Ever wondered who stands behind the powerful trading tools and opportunities in the vast world of financial markets? Let’s shine a light on Finpros Australia. They emerge as a prominent online broker, dedicated to empowering individuals to navigate the complexities of global trading. Catering primarily to Australian traders, Finpros Australia has carved a niche by focusing on reliability, advanced technology, and a robust trading environment.

At its core, Finpros Australia offers access to a diverse range of instruments, making it a go-to platform for those interested in forex trading, commodities, indices, and various other CFDs. Their mission is straightforward: to provide a secure, efficient, and user-friendly platform where traders can execute their strategies with confidence. They understand that success in the markets depends not just on skill, but also on the quality of the tools and support available.

- Key Characteristics of Finpros Australia:

- Regulatory Compliance and Security for Australian Traders

- What ASIC Regulation Means for You

- Key Security Measures Beyond Regulation

- The Trader’s Advantage: Trading with Confidence

- Trading Platforms Offered by Finpros Australia

- MetaTrader 4 (MT4): The Industry Standard

- MetaTrader 5 (MT5): The Next Generation

- Why Choose Our Platforms?

- Account Types Available with Finpros Australia

- Discover Your Perfect Trading Fit

- 1. Standard Account

- 2. ECN (Electronic Communication Network) Account

- 3. Islamic (Swap-Free) Account

- 4. Demo Account

- Financial Instruments You Can Trade with Finpros Australia

- Explore the Dynamic World of Forex Trading

- Unlock Potential with CFDs on Multiple Assets

- Step into the Future with Cryptocurrencies

- A Spectrum of Investment Opportunities

- Spreads, Commissions, and Fees Explained

- What is a Spread?

- Understanding Commissions

- Other Fees to Watch Out For

- Swap Fees (Overnight Interest)

- Inactivity Fees

- Deposit and Withdrawal Fees

- Funding and Withdrawal Methods for Finpros Australia Accounts

- Depositing Funds: Getting Started with Finpros Australia

- Common Deposit Methods:

- Withdrawing Your Profits: Accessing Your Earnings

- Key Aspects of the Withdrawal Process:

- A Quick Look at Funding & Withdrawal Options

- Customer Support and Resources for Australian Clients

- Your Local Connection: Dedicated Support Team

- Empowering Your Journey: Comprehensive Trading Resources

- Educational Tools and Market Analysis from Finpros Australia

- Master Your Trading Skills with Our Educational Arsenal:

- Unlock Market Opportunities with Expert Analysis:

- Our Market Analysis Features Include:

- Comparing Finpros Australia to Other Brokers

- Key Areas Where Finpros Australia Shines:

- Advantages of Choosing Finpros Australia

- Potential Drawbacks to Consider with Finpros Australia

- Things to Watch Out For

- Is Finpros Australia Right for Your Trading Needs?

- Key Aspects to Consider When Evaluating a Forex Broker:

- What Finpros Australia Offers: A Snapshot

- How to Get Started with Finpros Australia

- Your Easy Path to Trading with Finpros Australia:

- Frequently Asked Questions

Key Characteristics of Finpros Australia:

- Broad Market Access: They open doors to a wide array of global financial markets, allowing traders to diversify their portfolios across different asset classes.

- Advanced Trading Platforms: Finpros Australia provides state-of-the-art trading platforms designed for both beginners and seasoned professionals. These platforms offer intuitive interfaces, powerful analytical tools, and fast execution speeds.

- Dedicated Support: Understanding the dynamic nature of trading, they offer responsive customer support to assist traders with any queries or technical issues they might encounter.

- Educational Resources: They believe in empowering their clients through knowledge, offering resources that help traders enhance their understanding of market dynamics and trading strategies.

Ultimately, Finpros Australia positions itself not just as a broker, but as a comprehensive partner in your trading journey. They focus on creating an ecosystem where traders feel supported and equipped to pursue their financial goals. Whether you are taking your first steps into the world of online trading or you are an experienced investor looking for a reliable and feature-rich platform, understanding who Finpros Australia is, and what they offer, is crucial for making informed decisions.

Regulatory Compliance and Security for Australian Traders

Navigating the exciting world of forex trading requires more than just keen market insight; it demands a solid foundation of trust and security. For Australian traders, understanding regulatory compliance isn’t just a suggestion—it’s an absolute necessity. It acts as your primary shield, protecting your investments and ensuring you trade within a fair and transparent environment.

Australia boasts a robust regulatory framework, primarily overseen by the Australian Securities and Investments Commission (ASIC). This independent government body plays a crucial role in safeguarding consumers and investors. Their mandate is clear: maintain market integrity and protect those involved in financial services. Choosing an ASIC-regulated broker offers a significant peace of mind, knowing that your chosen platform adheres to strict operational and ethical standards.

What ASIC Regulation Means for You

When a forex broker operates under ASIC’s watchful eye, it commits to a series of stringent requirements designed to protect you. Here’s a snapshot of what this entails:

- Client Money Segregation: Your funds are kept in separate accounts from the broker’s operational capital. This means your money is safe even if the broker faces financial difficulties.

- Capital Adequacy: Brokers must hold sufficient capital to ensure they can meet their financial obligations, providing a buffer against market volatility.

- Dispute Resolution: ASIC-regulated brokers must offer access to an external dispute resolution scheme, giving you a clear pathway to address any grievances.

- Transparent Practices: They must provide clear and accurate information about their services, fees, and risks, empowering you to make informed decisions.

