Are you exploring the world of online trading and wondering about your options in the Middle East? Finpros Bahrain stands out as a prominent player in the region’s financial landscape. It offers a gateway to global markets for traders and investors seeking diverse opportunities. Essentially, Finpros Bahrain provides a robust platform for individuals and institutions to engage in various forms of financial trading, all while operating under local regulatory frameworks.

Operating from the heart of Bahrain, this entity focuses on delivering accessible and efficient trading experiences. Whether you are a seasoned investor or just starting your journey into the financial markets, understanding what Finpros Bahrain brings to the table is crucial. They are committed to providing services that cater to a wide range of trading preferences and strategies, making complex financial instruments more approachable for the everyday trader.

- What Finpros Bahrain Offers: Your Trading Toolkit

- Regulatory Compliance and Security

- Client Fund Segregation

- Data Protection and Cybersecurity

- Operational Transparency

- External Audits and Reporting

- Licensing and Client Fund Protection

- Trading Platforms Offered by Finpros Bahrain

- What Finpros Bahrain Platforms Offer You

- MetaTrader (MT4/MT5) Functionality

- Web and Mobile Trading Platforms

- Why our platforms stand out:

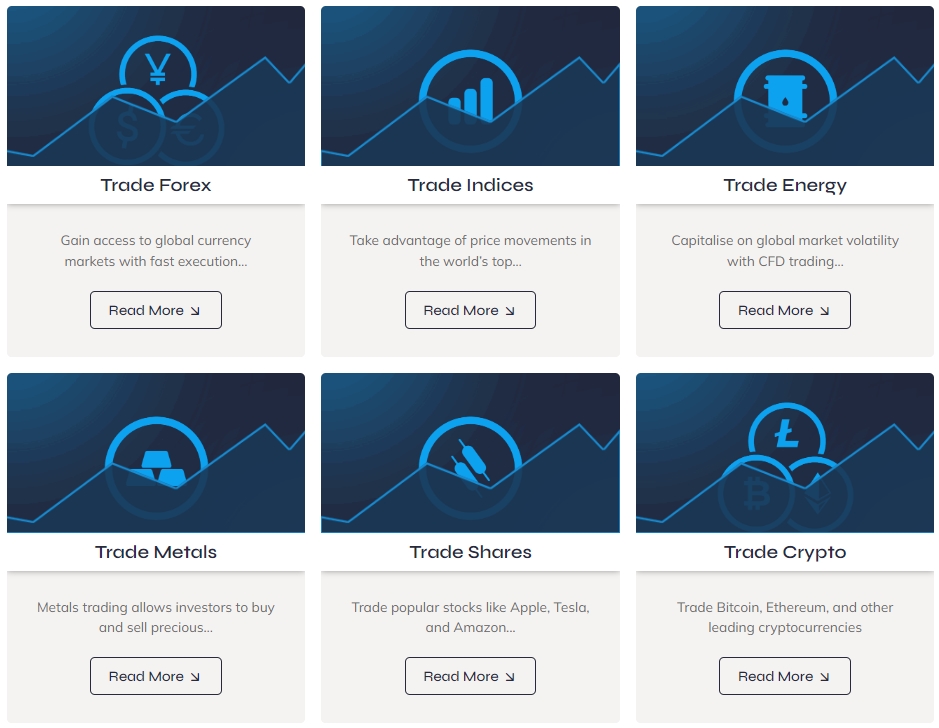

- Available Markets and Financial Instruments

- The Dynamic Forex Market

- Beyond Currencies: A World of Instruments

- Key Financial Instruments Available

- Forex, CFDs, and Equities

- Commodities and Digital Assets: A New Frontier for Traders

- Why Consider Commodities?

- The Rise of Digital Assets

- Comparing Your Options: Commodities vs. Digital Assets

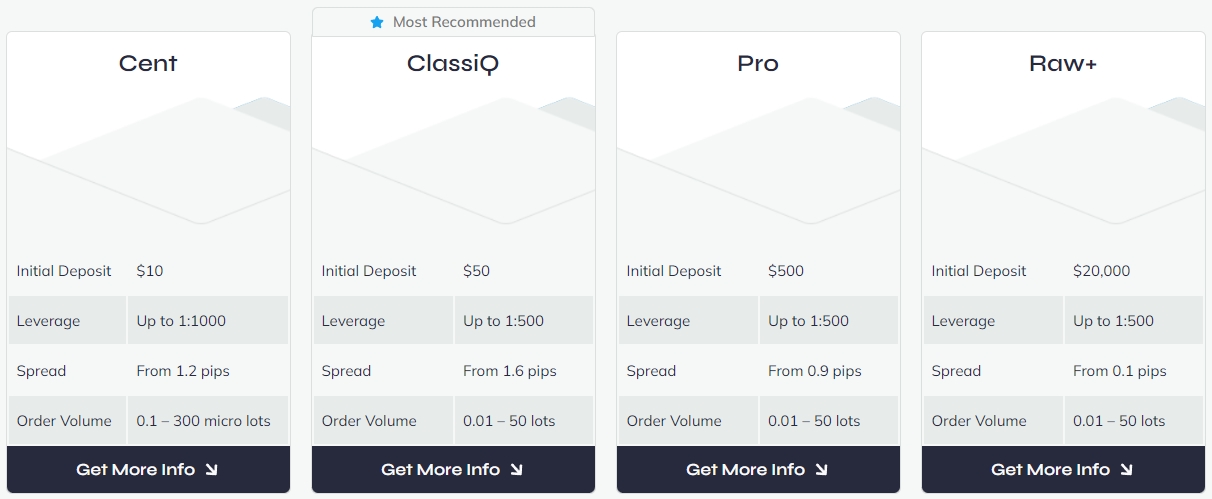

- Finpros Bahrain Account Types

- Standard Account: Your Gateway to Global Markets

- ECN Account: For Precision and Transparency

- Islamic Account: Swap-Free Trading

- Demo Account: Practice Without Risk

- Spreads, Commissions, and Fee Structure

- What is a Spread?

- Understanding Commissions

- Other Fees to Watch Out For

- Deposit and Withdrawal Methods

- Fund Your Trading Journey with Ease

- Access Your Profits When You Need Them

- Customer Support Experience and its Level

- What Defines High-Level Support?

- The Impact of Superior Client Service

- Assessing Support Quality: What to Look For

- Educational and Research Resources

- What We Offer: Your Learning Journey

- Unlock Informed Decisions with Our Research Tools

- Leverage and Margin Requirements

- Advantages of Trading with Finpros Bahrain

- Potential Drawbacks and Considerations

- The Double-Edged Sword of Leverage

- Market Volatility and Unpredictability

- The Steep Learning Curve

- Emotional Toll and Discipline Requirements

- Broker Reliability and Security

- How to Get Started with Finpros Bahrain

- Your Journey Begins Here: Simple Steps to Join Finpros Bahrain

- Why Choose Finpros Bahrain for Your Trading Journey?

- Advantages of Trading with Finpros Bahrain:

- What to Expect After Account Opening:

- Final Verdict: Is Finpros Bahrain Suitable for Your Trading Needs?

