Welcome to the world of Finpros, where your ambitions in the financial markets meet unparalleled trading excellence. We know you are looking for more than just a platform; you need a trusted partner who understands the dynamics of forex trading. This comprehensive guide is designed to illuminate every aspect of our online broker services, ensuring you make informed decisions and elevate your trading journey.

At Finpros, we dedicate ourselves to empowering traders like you with the tools, resources, and expert guidance necessary to navigate the complexities of currency pairs and other financial instruments. Whether you are taking your first steps into the market or are an experienced trader seeking an edge, our robust trading platform and client-centric approach are built for your success.

Why choose Finpros as your preferred forex broker? We offer:

- Cutting-edge technology for swift and secure transactions.

- A diverse range of currency pairs and other assets to broaden your portfolio.

- Dedicated support to assist you at every turn.

- Educational resources to sharpen your trading skills.

Embark on a journey with Finpros, where innovation meets reliability. We are committed to fostering an environment where your investment goals are not just aspirations but achievable realities. Dive into this guide to discover how our commitment to trading excellence can transform your outlook on the global forex market.

- Understanding Finpros Forex Broker: An Overview

- Regulation and Trust: Is Finpros a Secure Broker?

- Why Regulation Is Your Financial Guardian

- Finpros’s Commitment to Secure Trading

- The Bottom Line on Forex Broker Trust

- Finpros Trading Platforms: MT4, MT5, and Beyond

- MetaTrader 4 (MT4): The Global Standard

- MetaTrader 5 (MT5): The Next Evolution

- Advanced Features:

- Broader Market Access:

- Finpros Beyond: Web and Mobile Trading

- MetaTrader 4 Capabilities on Finpros

- MetaTrader 5 and Advanced Tools

- Web and Mobile Trading Experience with Finpros

- Account Types Offered by Finpros Forex Broker

- Explore Your Trading Options

- Standard Trading Accounts

- Key Characteristics of a Standard Account:

- Advantages and Disadvantages

- Advantages:

- Disadvantages:

- ECN and Pro Accounts: Your Gateway to Elite Trading

- What Makes ECN Accounts Stand Out?

- Embrace the Power of Pro Trading Accounts

- Islamic (Swap-Free) Accounts

- Key Characteristics of a Swap-Free Account:

- Spreads, Commissions, and Trading Costs at Finpros

- Deposit and Withdrawal Options with Finpros

- Funding Your Finpros Account

- Available Deposit Methods:

- Cashing Out: Your Withdrawal Process

- Key Benefits of Finpros’ Funding System

- Tradable Instruments: What Can You Trade with Finpros?

- Forex Trading: The Heart of the Market

- Commodities: Tangible Assets, Untapped Potential

- Indices: Track Global Markets

- Shares/Stocks: Individual Company Performance

- Cryptocurrencies: The Future of Finance

- Why Trade with Finpros?

- Customer Support: Reaching Finpros Broker Assistance

- How to Connect with Our Support Team

- What Makes Finpros Support Stand Out?

- Educational Resources for Finpros Traders

- What You Will Discover:

- Unique Features and Tools from Finpros

- The Finpros Mobile Trading Experience

- What Makes the Finpros Mobile App Stand Out?

- How to Open an Account with Finpros

- Finpros Forex Broker: Pros and Cons

- The Upside of Trading with Finpros

- Areas Where Finpros Could Improve

- Comparing Finpros to Other Leading Forex Brokers

- What Sets Finpros Apart?

- Final Verdict: Is Finpros the Right Choice for Your Forex Trading?

- What Finpros Brings to Your Trading Table:

- Considerations for Your Investment Goals:

- Frequently Asked Questions

Understanding Finpros Forex Broker: An Overview

Are you looking to dive into the dynamic world of forex trading? Understanding the platform you choose is your first, crucial step. Finpros emerges as a significant player in the online brokerage space, offering a gateway to the global currency markets. But what exactly sets Finpros apart, and why should it be on your radar?

Finpros isn’t just another broker; it’s a comprehensive trading environment designed with both new and experienced traders in mind. Our platform focuses on delivering a robust and intuitive experience, ensuring you have the tools and support you need to navigate the complexities of forex trading. We believe in empowering our clients, providing them with clear access to market data, advanced charting features, and a wide array of trading instruments.

When you consider Finpros, think about a partner committed to your trading journey. We pride ourselves on transparency, reliability, and cutting-edge technology. From the moment you explore our services, you’ll find a dedication to creating a smooth and efficient trading experience. Whether you’re interested in major currency pairs, exotic options, or other financial instruments, Finpros strives to offer a diverse portfolio to meet your trading ambitions.

Here’s a quick glance at what makes Finpros noteworthy:

- User-Friendly Interface: Navigate markets with ease, regardless of your experience level.

- Diverse Instrument Selection: Access a broad range of currency pairs and other assets.

- Advanced Trading Tools: Utilize sophisticated charting and analytical resources.

- Dedicated Support: Get assistance when you need it from our knowledgeable team.

- Commitment to Security: Trade with confidence, knowing your investments are handled with care.

Choosing the right forex broker is a pivotal decision. Finpros aims to simplify this choice by providing a strong foundation for your trading endeavors, focusing on clarity, innovation, and unwavering support. Get ready to explore the exciting possibilities with a broker that genuinely understands your needs.

Regulation and Trust: Is Finpros a Secure Broker?

Stepping into the world of online trading demands confidence, especially when choosing a broker. Your capital and personal data are on the line, so asking about security and regulation is not just smart – it’s essential. Many traders wonder: “Is Finpros a secure broker?” This section dives deep into what makes a broker trustworthy and how Finpros measures up, giving you peace of mind.

Why Regulation Is Your Financial Guardian

Think of financial regulation as the backbone of the forex market. It’s a set of rules and guidelines enforced by government agencies to protect investors, ensure market integrity, and prevent illicit activities. When a broker like Finpros operates under strict regulatory oversight, it signifies a commitment to transparency, ethical practices, and client safety. This isn’t just a fancy badge; it’s a shield for your investment.

Here’s what robust regulation typically brings to the table:

- Client Fund Segregation: Your money is held in separate bank accounts from the broker’s operational funds. This means if the broker faces financial difficulties, your capital remains untouchable. It’s a critical layer of Finpros security.

- Regular Audits: Regulated brokers undergo routine financial inspections to ensure compliance and financial stability. This adds another layer of investor protection.

- Dispute Resolution: If you ever have a disagreement with your broker, regulatory bodies often provide channels for fair and impartial resolution.

- Capital Requirements: Regulators often demand that brokers maintain a certain level of capital, ensuring they have the financial strength to meet their obligations.

Finpros’s Commitment to Secure Trading

Finpros understands that trust isn’t given; it’s earned. Our dedication to a secure trading environment goes beyond just meeting regulatory requirements. We actively seek to provide a platform where you can focus on your trading strategies without worrying about the safety of your funds or data.

When evaluating Finpros as a regulated broker, consider these factors:

| Security Aspect | Finpros Approach |

|---|---|

| Regulatory Body Adherence | Finpros operates under the watchful eyes of reputable financial regulation authorities, ensuring adherence to stringent international standards for financial services. |

| Data Encryption | We employ advanced SSL encryption to protect all your personal and financial information transmitted through our platform, safeguarding it from unauthorized access. |

| Negative Balance Protection | Finpros offers negative balance protection, which means you can never lose more money than you have deposited in your account. This is a crucial element for responsible risk management. |

| Two-Factor Authentication (2FA) | For an added layer of account safety, we strongly encourage and support 2FA on your trading account, making it extremely difficult for unauthorized users to gain access. |

The Bottom Line on Forex Broker Trust

Choosing Finpros means choosing a partner committed to your security. Our adherence to financial regulation, combined with proactive security measures like segregated client funds, robust data encryption, and negative balance protection, creates an environment where you can trade with assurance. We believe that a transparent and secure foundation is the best starting point for a successful trading journey. You deserve peace of mind, and Finpros delivers it.