- Regular Audits: Brokers undergo regular audits to ensure ongoing compliance with regulatory standards.

Key Security Measures Beyond Regulation

While regulatory compliance sets the baseline, top-tier brokers go even further to enhance your security. Look for platforms that prioritize your digital safety with advanced technological measures. These layers of protection are crucial in today’s digital landscape.

Consider the following security features when evaluating a forex broker:

| Security Feature | Why It Matters |

|---|---|

| Two-Factor Authentication (2FA) | Adds an extra layer of security to your account login, making it much harder for unauthorized access. |

| SSL Encryption | Encrypts all data transmitted between your device and the broker’s servers, protecting your personal and financial information. |

| Firewall Protection | Safeguards the broker’s servers from external threats and unauthorized intrusions. |

| Regular Security Audits | Independent third parties assess the broker’s systems for vulnerabilities, ensuring ongoing protection. |

The Trader’s Advantage: Trading with Confidence

Choosing a broker that excels in both regulatory compliance and advanced security measures offers immense advantages. It frees you to concentrate on your trading strategies, knowing that your funds are protected and your personal data is secure. This peace of mind is invaluable, allowing you to approach the markets with greater confidence and focus.

“In the world of forex, security isn’t just about protecting your capital; it’s about safeguarding your peace of mind and your ability to trade effectively.”

Always verify a broker’s regulatory status directly on the ASIC website. This simple step can save you from potential pitfalls and ensure you embark on your trading journey with a trusted and secure partner.

Trading Platforms Offered by Finpros Australia

At Finpros Australia, we believe your trading journey deserves the best tools available. That’s why we offer a suite of industry-leading **forex trading platforms** designed to empower both new and experienced traders. Our goal is to provide a seamless, efficient, and robust trading environment, giving you direct access to the global **financial markets**. You get advanced functionality, intuitive design, and the reliability you need to make informed decisions.

MetaTrader 4 (MT4): The Industry Standard

For many years, **MetaTrader 4** has stood as the cornerstone of online forex trading. Finpros Australia brings you MT4 with all its renowned features and stability. This platform is celebrated for its user-friendly interface, powerful charting capabilities, and a wide array of technical indicators. Traders often choose MT4 for its strong community support and extensive library of **Expert Advisors** (EAs), enabling sophisticated **algorithmic trading** strategies. You can analyze market trends, execute trades swiftly, and manage your positions with precision. MT4 is available on desktop, web, and mobile, ensuring you can trade wherever you are.

MetaTrader 5 (MT5): The Next Generation

Step up to the next generation of trading with **MetaTrader 5**. Finpros Australia provides MT5, offering an enhanced trading experience with even more features and flexibility. While it retains the beloved functionality of its predecessor, MT5 expands your capabilities with additional timeframes, more built-in indicators, and an economic calendar. It also supports trading in more asset classes beyond forex, including futures and stocks, depending on our offerings. MT5 delivers faster processing speeds and a more advanced programming language (MQL5) for developing complex EAs and custom indicators. Enjoy superior depth of market, multi-thread strategy testing, and a comprehensive set of **trading tools** for advanced analysis.

Why Choose Our Platforms?

No matter which platform you choose, Finpros Australia ensures you benefit from cutting-edge technology and a commitment to your trading success. Here’s what you can expect: Advanced Charting Features: Access a wealth of analytical tools, multiple chart types, and drawing objects to pinpoint market opportunities. Fast Execution: Experience rapid order execution, helping you capitalize on volatile market movements without delay. User-Friendly Interface: Navigate markets with ease thanks to intuitive designs that make placing trades and managing accounts straightforward.

- Advanced Charting Features: Access a wealth of analytical tools, multiple chart types, and drawing objects to pinpoint market opportunities.

- Fast Execution: Experience rapid order execution, helping you capitalize on volatile market movements without delay.

- User-Friendly Interface: Navigate markets with ease thanks to intuitive designs that make placing trades and managing accounts straightforward.

- Mobile Trading: Stay connected to the markets with our powerful **mobile trading** apps for iOS and Android. Manage your portfolio, monitor positions, and react to news events on the go.

- Web Trader Convenience: Access your account directly from any web browser with our **web trader** platforms – no downloads required.

- Automated Trading: Utilize **algorithmic trading** and **Expert Advisors** to automate your strategies and manage trades 24/5.

- Customization: Personalize your workspace with custom indicators and templates to suit your unique trading style.

We empower you with choice and ensure that your chosen platform, be it MT4 or MT5, provides the stability, speed, and features necessary to pursue your trading goals with confidence. Explore the possibilities and find the perfect fit for your trading strategy with Finpros Australia.

Account Types Available with Finpros Australia

Diving into the world of online trading can feel exciting, but choosing the right account is your first strategic move. At Finpros Australia, we understand that every trader has unique goals, experience levels, and capital. That’s why we offer a diverse range of account types, meticulously designed to cater to your specific trading style. Whether you’re just starting your journey or you’re a seasoned professional seeking advanced features, we have an account tailored just for you. Our aim is to provide a seamless and powerful trading experience, ensuring you have the tools and conditions necessary to thrive in the dynamic forex market.

Discover Your Perfect Trading Fit

We’ve streamlined our offerings to provide clarity and flexibility. Let’s explore the distinct features of each account type available with Finpros Australia:

1. Standard Account

The Standard Account is an excellent choice for new traders and those who prefer straightforward trading conditions. It’s designed to be user-friendly, offering competitive spreads and no commission per trade. This account type simplifies your trading cost structure, making it easier to manage your finances as you gain experience in the forex market.