- Key Considerations for Finpros Bahrain:

- Advantages and Disadvantages of Finpros Bahrain:

- Frequently Asked Questions

What Finpros Bahrain Offers: Your Trading Toolkit

Finpros Bahrain isn’t just another trading platform; it’s a comprehensive suite of financial services designed to empower your trading decisions. Their offerings are tailored to meet the demands of a dynamic global market, ensuring that clients have access to popular assets and advanced trading tools. When you consider forex trading Bahrain, Finpros often comes to mind due to its localized approach and international standards.

- Forex Trading: Dive into the world’s largest financial market. Trade major, minor, and exotic currency pairs with competitive spreads. Many aspiring traders look for a reliable partner for currency pairs, and Finpros Bahrain aims to fill that role.

- CFD Trading: Explore Contracts for Difference across various asset classes, including indices, commodities, and shares. This allows you to speculate on price movements without owning the underlying asset, offering flexibility in your investment strategy.

- User-Friendly Platforms: Access powerful trading platforms, often including industry-standard options, designed for both desktop and mobile use. This ensures you can manage your trades anytime, anywhere, leveraging technology for your investment opportunities Bahrain.

- Educational Resources: Benefit from a range of educational materials, from articles to webinars, helping you sharpen your trading skills and market knowledge. This commitment to client education is a hallmark of a professional online trading platform.

Choosing a regulated broker Bahrain gives traders peace of mind, knowing their investments operate within established guidelines. Finpros Bahrain strives to maintain high standards of transparency and security, making it a noteworthy consideration for anyone looking to engage in online trading and expand their financial horizons in the region.

Regulatory Compliance and Security

When you step into the dynamic world of forex trading, one of your biggest concerns should be the safety of your capital and personal information. This isn’t just about choosing a platform; it’s about partnering with entities that uphold the highest standards of regulatory compliance and security. Think of it as building your financial house on a rock-solid foundation, protecting your aspirations from unforeseen risks.

Regulatory compliance ensures that a forex broker operates within a strict legal framework set by specific licensing authorities. These regulations are designed with one primary goal: investor protection. They mandate transparent operations, fair trading practices, and robust financial stability. Dealing with regulated brokers gives you peace of mind, knowing there’s an oversight body watching your back and holding the broker accountable. It’s a critical differentiator in an often-unregulated global market.

Beyond just following rules, top-tier platforms prioritize the security of your assets and data. This goes far beyond basic encryption; it’s about a multi-layered approach to risk management and operational integrity. You want assurances that your trading environment is not only fair but also impenetrable to external threats.

-

Client Fund Segregation

A cornerstone of financial regulation is the requirement for client funds to be held in segregated accounts. This means your money is kept separate from the broker’s operational capital. In the unlikely event of a broker’s insolvency, your funds are protected and cannot be used to pay the company’s debts. This practice significantly enhances investor protection.

-

Data Protection and Cybersecurity

Your personal details, transaction history, and financial data are highly sensitive. Robust cybersecurity protocols are essential to safeguard this information. Look for platforms that employ advanced encryption technologies, multi-factor authentication, and regular security audits. Effective data protection is non-negotiable in modern forex trading.

-

Operational Transparency

Regulated brokers are typically required to provide clear and comprehensive information regarding their services, fees, and trading conditions. This transparency builds trust and helps you make informed decisions about your forex trading activities. It removes ambiguity and promotes a fair trading environment.

-

External Audits and Reporting

To maintain their licenses, regulated entities often undergo regular external audits. These independent reviews assess their financial health, operational practices, and adherence to regulatory standards. This consistent scrutiny reinforces their commitment to regulatory compliance and provides an extra layer of assurance for traders.

Choosing a platform that champions both regulatory compliance and strong security measures is not just a recommendation; it’s a fundamental aspect of smart forex trading. It significantly reduces your exposure to operational risks and builds a foundation of trust necessary for a successful trading journey. Always prioritize your safety and security in this exciting financial endeavor.

Licensing and Client Fund Protection

Diving into the world of forex trading requires more than just a keen eye for market movements; it demands confidence in the platform you choose. Nothing builds that confidence quite like robust licensing and unwavering client fund protection. These aren’t just bureaucratic checkboxes; they are your fundamental safeguards, ensuring your trading journey remains secure and fair.

A reputable forex broker operates under strict regulatory oversight. This means a recognized financial authority, such as the FCA in the UK, CySEC in Cyprus, or ASIC in Australia, has licensed and continually monitors their activities. This crucial step holds brokers accountable, compelling them to adhere to stringent operational standards, capital requirements, and ethical practices. When you choose a regulated broker, you’re not just picking a platform; you’re selecting a partner committed to transparency and integrity in every trade.

Beyond licensing, the way your funds are handled is paramount. Top-tier forex platforms prioritize safeguarding your capital through several vital mechanisms:

- Client Fund Segregation: Your funds are never mixed with the broker’s own operational capital. They reside in separate bank accounts, often held with top-tier banks. This ensures that even if the broker faces financial difficulties, your money remains untouched and accessible.

- Negative Balance Protection: Many regulated brokers offer this invaluable feature, guaranteeing that you cannot lose more than the funds in your trading account. It prevents your account balance from falling into negative territory due to sudden, drastic market movements.

- Investor Compensation Schemes: In many jurisdictions, regulated brokers contribute to investor compensation funds. These schemes provide an extra layer of protection, offering compensation up to a certain amount in the unlikely event of broker insolvency.

- Regular Audits: Independent auditors frequently examine the broker’s financial statements and operational procedures. These audits verify compliance with regulatory requirements and confirm that client funds are indeed segregated and properly managed, reinforcing the broker’s commitment to being a trustworthy forex platform.

Always make verifying a broker’s licensing and fund protection policies your absolute priority. It’s the smart way to ensure peace of mind as you navigate the exciting opportunities the forex market offers.

Trading Platforms Offered by Finpros Bahrain

Choosing the right trading platform is paramount to your success in the dynamic world of forex. At Finpros Bahrain, we understand this completely. That’s why we empower our traders with a selection of industry-leading platforms, designed to meet the diverse needs of both new market entrants and seasoned professionals. Our commitment is to provide robust, intuitive, and feature-rich environments where you can execute your strategies with precision and confidence.

We believe your trading tools should adapt to you, not the other way around. Finpros Bahrain ensures you have access to popular, reliable, and cutting-edge software, whether you prefer desktop analysis, web-based convenience, or trading on the go with your mobile device. Get ready to experience seamless execution and comprehensive market insights right at your fingertips.

What Finpros Bahrain Platforms Offer You

- Advanced Charting Tools: Dive deep into market trends with a vast array of technical indicators, drawing tools, and customizable chart types. Visualize price movements like never before.

- Real-Time Market Data: Stay ahead with live price feeds, economic calendars, and market news directly integrated into your platform. Make informed decisions instantly.

- One-Click Trading: Execute trades rapidly and efficiently. Seize fleeting opportunities without delay.

- Automated Trading Capabilities: Utilize Expert Advisors (EAs) to automate your strategies, allowing the platform to work for you even when you’re away from your screen.

