpros Cent Account is your perfect first step! This account type is specifically designed for new traders looking to gain real-world experience without the pressure of a large capital commitment. It’s also fantastic for seasoned traders who want to test new strategies or Expert Advisors (EAs) in a live trading environment with minimal risk. We make the process simple and straightforward, ensuring you can begin your forex trading journey quickly and confidently.

Here’s a clear, step-by-step guide to get your Finpros Cent Account up and running:

- Visit the Finpros Website: Navigate to the official Finpros homepage. Look for a “Register” or “Open Account” button, typically found at the top right corner of the page.

- Start Your Registration: Click on the registration button. You will usually be asked to provide basic information such as your name, email address, and phone number. Make sure all details are accurate.

- Complete the Application Form: Fill out the detailed application form. This will include personal details, financial information, and your trading experience. Be honest in your responses, as this helps Finpros understand your needs and provide appropriate services.

- Verify Your Identity: As part of regulatory compliance, you’ll need to upload identification documents. This typically includes a government-issued ID (like a passport or driver’s license) and a proof of residence (such as a utility bill or bank statement) dated within the last three months. This step is crucial for account security and compliance.

- Choose Cent Account Type and Fund Your Account: Once your identity is verified, log in to your new Finpros client portal. Navigate to the account opening section and select the “Cent Account” type. Then, proceed to the funding options. You can deposit funds using various methods like bank transfer, credit/debit card, or e-wallets. Remember, a cent account allows you to trade in cents, making it ideal for managing risk.

- Download Your Trading Platform: With your account funded and ready, download the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platform offered by Finpros. Log in using the credentials provided to you after your account creation.

Congratulations! You are now ready to begin trading on your Finpros Cent Account. This account type provides an excellent platform for learning effective risk management techniques and understanding market dynamics without putting significant capital at stake. It’s the perfect balance of practice and real market exposure, paving the way for your success in forex trading. Don’t delay—your journey to becoming a confident trader starts now!

Registration and Verification Steps

Embarking on your journey into the exciting world of forex trading starts with a crucial first step: setting up your account. Our streamlined registration and verification process ensures both your security and full compliance with international financial regulations. Think of it as laying a solid foundation for your future trading success. We make it simple, secure, and swift so you can focus on what truly matters – mastering the markets.

Your Seamless Registration Journey:

- Choose Your Path: Decide whether you want to start with a demo account to practice your skills risk-free, or dive straight into a live trading account. Both options are readily available and designed to cater to your experience level.

- Basic Information: Provide your essential personal details, including your full name, email address, and phone number. We prioritize your privacy and handle all data with the utmost confidentiality.

- Secure Your Account: Create a strong, unique password. We recommend a combination of uppercase and lowercase letters, numbers, and symbols to maximize security.

- Agree and Continue: Review and accept our terms and conditions. This document outlines your rights and responsibilities, ensuring transparency every step of the way.

Once you complete these initial registration steps, you gain access to your personal dashboard. However, to unlock all features, including depositing funds and executing live trades, you’ll need to complete our verification process.

Understanding the Verification Process (KYC):

Verification, also known as Know Your Customer (KYC), is a standard industry practice designed to prevent fraud, money laundering, and ensure a secure trading environment for everyone. It’s a quick, one-time procedure.

Here’s what you’ll typically need:

- Proof of Identity (POI): A clear, valid copy of a government-issued identification document. This could be your passport, national ID card, or driver’s license. Ensure all details are visible and the document is not expired.

- Proof of Address (POA): A recent utility bill (electricity, water, gas, internet) or a bank statement, usually issued within the last three to six months. Make sure your name and address are clearly visible on the document.

Our system is designed for quick document upload and review, often completing the process within a few hours during business days. We use advanced encryption to protect your sensitive information throughout.

Advantages of Completing Verification:

- Enhanced Security: Your funds and personal data are protected by a robust verification layer.

- Full Platform Access: Unlock all trading features, including deposits, withdrawals, and advanced trading tools.

- Seamless Withdrawals: Enjoy hassle-free processing of your profit withdrawals, knowing your identity is confirmed.

- Regulatory Compliance: Trade with confidence on a platform that adheres to global financial regulations, providing peace of mind.

We are here to assist you throughout this process. If you encounter any questions or need clarification, our dedicated support team is just a click away, ready to guide you through each step.

Trading Conditions on the Finpros Cent Account

Diving into the world of forex can feel overwhelming, especially for newcomers. That’s why platforms like the Finpros Cent Account are game-changers. It’s specifically designed to offer a smoother entry point into the dynamic currency markets, letting you trade with real money but significantly reduced risk. Think of it as your practical training ground, where every move you make has real-world implications, yet the stakes are kept incredibly low. This setup is perfect for learning the ropes, understanding market fluctuations, and getting comfortable with your trading platform without the pressure of large capital commitments.