- Accessibility: Low minimum deposit requirements, making it ideal for beginners.

- Cost Structure: Spreads start from a reasonable level, with no additional commissions.

- Trading Instruments: Access a wide array of currency pairs, commodities, and indices.

- Execution: Reliable market execution, ensuring your trades go through smoothly.

2. ECN (Electronic Communication Network) Account

For traders who demand raw spreads and lightning-fast execution, our ECN Account is the ultimate solution. This account connects you directly to deep interbank liquidity, allowing you to trade on true market prices with minimal spreads. While this account involves a small commission per lot, the benefit of incredibly tight spreads often outweighs this for high-volume traders and those employing scalping strategies.

Key advantages of the Finpros Australia ECN Account include:

| Feature | Description |

|---|---|

| Spreads | Ultra-tight, raw interbank spreads starting from 0.0 pips. |

| Commissions | A small, transparent commission applied per lot traded. |

| Execution Speed | Superior execution with direct market access. |

| Transparency | Full depth of market visibility for informed decisions. |

3. Islamic (Swap-Free) Account

Adhering to Sharia law, the Islamic Account at Finpros Australia offers a swap-free trading environment. This means no overnight interest (rollover) charges or credits on positions held open for more than a day. It’s crucial for our Muslim clients who wish to trade the forex market ethically and in accordance with their religious principles. This account retains all the features of our Standard Account but with the added benefit of being fully Sharia-compliant.

What makes our Islamic Account stand out?

- Sharia Compliance: No swap fees on overnight positions.

- Fair Trading: Transparent pricing and execution without hidden costs.

- Accessibility: Available for all trading instruments offered on our platform.

- Ease of Conversion: Easy process to convert an existing Standard account to an Islamic one.

4. Demo Account

Before you commit real capital, our free Demo Account offers the perfect risk-free environment to practice and refine your trading strategies. Fund it with virtual money and experience the real Finpros Australia trading platform, market conditions, and all available instruments. It’s an invaluable tool for both beginners to learn the ropes and experienced traders to test new approaches without any financial risk.

As the saying goes, “Practice makes perfect.” The Finpros Australia Demo Account allows you to:

- Learn the Platform: Get familiar with MetaTrader 4 or 5 without pressure.

- Test Strategies: Experiment with different trading methods and indicators.

- Understand Market Dynamics: See how currency pairs move in real-time.

- Build Confidence: Gain the necessary skills and confidence before live trading.

Choosing the right account at Finpros Australia sets the foundation for your trading success. Take your time to review each option, consider your trading goals, and select the account that best aligns with your ambitions. Our support team is always ready to assist you if you have any questions or need guidance in making your decision.

Financial Instruments You Can Trade with Finpros Australia

Embark on your trading journey with Finpros Australia and discover a vast universe of financial instruments at your fingertips. We understand that every trader has unique goals and risk appetites, which is why we provide access to a comprehensive range of global markets. Whether you’re a seasoned investor or just starting out, our platform empowers you to build a diversified portfolio and seize exciting investment opportunities.

Explore the Dynamic World of Forex Trading

The foreign exchange market, commonly known as forex trading, stands as the largest and most liquid financial market globally. With Finpros Australia, you gain access to major, minor, and exotic currency pairs, allowing you to speculate on price movements between different national currencies. Imagine the thrill of trading AUD/USD, EUR/GBP, or USD/JPY, reacting to economic news and geopolitical events. Our platform provides the tools you need to analyze market trends and execute your trades with precision, making it an ideal choice for those interested in currency speculation.

Unlock Potential with CFDs on Multiple Assets

Contracts for Difference (CFDs) offer a flexible way to trade on the price movements of underlying assets without owning them. This means you can potentially profit from both rising and falling markets. Finpros Australia provides an extensive selection of CFDs, opening up numerous avenues for your trading strategy:

- Stocks: Access popular company shares from major global exchanges. Trade CFDs on tech giants, financial institutions, or emerging market leaders.

- Indices: Speculate on the performance of entire stock markets. Gain exposure to key indices like the S&P 500, FTSE 100, or the ASX 200, representing broad economic health.

- Commodities: Dive into the world of raw materials. Trade CFDs on precious metals like gold and silver, energy products such as crude oil and natural gas, or agricultural goods.

Trading CFDs allows for greater leverage, which can amplify both potential profits and losses. It’s a versatile instrument for those looking to engage with various sectors and market dynamics.

Step into the Future with Cryptocurrencies

The digital asset revolution is here, and Finpros Australia ensures you don’t miss out. We offer CFD trading on a selection of the most popular cryptocurrencies. Engage with the volatility and rapid movements of Bitcoin, Ethereum, Ripple, and other leading digital coins. This exciting asset class provides unique trading possibilities for those interested in innovative technologies and disruptive financial trends. Our platform makes it straightforward to add crypto exposure to your trading activities, all within a regulated environment.