Finpros Trading Platforms: MT4, MT5, and Beyond

Choosing the right trading platform is crucial for your success in the financial markets. At Finpros, we understand that every trader has unique needs and preferences. That is why we provide access to a suite of industry-leading platforms, ensuring you have the best tools at your fingertips. Get ready to experience seamless **online trading** with powerful capabilities, whether you are a beginner or a seasoned professional.

MetaTrader 4 (MT4): The Global Standard

MetaTrader 4, or MT4, remains the most popular **forex trading platform** worldwide, and for good reason. Its intuitive interface and robust functionality make it a favorite among traders. MT4 offers a stable and reliable environment for executing trades, analyzing markets, and implementing your strategies. Here’s why traders love MT4:

- Comprehensive Charting Tools: Dive deep into price action with a wide range of analytical objects and timeframes.

- Customization Galore: Use custom indicators and scripts to tailor your trading experience.

- Automated Trading: Leverage Expert Advisors (EAs) for **algorithmic trading**, allowing the platform to trade on your behalf based on your defined rules.

- Reliable Trade Execution: Experience fast and efficient order placement, critical in volatile markets.

MT4 is perfect for those who value simplicity, power, and a proven track record for their **trading strategies**.

MetaTrader 5 (MT5): The Next Evolution

For traders seeking even more advanced features and access to a wider range of markets, MetaTrader 5 (MT5) is your ideal choice. Building on the strengths of MT4, MT5 offers enhanced capabilities and additional asset classes beyond just forex. It is a multi-asset platform designed for the modern trader.

What makes MT5 stand out?

Advanced Features:

- More timeframes and charting options for in-depth **market analysis**.

- Additional pending order types, giving you greater control over your entry points.

- Integrated economic calendar to track key market-moving events.

- Enhanced strategy tester with multi-currency and multi-threaded capabilities for robust backtesting.

Broader Market Access:

MT5 allows you to trade a greater variety of instruments, including:

- Forex

- Stocks and ETFs

- Commodities

- Indices

- Futures and Options

This expansion gives you more opportunities to diversify your portfolio and explore new markets.

MT5 provides sophisticated **trading tools** for those who demand more flexibility and a richer trading environment.

Finpros Beyond: Web and Mobile Trading

Your trading journey does not have to be confined to your desktop. Finpros ensures you stay connected to the markets anytime, anywhere, with our robust web and **mobile trading** solutions. Access your account directly from your browser with our WebTrader, or download our dedicated mobile apps for iOS and Android devices. You get the same powerful functionality and real-time market data right in the palm of your hand.

“With Finpros, you control your trades, not the other way around. Our platforms offer the flexibility and power you need to seize every market opportunity.”

Whether you prefer the reliability of MT4, the advanced features of MT5, or the convenience of **mobile trading**, Finpros provides the perfect solution. We equip you with the best platforms to make informed decisions and execute your **trading strategies** efficiently. Join Finpros today and elevate your trading experience!

MetaTrader 4 Capabilities on Finpros

Step into a world of powerful trading with MetaTrader 4 (MT4) on Finpros, your gateway to the global financial markets. Finpros empowers your trading journey by integrating this industry-standard platform, offering a robust and intuitive environment for both new and experienced traders. MT4 provides you with all the essential trading tools and advanced features you need to navigate the dynamic forex landscape with confidence and precision. We bring the full power of this premier forex trading platform directly to your fingertips, ensuring a seamless and efficient trading experience.

When you choose Finpros, you gain access to a comprehensive suite of MetaTrader 4 capabilities designed to elevate your trading strategy. This powerful platform offers unparalleled functionality:

- Advanced Charting Tools: Dive deep into market analysis with customizable charts, multiple timeframes, and a vast array of drawing tools. Visualize price movements and spot trends with exceptional clarity, making your technical analysis precise and effective.

- Expert Advisors (EAs): Embrace the future of automated trading. MT4 on Finpros fully supports Expert Advisors, allowing you to automate your strategies and execute trades automatically based on predefined rules. This means you can capitalize on opportunities even when you’re away from your screen, with our reliable infrastructure supporting your expert advisors.

- Extensive Technical Indicators: Utilize over 30 built-in technical indicators, along with thousands of custom indicators available in the MQL4 community. These indicators help you confirm trends, identify reversals, and generate timely trading signals based on real-time data.

- Multiple Order Types: Execute your strategies with flexibility using various order types, including market orders, pending orders (buy limit, sell limit, buy stop, sell stop), stop loss, and take profit. Manage your risk effectively and lock in gains with precision.

- Real-Time Market Quotes: Stay ahead with live, streaming real-time data for all available instruments. Instant access to price fluctuations ensures you make informed decisions quickly, reacting to market changes as they happen.

- Mobile Trading App: Never miss a beat with the MT4 mobile application. Trade directly from your smartphone or tablet, monitor your positions, and manage your account from anywhere in the world, ensuring you have a secure trading environment on the go.

- Customization and Personalization: Tailor your trading environment to fit your preferences. Customize chart colors, indicator settings, and workspace layouts for a truly personalized experience that enhances your focus and efficiency.

Finpros ensures that MetaTrader 4 provides a reliable and high-performance environment, supporting your pursuit of success in the forex market. Discover how these robust capabilities can transform your trading approach today.

MetaTrader 5 and Advanced Tools

Step into the future of online trading with MetaTrader 5 (MT5), the industry-leading platform designed to give you an unparalleled edge in the financial markets. Forget outdated interfaces and limited functionalities; MT5 is a powerhouse, offering a comprehensive suite of advanced tools that empower both novice and experienced traders to make informed decisions and execute strategies with precision. We believe in providing you with the best, and MT5 stands out as the ultimate choice for serious traders.

What makes MetaTrader 5 so revolutionary? It’s not just a trading platform; it’s a complete ecosystem built for peak performance. You gain access to an incredible array of features that go far beyond basic order execution. Let’s explore some of these game-changing capabilities:

- Superior Charting Capabilities: Analyze market movements with 21 timeframes and over 80 built-in technical indicators. Customize your charts, add graphical objects, and spot trends with incredible clarity. This robust charting system is essential for thorough market analysis.

- Algorithmic Trading Mastery: Unleash the power of automated trading. With MetaTrader 5, you can develop, test, and run Expert Advisors (EAs) that execute trades automatically based on your predefined rules. The integrated Strategy Tester is a potent tool for refining your automated trading systems.

- Advanced Order Types: Execute complex trading strategies with a wider range of pending orders, including Buy Stop Limit and Sell Stop Limit, alongside standard market and pending orders. This gives you greater control over your entry and exit points.

- Integrated Fundamental Analysis: Stay informed with direct access to economic news releases and a financial calendar within the platform. Combine technical and fundamental analysis seamlessly to form a holistic view of the market.

- Market Depth (DOM): Gain insights into market sentiment and liquidity with the Depth of Market feature, showing you bid and ask prices at different levels. This transparency helps you understand real-time market dynamics.

- Multiple Asset Classes: While renowned for forex trading, MT5 also supports trading of stocks, futures, and other CFDs, making it a versatile platform for diversifying your portfolio.