- User-Friendly Interface: Navigate effortlessly through a clean and intuitive layout, making your trading experience smooth and enjoyable.

- Multiple Order Types: Access a full spectrum of order types, from market orders to pending orders, to manage your risk and entry/exit points effectively.

- Comprehensive Account Management: Monitor your positions, equity, and balance with clear, real-time updates.

Let’s take a closer look at the primary platforms available through Finpros Bahrain:

| Platform Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

|---|---|---|

| Focus | Primarily Forex and CFDs | Forex, CFDs, Stocks, Futures, Options |

| Charting Tools | Excellent, with 9 timeframes, 30 indicators | Enhanced, with 21 timeframes, 38 indicators |

| Order Types | Market, Buy Limit, Sell Limit, Buy Stop, Sell Stop | Adds Buy Stop Limit, Sell Stop Limit |

| Pending Orders | 4 types | 6 types |

| Economic Calendar | Available via external tools/plugins | Built-in |

| Depth of Market (DOM) | Not native | Native with tick chart and trading capabilities |

| Programming Language | MQL4 | MQL5 (more powerful) |

| Hedge/Netting | Supports hedging | Supports both hedging and netting |

Both MT4 and MT5 are available across various devices, including desktop applications for Windows and Mac, web-based versions that run directly in your browser without installation, and powerful mobile apps for iOS and Android. This means you can manage your trades, analyze markets, and stay connected no matter where you are.

We constantly strive to optimize your trading environment. With Finpros Bahrain, you are not just getting a platform; you are gaining access to a complete ecosystem designed to support your trading journey every step of the way. Explore the possibilities and find the perfect fit for your trading style.

MetaTrader (MT4/MT5) Functionality

Step into the world of professional forex trading with MetaTrader 4 (MT4) and MetaTrader 5 (MT5), the industry-standard platforms. These aren’t just simple trading interfaces; they are comprehensive ecosystems designed to empower traders at every level. Let’s explore the core functionalities that make MT4 and MT5 indispensable tools for serious market participants.

At the heart of both platforms are their robust charting tools. You gain access to a wide array of timeframes, from minute charts to monthly views, allowing you to perform in-depth technical analysis. With dozens of built-in indicators like Moving Averages, RSI, and MACD, plus the ability to add custom indicators, you can easily identify trends, support, and resistance levels. This visual power helps you make informed trading decisions.

Executing trades is straightforward and flexible. MT4 and MT5 offer various order types to suit your strategy:

- Market Execution: Place instant trades at the current market price.

- Pending Orders: Set up trades to execute automatically when the market reaches a specific price. This includes buy limits, sell limits, buy stops, and sell stops, giving you precise control over your entry and exit points.

- Stop Loss and Take Profit: Essential risk management tools. Define your maximum acceptable loss and your target profit level before entering a trade.

A major draw for many traders is the support for algorithmic trading through Expert Advisors (EAs). These automated trading systems can execute trades based on predefined rules, removing emotional bias from your trading strategies. You can also develop or download custom EAs to fit your unique approach. The integrated Strategy Tester allows you to backtest these EAs using historical market data, refining your automated systems before deploying them live.

Furthermore, the platforms offer a customizable interface, real-time market data, and a news feed to keep you updated on global events impacting currency pairs. Whether you’re on your desktop or using the mobile trading apps, MT4 and MT5 provide a seamless and powerful trading experience, ensuring you stay connected to the markets no matter where you are.

Web and Mobile Trading Platforms

In today’s fast-paced world, staying connected to the financial markets is no longer a luxury—it’s a necessity. Whether you’re a seasoned trader or just starting your journey into forex trading, having robust, reliable, and accessible trading platforms is crucial. We empower you with state-of-the-art web and mobile solutions that put the global currency markets right at your fingertips.

Our platforms are designed with you in mind, blending powerful functionality with intuitive design. This means you can execute trades, analyze market trends, and manage your portfolio with unparalleled ease, no matter where you are.

Why our platforms stand out:

- Unmatched Accessibility: Trade from any device, anywhere. Our web platform requires no downloads, and our dedicated mobile app keeps you connected on the go.

- Real-Time Data: Get instant access to live price feeds, charts, and market news, ensuring you always have the most current information.

- Advanced Charting Tools: Utilize a comprehensive suite of technical indicators and drawing tools to perform in-depth market analysis.

- Seamless Execution: Experience lightning-fast trade execution with minimal slippage, even during volatile market conditions.

- Customizable Interface: Personalize your trading environment to match your preferences and trading style.

We understand that different traders have different needs. That’s why our offerings cater to both those who prefer the expansive view of a desktop browser and those who need the ultimate convenience of trading from their smartphone.

| Feature | Web Platform Advantage | Mobile Platform Advantage |

|---|---|---|

| Screen Real Estate | Ideal for multi-chart analysis and complex strategies. | Optimized for quick trades and monitoring on the move. |

| Analysis Depth | Access to a full suite of analytical tools and indicators. | Essential indicators readily available for immediate insights. |

| Convenience | Trade from any computer without software installation. | Ultimate accessibility; trade anytime, anywhere. |

| Speed | Fast loading for comprehensive market overviews. | Rapid deployment for instant trade execution. |

Choose the platform that best fits your lifestyle and trading goals. With our web and mobile trading platforms, you’re always in control of your financial journey. Embrace the freedom and flexibility that modern trading demands.

Available Markets and Financial Instruments

Step into the expansive world of financial trading where opportunities abound across a multitude of markets. Whether you are a seasoned investor or just beginning your journey, understanding the diverse range of available instruments is key to crafting a robust trading strategy and achieving your financial goals. We provide you with access to a powerful platform, connecting you to global markets and empowering you to capitalize on their dynamic movements.

The Dynamic Forex Market

At the heart of global finance lies the foreign exchange market, or Forex – the largest and most liquid financial market in the world. Here, you engage in currency pairs trading, speculating on the relative value of one currency against another. This market operates 24 hours a day, five days a week, offering constant trading opportunities.

You will find a broad spectrum of pairs to trade:

- Major Pairs: These include the most frequently traded currencies against the US Dollar, like EUR/USD, GBP/USD, USD/JPY. They typically offer tighter spreads and high liquidity, making them popular for active traders.

- Minor Pairs: Also known as cross-currency pairs, these involve major currencies but do not include the US Dollar, such as EUR/GBP or AUD/JPY. They can present unique trends and market volatility.

- Exotic Pairs: These combine a major currency with a currency from an emerging or smaller economy, for instance, USD/TRY or EUR/MXN. While potentially offering higher rewards, they often come with wider spreads and require careful risk management due to their lower liquidity.

Beyond Currencies: A World of Instruments

While currency pairs are a cornerstone, your trading horizon extends far beyond. Our platform allows you to diversify your portfolio by engaging with a variety of other exciting financial instruments, primarily through Contracts for Difference (CFDs). CFDs let you speculate on price movements without owning the underlying asset, often with the benefit of leverage.