What Makes Finpros Cent Account Stand Out?

The core appeal of a cent account lies in its unique denomination. Instead of trading standard lots or even mini lots, you deal in cent lots. This means your deposit and profits are measured in cents, not dollars. For example, if you deposit $10, your account balance shows as 1000 cents. This simple yet effective approach dramatically reduces the perceived and actual risk, making it an ideal choice for gradual learning and strategy refinement.

Here’s a closer look at the key trading conditions you’ll encounter:

- Low Minimum Deposit: You don’t need a massive capital outlay to begin. The Finpros Cent Account typically allows you to start with a very low minimum deposit, making it accessible to almost anyone interested in forex. This removes a significant barrier to entry for many aspiring traders.

- Micro Lot and Cent Lot Trading: Instead of standard lots (100,000 units of base currency), you trade in micro lots (1,000 units) or even cent lots (100 units). This granular control over trade size is crucial for effective risk management and allows you to test strategies with minimal exposure.

- Competitive Spreads: Even with its beginner-friendly nature, the Finpros Cent Account aims to offer competitive spreads. Tighter spreads mean lower trading costs, which is always a benefit, especially when you’re making frequent, smaller trades as part of your learning process or scalping strategies.

- Flexible Leverage Options: Access to flexible leverage means you can control larger positions with a smaller amount of capital. While leverage amplifies both profits and losses, on a cent account, the reduced notional value of your trades makes managing this risk more straightforward as you gain experience.

- Popular Trading Platforms: You’ll typically find support for industry-standard platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). These platforms offer a wealth of analytical tools, charting capabilities, and the ability to use Expert Advisors (EAs), giving you a full trading experience.

- Strategy Testing Environment: This account type is a prime environment for strategy testing. You can try out new indicators, entry/exit techniques, and different trading styles in real market conditions without the financial stress associated with larger accounts.

Consider this perspective:

“The Finpros Cent Account is not just for beginners; it’s also a powerful tool for experienced traders looking to backtest new systems or adapt to different market conditions without putting substantial capital at risk. It bridges the gap between demo trading and live trading seamlessly.”

Who Benefits Most from the Finpros Cent Account?

This account structure caters to several types of traders:

- Forex Beginners: It offers a practical and safe introduction to live forex trading, allowing them to familiarize themselves with market dynamics and platform functionalities.

- Traders Testing New Strategies: For those developing or refining trading strategies, the cent account provides a cost-effective way to validate their approach in a live environment.

- Traders with Limited Capital: It enables individuals with a smaller budget to participate in the forex market and build their trading experience.

- Those Refining Risk Management Skills: The smaller trade sizes make it easier to practice and perfect risk management techniques without high stakes.

The Finpros Cent Account truly empowers traders by offering an accessible, low-risk, and educational path into the exciting world of currency trading. It’s an opportunity to build confidence and practical skills before scaling up your trading operations.

Spreads, Commissions, and Execution Speed

Understanding the costs and operational efficiency of your forex broker is paramount for successful trading. Spreads, commissions, and execution speed are three critical factors that directly impact your profitability and overall trading experience. Let’s break down why each of these elements demands your close attention.

The Lowdown on Spreads

The spread is the difference between the bid (sell) price and the ask (buy) price of a currency pair. It’s essentially your broker’s primary way of making money on your trades, built right into the pricing.

- Variable Spreads: These spreads fluctuate based on market volatility, liquidity, and time of day. They can be lower during calm market conditions but widen significantly during major news events or less liquid hours.

- Fixed Spreads: As the name suggests, these spreads remain constant, regardless of market conditions. While they offer predictability, they might be slightly wider than the lowest variable spreads during quiet periods.

A tighter spread means lower transaction costs for you, which is particularly beneficial for active traders or those employing scalping strategies. Always compare average spreads across different brokers for the currency pairs you frequently trade.

Decoding Commissions

While spreads are a universal cost, commissions are another fee charged by some brokers, especially on ECN (Electronic Communication Network) or STP (Straight Through Processing) accounts. These accounts often boast ultra-tight, sometimes even zero-pip spreads, but compensate with a per-trade commission.

“Many professional traders favor commission-based accounts because they believe the transparency of a clear commission, coupled with raw, interbank spreads, provides a more predictable and potentially lower overall cost structure, especially during volatile periods.”

When evaluating a broker, consider the total cost: spread + commission. Sometimes a slightly wider spread with no commission can be more cost-effective than a tiny spread paired with a high commission, depending on your trade volume.

The Essence of Execution Speed

Execution speed refers to how quickly your trade order is processed and confirmed by your broker. In the fast-paced world of forex, every millisecond counts. Swift execution can be the difference between hitting your target price and experiencing costly slippage.

Here’s why speedy execution matters:

- Minimizing Slippage: Slippage occurs when your order is filled at a price different from what you requested, often due to market volatility or slow execution. Faster execution reduces the likelihood and magnitude of slippage.