The transition to MetaTrader 5 means embracing efficiency and innovation. You get lightning-fast execution speeds, reliable data feeds, and a secure environment for all your trading activities. This platform is truly built for the modern trader who demands performance and sophistication.

“MT5 isn’t just an upgrade; it’s a leap forward. It transforms how you interact with the markets, giving you powerful analytical tools and automation capabilities that truly make a difference in your trading journey.”

Ready to elevate your trading experience? Discover the full potential of MetaTrader 5 and its advanced tools. It’s time to equip yourself with the best platform to conquer the financial markets and achieve your trading ambitions.

Web and Mobile Trading Experience with Finpros

At Finpros, we understand that modern traders need flexibility and power at their fingertips, whether they are at their desk or on the move. That’s why we’ve meticulously crafted our web and mobile trading platforms to deliver a truly seamless and intuitive experience. We put you in control, giving you all the tools to navigate the dynamic forex markets with confidence.

Our robust web platform offers a comprehensive trading environment accessible directly through your browser. No downloads, no installations – just instant access to the global markets. You’ll find a suite of advanced charting tools, a variety of technical indicators, and real-time market data to support your analysis and decision-making. Managing your account, executing trades, and monitoring your portfolio has never been simpler.

Here are some of the standout features of our web platform:

- Intuitive Interface: Designed for clarity and ease of use, even for beginners.

- Advanced Charting: Powerful analytical tools to spot trends and make informed choices.

- Diverse Order Types: Execute trades with precision using a range of order options.

- Customizable Layouts: Tailor your workspace to fit your personal trading style.

- Secure Access: Robust security measures protect your data and transactions.

Beyond the desktop, the Finpros mobile trading app ensures you never miss a beat. Our app transforms your smartphone or tablet into a portable trading station, allowing for true on-the-go trading. Check live prices, manage open positions, and even place new orders from anywhere, at any time. The mobile app mirrors the core functionality of our web platform, optimized for smaller screens without compromising on performance or security.

The synergy between our web and mobile platforms means your trading journey is always connected. Start an analysis on your desktop, then execute a trade while commuting. Review your performance data during your lunch break, or set up alerts to catch key market movements even when away from your primary screen. This integrated approach defines the superior Finpros experience, empowering you to stay agile and responsive in the fast-paced world of forex.

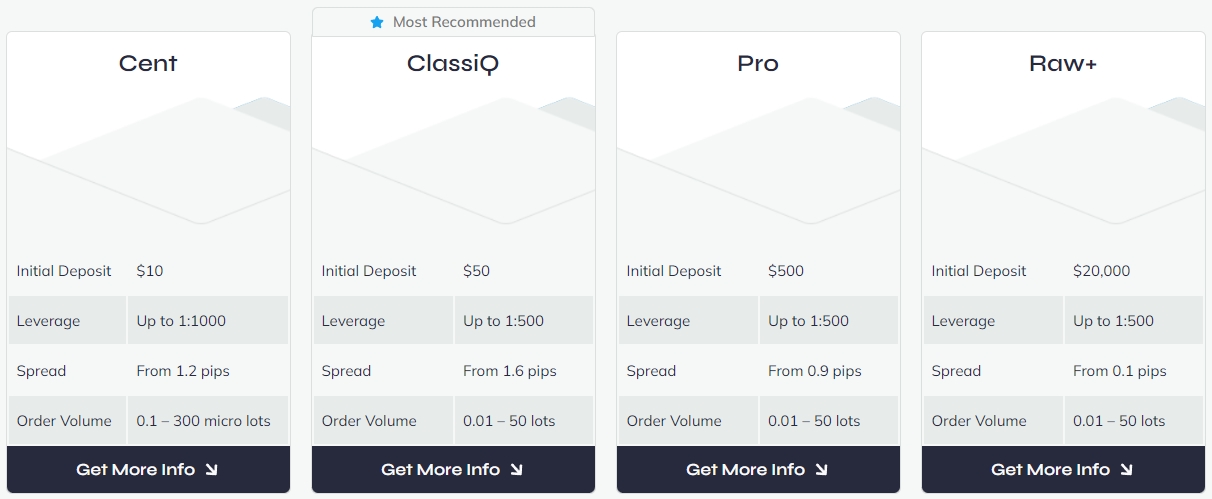

Account Types Offered by Finpros Forex Broker

Are you ready to dive into the exciting world of forex trading with Finpros? We believe every trader is unique, with different goals, strategies, and capital. That’s why we crafted a range of account types designed to perfectly match your trading style, whether you are just starting out or you’re a seasoned market veteran. Discover the perfect home for your trading journey right here.

Explore Your Trading Options

Finpros prides itself on offering flexible solutions. We understand that what works for one trader might not work for another. Our diverse account options ensure you find the features, spreads, and leverage that align with your personal trading approach.

- Standard Account: Our most popular choice for general traders. It offers competitive spreads and no commissions, making it ideal for those who prefer straightforward pricing.

- ECN Account: For traders who demand razor-thin spreads and lightning-fast execution. This account provides direct access to interbank liquidity, perfect for scalpers and high-volume traders.

- Cent Account: An excellent starting point for beginners or those testing new strategies. Trade in smaller lot sizes (cents), minimizing risk while gaining real market experience.

- Islamic (Swap-Free) Account: Adhering to Sharia law, this account type eliminates swap fees, ensuring compliance for our Muslim traders without compromising trading conditions.

Choosing the right account type is a crucial step in your trading success. Let’s take a closer look at what each Finpros account offers:

| Account Type | Minimum Deposit | Spreads From | Commissions | Best For |

|---|---|---|---|---|

| Standard Account | $100 | 1.2 Pips | No Commission | General Traders, Beginners |

| ECN Account | $500 | 0.0 Pips | Per Lot Traded | Scalpers, High-Volume Traders |

| Cent Account | $10 | 1.5 Pips | No Commission | Beginners, Strategy Testing |

| Islamic Account | $100 | 1.2 Pips | No Commission (Swap-Free) | Muslim Traders |

Every account at Finpros provides access to our full suite of trading instruments, including major and minor currency pairs, commodities, indices, and cryptocurrencies. You also benefit from our robust trading platforms and dedicated customer support, no matter which account you choose.

Ready to make your move? Review our account options and select the one that truly empowers your trading journey. Join the Finpros community today!

Standard Trading Accounts

Diving into the world of currency markets often starts with choosing the right trading account. A Standard Trading Account is typically the most popular choice for traders who want a balanced approach to the forex market. It strikes a sweet spot, offering a robust trading experience without requiring the massive capital of institutional accounts, while still providing more significant exposure than micro or mini accounts. Many find this account type ideal for gaining solid experience and executing more substantial trades.

Key Characteristics of a Standard Account:

- Standard Lot Size: You typically trade in standard lots, which represent 100,000 units of the base currency. This allows for meaningful profit and loss potential with each pip movement.

- Competitive Spreads: Enjoy tight and competitive spreads on major currency pairs, helping to reduce your trading costs. Spreads are often variable, reflecting real-time market conditions.

- Wide Instrument Access: Gain full access to a broad range of trading instruments. This usually includes major, minor, and exotic forex pairs, as well as commodities, indices, and cryptocurrencies.

- Flexible Leverage Options: Brokers offer various leverage settings, enabling you to control larger positions with a smaller initial capital. Always manage your leverage carefully, as it amplifies both gains and losses.

- Advanced Trading Platforms: Standard accounts generally offer access to industry-leading trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), complete with advanced charting tools, technical indicators, and automated trading capabilities.

- Dedicated Support: Benefit from quality customer support and often access to educational resources that can enhance your market analysis and overall trading strategy.