Consider these popular choices:

Key Financial Instruments Available

| Instrument Type | Description & Examples | Trading Appeal |

|---|---|---|

| Commodities | Precious metals (Gold, Silver), Energies (Crude Oil, Natural Gas), Agricultural products. | Hedge against inflation, respond to geopolitical events, commodities trading offers unique drivers. |

| Indices | Track performance of a group of stocks from a specific market, like S&P 500, Dow Jones Industrial Average, DAX 40. | Gauge overall market sentiment, broad stock market indices exposure without individual stock analysis. |

| Cryptocurrencies | Digital assets like Bitcoin, Ethereum, Ripple, Litecoin. | High volatility can lead to significant profit potential, ideal for cryptocurrency trading enthusiasts. |

| Stocks/ETFs (CFDs) | Individual company shares (Apple, Tesla) or baskets of assets (Exchange Traded Funds). | Engage with global corporate performance and sector trends, adds depth to diversification. |

Having access to this wide array of financial instruments allows you to implement sophisticated trading strategies. You can hedge existing positions, speculate on specific economic data, or simply spread your capital across different asset classes to enhance diversification. Our advanced tools support your market analysis, helping you make informed decisions across all these exciting markets.

Forex, CFDs, and Equities

Are you ready to explore the dynamic world of financial markets? Understanding the different avenues available for trading is your first step towards unlocking incredible opportunities. At our core, we guide you through the exciting landscapes of Forex, Contracts for Difference (CFDs), and Equities, each offering unique ways to engage with global economic movements.

Forex: The Global Currency Powerhouse

Imagine a market that never sleeps, where trillions of dollars change hands daily. That’s the foreign exchange (Forex) market! It’s the largest and most liquid financial market in the world, allowing you to trade currency pairs like EUR/USD or GBP/JPY. What makes Forex so compelling? Its 24/5 availability means you can trade whenever opportunities arise, from Monday morning in Sydney to Friday afternoon in New York. We help you navigate its volatility and leverage its immense potential, understanding how global events influence currency values.

CFDs: Versatility Across Markets

Contracts for Difference (CFDs) offer an incredibly versatile way to participate in the price movements of a vast array of assets without actually owning them. Think about it: you can trade on the price changes of stocks, indices, commodities, and even cryptocurrencies! CFDs allow for both long (buy) and short (sell) positions, giving you flexibility to potentially profit whether markets rise or fall. This instrument is about speculating on price direction, making it a powerful tool for short-term strategies and diversification across different market sectors. We empower you to understand how to use CFDs to capture opportunities in various market conditions.

Equities: Investing in Company Growth

When you think of the stock market, you’re thinking about equities. These are shares in publicly traded companies, representing a slice of ownership. Trading equities means you are buying or selling parts of businesses like tech giants, innovative startups, or established industry leaders. While often associated with long-term growth and capital appreciation, equities also present shorter-term trading possibilities. We help you discover how to research companies, understand market trends, and make informed decisions about which stocks to add to your portfolio.

Each of these trading instruments offers a distinct experience and set of possibilities. Whether you’re drawn to the fast-paced world of currency trading, the versatile nature of CFDs, or the long-term potential of equities, we provide the insights and community to help you succeed. Join us to explore these markets and elevate your trading journey!

Commodities and Digital Assets: A New Frontier for Traders

Are you looking to diversify your trading portfolio beyond traditional currency pairs? The world of commodities and digital assets offers exciting new avenues for potential growth and strategic trading. These markets bring unique opportunities, different risk profiles, and dynamic price movements that can perfectly complement your existing forex strategies.

Why Consider Commodities?

Commodities are tangible assets, making them a cornerstone of global trade and a fascinating area for investors. They often react to different economic and geopolitical factors than currencies, offering excellent diversification.

- Hard Commodities: Think about precious metals like gold and silver, which often act as safe-haven assets during economic uncertainty. Industrial metals such as copper also present intriguing trading prospects.

- Energy Commodities: Crude oil and natural gas are critical to the global economy. Their prices can be highly volatile, driven by supply-demand dynamics, geopolitical events, and even weather patterns, creating frequent trading chances.

- Soft Commodities: Agricultural products like wheat, corn, coffee, and sugar are influenced by weather, harvest cycles, and consumer demand. These can offer distinct trading patterns.

The Rise of Digital Assets

Digital assets, especially cryptocurrencies like Bitcoin and Ethereum, have revolutionized the financial landscape. They operate on decentralized networks, offering transparency and a new paradigm for value exchange. While highly volatile, their rapid growth has captured the attention of traders worldwide.

Trading digital assets means engaging with a market that never sleeps. It’s a 24/7 opportunity driven by technological advancements, regulatory news, and investor sentiment. This constant activity can present numerous entry and exit points for nimble traders.

Comparing Your Options: Commodities vs. Digital Assets

Both markets offer unique advantages for traders looking to expand their horizons. Here’s a quick look:

| Feature | Commodities | Digital Assets |

|---|---|---|

| Market Drivers | Supply/demand, geopolitics, economic data, weather | Technology adoption, regulation, investor sentiment, network development |

| Volatility | Moderate to High | Typically Very High |

| Trading Hours | Specific market hours, but some derivatives trade 24/5 | 24/7 global markets |

| Tangibility | Physical assets | Intangible, blockchain-based assets |

Engaging with commodities and digital assets means embracing new challenges and unlocking potential rewards. Both require careful analysis, robust risk management, and a keen eye on global trends. They offer incredible avenues for portfolio diversification and exciting trading experiences within the dynamic world of forex.

Finpros Bahrain Account Types

Embarking on your trading journey with Finpros Bahrain means gaining access to a suite of carefully designed account types, each crafted to match diverse trading styles and experience levels. We understand that every trader is unique, and that’s why we offer options that cater to everyone, from the absolute beginner to the seasoned market veteran. Choosing the right account is a crucial step; it influences your trading conditions, costs, and overall experience. Let’s explore the options available to help you find your perfect fit.

Standard Account: Your Gateway to Global Markets

The Standard Account is our most popular choice, offering a balanced and accessible entry point into the world of forex and CFD trading. It’s ideal for those just starting out or traders who prefer a straightforward approach without complex features. With competitive spreads and no commission per trade on most instruments, it simplifies your trading costs and allows you to focus purely on market analysis and strategy execution. This account provides a robust platform for learning and growing, supported by all our trading tools and educational resources.

- Accessibility: Low minimum deposit requirements make it easy to begin.

- Cost-Effective: Enjoy commission-free trading on a wide range of assets.

- Comprehensive Access: Trade major, minor, and exotic forex pairs, along with various CFDs.

- Support: Full access to our dedicated customer support and educational materials.

ECN Account: For Precision and Transparency

If you demand razor-thin spreads and direct market access, our ECN (Electronic Communication Network) Account is built for you. This account is particularly favored by experienced traders, scalpers, and those employing automated strategies who prioritize speed and minimal latency. With an ECN account, you trade directly with liquidity providers, leading to very tight spreads, often starting from 0 pips, in exchange for a small, transparent commission per lot traded. It offers a level playing field, reflecting true market prices and ensuring rapid execution.