- Capturing Opportunities: In rapidly moving markets, quick execution allows you to enter and exit trades precisely when you intend, capitalizing on fleeting market movements.

- Reliability: A broker with excellent execution speed demonstrates robust technology and reliable infrastructure, which instills confidence in your trading operations.

Before committing to a broker, consider checking their typical execution times. Some brokers offer different execution models, such as “market execution” (filling at the best available price) or “instant execution” (filling at your requested price or not at all).

Ultimately, a deep understanding of spreads, commissions, and execution speed empowers you to choose a broker that aligns with your trading style and financial goals. Always prioritize transparency and efficiency.

Risk Management Strategies for Finpros Cent Account Holders

Embarking on your forex trading journey with a Finpros Cent Account offers a fantastic opportunity to learn and grow without risking substantial capital. However, the smaller investment doesn’t mean you can ignore robust risk management. In fact, it’s precisely because you’re in a learning phase that discipline becomes paramount. Mastering risk control on a smaller scale builds the foundation for success when you eventually scale up your trading.

Why Risk Management is Your Best Friend

Think of your trading strategy as a powerful engine and risk management as the brakes. You need both to drive safely and effectively. Without proper risk management, even a winning strategy can lead to significant losses if one or two trades go unexpectedly wrong. It’s all about protecting your hard-earned capital and ensuring longevity in the markets.

- Capital Preservation: Your primary goal should always be to protect your trading capital. You can’t make profits if you run out of funds.

- Emotional Discipline: A clear risk plan helps you stay rational, preventing impulsive decisions driven by fear or greed.

- Sustainable Growth: Consistent, controlled risk allows for steady account growth over time, even with small wins.

Key Strategies to Implement Immediately

As a Finpros Cent Account holder, you have the perfect environment to practice these essential techniques. Don’t skip these steps; they are critical for long-term success.

1. Define Your Risk Per Trade

This is arguably the most crucial rule. Decide what percentage of your account you are willing to lose on any single trade. A common recommendation for beginners is 1-2%. So, if your cent account balance is $100 (10,000 cents), a 1% risk means you’re willing to lose no more than $1 (100 cents) on one trade. This limits potential damage and keeps you in the game longer.

2. Implement Stop-Loss Orders Religiously

A stop-loss order is your safety net. It automatically closes your trade if the market moves against you to a predetermined price. Never enter a trade without setting one. For Finpros Cent Account users, this is an excellent way to practice precise entry and exit points and understand market volatility without wiping out your balance.

3. Master Position Sizing

Once you know your risk per trade and where your stop-loss will be, you can calculate your position size. This tells you how many micro-lots (or cent-lots) to trade. It ensures that if your stop-loss is hit, you only lose your predefined risk percentage. This is a skill that takes practice, and your cent account is the ideal place to hone it without financial pressure.

| Risk Management Element | Description for Cent Accounts | Benefit |

|---|---|---|

| Risk % per Trade | Typically 1-2% of your account balance. | Protects capital from single large losses. |

| Stop-Loss Orders | Always set a specific exit point for losing trades. | Limits downside, removes emotional decision-making. |

| Position Sizing | Adjust your trade size (micro-lots) based on risk and stop-loss. | Ensures consistent risk exposure per trade. |

| Take-Profit Orders | Define your target profit level before entering a trade. | Secures gains, prevents greed from taking over. |

4. Diversify Across Currency Pairs (Carefully)

While cent accounts are great for focusing on a few select currency pairs, don’t put all your eggs in one basket. If you choose to trade multiple pairs, ensure they are not highly correlated. However, for beginners, it’s often better to master one or two pairs before expanding. The key is never to overextend yourself.

5. Understand Leverage

Finpros Cent Accounts often come with significant leverage. While this allows you to control larger positions with less capital, it also amplifies losses. Use leverage wisely and always respect the power it gives you. Your risk management strategies become even more critical when using leverage.

By diligently applying these risk management principles to your Finpros Cent Account, you are not just trading; you are investing in your future as a disciplined and successful forex trading expert. Start today, practice consistently, and watch your confidence and skills grow!

Is the Finpros Cent Account Ideal for New Traders?

Embarking on the exhilarating journey of forex trading can feel daunting, especially for those just starting out. The sheer volume of information, the volatile market conditions, and the fear of financial loss often deter enthusiastic newcomers. This is where specialized accounts, like the Finpros Cent Account, come into play. But does it truly serve as the perfect launchpad for new traders?

Understanding the Finpros Cent Account

A cent account, by its very nature, allows you to trade in micro-lots, where your balance and trades are denominated in cents rather than dollars. For instance, if you deposit $100, your account will show 10,000 cents. This fundamental difference drastically reduces the actual capital at risk while still providing an authentic live trading experience.