Advantages and Disadvantages

Understanding the pros and cons helps you make an informed decision for your forex trading journey.

Advantages:

- Significant Market Exposure: Trade larger volumes, leading to more substantial potential profits from successful trades.

- Realistic Trading Environment: Mimics professional trading conditions more closely than smaller account types, preparing you for higher-stakes trading.

- Full Feature Access: Unlock all features offered by your broker, including advanced tools, comprehensive market analysis, and premium support.

- Optimal for Strategy Testing: Ideal for implementing and testing various trading strategies with realistic position sizes.

- Lower Transaction Costs (Relative): Often comes with tighter spreads compared to micro accounts, making your trades more cost-effective over time.

Disadvantages:

- Higher Capital Requirement: Typically requires a larger minimum deposit compared to mini or micro accounts, which might be a barrier for new traders.

- Increased Risk Exposure: Larger position sizes mean that each pip movement results in a greater dollar amount of profit or loss, requiring robust risk management.

- Steeper Learning Curve (Potentially): Beginners might find the larger lot sizes intimidating if they haven’t thoroughly practiced their trading strategy.

- Psychological Pressure: Dealing with larger sums can add psychological pressure, impacting decision-making if not managed effectively.

A Standard Trading Account is often the natural progression for traders moving beyond demo or micro accounts. It offers a solid foundation for serious trading, providing the tools and conditions necessary to develop and execute sophisticated trading strategies. Always ensure your capital and risk tolerance align with the characteristics of a standard account before you commit.

ECN and Pro Accounts: Your Gateway to Elite Trading

Ready to elevate your forex journey from casual observer to serious player? Then it’s time to explore ECN and Pro Accounts. These aren’t just fancy names; they represent a significant step up in the trading world, offering an environment tailored for those who demand the best in execution, pricing, and transparency. Think of it as upgrading from a standard vehicle to a high-performance sports car built for speed and precision.

What Makes ECN Accounts Stand Out?

ECN, or Electronic Communication Network, represents the pinnacle of forex trading environments. When you trade with an ECN forex account, you’re not trading against your broker. Instead, your orders are directly routed to a vast network of liquidity providers, including major banks, financial institutions, and other market participants. This direct interbank market access means no dealing desk intervention and a truly transparent trading experience.

Here’s why ECN accounts are a game-changer:

- Raw Spreads: Experience incredibly tight, often near-zero, raw spreads. You get the actual market price without significant markups.

- Low Commission Forex: While you pay a small, fixed commission per trade, this fee structure often works out to be more cost-effective than wider spreads found in standard accounts, especially for active traders.

- Fast Trade Execution: With direct access to liquidity pools, your orders are filled almost instantaneously. This rapid execution is crucial for capitalizing on fleeting market opportunities.

- High Liquidity Trading: ECN environments boast deep liquidity, ensuring that even large orders can be executed efficiently with minimal slippage.

- No Dealing Desk: Say goodbye to potential conflicts of interest. Your broker simply acts as a conduit, connecting you directly to the market.

- Market Depth: Some ECN platforms even provide deep market depth, letting you see the full range of buy and sell orders at various prices. This transparency offers invaluable insight.

These features make ECN accounts ideal for scalping strategies, high-frequency traders, and those who rely on Expert Advisors (EAs) where every millisecond and pip counts.

Embrace the Power of Pro Trading Accounts

Pro trading accounts often share many characteristics with ECN accounts, specifically designed for professional forex traders and those with higher trading volumes. While the exact features can vary between brokers, the core philosophy remains the same: provide an optimized trading environment for serious participants. Many brokers classify their ECN offering as their “Pro” account due to the advanced features and lower costs for active trading.

What can you typically expect from a Pro account?

- Competitive Pricing: Similar to ECN, expect very tight spreads and a commission-based structure. The goal is to minimize trading costs for active traders.

- Advanced Tools: Access to sophisticated trading platforms, advanced charting features, and potentially premium analytical tools that might not be available in standard accounts.

- Dedicated Support: Often, professional traders receive priority or dedicated account management, ensuring prompt assistance when needed.

- Higher Leverage Options: While leverage always carries risk, Pro accounts might offer more flexible or higher leverage options, subject to regulatory constraints and trader experience.

Choosing between an ECN or a Pro account ultimately depends on your trading style, frequency, and capital. If you’re an experienced trader seeking the lowest possible costs, superior execution, and true market access, then embracing these advanced account types is a smart strategic move. They provide the transparent and efficient environment that serious traders need to thrive in the dynamic forex market.

Islamic (Swap-Free) Accounts

Are you looking to engage with the dynamic world of forex trading while adhering to your faith? Many traders seek options that align with Sharia law, and that’s exactly where Islamic, or swap-free, accounts come into play. These specialized trading accounts are designed to ensure your trading activities are compliant with Islamic finance principles, making them a cornerstone for many Muslim traders globally.

The core concept behind an Islamic account is its “swap-free” nature. In conventional forex trading, a swap fee (or rollover interest) is charged or credited on positions held overnight. This is essentially an interest payment, which is prohibited under Sharia law as it constitutes riba (usury). Islamic accounts meticulously eliminate this aspect, allowing you to hold positions without incurring or receiving interest, thereby providing a halal trading environment.

Choosing an Islamic account doesn’t mean compromising on your trading opportunities. You still gain access to the same markets, currency pairs, and trading instruments available to other account types. The primary difference lies in the account structure, specifically designed to bypass interest-based transactions.

Key Characteristics of a Swap-Free Account:

- No Overnight Interest: The most significant feature. You won’t pay or receive interest on positions held open past the market close.

- Transparency: Reputable brokers ensure all terms for Islamic accounts are clear and upfront, often including any administrative fees that might replace swaps (though many offer truly zero-swap for a set period).

- Sharia Compliance: These accounts strictly adhere to Islamic finance principles, particularly by avoiding riba, gambling (maysir), and excessive uncertainty (gharar).

- Access to Markets: You can trade major, minor, and exotic currency pairs, commodities, and sometimes indices, just like with standard accounts.

For traders prioritizing ethical and faith-compliant financial practices, Islamic accounts offer a seamless bridge into the bustling forex market. They represent a thoughtful solution that respects religious tenets while providing the excitement and potential rewards of global currency exchange. It’s about trading with peace of mind, knowing your financial activities align with your beliefs.

Spreads, Commissions, and Trading Costs at Finpros

Understanding the full scope of trading costs is crucial for any successful forex trader. At Finpros, we believe in transparent pricing, ensuring you know exactly what to expect when you open a trade. Your profitability hinges not just on your strategy, but also on how effectively you manage expenses like spreads and commissions. Let’s delve into the various costs you might encounter.

Spreads represent the difference between the bid and ask price of a currency pair. This is a primary way brokers make money. At Finpros, we strive to offer highly competitive spreads across a wide range of instruments. Our spreads can be variable, meaning they fluctuate with market volatility and liquidity, or fixed, depending on your account type and the asset you trade. For major currency pairs, you’ll often find some of the tightest spreads in the industry, helping to keep your Finpros trading costs low. We continuously monitor market conditions to ensure our pricing remains advantageous for our clients.

Commissions are another important factor. Unlike some brokers who only charge through the spread, Finpros offers various account types that might include commissions, particularly for our ECN (Electronic Communication Network) accounts. These accounts typically feature raw, razor-thin spreads directly from our liquidity providers, with a small, fixed commission charged per standard lot traded. This model is often preferred by high-volume traders and scalpers who prioritize minimal spreads. Understanding when commissions on Finpros apply is key to choosing the right trading environment for your strategy.