Benefits of an ECN Account:

| Feature | Description |

|---|---|

| Raw Spreads | Access interbank market spreads, often starting from 0.0 pips. |

| Transparent Commissions | Clear, fixed commission per lot traded, no hidden costs. |

| High Liquidity | Direct access to aggregated liquidity from top-tier providers. |

| Fast Execution | Experience superior trade execution speeds. |

As one of our seasoned traders once put it, “The ECN account at Finpros Bahrain changed how I approach my high-frequency strategies. The transparency and low spreads are unbeatable.”

Islamic Account: Swap-Free Trading

In adherence to Sharia law principles, Finpros Bahrain offers an Islamic Account, also known as a swap-free account. This account type ensures that no interest (swap) charges or credits are applied to overnight positions, making it fully compliant with Islamic finance. It allows Muslim traders to participate in the financial markets without compromising their faith. While there are no overnight swap charges, other administrative fees may apply to compensate for holding positions for extended periods. We maintain the same excellent trading conditions and access to instruments as our other accounts, just with this crucial difference.

Key aspects of the Islamic Account:

- No overnight interest (swap) charges or credits.

- Consistent trading conditions and execution speeds.

- Available for a wide range of trading instruments.

- Designed for ethical and Sharia-compliant trading.

Demo Account: Practice Without Risk

Before you commit real capital, we highly encourage you to utilize our free Demo Account. This invaluable tool mirrors live market conditions, allowing you to practice trading with virtual funds in a risk-free environment. It’s the perfect place to test strategies, familiarize yourself with our platform, and gain confidence without any financial pressure. Whether you’re a beginner learning the ropes or an experienced trader backtesting a new system, the demo account is an indispensable resource. You can open a demo account quickly and start exploring the markets today.

Choosing the right Finpros Bahrain account type is a personal decision that aligns with your trading goals and preferences. We provide detailed information and support to help you make an informed choice, ensuring your trading experience is as effective and rewarding as possible.

Spreads, Commissions, and Fee Structure

Diving into the forex market means understanding every element that impacts your potential profits. Among the most crucial are the spreads, commissions, and various other fees. These costs, though sometimes appearing small, accumulate over time and significantly influence your overall trading strategy and profitability. A clear grasp of your broker’s fee structure isn’t just smart; it’s essential for success.

What is a Spread?

The spread is arguably the most common cost you’ll encounter in forex trading. It represents the difference between the bid (sell) price and the ask (buy) price of a currency pair. When you open a trade, you immediately face this difference, and it’s how many brokers make their profit.

- Bid Price: The price at which you can sell the base currency.

- Ask Price: The price at which you can buy the base currency.

Spreads can be either fixed or variable. Fixed spreads remain constant regardless of market conditions, offering predictability but often being slightly wider. Variable spreads, on the other hand, fluctuate with market volatility and liquidity. They can be very tight during calm periods but widen significantly during major news events or less liquid trading hours.

Understanding Commissions

While some brokers primarily use spreads as their main revenue stream, others, especially those offering ECN (Electronic Communication Network) or STP (Straight Through Processing) accounts, charge commissions. These brokers often provide much tighter, raw spreads, and then add a separate commission per trade or per lot traded.

Consider the pros and cons of commission-based trading:

| Advantages of Commissions | Disadvantages of Commissions |

|---|---|

| Typically tighter raw spreads | Adds an explicit cost per transaction |

| Transparency in pricing | Can feel more expensive for high-frequency traders |

| Often indicative of an ECN/STP model | Needs careful calculation for profit targets |

For example, a broker might charge $7 per standard lot (100,000 units of currency) traded round-turn (opening and closing a position). This fee applies directly to your account, separate from the spread.

Other Fees to Watch Out For

Beyond spreads and commissions, several other fees can impact your trading experience and account balance. Staying informed about these ensures no unexpected surprises.

- Swap/Rollover Fees

- These are charges or credits applied when you hold a position open overnight. They are based on the interest rate differential between the two currencies in a pair and can be positive or negative. If you’re holding a position for an extended period, swap fees can accumulate significantly.

- Inactivity Fees

- Some brokers charge a fee if your trading account remains dormant for a specified period, typically several months. Always check your broker’s terms to avoid these unexpected deductions.

- Deposit and Withdrawal Fees

- While many brokers offer free deposits, some might charge for certain withdrawal methods, especially bank wires or specific e-wallets. Always confirm the associated costs before initiating a transfer.

- Currency Conversion Fees

- If your trading account is in a different currency than the one you are depositing or withdrawing, you might incur conversion fees. It’s often best to fund your account in its base currency if possible.

Understanding the complete fee structure of your chosen broker is non-negotiable. It allows you to calculate your true trading costs, set realistic profit targets, and select a broker that aligns with your trading style and frequency. Always choose transparency; it is your best friend in the forex market.

Deposit and Withdrawal Methods

Navigating the financial side of forex trading should be the least of your worries. We understand that quick, secure, and flexible funding options are critical for a seamless trading experience. That’s why we’ve designed our deposit and withdrawal methods to be straightforward, efficient, and accessible, ensuring you can focus on what truly matters: making informed trading decisions.

Fund Your Trading Journey with Ease

Getting started with your forex trading account is incredibly simple thanks to our diverse range of deposit methods. We pride ourselves on offering options that cater to traders from various regions, ensuring you always find a convenient way to fund your account.

Here are some of the popular ways you can deposit funds:

- Credit and Debit Cards: Experience fast transactions using major credit cards like Visa and MasterCard. These secure payments often process instantly, getting you into the market without delay.

- Bank Transfers: For larger deposits or those who prefer traditional banking, direct bank transfers are a reliable choice. While they might take a little longer to process, they offer a secure and well-established method for moving your capital.

- E-Wallets: Embrace the speed and convenience of modern e-wallets such as Skrill, Neteller, and others. These digital payment solutions are perfect for quick, secure deposits and are widely used by online traders for their efficiency.

- Local Payment Methods: We recognize the importance of regional preferences. Our platform supports various local payment methods, making funding even more accessible, no matter where you are trading from.

Our commitment is to ensure your deposit process is not just easy but also protected by robust security protocols, safeguarding your financial information every step of the way.

Access Your Profits When You Need Them

The thrill of successful forex trading culminates in the ability to confidently withdraw your profits. We’ve streamlined our withdrawal process to be just as efficient and secure as our deposits, ensuring you can access your earnings without unnecessary hurdles.

When it’s time to cash out, you’ll find the methods mirror your deposit options for consistency and convenience. You can typically withdraw funds back to your:

- Credit or Debit Card

- Bank Account via Wire Transfer

- Preferred E-Wallet (e.g., Skrill, Neteller)

We are dedicated to processing your withdrawal requests promptly. While specific processing times can vary depending on the method chosen and bank procedures, we work diligently to ensure your funds reach you as quickly as possible. Our transparent policies on withdrawal limits and any associated fees are always clearly outlined, so you have full clarity before initiating a transfer. We believe in making your financial management as clear and stress-free as your trading.