A Spectrum of Investment Opportunities

At Finpros Australia, your choice of financial instruments is broad, designed to cater to diverse trading styles and market outlooks. We empower you with the flexibility to adapt your strategies and explore new market segments as they arise. From traditional markets to cutting-edge digital assets, your trading journey is set for success.

| Instrument Category | Examples | Key Benefit |

|---|---|---|

| Forex (Currencies) | EUR/USD, AUD/JPY, GBP/CHF | High liquidity, 24/5 trading |

| CFD Stocks | Apple, Commonwealth Bank, Tesla | Access to global equities without direct ownership |

| CFD Indices | S&P 500, ASX 200, DAX 40 | Trade broad market movements |

| CFD Commodities | Gold, Crude Oil, Natural Gas | Hedge against inflation, react to supply/demand |

| CFD Cryptocurrencies | Bitcoin, Ethereum, Litecoin | Exposure to volatile digital assets |

With Finpros Australia, you are not just a trader; you are an explorer of global financial markets. We provide the tools, the access, and the support to help you navigate these exciting opportunities effectively.

Spreads, Commissions, and Fees Explained

Diving into the world of forex trading brings exciting opportunities, but understanding the costs involved is absolutely crucial. These aren’t hidden charges; they are transparent expenses that impact your overall profitability. Let’s break down spreads, commissions, and other fees so you can trade with confidence and make informed decisions.

What is a Spread?

Think of the spread as the fundamental cost of trading. It’s the difference between the buy price (ask) and the sell price (bid) of a currency pair. When you enter a trade, you immediately encounter this small difference, which is essentially the broker’s profit for facilitating your transaction.

Here’s how it works:

- Bid Price: This is the price at which you can sell the base currency.

- Ask Price: This is the price at which you can buy the base currency.

The tighter the spread, the better for you as a trader, as it means lower transaction costs. Spreads can be fixed or variable, depending on your broker and the market conditions. During highly volatile periods or major news events, variable spreads can widen significantly.

Understanding Commissions

While many retail forex brokers primarily make money through spreads, some brokers, especially those offering ECN (Electronic Communication Network) or STP (Straight Through Processing) accounts, charge a separate commission. These brokers often provide tighter spreads, compensating with a commission per trade.

Consider the trade-off:

| Broker Type | Primary Cost | Spreads | Transparency |

|---|---|---|---|

| Market Maker | Wider Spreads | Often fixed or wider variable | Simpler, spread-focused |

| ECN/STP | Commissions + Tight Spreads | Very tight, often variable | Clear separation of costs |

When you choose an ECN broker, you pay a fee for each lot traded. For example, you might pay $3.50 per standard lot to open a position and another $3.50 to close it. This structure can be highly beneficial for active traders who value extremely tight spreads and direct market access.

Other Fees to Watch Out For

Beyond spreads and commissions, a few other charges might pop up. Knowing about them helps you avoid surprises and manage your capital effectively.

Swap Fees (Overnight Interest)

If you hold a forex position open overnight, you might incur or receive a swap fee, also known as an overnight interest fee. This is the interest difference between the two currencies in the pair you are trading. Depending on whether you are long or short, and the interest rates of the respective countries, you could either pay or earn this interest.

“Ignoring swap fees on long-term positions can significantly erode your profits. Always factor them into your trading strategy.”

Inactivity Fees

Some brokers charge a small fee if your account remains dormant for a specified period, typically three to six months. It’s their way of encouraging active trading or covering administrative costs for inactive accounts. A simple login or a small trade usually resets this timer.

Deposit and Withdrawal Fees

While many brokers offer free deposits, some might charge a fee, especially for certain payment methods like bank wires or specific e-wallets. Similarly, withdrawal fees can apply. Always check your broker’s terms and conditions regarding these transactional costs before funding your account or requesting a payout.

Understanding these costs isn’t just about saving money; it’s about optimizing your trading strategy and maximizing your potential returns. A well-informed trader is a successful trader!

Funding and Withdrawal Methods for Finpros Australia Accounts

Managing your capital effectively is paramount in the fast-paced world of forex trading. At Finpros Australia, we understand that seamless and secure funding and withdrawal options are not just a convenience, but a necessity for our traders. We prioritize offering a diverse range of reliable payment solutions designed to get you trading faster and to access your profits without hassle. Our goal is to ensure your account management is as smooth and efficient as your trading strategy.

Depositing Funds: Getting Started with Finpros Australia

Ready to jump into the market? Funding your Finpros Australia account is straightforward, with several popular and secure deposit options available. We make sure you can add capital quickly so you do not miss trading opportunities. Our platform supports various payment methods to cater to your preferences, ensuring a hassle-free funding process.

Common Deposit Methods:

- Bank Transfer: A traditional and highly secure way to deposit funds directly from your bank account. While typically taking 1-3 business days to process, bank transfers are ideal for larger sums and offer peace of mind with their robust security protocols. Always remember to include your Finpros Australia account ID as the reference.

- Credit/Debit Cards (Visa/Mastercard): One of the quickest and most popular ways to fund your account. Deposits made via credit or debit cards are usually processed instantly, allowing you to start trading almost immediately. We employ advanced encryption to protect your card details, ensuring secure transactions.

- E-wallets (e.g., Neteller, Skrill): For those who prefer digital convenience, e-wallet payments offer rapid processing times and an additional layer of privacy. These popular services allow you to fund your trading account swiftly, often with instant crediting, making them an excellent choice for traders seeking speed and efficiency.

When you choose your deposit method, consider factors like transaction fees, processing times, and your personal banking habits. Our client portal provides clear instructions for each method, guiding you through every step of the funding process.

Withdrawing Your Profits: Accessing Your Earnings

The moment every trader looks forward to is withdrawing their hard-earned profits. Finpros Australia makes the withdrawal process simple and transparent. We understand the importance of fast withdrawals, so we strive to process your requests promptly, ensuring you can access your funds when you need them.