Beyond spreads and commissions, other trading fees at Finpros can impact your bottom line. These might include:

- Swap Rates (Overnight Fees): If you hold positions open overnight, you may incur or receive swap fees. These are interest adjustments based on the interest rate differential between the two currencies in a pair. Swap rates at Finpros are clearly displayed on our trading platforms, allowing you to plan your long-term trades effectively.

- Inactivity Fees: To encourage active trading, a small inactivity fee might apply to accounts that remain dormant for an extended period, typically several months, with no trading activity.

- Deposit and Withdrawal Fees: While Finpros aims to offer numerous free deposit and withdrawal methods, some specific payment providers or unusually large transactions might incur charges. We always inform you of any potential fees before you confirm your transaction.

Finpros is committed to providing a clear and straightforward pricing structure. We believe that transparency around all forex spreads Finpros offers, along with commission structures and other potential charges, empowers you to make informed decisions. We work hard to ensure you receive a cost-effective and efficient trading experience. Reviewing our detailed fee schedule on our platform gives you the complete picture of what to expect.

Deposit and Withdrawal Options with Finpros

Navigating the world of forex trading requires not just a keen eye for market trends, but also the confidence that your funds are accessible and secure. At Finpros, we understand that flexibility and reliability in managing your capital are paramount. That’s why we’ve streamlined our deposit and withdrawal processes to be as efficient and user-friendly as possible, ensuring you can focus on what truly matters: your trading strategy.

Funding Your Finpros Account

Getting started with Finpros is simple. We offer a variety of convenient methods to fund your trading account, catering to different preferences and geographical locations. Our goal is to make your initial deposit, or any subsequent top-up, a smooth experience. You’ll find options that are not only quick but also backed by robust security protocols.

Available Deposit Methods:

- Credit/Debit Cards: Instant funding with major cards like Visa and Mastercard. Secure and widely accepted.

- Bank Wire Transfers: Ideal for larger amounts, offering a traditional and highly secure way to transfer funds directly from your bank account.

- E-Wallets: Popular choices such as Neteller and Skrill provide fast and easy transfers, often with minimal fees.

- Other Local Payment Solutions: Depending on your region, Finpros supports various local payment gateways to offer even greater convenience.

Most electronic deposits are processed instantly, allowing you to seize market opportunities without delay. Bank transfers may take a few business days to clear, so plan accordingly if choosing this option.

Cashing Out: Your Withdrawal Process

When it’s time to enjoy your trading success, withdrawing your funds from Finpros is just as straightforward. We prioritize secure transactions and aim for fast withdrawals, ensuring your profits reach you promptly. Our dedicated team works diligently to process your requests with efficiency and transparency.

The withdrawal process typically follows these steps:

- Submit Your Request: Log into your Finpros trading portal and navigate to the withdrawal section. Enter the desired amount and choose your preferred withdrawal method.

- Verification: To ensure the security of your funds, we may ask for identity verification if you haven’t completed it already. This is a standard anti-money laundering (AML) and know-your-customer (KYC) procedure.

- Processing: Our finance department reviews and processes your request. We strive to process withdrawals within a short timeframe, often within 24-48 business hours for e-wallets and cards. Bank wires may take slightly longer due to interbank processing times.

- Funds Received: Your funds will be sent to your chosen account, ready for your use.

“At Finpros, we believe your trading experience extends beyond charts and trades. It includes seamless fund management, giving you peace of mind.”

Key Benefits of Finpros’ Funding System

Choosing Finpros for your trading journey means benefiting from a funding system designed with traders in mind. We stand out by offering:

| Feature | Description |

|---|---|

| Variety of Options | Multiple secure deposit and withdrawal methods to suit global clients. |

| Enhanced Security | Utilizing advanced encryption and compliance protocols to protect your financial information. |

| Fast Processing | Commitment to quick deposit crediting and efficient withdrawal processing. |

| Transparent Fees | Clear communication on any potential fees, ensuring no hidden surprises. |

| Dedicated Support | Our customer service team is always ready to assist with any funding queries. |

Managing your forex trading account with Finpros is a straightforward and secure experience. From the moment you decide to fund your account to the point of withdrawing your well-earned profits, we ensure every step is transparent, efficient, and reliable. Trade with confidence, knowing your capital is in expert hands.

Tradable Instruments: What Can You Trade with Finpros?

Are you ready to explore a world of trading opportunities? Finpros opens the door to a vast array of financial instruments, empowering you to build a diversified portfolio and seize market movements across various asset classes. Our robust online trading platform gives you access to the markets you want to trade, all from a single account. Whether you are interested in currency pairs, stock CFDs, commodity trading, or the latest cryptocurrencies, Finpros has you covered. Let’s dive into the exciting range of options available to you.

Forex Trading: The Heart of the Market

Forex trading, or foreign exchange, remains one of the most liquid and dynamic markets globally. With Finpros, you can trade a wide selection of currency pairs, capitalizing on fluctuations between national currencies. This includes major pairs, minor pairs, and even exotic pairs, offering endless possibilities for strategic market entry.

- Major Pairs: These are the most frequently traded, involving the US Dollar (USD) against other major currencies like the Euro (EUR), Japanese Yen (JPY), British Pound (GBP), and Swiss Franc (CHF). You will find tight spreads and high liquidity here.

- Minor Pairs (Cross-Currency Pairs): These do not involve the USD but feature other major currencies, such as EUR/GBP or AUD/JPY. They can offer unique trading patterns.

- Exotic Pairs: These combine a major currency with a currency from an emerging market, like USD/TRY (Turkish Lira) or EUR/MXN (Mexican Peso). They often have higher volatility and wider spreads but can present significant profit potential.

Commodities: Tangible Assets, Untapped Potential

Commodity trading allows you to speculate on the price movements of raw materials. These assets often react differently to global economic events than currencies or stocks, making them excellent tools for portfolio diversification. Finpros provides access to popular commodities through Contracts for Difference (CFDs), meaning you can trade without owning the physical asset.

You can trade precious metals like gold and silver, often considered safe-haven assets during economic uncertainty. Energy commodities such as crude oil and natural gas also present frequent trading opportunities driven by supply, demand, and geopolitical factors.

Indices: Track Global Markets

Indices trading lets you speculate on the performance of an entire stock market or a specific sector. Instead of trading individual company shares, you trade an instrument that tracks the aggregate movement of a basket of stocks. This offers exposure to broader economic trends and can reduce individual company risk.

Finpros offers CFDs on major global indices from around the world. Imagine trading the Germany 40 (DAX), the US 30 (Dow Jones Industrial Average), the UK 100 (FTSE 100), or the Japan 225 (Nikkei). You can take a position on the general health of a nation’s economy or a specific industry with ease.

Shares/Stocks: Individual Company Performance

Want to trade the performance of specific companies without purchasing their shares directly? Finpros offers stock CFDs on a wide range of popular global companies. This means you can speculate on whether a company’s share price will rise or fall, benefiting from both upward and downward market movements. From tech giants to established blue-chip companies, you can find numerous trading possibilities and integrate your fundamental and technical analysis.

Cryptocurrencies: The Future of Finance

The cryptocurrency market is revolutionary, offering incredible volatility and exciting prospects. With Finpros, you can engage in cryptocurrency trading, speculating on the price movements of leading digital assets against fiat currencies. Our platform makes it straightforward to access this innovative market.

| Cryptocurrency | Description |

|---|---|

| Bitcoin (BTC) | The pioneering decentralized digital currency. |

| Ethereum (ETH) | The leading platform for smart contracts and decentralized applications. |

| Ripple (XRP) | A digital payment protocol designed for fast, low-cost international transactions. |

| Litecoin (LTC) | Often called “digital silver,” offering faster transaction times than Bitcoin. |

Trading crypto CFDs allows you to take advantage of the market’s significant price swings without the complexities of owning and storing the underlying digital assets directly.