Customer Support Experience and its Level

In the fast-paced world of forex trading, having exceptional customer support isn’t just a bonus – it’s a necessity. Your trading journey can present various challenges, from technical glitches on the trading platform to complex questions about market analysis or account management. This is where a top-tier support team truly shines, transforming potential frustrations into smooth resolutions and building trust with every interaction. A robust customer service experience empowers you, giving you confidence as you navigate the global currency markets.

What Defines High-Level Support?

The “level” of customer support isn’t just about being available; it’s about the quality and impact of that availability. Here are key factors that elevate a support experience:

- Accessibility: Can you reach them easily? Multiple channels like live chat, email, and phone support are vital.

- Responsiveness: How quickly do they reply? Immediate assistance, especially for urgent trading issues, is paramount.

- Knowledgeability: Do they understand your problem? A well-trained support team possesses deep knowledge about forex trading and the broker’s specific services. They provide accurate information, not just generic responses.

- Problem Resolution: Can they actually fix your issue? Effective support leads to swift problem resolution, not just endless back-and-forths.

- Personalization: Do you feel like a valued client? Sometimes, a dedicated account manager or personalized guidance can make a significant difference.

The Impact of Superior Client Service

When a forex broker invests in its customer support, you directly reap the benefits. It’s more than just getting your questions answered; it’s about fostering a secure and efficient trading environment. Excellent support translates into:

- Reduced Stress: Knowing help is readily available calms nerves during volatile market conditions or unexpected technical difficulties.

- Faster Learning: Support can guide you to educational resources or explain complex concepts, accelerating your understanding of forex trading.

- Optimized Trading: Quick fixes to platform issues mean less downtime and fewer missed trading opportunities.

- Increased Client Satisfaction: A positive experience builds loyalty and trust, making you feel valued and supported on your financial journey.

Assessing Support Quality: What to Look For

Before committing to a broker, always test their support. Here’s a quick checklist:

| Support Aspect | What to Check |

|---|---|

| Live Chat | Response time (ideally under 60 seconds), agent’s ability to answer specific questions. |

| Email Support | Turnaround time for a detailed response (aim for under 24 hours), clarity of the answer. |

| Phone Support | Availability hours, wait times, professionalism and helpfulness of the representative. |

| FAQ/Help Center | Comprehensiveness, ease of navigation, presence of practical trading platform guides. |

As one seasoned trader aptly put it, “Your broker’s support team is your first line of defense in the markets. Choose wisely.” A strong customer support experience ensures you always have a reliable partner by your side, ready to assist with any inquiry, big or small, making your forex trading journey smoother and more successful.

Educational and Research Resources

Entering the dynamic world of currency trading can feel overwhelming. Without proper guidance, the vast forex market presents many challenges. That’s precisely why a strong foundation of knowledge and access to reliable research tools are not just beneficial—they are absolutely essential for anyone looking to succeed. We believe in empowering our community with the best possible learning experience, turning complex concepts into clear, actionable insights.

What We Offer: Your Learning Journey

Our educational hub is designed to cater to traders at every stage, from absolute beginners taking their first steps to seasoned pros refining their trading strategies. We cover a comprehensive range of topics to ensure you have all the information you need:

- Beginner-Friendly Modules: Learn the basics of “what is forex,” how currency pairs work, and essential terminology. We make starting your trading journey easy and understandable.

- Advanced Trading Strategies: Dive deep into technical analysis, fundamental analysis, and various approaches to market entry and exit. Explore different methodologies to find what suits your style.

- Risk Management Principles: Understand how to protect your capital. We provide crucial insights into managing your exposure and safeguarding your investments, a cornerstone of sustainable trading.

- Live Webinars and Expert Sessions: Join our regular live sessions where industry experts share market insights, discuss current trends, and answer your questions in real-time. This interactive approach provides invaluable practical knowledge.

- Extensive Video Tutorials: For visual learners, our video library offers step-by-step guides on using our platform, executing trades, and applying analytical tools effectively.

- Comprehensive Article Library: Browse through a vast collection of articles covering everything from economic indicators to psychological aspects of trading, designed to deepen your understanding of the forex market.

Unlock Informed Decisions with Our Research Tools

Beyond education, making informed trading decisions requires robust research capabilities. Our platform integrates powerful tools to help you analyze market conditions, identify potential opportunities, and plan your trades with confidence. We provide:

- Real-time Market Data: Access live price feeds and up-to-the-minute market information for all major currency pairs. Stay current with market movements as they happen.

- Economic Calendar: Keep track of key economic events and data releases that impact currency valuations. Understand the potential market reactions before they occur.

- Customizable Charting Tools: Utilize advanced charting features with a wide array of indicators to perform thorough technical analysis. Identify trends, support, and resistance levels effectively.

- Market Sentiment Indicators: Gauge the collective mood of the market. Our sentiment tools offer a unique perspective, helping you understand whether the bulls or bears are currently in control.

- News Feed Integration: Stay abreast of global news and geopolitical developments that influence the forex market directly within your trading platform.

Our commitment is to be your trusted partner in the forex market. By combining comprehensive educational materials with cutting-edge research tools, we equip you with the knowledge and resources necessary to navigate the complexities of trading. Explore our educational and research resources today and take a significant step towards mastering the art of currency trading.

Leverage and Margin Requirements

Leverage is essentially a loan from your broker, allowing you to control a significant amount of money in the market with a relatively small amount of your own trading capital. For example, with 1:100 leverage, you can control $100,000 worth of currency with just $1,000 of your own funds. This magnification of your purchasing power makes forex trading accessible, enabling you to participate in market movements that would otherwise require much larger initial investments. It’s a key reason why many find the forex market so appealing, as it opens doors to substantial potential gains from even minor price fluctuations.

Diving into forex trading means understanding two fundamental concepts that empower—and challenge—every trader: leverage and margin. These aren’t just technical terms; they are the gears that drive your potential to open larger trading positions with less upfront capital. Think of them as a powerful double-edged sword, offering incredible opportunities for potential gains but also amplifying the risks involved. Mastering how they work is crucial for effective risk management strategies and sustainable success in the dynamic world of currency exchange.

However, this increased power comes with amplified responsibility. While leverage can boost your profits, it can just as easily magnify your potential losses. A small adverse market movement against your trading position, when leveraged, can quickly deplete your account. Therefore, approaching leverage with caution and employing sound risk management is not just advised—it’s essential.

Here’s a simple look at the impact of leverage:

- Increased Market Exposure: Control larger positions with a smaller deposit.

- Higher Potential Profits: Even small price changes can lead to significant returns.

- Magnified Potential Losses: Adverse market movements affect your capital more intensely.

- Capital Efficiency: You don’t need to tie up large sums of capital for each trade.

Margin, on the other hand, is the actual amount of money your broker requires you to set aside as collateral to open and maintain a leveraged trading position. It’s not a transaction cost; it’s a portion of your account balance that is “held” while your trade is open, ensuring you have sufficient funds to cover potential losses. The margin requirement is often expressed as a percentage of the total position value. For instance, if you have 1:100 leverage, your margin requirement might be 1% of the trade’s total value.