Our withdrawal methods typically mirror the deposit options, adhering to international financial regulations designed to protect your funds and prevent money laundering. This means you will generally withdraw funds back to the same source from which they were deposited.

Key Aspects of the Withdrawal Process:

- Account Verification: Before your first withdrawal, we require a full account verification. This critical step involves submitting identification documents and proof of address. It is a one-time process that safeguards your funds and complies with regulatory standards, ensuring secure transactions.

- Processing Times: While we aim for fast withdrawals, processing times can vary based on the method chosen and external factors like bank holidays. E-wallet withdrawals are often the quickest, while bank transfers might take a few business days.

- Withdrawal Fees: Finpros Australia aims to keep fees minimal, but some third-party payment providers or banks may impose their own charges. We always recommend checking our website’s dedicated funding section or contacting our support team for the latest information on transaction fees.

A Quick Look at Funding & Withdrawal Options

| Method | Typical Deposit Time | Typical Withdrawal Time | Potential Fees (Finpros Australia) |

|---|---|---|---|

| Bank Transfer | 1-3 Business Days | 2-5 Business Days | Usually Free (Bank charges may apply) |

| Credit/Debit Card | Instant | 1-3 Business Days | Usually Free (Card issuer fees may apply) |

| E-wallets (e.g., Neteller, Skrill) | Instant | Within 24 Hours | Usually Free (Provider fees may apply) |

We commit to providing transparent and efficient financial services. Our dedicated support team is always ready to assist you with any questions regarding deposit options or the withdrawal process. Choose Finpros Australia for reliable account management and focus on what you do best: trading the markets.

Customer Support and Resources for Australian Clients

Navigating the dynamic world of forex trading requires more than just a great platform; it demands exceptional support and a wealth of resources, especially for Australian forex traders. We understand the unique needs and time zones of our clients down under. That’s why we’ve tailored our support infrastructure and educational materials to ensure you always have a helping hand and the knowledge you need to succeed.

Your Local Connection: Dedicated Support Team

Forget generic, one-size-fits-all assistance. Our dedicated support team is specifically trained to address the nuances and queries of Australian traders. We pride ourselves on providing prompt, knowledgeable, and friendly service whenever you need it. You can reach out through various channels:

- Live Chat: Get instant answers to your questions, perfect for quick troubleshooting or urgent queries. Our response times are incredibly fast.

- Phone Support: Prefer a human voice? Our local support team is just a call away, ready to assist with account management, technical issues, or platform guidance.

- Email Assistance: For more detailed inquiries or when you need to send documents, our email support ensures a comprehensive and documented response.

We operate with a commitment to offering 24/5 support, ensuring that help is always available during market hours, aligning with Australian trading times. This means less waiting and more trading for you.

Empowering Your Journey: Comprehensive Trading Resources

Successful trading is an ongoing learning process. We believe in empowering our Australian clients with top-tier trading resources designed to enhance your skills and understanding. Whether you’re a beginner or an experienced trader, our extensive library covers everything you need.

Here’s a glimpse of what’s available:

| Resource Type | Benefit to Traders |

|---|---|

| Forex Education Australia Guides | In-depth articles and tutorials covering basic to advanced forex concepts, tailored for the local market context. |

| Live Webinars & Workshops | Interactive sessions with expert traders discussing market analysis, strategies, and real-time trading insights. |

| Video Tutorials | Easy-to-follow visual guides on platform features, technical indicators, and trade execution. |

| Economic Calendar & News Feeds | Stay informed about critical market-moving events and news that impact currency pairs. |

| Risk Management Tools | Tools and guides to help you understand and mitigate potential risks in your trading strategy. |

We are committed to providing robust educational materials that cater to every stage of your trading journey. From understanding basic terminology to mastering complex strategies, our resources are designed to boost your confidence and improve your trading outcomes. Our focus is always on practical, actionable advice that you can apply immediately.

Ultimately, our goal is to ensure every Australian client feels supported, informed, and equipped to navigate the forex markets successfully. Your journey is our priority, and our extensive support and resources reflect that commitment.

Educational Tools and Market Analysis from Finpros Australia

Embarking on your trading journey, or even aiming to sharpen your existing skills, requires access to top-tier educational resources and insightful market analysis. At Finpros Australia, we understand that knowledge is power, especially in the dynamic world of forex. We dedicate ourselves to equipping our traders with a comprehensive suite of tools designed to foster informed decision-making and strategic trading.

Our commitment goes beyond just providing a trading platform; we aim to build a community of educated and confident traders. We believe that a well-informed trader is a successful trader, and our resources are meticulously crafted to cater to everyone, from the absolute beginner taking their first steps to the seasoned professional seeking an edge.

Master Your Trading Skills with Our Educational Arsenal:

- Interactive Webinars: Join live sessions led by industry experts. These cover a broad spectrum of topics, from basic forex concepts to advanced trading strategies, technical indicators, and risk management. You get the chance to ask questions and gain real-time insights.

- Comprehensive Trading Guides: Dive deep into our extensive library of e-books and articles. These cover everything from understanding currency pairs and leverage to mastering chart patterns and developing a robust trading plan. Our guides are easy to follow and broken down into digestible sections.

- Video Tutorials: Prefer visual learning? Our collection of video tutorials breaks down complex topics into simple, easy-to-understand segments. Learn how to navigate our platform, execute trades, and interpret market signals at your own pace.

- Glossary of Terms: Never feel lost with industry jargon again. Our comprehensive glossary provides clear, concise definitions for all the essential trading terms you’ll encounter.