Why Trade with Finpros?

Our extensive range of tradable instruments means you have more ways to engage with the financial markets. Whether you prefer the stability of major currency pairs, the growth potential of stock CFDs, or the excitement of cryptocurrency trading, Finpros provides the tools and environment for your trading journey. This diversity empowers you to diversify portfolio exposure and adapt your strategy to various market conditions, seeking out new opportunities as they arise.

Customer Support: Reaching Finpros Broker Assistance

In the dynamic world of forex trading, having reliable and accessible customer support isn’t just a luxury; it’s a necessity. At Finpros, we understand that questions can arise at any moment, whether you’re a seasoned trader or just starting your journey. That’s why we’ve built a robust support system designed to provide you with prompt, knowledgeable, and friendly assistance whenever you need it.

We believe that strong support fosters confidence and empowers our traders. Our dedicated team is always ready to guide you through account setup, technical issues, trading platform inquiries, or any other challenge you might encounter. Your peace of mind is our priority, ensuring you can focus on your trading strategies.

How to Connect with Our Support Team

Reaching Finpros broker assistance is straightforward. We offer multiple channels, so you can choose the method that best suits your convenience and urgency. Our goal is to make sure help is always just a few clicks or a call away.

- Live Chat: For immediate questions and quick resolutions, our live chat service is your go-to option. Available directly on our website, it connects you with a support agent in real-time, offering instant solutions to your queries.

- Email Support: If your query is less urgent or requires detailed documentation, sending an email is an excellent choice. Our support team meticulously reviews every email, providing comprehensive and clear responses, often within a few hours.

- Phone Assistance: Sometimes, a direct conversation is the most effective way to resolve complex issues. Our phone lines are open during business hours, allowing you to speak directly with an experienced support representative who can offer personalized guidance.

What Makes Finpros Support Stand Out?

We pride ourselves on offering more than just basic help. Our customer support is a cornerstone of the Finpros trading experience. We invest in our team to ensure they are well-equipped to handle a wide range of inquiries with expertise and empathy.

- Expert Knowledge: Our support agents are highly trained professionals with in-depth knowledge of the forex market, our trading platforms, and all Finpros services. They provide accurate information and effective solutions.

- Multilingual Team: We serve a global community of traders. Our support staff can assist you in multiple languages, breaking down communication barriers and ensuring clear understanding regardless of where you are in the world.

- Timely Responses: We respect your time. Our system is optimized to ensure that your inquiries receive prompt attention, minimizing your wait times and getting you back to trading faster.

- Client-Centric Approach: Every interaction with our support team is geared towards understanding your specific needs and providing tailored solutions. We listen carefully and act efficiently to enhance your trading journey.

Experience the difference that dedicated, professional customer support makes. At Finpros, we are more than just a broker; we are your partner in the exciting world of forex trading. Don’t hesitate to reach out – our team is eager to assist you.

Educational Resources for Finpros Traders

Success in the dynamic world of forex trading hinges on continuous learning. At Finpros, we understand that well-informed traders are confident traders. That’s why we offer a robust suite of educational resources designed to empower every individual, whether you are just starting your journey or looking to refine your advanced trading strategies.

Our comprehensive learning platform goes beyond basic definitions. We delve deep into the intricacies of the global currency markets, providing you with the essential knowledge and skills needed to navigate its complexities. We believe that a strong foundation in forex trading education is your most valuable asset.

What You Will Discover:

- In-Depth Courses: Our structured modules cover everything from the absolute fundamentals to sophisticated market analysis techniques. Learn at your own pace and revisit topics as often as you need.

- Live Interactive Webinars: Join our seasoned market professionals for real-time discussions, market updates, and Q&A sessions. These interactive events are perfect for gaining fresh market insights and understanding practical application.

- Extensive Article Library: Dive into our rich collection of articles and guides. Explore topics like effective **risk management**, the nuances of **technical analysis**, and the impactful events driving **fundamental analysis**.

- Practical Trading Tools: Education isn’t just theory. We provide insights into using various **trading tools** and indicators, showing you how to integrate them into your daily routine for better decision-making.

- Trading Psychology Insights: Master the mental game of trading. Our resources help you develop resilience, manage emotions, and build a strong **trading psychology** crucial for long-term success.

For **beginner traders**, our foundational programs demystify core concepts, guiding you through setting up your first trade on a free **demo account**. This risk-free environment allows you to practice new **trading strategies** and build confidence without real financial exposure.

Meanwhile, **advanced traders** will find specialized content focused on optimizing existing strategies, exploring algorithmic trading concepts, and understanding advanced charting patterns. We continually update our content to reflect current market dynamics and emerging trends, ensuring you always have access to relevant information.

Our commitment to your growth means providing clear, actionable content that translates directly into improved trading performance. We use simple language and real-world examples to make complex subjects accessible and engaging. Take control of your financial future by embracing continuous **forex trading education** with Finpros.

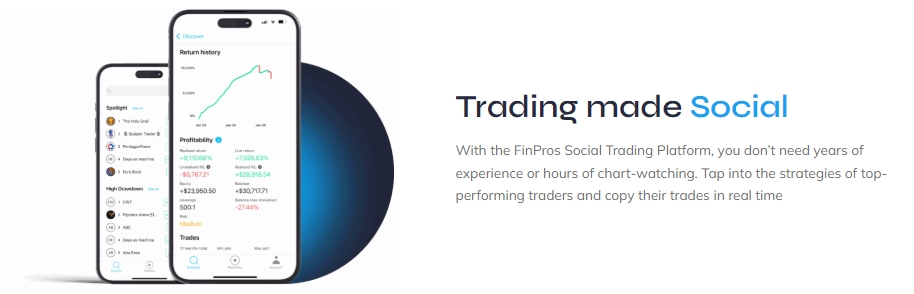

Unique Features and Tools from Finpros

At Finpros, we understand that successful forex trading demands more than just access to markets. It requires a robust ecosystem of cutting-edge tools and distinctive features designed to give you an undeniable edge. We’ve meticulously crafted our offerings to empower every trader, from the budding enthusiast to the seasoned professional, with precision, insight, and control.

Our commitment to innovation means you won’t find generic solutions here. Instead, we provide bespoke functionalities that truly set your trading platform experience apart. Here’s a glimpse into what makes Finpros an exceptional choice:

- AI-Powered Market Insights: Get predictive analytics and sentiment indicators generated by our proprietary artificial intelligence, giving you a deeper understanding of market movements before they happen.

- Customizable Strategy Builder: Design, backtest, and deploy your own automated expert advisors without needing to write a single line of code. Our intuitive drag-and-drop interface makes sophisticated strategy creation accessible to everyone.

- Advanced Risk Management Suite: Beyond basic stop-loss orders, utilize dynamic trailing stops, partial profit-taking, and automated position sizing tools to protect your capital and optimize your trade exits.

- Interactive Economic Calendar with Impact Analysis: Don’t just see economic events; understand their potential market impact with our integrated real-time volatility projections, crucial for informed decisions in real-time data environments.

- Social Trading Network (Finpros Connect): Learn from and replicate the strategies of top-performing traders within our secure community, fostering growth and shared success.