Understanding margin calls is vital. A margin call occurs when the equity in your trading account falls below a certain level, usually because your open positions are losing money. Your broker will then ask you to deposit more funds to bring your account balance back up to the minimum required margin. If you fail to do so, your broker may automatically close some or all of your open positions to prevent further losses and protect both your account and their own risk exposure. This mechanism highlights the critical link between leverage, margin, and the need for vigilant account monitoring.

Responsible forex trading demands a clear understanding of how leverage and margin intertwine. Never trade with more leverage than you are comfortable with, and always keep an eye on your available margin. By carefully managing your position sizes and implementing robust risk management strategies, you can harness the power of leverage and margin to your advantage, turning them into valuable tools for navigating the exciting opportunities in the forex market.

Advantages of Trading with Finpros Bahrain

Venturing into the dynamic world of forex trading requires a partner you can trust, one that truly understands your needs as a trader. Finpros Bahrain stands out as a beacon for aspiring and seasoned traders alike, offering a suite of advantages designed to empower your trading journey. Choosing the right broker makes all the difference, transforming potential challenges into opportunities for growth and success.

One of the foremost benefits of choosing Finpros Bahrain is the robust regulatory framework. Operating under the stringent supervision of local authorities ensures that your investments are handled with the highest standards of transparency and security. This local presence provides an invaluable layer of trust and accountability, giving you profound peace of mind as you navigate the global markets. We prioritize the safeguarding of client funds, employing advanced security protocols and segregated accounts to protect your capital with utmost care.

Accessing the markets efficiently is crucial, and Finpros Bahrain delivers with a state-of-the-art trading platform. It’s both powerful and incredibly user-friendly, designed to cater to every level of experience. Whether you are just starting or are a seasoned professional, our platform offers intuitive navigation, real-time market data, sophisticated charting tools, and swift execution capabilities. You can easily customize your trading environment to suit your unique style, making every trade a seamless experience. Our technology keeps you ahead, ensuring you never miss a beat in the fast-paced forex arena.

Here are some key features of our cutting-edge platform:

- Intuitive and customizable interface

- Real-time market data and advanced charting tools

- Lightning-fast trade execution

- Access across multiple devices

- Comprehensive analytical resources

Diversify your portfolio and explore a vast array of trading opportunities with Finpros Bahrain. We offer access to a comprehensive selection of financial instruments, including major and minor currency pairs, precious metals, energy commodities, and global indices. This broad market access allows you to capitalize on various global economic events and market trends, significantly expanding your potential for profit. Our wide range of options ensures that you can always find an asset class that aligns perfectly with your trading strategy and risk appetite.

Knowledge truly empowers, especially in the volatile world of forex trading. Finpros Bahrain is deeply committed to empowering its traders with high-quality educational resources. From beginner-friendly tutorials to advanced strategy webinars and insightful market analyses, our extensive learning materials are meticulously designed to enhance your understanding of market dynamics and trading techniques. We provide practical guides and expert insights to help you make informed decisions and continually refine your trading skills. Continuous learning is fundamental to sustained success, and we are here to support you every step of the way.

Having reliable support can significantly impact your trading experience, and Finpros Bahrain excels in this area. We pride ourselves on offering exceptional, localized customer service. Our dedicated team of experts is readily available to assist you with any queries or concerns you might have, providing prompt and professional support in your preferred language. We deeply understand the nuances of the local market and are always prepared to offer personalized assistance, ensuring a smooth and hassle-free trading journey. Your success remains our foremost priority, and our responsive support team is a testament to that unwavering commitment.

As one of our long-term traders recently shared: “Trading with Finpros Bahrain gives me confidence. The local regulation, fast platform, and quick support make a real difference in my daily trading.” This sentiment reflects our dedication to providing an outstanding trading environment.

Potential Drawbacks and Considerations

While the world of forex trading offers exciting opportunities for profit and growth, it’s crucial to approach it with a clear understanding of its inherent challenges. Every successful trader knows that acknowledging and preparing for potential pitfalls is just as important as chasing gains. We believe in empowering you with a full picture, so let’s explore some key drawbacks and considerations you absolutely need to keep in mind on your trading journey.

The Double-Edged Sword of Leverage

Leverage is a powerful tool in forex, allowing you to control large positions with a relatively small amount of capital. It amplifies your potential profits, which is fantastic. However, it equally amplifies your potential losses. A small market movement against your position can quickly erode your capital, sometimes even leading to a margin call where your broker demands more funds or closes your position. Understanding and managing leverage responsibly is not just advised, it’s essential for survival.

Market Volatility and Unpredictability

The forex market is the largest and most liquid financial market in the world, which means it’s constantly moving. While this creates trading opportunities, it also brings significant volatility. Unexpected economic data releases, geopolitical events, or even central bank statements can cause rapid and unpredictable price swings. Even the most seasoned traders can face challenges predicting these shifts, making robust risk management strategies indispensable.

The Steep Learning Curve

Forex trading is not a get-rich-quick scheme. It demands continuous learning, dedicated practice, and a deep understanding of market dynamics, technical analysis, fundamental analysis, and trading psychology. Many new traders underestimate this complexity, jumping in without adequate preparation. This often leads to frustration and financial setbacks. Think of it as mastering a skill – it takes time, effort, and mentorship.

Emotional Toll and Discipline Requirements

- Fear and Greed: These two powerful emotions are often the downfall of traders. Fear can lead you to close winning trades too early or hold onto losing trades too long. Greed can push you to overtrade or take on excessive risk.

- Impatience: Waiting for the right setup requires patience. Rushing into trades often results in poor decisions.

- Discipline: Sticking to your trading plan, even when emotions run high, is paramount. This includes adhering to your risk limits, entry/exit rules, and money management strategies.

Forex trading can be an emotionally taxing endeavor. Maintaining discipline and managing your psychology are crucial for consistent success.

Broker Reliability and Security

Choosing the right forex broker is a critical consideration. Not all brokers offer the same level of security, transparency, or customer service. Some may have hidden fees, unreliable platforms, or even questionable regulatory compliance. You must conduct thorough due diligence to ensure your chosen broker is reputable, regulated, and provides a safe environment for your funds and trading activities.

In summary, while the allure of forex trading is strong, a realistic perspective on its drawbacks is vital. By acknowledging the risks of leverage, market volatility, the extensive learning required, the emotional challenges, and the importance of broker selection, you can build a more resilient and informed approach to your trading journey. We encourage you to educate yourself thoroughly and prepare for these considerations to navigate the market successfully.

How to Get Started with Finpros Bahrain

Ready to dive into the exciting world of financial markets? Finpros Bahrain offers a fantastic gateway for traders of all levels. Whether you’re a complete beginner eager to learn the ropes of online trading or an experienced investor looking for a reliable partner, getting started with us is a straightforward process designed for your convenience.

Your Journey Begins Here: Simple Steps to Join Finpros Bahrain

We believe that accessing the financial markets should be as simple as possible. That’s why we’ve streamlined our account opening process. You can set up your trading account quickly and efficiently, giving you more time to focus on what matters: making informed trading decisions.

- Visit Our Website: Head over to the Finpros Bahrain official website. You’ll find a prominent “Open Account” button, usually located at the top right corner.