Consider this perspective:

“The cent account bridges the gap between demo trading and a standard live account. It’s a crucial stepping stone that allows traders to get their feet wet without diving headfirst into deep waters, fostering skill development in a low-stress environment.”

For new traders, this setup offers significant advantages:

- Reduced Risk Exposure: You can execute trades with minimal real capital, making potential losses much more manageable. This is invaluable when learning the ropes of forex trading.

- Live Market Practice: Unlike a demo account, you are trading with real money under real market conditions. This helps you build confidence and understand the psychological aspects of trading without the heavy financial burden.

- Strategy Testing: It provides a safe environment to test new trading strategies, indicators, and expert advisors (EAs) with actual market data and execution speeds, refining your approach before scaling up.

- Emotional Discipline: Trading with even a small amount of real money helps new traders develop crucial emotional discipline, an often-overlooked aspect that can make or break a trading career.

- Low Minimum Deposit: Typically, Finpros Cent Accounts require a very low minimum deposit, making them accessible to almost anyone interested in exploring the forex market.

Key Considerations for New Traders

While the Finpros Cent Account presents numerous benefits, it’s also important for new traders to approach it with the right mindset. Here are a few points to remember:

| Aspect | Impact on New Traders |

|---|---|

| Profit Expectations | Profits will be small, proportional to the reduced risk. Focus on learning, not significant gains. |

| Psychological Shift | Treat every cent like a dollar. This fosters good risk management habits for future larger accounts. |

| Market Volatility | Though risk is low, market conditions can still be volatile. Learn to manage trades during these times. |

| Transition Plan | Consider how long you will use the cent account and your criteria for moving to a standard account. |

In conclusion, the Finpros Cent Account is indeed an excellent choice for new traders. It offers a unique blend of real market exposure and significantly reduced risk, providing an invaluable training ground. It empowers individuals to take their first steps into the complex world of forex trading with confidence and a practical understanding of how things work, without the overwhelming fear of substantial capital loss. It’s an ideal way to practice trading, test strategies, and solidify your understanding before you ever consider larger positions.

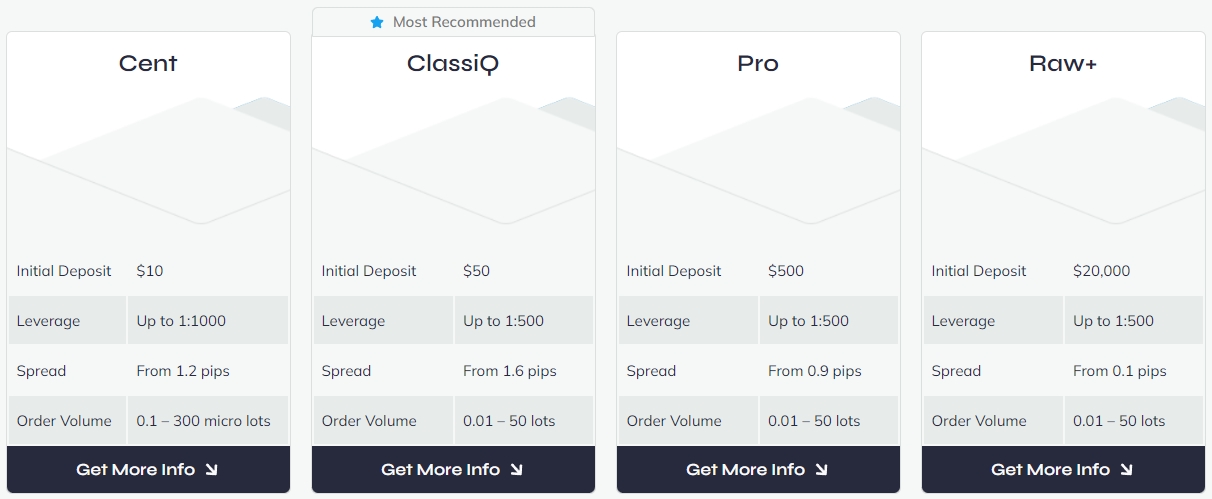

Comparing Finpros Cent Account with Other Account Types

Embarking on your forex trading journey means navigating a world of account options. Choosing the right one is crucial for your success, and Finpros offers a diverse range to meet various needs. Let’s dive into how the Finpros Cent Account stacks up against other popular account types, helping you pinpoint the perfect fit for your trading aspirations.

The Finpros Cent Account stands out as a unique entry point for many. Unlike traditional accounts that deal in standard currency units, a Cent Account allows you to trade in cents. This means if you deposit $100, your account balance will show 10,000 cents. This fundamental difference dramatically impacts your exposure to the live market, making it an excellent choice for controlled learning and applying various trading strategies with minimal financial risk.