One of our standout offerings is the Finpros Analytics Dashboard. This powerful tool consolidates your trading history, performance metrics, and market analysis into an easily digestible visual format. It helps you identify your strengths and weaknesses, pinpointing areas where you can refine your approach. This isn’t just about showing you numbers; it’s about providing actionable intelligence to evolve your trading strategy consistently.

Consider the immediate benefits our advanced charting and analysis tools bring to your daily operations:

| Feature Category | Finpros Advantage | Trader Benefit |

|---|---|---|

| Charting Tools | 100+ technical indicators, multi-timeframe analysis, custom drawing tools | Deeper insights, clearer trend identification, personalized visual analysis |

| Analytical Power | AI sentiment analysis, predictive price zones, real-time news integration | Anticipate shifts, validate entry/exit points, stay ahead of the curve |

| Execution Speed | Ultra-low latency infrastructure, one-click trading from charts | Minimize slippage, seize fleeting opportunities swiftly |

From comprehensive educational resources that demystify complex concepts to a highly intuitive mobile app that keeps you connected on the go, every element at Finpros is designed to elevate your trading journey. We provide the sophisticated arsenal you need to navigate the dynamic world of forex with confidence and precision.

The Finpros Mobile Trading Experience

Imagine having the global financial markets right in your pocket. With the Finpros mobile trading app, that’s not just a dream – it’s your daily reality. Our cutting-edge application transforms your smartphone or tablet into a powerful trading station, giving you unprecedented access to forex and other markets, no matter where you are. We designed this experience for traders who demand flexibility, speed, and precision.

Life moves fast, and so do the markets. The Finpros mobile experience ensures you never miss a beat. You can monitor your positions, execute trades, and react to market movements with just a few taps. We believe that professional-grade trading should be accessible to everyone, everywhere, and our mobile platform delivers exactly that.

What Makes the Finpros Mobile App Stand Out?

Our commitment to an intuitive interface means you’ll find navigation a breeze, whether you’re a seasoned trader or just starting your journey. We integrate a suite of powerful trading tools and features directly into the app, ensuring you have everything you need for effective market analysis and strategic decision-making. Here’s a glimpse of what you get:

- Instant Access: Dive into the markets anytime, anywhere with our robust forex on the go solution.

- Real-Time Data: Stay ahead with live quotes and real-time market data directly on your device.

- Advanced Charting: Utilize a variety of technical indicators and chart types to perform in-depth market analysis.

- Seamless Execution: Place trades, set stop-loss and take-profit orders quickly and efficiently.

- Account Management: Easily manage your funds, deposit, and withdraw directly from the app.

- Push Notifications: Receive custom alerts for price movements, economic events, and order statuses, keeping you fully informed.

We built our mobile trading app with a focus on a secure platform, ensuring your data and transactions are protected with the latest encryption technologies. This means you can trade with confidence, knowing your financial information is safe. Embrace the freedom of powerful trading in the palm of your hand and elevate your trading strategy with Finpros.

How to Open an Account with Finpros

Embarking on your forex trading journey with a reliable partner is crucial. Finpros offers a streamlined and secure path to the global financial markets. Opening an account with us is designed to be straightforward, ensuring you can quickly move from registration to making your first trade. We understand that time is money, and we’ve optimized our process for efficiency and clarity. Whether you’re a seasoned trader or just starting, we’re here to guide you every step of the way.

Your Easy Path to Trading: Step-by-Step

Getting started with Finpros is simpler than you might think. Follow these clear steps to unlock your trading potential:

- Visit Our Official Website: Navigate to the Finpros homepage. Look for the prominent “Open Account” or “Sign Up” button, usually located in the top right corner.

- Complete the Registration Form: You’ll be directed to a secure registration page. Provide your basic personal details such as your full name, email address, phone number, and country of residence. Make sure all information is accurate to avoid delays.

- Choose Your Account Type: Finpros offers various account types tailored to different trading styles and experience levels. Consider options like Standard, ECN, or Islamic accounts. Each comes with unique features, spreads, and leverage options. Take a moment to review them and select the one that best suits your trading goals.

- Pass the KYC (Know Your Customer) Verification: This is a standard regulatory requirement to ensure the security of your funds and combat financial crime. You will need to upload copies of a valid identification document (e.g., passport or national ID card) and a proof of address (e.g., utility bill or bank statement) issued within the last three months. Our team processes these swiftly.

- Fund Your Account: Once your account is verified, you can deposit funds using a variety of secure payment methods. These typically include bank transfers, credit/debit cards, and popular e-wallets. Choose the method most convenient for you and follow the on-screen instructions.

- Start Trading: Congratulations! With funds in your account, you’re ready to access our powerful trading platforms. Explore the markets, analyze charts, and execute your first trade with confidence.

Essential Requirements for Account Opening

To ensure a smooth registration process, please have the following ready:

- Valid Identification: A government-issued ID (passport, national ID card, driver’s license) that clearly shows your photo, name, and date of birth.

- Proof of Residence: A recent utility bill (electricity, water, gas) or bank statement, usually not older than three months, showing your name and address.

- Email Address and Phone Number: These will be used for communication and account verification.

Why Choose Finpros for Your Trading Account?

Opening an account with Finpros isn’t just about accessing markets; it’s about partnering with a broker committed to your success. Here’s a quick glance at what sets us apart:

| Feature | Benefit to You |

|---|---|

| User-Friendly Platform | Intuitive interface for seamless trading experience. |

| Competitive Spreads | Lower trading costs, enhancing your potential profits. |

| Robust Security Measures | Your funds and personal data are protected with advanced encryption. |

| Dedicated Support Team | Expert assistance available whenever you need it. |

| Educational Resources | Tools and guides to help you refine your trading skills. |

“Joining Finpros opened up a world of opportunities for me. Their account opening process was incredibly smooth, and their support team was there every step of the way.” – A satisfied Finpros Trader.

We are excited to welcome you to the Finpros community. Take the first step today towards achieving your financial aspirations in the dynamic forex market.

Finpros Forex Broker: Pros and Cons

Diving into the world of online trading requires choosing the right partner. Finpros, a name gaining traction in the forex market, offers a distinct set of features that appeal to various traders. But like any financial service, it comes with its own strengths and weaknesses. Understanding these can help you make an informed decision about whether Finpros aligns with your trading goals and preferences. We’ll break down what makes Finpros stand out and where it might fall short, giving you a complete picture.

The Upside of Trading with Finpros

Many traders find compelling reasons to choose Finpros as their preferred forex broker. Here’s a look at some of the key advantages:

- Competitive Spreads: Finpros is known for offering some of the market’s *low spreads*, which can significantly reduce your trading costs over time. This is especially beneficial for active traders who execute many transactions.

- Robust Trading Platform: The broker provides a powerful and intuitive *trading platform*. Whether you’re a beginner or an experienced pro, you’ll find the tools and interface easy to navigate, making trade execution swift and efficient.

- Excellent Customer Support: Getting timely help is crucial in fast-paced *forex trading*. Finpros boasts responsive and knowledgeable *customer support* teams, ready to assist with any queries or technical issues you might encounter.

- Diverse Account Types: Finpros understands that not all traders are the same. They offer a range of *account types*, catering to different experience levels and capital sizes, ensuring you can find an Paccount that fits your specific needs.

- Educational Resources: For those new to the market or looking to hone their skills, Finpros provides valuable *educational resources*. These materials can help you understand market dynamics, develop trading strategies, and improve your overall knowledge.