- Complete the Registration Form: We’ll ask for some basic personal information. This includes your name, email address, phone number, and country of residence. Make sure all details are accurate.

- Verify Your Identity: As a regulated financial institution, we adhere to strict Know Your Customer (KYC) protocols. You’ll need to upload copies of a valid ID (passport or national ID card) and a proof of address (utility bill or bank statement). This step ensures the security of your account and compliance with global financial regulations.

- Fund Your Account: Once your account is verified, you can deposit funds using a variety of secure payment methods. We support bank transfers, credit/debit cards, and several e-wallets, making it easy to start trading.

- Download Your Trading Platform: Choose your preferred trading platform – MetaTrader 4 (MT4) or MetaTrader 5 (MT5) – and download it to your device. Alternatively, you can use our web-based platform directly from your browser.

- Start Trading: With funds in your account and your platform ready, you are all set to explore the diverse range of instruments available. Begin your journey in forex trading, commodities, indices, and more!

Why Choose Finpros Bahrain for Your Trading Journey?

Many traders wonder what makes one broker stand out from another. At Finpros Bahrain, we focus on providing a superior trading environment tailored to your needs. Our commitment to client success sets us apart.

“Success in trading isn’t just about making profits; it’s about building a sustainable strategy with a trusted partner. Finpros Bahrain provides the tools and support for that journey.”

— A Finpros Bahrain Trading Specialist

Advantages of Trading with Finpros Bahrain:

- Robust Regulation: We operate under strict regulatory oversight, ensuring a secure and transparent trading environment. This gives you peace of mind knowing your funds are handled with the utmost care.

- Competitive Spreads: We offer tight spreads across a wide range of assets, which can significantly reduce your trading costs and improve your potential profitability.

- Advanced Trading Platforms: Access industry-leading MT4 and MT5 platforms, renowned for their powerful charting tools, technical indicators, and automated trading capabilities.

- Diverse Instrument Selection: Trade a broad spectrum of financial instruments, including major and minor currency pairs, precious metals, energies, global indices, and even cryptocurrencies.

- Dedicated Customer Support: Our multilingual support team is available around the clock to assist you with any questions or issues, ensuring a smooth trading experience.

- Educational Resources: Benefit from our comprehensive library of educational materials, including webinars, tutorials, and market analysis, designed to enhance your trading knowledge and skills.

What to Expect After Account Opening:

Once you complete your registration and verification, you gain access to a wealth of resources. You will receive login credentials for your chosen trading platform and your client portal. Here, you can manage your account, deposit and withdraw funds, and access our educational content. Our team is always ready to guide you through your first trades or answer any questions you might have about market dynamics.

| Feature | Description |

|---|---|

| Minimum Deposit | Low entry barrier to start trading |

| Available Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader |

| Leverage Options | Flexible leverage ratios based on regulatory guidelines |

| Account Types | Standard, ECN, Islamic (swap-free) accounts |

| Customer Support | 24/5 multilingual support via live chat, email, phone |

Embarking on your online trading adventure with Finpros Bahrain means choosing a partner committed to your success. We provide the tools, support, and security you need to navigate the financial markets confidently. Take the first step today and discover a world of trading opportunities!

Final Verdict: Is Finpros Bahrain Suitable for Your Trading Needs?

After a thorough examination of Finpros Bahrain, it is time to draw a conclusion that can genuinely assist your decision-making process. Choosing a forex broker is a significant step, directly impacting your trading journey and potential for success. We’ve explored various facets, from its regulatory framework to the trading experience it offers. Now, let’s synthesize these insights to determine if Finpros Bahrain aligns with your individual requirements and ambitious investment goals.

Consider what truly matters most to you as a trader. Are you seeking a highly regulated environment, robust trading platforms, or exceptional customer support? Perhaps competitive spreads and a diverse range of assets are your top priorities. Finpros Bahrain aims to cater to a broad spectrum of traders, from newcomers taking their first steps in the market to seasoned professionals seeking advanced tools and reliable execution. Your personal trading style and risk tolerance will ultimately guide your choice.

Key Considerations for Finpros Bahrain:

- Regulatory Assurance: Finpros Bahrain operates under the scrutiny of respected financial authorities, offering a layer of security and trust for its clients. This regulatory oversight ensures adherence to strict operational standards and client fund protection policies, which is paramount in the volatile world of forex trading.

- Platform Versatility: The broker provides access to industry-standard trading platforms, known for their powerful charting tools, technical indicators, and customizable interfaces. Whether you prefer desktop, web, or mobile trading, Finpros Bahrain offers solutions to keep you connected to the markets.

- Asset Diversity: Explore a wide array of financial instruments, including major and minor currency pairs, commodities, indices, and potentially cryptocurrencies. This variety allows you to diversify your portfolio and capitalize on different market opportunities.

- Customer Support: Responsive and knowledgeable customer service can make a significant difference, especially when you encounter technical issues or have urgent queries. Finpros Bahrain strives to offer accessible support channels to assist its global client base.

Advantages and Disadvantages of Finpros Bahrain:

| Advantages | Disadvantages |

|---|---|

| Strong regulatory compliance provides peace of mind. | May have specific regional restrictions or limitations. |

| Access to popular and feature-rich trading platforms. | Spreads and commissions might vary for different account types. |

| Broad selection of tradable assets for portfolio diversification. | Some advanced features could require a higher initial deposit. |

| Dedicated customer support with multiple contact options. | Educational resources, while present, might not suit all learning styles. |

| Transparent fee structure and clear trading conditions. | Newer traders might find the initial learning curve steep without extensive guidance. |

Ultimately, the suitability of Finpros Bahrain hinges on your unique trading needs. Do you value robust security and a well-regulated environment above all else? Are you looking for a broker that offers diverse assets and a reliable platform? If your priorities align with the strengths of Finpros Bahrain, then it certainly presents a compelling option for your forex trading endeavors. We encourage you to weigh these points carefully against your personal investment goals and preferences before making your final choice. Your success in the markets begins with selecting the right partner.

Frequently Asked Questions

What is Finpros Bahrain?

Finpros Bahrain is a prominent financial entity in the Middle East that provides a platform for individuals and institutions to trade various financial instruments in global markets, operating under local regulatory frameworks.

Is Finpros Bahrain a regulated broker?

Yes, Finpros Bahrain operates under robust regulatory frameworks and supervision of local authorities, ensuring high standards of transparency, security, and client fund protection.

What trading platforms does Finpros Bahrain offer?

Finpros Bahrain offers industry-leading trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), accessible via desktop, web, and mobile devices (iOS and Android).

What types of financial instruments can I trade with Finpros Bahrain?

Clients can trade a diverse range of financial instruments, including Forex (major, minor, exotic currency pairs), CFDs on indices, commodities (precious metals, energies), cryptocurrencies, and individual stocks/ETFs.

Does Finpros Bahrain offer a demo account?

Yes, Finpros Bahrain provides a free Demo Account that mirrors live market conditions, allowing traders to practice strategies and familiarize themselves with the platform using virtual funds in a risk-free environment.