Cent Account vs. Standard Account

The most common comparison often involves the Standard Account. Here’s a breakdown:

- Trade Size: A Finpros Cent Account lets you trade in micro lots (0.01 standard lots), but your actual **trade volume** is denominated in cents. This means opening a 0.01 lot position might represent a much smaller real-dollar value than on a standard account. A Standard Account, on the other hand, typically starts with micro lots, mini lots (0.1 standard lots), or even full standard lots (100,000 units of base currency), offering greater **profit potential** but also higher risk.

- Capital Requirements: With a Cent Account, you can start with a significantly smaller amount of **trading capital**. This makes it incredibly accessible for **new traders** who want to experience real **forex trading** without a large initial investment. Standard Accounts generally require more capital to open positions and manage margin effectively.

- Risk Management: This is where the Cent Account truly shines. Its small trade sizes are ideal for rigorous **risk management** practice. You can execute trades, observe market movements, and test your **entry point** and exit strategies with real money, but the financial impact of any losses remains incredibly small. A Standard Account, while offering greater returns, also carries proportionally higher risk, demanding more refined **risk management** skills.

Cent Account vs. ECN Account

While both allow you to trade forex, the Finpros Cent Account and an ECN (Electronic Communication Network) Account cater to different trading styles and preferences:

- Execution Model: A Cent Account often operates under an STP (Straight Through Processing) or Market Maker model, meaning your trades might pass through an intermediary before reaching liquidity providers. An ECN Account, however, provides direct market access, connecting you directly to interbank liquidity. This typically results in ultra-tight raw spreads, though often accompanied by a commission per trade.

- Spreads and Commissions: Cent Accounts might have slightly wider, sometimes fixed, spreads built into the pricing. ECN Accounts boast razor-thin, variable spreads but charge a commission, making them attractive for scalpers and those executing high-frequency **trading strategies** where every pip counts.

- Transparency: ECN Accounts offer a high degree of transparency in pricing and execution. While Finpros Cent Accounts are transparent regarding their terms, the ECN model provides an unfiltered view of the market’s bid/ask prices from multiple providers.

Cent Account vs. Demo Account

Many beginners start with a **demo account**, and it’s essential to understand how a Cent Account differs:

| Feature | Finpros Cent Account | Demo Account |

|---|---|---|

| Funds Used | Real Money (in cents) | Virtual/Play Money |

| Psychological Impact | Real emotions of winning/losing | No emotional attachment, risk-free |

| Market Conditions | Live market, real execution | Simulated market (mostly real-time prices, but no real execution) |

| Risk Management Practice | Crucial and impactful practice | Practice without real consequences |

| Suitability | Beginners transitioning to live trading, strategy testing | Learning platform, initial strategy testing, no financial risk |

A **demo account** is invaluable for learning the platform and understanding basic order types without any financial commitment. However, it lacks the psychological pressure and real-world consequences that come with trading real money. The Finpros Cent Account bridges this gap, allowing you to experience the emotional rollercoaster of **live market** trading with such small sums that you can focus on mastering your **trading strategies** and **risk management** without fear of significant losses.

In conclusion, the Finpros Cent Account is a powerful tool for those seeking a practical, low-risk **entry point** into **forex trading**. It’s the perfect stepping stone from a demo environment to full-fledged trading, allowing you to refine your skills, test new approaches, and build confidence with real, albeit small, stakes in the dynamic **live market**.

Advanced Techniques for Finpros Cent Account Users

You’ve mastered the basics on your Finpros Cent Account, executing trades, understanding market movements, and getting a feel for the rhythm of forex trading. Now, it’s time to elevate your game. A Finpros Cent Account isn’t just for beginners; it’s a powerful environment for seasoned traders to test, refine, and deploy advanced strategies with minimal capital at risk. Think of it as your high-tech lab where you can experiment with sophisticated approaches before you unleash them on larger live accounts. This is where you transform theoretical knowledge into practical, profitable skills.

Pushing the boundaries of what your cent account can do involves more than just opening and closing trades. It’s about strategic thinking, meticulous planning, and leveraging every feature to your advantage. Here’s how you can dive deeper into advanced techniques.

Refining Your Risk Management with Precision

One of the greatest strengths of a Finpros Cent Account lies in its ability to facilitate ultra-precise risk management. Because you trade in micro lots (0.01 standard lots), every pip movement has a smaller monetary value. This allows for incredibly granular control over your exposure.

- Dynamic Position Sizing: Practice adjusting your position size based on volatility, confidence in a setup, or market conditions. With cent accounts, you can test how different percentages of your equity perform without significant risk.

- Complex Stop-Loss & Take-Profit Strategies: Experiment with trailing stops, multiple take-profit levels, or even partial closes. See how these advanced orders interact with market dynamics in a low-stakes environment.

- Correlation Trading: If you’re looking into trading multiple currency pairs, use your cent account to understand how correlated assets move. Observe how AUD/USD and NZD/USD, for instance, often track together, and develop strategies to exploit or hedge against these relationships.