Unlock Market Opportunities with Expert Analysis:

Understanding market sentiment and future price movements is crucial for successful trading. Finpros Australia delivers timely and relevant market analysis directly to your fingertips, helping you anticipate shifts and identify potential opportunities. Our team of analysts works tirelessly to distill complex market data into actionable insights.

Our Market Analysis Features Include:

| Analysis Type | Description | Benefit to You |

|---|---|---|

| Daily Market Updates | A concise summary of the most significant economic events and market movements affecting major currency pairs. | Stay informed on key developments without sifting through endless news feeds. |

| Technical Analysis Reports | In-depth analysis of price charts, identifying support and resistance levels, trend lines, and potential entry/exit points using various indicators. | Spot potential trading setups and understand chart patterns to refine your strategies. |

| Fundamental Analysis Insights | Examination of economic data, geopolitical events, and central bank policies that influence currency valuations. | Understand the underlying forces driving market trends and make informed decisions based on economic health. |

| Economic Calendar | A real-time schedule of upcoming economic releases, interest rate decisions, and other market-moving events from around the globe. | Prepare for volatility and plan your trades around high-impact news events. |

Finpros Australia empowers you to approach the markets with confidence. Utilize our robust educational tools to build your knowledge base, and then leverage our insightful market analysis to pinpoint opportunities and manage your risk effectively. We are here to support your trading journey every step of the way, providing the resources you need to thrive.

Comparing Finpros Australia to Other Brokers

Choosing the right forex broker is a critical decision that can significantly impact your trading journey. With a multitude of options available, it’s essential to look beyond the surface and understand what truly sets a broker apart. When you compare Finpros Australia to other players in the market, several key differentiators come into focus, making it a compelling choice for both new and experienced traders.

Many traders start by looking at a broker’s offering, but a deeper dive into specific features reveals the true value. What makes Finpros Australia stand out in a competitive landscape?

Key Areas Where Finpros Australia Shines:

- Regulatory Compliance and Trust: Operating in a strictly regulated environment is non-negotiable for serious traders. Finpros Australia adheres to robust Australian financial regulations, providing a layer of security and peace of mind that not all offshore or less-regulated brokers can offer. This commitment to compliance protects your funds and ensures fair trading practices.

- Competitive Trading Conditions: Spreads and commissions directly affect your profitability. Finpros Australia consistently strives to offer highly competitive spreads, often starting from 0.0 pips on major currency pairs, alongside transparent commission structures. This contrasts sharply with brokers who might have hidden fees or wider spreads that erode your potential gains over time.

- Advanced Trading Platforms: While many brokers offer MetaTrader 4 (MT4) or MetaTrader 5 (MT5), Finpros Australia ensures a premium trading experience with these platforms. They also integrate seamlessly, providing reliable execution speeds and comprehensive charting tools that empower your trading strategies. Not all brokers provide the same level of platform stability or the full suite of features.

- Dedicated Local Support: Access to timely and effective customer support is invaluable. Finpros Australia prides itself on offering responsive, multilingual support, with a strong emphasis on understanding the unique needs of Australian traders. This local presence often translates into quicker resolution times and more personalized assistance compared to brokers with purely international support centers.

- Educational Resources and Tools: For those looking to refine their skills or learn the ropes, a broker’s educational offerings are crucial. Finpros Australia provides an array of resources, including webinars, market analysis, and trading guides, designed to empower traders at every level. This focus on trader development often exceeds what many standard brokers provide, fostering a more informed trading community.

Consider the typical pros and cons when evaluating a forex broker:

| Feature | Finpros Australia’s Approach | Common Broker Pitfalls |

|---|---|---|

| Spreads & Fees | Ultra-low, transparent spreads; clear commissions. | Hidden fees; wide, fluctuating spreads. |

| Regulation | Strict ASIC compliance; secure client funds. | Lax or no regulation; unclear fund segregation. |

| Platform Stability | Robust MT4/MT5; reliable execution. | Frequent disconnections; slippage issues. |

| Customer Service | Responsive, local, expert support. | Slow, generic, offshore support. |

| Account Types | Diverse options for various trading styles. | Limited choices; high minimum deposits. |

Ultimately, the decision rests on your individual trading preferences and priorities. However, by carefully examining the core aspects of a broker’s offering, you’ll find that Finpros Australia consistently stands out for its commitment to security, advanced trading conditions, and dedicated support, making it a strong contender in the Australian forex market.

Advantages of Choosing Finpros Australia

Stepping into the world of online trading demands a partner you can trust, one that empowers your journey with robust tools and unwavering support. When you consider Finpros Australia, you are not just selecting a broker; you are aligning with a comprehensive trading ecosystem designed for success. We pride ourselves on creating an environment where both novice traders and seasoned professionals can thrive, making informed decisions with confidence.

Here’s why Finpros Australia stands out as a premier choice for your trading endeavors:

- Robust Regulatory Framework: We operate under strict Australian financial regulations, providing an unparalleled level of security and transparency. This commitment to compliance means your investments are handled with the highest standards of integrity and accountability.

- Competitive Trading Conditions: Experience tight spreads and lightning-fast execution across a wide range of financial instruments, including major and minor currency pairs, commodities, and indices. Our goal is to minimize your trading costs and maximize your opportunities.

- Advanced Trading Platforms: Gain access to industry-leading trading platforms that offer intuitive interfaces, powerful analytical tools, and customizable features. Whether you prefer desktop, web, or mobile trading, our platforms ensure a seamless and efficient experience.