Areas Where Finpros Could Improve

While Finpros presents many attractive features, it’s also important to consider potential drawbacks that might influence your choice. No broker is perfect for everyone, and Finpros has aspects where some traders might find it less ideal:

- Limited Asset Diversity: Some advanced traders might find the range of tradable assets outside of forex somewhat limited compared to brokers offering a wider array of stocks, commodities, and indices. If you seek a one-stop shop for extensive market access, this could be a factor.

- Minimum Deposit Requirements: While there are various *account types*, some of the premium options with more advanced features might come with a higher minimum deposit, potentially making them less accessible for traders with smaller starting capital.

- Withdrawal Process Speed: While generally reliable, some users have noted that the *withdrawal process* can occasionally take longer than with some competitor brokers, depending on the method used. Always review their terms for specific timeframes.

- Fewer Advanced Trading Tools: Highly experienced traders looking for very specialized or niche *trading tools* might find the platform’s advanced features sufficient but not as extensive as some institutional-grade platforms.

Ultimately, your choice depends on what you prioritize in a forex broker. Finpros offers a solid foundation for *forex trading* with its focus on competitive costs and user experience, but be sure to weigh these pros and cons against your individual trading style and requirements.

Comparing Finpros to Other Leading Forex Brokers

Choosing the right forex broker is a pivotal decision that can significantly impact your trading journey. With a vast array of options available, understanding where a broker stands against its peers is crucial. When you compare Finpros to other leading forex brokers, you quickly uncover a commitment to excellence across several key areas that matter most to traders.

Many traders start their search by looking at basic offerings, but the real value lies in the details. Leading forex brokers often boast similar core services, yet Finpros distinguishes itself through a blend of superior technology, competitive trading conditions, and an unwavering focus on trader success. We believe in providing a seamless trading experience, whether you are a seasoned pro or just starting out.

What Sets Finpros Apart?

- Unrivaled Trading Conditions: Finpros is dedicated to offering some of the market’s tightest spreads and low commissions, ensuring that more of your profits stay with you. We understand that transparent pricing is fundamental to a trader’s confidence.

- Cutting-Edge Platforms: Access a suite of advanced trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and our robust WebTrader. These platforms come equipped with sophisticated charting tools, indicators, and automated trading capabilities, empowering you to execute your strategies effectively.

- Robust Regulation & Security: We prioritize your peace of mind. Finpros operates under stringent broker regulation, providing a secure trading environment for your funds and data. This commitment to security is a cornerstone of our reputation among leading forex brokers.

- Exceptional Customer Support: Our dedicated, multilingual support team is available around the clock to assist you. From technical queries to account management, we deliver customer support excellence, ensuring you receive timely and professional help whenever you need it.

- Diverse Trading Instruments: Expand your trading horizons with a diverse trading instrument portfolio. Beyond major and minor forex pairs, you can access commodities, indices, cryptocurrencies, and more, all from a single account.

To give you a clearer picture, consider this comparison across common benchmarks:

| Feature | Finpros | Other Leading Forex Brokers (General) |

|---|---|---|

| Spreads & Commissions | Ultra-tight spreads, low commissions, high transparency. | Varies greatly; often competitive but can include hidden fees. |

| Trading Platforms | MT4, MT5, advanced WebTrader with custom tools. | Primarily MT4/MT5, sometimes proprietary platforms. |

| Regulation | Strong, multi-jurisdictional regulatory oversight. | Can range from well-regulated to less stringent. |

| Asset Diversity | Extensive – 300+ instruments (Forex, Metals, Energy, Indices, Cryptos). | Generally good, but instrument range can be limited. |

| Customer Support | 24/5 dedicated, multilingual, responsive, personalized. | Often 24/5, but quality and response times can vary. |

| Educational Resources | Comprehensive tutorials, webinars, market analysis, expert insights. | Basic to good, sometimes limited to platform guides. |

“In the fast-paced world of forex, having a broker that not only meets but exceeds industry standards is non-negotiable. Finpros continuously strives to provide the edge traders need to succeed.”

When evaluating different options, consider the long-term relationship you’re building with your broker. Finpros offers not just forex trading tools but a partnership, committed to your growth and security in the market. Our dedication to providing an exceptional trading environment, backed by robust technology and stellar service, truly distinguishes us among other leading forex brokers.

Final Verdict: Is Finpros the Right Choice for Your Forex Trading?

Making the right choice for your forex trading partner is a crucial decision that impacts your entire investment journey. You’re looking for reliability, advanced tools, and support that truly aligns with your financial aspirations. So, when it comes to Finpros, how does it stack up? Let’s break down the key factors to help you make an informed decision about your future in the dynamic world of currency trading.

What Finpros Brings to Your Trading Table:

- Robust Trading Platform: Finpros offers a sophisticated yet intuitive trading platform. Whether you’re a beginner or an experienced trader, you’ll find the interface user-friendly, equipped with advanced charting tools and analytical features to help you make smart decisions on various currency pairs.

- Diverse Asset Selection: Beyond major and minor currency pairs, Finpros often provides access to a broader range of trading instruments, giving you more opportunities to diversify your portfolio and explore different market conditions.

- Commitment to Security and Regulation: A top priority for any serious forex trader is the safety of their funds and personal data. Finpros maintains strong regulatory compliance, offering a secure environment where you can focus on your trading strategy without unnecessary worry. This commitment builds trust and peace of mind.

- Dedicated Customer Support: Facing a technical issue or needing clarity on a trade? Responsive and knowledgeable customer support is vital. Finpros prides itself on providing timely assistance, ensuring your trading experience remains smooth and uninterrupted.

- Educational Resources: For those keen on expanding their knowledge, Finpros frequently provides educational materials, webinars, and market analysis. These resources are invaluable for developing your trading skills and understanding complex market dynamics, especially concerning risk management.

Considerations for Your Investment Goals:

While Finpros offers many advantages, your personal trading style and investment goals are paramount. Consider these points when evaluating if Finpros is the perfect match for your forex trading ambitions:

- Trading Style Match: Does the platform’s execution speed and available order types align with your high-frequency or long-term strategies?

- Leverage and Risk Tolerance: Finpros provides various leverage options. Understand how these can amplify both profits and losses, and ensure you have a solid risk management plan in place.

- Account Types: Review the different account types available. Does one offer features, spreads, or commission structures that best suit your volume and capital?

Ultimately, Finpros presents a compelling option for many seeking to engage in forex trading. Its blend of a powerful trading platform, extensive market access, strong regulatory backing, and supportive services creates an environment conducive to growth. If you value security, a comprehensive trading experience, and the tools to navigate the global currency markets effectively, Finpros could indeed be the right choice to help you achieve your financial objectives. Take the time to explore their offerings and see how they can support your unique journey.

Frequently Asked Questions

What is Finpros Forex Broker?

Finpros is a comprehensive online trading environment designed for both new and experienced traders, offering access to global currency markets and other financial instruments with robust tools and support.

Is Finpros a regulated and secure broker?

Yes, Finpros operates under reputable financial regulation authorities, employs advanced SSL encryption for data protection, offers negative balance protection, and supports two-factor authentication (2FA) for enhanced account security.

What trading platforms does Finpros offer?

Finpros provides industry-leading platforms including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and robust web and mobile trading solutions, catering to diverse trader needs and preferences.

What types of trading accounts are available at Finpros?

Finpros offers various account types, including Standard, ECN, Cent, and Islamic (Swap-Free) accounts, each tailored with different spreads, commissions, and features to suit various trading styles and experience levels.

What are the primary costs associated with trading on Finpros?

The main trading costs on Finpros include competitive spreads (variable or fixed), commissions (especially for ECN accounts), swap rates for overnight positions, and potentially small inactivity or specific deposit/withdrawal fees.