Unleashing the Power of Automated Trading (EAs)

Expert Advisors (EAs) or trading robots are a staple of advanced forex trading. Your Finpros Cent Account is the perfect playground for these automated systems. It provides a real-market environment without the psychological pressure of substantial capital.

Many professional traders use cent accounts to:

“A cent account is an indispensable tool for stress-testing automated strategies. It’s where theoretical code meets real-world market chaos, allowing for invaluable optimization before full deployment.”

– Renowned Forex Algorithm Developer

You can fine-tune your EA’s parameters, optimize its entry and exit logic, and even backtest its performance in real-time market conditions. This practical experience is far more valuable than historical backtesting alone, as it accounts for latency, slippage, and broker execution nuances.

Mastering Scalping and High-Frequency Approaches

Scalping, the art of making numerous small profits from minor price changes, demands exceptional precision and speed. While challenging, a Finpros Cent Account offers a fantastic environment to practice these high-intensity trading strategies. The lower capital requirement means you can enter and exit trades rapidly without significant slippage costs eating into your small profits, which can happen if you were trading larger volumes.

Consider these aspects when practicing advanced scalping techniques:

| Advanced Technique | Benefit on Cent Account | Key Consideration |

|---|---|---|

| Order Flow Reading | Develop sensitivity to market momentum. | Requires quick decision-making. |

| Tight Spreads Exploitation | Maximize small pip gains. | Broker’s execution speed is critical. |

| Latency Minimization | Optimize your trading setup for speed. | Proximity to server, internet connection. |

Remember, successfully scalping requires not just a solid strategy but also robust infrastructure and unwavering focus. The Finpros Cent Account allows you to hone these elements without putting your primary capital at risk.

Developing Your Trading Psychology Edge

Even with advanced strategies, trading psychology remains a critical component. Using your cent account for advanced techniques allows you to experience the emotional highs and lows associated with more complex trading scenarios, but with reduced financial pressure. This is invaluable for building mental resilience.

Use this opportunity to:

- Practice Discipline: Stick to your advanced trading plan without deviation.

- Manage Fear and Greed: Observe how emotions influence your decision-making, even with small capital.

- Recover from Losses: Develop a structured approach to bounce back from losing streaks, a skill vital for any professional forex trader.

By consciously practicing these psychological aspects, your Finpros Cent Account transforms into a powerful tool for holistic trader development. It’s about building a robust trading mind, not just a robust strategy.

Finpros Customer Support and Resources for Cent Accounts

Navigating the forex market, especially with a cent account, should feel supported, not overwhelming. At Finpros, we understand the unique needs of traders utilizing cent accounts, from beginners taking their first steps to experienced traders refining their strategies with smaller stakes. Our customer support team dedicates itself to providing swift, clear, and comprehensive assistance tailored specifically for your trading journey.

Your Dedicated Support Channels

We believe accessible support is paramount. That’s why Finpros offers multiple ways for you to connect with our expert team. Whether you have a question about platform functionality, need clarification on a trading term, or require assistance with your account, we’re here for you.

- Live Chat: Get instant answers to your queries through our real-time live chat service. Our support agents are ready to assist you directly, ensuring minimal downtime in your trading activities.

- Email Support: For more detailed inquiries or when you need to send screenshots or documents, our email support offers a reliable way to get comprehensive responses. We strive for prompt replies to all emails.

- Phone Assistance: Sometimes, a direct conversation is best. Our phone lines connect you with knowledgeable professionals who can walk you through solutions and provide personalized guidance.

Empowering Your Trading with Resources

Beyond direct support, Finpros invests heavily in creating a rich library of resources designed to empower our cent account traders. We want you to feel confident and well-informed every step of the way.

Here are some key resources readily available:

| Resource Type | Description |

|---|---|

| FAQ Section | A comprehensive database of frequently asked questions covering everything from account setup to platform usage and common trading queries for cent accounts. |

| Trading Guides | Step-by-step guides explaining various trading concepts, strategies, and how to effectively manage your cent account, including risk management techniques. |

| Video Tutorials | Visual walkthroughs demonstrating how to use the Finpros trading platform, place trades, set up indicators, and much more, perfect for visual learners. |

| Webinars & Seminars | Regular educational sessions led by market experts, often covering topics highly relevant to traders utilizing smaller account sizes to grow their skills. |

We continuously update our resource library to ensure you have access to the latest information and tools. Our commitment extends to helping you understand the nuances of the forex market and make informed decisions, especially when you are building your experience with a cent account. Finpros is more than just a broker; we are your partner in financial growth, offering robust support and educational materials to help you succeed.

Security and Regulatory Aspects of Finpros

Diving into the world of online trading demands trust, and at Finpros, we understand that deeply. Your peace of mind is paramount. This is why we place such a high emphasis on robust security measures and strict regulatory compliance. We believe that a secure and regulated environment is the bedrock of successful forex trading, offering you the confidence to focus on your strategies without worry.