- Dedicated Customer Support: Our expert support team is available around the clock to assist you with any queries or technical issues. We believe in proactive, personalized support to ensure your trading experience is smooth and uninterrupted.

- Comprehensive Educational Resources: Elevate your trading knowledge with our extensive library of educational materials. From beginner guides and advanced strategies to market analysis and webinars, we provide the resources you need to continually improve your skills.

- Diverse Account Options: We understand that every trader is unique. That’s why we offer a variety of account types tailored to different experience levels and trading styles, ensuring you find the perfect fit for your financial goals.

- Secure Fund Management: Your financial security is our top priority. We employ advanced encryption technologies and segregated client accounts, providing peace of mind knowing your funds are protected and managed responsibly.

Choosing Finpros Australia means opting for a trading partner that prioritizes your success through a blend of regulatory strength, technological innovation, and client-centric services. Embark on your trading journey with a broker committed to empowering your financial aspirations.

Potential Drawbacks to Consider with Finpros Australia

While exploring any financial platform, especially in the dynamic world of forex, it’s always wise to look at both sides of the coin. Finpros Australia, like any service provider, might present certain aspects that prospective traders should carefully consider before committing. Understanding these potential drawbacks helps you make a truly informed decision, ensuring your trading journey aligns with your expectations and risk tolerance.

Here are a few areas where you might want to dig deeper:

Things to Watch Out For

- Competitive Spreads and Fees: In the fast-paced forex market, every pip counts. While Finpros Australia might offer competitive spreads on some pairs, always scrutinize the full fee structure. This includes not just spreads, but also commissions, overnight swap fees for positions held open, and any potential inactivity charges. These costs can significantly impact your profitability over time, especially if you engage in frequent trading.

- Customer Support Responsiveness: When market conditions shift unexpectedly or you encounter a technical glitch, quick and efficient customer support is invaluable. Investigate the average response times, the availability of support channels (phone, live chat, email), and the languages supported. Delays in getting assistance can lead to missed opportunities or exacerbated losses during critical moments.

- Limited Instrument Diversity: Your trading strategy might require access to a wide array of financial instruments beyond major forex pairs. Check if Finpros Australia offers a sufficient selection of exotic pairs, commodities, indices, or cryptocurrencies if these are part of your trading plan. A narrower selection could restrict your diversification options and limit your market exposure.

- Platform Features and Tools: Every trader has unique needs when it comes to their trading platform. While Finpros Australia might provide a robust platform, assess if it offers advanced charting tools, custom indicators, automated trading capabilities, or specific analytical features you rely on. A platform that lacks essential functionalities for your trading style could hinder your efficiency and effectiveness.

- Withdrawal Processing Times: Easy deposit is great, but hassle-free withdrawal is even better. Some users might find that withdrawal requests, depending on the method, could take longer than expected. Always review their withdrawal policies, typical processing times, and any associated fees to ensure your funds are accessible when you need them.

Taking the time to investigate these potential downsides empowers you to navigate the forex landscape more confidently and make choices that best suit your individual trading goals and comfort level.

Is Finpros Australia Right for Your Trading Needs?

Choosing the right forex broker is a pivotal decision that can significantly impact your trading journey. With a multitude of options available, each promising unique advantages, it’s essential to thoroughly evaluate if a specific broker aligns with your individual trading style, goals, and risk tolerance. This section delves into Finpros Australia, helping you determine if their offerings resonate with your personal trading requirements and aspirations.

When you’re searching for an online trading platform, several factors come into play. It’s not just about flashy features; it’s about reliability, transparency, and a platform that genuinely supports your growth as a trader. Let’s explore what Finpros Australia brings to the table and if it ticks your boxes.

Key Aspects to Consider When Evaluating a Forex Broker:

- Regulatory Compliance: Is the broker licensed and regulated by a reputable authority? For Australian traders, ASIC regulation is crucial.

- Trading Instruments: What range of assets can you trade? Think forex pairs, commodities, indices, and potentially cryptocurrencies.

- Trading Conditions: What are the typical spreads, commissions, and leverage options? Competitive pricing is key for profitable trading.

- Platform Usability: Is the trading platform intuitive, stable, and equipped with the necessary tools and indicators?

- Customer Support: How responsive and helpful is their support team? Access to timely assistance can be invaluable.

- Deposit and Withdrawal: Are the processes smooth, fast, and transparent? Look for various convenient methods.

- Educational Resources: Does the broker offer materials to help you improve your trading knowledge and skills?

Finpros Australia aims to cater to a diverse clientele, from novice traders taking their first steps in the market to seasoned professionals seeking advanced functionalities. Their emphasis often lies on providing a robust trading environment coupled with accessible resources.

What Finpros Australia Offers: A Snapshot

Based on typical Finpros Australia review observations, here’s a general overview of what you might expect:

“A well-regulated broker prioritizing a secure trading environment. They often provide competitive spreads on major forex pairs and offer various account types to suit different trader profiles.”

Consider the following aspects regarding their services:

| Feature | Description |

|---|---|

| Regulatory Standing | Typically regulated by top-tier authorities, ensuring a secure framework for clients. This instills confidence, especially for a forex broker Australia based. |

| Trading Platforms | Often offers industry-standard platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), known for their reliability and comprehensive charting tools. |

| Spreads & Commissions | Competitive pricing models, with tight spreads on popular currency pairs. They may offer different commission structures based on account type. |

| Customer Support | Multilingual support channels, including live chat, email, and phone, often available during extended trading hours. |

If you prioritize a broker with strong regulatory oversight, a familiar and powerful trading platform, and transparent trading conditions, then Finpros Australia could certainly be a contender. They often strive to provide a balance between advanced features for experienced traders and user-friendly interfaces for beginners. However, it’s always advisable to open a demo account first to personally experience their services without financial commitment. This allows you to evaluate their platform, execution speeds, and overall fit for your unique trading needs before making a real money deposit.