When you choose Finpros, you’re not just picking a platform; you’re partnering with a broker dedicated to safeguarding your investments and personal data. We operate under stringent guidelines to ensure fairness, transparency, and accountability in every trade you make.

What Does Finpros Do to Keep You Secure?

Our commitment to your security is multifaceted. We implement a range of advanced technologies and operational protocols to create a safe trading environment:

- Client Fund Protection: We segregate all client funds from our operational capital. This means your money is held in separate bank accounts, ensuring it remains untouchable even in unforeseen circumstances concerning the company. This is a crucial element of financial security in the forex market.

- Advanced Data Encryption: Your personal and financial information is always protected using state-of-the-art encryption technologies. We employ SSL (Secure Socket Layer) encryption across our platforms, making sure that your data transfers are private and secure from unauthorized access.

- Secure Trading Infrastructure: Our trading servers are housed in highly secure data centers, protected by advanced firewalls and intrusion detection systems. We maintain constant vigilance against cyber threats to ensure uninterrupted and safe access to the markets.

- Negative Balance Protection: We provide negative balance protection for our retail clients. This means you can never lose more money than you have deposited into your trading account, offering a vital safety net in volatile market conditions.

- Two-Factor Authentication (2FA): For an extra layer of security, we offer 2FA on your account login. This requires a second verification step, usually through your mobile device, making it much harder for unauthorized individuals to gain access.

Our Commitment to Regulatory Compliance

Being a regulated broker is not just a badge; it’s a promise. Finpros adheres to the highest industry standards set by reputable financial authorities. We hold licenses from leading regulatory bodies, which require us to uphold strict operational procedures, financial transparency, and ethical conduct. This regulatory oversight ensures:

| Aspect | Finpros’ Regulatory Practice |

|---|---|

| Transparency | Clear communication of terms, conditions, and pricing. No hidden fees. |

| Fair Trading Practices | Ensuring fair execution of trades and preventing market manipulation. |

| Regular Audits | Undergoing routine financial and operational audits by independent third parties. |

| Dispute Resolution | Providing clear channels for client complaints and robust resolution procedures. |

Our commitment to regulatory compliance provides a robust framework that protects your interests and fosters a trustworthy trading environment. Choosing Finpros means choosing a partner that prioritizes your security and operates with the highest standards of integrity in the forex trading world. Your safety is our business.

Optimizing Your Experience with a Finpros Cent Account

Embarking on your forex trading journey, or refining existing strategies, demands a platform that supports growth without overwhelming risk. A Finpros cent account offers precisely this unique advantage, providing a vital stepping stone into the dynamic world of currency markets. It’s more than just a demo; it’s a live trading environment where you engage with real market conditions using micro-lots, effectively minimizing your capital exposure.

This setup allows aspiring traders to gain invaluable practical experience and build confidence. You execute trades, manage positions, and observe market movements just as you would with a standard account, but with significantly smaller financial stakes. It’s the perfect playground to test new trading strategies, understand the nuances of various currency pairs, and get comfortable with the Finpros trading platform without the intense pressure of larger capital at risk.

To truly optimize your experience with a Finpros cent account, consider these key approaches:

- Treat it Seriously: Approach your cent account trades with the same discipline and analytical rigor you would a standard account. This habit formation is crucial for long-term success in forex trading.

- Focus on Strategy Development: Use this opportunity to rigorously test and refine different trading strategies. Document your entries, exits, and reasons for each trade to identify what works best for you.

- Practice Risk Management: Even with small amounts, implement robust risk management principles. Define your stop-loss and take-profit levels, and never risk more than a tiny percentage of your account on any single trade.

- Monitor Market News: Stay informed about global economic events and news releases. Understand how these factors influence currency prices, integrating fundamental analysis into your trading decisions.

- Get Familiar with Platform Features: Explore every tool and feature available on the Finpros trading platform. Mastering its functionalities will make your transition to larger accounts smoother and more efficient.

A Finpros cent account empowers you to master market dynamics at your own pace. It bridges the gap between theoretical knowledge and practical application, allowing you to develop a robust trading methodology and gain the hands-on experience vital for navigating the complex yet rewarding world of forex.

Potential Downsides and Considerations of a Cent Account

While cent accounts offer a fantastic gateway into the forex market, it’s crucial to approach them with a clear understanding of their limitations. They are not a one-size-fits-all solution, and what makes them ideal for beginners can become a hurdle for those looking to scale their trading endeavors. Let’s explore some of the key drawbacks and considerations.

Limited Profit Potential

The very nature of a cent account means you trade in much smaller units. This translates directly into significantly smaller profit margins. Even if you nail a perfect trade, a 100-pip move on a micro lot (0.01 standard lots) yields just $1. On a cent account, that same 100-pip move on a 0.01 lot (which is 0.0001 standard lots) could be as little as $0.01. This can be demotivating for traders aiming for substantial returns, making it challenging to grow a small account significantly within a short timeframe. It’s an excellent training ground, but not a rapid wealth builder.

Psychological Pitfalls

Trading with minimal capital, where losses are often just a few cents or dollars, can inadvertently foster bad habits. Because the financial risk feels negligible, traders might:

- Take trades without thorough analysis, treating it more like a game than a serious investment.

- Over-leverage their positions, as the potential loss seems insignificant.

- Fail to develop proper risk management strategies, which are vital when transitioning to standard accounts.

- Not take losses seriously, thus not learning from their mistakes effectively.

The lack of real financial pressure can hinder the development of disciplined trading psychology, which is paramount for long-term success in forex.

Broker-Specific Restrictions

Not all cent accounts are created equal, and some brokers may impose additional limitations:

| Consideration | Impact on Cent Accounts |

|---|---|

| Available Instruments | Some brokers might offer a reduced selection of currency pairs or other assets compared to their standard accounts. |

| Spreads & Commissions | It’s not uncommon for cent accounts to have slightly wider spreads or different commission structures, which can eat into small profits. |

| Execution Speed | While rare, some brokers might prioritize order execution for larger, standard accounts during periods of high volatility. |

| Platform Compatibility | Occasionally, certain advanced features or third-party tools might not be fully compatible or optimized for cent account trading. |

Always review the specific terms and conditions offered by your chosen forex broker for their cent account options.

Scaling Challenges

The transition from a cent account to a standard account can be a significant hurdle. What worked well with $10 in a cent account might not be sustainable or emotionally manageable with $1,000 in a standard account. The psychological leap from risking cents to risking tens or hundreds of dollars per trade demands a strong, established trading plan and emotional resilience that might not have been fully developed in the low-risk cent environment.

In essence, a cent account is a fantastic sandbox, but it’s crucial to remember that the real-world trading playground operates with different rules and higher stakes. Use it wisely for learning and practice, but be mindful of its inherent limitations as you progress on your trading journey.

Conclusion: Is a Finpros Cent Account Right for You?

After exploring the distinctive advantages of a Finpros Cent Account, the crucial question emerges: does it align with your trading aspirations? This account type serves a specific, yet broad, spectrum of traders, making it an excellent consideration for many looking to navigate the exciting world of forex.

Consider a Finpros Cent Account if:

- You are new to forex and want to gain practical experience without substantial financial exposure. It offers a safe environment to learn the ropes.

- You have a limited budget but still wish to participate in live market trading. You can start with a very small deposit and trade micro-lots.

- You want to test new trading strategies or indicators under real market conditions before applying them to a larger, standard account.

- You are evaluating Finpros as a broker, assessing its platform, execution speeds, and customer support without committing significant capital.

- You prioritize strict risk management and prefer to trade with smaller position sizes, even if you are an experienced trader.

A Finpros Cent Account empowers you to build confidence, refine your skills, and understand market behavior with minimal stress. It’s a strategic entry point for beginners and a smart testing ground for seasoned traders.

Ultimately, the decision rests on your individual goals:

Do you seek a low-risk environment for skill development? Do you aim to test strategies with precision? Is capital preservation your top priority while still engaging with live markets? If your answers lean towards yes, then a Finpros Cent Account could be an invaluable tool in your trading journey. It offers a unique blend of accessibility, practical experience, and disciplined risk management, setting a solid foundation for your success in the currency markets.

Frequently Asked Questions

What is a Finpros Cent Account?

A Finpros Cent Account is a specialized trading account where your balance and trade sizes are denominated in cents instead of dollars. This dramatically reduces your financial exposure, making it ideal for new traders to experience real market conditions with minimal risk.

Who is the Finpros Cent Account best suited for?

It’s primarily designed for forex beginners, traders with limited capital, and experienced traders who want to test new strategies or Expert Advisors (EAs) in a live, low-risk environment before committing larger funds.

What are the key benefits of trading with a Finpros Cent Account?

Key benefits include exceptional risk management due to smaller trade sizes, the ability to experience real market conditions (unlike a demo), a low entry barrier with minimal deposit requirements, and the opportunity to build confidence and test strategies without significant financial pressure.

How does a Cent Account help with risk management?

By denominating trades in cents, it allows for incredibly precise control over position sizing. Traders can define their risk per trade (e.g., 1-2% of their cent balance) and use stop-loss orders more effectively, limiting potential losses in real dollar terms while still learning crucial risk control techniques.

What are the potential downsides of using a Finpros Cent Account?

While beneficial, downsides include limited profit potential due to small trade sizes, the risk of developing lax psychological habits if traders don’t take small losses seriously, and potential broker-specific restrictions on available instruments or slightly wider spreads compared to standard accounts.