How to Get Started with Finpros Australia

Ready to dive into the exciting world of forex trading with Finpros Australia? Getting started is a straightforward process designed to get you trading quickly and confidently. We believe in making trading accessible, whether you’re a seasoned pro or just beginning your journey. Our platform is built with your success in mind, offering a robust environment for your trading ambitions.

Joining our community means gaining access to competitive spreads, fast execution, and comprehensive support. Follow these simple steps to begin your trading adventure and unlock new opportunities in the financial markets.

Your Easy Path to Trading with Finpros Australia:

- Account Registration: Your first step is to open a trading account. Our online application is quick, intuitive, and takes just a few minutes. You will provide some basic personal information to create your secure profile. This is where your journey with Finpros Australia truly begins.

- Identity Verification: To comply with regulatory standards and ensure the security of your funds, we require identity verification. This typically involves submitting a valid ID and proof of address. We streamline this process to be as fast and unobtrusive as possible, protecting your information every step of the way.

- Fund Your Account: Once your account is verified, you can deposit funds using a variety of convenient payment methods. Finpros Australia offers flexible funding options to suit your needs, ensuring your capital is ready for action when you are. We prioritize secure transactions for your peace of mind.

- Explore Our Platforms: Download and get familiar with our advanced trading platforms. Whether you prefer the industry-standard MetaTrader 4 (MT4) or our cutting-edge web platform, you’ll find powerful tools and a user-friendly interface designed to enhance your trading experience. Practice with a demo account first if you wish!

- Start Trading: With funds in your account and a platform ready, you are now equipped to place your first trade. Explore a wide range of currency pairs, commodities, and other instruments. Remember to start small, manage your risk, and leverage our educational resources to refine your strategy.

We are committed to providing an environment where you can thrive. Finpros Australia is more than just a broker; we are your partner in navigating the global financial markets. Our dedicated support team is always on hand to assist you with any questions or guidance you might need as you embark on this exciting path. Welcome aboard!

Frequently Asked Questions

What is Finpros Australia?

Finpros Australia is an online broker primarily catering to Australian traders, offering access to diverse instruments like forex, commodities, indices, and CFDs with a focus on reliability and advanced technology.

Is Finpros Australia regulated for Australian traders?

Yes, Finpros Australia operates under the robust regulatory framework of the Australian Securities and Investments Commission (ASIC), ensuring client money segregation, capital adequacy, and transparent practices.

What trading platforms does Finpros Australia offer?

Finpros Australia offers industry-leading platforms including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available on desktop, web, and mobile, providing advanced charting, fast execution, and automated trading capabilities.

What types of trading accounts are available?

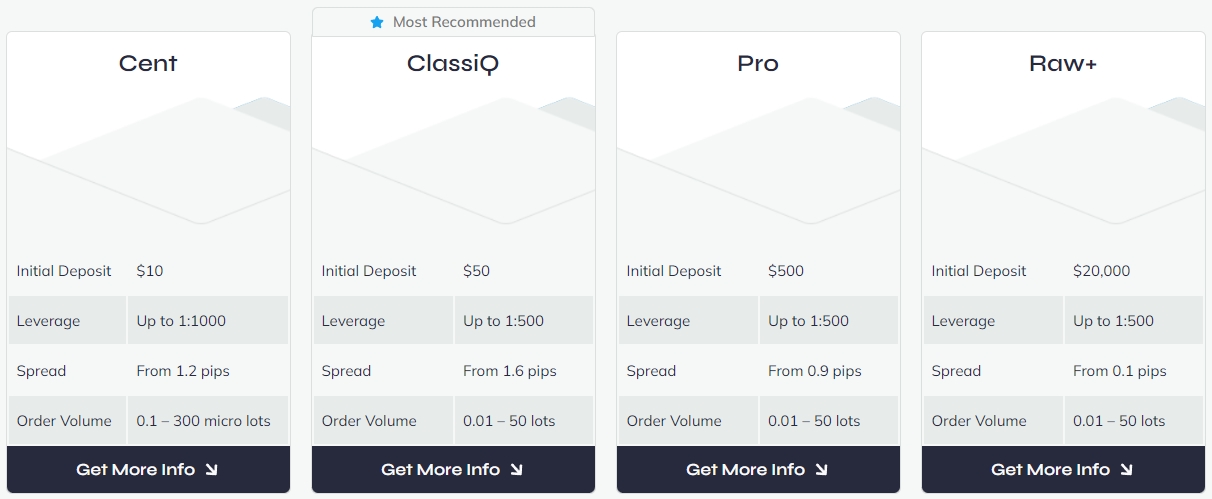

Finpros Australia provides various account types, including Standard, ECN (Electronic Communication Network) for raw spreads, Islamic (Swap-Free) for Sharia compliance, and a free Demo Account for practice.

How can I fund and withdraw from my Finpros Australia account?

You can deposit funds via bank transfer, credit/debit cards (Visa/Mastercard), and e-wallets (Neteller, Skrill). Withdrawals typically use the same methods after account verification, with varying processing times.